February 2025

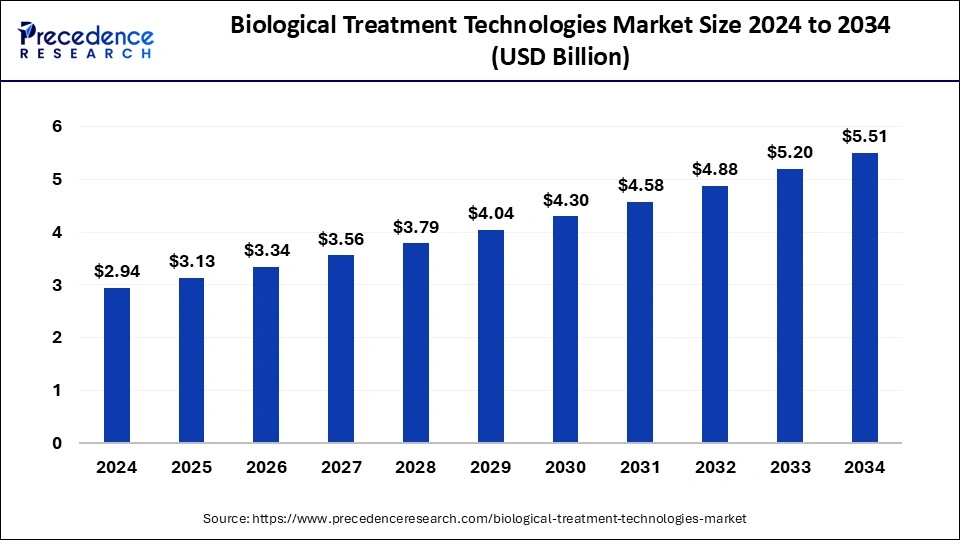

The global biological treatment technologies market size is accounted at USD 3.13 billion in 2025 and is forecasted to hit around USD 5.51 billion by 2034, representing a CAGR of 6.48% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biological treatment technologies market size was estimated at USD 2.94 billion in 2024 and is predicted to increase from USD 3.13 billion in 2025 to approximately USD 5.51 billion by 2034, expanding at a CAGR of 6.48% from 2025 to 2034. There are many benefits of biological treatment technologies in environmental conservation and wastewater management. The advantages of biological treatment technologies include waste and energy reduction, sludge reduction, cost reductions, and improved operational efficiency. These factors help to the growth of the market.

Biological treatment is the most effective technology for removing biodegradable dyes and textile auxiliaries. The biological treatment technologies market includes commercial, residential, and industrial applications. Biological treatment technology is an attractive technology that helps to complete the conversion of organic compounds into less harmful end products like CO2 and H2O. This technology is environmentally friendly and has a low cost compared to chemical or physical methods of removing contaminants. Biological treatment technologies offer many benefits in environmental conservation and wastewater treatment. Advantages of biological treatment technologies include waste and energy reduction, environmental conservation, sludge reduction, cost reductions, and improved operational efficiency. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.51 Billion |

| Market Size in 2025 | USD 3.13 Billion |

| Market Size in 2024 | USD 2.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.48% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing industrial waste generation

Biotechnological treatment technologies play an important role in industrial wastewater management. Industrial waste contains many organic and inorganic pollutants. The occurrence of harmful compounds spreads inhibitory or toxic effects on microorganisms, which may lead to the failure of the biological units. In industrial waste management, advanced biotechnology reactors like granular sludge technologies and membrane bioreactors are primarily used.

In industrial waste management, biological treatment technologies are used, including activated sludge process, anaerobic-aerobic treatment, membrane bioreactors, biofilm reactors, advanced oxidation processes, bioremediation, electrochemical methods, fermentation, anaerobic digestion, black soldier fly treatment, vermicomposting, and composting. These treatment technologies are low-cost and environmentally friendly as compared to chemical or physical methods for removing contaminants. These factors help to the growth of the biological treatment technologies market.

Increasing concern about municipal solid waste treatment

Increasing concern about municipal solid waste treatment helps to the growth of the market. The increase in government initiatives and private & decentralized companies' initiatives for waste management contribute to the growth of the biological treatment technologies market. Increased solid waste treatment concerns driving the growth of the market.

In agriculture industries, biological treatment technologies for savage sludge treatment, food waste, green garden waste, and source-segregated waste are used. With increased environmental concerns and growing activities of solid waste management, biological treatment providers prefer to use natural processes for the decomposition of organic contaminants. Customers' high demand for eco-friendly services and technologies. These factors help to the growth of the market.

High operating costs and other drawbacks

In wastewater treatment, biological treatment technology is used, which is a slow treatment process and requires a large area to store and treat water, which leads to high operating costs. Biological treatment technologies for wastewater treatment produce unwanted microorganisms that produce bad odors and gases. The aerobic digestion type of biological wastewater treatment technology requires aeration, which uses a large amount of electrical energy.

This electrical energy is produced by burning fossil fuels, which produce greenhouse gases. Aerobic digestion produces large amounts of sludge or biosolids, and it requires disposal. This type of wastewater cannot be released into the water bodies; it may cause a change in the water’s physicochemical properties, which leads to decreases in the aquatic animal population. These factors restrict the growth of the biological treatment technologies market.

Rising investment in R&D and advanced technologies

Increasing investment in research and development of biological treatment technologies to reduce operational costs and time required for the process offers an opportunity for the growth of the market. Advancements in synthetic biology and biotechnology lead to the development of highly specialized and efficient microorganisms for many different biological treatment technologies. To remove contaminants as compared to chemical and physical methods, biological treatment technology is environmentally friendly and has a low cost. These factors help to the growth of the biological treatment technologies market.

The anaerobic digestion segment dominated the market in 2023 and is expected to be the fastest-growing segment during the forecast period. Anaerobic digestion is more environmentally friendly than aerobic digestion. Anaerobic digestion produces less biomass and biogas, which can be recycled and requires less energy than aerobic digestion. The advantages of anaerobic digestion include that it collects methane and produces a renewable source of energy. Biogas may be used for heating or as electricity and may be improved for renewable natural gas. By using anaerobic digestion of biomass, solid digestate is produced and can be used for composting, animal bedding, etc. Liquid digestate is used as fertilizer for land application.

It helps to eliminate or reduce weed seeds, malodorous compounds, and pathogens. It produces compost and fertilizers, which are rich in nitrogen and helpful for soil health. It also helps to lower the odor by up to 80% from farm slurries. It helps to reduce organic waste, which is associated with methane emissions. It helps to increase rural employment and self-sufficiency and reduces dependence on energy imports.

The main two benefits of anaerobic digestion include the fact that it can provide direct financial returns and also may have a positive effect on the environment. The effect of anaerobic digestion-based fertilizer is more than that of untreated organic waste. The benefits of anaerobic digestion include manure management to increase biogas production, methane emissions reduction, soil health benefits to increase plant growth and organic matter content and to reduce nutrient runoff and soil erosion, renewable energy generation, help to increase soil’s water retention ability, and diversion of organics from landfills which is helpful for the environment. These factors help the growth of the anaerobic digestion segment and contribute to the growth of the biological treatment technologies market.

The industrial segment dominated the biological treatment technologies market in 2023. There are many industrial processes, including food production, petrochemicals, mining, and manufacturing, that generate a considerable amount of chemical and organic waste. There is a need for proper treatment of this waste to comply with sustainability goals and environmental regulations. Advanced technologies like bioreactors are used to address environmental contaminants in the treatment of industrial wastewater. Bioreactors offer ecologically useful and long-term solutions that help to a sustainable and greener future.

Industries like the municipal sector, oil and gas, chemical manufacturing, food, and beverages sectors benefit from these economical and efficient technologies to remove organic components. The applications of biological treatment technologies are used in many areas, including food/agriculture, textile production, laundries, pulp and paper, energy, semiconductors, pharmaceuticals, and chemical companies. The advantages of biological treatment technologies include high stability, high performance, simple operation, and no recirculation of biomass. These factors help the growth of the industrial segment and contribute to the growth of the market.

The residential segment is estimated to be the fastest-growing during the forecast period. For sustainable waste management, biological treatment technologies play an important role in many sectors, including the residential sector. In wastewater treatment, organic waste management, energy, and resource recovery, strict environmental regulations on municipalities and industries for waste management and wastewater treatment, and advancement in biotechnologies. These factors help to the growth of the residential segment and contribute to the growth of the biological treatment technologies market.

North America dominated the biological treatment technologies market in 2023. In North America, many towns and cities have a highly developed wastewater treatment industry and advanced treatment facilities. North America’s strong environmental regulations motivated the adoption of advanced biological treatment technologies. According to the United States Environmental Protection Agency, the biological treatment of drinking water uses indigenous bacteria to remove contaminants, and the process involves a basin or vessel known as a bioreactor that contains the bacteria in the bed.

Europe is estimated to grow at a notable rate during the forecast period of 2024-2033. Germany is the leading country in terms of market growth, and the UK is the fastest-growing market in the European region. These factors help to grow the biological treatment technologies market in the European region.

By Treatment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

February 2025

February 2025