February 2025

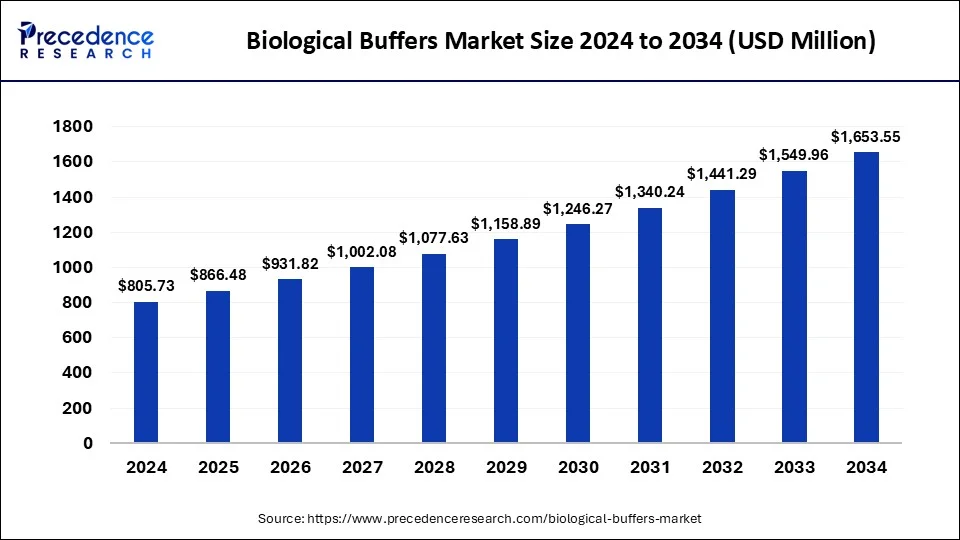

The global biological buffers market size is calculated at USD 866.48 million in 2025 and is forecasted to reach around USD 1,653.55 million by 2034, accelerating at a CAGR of 7.45% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biological buffers market size was estimated at USD 805.73 million in 2024 and is predicted to increase from USD 866.48 million in 2025 to approximately USD 1,653.55 million by 2034, expanding at a CAGR of 7.45% from 2025 to 2034. The biological buffers market has a variety of products, including biological and pharmaceutical buffers, biochemical-grade buffers, and diagnostic-grade buffers, all of which contribute to its growth and vitality.

The biological buffers market involves the production and distribution of chemical compounds essential for maintaining pH stability in various biological and biochemical processes. These buffers are vital for numerous laboratory applications, such as cell culture, molecular biology, and protein biochemistry, driving demand throughout the life sciences industry.

The biological buffers market is complex and global, with biological buffers being indispensable in biological research, diagnostics, and analytical chemistry to guarantee precise and reliable experimental outcomes. By stabilizing pH in biological systems, even in the presence of strong acids or bases, these buffers ensure consistent pH levels.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,653.55 Million |

| Market Size in 2025 | USD 866.48 Million |

| Growth Rate from 2025 to 2034 | CAGR of 7.45% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing interest in biological buffers in life sciences

In recent years, the global biological buffers market has grown considerably due to increased demand in life sciences research and biopharmaceutical production. These buffers are important for maintaining a stable pH in solutions, which makes them essential for advancements in cell culture and other laboratory techniques.

There is a need for pH regulation across various industries, including healthcare and pharmaceuticals, hence driving the growth of the biological buffers market. Additionally, regulations govern the use of biological buffers in different applications. Any modifications to these regulations can impact on the market.

Competition from alternative technologies

The presence of alternative pH control methods, like titratable acids and bases, might restrict the biological buffers market growth of biological buffers, particularly in applications where cost sensitivity is a concern. Moreover, disruptions in the supply chain, such as raw material shortages and logistical issues, can affect the availability and pricing of biological buffers and create challenges for both manufacturers and end-users.

Expanding academic and industrial laboratories

The increasing number of academic and industrial laboratories involved in life sciences research and bioprocessing is driving the demand for biological buffers. As these facilities expand, the need for buffers to maintain pH stability and enzymatic activity grows, which leads to higher consumption. This trend highlights the important role of buffers in supporting various laboratory applications. Moreover, the rising demand for blood and blood plasma for transfusions, along with ongoing vaccination programs for diseases like polio and rubella, is propelling the growth of the biological buffers market.

The expansion in the biopharmaceutical industry

The expanding biopharmaceutical industry increasingly depends on biological buffers during research, development, and production stages, driving the demand for high-quality buffers. These buffers are important for maintaining proper pH levels and enzymatic activity and ensuring the integrity and effectiveness of biologics. The demand for premium buffers is rising in parallel with the growth of biological buffers in the biological buffers market.

The growing use of cell culture techniques in drug discovery, vaccine production, and regenerative medicine highlights the necessity of biological buffers to maintain optimal pH conditions. This rising demand for buffers demonstrates their crucial role in ensuring the success and efficiency of various cellular processes by boosting the biological buffers market growth accordingly.

The phosphate type segment dominated the biological buffers market in 2024 and is anticipated to experience rapid growth during the forecast period. The segment is also anticipated to experience the most rapid growth during the forecast period. This can be attributed to factors such as economic development in emerging markets, evolving consumer trends and behaviors, and the increased need for biochemical research. The rising incidence of chronic diseases and the urgent need to develop effective treatments are also driving the demand for advanced biological buffers.

Due to the strong demand from the research and pharmaceutical sectors, the phosphate-type segment is projected to achieve the highest growth rate in the upcoming years. The increasing need for high-quality biological buffers is likely to boost the use of phosphate-type biological buffers in the global biological buffers market. These phosphate-type buffers are essential for numerous research applications, such as cell culture and protein purification, as they can maintain an optimal pH for enzyme activity.

The research institution segment dominated the biological buffers market in 2024 and is expected to experience the fastest growth during the projected period. The market is anticipated to expand due to factors such as economic growth in developing economies, evolving consumer trends, and an increasing need for biochemical research.

Advanced biological buffers are vital for ensuring the stability and precision of these models, boosting the demand for high-quality buffers among research organizations. Moreover, the rising need for advanced research tools to investigate complex biological processes is driving the demand for biological buffers, which is expected to stimulate the growth of the research institution segment in the global biological buffers market.

Europe led the global biological buffers market in 2024. Advancements in biopharmaceuticals and molecular biology research are driving market growth. Academic institutions and biotech firms are key contributors to this expansion. Partnerships between universities and buffer suppliers foster product innovation and increase market reach.

The region has also made significant investments in the pharmaceutical sector, which resulted in the development of state-of-the-art biological buffer facilities and technologies that produce high-quality buffers. Additionally, the European Union supports scientific research and development at both regional and international levels through various organizations and agencies that provide funding for biological buffer research.

Asia Pacific is expected to show significant growth in the biological buffers market during the forecast period. The region's growth is propelled by growing investments in life sciences research and drug development. The surging demand for biopharmaceuticals and diagnostics is a significant driver. Collaborations with international pharmaceutical firms boost market presence and distribution networks. Furthermore, this expansion is attributed to rising investments in biotechnology, the growth of pharmaceutical manufacturing, and an increased emphasis on healthcare advancements. Key markets fueling this regional growth include China, India, and Japan.

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

February 2025

February 2025