What is the Blockchain In Healthcare Market Size?

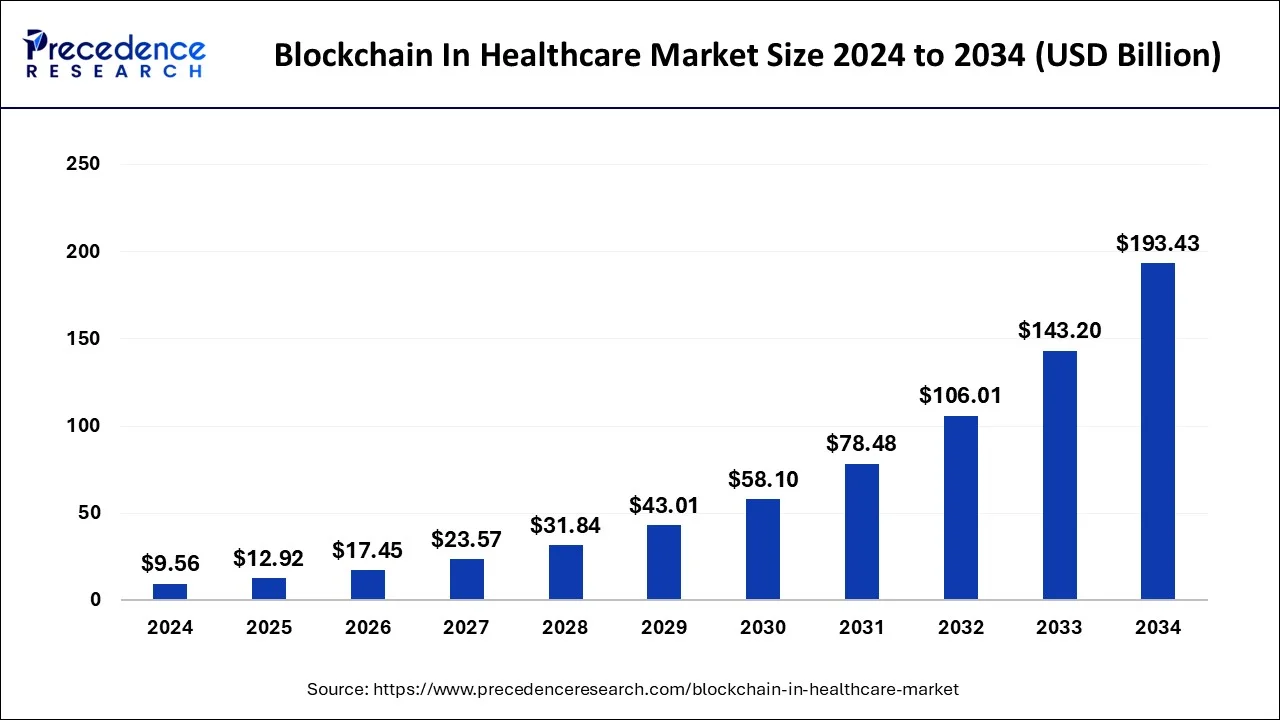

The global blockchain in healthcare market size was accounted for USD 12.92 billion in 2025 and is anticipated to reach around USD 234.97 billion by 2035, growing at a CAGR of 33.65% from 2026 to 2035. The rising adoption of the digitization across the healthcare industry and the demand for the efficient medical data storage system or technology is driving the growth of the market.

Blockchain In Healthcare Market Key Takeaways

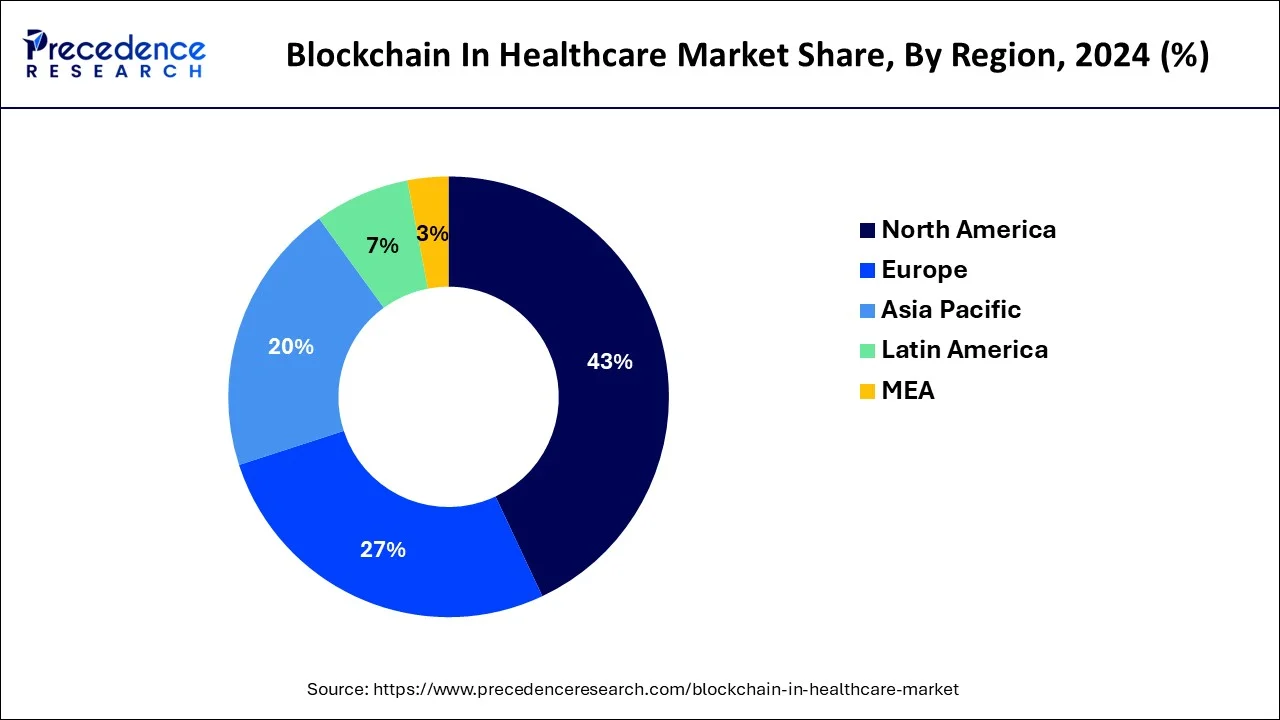

- North America dominated the blockchain in healthcare market with revenue share of 43% in 2025.

- Asia Pacific expects significant growth in the market during the forecast period.

- By network type, the public segment dominated the market in 2025.

- By network type, the private segment expects significant growth in the blockchain in healthcare market during the forecast period.

- By application, the supply chain management segment led the market in 2025.

- By application, the data exchange and interoperability segment accounted for the substantial growth in the market during the predicted period.

- By end-user, the pharmaceutical & medical device companies segment accounted largest share in 2025.

- By end-user, the healthcare payers segment expecting a significant growth in the market during the forecast period.

What is the Blockchain In Healthcare?

The blockchain is one of the efficient technology that used in the healthcare industry in the wide range of applications including clinical trial, enhancing safety, patient monitoring, display information and transparency. Blockchain in healthcare effectively manages the financial and clinical data of patient and reduce the cost and time of the data storage and transformation. The blockchain is used to do complex coding for every individuals medical data to prevent sensitive information and data leakage. The increasing automation and digitization across the healthcare sector for increasing the operational output is driving the growth of the market.

How Can AI Impact the Blockchain in Healthcare Market?

The integration of AI into healthcare is revolutionalize the overall healthcare applications. The AI and blockchain are one of the revolutionary technologies which are associated with the healthcare industry. while the blockchain used to store and manage all the clinical or healthcare data and the integrated AI technology enhance the decision making process for analysis of large quantity of data. The integration of AI into the healthcare enhance the efficiency of the healthcare applications.

For Instance,

- In September 2024, XRP Healthcare launched the XRPH AI Chatbot, an efficient tool that made to provide personalized healthcare advice based on users requirement. It is the significant step towards the integration of AI and blockchain into its operations

Blockchain In Healthcare Market Growth Factors

- Rising healthcare sector: The rapid growth in the healthcare sector across the world owing to the rising population, increasing demand, prevalence of the chronic illness, geriatric population, environmental disease, and others that created the large number of clinical data that drives the demand for the market.

- Technological association: The technological integration in the healthcare application, the modernization of industry for improving the operational efficiency, result outcomes, and transparency, and the demand for the clinical data security is driving the growth of the market.

- Government interventions: The increasing government interventions in the development of the healthcare sector with the heavy investment on infrastructural and technological development and continuous R&D activities in the healthcare technologies are driving the growth of the blockchain in healthcare market.

Market Outlook

- Industry Growth Overview: Blockchain in healthcare is now a central enterprise infrastructure, which makes it interoperable, automated, and trusted to share data.

- Sustainability Trends: Sustainable sources and social responsibility with the blockchain network contribute to its alignment with the changing environmental requirements.

- Global Expansion: Europe moves forward with compliance-based innovation, privacy leadership, and developed regional blockchain ecosystems.

- Major investors: Andreessen Horowitz, Paradigm, Coinbase Ventures, SoftBank Vision Fund, Galaxy Digital support infrastructure-driven innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.92 Billion |

| Market Size by 2035 | USD 234.97 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 33.65% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | North America |

| Segments Covered | By Network Type, By Application, By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Driver

The integration of blockchain helps in enhancing healthcare operations

The adaptation of technologies into the healthcare operations or applications for enhancing its efficiency is driving the growth of the market. blockchain is uses in the wide range of healthcare applications such as patient data management, store clinical trail, pharmaceutical supply chain, telemedicine and remote monitoring, interoperable health data exchange, healthcare payments, and tracking doctors and health workers credentials. The blockchain enhance the cost efficiency, increase data security, enhance transparency, and efficient claim processing that enhance overall profitability and growth of the healthcare industry.

Restraint

High cost

The high cost associated with the use of this technology in the healthcare sector is the major factor hampering the market growth. This high cost is due to various factors such as regulatory complexities, development expenses, and the requirement for specialized expertise. However, blockchain's encrypted and decentralized nature is convenient for healthcare data security, but securing data requires extensive investment, which can be challenging.

Opportunity

Enhancing investment in healthcare technologies

The growing healthcare industry owing to the increasing prevalence of the chronic disease in the population and the demand for the technological integration in clinical application is driving the larger investment by the stakeholders or the government agencies. Furthermore, the rising research and development program in the technological advancements and emerging healthcare technologies are emerging as the potential opportunity for the market.

- In March 2025, OmegaX Health, a groundbreaking AI-powered healthcare ecosystem, redefined the future of medicine by combining artificial intelligence and blockchain technology. Following a highly successful launch on Solana, OmegaX Health expanded to Binance Smart Chain (BSC) in March 2025.

Segment Insights

Network Type Insights

The public segment dominated the blockchain in healthcare market in 2025. The rising deployment of the public blockchain in healthcare owing to its transparency and these type of network allows access information such as supply chain management, patient records, medical data to all the participants. The increasing demand for the healthcare data security, enhance transparency and traceabilty, efficient supply chain management is driving the demand for the public network blockchain technology in healthcare.

The private segment expects significant growth in the market during the forecast period. the increasing adoption of the private network due to its enhance safety features and properties that makes its ideal for preventing the sensitive clinical information of patients. The private blockchain limits the accessibility of the authorized participants only. These network restraint the data breaches and unauthorized access. Private blockchain also benefits in the applications like immutable and auditable records, secure data sharing, consent management, smart contracts for compliance automation, and data integrity and non-repudiation.

Application Insights

The supply chain management segment led the blockchain in healthcare market in 2025. The blockchain technology is efficiently helps in managing all the information in the healthcare supply chain by increasing interoperability, security, and data integrity. In the supply chain management application blockchain provides the continuous audit to timely actions. It enables real-time availability for the better communication.

The data exchange and interoperability segment accounted for the substantial growth in the blockchain in healthcare market during the predicted period. the increasing use of blockchain in the healthcare data and exchange due to its seamless transfer of assets and data. The blockchain interoperability is used to interact of connect different blockchain systems, conduct transaction, and share information with one another in healthcare. It provides the several benefits to the such as enhance functionality, flexibility, and increase the adaptation of blockchain technology.

End-User Insights

The pharmaceutical & medical device companies segment accounted for the largest share in 2025. The adaptation of the blockchain into the pharmaceutical industry aims to increase transparency and traceability within industry. The integration of blockchain into the pharmaceutical industry is transforming the supply chain management, patient safety, and data integrity. It improves the quality management of the clinical data with association with different features such as decentralization, immutability, smart contracts, transparency, traceability, and data security. The blockchain enhance the transparency and traceability in operations which enhance patient safety, counterfeit drug mitigation, regularity compliance, data integrity, and quality assurance.

For Instance,

- IBM's Drug Supply Chain Application partnered with the global pharmaceutical companies, in which the IBM's blockchain offers transparency and visibility over the drug supply chain. There real time tracking provides the quality standards assurance, maintain the risk associated with the substandard products, and stands for recall when required. The collaboration enhance the regularity compliance and patient safety.

The healthcare payers segment expecting a significant growth in the blockchain in healthcare market during the forecast period. The healthcare payers includes the different agencies or institutes such as government agencies, and insaurance companies. There are the large number of healthcare payers are adopting the blockchain technology for enhancing trasperancy, maintaining operations, and minimize the risk of fraud. The rising investment in the latest technologies by the leading healthcare payers and the digitization and automation across the healthcare operations are driving the expansion of the blockchain technology in healthcare industry.

Regional Insights

What is the U.S. Blockchain In Healthcare Market Size?

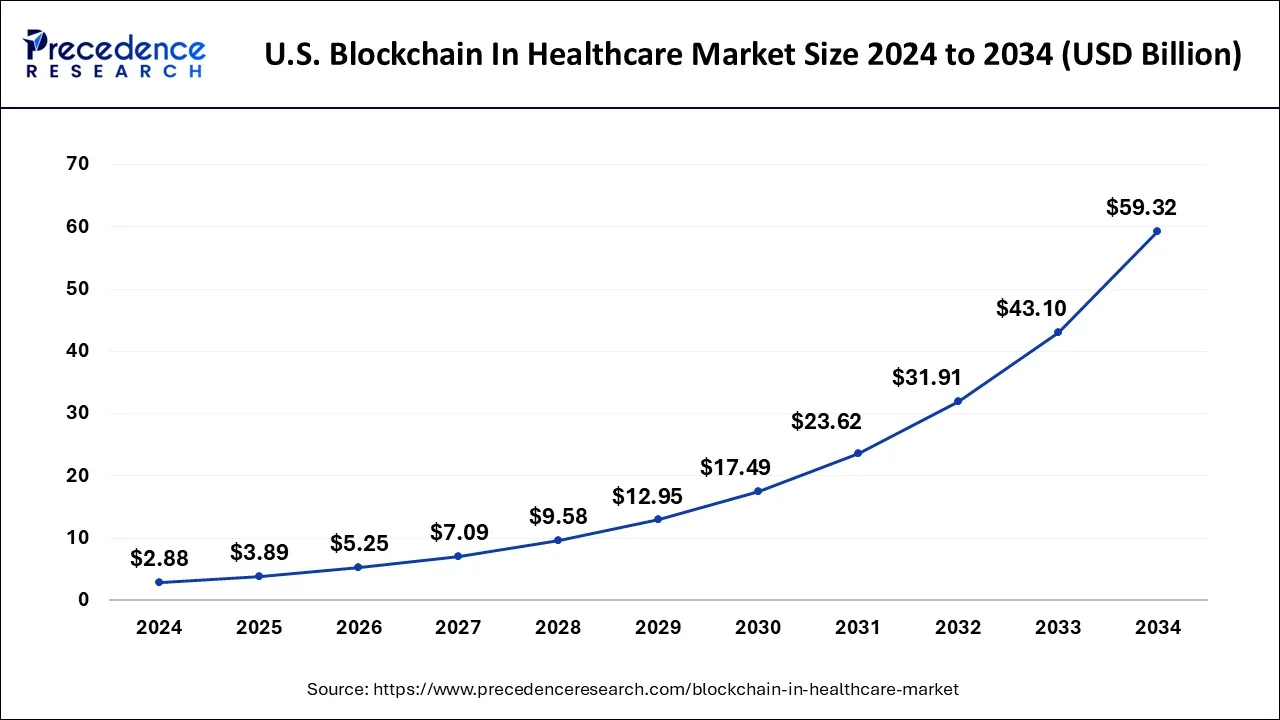

The U.S. blockchain in healthcare market size was evaluated at USD 3.89 billion in 2025 and is predicted to be worth around USD 72.19 billion by 2035, rising at a CAGR of 33.92% from 2026 to 2035.

North America dominated the blockchain in healthcare market with revenue share of 43% in 2025. The growth of the market is attributed to the regional countries are the early adopter of technologies in every field of industries. The increasing evaluation of the healthcare sector and the integration of modernization with technological association such as blockchain, automation, artificial intelligence, and other for improving the overall operational efficiency of the industry is driving the growth of the market. Additionally, the rising investment on the technological development and the continuous research and development program on the expanding healthcare efficiencies are collectively driving the growth of the blockchain in healthcare market in the region.

U.S. Blockchain In Healthcare Market Trends

Institutional involvement and the growing acceptance of digital assets are high in the U.S. The use of blockchains promotes the digitization of assets, smart automation, and the modernization of payments. Openness in regulating enhances confidence. Intersection with AI enhances decentralized systems, enterprise platforms, and conforming financial infrastructure.

For Instance,

- In March 2025, Circular Protocol, Arculus by CompoSecure, and IT Lab announced plans to launch a blockchain-compliant ecosystem for healthcare providers in the U.S. market in the second quarter. The companies' solution will integrate into clinical networks and serve as the secure passkey for recording, managing, and safeguarding healthcare data.

- In 2022, there are 58.5% of the U.S. adults internet or technologies to look for medical and health information.

Europe held a notable share in the market in 2024. The European countries are one of the significant contributors on the expansion of the healthcare technologies. The region is widely accepted the blockchain in healthcare for maintaining and managing the data storage and supply with the transparency and traceability which contribute in the growth of the blockchain in healthcare market in the region.

Germany Blockchain In Healthcare Market Trends

Germany is oriented towards regulatory clarity, innovation guided by compliance, and a trusted digital infrastructure. Blockchain aids in government administration, identity, and traceability in the enterprise. Sustainability influences the protocols. Privacy protection and alignment of governance promote usage in wider industries and cross-border digital ecosystems.

Asia Pacific expects significant growth in the market during the forecast period. The growth of the market is attributed due the continuous rise in the population and the demand for the healthcare sector with more efficiency and transparency is driving the demand for the blockchain into the healthcare sector. The increasing investment by the leading market players and the government agencies on the expansion of healthcare sector with integrating smart technologies are accelerating the growth of the blockchain in healthcare market across the region.

China Blockchain in Healthcare Market Trends

China focuses on the utilization and regulation of innovation as well as blockchain, which is state-aligned. Adoption is based on government services, supply chain, and coordination of the enterprise. AI integration enhances information control and audit. The emphasis is placed on permissioned networks in the pursuit of transparency, efficiency, and national-level digital infrastructure goals.

For Instance,

- The Healthcare industry in India is growing with the rapid pace with reached value of US$372 billion driven by both the private sector and the government in 2023.

- The telemedicine market is anticipated to reach about US$ 5.4 billion by 2025 due to the rising demand for the technological advancements and remote healthcare solutions.

- The e-health market size is expected to reach US$ 10.6 billion by 2025

Value Chain Analysis of the Blockchain In Healthcare Market

- R&D: R&D applies blockchain to protect intellectual property and present verifiable research information on genomics.

Key Players: MELLODDY Consortium, Owkin, Iktos, NVIDIA - Clinical Trials and Regulatory Approvals: Blockchain is used in clinical trials to record an immutable trial record and regulatory validation through a transparent mechanism.

Key players: PharmaLedger, FarmaTrust, Triall, Embleema - Formulation and Final Dosage Preparation: Blockchain can be used to monitor the sources of ingredients, proportions, and integrity of formulations throughout pharmaceutical production processes.

Key players: SAP, Chronicled (MediLedger), Pfizer, Amgen - Packaging and Serialization: Decentralized ledger verifies unique identifiers, which guarantees authenticity and minimizes the risk of counterfeiting.

Key players: Chronicled, Modum, Tracelink, Merck - Hospitals and Pharmacies Distribution: Blockchain allows real-time visibility of the logistics and traceability, along with cold-chain monitoring.

Key players: StaTwig (VaccineLedger), LedgerDomain, Cardinal Health

Blockchain in Healthcare Market

- IBM: IBM is offering enterprise blockchain systems that boost transparency, traceability, and safe partnership in intricate international supply chains.

- iSolve, LLC: iSolve has developed advanced digital ledger solutions designed aimed at healthcare data integrity, provenance, and trusted pharmaceutical supply chains.

- Guardtime: Guardtime provides cryptography on scales of integrity systems that utilize blockchain based system securing large-scale data and decentralized trust models.

Other Major Key Players

- Oracle

- Solve. Care

- BurstIQ

- Change Healthcare

- Blockpharma

- Medicalchain SA

Latest Announcement by Industry Leaders

- In December 2024, IBM and Illinois Governor JB Pritzker announced the strategic partnership to introduce the new National Quantum Algorithm Center in Chicago's Illinois Quantum and Microelectronics Park (IQMP).

- In July 2024, Oracle was named as the leading platform in the three reliable analyst reports: the 2024 Gartner Magic Quadrant™ for Supply Chain Planning Solutions, the 2024 Gartner Magic Quadrant™ for Transportation Management Systems, and the 2024 Gartner Magic Quadrant™ for Warehouse Management Systems.

Recent Developments

-

In March 2025, China opened the world's first AI hospital equipped with 14 artificial intelligence doctors, marking a significant milestone in healthcare technology. This development is likely to boost interest in healthcare-related blockchain and AI crypto projects, as traders may anticipate increased adoption of decentralized medical data solutions and tokenized AI healthcare platforms.

-

In April 2025, ChatGPT Edu will be available to every medical and graduate student at Icahn Mount Sinai. This development signals increased adoption of advanced AI tools in the healthcare and education sectors, which could accelerate blockchain integration for secure data management and compliance in medical research. This development, while primarily focused on educational applications, has potential effects on the cryptocurrency markets.

-

In October 2023,Solve. Care collaborated with Binance to expand the integration of cryptocurrency in the healthcare sector. The connection broadens the applications for cryptocurrencies, which makes it easier and more convenient to use them to pay for healthcare services.

- In July 2024, Algorand Foundation's India initiative, ‘AlgoBhara' developing the digital health passport in partnering with Lok Swasthya SEWA. The company signed the Memorandum of Understanding (MoU) providing blockchain-based solution to users with secure and immutable record of their verified credentials.

- In November 2024, The Ethiopia Food and Drug Authority (EFDA) comes into the partnership with the Medical Value Chain (MVC) for the implementation of revolutionary blockchain-enabled pharmaceutical track-and-trace system across Ethiopia.

Segments Covered in the Report

Network Type Insights

- Public

- Private

- Consortium

- Fully private

Application Insights

- Supply Chain Management

- Data Exchange & Interoperability

- Claims Adjudication & Billing

- Others

End-User Insights

- Pharmaceutical & Medical Device Companies

- Healthcare Payers

- Healthcare Providers

- Other

Regional Insights

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting