May 2025

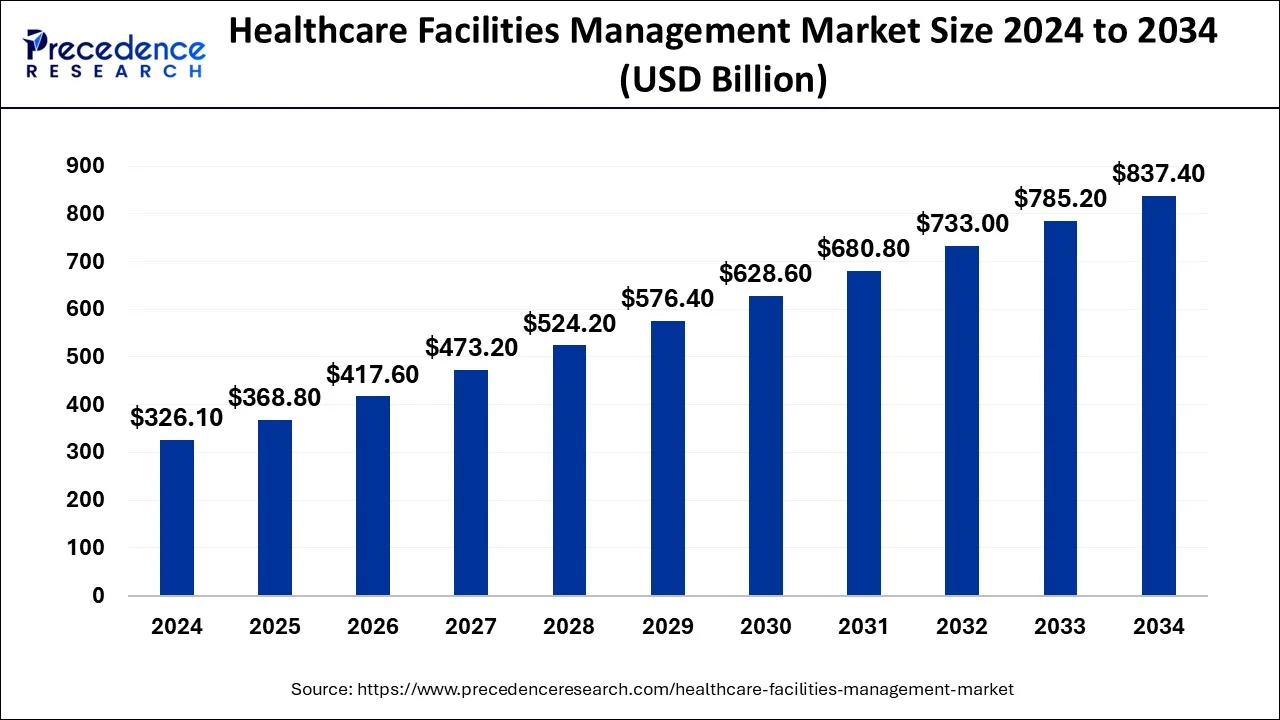

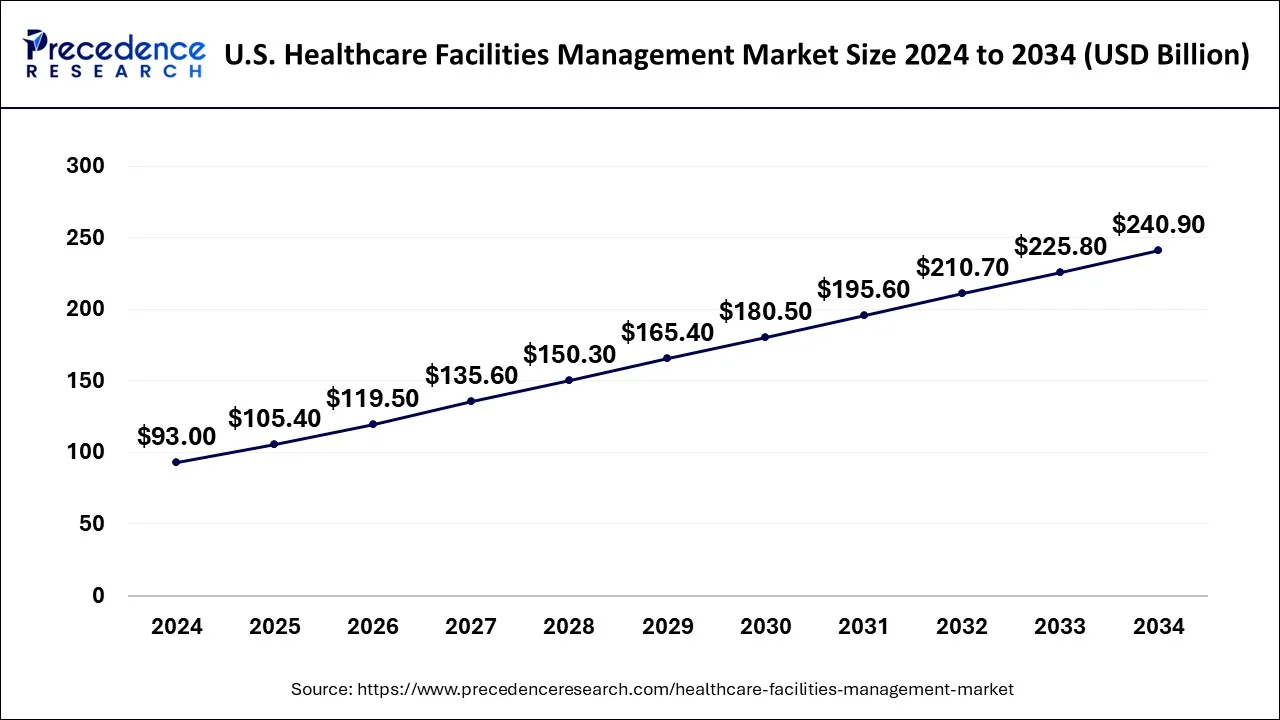

The global healthcare facilities management market size is calculated at USD 368.8 billion in 2025 and is forecasted to reach around USD 837.4 billion by 2034, accelerating at a CAGR of 9.89% from 2025 to 2034. The North America healthcare facilities management market size surpassed USD AA billion in 2024 and is expanding at a CAGR of AA% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare facilities management market size reached USD 326.1 billion in 2024 and is anticipated to reach around USD 837.4 billion by 2034, growing a CAGR of 9.89% from 2025 to 2034.

The global healthcare facilities management market size was estimated atUSD 326.1 billion in 2024 and is expected to be worth around USD 837.4 billion by 2034. expanding at a CAGR of 9.89% from 2025 to 2034.

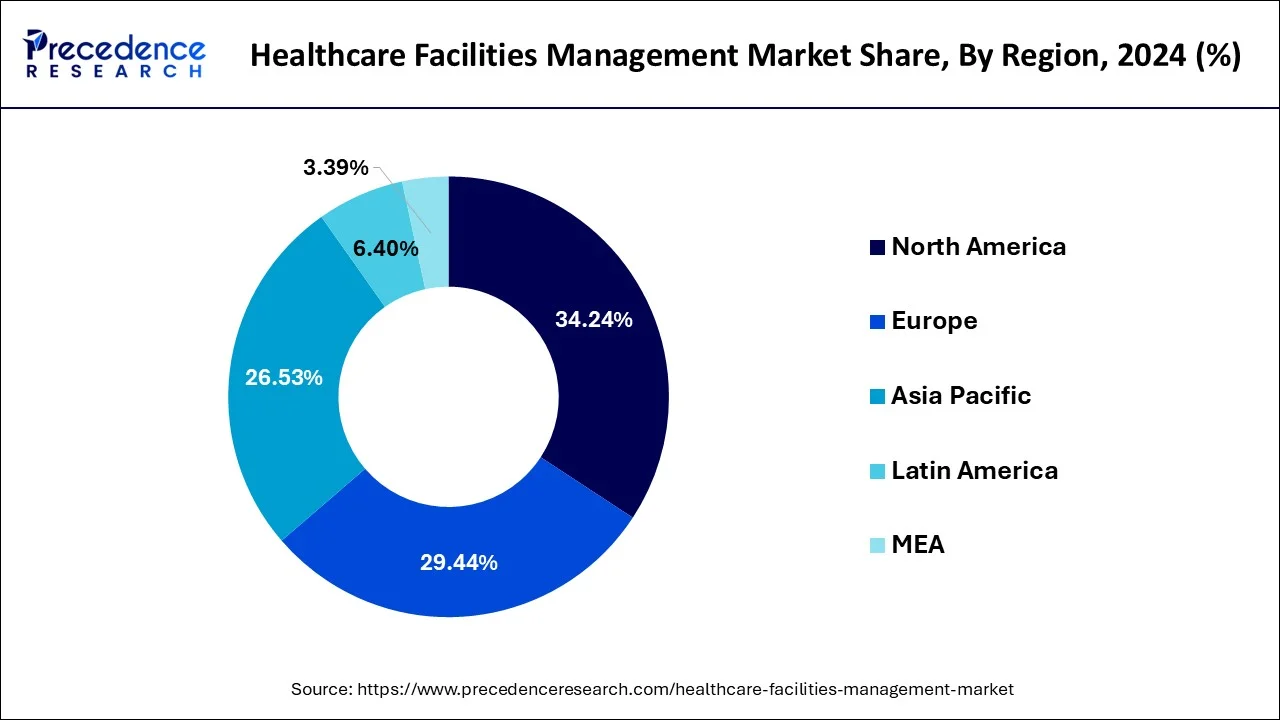

North America is projected to lead the global healthcare facilities management market during years to come. This growth is on account of the strong healthcare organization and the introduction of diverse technologies for healthcare facilities. The complete circumstance of the healthcare structure varies extensively in North American. Presently, some of the hospitals have formed robust market position and certain hospitals have recognized a basic healthcare facility management. In 2020, American Cancer Society projected that there will be about 1.8 million new cancer cases detected and around 606,520 cancer deaths will occur in the U.S. Additionally, growing elderly population and rising chronic diseases throughout the region is expected to supplement the development of the healthcare facilities management market in the near future.

In Europe, around 29.44% of integrated FM revenue is produced by the healthcare industry. Growing pressure on public budgets may alter healthcare institutions thus driving service provision towards decentralized delivery. Quality and specialized services will be obtainable at a finest, motivating healthcare provider and consumer from a cure-based delivery demand to prevention based one.

Developing markets such as Middle East & Africa and Asia Pacific propose alluring market prospects new in case of health care facility management service providers. These nations are undergoing entry of small companies in the marketplace. The quick upsurge in the medical tourism in the developing markets such as China and India act as profitable markets for the companies for investments, thus anticipated to flourish the growth of the healthcare facilities management market in these nations.

Growing focus on health and wellness will infuse more facets of business and private life during coming years. Healthcare facility management market is observing a change in technology to advance facility monitoring, efficiency and cost effectiveness. IoT is anticipated to transform the current healthcare BAS (Building Automation System). Implementation of new ICT such as IoT by facility management service providers is anticipated to empower healthcare facilities access real-time information via interconnected sensors that may aid them to enhance manage their business.

Healthcare has emerged as one of the most promising sectors due to growing number of patients and increasing healthcare spending by the private and public participants in healthcare systems. In 2017, according to the CMS (Office of the Actuary) report, the U.S. spent around USD 3.5 trillion on healthcare sector and this number was augmented to around USD 3.8 trillion in 2019. Thus there has been excellent growth in the healthcare expenses that has led to the expansion of numerous facilities in clinics or hospitals for the welfare of patients. These factors are propelling the growth of healthcare facilities management market across the world. Hospitals and clinics are expected to observe profitable progress because of the growing awareness about the cleanliness required to evade scattering of diseases and responsiveness concerning the requirement for controlling the pollution of the environment. However, lack of technical expertise may impede the growth of the market in few regions.

| Report Highlights | Details |

| Market Size in 2024 | USD 326.1 Billion |

| Market Size in 2024 | USD 837.4 Billion |

| Growth Rate | CAGR of 9.89% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type, By End User, By Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory Compliance and Safety Standards

Local, state, and federal government entities impose a variety of rules on healthcare facilities. Building codes, fire safety rules, environmental restrictions, infection control procedures, and licensing requirements are only a few of the many topics covered by these regulations. In order to stop illnesses from spreading among patients, employees, and visitors, facilities put infection control procedures into place. Plans for emergency readiness must be in place at healthcare facilities so that they can react to pandemics, natural disasters, terrorist attacks, and other catastrophes with efficiency.

Cybersecurity Risks

Large volumes of sensitive patient data, such as billing information, personal information, and medical records, are managed by healthcare facilities. Numerous techniques, including virus assaults, phishing scams, and insider threats, can result in data breaches. The administration of healthcare facilities is seriously threatened by ransomware. The organization's data is encrypted by attackers, who then demand a ransom to unlock it. This may impair patient care, cause delays in healthcare services, and result in losses of money. Strict laws, including the Health Insurance Portability and Accountability Act (HIPAA) in the US, must be followed by healthcare facilities in order to safeguard patient privacy and guarantee data security.

Telehealth and Remote Monitoring

Patients in remote or underserved locations can now receive care by teleconsulting with healthcare providers, which eliminates the need for in-person visits. With the use of remote monitoring technology, patients' health indicators may be continuously tracked. This allows for the early identification of irregularities and prompt action, which lowers the need for hospital readmissions and overall healthcare expenses. Features like prescription reminders, appointment scheduling, and secure messaging are frequently included in telehealth platforms, which improve patient happiness and participation with the healthcare process. By streamlining administrative procedures, the integration of telehealth and remote monitoring data into electronic health records (EHRs) and other healthcare management systems improves workflow efficiency for healthcare practitioners.

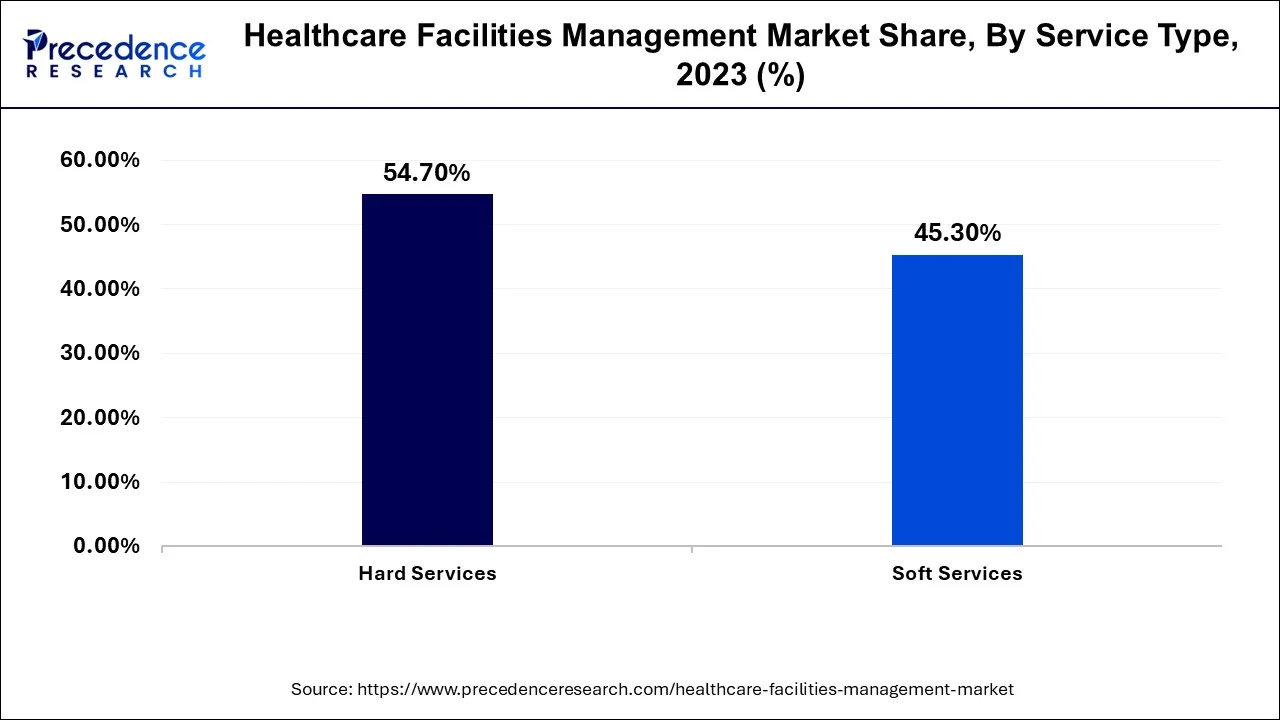

The hard service held a significant share in healthcare facilities management market. "Hard services" in the context of healthcare facilities management usually refers to the technical and physical management and maintenance duties required to guarantee the efficient, safe, and appropriate operation of healthcare facilities. These services frequently entail systems, equipment, and infrastructure that need to be maintained by people with certain training and experience. This covers the upkeep and repairs of boilers, chillers, HVAC (heating, ventilation, and air conditioning) systems, and other mechanical devices that are necessary to keep healthcare facilities' interior temperatures, humidity levels, and air quality within acceptable bounds. This entails maintaining electrical systems, such as lighting, emergency backup systems (like generators), power distribution systems, and power supply for medical equipment. services pertaining to the upkeep of water supply systems, pipes, and fixtures in plumbing systems. This includes managing and treating the water to guarantee that it is safe and clean for the facility's many applications. The physical structure of the building, which consists of the walls, floors, ceilings, windows, doors, and roofing, must be maintained. To avoid structural problems and keep patients, employees, and visitors in a secure and comfortable environment, routine inspections and repairs are crucial. Upkeep and testing of fire detection, alarm, and suppression systems are necessary to guarantee adherence to safety protocols and safeguard inhabitants during a fire emergency.

The soft services section has been further classified as laundry, medical waste management, catering, cleaning and pest control, security, and other soft services including administrative services. In 2023, soft healthcare facility management services segment occupied majority of the market share compared to hard healthcare facility management services. However, the hard services segment is foreseen to develop at a sophisticated growth rate years to come.

The hospitals and clinics segment led the healthcare facilities management market with the largest share in 2024. Hospitals and clinics are typically larger and more complex facilities compared to other healthcare settings such as physician practices or outpatient centers. Managing these facilities requires a wide range of services including maintenance, housekeeping, security, catering, and more. Healthcare facilities are subject to stringent regulatory requirements to ensure patient safety and quality of care. Hospitals and clinics, being primary providers of healthcare services, must comply with a multitude of regulations and standards, which requires specialized expertise in facilities management.

Many players operational into this market provide variety of superior and value added healthcare facility management facilities such maintenance and warranty in order to upsurge customer base and preserve prevailing customers. Occasionally, healthcare facility management service providers experience few challenges associated to third-party suppliers. For occurrence, the quality of cleaning chemicals might not up to the standard or they might face labor problems.

Global healthcare facilities management market is competitive and fragmented in nature with presence of numerous dominant players. These companies are concentrating on offering modern technologies and economical services. The significant firms present in the market are also in the procedure of presenting cutting-edge products to recover treatment competence, in turn, seizing a higher share of the market. Some of the noteworthy players in the healthcare facilities management market include:

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2020 to 2033. This report includes market segmentation and its revenue estimation by classifying it on the basis of end-use and region as follows:

By Service Type

By End User

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

February 2025

May 2025

May 2025