Regenerative Medicine Market Size and Forecast 2025 to 2034

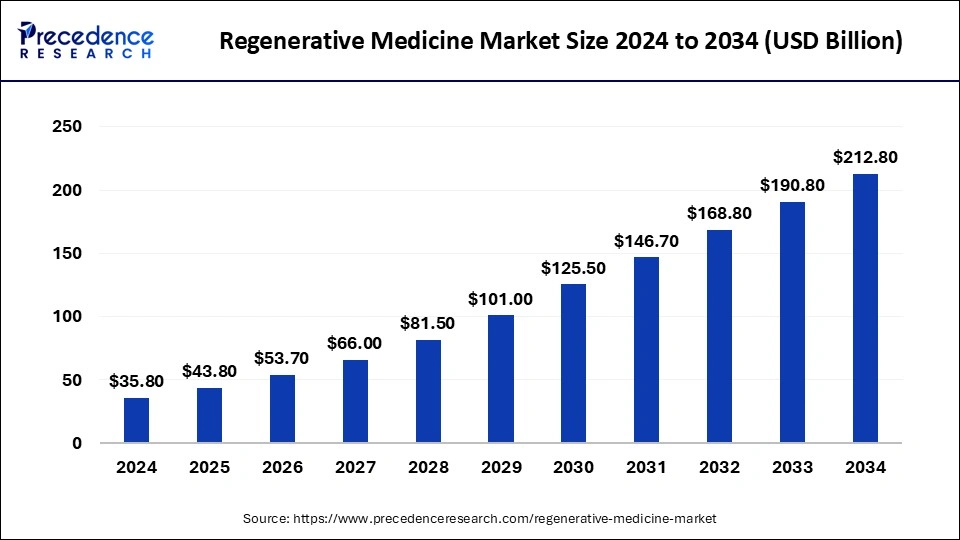

The global regenerative medicine market size accounted for USD 35.80 billion in 2024 and is predicted to increase from USD 43.80 billion in 2025 to approximately USD 212.80 billion by 2034, expanding at a CAGR of 19.20% from 2025 to 2034.

Regenerative Medicine Market Key Takeaways

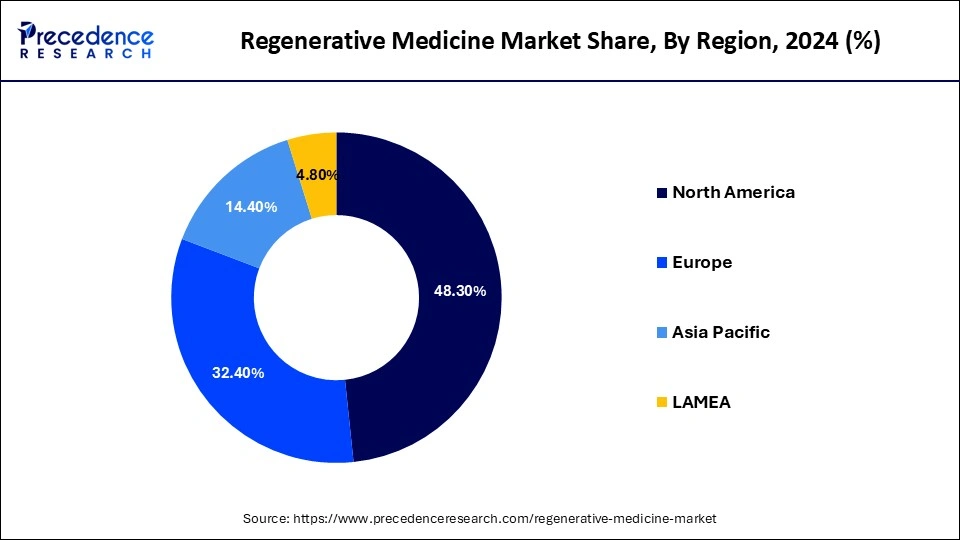

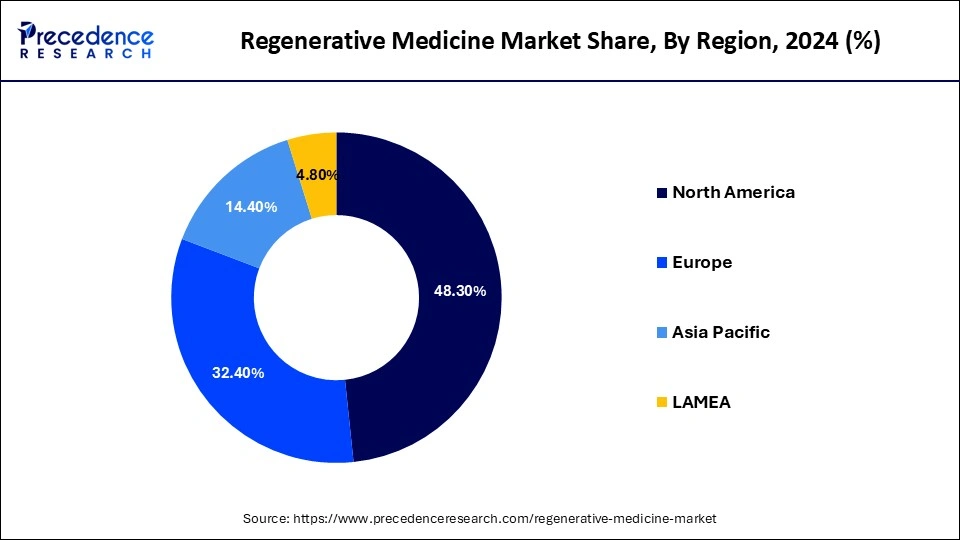

- North America region hit a share of over 48.57% in 2024.

- North America regenerative medicine market size was valued at USD 17.31 billion in 2024 and is growing at a CAGR of 21.40% from 2025 to 2034.

- Asia Pacific market was reached at USD 5.16 billion in 2024 and is growing at a registered CAGR of 25% from 2025 to 2034.

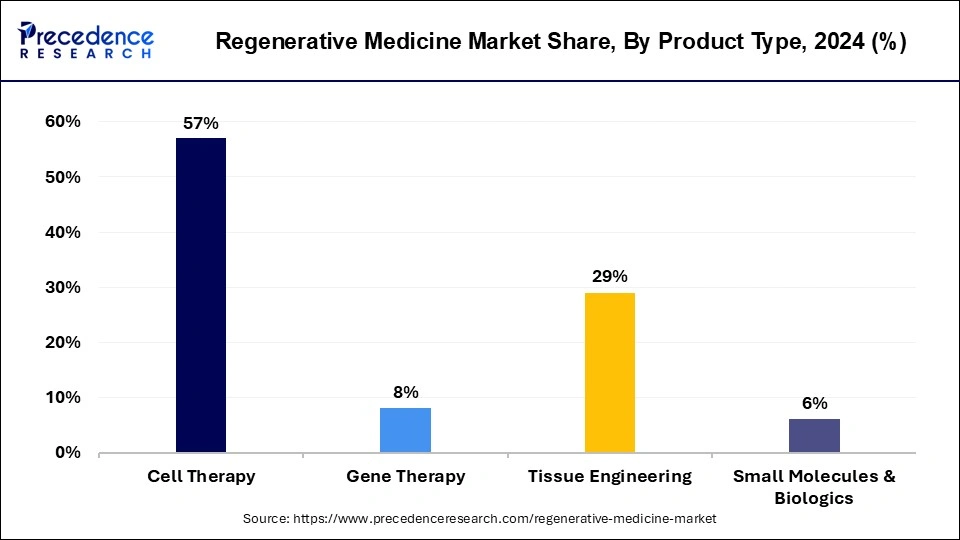

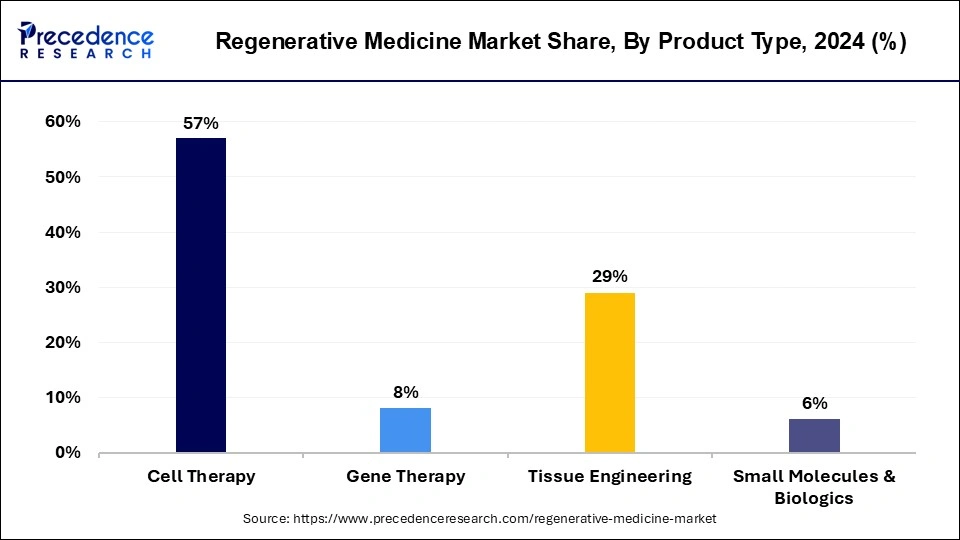

- By product, the cell therapy segment garnered the highest revenue share of around 56.88% in 2024.

- Tissue engineering product segment accounted for 28.84% of revenue share in 2024.

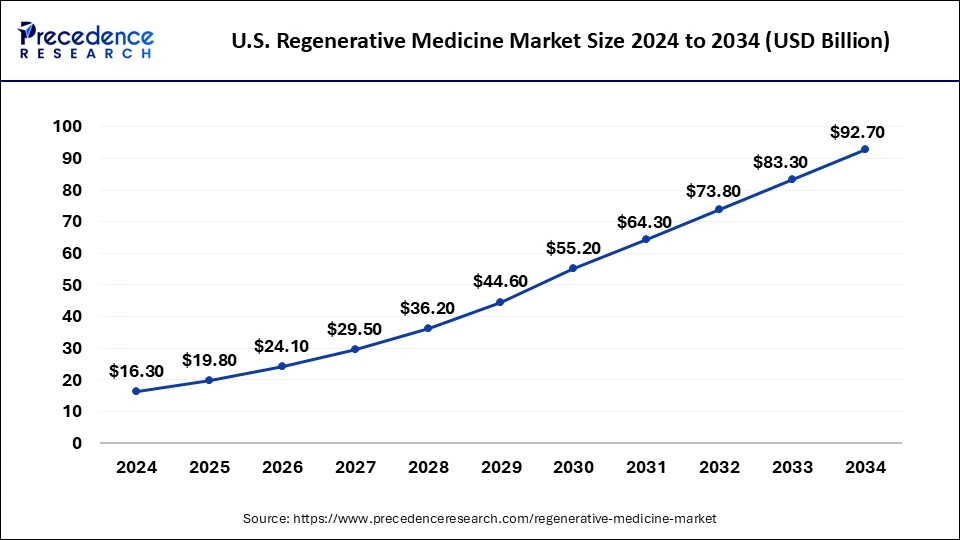

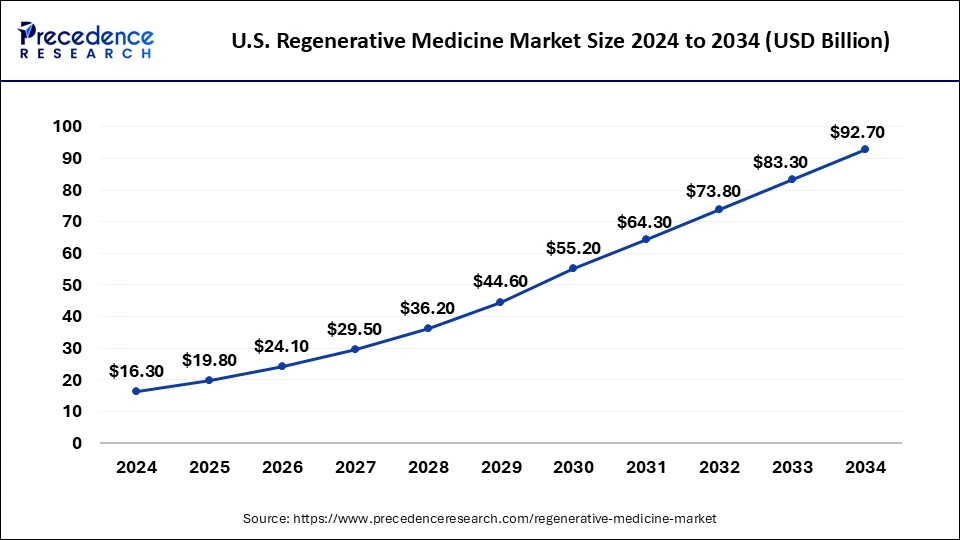

U.S. Regenerative Medicine Market Size and Growth 2025 to 2034

The U.S. regenerative medicine market size was valued at USD 16.30 billion in 2024 and it is expected to be worth around USD 92.70 billion by 2034 with a CAGR of 18.70% from 2025 to 2034.

Geographically, regenerative medicine market is conquered by North America owing to high incidence of chronic diseases and presence of sophisticated healthcare framework. On the other hand, Asia-Pacific is anticipated to witness the rapid growth rate, on account of increasing healthcare expenditure and growing investment by major manufactures to launch new products. The North American regenerative medicine market is in its growing phase and is expected to exhibit high potential in future, as most of the therapies are in the 3rd phase of clinical trials. This shows the intervention of companies for commercialization of regenerative medicine products. Favorable regulatory and reimbursement policies for tissue engineering exhibit interest of the government authorities in fulfilling the growth in need of regenerative products. However, stringent regulatory policies pertaining to stem cell technologies have posed major challenges for the adoption of embryonic stem cells, owing to ethical issues and controversies regarding its source; thereby, restricting the market growth.

These challenges are expected to be resolved in future, as companies and research institutes provide novel therapies, which are anticipated to replace embryonic stem cells for various applications. In addition, technology advancement for tissue and organ transplantation, emerging technologies, and focus on stem cells, expand the growth of the market. Among the countries in North America, the U.S. is the largest contributor to the market growth, Canada offers a productive location, and Mexico has a well-established R&D infrastructure.

The Asia-Pacific region includes China, Japan, India, Indonesia, Myanmar, Thailand, Australia, New Zealand, and other countries in the Pacific Rim. It influences the market substantially due to their varied culture and demography. High incidence rate of unintentional trauma injuries has triggered the growth of the regenerative medicine market. Global players have focused on provision of cost-effective therapies to patients and adoption of novel stem cells-based technologies useful in the development of products for the treatment of diseases. This is primarily due to the increase in incidence of injuries and growth in geriatric population. Lack of awareness about regenerative medicine and stringent growth regulations hamper the market growth.

Among Asia-Pacific countries, Japan has the largest influence on pharmaceutical and biotechnology markets, while China is the fastest growing economy. Moreover, Australia has higher healthcare costs as compared to other countries of the Asia-Pacific region due to increase in geriatric patients. Rest of the region provides substantial growth opportunities to the market players.

Europe is expected to grow significantly in the regenerative medicine market during the forecast period. The growing incidence of diseases is increasing the demand for regenerative medicine in Europe. At the same time, the increasing adoption of advanced technologies is enhancing the development process of regenerative medications. Thus, this in turn increases the market growth.

UK Regenerative Medicine Market Trends:

The industries in the UK are using advanced technologies for the development of regenerative medicine due to the growing demand. Moreover, new applications of regenerative medicine in various diseases are also rising. Thus, these development leads to new collaboration. This, in turn, is supported by the government investment.

Regenerative Medicine Market Revenue, By Region (Million) 2022-2024

| Region |

2022 |

2023 |

2024 |

| North America |

11,836.5 |

14,291.5 |

17,313.4 |

| Europe |

8,022.7 |

9,638.0 |

11,617.3 |

| Asia Pacific |

3,286.0 |

4,111.1 |

5,160.6 |

| LAMEA |

1,102.9 |

1,383.8 |

1,734.1 |

Key market Insights

Stem cell therapy is one of the most revolutionary applications of regenerative medicine in the real-world scenario. Stem cell therapy encourages the repair response of ailing, dysfunctional or wounded tissue by means of stem cells or their by products. It is the next big thing in organ transplantation and makes use of cells in the place of donor organs, that are limited in stock. Scientists cultivate stem cells in a laboratory. These stem cells are operated to specialize into particular cells, such as blood cells, heart muscle or nerve cells. The specific cells can then be implanted into an individual. Stem cells have the capability to build all tissue in the human body, therefore have great possibility for future healing uses in tissue repair and regeneration.

Regenerative Medicine Market Growth Factors

- Increasing prevalence of chronic ailments

- Growing incidence of genetic disorders

- Rapidly increasing trauma cases

- Growing investment in research and development for regenerative medicine

- Strong product pipeline of regenerative medicine products

- Increasing popularity of stem cell therapy

Market Scope

| Report Coverage |

Details |

| Market Size by 2034 |

USD 212.80 Billion |

| Market Size by 2025 |

USD 43.80 Billion |

| Market Size by 2024 |

USD 35.80 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 19.20% |

| Largest Market |

North America |

| Fastest Growing Market |

Asia Pacific |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Material, Application, End User, and Region |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

HIGH ADOPTION OF STEM CELL TECHNOLOGY

- Stem cell research is one of the most important scientific developments in this sector. It plays a crucial role in tissue regeneration and regenerative medicine studies. It has an impact not only on nerve regeneration, but also on the whole organ reengineering and product development for cardiovascular disease. The stem cell market is expected to increase by three times in the next five years. Moreover, the developments in stem cell research are expected to boost the growth of the regenerative medicine market and accelerate product development. Stem cells derived from sources, such as embryonic, adult, and cord blood, have promising potential to trigger the growth of the regenerative medicine market. Novel therapeutics derived from stem cells have fueled the commercialization of stem cells in tissue engineering and regenerative medicine market. Cord blood stem cell is one of the potential sources of stem cell that is used in regenerative medicine and organ regeneration.

EMERGING APPLICATION OF NANOTECHNOLOGY

- Nanotechnology has emerging applications in tissue engineering. Nanomaterials have created opportunities for tissue engineering technologies. These materials have dimension of less than 100nm such as nanograft and nanotubes. These materials have the potential to increase the efficiency of tissue engineering and regenerative medicine technologies. Nanomaterials, such as nanofibrous scaffolds and drug delivery system, have emerged as biocompatible and biodegradable regenerative medicines due to their usage in wound care and wound management. Nanofibers have made an invaluable addition to tissue engineering and regenerative medicine technology, and are expected to boost this market in future.

- One of the promising features of nanomaterials is to avoid immune responses from the body during transplants. These materials are used during tissue engineering and regenerative medicine operations without causing damage to the neighboring tissues. Therefore, nanotechnology holds immense potential in the regenerative medicine market.

INCREASING PREVALENCE OF CHRONIC DISEASES AND TRAUMA EMERGENCIES

- Increase in prevalence of trauma injuries has boosted the adoption of regenerative medicine and organ transplantation. Increase in incidence of accidents, burn injuries, and other trauma injuries has fueled the regenerative medicine market. According to Center for Disease Control and Prevention, there were approximately 223,135 Traumatic Brain Injury (TBI) related hospitalizations in 2019 and 64,362 TBI-related deaths in 2020. This represents more than 611 TBI-related hospitalizations and 176 TBI-related deaths per day across the U.S. This increase in rate of accident trauma cases has boosted the demand for regenerative medicines, globally. Several companies have expanded their foothold in the regenerative medicine market for trauma injuries. Currently, tissue-engineering and regenerative medicine market for trauma injuries is not dominant. It is sparingly used in organ transplantation. However, as the technologies for accidental care units are estimated to increase, the regenerative medicine market is expected to grow rapidly during the forecast period.

ADVANCEMENTS IN MEDICAL EQUIPMENT TECHNOLOGIES

- Advancements in medical equipment technologies have transformed the tissue engineering and regenerative medicines to translational medicines. Several companies have made innovative developments for providing instruments to the tissue engineering and regenerative medicine, organ regeneration, and organ transplantation markets. The commercialization of advanced surgical instruments has made the regenerative medicine procedures more accessible and simpler. For instance, product category by Bose Electroforce comprised 5210 BioDynamic System and 5270 BioDynamic System, which provide sterile environment during tissue engineering.

- Advancement in medical automation technologies has shifted the trend of regenerative medicines and tissue engineering from clinical to commercial market. Nowadays, medical devices and equipment manufacturers have mainly focused on the development and commercialization of novel regenerative medical solutions.

Restraints

ETHICAL HURDLES

- There are numerous operational inefficiencies in tissue engineering and regeneration market, which hamper the market growth. During tissue repair procedures, cell adhesions break that lead to proliferation. This proliferation then results into an incomplete colonization in the external layers of a scaffold. Absence of built-in vascularization is the major problem faced during tissue engineering. Implantation of tissues, which are more than 100-200μm require separate blood vessel supply for nutrients and oxygen, which is not feasible for tissue engineering transplantation.

- Apart from the above internal inefficiencies, some external factors restrict the growth of tissue engineering and regenerative medicine market. These factors include external environmental conditions and isolation techniques. Inefficient cell isolation and cell culture techniques lead to failure in tissue growth after implantations. The external environmental conditions reduce the growth momentum and differentiation of cells. Moreover, other external factors, such as hormones and specific metabolites, hamper the growth and differentiation of endothelial cells and others.

COSTLY TREATMENT ASSOCIATED WITH REGENERATIVE MEDICINE

- High cost involved in the tissue engineering and regenerative medicine hampers the market growth. The emerging tissue engineering industry faces challenges due to monopolistic environment due to scarce availability of tissue engineering and regenerative medicine. These services lead to rise in cost due to less competition in the suppliers. In the U.S., organ defects and failures cost more than $400 billion per year, which highlights the potential of the market. However, the tissue engineering and regenerative medicine market in developing economies has witnessed a downward trend due to high cost of treatment, which needs to be controlled.

Opportunities

LUCRATIVE OPPORTUNITIES OF NOVEL STEM CELL TECHNOLOGIES

- The emergence of stem cell technologies has created a new platform for tissue engineering and regenerative medicine market. However, there are some unexplored areas of stem cell technologies, such as umbilical cord blood stem cell, which offer lucrative opportunities to the tissue engineering and regeneration industry. Every organ regeneration and tissue engineering require highly proliferative and differentiated type of cells. Cord blood stem cells are highly undetermined cells derived from two sources, namely, allogenic and autologous stem cells.

- Cells are derived from body parts of the patient. The advantage of these cells is its positive tendency towards immune responses. These cells do not activate the immune response from the body after implantations. The second type of stem cells is known as adult stem cells (ASC). These cells are highly undetermined cells, which are modified into any type of cells. These stem cells are derived from bone marrow tissues and have better replacement properties than normal cells.

- The third types of cells are Embryonic Stem Cells (ESC), which have huge potential in the industry. However, these cells face ethical challenges due to their source of collection, i.e. baby/fetus. Hence, the commercial and research use of these stem cells is restricted. However, rise in awareness among tissue engineering and stem cell therapies is expected to resolve these ethical issues in future.

- Furthermore, the stem cells obtained from foreign sources, such as cell from other species, are known as xenogenic cell. These cells have huge potential in the regenerative medicine industry; however, these cells face ethical problems from the society. These ethical problems are expected to dissipate, as xenogenic cells have huge potential to be transformed and practically used in tissue engineering and regeneration.

INCREASE IN POTENTIAL IN EMERGING ECONOMIES

- Developing economies have potential for the regenerative medicine market due to increase in prevalence of traumatic injuries and organ transplantations, globally. The key players have strategically analyzed the potential of tissue engineering and regenerative medicine in the developing economies and have adopted various developmental strategies such as product launch, approval, agreement, partnership, and merger. Although the market faces ethical challenges due to unfavorable norms, the developing economies are expected to adopt tissue-engineering and regeneration technology.

GROWTH IN NEED OF REGENERATIVE MEDICINE IN ORGAN TRANSPLANTATION

- As per the U.S. department of Health Resources & Services Administration (HRSA), as of March 2022, there are over 106,005 patients in need of organ transplants, of which an estimated 17 people die every day in its absence. Kidney transplants are the most availed procedures, with 80% of the waiting list consisting of patients requiring kidneys. However, there is a growth in need for organ transplantations despite the proactive measures taken by the government to increase the number of donors.

- Tissue engineering and regenerative medicine has huge potential to cater to the growth in need of organ transplants, globally. However, major challenges, such as vascularization and tissue signaling, to mimic the original organ functions are still in the development phase. There is a greater possibility of successfully producing complex tissues and whole organs to address this need of organ transplants. For instance, prototypes for human liver have been produced using tissue engineering regeneration and bioprinting technologies. There is a huge scope for commercialization of regenerative medicine products due to the large number of products in the pipeline, which are under various phases of clinical trials, and are expected to be commercialized in future.

Product Insights

Cell Therapy Segment Reported Foremost Market Share in 2024. The cell therapy segment led the regenerative medicine market with a share of 56.88% in 2024. The cell therapy segment has emerged as a dominant force in the regenerative medicine market. Its leadership is driven by its transformative potential in treating a wide range of diseases and medical conditions, from cancer to neurological disorders. By utilizing living cells to repair, replace, or regenerate damaged tissues and organs, cell therapy offers groundbreaking solutions that traditional treatments often cannot match. With numerous clinical trials underway and ongoing research, the cell therapy segment is expected to remain a key driver of innovation and revenue in the regenerative medicine landscape.

Tissue-Engineering segment is projected grow at the highest CAGR during the forecast period due to multiple advantages such as ability to replace a defective structure with an entirely living structure and potential in developing treatments for previously untreatable medical conditions. Moreover, high investment in research and development for developing effective treatments, and constant launch of new and effective products are expected to boost the demand in tissue engineering segment.

- The cell therapy segment was accounted at USD 20.37 billion in 2024 and to reach at a CAGR of 21.40% from 2025 to 2034.

- The gene therapy segment size was estimated at USD 2.95 billion in 2024 and growing at a CAGR of 22.10% over the forecast period 2025 to 2034.

Regenerative Medicine Market Revenue, By Product (Million), 2022 to 2024

| Product |

2022 |

2023 |

2024 |

| Cell Therapy |

13,932.5 |

11,577.1 |

20,379.3 |

| Gene Therapy |

1,990.5 |

1,642.5 |

2,952.7 |

| Tissue Engineering |

6,910.7 |

5,679.6 |

10,333.1 |

| Small Molecules & Biologics |

1,414.4 |

1,148.9 |

2,160.4 |

Application Insights

Musculoskeletal Applications are Projected to Dominate the Regenerative Medicine Market Revenue

Regenerative medicine, specifically cellular therapy, is a rapidly emerging field that is being explored as a possibility for the repair of function in numerous disease areas including musculoskeletal ailments. High research and development activity in use of regenerative medicine for the treatment of musculoskeletal disorders is the major reason for the high revenue share of regenerative medicines.

Oncology segment will hold a significant share in the global regenerative medicine market mainly due to the high incidence of cancer globally and increasing demand for development of new technologies for the treatment of cancer.

- The musculoskeletal segment was worth around USD 11.80 billion in 2024 and will reach around USD 40.63 billion by 2030.

- The wound healing segment size was estimated at USD 10.32 billion in 2024 and it is expanding around USD 36.84 billion by 2030.

- The oncology segment was worth around USD 4.32 billion in 2024 and is expanding over USD 15.23 billion by 2030.

- The dermatology segment was valued at USD 2.26 billion in 2024 and it is expected to reach around USD 7.66 billion by 2030.

Regenerative Medicine Market Revenue, By Application (Million), 2022 to 2024

| Application |

2022 |

2023 |

2024 |

| Cardiovascular |

1,118.4 |

1,373.4 |

1,692.2 |

| Oncology |

2,918.5 |

3,545.1 |

4,320.6 |

| Dermatology |

1,553.9 |

1,874.3 |

2,268.3 |

| Musculoskeletal |

8,040.1 |

9,727.3 |

11,807.8 |

| Wound healing |

6,948.6 |

8,457.3 |

10,328.0 |

| Ophthalmology |

1,288.2 |

1,547.5 |

1,865.3 |

| Neurology |

751.0 |

916.8 |

1,122.9 |

| Others |

1,629.5 |

1,982.9 |

2,420.4 |

Regenerative Medicine Market Companies

Recent Developments

- In May 2025, a collaboration between the University of Bridgeport (UB) and TulsiHub Institute will be holding an innovative certificate program in the rapidly evolving field of Regenerative Medicine, which was announced by UB. In this program, which is the first of its kind in the nation and CE-approved, the graduates, eligible to receive seed funding, healthcare professionals, and students with industry-leading skills in regenerative therapies, will be guided for 12 weeks to open their own clinics upon completion of this program. (Source: https://finance.yahoo.com)

- In June 2025, Shookra Clinics, which is a state-of-the-art regenerative aesthetics and longevity center consisting of advanced cellular therapies, biotechnology, and precision diagnostics, was launched by Dubai’s wellness sector. Furthermore, by being first-of-its-kind in the region, to bridge the gap between preventative medicine, healthtech, and aesthetics, Shookra Clinics will introduce a 4-phase medical protocol which utilizes personalised longevity programmes, AI-powered diagnostics, and stem cell-based treatments. (Source: https://www.msn.com)

Segments Covered in the Report

By Product

- Gene Therapies

- Cell Therapies

- Tissue-Engineering

- Small Molecules & Biologics

By Material

- Synthetic material

- Biodegradable synthetic polymers

- Scaffold

- Artificial Vascular Graft

- Materials Hydrogel Material

- Biologically derived material

- Collagen

- Xenogeneic material

- Genetically Engineered Material

- Deoxyribonucleic Acid Transfection Vectors

- Genetically Manipulated Cell

- Three-Dimensional Polymer Technology

- Transgenics

- Fibroblast

- Neural Stem Cell

- Gene-Activated Matrices

- Pharmaceutical

- Biologics

- Small Molecules

By Application

- Wound Care

- Musculoskeletal

- Ophthalmology

- Oncology

- Cardiovascular

- Dermatology

- Neurology

- Others

By End User

- Hospitals & Clinics

- Commercial Industries

- Government & Academic Research Institutes

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa