What is the Clinical Trials Market Size?

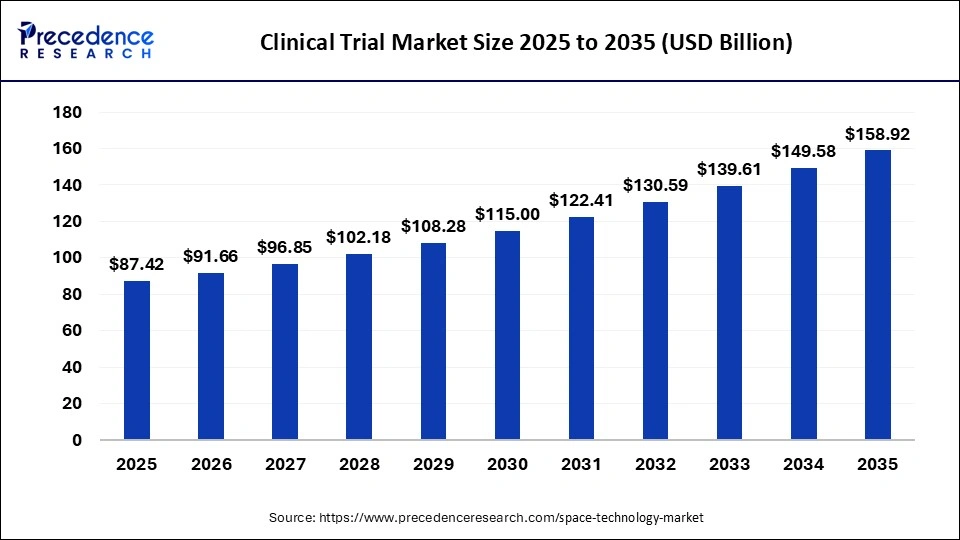

The global clinical trials market size is estimated at USD 87.42 billion in 2025 and is predicted to increase from USD 91.66 billion in 2026 to approximately USD 158.92 billion by 2034, expanding at a CAGR of 615% from 2026 to 2035.

Market Highlights

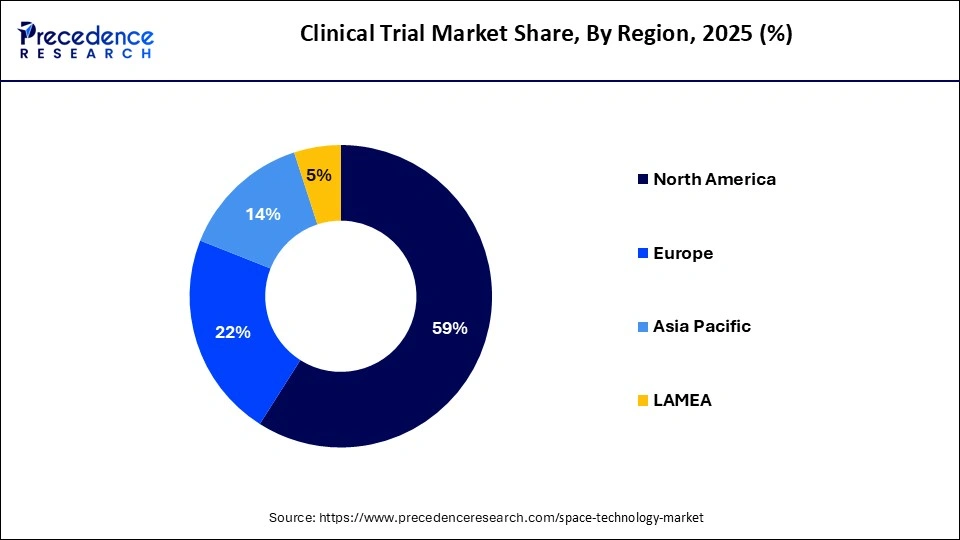

- North America held 59% of the total market share in 2025.

- Asia Pacific region is growing at a CAGR of 7.16% during the forecast period.

- By study design, the interventional study segment has captured 70.50% market share in 2025.

- By study design, the expanded access segment is expected to grow at a solid CAGR of 8.20% during the forecast period.

- By indication, the oncology segment captured the biggest market share of 31.70% in 2025.

- By indication, the CNS conditions segment is projected to grow at a solid CAGR of 7.60% during the forecast period.

- By service type, the laboratory services segment generated the major market share of 24.60% in 2025.

- By service type, the decentralized clinical trial services segment is expected to expand at a solid CAGR of 9.40% during the forecast period.

Market Overview

Clinical trials are a process of clinical research that is governed by a defined protocol which is carefully established to answer a precise patient care query. Clinical trials can be divided into five phases, with every phase playing a distinct purpose within the clinical trial. Every trial adheres to a procedure that designates what types of individuals may participate in the study.

The trials also outline exact plan of procedures, tests, medications, and doses within the trial apart from specifying the span of the study. In recent years, the costs associated with drug development have increased significantly, driving pharma and biotech companies to look for modernizations and smarter ways of conducting business.

One important trend is the outsourcing of clinical research activities by manufacturers. By subcontracting their R&D activities, pharma and biotech companies are reforming the drug development facilities business. The R&D service providers have risen from just a few establishments providing restricted clinical trial facilities to big conglomerates offering a extensive range of facilities like study design, preclinical evaluations, clinical trial management and planning, autonomous safety data audit, bio-statistical analysis and several more. CROs (Contract Research Organizations) started off by providing preclinical & clinical trial services, however they are now venturing into project administration.

Growth Factors

- Growing prevalence of chronic disorders

- Increasing number of clinical trials in developing regions

- Growing number of biologics

- Increasing demand for advanced treatments such as personalized medicines

Clinical Trials Market - Production, manufacturing, investment data and market statistics

- According to the U.S. National Library of Medicine, as of June 2023, approximately 55,483 interventional clinical studies were posted with results on the Clinicatrial.gov. website.

- According to the World Health Organization (WHO), as of 2022, approximately 39% clinical trials were done for non-communicable diseases across the globe. Whereas the clinical trials for communicable diseases reached 60%.

- Europe registered almost 13,254 clinical trials in 2022. Whereas South-East Asia enrolled 11,052 number of clinical trials in the same year.

- In 2022, approximately 54% clinical trial initiations reached at the Phase-III level in India. Whereas 28% of them made it to the Phase IV level.

- Charles River Laboratory, a globally leading clinical trial company witnessed a significant growth in drug research fundings in 2022, the company's annual generated revenue for 2022 was $3.98 billion. The revenue represented the growth of 12.3% over the previous year.

- The Cancer Research UK funded 193 million Euros on clinical research projects that focus on specific cancers in the financial year 2021-2022

- Japan accounted for 4.7% share in the worldwide clinical trial activities in 2022. The industry sponsored clinical trials held 54% share of the total Japanese industry in 2022

- For year 2022, in Japan, the oncology sector led the clinical trial activities with 25.1% share of the overall industry for clinical trials in the country. Whereas clinicals trials on infectious diseases held 7% share.

- The United Kingdom held total 178 Advanced Therapy Medicinal Product (ATMP) clinical trials in 2022.

- MedPace, a globally leading contract research organization's annual revenue increased by 27.7% in 2022 and reached $394.1 million.

Clinical Trials Market Outlook: The Emerging Opportunities

- Industry Growth Overview: The growing global investment in R&D, integration of advanced technologies, and increasing relevance of chronic diseases are increasing the industrial growth in the market.

- Major Investors: Large pharmaceutical and biotechnology companies, private equity firms, leading CROs, and venture capital firms are the major investors in the market.

- Startup Ecosystem: The startup ecosystem in clinical trials focuses on utilizing advanced technology to enhance patient recruitment, data analysis, and data management.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 158.92 Billion |

| Market Size in 2026 | USD 91.66 Billion |

| Market Size in 2025 | USD 87.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.16% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Study Design, Indication, Service Type, and Region |

| Companies Mentioned | Parexel, IQVIA, Charles River Laboratory, Omnicare, Kendle, Chiltern, and Pharmaceutical Product Development, LLC. |

Market Dynamics

Drivers

ADOPTION OF NEW TECHNOLOGY IN CLINICAL RESEARCH

Digitization in biomedical research is also paving the way for the market growth. Digitization also helps in meeting stringent regulations by maintaining patient data records that reduces trial process errors through adoption of software such as electronic clinical outcome assessment (e-COA). Digitization helps in streamlining the clinical trial process thereby probing sponsors to invest more in the clinical trial process as chances of successful clinical trials are more through the adoption of newer technologies.

SHIFT TOWARDS PERSONALIZED MEDICINE

The paradigm shift towards personalized medicine is expected to have a positive impact on the clinical trial market. The classic clinical trial process is carried out on thousands of people while personalized medicine will focus only on the effect of drugs on individual patients for a specific period. Very few medicines in the development phase pass all phases of a clinical trial due to the traditional clinical trial approach. The mentality of “one size will fit all” is acting as a barrier for drugs that are currently in pipeline but would never see the day. The use of pharmacogenetics in the clinical trial process is expected to increase the number of drugs passing all phases of the clinical trial process. The shift towards personalized medicine is expected to increase the use of pharmacogenetics in the clinical trial phase thereby increasing the pipeline of drugs. This trend is expected to instigate biopharmaceutical companies to invest more in the clinical trial phase.

GROWING DISEASE VARIATION AND PREVALENCE

Growing prevalence of disease and incidence of new disease is expected to give further boost to the clinical trial market. Worldwide population has varied disease profile with emerging countries having the most diverse disease profile. This is expected to boost the clinical trial of new or rare disease which otherwise would not have found any sponsors. More number of patients having a specific disease would act as a stimulus for biopharmaceutical companies to invest more in clinical trials for a disease segment. Diverse population would also mean easy recruitment of patients and faster clinical trial process. Rare diseases are given a status of “Orphan disease” in U.S and biopharmaceutical companies who sponsor clinical trials for Orphan drugs would get incentives for the process. This trend is likely to have a positive impact on clinical trials for rare disease thereby increasing the global clinical trials market.

INCREASING COLLABORATION IN BIOMEDICAL RESEARCH

The trend of combination trials and collaborations in clinical trial is expected to rise which would further boost the global clinical trials market. Due to high drug development cost biopharmaceutical companies are now forming an alliance with each other to increase the resources and share the risk of high cost. Immuno-oncology collaborations in 2015 is a prime example of increase collaboration to combat risk associated with clinical trials. Recent example of immuno-oncology collaboration is of MSD and Lily for clinical trial phase for treatment of advanced soft tissue sarcoma.

The race to launch the molecule in the market in a feasible timeline and cost will propel the need for CROs service provides. The pharmaceutical companies, along with the increased research cost, also witness global regulation complexity. All of these variables create a need for expertise in different portfolios, driving the need for outsourcing the market. Drug companies are not only outsourcing the production of medicines but also clinical trials. With the increasing clinical trial privatization, there is a surge in outsourcing to developing countries such as India, China, and Latin America.

Segment Insights

Study Design Insights

The interventional studies segment held the largest share in the clinical trials market. In the clinical trials market, interventional studies are a particular subset of clinical trials that are intended to assess the efficacy and safety of novel medical procedures, therapies, or interventions. These studies are usually carried out with human subjects in order to collect information about the possible advantages and disadvantages of the intervention under study. Evaluating the efficacy and safety of novel medical devices, such as implantable gadgets, diagnostic tools, or surgical instruments, is the goal of clinical trials. In certain interventional research, a combination of intervention, such as a novel medication used in conjunction with an established therapy may be tested to see if the combined strategy produces better results than either treatment alone.

The expanded access segment is expected to grow at a CAGR of 8.20% during the forecast period. Expanded access closely refers to compassionate use. This emergency need for severe health conditions is rising due to increasing diseases. It's a last resort for patients who are tired of other treatments. Though not approved drugs, it's an emergency-proven solution for temporary relief in urgency. The investigational products/drugs have become a rescue for various health conditions. The demand for this segment is increasing among individuals seeking quick access.

Indication Insights

The oncology segment holds the largest share in clinical trials market. A subset of the pharmaceutical and healthcare industries, the oncology clinical trials market is dedicated to carrying out research studies, or clinical trials, for novel medications, therapies, or treatments that are intended especially for cancer patients. Through assessing the safety and effectiveness of novel treatments prior to their approval for general use, this market is essential to the advancement of cancer research and the improvement of patient care. The value of patient participation in clinical research is becoming increasingly apparent. More patient-centered trials are being conducted as a result of the active participation of patient advocacy groups and organizations in clinical trial design and recruiting. Pharmacies are progressively carrying out clinical studies in a variety of geographical locations in order to reach a wider patient base, cut expenses, and expedite the medication development process.

The CNS conditions segment is expected to grow at a CAGR of 7.60% during the forecast period. Clinical trials for the central nervous system (CNS) are important for introducing new treatments for a broader area of psychiatric and neurological disorders. The decentralized clinical trial (DCT) model is an advancement in the clinical trial design, as well as a support and a development of the CNS trials challenges. The conditions affecting the central nervous system (CNS), such as stroke, muscle regeneration, Parkinson's disease (PD), epilepsy, Huntington's disease, amyotrophic lateral sclerosis (ALS), and traumatic brain injury (TBI), are significantly more impactful in individuals. The primary focus is on developing new methods in this area.

Service Type Insights

The laboratory services segment held the largest share of 24.60% in the 2024 global clinical trials market. The drug development process holds the widest spectrum and space for interruption-free access to services. The data collection across various regions is crucial for commercializing and initiating the drugs needed globally. The different diseases and the solutions to those conditions are a primary need for the patient's health. The development of the laboratory services and infrastructure represents it as a reliable source to evaluate and develop new treatments in the healthcare sector.

The decentralized clinical trial services segment is expected to grow at a CAGR of 9.40% during the forecast period. The DCTs are revolutionizing global clinical research by providing easy accessibility, efficiency, and advanced technologies for remote trials. The demand for this segment changed and increased extensively with the need for real-world data and more recruitment options for quick evaluation.

Regional Insights

U.S. Clinical Trials Market Size and Growth 2026 to 2035

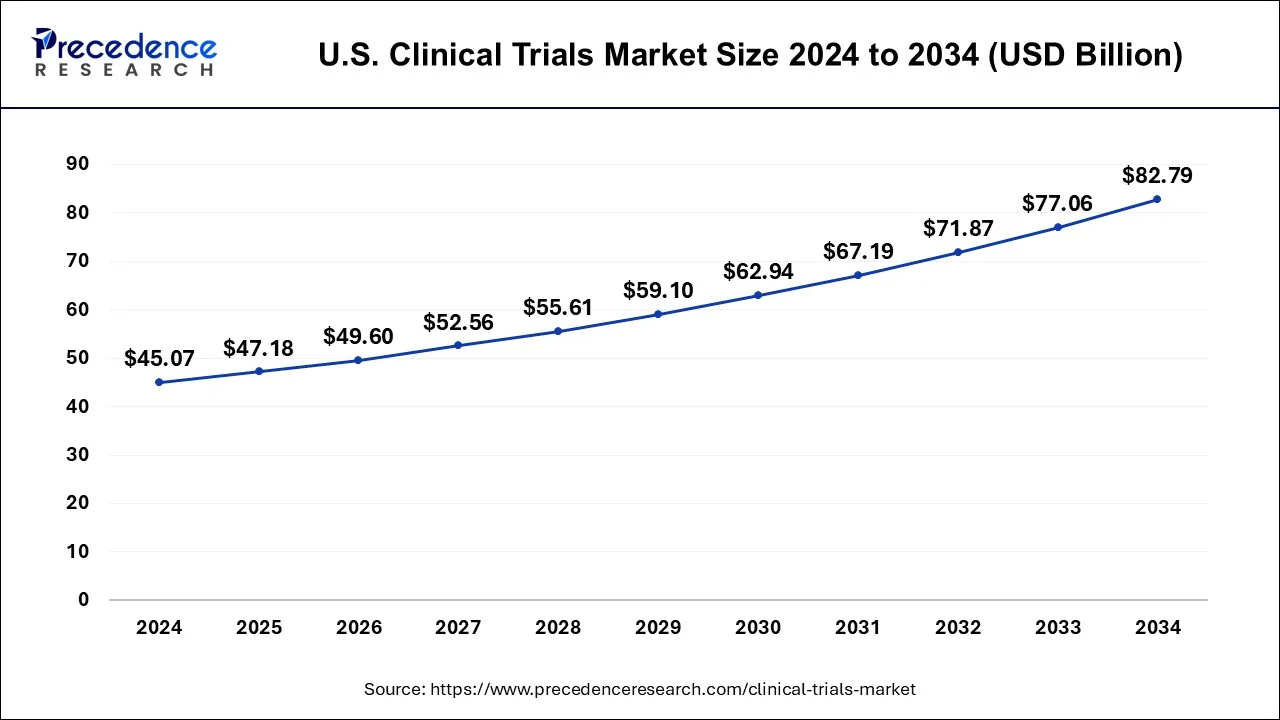

The U.S. clinical trials market size is estimated at USD 47.18 billion in 2025 and is expected to reach around USD 88.16 billion by 2034 with a CAGR of 6.27% from 2025 to 2035.

The research study covers key prospects and trends of clinical trials products throughout different regions including Europe, North America, Asia-Pacific, Middle East and Africa, and Latin America. Regionally, clinical trials market is dominated by North America due to high incidence of chronic disorders and presence of latest healthcare infrastructure. North America accounted largest revenue share 59.31% in 2024.

Why is North America the Dominant Region in the Clinical Trials Market?

The clinical trials market is dominated by North America as a result of the healthcare system, regulatory processes, and R&D spending in the region. The region provides a huge number of trials, in a large number of therapeutic areas, with more than 150,000 registered studies as of 2024. The region leads the adoption of innovative designs including decentralized, and adaptive designs . The preponderance of pharmaceutical companies and CROs provides better execution in all trial phases.

The United States is the principal engine of North America's dominance. There are host of more than 130,00 ongoing visible trials or completed trials. The United States has a strong set of NIH funded institutions and clinical network. The FDA is involved at many levels and is undergirded by a large pool of volunteers that is in the millions allowing for more rapid recruitment and trial completion.

On the other hand, Asia-Pacific is anticipated to witness the rapid growth rate 6.7%, on account of increasing investment by governments in research and growing awareness regarding precision medicine.

- The North Americaclinical trials market was valued at USD 49.67 billion in 2024 and it is expected to grow at a CAGR of 6.3% over the forecast period.

- The Europeclinical trials market was valued at USD 18.74 billion in 2024 and it is expected to grow at a CAGR of 5.5% over the forecast period.

- The Asia Pacificclinical trials market was valued at USD 11.86 billion in 2024 and it is expected to grow at a CAGR of 6.7% over the forecast period.

- The MEA clinical trials market size was valued at USD 859.6 million in 2024 and is expected to reach a CAGR of 4.1% from 2025 to 2034.

Why is Asia Pacific the Fastest Growing Region in the Clinical Trials Market?

Asia Pacific is rapidly growing region due to the cost benefits of clinical trials, rapid patient recruitment rates and regulatory updates. 25% of new global trials are initiated in this region. Nation States are moving to accelerate the ethics review processes, and are supporting digital trial models that attract sponsors from the globe.

China is leading the region by over 25,000 trials in 2024 China's market potential was recently unlocked through regulatory changes, and as an outcome of government and corporate investments in biotechs. China has faster review timelines with PRC-IRO approval often arranging for international-level collaborative reviews that make Chinese study sites favourable from a regional and global perspective.

Strict Regulation Booms the Europe Market

Europe is expected to grow significantly in the clinical trials market during the forecast period, due to stringent regulations. The presence of advanced industries is increasing innovation, driving clinical trials, where expanding hospitals are providing suitable clinical trial candidates. Thus, this promotes the market growth.

Advanced Research Ecosystem Powers UK

The presence of top-notch research infrastructure in the UK is attracting innovators. This, in turn, is providing the new products and experienced clinical staff for clinical trials. The presence of advanced technologies is enhancing patient identification, recruitment, and clinical trials, where government funding is also providing support.

Rising Investments in Health Expand MEA

MEA is expected to grow in the clinical trials market during the forecast period, due to growing healthcare investments supporting the research centres. The government initiatives are enhancing the clinical trials, where growing diseases are leading to increased patient availability. Additionally, growing R&D and specialized therapies are also enhancing the market growth.

Saudi Arabia Flourishes With Healthcare Expansion

Expanding healthcare backed by government initiatives is driving the clinical trials in Saudi Arabia. The growing fast-track approval and decentralized trials are also attracting companies, accelerating their innovation, and leading to collaboration among companies and institutes for R&D.

The Game Changers: Clinical Trials Market Key Players' Offerings

- Parexel: Phase I and IV clinical development services are provided by the company.

- IQVIA: The company provides a suite of clinical research services for data and analytics.

- Charles River laboratory:Discovery services, reach models and services, manufacturing support, safety assessments, etc, are provided by the company.

- Kendle: The company offers phase I AND IV clinical development services.

- Pharmaceutical Product Development, LLC: Services such as clinical development, laboratory services, pharmacovigilance, regulatory consulting, etc., are offered by the company.

Clinical Trials Market Companies

- Parexel

- IQVIA

- Charles River Laboratory

- Omnicare

- Kendle

- Chiltern

- Pharmaceutical Product Development, LLC

In order to better recognize the current status of clinical trials, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the clinical trials market. This research study bids qualitative and quantitative insights on clinical trials market and assessment of market size and growth trend for potential market segments.

Recent Development

- In March 2025, PATH launches clinical trial on the use of artificial intelligence in primary health care. The Nairobi-based trial aims to build evidence for whether AI can improve quality of care, by reducing instances of incorrect or missed diagnoses, spare patients unnecessary repeat visits, and ensure guideline-based treatment plans.

(Source: https://www.path.org) - In March 2025, IQVIA Laboratories, a leading global drug discovery and development laboratory services organization, announces the launch of Site Lab Navigator, an advanced suite of solutions that automates and streamlines lab workflows for clinical trial sponsors and investigator sites.

(Source: https://www.businesswire.com)

Major Market Segments Covered

By Study Design

- Interventional

- Observational

- Expanded Access

By Indication

- Autoimmune/Inflammation

- Rheumatoid arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Condition

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

By Service Type

- Laboratory Services

- Bioanalytical Testing Services

- Decentralized Clinical Trial Services

- Patient Recruitment

- Site Identification

- Analytical Testing Services

- Clinical Trial Supply & Logistic Services

- Other Services

By Geography

- North America

- Europe

- Asia-pacific

- Latin America

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting