January 2025

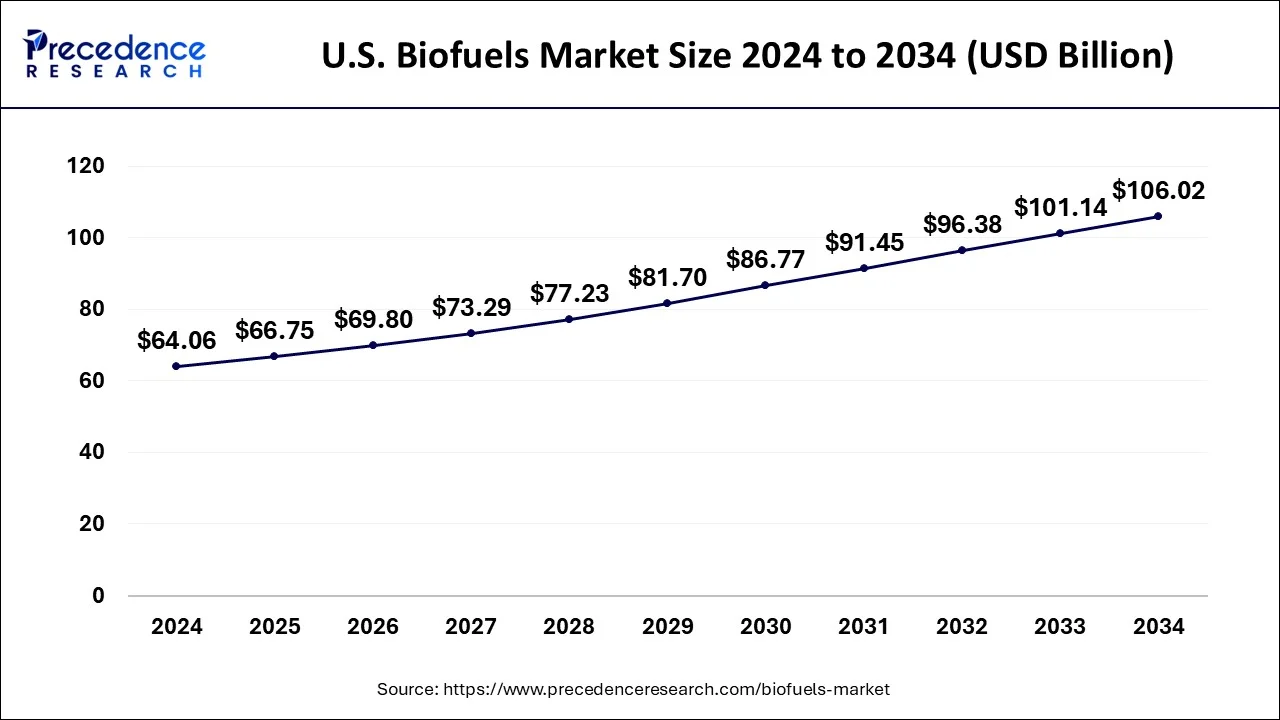

The U.S. biofuels market size is calculated at USD 64.06 billion in 2024, grew to USD 66.75 billion in 2025, and is predicted to hit around USD 106.02 billion by 2034, expanding at a CAGR of 5.17% between 2025 and 2034.

The U.S. biofuels market size is worth around USD 64.06 billion in 2024 and is anticipated to reach around USD 106.02 billion by 2034, growing at a CAGR of 5.17% over the forecast period 2024 to 2034.

The U.S. biofuels market refers to the global industry involved in the production, distribution, and consumption of renewable fuels derived from organic materials, primarily plants and animal fats. Biofuels are considered a sustainable alternative to fossil fuels such as coal, oil, and natural gas because they are produced from renewable biomass sources and emit lower levels of greenhouse gases when burned. Since they offer the potential to lower dependency on fossil fuels and lessen greenhouse gas emissions, biofuels derived from renewable biological resources like plants and algae have attracted much attention. They are widely employed in transportation as an alternative to traditional fossil fuels.

The two most popular biofuels in the U.S. are ethanol, mainly sourced from corn, and biodiesel, usually made from soybean oil or leftover cooking oil. They are combined with gasoline and diesel to promote greener energy sources and lower emissions.

The aviation and maritime sectors are investigating biofuels to lower their carbon footprint. Bio-based sources of sustainable aviation fuels (SAF) are being tested and used in commercial aircraft. Simultaneously, biofuels are being researched as potential substitutes for maritime vessels to meet emissions standards.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.17% |

| U.S. Market Size in 2024 | USD 64.06 Billion |

| U.S. Market Size by 2034 | USD 106.02 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Fuel Type and By Feedstock |

Growing demand for cleaner fuels

The U.S. biofuels market is observed to grow with increasing demand for cleaner fuels. People are choosing cleaner energy sources over traditional fossil fuels because they emit fewer greenhouse gases and other pollutants and are more conscious of the effects of climate change and air pollution. Growing consumer inclinations toward renewable and sustainable energy sources fuel the need for biofuels in transportation and other industries. Furthermore, companies see the financial benefits of producing biofuels and invest to increase capacity.

Development of advanced biofuels

In broad terms, first-generation biofuels and conventional fossil fuels emit more greenhouse gases than advanced biofuels. In a world where the focus is on reducing climate change, this reduction in carbon footprint is caused by sustainability goals and legislation, making them more and more appealing. Advanced biofuels attract money and promote economic growth by opening new market niches and investment opportunities. Advanced biofuels should become more affordable as production increases and technology advances, giving them a competitive edge.

Uncertain future of mandates

Market demand and investment decisions within the biofuel business can be significantly impacted by changes in government policies and laws regulating biofuel requirements. Future mandate uncertainty makes manufacturers and investors hesitant, which lowers investment and innovation. Such uncertain future of mandates creates a restraint to the U.S. biofuels market.

Mandates about biofuels that need more clarity may discourage prospective investors from joining the market or growing their current businesses. Investors may see biofuel projects as risky endeavors without precise and reliable regulations, which would discourage investment in new infrastructure and technology.

Addressing potential land-use change concerns

Changes in land use issues can be reduced by highlighting sustainable feedstocks, including algae, non-food crops, and agricultural waste. This strategy ensures biofuel production doesn't interfere with food crops or invade essential ecosystems. A more ecologically conscious biofuel business can be promoted by implementing regulations that support sustainable feedstocks and prohibit changing land use for biofuel production. This could involve penalizing land-use changes and offering incentives for sustainable behaviors.

Developing bio-based chemicals and plastics from biofuels

When biofuels are used as feedstock for manufacturing chemicals and plastics, product offerings can be diversified, lowering reliance on conventional fossil fuels and offering substitutes made from renewable resources. There is a sizable market for bio-based chemicals and plastics due to rising consumer awareness and governmental pressure to choose ecologically friendly products, creating growth opportunities for the U.S. biofuels market.

Economic development opportunities include job creation and investment in rural regions where biofuel feedstock farming and biorefineries are created by manufacturing bio-based chemicals and polymers.

The bioethanol segment was found to dominate the U.S. biofuels market in 2024. As a result of regulations like the renewable fuel standard (RFS), which requires ethanol to be blended into gasoline, ethanol producers now have a guaranteed market. The United States has a lot of corn, which makes it easy and dependable to produce ethanol from feedstock. The most prevalent kind generated in the US is corn ethanol. When government incentives exist or oil prices are high, ethanol has proven to be economically competitive with gasoline.

The biodiesel segment is observed to be the fastest growing in the U.S. biofuels market during the forecast period. renewable fuel standards (RFS) require a specific number of renewable fuels to be blended with transportation fuels also impacts the biodiesel segment of the U.S. biofuels market. Moreover, the production and use of biodiesel are encouraged by several federal and state incentives, including tax credits and grants, making it profitable for producers and users. Growth in the industry has been aided by investments in biodiesel production facilities and infrastructural expansion, which have strengthened capacity and distribution networks.

The vegetable oil segment dominated the U.S. biofuels market in 2024. Cleaner, renewable fuel sources, such as biodiesel derived from vegetable oil, are in higher demand as global warming and the need to cut greenhouse gas emissions become more widely recognized. Within the U.S. biofuels market, the demand for vegetable oil-based biodiesel is growing due to growing interest in sustainable alternatives to conventional fossil fuels, which presents growth and investment prospects in the industry.

The coarse grain segment is expected to witness expansion at a significant level during the forecast period. The US is one of the world's top producers of maize, and it serves as the nation's primary feedstock for ethanol manufacturing. Corn is a cheap and easily accessible material for the manufacturing of biofuels due to its plentiful domestic availability. The processing and delivery of ethanol derived from corn is the primary focus of the current infrastructure, which includes ethanol facilities and distribution networks. This developed infrastructure facilitates the production of ethanol derived from corn. The efficiency of producing ethanol from maize has increased due to technological advancements, making it a more financially viable option than other feedstocks.

By Fuel Type

By Feedstock

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025