What is the Liquid Biospy Market Size?

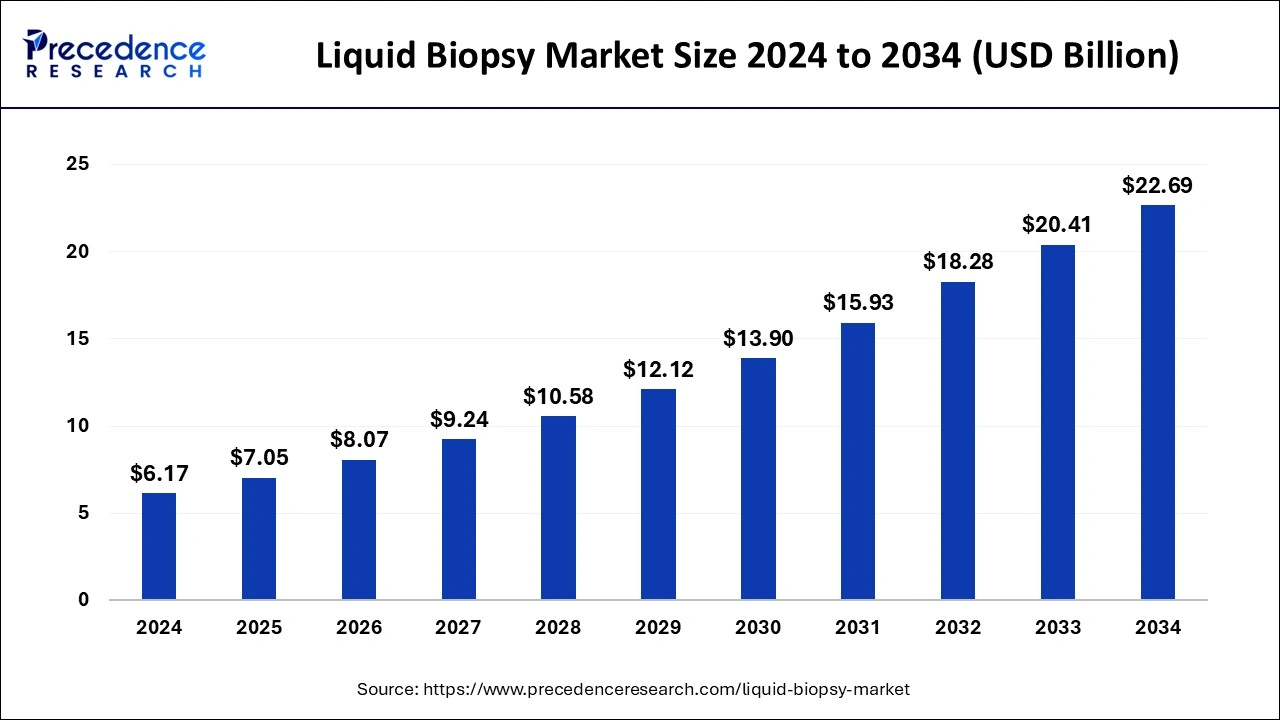

The global liquid biopsy market size is accounted at USD 7.05 billion in 2025 and predicted to increase from USD 8.07 billion in 2026 to approximately USD 22.69 billion by 2034, representing a CAGR of 13.91% from 2025 to 2034.

Liquid Biopsy Market Key Takeaways

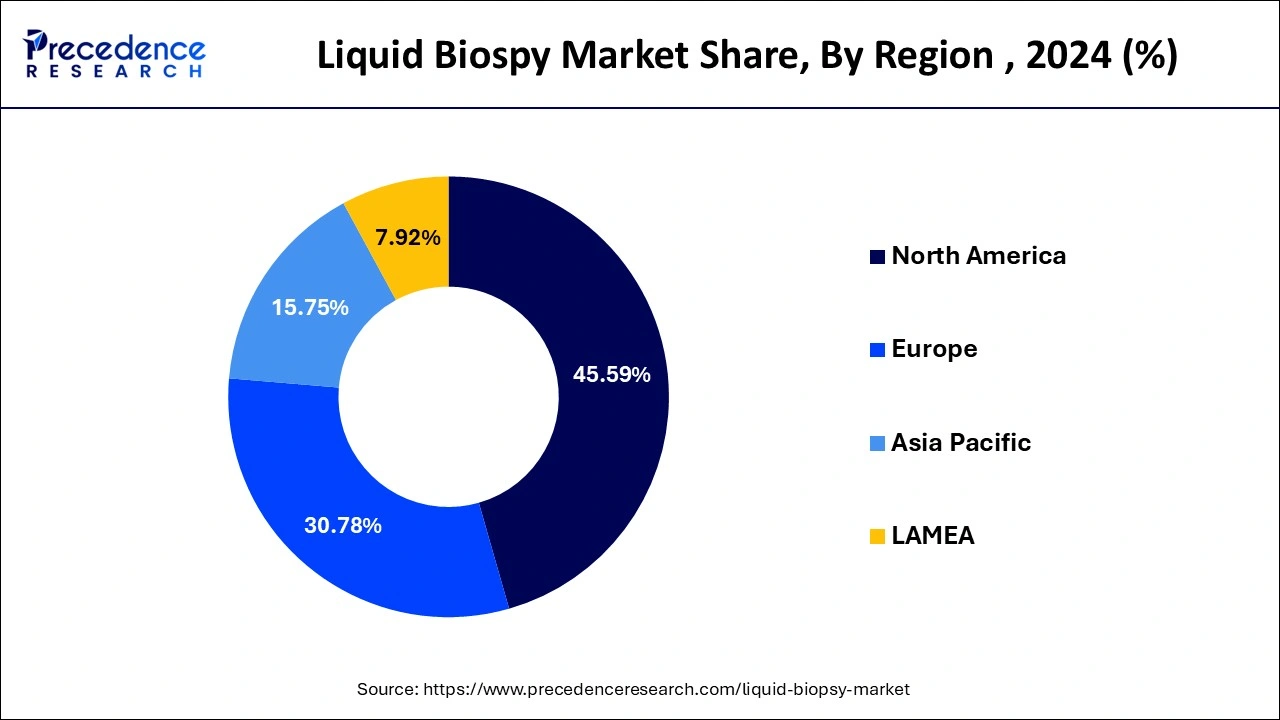

- North America region has contributed 45.59% in 2024.

- By technology, the NGS segment hit revenue share of around 65.20% in 2024.

- By sample type, blood sample-based tests hit highest market share 67.59% in 2024.

- By usage, clinical segment has held revenue share of 72.17% in 2024.

- By biomaker, cell-free DNA segment has held revenue share of 47.87% in 2024.

- By product, kits & consumables has held revenue share of 53.12% in 2024.

- By indication, lung cancer has generated revenue share of 32.10% in 2024.

- By application, screening segment has accounted revenue share of 39.27% in 2024.

- By circulating biomarker, the cell-free DNA segment is anticipated to show considerable growth in the market over the forecast period.

- By products, the test/services segment held a significant share in 2024.

How is AI enhancing the liquid biopsy industry?

AI is significantly improving the liquid biopsy industry by enhancing early cancer detection, disease monitoring, and even personalized treatment strategies. AI can integrate information from numerous sources, including proteomics , genomics , and imaging, to offer a more comprehensive view of the disorder, contributing to more accurate diagnoses. AI can predict treatment results and detect patients who are most likely to respond to specific therapies, permitting personalized treatment plans. AI-based liquid biopsies are crucial to understanding the promise of precision oncology , where treatments are monitored to the individual patient's specific genetic along with molecular profile.

Market overview

The Silent Detective: How Liquid Biopsy Is Finding Cancer Early

The liquid biopsy market holds remarkable importance in modern healthcare because of its potential for early cancer detection, enhanced patient outcomes, and personalized treatment strategies. It provides a less invasive option to traditional tissue biopsies, permitting for repeated monitoring of disorder progression and even response to therapy. Liquid biopsies offer valuable insights into the genetic profile of a tumor, permitting oncologists to choose the most effective treatment for individual patients.

This personalized approach to cancer treatment reduces unnecessary treatments and even maximizes the chances of successful results. The market is anticipated to expand thus as liquid biopsies become more broadly adopted in clinical practice and even new applications are discovered.Researchers at the University of Chicago have studied and developed a more sensitive liquid biopsy test that uses RNA in place of DNA for detecting cancer.

Liquid Biopsy Market Outlook

- Industry Growth Overview: The global liquid biopsy market is poised for substantial expansion between 2025 and 2030, driven by the rising global cancer burden, growing preference for non-invasive diagnostics, and the accelerating shift toward precision medicine. Liquid biopsy is in high demand for multi-cancer early detection (MCED) and minimal residual disease (MRD) monitoring applications, as clinicians and researchers increasingly prioritize early intervention and personalized treatment planning.

- Major Trend: One major trend in the market is the transition from traditional tissue biopsies to liquid-based assays that use simple blood samples. These non-invasive tests reduce patient risk, lower healthcare costs, and enable faster clinical decision-making. The integration of artificial intelligence (AI) and multi-omics platforms is further enhancing diagnostic accuracy, minimizing false positives, and enabling the detection of multiple cancer types in a single test. This combination of convenience, efficiency, and precision is reshaping how cancer is diagnosed and monitored.

- Global Expansion: Leading companies are broadening their reach into high-growth regions such as Asia-Pacific, Latin America, and Eastern Europe. Growth in APAC is driven by rising cancer rates and growing investments in healthcare infrastructure. Collaborations between local and international companies are essential for navigating regional regulations and meeting unique market needs.

- Major Investors: The liquid biopsy sector is attracting robust investment from venture capital firms and major diagnostics companies. Industry pioneers such as Guardant Health, Illumina, and Roche continue to lead through intensive R&D, acquisitions, and collaborations aimed at enhancing test accuracy and clinical adoption. Investors are drawn by the technology's potential to revolutionize oncology diagnostics, align with global precision medicine initiatives, and capture a significant share of the market.

- Startup Ecosystem: A growing startup ecosystem focuses on developing innovative technologies for early cancer detection and monitoring. Innovators are employing advanced methods like methylation profiling, fragmentomics, and AI to develop highly sensitive and accessible tests. Many are securing substantial VC funding to create scalable, next-generation sequencing-based solutions.

Clinical Trials Market Growth Factors

The global liquid biopsy market is primarily driven by the rising prevalence of cancer among the global population and rising awareness regarding the availability of different non-invasive treatments. As per the data provided by the International Agency for Research on Cancer in the GLOBOCAN 2020 estimates, around 19.3 million new cases of cancer and around 10 million deaths were reported due to cancer in 2020. The rising prevalence of breast cancer among the female population has made it the most common type of cancer diagnosed across the globe. In 2020, around 2.3 million new breast cancer cases were recorded, closely followed by the lungs cancer, colorectal cancer, and prostate cancer . Cancer is the second most leading cause of death across the globe, as per the World Health Organization. There are several benefits associated with the new liquid biopsy technique such as rapid results, low cost, early prognosis, overcoming tumor heterogeneity, low risk, and non-invasiveness. All these benefits of the liquid biopsy over the traditional diagnosis is fueling the adoption of the liquid biopsy among the patients across the globe, and is expected to significantly drive the demand during the forecast period.

The increased awareness about the cancer is boosting the liquid biopsy market growth as liquid biopsy technique can detect the cancer early, can monitor progression of tumor, and can assess clinical prognosis. Moreover, the proliferation of advanced technologies has boosted the demand for the non-invasive diagnosis and treatments that is expected to spur the demand for the liquid biopsy in the forthcoming years. The rising investments by the market players in the clinical trials for the development of innovative diagnostic solutions is exponentially contributing towards the market growth.

- The global liquid biopsy market is primarily driven by the rising prevalence of cancer among the global population and rising awareness regarding the availability of different non-invasive treatments.

- The rising prevalence of breast cancer among the female population has made it the most common type of cancer diagnosed across the globe. Cancer is the second leading cause of death across the globe, as per the World Health Organization. There are several benefits associated with the new liquid biopsy technique, such as rapid results, low cost,early prognosis, overcoming tumor heterogeneity, low risk, and non-invasiveness. All these benefits of the liquid biopsy over the traditional diagnosis are fueling the adoption of the liquid biopsy among patients across the globe and are expected to significantly drive the demand during the forecast period.

- The increased awareness about cancer is boosting the liquid biopsy market growth as the liquid biopsy technique can detect cancer early, can monitor the progression of the tumor, and can assess clinical prognosis.

- Moreover, the proliferation of advanced technologies has boosted the demand for non-invasive diagnosis and treatments, which is expected to spur the demand for liquid biopsy in the forthcoming years.

- The rising investments by the market players in the clinical trials for the development of innovative diagnostic solutions are exponentially contributing to the market growth.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 7.05 Billion |

| Market Size in 2026 | USD 8.07 Billion |

| Market Size by 2034 | USD 22.69 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 13.91% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Prevalence of Cancer and Need for Early Identification

The global liquid biopsy industry is motivated by an increase in the cases of many types of cancer, such as lung, breast, colorectal, and prostate cancer. As the number of cancer cases in the world keeps increasing, there is a need to search for ways to find cancer earlier, so that it increases the chances of treatment and survival. The liquid biopsy can be non-invasive, highly effective as an alternative to conventional tissue biopsies, reliably allowing the early detection of circulating tumor cells (CTCs), circulating tumor DNA (ctDNA), and other cancer markers within the blood and other body fluids. As the world continues to focus on the development of sophisticated diagnostic tools and personalized cancer treatment, the liquid biopsies market is getting popular.

Restraint

High Expenses and Limited Reimbursement Guidelines

The liquid biopsy methods commonly involve the use of expensive technology sets, such as next-generation sequencing (NGS) and biomarker-detecting solutions, which are costly. Such costs reduce accessibility, especially in low- and middle-income countries whose healthcare budget is limited. The absence of clearly defined reimbursement parameters would raise concerns among healthcare professionals about suggesting a liquid biopsy. Absence of standardized pricing models as well as clinical validation of some cancer types also further hampers adoption. Besides, cost-cutting policies are of primary importance to the majority of healthcare systems, which may become an obstacle to the adoption of new, premium-priced diagnostic technologies.

Opportunity

Developments in Precision Medicine and Biomarker Technologies

The exploration of circulating tumor cells, circulating tumor DNA, and extracellular vesicles is enhancing the sensitivity, specificity, and clinical usefulness of liquid biopsy tests. Such innovations provide an opportunity to detect tumor-specific changes more precisely and monitor their response to treatment and progression in real-time. Accurate medicine utilizes these possibilities to personalize cancer treatment on the basis of a specific genetic make-up of a person, making it more efficient and causing fewer side effects. Due to the increasing focus on personalized oncology as one of the central factors in cancer care, pharmaceutical and diagnostic companies are putting their efforts into developing liquid biopsy technology to efficiently develop targeted treatments.

Product Insights

The kits & consumables segment dominated the market with a 53.12% share in 2024. The segment's dominance is due to the increasing demand for kits, caused by the lack of accessible laboratories with the infrastructure to perform liquid biopsy tests for most patients in need. The liquid biopsy market heavily depends on remote sample collection, where diagnostic kits are transported to the patient.

The test/services segment held a significant market share in 2024 and is expected to grow at the fastest rate in the upcoming period. This is mainly due to the increasing demand for testing and services because of the complex processes needed to deliver clinically meaningful results, the necessity for specialized expertise, and the integration of advanced technologies like AI. This dominance is further driven by the demand for comprehensive genomic profiling, AI-powered diagnostics, and ongoing longitudinal monitoring for cancer management, all of which rely heavily on sophisticated services rather than just consumable products.

Technology Insights

Based on the technology, the next generation sequensing segment accounted highest revenue share in 2024. This is attributed to the higher efficiency of the NGS technology to detect even the lower frequency variants of cancer. The advancements in the NGS has resulted in the increased adoption of this technology as it can detect rare and novel mutations of cancer easily.

The NGS segment dominating and fastest-growing in the liquid biopsy market in 2024. This is basically due to its ability to determine multiple genes simultaneously, offering a comprehensive view of tumor mutations along with enabling personalized medicine approaches. NGS data assists in selecting the most specific therapies for individual patients, contributing to more effective and also personalized treatment strategies. NGS-based liquid biopsy tests are taking clinical validation, with few receiving FDA acceptance as companion diagnostics.

On the other hand, the PCR is estimated to be the most opportunistic segment during the forecast period. The adoption of PCR is rising owing to its rising uses for numerous purposes such as detecting fungal infections, bacterial infections, gene mapping, and other genomic applications. The quick and real-time diagnostic results provided by the PCR tests is accurate and it can guide the targeted therapies for the cancer treatment. The PCR is gaining immense popularity and is expected to witness a significant growth rate in the upcoming years.

Usage insights

The clinical segment led the liquid biopsy market with a 72.17% share in 2024 and is expected to continue growing during the forecast period. This increase is mainly driven by the rising use of liquid biopsies in oncology for early cancer detection, monitoring therapy, selecting treatments, and surveillance for recurrence. Liquid biopsies provide a less invasive alternative to traditional tissue biopsies, enabling repeated monitoring and early cancer detection. Advances in technologies such as NGS and bioinformatics are improving the sensitivity and accuracy of liquid biopsy analyses, further fueling this segment's expansion.

Types of sample insights

The blood segment led the liquid biopsy market, holding a 67.59% share in 2024. This is due to its ease of collection, minimal invasiveness, and the wide variety of cancer-related biomarkers it offers. Since blood circulates throughout the body, a blood-based liquid biopsy can detect a broader range of molecular data, providing a more comprehensive profile of the cancer's genetic diversity. Unlike traditional tissue biopsies, blood-based liquid biopsies provide a much more convenient and repeatable way to get a real-time, complete view of a patient's cancer.

Clinical Application Insights

The diagnosis and screening segment dominated the market in 2024 due to the growing demand for early cancer detection and non-invasive testing methods that improve patient comfort and outcomes. Advances in technologies like multi-cancer early detection (MCED) and circulating tumor DNA (ctDNA) analysis enabled more accurate, real-time insights, driving adoption among clinicians for both routine screening and initial diagnostic purposes.

The treatment selection segment is expected to grow the fastest in the coming years. This is mainly because it enables personalized medicine by identifying specific genetic mutations driving a patient's cancer, overcoming the limitations of invasive and sometimes unfeasible tissue biopsies, and facilitating dynamic, real-time monitoring of treatment resistance. Liquid biopsies offer a less invasive, quicker method for collecting critical genetic information necessary to guide treatment decisions for individual patients by supporting targeted therapy development.

The prognosis and recurrence monitoring segment is expected to expand because of its clear advantages over traditional tissue biopsies. By analyzing ctDNA and other biomarkers from a simple blood sample, liquid biopsies offer a non-invasive, real-time way to track tumor changes, treatment response, and disease progression. This is especially important for MRD detection, where small amounts of leftover cancer cells can be identified months before a recurrence shows up on imaging scans, enabling earlier and more effective intervention.

Indication Insights

The lung cancer segment dominated the liquid biopsy market in 2024. This is primarily due to the high incidence and mortality rates of the disease, the critical need for molecular profiling to guide therapy, and the limitations and risks of traditional tissue biopsies. Lung cancer is one of the most prevalent and deadliest cancers globally, creating a substantial and urgent need for better diagnostic and monitoring tools. Liquid biopsies offer a superior, non-invasive alternative for testing, treatment monitoring, and detecting recurrence, which is particularly relevant in managing lung cancer patients. This helps doctors quickly adjust treatment plans, anticipate resistance, and monitor for MRD.

Biomarker Insights

The cell-free DNA segment dominated the liquid biopsy market in 2024 and is expected to continue its growth trajectory in the coming years. The segment's growth is attributed to the rising demand for cfDNA kits due to easier isolation of cfDNA in the bloodstream, owing to early detection of cancer by liquid biopsy tests. It aims to identify DNA fragments circulating in the bloodstream that have been released from tumor cells. This is a rapidly expanding area because of its potential for early cancer detection and monitoring treatment response. Innovations in NGS along with AI are thus driving its growth. Moreover, the concept of genetic testing based on cfDNA is gaining popularity due to its usefulness across most cancer types and is being integrated into standard clinical practices.

Circulating Biomarker Insights

The circulating tumor cells segment is expected to grow significantly during the forecast period due to the increasing demand for CTCs biomarkers for early cancer detection through non-invasive biopsies. Circulating tumor cells have gained rapid traction in the market as liquid biopsy is considered the most reliable method for detecting these cells. Additionally, it aids in cancer prognosis, guides cancer therapeutics, and monitors treatment regimens by identifying the outgrowth of different tumor cells in new micro-environments of the body, along with detecting CTCs and extracting important data. This process is challenging because of their low concentrations in biological fluids.

Products Insights

The test/services contributed the most revenue in 2024 and are expected to dominate throughout the projected period. Such services are in the form of complete genomic profiling, mutation monitoring, and ctDNA, CTCs, and other molecular signatures in blood, urine, or saliva. The test/service providers have provided a sophisticated testing platform based on next-generation sequencing (NGS), digital PCR, and useful bioinformatics applications to facilitate a high level of sensitivity and specificity of the genetic changes detected related to cancer. The increase in the personalization of treatment schedules and real-time disease tracking has compelled pharmaceutical and diagnostic organizations to create customized, specific assays for individual cancer types. These tests are highly scalable and convenient in comparison to conventional tissue biopsies; thus, they are especially attractive in oncology contexts.

The kits and consumable segment is the fastest growing in the liquid biopsy market during the forecast period. The rising adoption of liquid biopsy for cancer screening, therapy selection, as well as recurrence monitoring, along with the growth of precision oncology, is driving the need for these kits and consumables.

Technology Insights

The next-generation sequencing (NGS) segment held about 65.20% of the market in 2024. This is primarily due to its ability to analyze multiple genes at once, providing a detailed view of tumor mutations and enabling personalized medicine approaches. NGS data help in selecting the most precise therapies for individual patients, leading to more effective and personalized treatments. Advances in NGS have driven increased adoption of this technology, as it can easily identify rare and new cancer mutations. NGS-based liquid biopsy tests are under clinical validation, with some receiving FDA approval as companion diagnostics.

Regional Insights

U.S. Liquid Biopsy Market Size and Growth 2025 to 2034

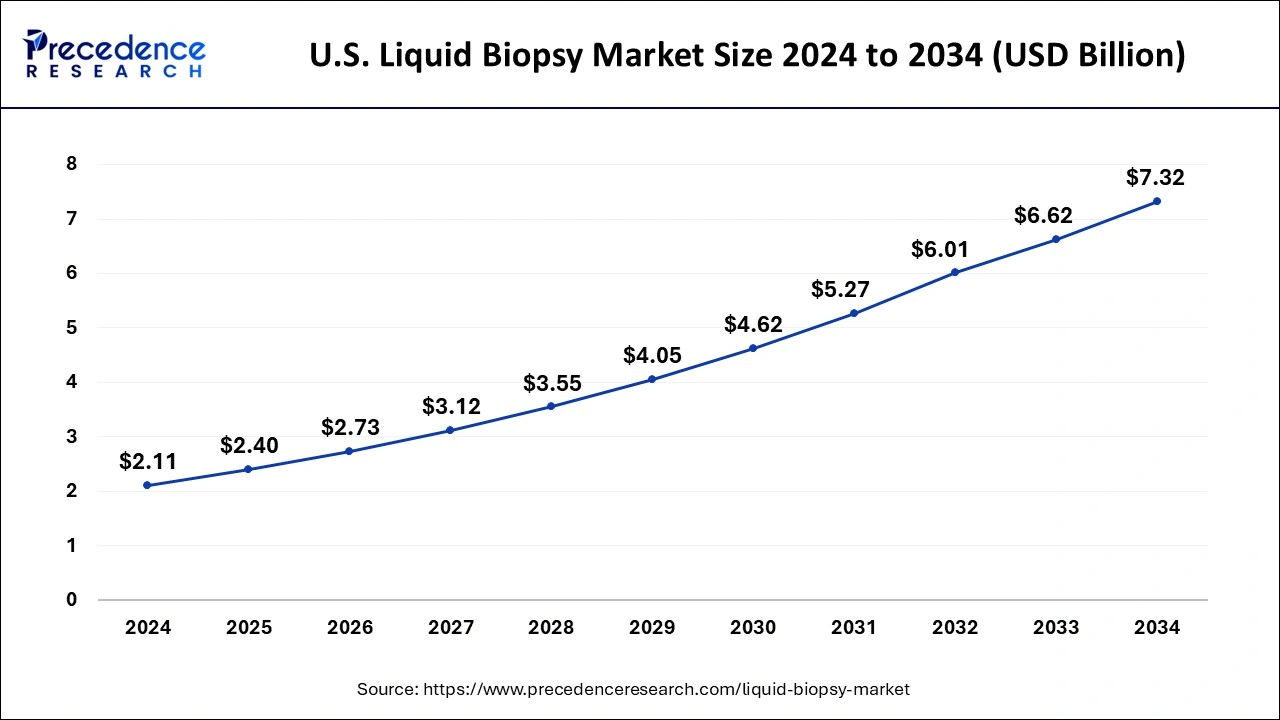

The U.S. liquid biopsy market size was estimated at USD 2.40 billion in 2025 and is expected to hit around USD 7.32 billion by 2034 with a CAGR of 13.80% from 2025 to 2034.

Based on region, North America held the revenue share of 45.59% in 2024.This is mainly due to the increased adoption of the liquid biopsy in the North American region for the diagnosis of cancer. The rapidly growing cases of cancer in the huge market like US has resulted in the dominance of this region in the global liquid biopsy market. According to the American Cancer Society, in 2020, there were around 1.8 million new cancer cases were estimated in US.

The Next Wave: Asia-Pacific's Rapid Rise in Liquid Biopsy

On the other hand, Asia Pacific is estimated to be the fastest-growing market during the forecast period. Asia Pacific is characterized by the increasing disposable income, increasing healthcare expenditure, rising awareness regarding the liquid biopsy techniques, and rising adoption of the advanced techniques in the hospitals, clinics, and diagnostic laboratories for the diagnosis. The growing penetration of hospitals and diagnostic centers in the region is expected to fuel the growth of the liquid biopsy market during the forthcoming years.

U.S. Liquid Biopsy Market Trends

The liquid biopsy market in the U.S. accounted for the largest market revenue share in North America in 2024, which is fueled by a well-developed technological innovation and growing clinical use. Clinical acceptance has been fast-tracked with the recent U.S. FDA approval of liquid biopsy tests to use in the early detection of cancer, selection of cancer therapies, and monitoring. Moreover, the availability of market players and research institutes creates a competitive atmosphere that leads to advancements in terms of the sensitivity and specificity of the assay. Market growth is further enhanced through strategic alliances, mergers, or acquisitions within the diagnostics industry.

Japan Liquid Biopsy Market Trends

The Japanese liquid biopsy market is expected to grow at a rapid CAGR over the forecast period, backed by governmental efforts and research-oriented investment to fight the increasing cancer cases. Grants have been offered to institutions and companies in the country to hasten the development and implementation of liquid biopsy instruments. As the population of Japan gets older and the number of people with cancer remains a problem, it is increasingly necessary to have early and precise means of diagnostics. The government support of personalized medicine, as well as the improvement of the public-private partnership, is likely to reinforce the presence of Japan in the Asia Pacific liquid biopsy market further.

Europe: Building a New Diagnostic Framework with Liquid Biopsy

The liquid biopsy market in Europe is expected to grow at an exponential CAGR during the forecast period, backed by the growth in regulatory approvals, the growth in cancer prevalence, and high levels of government support for advanced diagnostics. The use of liquid biopsy assays is likewise gaining traction in the clinical setting, with the European Medicines Agency (EMA) and other national regulatory bodies endorsing the use of the assays in a wider clinical practice within oncology. The trend towards the replacement of invasive tissue with liquid biopsy-based solutions, generally more comfortable to patients, monitored in real-time, and allow early detection of mutation, is gaining momentum in the region.

UK Liquid Biopsy Market Trends

The UK liquid biopsy market is expected to increase at a large CAGR throughout the forecast period due to a well-developed healthcare system. A few pilot projects and trials are underway to justify the utilization of liquid biopsy in regular population screening. The joint efforts of universities, biotechnology companies, and government institutions are stimulating the production and marketing of the next-generation liquid biopsy technologies. Moreover, the UK government has paid attention to precision medicine and its financial climate of cancer research in the country, which contributes to innovation and the speed of product approvals.

Localization Strategy: Tailoring Liquid Biopsy Products for Latin American Needs

Latin America plays a distinctive role in the global market, mainly due to a high cancer burden and growing healthcare investments, especially in major economies like Brazil and Argentina. While the region has significant growth potential, driven by increased awareness and adoption of minimally invasive diagnostics, investments from multinational companies and government efforts to improve oncology services are crucial for overcoming many challenges and unlocking the market's full potential in Latin America.

Brazil Market Trends

As the largest economy in Latin America, Brazil is a key player in the regional liquid biopsy market, showing strong growth driven by a high prevalence of cancer and increasing healthcare spending, which are accelerating the adoption of non-invasive diagnostics. Notable market activity includes partnerships between multinational companies and local healthcare providers, as well as the integration of advanced technologies like NGS for cancer detection and monitoring.

Market Entry and Expansion: A Strategic Blueprint for Liquid Biopsy in the MEA

The Middle East and Africa (MEA) region is emerging as a growth hub in the global market, driven by rising cancer rates, modern healthcare infrastructure, and increased investment in precision medicine, particularly in GCC countries and South Africa. The non-invasive nature of liquid biopsy is especially important in many parts of Africa where access to traditional biopsy infrastructure is limited. Ongoing collaborations between international and local healthcare partners, along with growing health awareness, are propelling the market forward in the MEA region.

Saudi Arabia Market Trends

Saudi Arabia is a major driver of the liquid biopsy market, supported by increasing cancer rates and significant government investments in modernizing healthcare infrastructure, as part of its strategic plan to promote precision medicine. Growing awareness of non-invasive diagnostic methods and the adoption of advanced technologies like NGS are also fueling market growth.

Regulatory Landscape for the Liquid Biopsy Market

| Country | Approval Pathway | Key Focus |

| U.S. | FDA (IVD/CDx): Formal approval for diagnostics. LDTs (Lab-developed tests): Less-regulated pathway, potentially facing increased oversight. | Clinical validity and utility are key for FDA approvals; companion diagnostics (CDx) are a priority. |

| EU | IVDR (Risk-based): In Vitro Diagnostic Regulation (IVDR) has a risk-based classification system (A-D) and requires certification. | Higher-risk liquid biopsies require rigorous assessment by a Notified Body for market entry. |

| China | NMPA (Evolving): The National Medical Products Administration (NMPA) is establishing its framework, with initial approvals issued. | Framework still developing, with early approvals targeting specific cancer mutations. Focus on validating new technologies. |

| Australia | TGA/MSAC (Funding focus): Approval from the Therapeutic Goods Administration (TGA), with funding dependent on the Medical Services Advisory Committee (MSAC). | Framework still developing, with early approvals targeting specific cancer mutations. Focus on validating new technologies. |

Top Companies in the Liquid Biopsy Market and their Offerings

- Guardant Health

Guardant Health offers advanced blood-based cancer diagnostics, including Guardant360 Liquid for comprehensive genomic profiling of advanced solid tumors and Guardant Reveal for minimal residual disease assessment and recurrence monitoring. They reported USD 739 million in revenue in 2024.

- F. Hoffmann-La Roche

Roche, through its subsidiary Foundation Medicine, provides liquid biopsy solutions such as the FoundationOneLiquid CDx comprehensive pan-tumor test and AVENIO ctDNA Analysis Kits. Their revenue in 2024 was USD 70.874 billion.

- Exact Sciences

Exact Sciences, a leader in cancer screening, offers the Cancerguard™ multi-cancer early detection blood test and Oncodetect™ for molecular residual disease and recurrence monitoring. Their reported revenue for 2024 is USD 2.759 billion.

- Illumina

Illumina provides the next-generation sequencing (NGS) platforms and tools used in many liquid biopsy applications. Their offerings include NGS solutions for detecting cancer biomarkers and the TruSight Oncology 500 ctDNA research panel. In 2024, their revenue was USD 4.37 billion.

- Bio-Rad Laboratories

Bio-Rad Laboratories is known for its digital PCR (ddPCR) technology and circulating tumor cell (CTC) analysis in the liquid biopsy market. Their offerings include Droplet Digital™ PCR systems for sensitive detection of biomarkers and the Genesis Cell Isolation System for CTC analysis. They reported USD2.567 billion in revenue for 2024.

- Biocept Inc.

- Johnson & Johnson

- Laboratory Corporation of America Holdings

- MDxHealth SA

- QIAGEN N.V

- Thermo Fisher Scientific Inc.

Recent Developments

- In April 2025, Labcorp reported adding two new products to its precision Oncology portfolio. The first one is Labcorp Plasma Detect, which was created as a clinical test, which was used as a method to determine the chances of patients with stage III colon cancer having the same illness again. The PGDx elio plasma focus Dx, the first and only FDA-cleared kitted liquid biopsy test in pan-solid tumors and assists in determining patients for targeted therapies. (Source : https://ir.labcorp.com )

- In January 2025, Tempus AI, Inc. claimed to launch the FDA-approved next-generation sequencing (NGS)-based in vitro diagnostic test, xT CDx. All ordering clinicians in the U.S. can order the test, which offers a full picture of genomic knowledge with one of the broadest and FDA-approved gene panels present in the market. (Source: https://in.marketscreener.com )

- In February 2024, Myriad Genetics, Inc. announced a partnership with the National Cancer Center Hospital East in Japan to start a SCRUM MONSTAR-SCREEN-3 study looking at the prognostic and predictive value of molecular residual disease testing.(Source: https://investor.myriad.com )

Value Chain Analysis

- R&D: The process consists of finding, developing, and validating blood biomarkers to ensure that cancer detection and monitoring are both accurate.

Key players: Guardant Health, F. Hoffmann-La Roche Ltd - Clinical Trials and Regulatory Approvals: A series of multi-phase testing for safety and efficacy, then regulatory authorities' approval for the drug's clinical use.

Key players: IQVIA, CellMax Life, Natera - Formulation and Final Dosage Preparation: The design of the diagnostic assays and preparation of the reagents that are needed for accurate laboratory testing of patient blood samples.

Key players: Bio-Rad Laboratories, QIAGEN, Thermo Fisher Scientific - Packaging and Serialization: Test kits are packaged securely and carry traceable identifiers that allow for ensuring authenticity, quality control, and regulatory compliance.

Key players: Thermo Fisher Scientific, Bio-Rad Laboratories - Distribution to Hospitals, Pharmacies: Logistics management in such a way that diagnostic kits are delivered safely to laboratories and healthcare facilities under optimal conditions.

Key players: Guardant Health, F. Hoffmann-La Roche Ltd - Patient Support and Services: Providing instructions, technical support, and timely communication of accurate results to patients and healthcare providers.

Key Players: Myriad Genetics, F. Hoffmann-La Roche Ltd

Segments Covered in the Report

By Technology

- NGS

- PCR

- FISH

- Other

By Usage

- RUO

- Clinical

By Types of Sample

- Blood

- Urine

- Saliva

- CerebroSpinal Fluid

By Circulating Biomarker

- Circulating Tumor Cells

- Cell-free DNA

- Circulating Cell-Free RNA

- Exosomes and Extracellular Vesicles

- Others

By Products

- Test/Services

- Kits and Consumable

- Instruments

By Indication Type

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Other cancers

- Non-Oncology Disorders

By Clinical Application

- Treatment Monitoring

- Prognosis and Recurrence Monitoring

- Treatment Selection

- Diagnosis and Screening

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting