January 2025

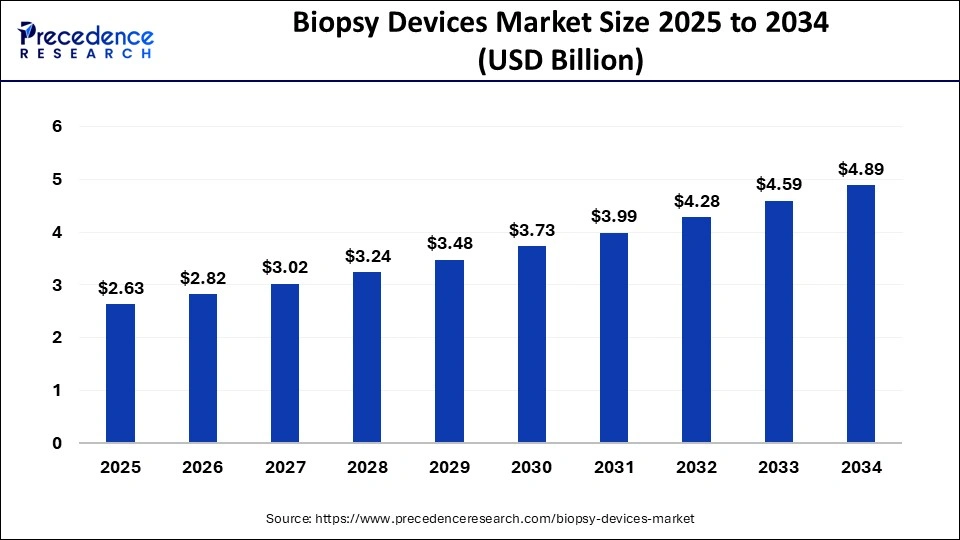

The global biopsy devices market size was USD 2.29 billion in 2023, estimated at USD 2.45 billion in 2024 and is anticipated to reach around USD 4.89 billion by 2034, expanding at a CAGR of 7.15% from 2024 to 2034.

The global biopsy devices market size accounted for USD 2.45 billion in 2024 and is predicted to reach around USD 4.89 billion by 2034, growing at a CAGR of 7.15% from 2024 to 2034.

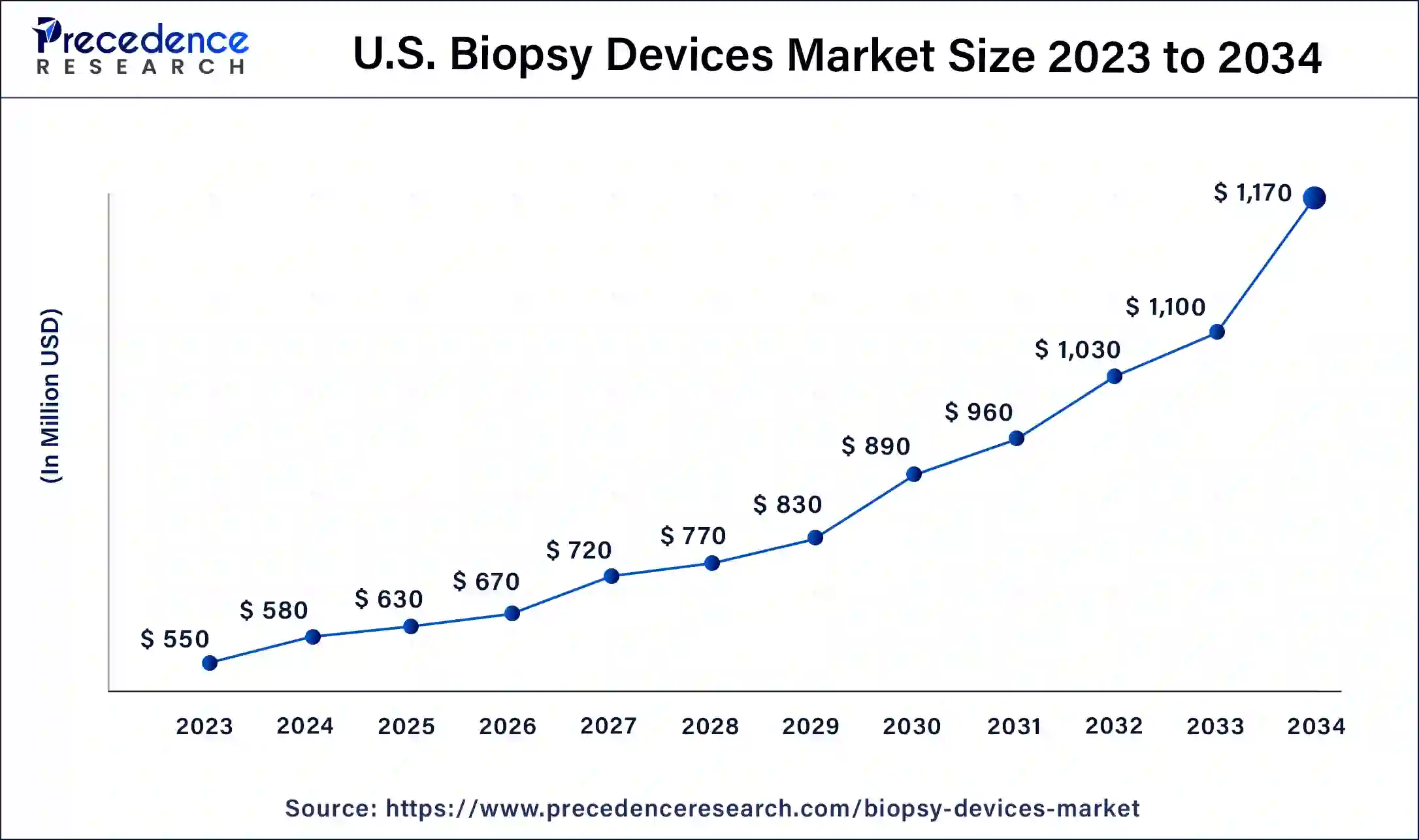

The U.S. biopsy devices market size was valued at USD 550 million in 2023 and is expected to be worth around USD 1,170 million by 2034, at a CAGR of 7.27% from 2024 to 2034.

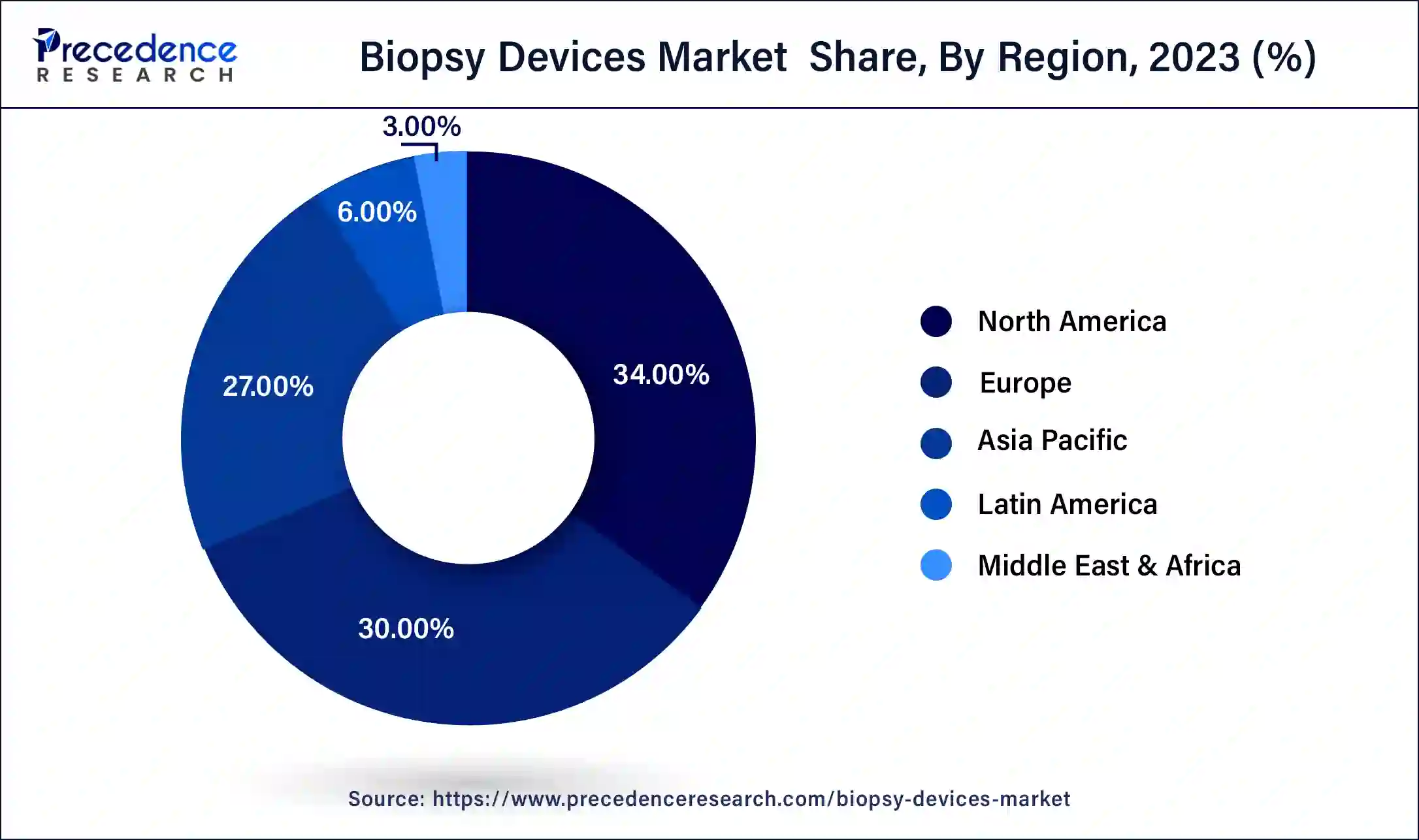

North America has held the largest revenue share of 34% in 2023 North America commands a significant share in the biopsy devices market due to factors such as a well-established healthcare infrastructure, high healthcare expenditure, and a robust research and development ecosystem. The region's emphasis on early disease detection, coupled with a rising incidence of cancer, propels the demand for advanced biopsy technologies. Additionally, a proactive regulatory framework and strong industry collaborations contribute to the dominance of North America in the biopsy devices market, with the presence of key market players and a focus on technological innovations further reinforcing its leading position.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the biopsy devices market due to factors such as the region's large and aging population, increasing prevalence of chronic diseases, and growing awareness about early disease detection. Rising healthcare investments, improving healthcare infrastructure, and a surge in demand for advanced diagnostic technologies contribute to the market's prominence. Moreover, the presence of key market players, strategic collaborations, and efforts to address unmet medical needs further drive the adoption of biopsy devices in the Asia-Pacific region, solidifying its major market share.

Biopsy devices are specialized medical tools designed for extracting small tissue samples from the body for diagnostic purposes. They are critical in identifying and studying various illnesses, especially cancer. These devices, used by medical experts like surgeons or interventional radiologists, come in different types, such as needles, forceps, or probes, tailored to specific organs or tissues.

In a biopsy procedure, a minute tissue sample is taken from a suspicious or abnormal area, enabling pathologists to examine it closely under a microscope. This examination yields crucial information about the tissue's nature, facilitating accurate diagnosis and treatment planning. Ongoing technological advancements in biopsy devices have resulted in minimally invasive techniques, reducing patient discomfort and expediting recovery. These tools are indispensable in modern healthcare, allowing for precise and targeted tissue sampling, thereby aiding in early disease detection and effective treatment strategies.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.29 Billion |

| Market Size in 2024 | USD 2.45 Billion |

| Market Size by 2034 | USD 4.89 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.15% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancements and increasing disease burden

Technological advancements and the increasing disease burden drive the demand for biopsy devices in the healthcare market. Continuous innovation in biopsy device technology, marked by the development of minimally invasive tools, has significantly enhanced the precision and efficacy of diagnostic procedures. These advancements not only contribute to improved patient outcomes but also reduce procedural discomfort, fostering greater acceptance among both healthcare providers and patients.

Simultaneously, the escalating global disease burden, notably the rising incidence of cancer and other conditions requiring diagnostic biopsies, intensifies the need for sophisticated and efficient biopsy devices. As healthcare systems worldwide prioritize early detection and personalized treatment strategies, biopsy devices play a pivotal role in delivering timely and accurate diagnostic information. The integration of cutting-edge technology into these devices enhances diagnostic capabilities, making them indispensable tools for healthcare professionals navigating the challenges posed by the increasing complexity and prevalence of diseases.

Invasive nature and limited expertise

The invasive nature of certain biopsy procedures poses a significant restraint on the market demand for biopsy devices. Patients may express reluctance to undergo invasive tests due to concerns about pain, discomfort, or potential complications associated with the procedure. This reluctance can lead to a delay in seeking necessary diagnostic assessments, hindering the adoption of biopsy devices in clinical settings.

Additionally, the perception of invasiveness may contribute to patient anxiety, impacting overall patient compliance and satisfaction. Limited expertise required for some biopsy devices acts as another restraint.

The successful application of certain advanced biopsy technologies demands specialized skills and training, which may not be uniformly available across healthcare settings. The scarcity or uneven distribution of professionals with the requisite expertise may impede the widespread adoption of these devices, particularly in regions facing healthcare workforce challenges. This constraint underscores the importance of comprehensive training programs to ensure the effective and widespread utilization of biopsy devices in diverse healthcare environments.

Rising focus on liquid biopsy and point-of-care biopsy devices

The rising focus on liquid biopsy and the development of point-of-care biopsy devices represent significant opportunities in the market for biopsy devices. Liquid biopsy techniques, involving the analysis of blood or other bodily fluids for biomarkers, offer a less invasive and more accessible approach to diagnostics. This innovation allows for early detection of diseases, especially cancers, and facilitates monitoring of treatment responses. As liquid biopsies become integral to personalized medicine, biopsy device manufacturers have the opportunity to contribute to this evolving field by developing devices capable of analyzing circulating tumor DNA and other relevant biomarkers.

Simultaneously, the emergence of point-of-care biopsy devices is transforming diagnostic workflows by enabling rapid and on-site assessments. These devices are particularly valuable in resource-limited settings and urgent medical situations, providing real-time results and reducing the need for extensive laboratory infrastructure. The accessibility and efficiency offered by point-of-care biopsy devices create opportunities for improved patient care, especially in scenarios where timely diagnostic information is critical, such as emergency situations or remote healthcare settings. Both liquid biopsy and point-of-care devices cater to the growing demand for more patient-friendly, efficient, and accessible diagnostic solutions, driving positive momentum in the biopsy devices market.

In 2023, the needle-based biopsy guns segment had the highest market share of 36% on the basis of the product. Needle-based biopsy guns are a key segment in the biopsy devices market, encompassing devices designed for extracting tissue samples using a spring-loaded or compressed-air mechanism. These guns offer precise and minimally invasive tissue collection, aiding in the diagnosis of various medical conditions, especially cancers. Current trends in this segment include ongoing advancements in needle design for improved accuracy, enhanced safety features, and the integration of imaging technologies, such as ultrasound guidance. These innovations aim to make the biopsy process more efficient, reducing patient discomfort and contributing to the overall growth of the market.

The biopsy needles segment is anticipated to expand at a significant CAGR of 8.6% during the projected period. Biopsy needles constitute a vital segment in the biopsy devices market, serving as core instruments for tissue sample extraction. These needles are characterized by their diverse designs, including core biopsy, fine needle aspiration, and vacuum-assisted types.

A notable trend in this segment is the ongoing development of advanced biopsy needle technologies, such as those with improved precision, enhanced visibility under imaging, and reduced patient discomfort. The market witnesses a shift towards more minimally invasive and accurate biopsy needle options, reflecting a commitment to improving diagnostic outcomes and patient experiences.

According to the end use, the hospitals segment has held 46% revenue share in 2023. In the biopsy devices market, the hospital segment refers to the utilization of biopsy tools and technologies within hospital settings for diagnostic and treatment purposes. As key healthcare institutions, hospitals are prominent end-users of biopsy devices, employing these tools across various medical specialties. A notable trend in this segment involves the increasing integration of advanced biopsy technologies, such as minimally invasive procedures and digital pathology, within hospital workflows. This trend aims to enhance diagnostic accuracy, streamline procedures, and contribute to improved patient outcomes within the hospital environment.

The clinics segment is anticipated to expand fastest over the projected period. The clinics segment in the biopsy devices market refers to healthcare facilities, independent of hospitals, that offer diagnostic and treatment services. Clinics play a vital role in biopsy procedures, providing a more accessible and streamlined environment for patients. A notable trend in this segment includes the integration of advanced biopsy technologies into clinic settings, allowing for quicker diagnoses and more patient-centric care. As clinics increasingly focus on expanding their diagnostic capabilities, the demand for biopsy devices in these settings is expected to continue growing.

Segments Covered in the Report

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

July 2024

August 2022