What is the Biopharmaceuticals Market Size?

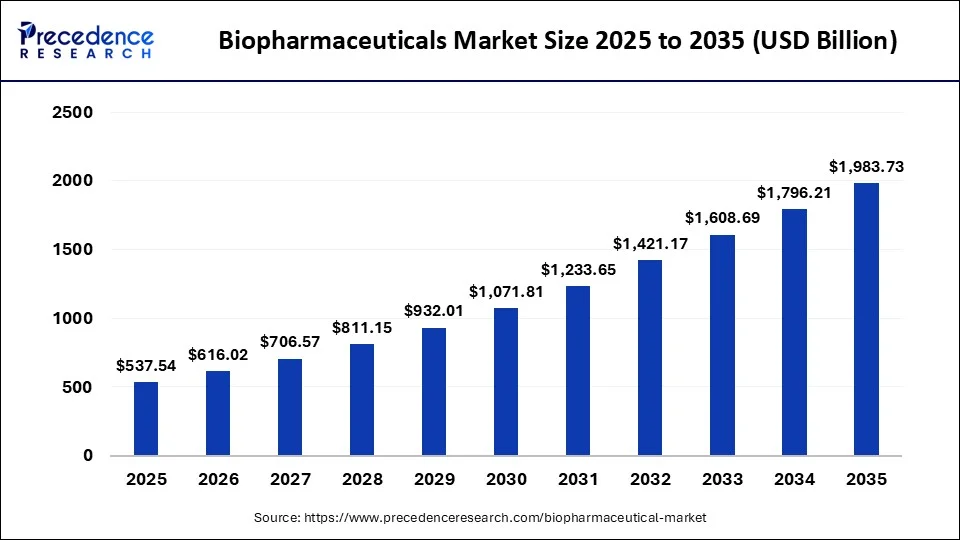

The global biopharmaceuticals market size is calculated at USD 537.54 billion in 2025 and is predicted to increase from USD 616.02 billion in 2026 to approximately USD 1,983.73 billion by 2035, expanding at a CAGR of 13.95% from 2026 to 2035.

Biopharmaceuticals Market Key Takeaways

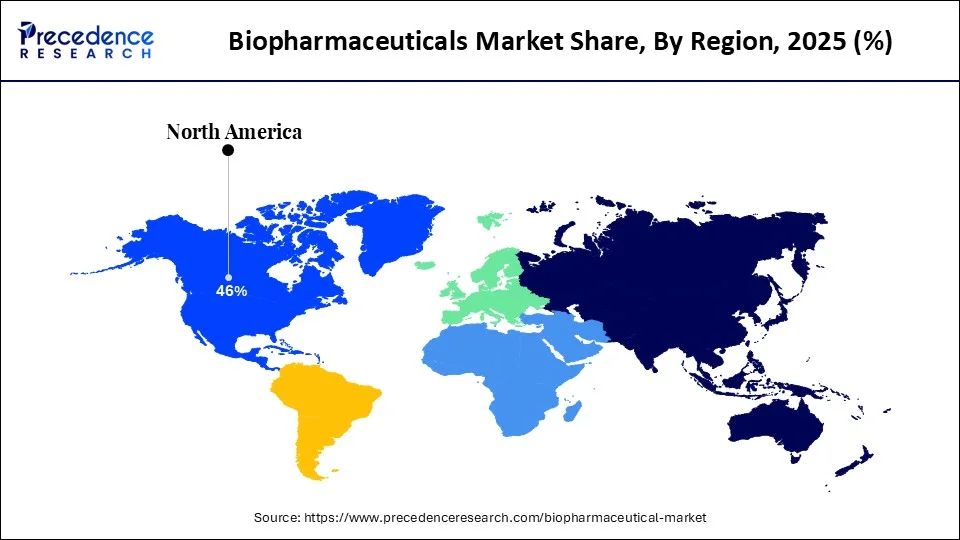

- North America dominated the global biopharmaceutical market with the highest market share of 46% in 2025.

- By type, the monoclonal antibodies segment accounted for the largest market share of 38% in 2025.

- By application, the oncology segment dominated the global market in 2025.

Market Overview

Biopharmaceuticals are complex medicines produced by living cells or organisms, often produced using advanced biotechnological methods. Biopharmaceuticals are also broadly known as biologics or biologicals. They are created using biological processes instead of being chemically synthesized like other pharmaceutical products. The rapid advances in biopharmaceuticals have paved the innovative way for transforming care for billions of people by treating several chronic diseases.

Integration of Artificial Intelligence for Biopharmaceuticals

The integration of artificial intelligence (AI) into the biopharmaceuticals market has guided an era of transformation in healthcare. Artificial intelligence (AI) tools are most widely used in the biopharmaceutical industry. AI is streamlining various processes in the biopharma industry contributing both money and time savings. The major applications of AI in the biopharmaceuticals industry such as research in drug R&D, drug discovery, massive data analysis, automating workflows, clinical trials, developing advanced Therapies, manufacturing operations, personalized medicines, supply chain, commercialization, and others. The future possibilities of AI integration into biopharma processes are endless, setting up various facets of the industry to be changed for the better. By embracing AI within the biopharmaceutical landscape, paving the way for groundbreaking advancements that could improve patient lives significantly.

Biopharmaceuticals Market Growth Factors

- The growing population along with age-related diseases are expected to spur the demand for biopharmaceuticals, accelerating the market's revenue in the coming years.

- The strong presence of Contract Manufacturing Organizations (CM0s) and contract research organizations (CROs) around the world is expected to contribute significantly to the rapid growth of the global biopharmaceutical market during the forecast period.

- The supportive government framework and rising healthcare expenditure are anticipated to propel the expansion of the biopharmaceutical market during the forecast period.

- The rising new product launches and increasing approvals of biologics and biosimilars from regulatory bodies such as EMA and FDA to treat chronic diseases are anticipated to create substantial opportunities for the market's expansion in the coming years.

- The growing demand for targeted therapies is expected to promote the growth of the biopharmaceuticals market. Biopharmaceuticals can be tailored to treat specific diseases.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 537.54 Billion |

| Market Size in 2026 | USD 616.02 Billion |

| Market Size by 2035 | USD 1,983.73 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.95% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for biopharmaceuticals

The rising demand for biopharmaceuticals globally is expected to boost the expansion of the biopharmaceuticals market during the forecast period. Biopharmaceuticals, such as biologics, include a wide range of medicinal products such as vaccines, gene therapy, tissue, recombinant therapeutic proteins, blood and blood components, tissues, monoclonal antibodies, and others. Biopharmaceuticals are transforming healthcare and changing the lives of billions of people by treating people with life-threatening and chronic diseases including diabetes, cancer, cardiovascular, multiple sclerosis, HIV/AIDS, genetic disorders, and others. Biopharmaceuticals advance more treatment options for patients and hold the great potential to deliver precise and personalized treatment. Therefore, the growing demand for biopharmaceuticals as a result of the increasing chronic diseases, bolstering the market's growth in the coming years.

- According to the World Health Organization (WHO)'s cancer agency, the International Agency for Research on Cancer (IARC) in February 2024, there were around 20 million new cases of cancer and approximately 9.7 million deaths in 2022. It is reported that about one in five people will develop cancer during970,000 their lifetime.

Restraint

High costs

The high cost associated with the production of biopharmaceuticals is anticipated to projected to hamper the market's growth. Small and medium-sized companies may find it difficult to bear these high expenses which can prevent them from bringing new products to the market. In addition, stringent regulatory requirements may limit the growth of the biopharmaceuticals market during the forecast period.

Stringent Regulatory Requirements

The biopharmaceutical industry has faced numerous challenges because of its stringent regulations. These standards are set concerning safety, efficacy, and quality, making the approval process more complex. But in the process, they also delay the product launches and extend the timelines of development. The growing entry of biosimilars only aggravates the regulations and presents uncertainties for manufacturers. Regulatory uncertainty could lead to increased costs, chances of resources being misallocated, and complications in strategic planning. On top of that, differences in regulations from one country to another add more complexity and require heavy expertise and investment. So, these challenges hamper innovation and further delay the arrival of new biopharmaceutical treatments. So, in conclusion, stringent regulatory requirements are the biggest challenges or restraints that affect product development, product commercialization, and the competitive landscape.

Opportunity

Increasing R&D activities to develop innovative and effective therapies

The rising R&D activities to develop innovative and effective therapies are projected to create lucrative growth opportunities for the growth of the biopharmaceutical market during the forecast period. The market has witnessed a rise in research and development activities by prominent biopharmaceutical market players to develop innovative and effective drugs. Additionally, the active role of regulatory authorities like EMA and FDA in monitoring and providing approvals for the various new drugs to treat a range of diseases in the biopharmaceutical industry is driving the market's growth.

- For instance, The US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) continued 2024 with 26 new or expanded indications for previously approved agents and 9 new oncology agents in the second quarter of the year. The approvals were for approximately 19 solid tumor types and 5 hematologic malignancies.

More than half of the approvals were for biologics or biosimilars; there were 17 biologics approved and 3 biosimilars. Three treatments were approved by both the FDA and the EMA for new indications: alectinib (Alecensa; Roche), an anaplastic lymphoma kinase inhibitor; durvalumab (Imfinzi; AstraZeneca), a programmed death-ligand 1 (PD-L1) blocker; and epcoritamab (Epkinly [US]/Tepkinly [EU]; Genmab/AbbVie), a bispecific antibody.

Segment Insights

Type Insights

The monoclonal antibodies segment accounted for the largest market share of 38% in 2025. The higher success rate of the monoclonal antibodies in therapeutics is a major driver. The monoclonal antibodies are effective in the treatment of various chronic diseases such as cancer, cardiovascular diseases, multiple sclerosis, and rheumatoid arthritis. Moreover, the monoclonal antibodies are less toxic or have low side-effects as it only affects the targeted cells without harming the normal cells. Increasing awareness regarding the benefits of monoclonal antibodies among the patients has boosted its adoption for the treatment of various diseases across the globe.

On the other hand, the vaccines is estimated to be the most opportunistic segment during the forecast period. This is attributed to the rising burden of diseases and rising investments by the developers in the development of vaccines.

Application Insights

The oncology segment dominated the global biopharmaceutical market in 2025, in terms of revenue. This simply attributable to the increased adoption of the biopharmaceuticals in the treatment of various cancers such as lungs cancer, breast cancer, colorectal cancer, and prostate cancer. The global cancer cases is rising at an alarming pace. The global cancer burden is expected to reach at 28.4 million by 2040, rising by 47% from 2020, according to the International Agency for Research on Cancer.

On the other hand, the cardiovascular disease is estimated to be the most opportunistic segment during the forecast period. According to the World Health Organization, around 17.9 million death occur due to the cardiovascular diseases each year, contributing to around 32% of the global deaths each year. Therefore, the increased prevalence of CVDs across the globe, and rising investments by the biopharmaceutical manufacturers to develop innovative drugs for the CVDs is expected to fuel the market growth during the forecast period.

Regional Insights

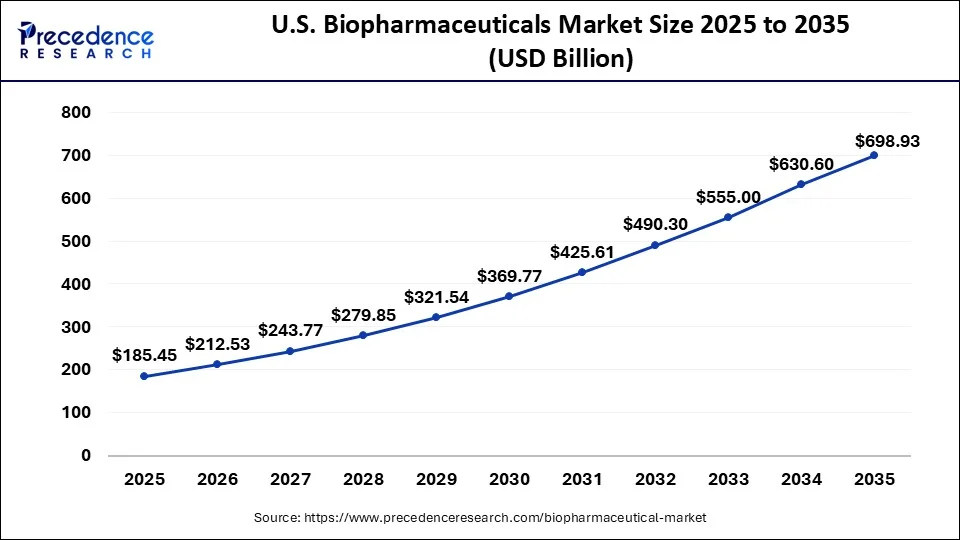

What is the U.S. Biopharmaceuticals Market Size?

The U.S. biopharmaceuticals market size was evaluated at USD 185.45 billion in 2025 and is predicted to be worth around USD 698.93 billion by 2035, rising at a CAGR of 14.19% from 2026 to 2035.

North America dominated the global biopharmaceutical market with revenue of 46% in 2025. The increased investments by the market players and supportive government policies in the huge market like US is supplementing the market growth. In fact, US holds the intellectual property rights of the majority of the newly produced medicines. Further, increased healthcare expenditure, increased awareness regarding the availability of biopharmaceuticals, and increased prevalence of various chronic diseases had resulted in the dominance of North America in the global biopharmaceutical market. According to the American Cancer Society, in 2020, around 1.8 million new cancer cases and 606,520 cancer deaths were reported in the US. Moreover, it is estimated that around 60% of the American population are suffering from at least one chronic diseases. Hence, the demand for the biopharmaceuticals is high in North America.

North America Biopharmaceuticals Market Trends

In October 2025, Accord BioPharma, Inc., the U.S. specialty division of Intas Pharmaceuticals, Ltd., focused on the development of oncology, immunology, and critical care therapies, announced that the U.S. Food and Drug Administration (FDA) has approved IMULDOSA (ustekinumab-srlf), a biosimilar to STELARA (ustekinumab), for the treatment of chronic inflammatory conditions, including psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis. The FDA approved IMULDOSA for all indications of its reference medicine, STELARA. Accord anticipates a commercial launch of IMULDOSA in the first half of 2025.

According to the Centers for Disease Control and Prevention, Heart disease is one of the leading causes of death in the United States, with 1 person dying every 33 seconds from cardiovascular disease. Nearly 695,000 people in the United States died from heart disease in 2021, that's 1 in every 5 deaths. It is estimated that 805,000 people suffer from heart attacks in the United States every year

- According to the Commonwealth Fund report published in January 2023, the United States spends roughly 18 percent of GDP on health care. The U.S. spends 3 to 4 times more on health care than South Korea, New Zealand, and Japan.

What Makes Asia Pacific the Most Opportunistic Region in the Biopharmaceuticals Market?

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific is home to around 60% of the global population. The rising prevalence of various chronic disease in the region, rising healthcare expenditure, and growing government investments in the development of sophisticated healthcare infrastructure in the region is expected to boost the growth of the biopharmaceutical market. Moreover, the region is characterized by the presence of few of the top CMOs, which significantly contributes towards the growth of the market.

India Biopharmaceuticals Market Trends

The market in India is growing due to the rising prevalence of chronic diseases, increasing healthcare expenditure, and expanding access to advanced therapies. Government initiatives to support biotech innovation, local manufacturing, and clinical research are fostering industry growth. Additionally, the presence of skilled workforce, cost-competitive manufacturing, and growing domestic and export demand for biosimilars and innovative biologics are further driving market expansion.

What Potentiates the Market in Europe?

The biopharmaceuticals market in Europe is potentiated by stringent regulatory frameworks, high healthcare expenditure, and strong R&D capabilities. Growing demand for innovative therapies, biologics, and personalized medicines, along with supportive government initiatives and robust clinical trial infrastructure, is driving market growth. Additionally, well-established manufacturing facilities and skilled talent pools enable the region to maintain a competitive edge in biopharmaceutical production and innovation.

Germany Market Trends

Germany is a major contributor to the European biopharmaceuticals market due to its well-established pharmaceutical infrastructure, strong R&D ecosystem, and supportive regulatory environment. The country hosts numerous global biopharma companies and biotech startups, driving innovation in biologics, biosimilars, and personalized medicines. Additionally, high healthcare spending, access to advanced technologies, and government incentives for life sciences reinforce Germany's leading position in the European biopharmaceuticals market.

Value Chain Analysis

- R&D: This is the initial stage, focusing on the discovery of novel biologics, biosimilars, and gene/cell therapies.

Key Players: Roche, Novartis, Pfizer, Biogen, and Amgen. - Clinical Trials & Testing: After discovery, candidates undergo phase I–III clinical trials to validate safety, efficacy, and dosage.

Key Players: IQVIA, PPD, Parexel, and ICON plc. - Manufacturing & Production: Biopharmaceuticals require highly controlled biologic manufacturing involving cell culture, fermentation, purification, and formulation.

Key Players: Lonza, Samsung Biologics, WuXi Biologics, Boehringer Ingelheim, and Catalent. - Distribution & Logistics: Due to the sensitive nature of biologics, cold chain logistics, temperature-controlled storage, and secure distribution are essential. Efficient supply chains ensure products reach hospitals, clinics, and pharmacies safely.

Key Players: UPS Healthcare, DHL Life Sciences & Healthcare, FedEx Custom Critical, and Marken.

Biopharmaceuticals Market Companies

- Abbott Laboratories

- Amgen, Inc.

- Biogen, Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche, Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Novo Nordisk A/S

- Pfizer, Inc.

- Sanofi

Recent Developments

- In August 2025, Oxford Nanopore Technologies and VirtuSure launched the first Good Laboratory Practice (GLP) validated adventitious viral agent (AVA) detection test using nanopore-based sequencing technology. (Source: https://www.businesswire.com)

- In July 2025, Inmagene Biopharmaceuticals completed its merger with Ikena Oncology, forming ImageneBio, Inc., a clinical-stage biotechnology company focused on developing disease-modifying treatments for immunological/autoimmune and inflammatory diseases. (Source: https://www.globenewswire.com)

- In August 2024, Biopharma Technology LLC. the dedicated United States division of Biopharma Group, announced the strategic partnership with Arete Biosciences to offer enhanced CDMO services in the USA. This collaboration establishes a dedicated R&D analysis and small batch manufacturing laboratory in the USA, specifically catering to the needs of American customers.

- In October 2024, Lonza, a global manufacturing partner to the pharmaceutical, biotech, and nutraceutical markets, announced a long-term extension of its collaboration with a major global biopharmaceutical partner for commercial-scale manufacture of ADCs. The extended agreement will expand the dedicated bioconjugation footprint for the customer through the construction of a new bioconjugation suite at Lonza's Ibex Biopark in Visp (CH). In addition, Lonza will provide commercial-scale monoclonal antibody (mAb) manufacturing services for a new ADC therapy.

- In September 2024, GENFIT, a late-stage biopharmaceutical company dedicated to improving the lives of patients with rare and life-threatening liver diseases, announced that the European Commission has conditionally approved Iqirvo1 (elafibranor) 80mg tablets for the treatment of Primary Biliary Cholangitis (PBC) in combination with ursodeoxycholic acid (UDCA) in adults with an inadequate response to UDCA or as a monotherapy in patients unable to tolerate UDCA.

Segments Covered in the Report

By Type

- Monoclonal Antibodies

- Insulin

- Vaccine

- Hormone

- Interferon

- Erythropoietin

- Growth & Coagulation Factor

- Others

By Application

- Blood Disorder

- Oncology

- Infectious Disease

- Neurological Disease

- Cardiovascular Disease

- Metabolic Disease

- Immunology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting