January 2025

Blockchain AI Market (By Component: Platform, Services; By Technology: Machine Learning, Computer Vision, Natural Language Processing-NLP, Others; By Deployment: Cloud-based, On-premises; By Application: Smart Contracts, Logistics & Supply Chain Management, Payments & Settlements, Governance, Risk & Compliance Management; By Industry) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

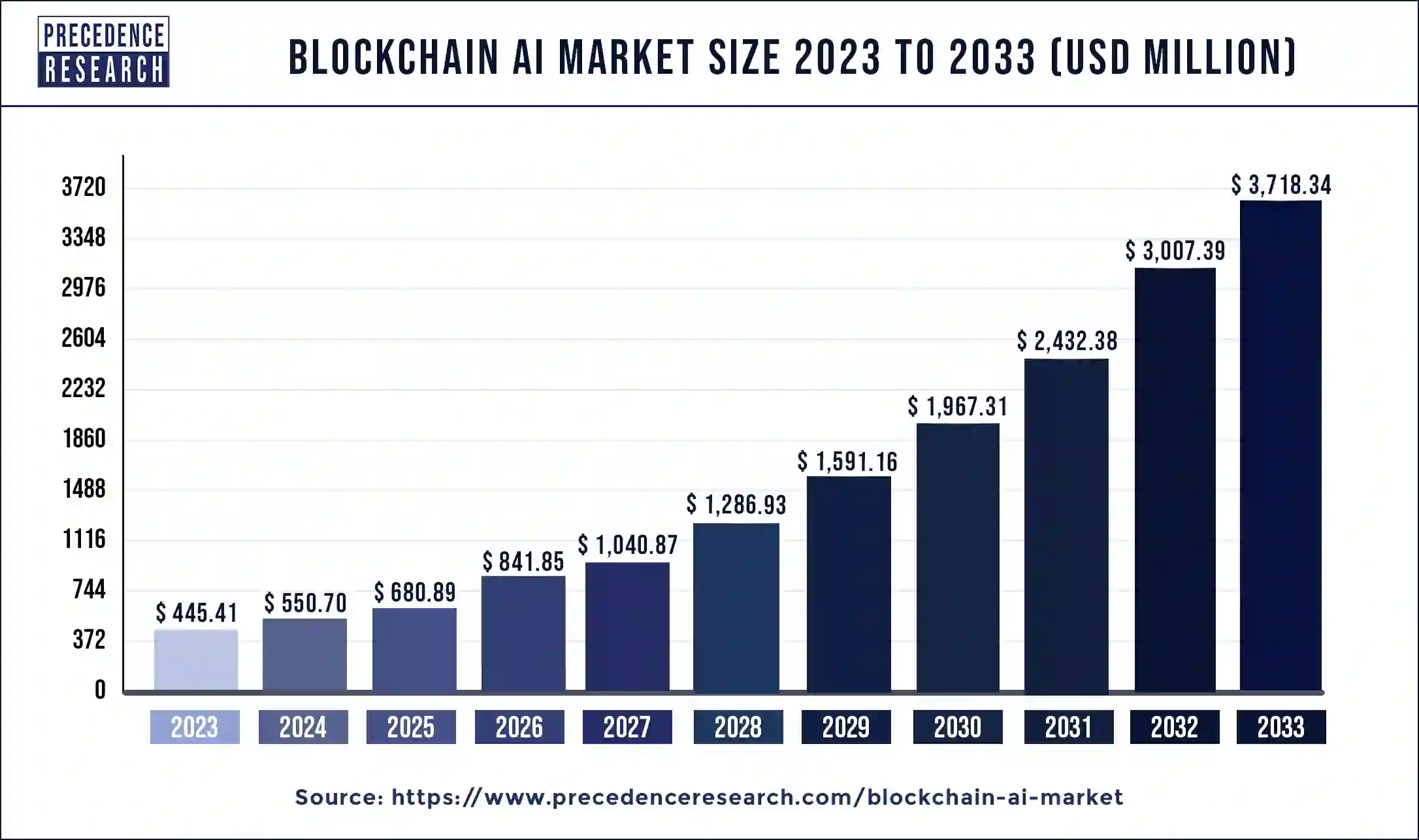

The global blockchain AI market size was USD 445.41 million in 2023, calculated at USD 550.70 million in 2024 and is expected to reach around USD 3,718.34 million by 2033. The market is expanding at a solid CAGR of 23.64% over the forecast period 2024 to 2033. An increasing amount of data generation pervades almost every sector, which needs to be analyzed precisely with advanced technology like AI and blockchain to provide a secure ledger system.

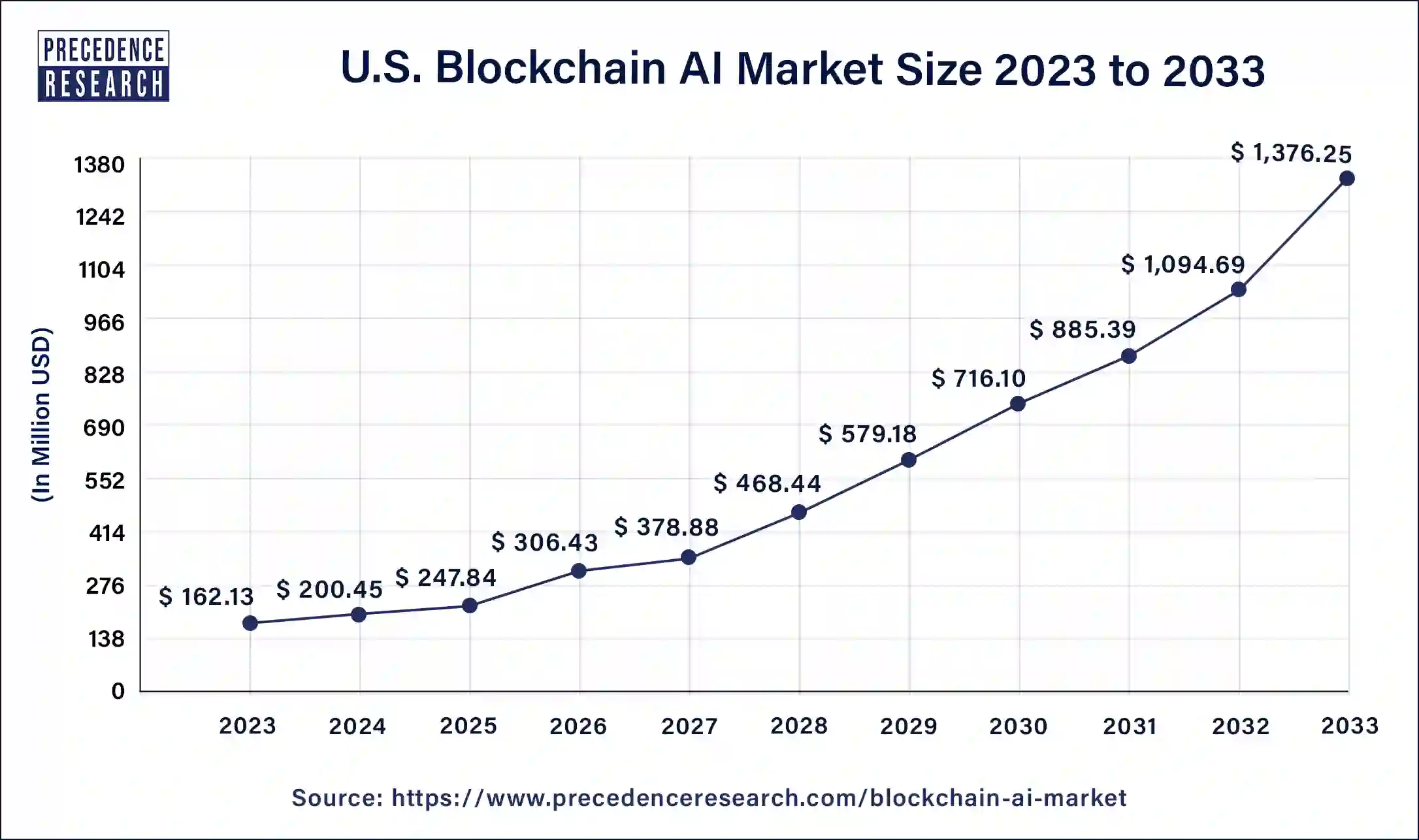

The U.S. blockchain AI market size was exhibited at USD 162.13 million in 2023 and is projected to be worth around USD 1,376.25 million by 2033, poised to grow at a CAGR of 23.84% from 2024 to 2033.

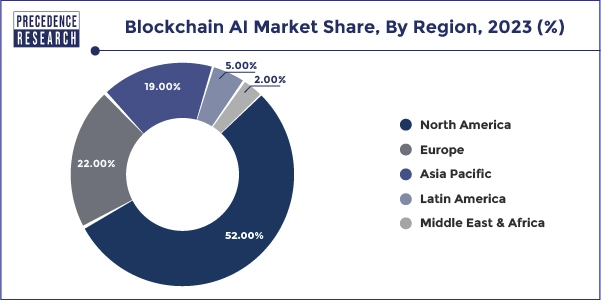

North America became a frontier in the global blockchain AI market in 2023, driven by substantial technological advancements and significant investments in research and development. The region hosts numerous leading tech companies and startups pioneering blockchain and AI integration, particularly in sectors like finance, healthcare, and supply chain management. Supportive government policies, robust infrastructure, and a high adoption rate of advanced technologies further bolster market growth. Additionally, North America's strong emphasis on data security and transparency aligns well with the benefits of blockchain AI solutions, ensuring continued leadership in this rapidly evolving market.

Asia Pacific is considered the fastest-growing blockchain AI market in the forecasted years due to several key factors. Firstly, the region is experiencing robust technological advancements and increased adoption of innovative technologies across various industries. Countries like China, India, and Japan are heavily investing in AI and blockchain research, fostering a dynamic ecosystem of startups and tech companies. Favorable government policies and initiatives promoting digital transformation and blockchain integration are accelerating market growth.

China's extensive blockchain development plans and India's push for digital innovation provide a conducive environment for expansion. The region's large population and expanding internet penetration create a vast market for blockchain AI applications, especially in sectors like finance, healthcare, and supply chain management. Collaboration between academic institutions, tech giants, and government bodies further drives research and practical implementation, positioning Asia-Pacific as a crucial hub for blockchain AI innovation and adoption.

Europe is expected to gain a significant share of the blockchain AI market in the upcoming years due to strong regulatory support and strategic investments in technology innovation. The European Union's proactive stance on data privacy and security fosters trust in blockchain applications. Additionally, the region's robust tech ecosystem, with numerous startups and collaborations between academia and industry, accelerates development. Sectors such as finance, healthcare, and logistics particularly benefit from blockchain AI integration, driving significant market expansion.

The blockchain AI market is rapidly evolving due to the influence of its secure and decentralized technology and advanced data processing capabilities provided by AI with blockchain. The market has a considerable expansion rate due to rising demand for efficient data handling, data transparency, and security. Key applications for the market are supply-chain management, healthcare domain, BFSI, fraud detection methods, etc. Major tech companies are investing heavily in the development and research to enhance the functionalities of blockchain AI technology and integrate AI algorithms into the blockchain.

Based on a regional perspective, North America currently dominates the blockchain AI technology market, while Asia Pacific shows the highest growth rate owing to technological advancements and supportive regulatory backup. Despite the number of benefits, the blockchain AI market is challenged by some hurdles, like the need for a highly skilled workforce and limitations in scalability. However, as the technology grows and matures with time, these hurdles will be mitigated. Thus, the market presents a promising future and the potential to transform several industries.

| Report Coverage | Details |

| Market Size by 2033 | USD 3,718.34 Million |

| Market Size in 2023 | USD 445.41 Million |

| Market Size in 2024 | USD 550.7 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 23.64% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Technology, Deployment, Application, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Immutable ledger system by blockchain

The primary driver for the blockchain AI market is the highly secure and immutable ledger system offered by blockchain, which further provides decentralization data that aids in reliable transactions and reduces data privacy concerns. Blockchain AI systems can be deployable in major industries like automation, healthcare, electronics and services, banking, fiancé, etc., due to their data integrity to avoid financial loss and, thereby, the reputation of firms or institutes.

When AI is combined with blockchain, which excels at analysing and processing vast amount of data, it holds potential to create more efficient and secure system is substantial. Moreover, the integration of blockchain and AI can enhance the functionalities of smart contracts and decentralized applications to foster innovations and new business models, which again propels the blockchain AI market.

Scalability and performance

A major setback for the blockchain AI market is the issue of scalability and performance limitations. These limitations become more pronounced when combined with AI applications, which require substantial computational power and real-time data processing capabilities. Executing complex AI algorithms on a blockchain can lead to network congestion, delayed processing times, and increased operational costs. This scalability issue hampers the seamless integration and efficiency of AI functionalities, limiting their potential to handle large-scale, real-world applications.

Blockchain networks, particularly public ones like Ethereum and Bitcoin, often suffer from slow transaction speeds and high processing costs as they scale. Interoperability between different blockchain platforms remains a challenge, further complicating the integration of AI across diverse systems. As AI and blockchain technologies evolve, ensuring they can operate efficiently together at scale is critical. Without significant advancements in blockchain scalability and performance, the widespread adoption and effectiveness of blockchain AI solutions could be severely limiting their impact across industries.

Decentralized finance sector

One significant future opportunity for the blockchain AI market lies in the financial services sector, particularly in enhancing decentralized finance. It leverages blockchain technology to create open, transparent, and reliable financial systems without intermediaries. Integrating AI into Decentralized finance can further revolutionize this space by improving risk assessment, fraud detection, and automated decision-making. AI algorithms can analyze vast amounts of financial data to identify patterns, predict market trends, and optimize investment strategies, providing more sophisticated and personalized financial services.

AI-driven smart contracts could automatically adjust lending rates based on real-time market conditions or perform real-time credit scoring for loan approvals, enhancing the efficiency of the platforms. Furthermore, AI can enhance security measures by detecting and mitigating fraudulent activities on blockchain networks, thus building greater trust among users. By combining AI's data processing capabilities with blockchain's transparency and security, this integration can drive the next wave of innovation in financial services, making them more accessible, efficient, and secure.

The platform segment held the largest share of the global blockchain AI market in 2023 because it provides essential infrastructure and tools for developing, deploying, and managing blockchain-based AI applications. These platforms offer scalable, customizable solutions that streamline integration and foster innovation. By enabling easier implementation and reducing development costs, platforms attract widespread adoption across various industries, driving their market leadership.

The service segment is anticipated to reach the highest growth rate in the blockchain AI market during the upcoming period. The service segment is fast-growing due to increasing demand for expert consulting, integration, and maintenance of blockchain AI solutions. Businesses seek specialized services to effectively implement and manage these complex technologies, driving rapid expansion in this market segment.

The machine learning segment was estimated to showcase the largest share of the blockchain AI market in 2023. The machine learning (ML) segment dominates the blockchain AI market as ML algorithms excel at analyzing vast datasets, identifying patterns, and making predictions, which are crucial for optimizing blockchain operations. Integrating ML enhances functionalities like fraud detection, smart contract execution, and data management. The synergy between ML's analytical power and blockchain's security and transparency drives widespread adoption across industries, solidifying ML's dominant position.

The NLP segment is expected to grow significantly in the blockchain AI market over the forecast period. The natural language processing (NLP) segment is fast growing due to its ability to enable more intuitive human-computer interactions and analyze unstructured text data. As businesses increasingly adopt AI for customer service, sentiment analysis, and content generation, the demand for NLP solutions rises, driving rapid market expansion.

The cloud-based segment held the largest share of the blockchain AI market in 2023 and is expected to continue its dominance during the foreseeable future period due to its scalability, flexibility, and cost-effectiveness. Cloud deployment allows businesses to access powerful AI and blockchain tools without substantial upfront investments in infrastructure. It also facilitates easier updates, maintenance, and integration of advanced features. Additionally, cloud services offer enhanced collaboration capabilities and remote access, enabling companies to efficiently manage and deploy their blockchain AI solutions, thus driving widespread adoption and market leadership.

The on-premises segment is likely to foster in the global blockchain AI market over the forecast period. The on-premises segment is growing due to heightened concerns about data security and regulatory compliance. Businesses prefer on-premises solutions to maintain direct control over sensitive data, ensuring privacy and meeting stringent regulatory requirements, particularly in industries like finance and healthcare.

The logistics & supply chain management segment dominated the blockchain AI market globally. Blockchain technology ensures immutable records of transactions and product movements, reducing fraud and errors. AI complements this by optimizing logistics, predicting demand, and improving inventory management. These combined capabilities address longstanding challenges in supply chain operations, making this application area highly attractive and driving its leadership in the market.

The payments & settlements segment is expected to witness significant growth in the blockchain AI market in the upcoming years. This segment is fast-growing due to increasing demand for secure, transparent, and efficient financial transactions. Blockchain AI solutions offer faster and more reliable payment processing, reducing costs and mitigating the risks of fraud. This application is particularly appealing in the finance and banking sectors, driving rapid adoption and market expansion.

The BFSI segment accounted for a significant revenue share of the blockchain AI market in 2023. The BFSI (Banking, financial services, and insurance) segment dominates the blockchain AI market due to its stringent security requirements, complex transactions, and regulatory compliance needs. Blockchain AI enhances security, transparency, and operational efficiency in financial transactions, while AI algorithms optimize risk management and customer service. These capabilities are pivotal in modernizing financial services and driving extensive adoption of blockchain AI solutions within the BFSI industry.

The retail & consumer goods segment is projected to showcase the highest CAGR in the blockchain AI market during the studied period. The retail and consumer goods segment is fast-growing in the market due to its potential to enhance supply chain transparency, streamline inventory management, and improve customer experience. Blockchain's ability to verify product authenticity and AI's insights into consumer behaviors drive efficiency and innovation in this sector.

Segments Covered in the Report

By Component

By Technology

By Deployment

By Application

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

November 2024

December 2024