April 2025

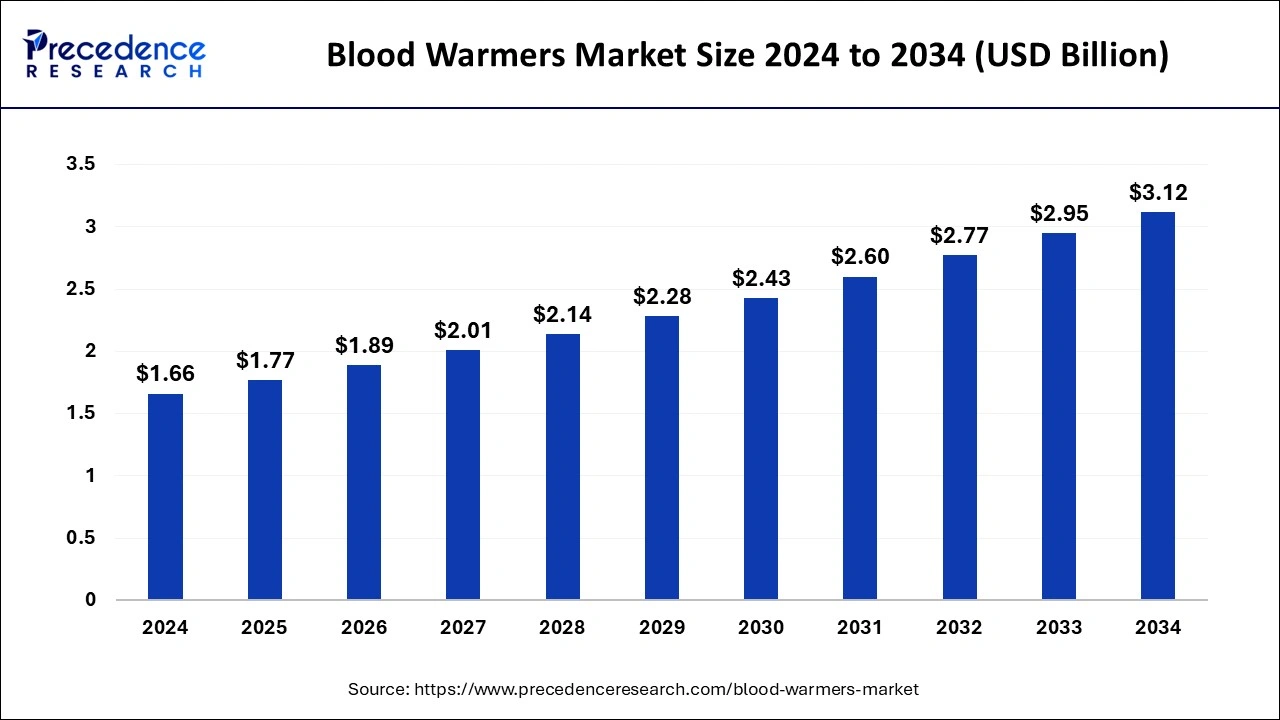

The global blood warmers market size is calculated at USD 1.77 billion in 2025 and is forecasted to reach around USD 3.12 billion by 2034, accelerating at a CAGR of 6.51% from 2025 to 2034. The North America blood warmers market size surpassed USD 700 million in 2024 and is expanding at a CAGR of 5.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global blood warmers market size was estimated at USD 1.66 billion in 2024 and is predicted to increase from USD 1.77 billion in 2025 to approximately USD 3.12 billion by 2034, expanding at a CAGR of 6.51% from 2025 to 2034.

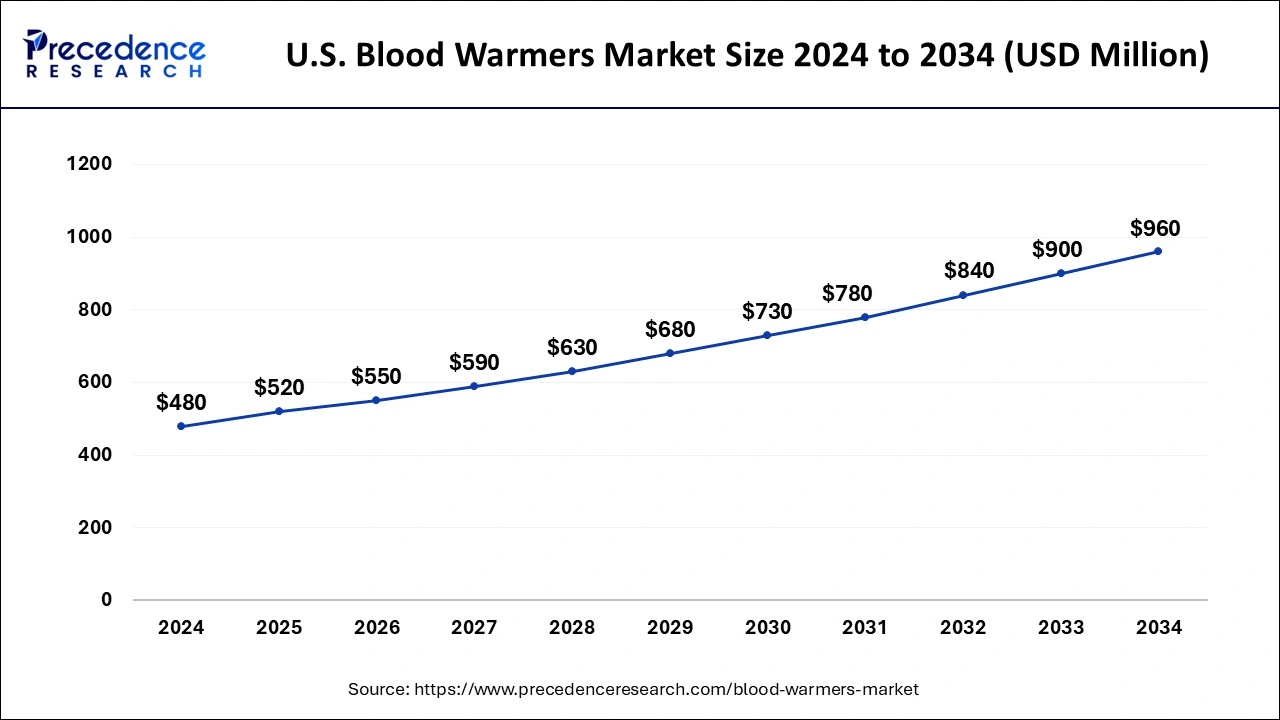

The U.S. blood warmers market size was estimated at USD 480 million in 2024 and is predicted to be worth around USD 960 million by 2034, at a CAGR of 7.18% from 2025 to 2034.

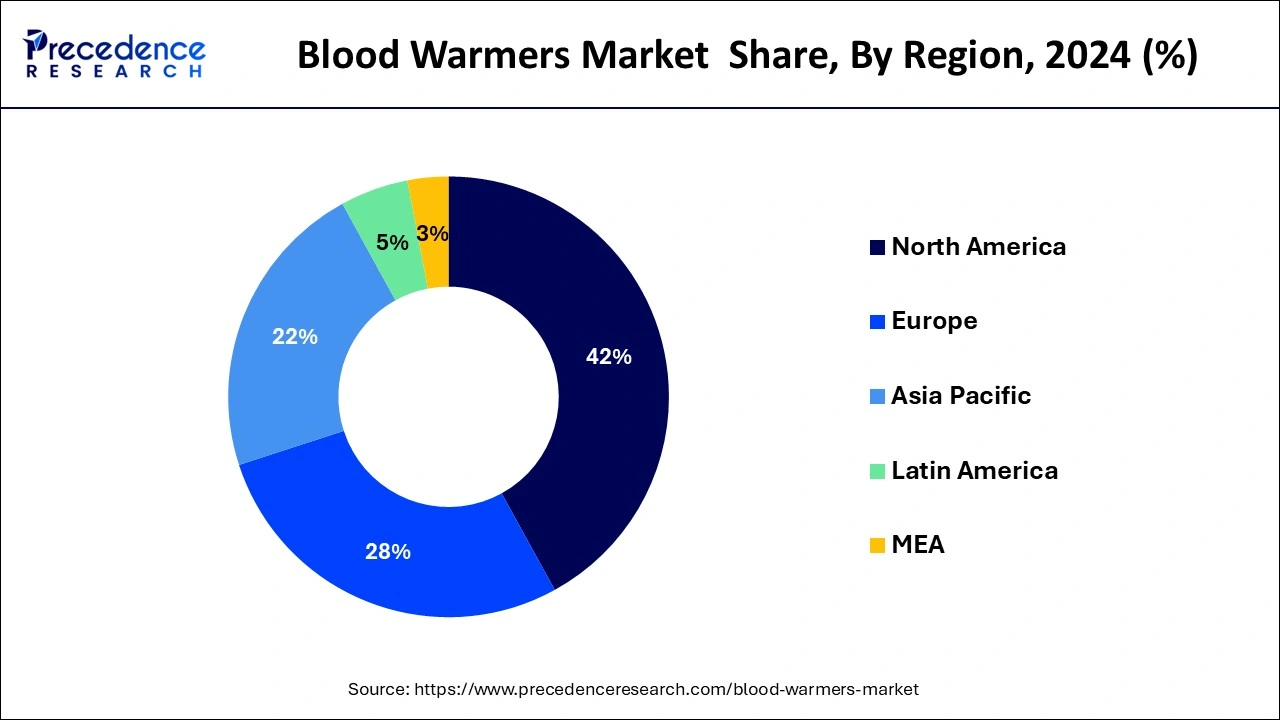

North America controlled the market in 2024 and provided 42% of total revenue. The industry is growing in the region as a result of the presence of significant businesses, significant government investments in the development of cutting-edge medical equipment, and favourable reimbursement conditions.

The increased expenditure in the defence sector and emergency search and rescue services has also raised the demand for blood warmers. Because of its geographic location, this area experiences icy weather patterns that leave it susceptible to hurricanes, blizzards, and heavy snowfall. Many fatalities attributable to extreme snow/frost-related events are predicted to drive the regional economy. As a result, North America will control the entire regional market over the projection period.

Nonetheless, during the expected ten years, the market in Asia Pacific is predicted to see the highest CAGR. Due to the large patient base and the region's growing demand for technologically advanced and reasonably priced healthcare solutions, the industry is predicted to have enormous growth potential. Also, due to the region's aging population and the rising prevalence of chronic diseases, it is projected that the demand for blood warmers in the Asia Pacific would rise in the coming years.

According to the WHO report Non-Communicable Diseases Burden in the South-East Asia Area, non-communicable illnesses are to blame for all mortality in this area. Also, the growing number of surgeries in the Asia Pacific region as a result of the region's higher population and rising prevalence of accidental accidents are significant market drivers.

Patients shiver and feel uncomfortable as a result of receiving cold blood and fluids. Patients can get warm blood and liquids by using more warm blood, enhancing their comfort and overall experience. Blood arteries can narrow due to cold, restricting blood flow to the organs and tissues. Blood warmer can treat patients with cardiovascular disease by warming their blood and bodily fluids, which can help increase blood flow and oxygenation.

Hypothermia is a disorder that can be brought on by a number of things, including exposure to cold weather, medical conditions, physical trauma, advancing age, and surgical issues. Amnesia, loss of fine motor abilities, and confusion are the effects of acute hypothermia. Blood warmers are devices that lessen the risks associated with blood transfusions. In sample warmer markets during the predicted period, this is the main driver of demand.

To reduce the danger of hypothermia and treat hypothermia, various devices are utilized to warm the blood. Hypothermia frequently causes abnormalities in the heart, neurological system, and respiratory system. Even in extreme circumstances, it may result in total cardiac or respiratory failure. Blood warmers are therefore required for this aspect, and it is projected that the market for blood warmer devices will grow during the forecast period.

As cold liquids slow down the immune response, they can make you more susceptible to illness. A blood warmer can help lower the risk of sickness and strengthen the body's defenses against bacteria and viruses by warming the blood and other fluids. The temperature of the blood and fluids given to patients can drop quickly in colder climates, resulting in hypothermia. By maintaining the blood and fluids at a safe temperature, blood warmer can assist in preventing hypothermia.

The growth of the elderly and newborn populations, rise in surgeries, and rise in trauma cases are the drivers driving the blood warmer industry. Some people may experience negative effects from cold blood, such as hemolysis that results in kidney failure. The likelihood of transfusion responses can be decreased by warming the blood. According to the Lancet Commission prediction, around 5,000 surgeries are needed to meet the surgical burden of 1,00,000 populations in countries like India, which invest low financial aid.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.77 Billion |

| Market Size by 2034 | USD 3.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.51% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Warm fluids can boost blood flow, which can lessen tissue oxygenation and hasten healing, thus patients who receive them may recover more quickly than those who receive cold fluids. According to a report released by the Health and Social Care Information Center and Hospital Episode Statistics (HES), the detection incidence of hypothermia in the UK has significantly increased from 2005 to 2014. As a result, the need for blood warmer devices and sample warmers is expected to increase in the future years.

The improvement of patients by lowering the risk of complications connected with the administration of cold fluids, which can result in complications like arrhythmias, coagulopathy, and decreased tissue oxygenation, across the globe, is another factor influencing the increase in demand for blood warmer devices. Faster recovery times and better patient outcomes are two other factors boosting the blood warmer market's expansion.

In 2024, the non-portable blood-IV fluid warmers market held a major share of around 56%. The increase in traffic accidents, mishaps, gunshot wounds, and other injuries is expected to boost category growth. Together with these factors, the market expansion is anticipated to be aided by the growing older population, rising hospitalization rates due to a variety of medical disorders, and improved finance for emerging countries' healthcare infrastructure.

The most crucial prerequisites for IV fluids or blood transfusion infusions also include hospital stays and surgical operations. The segment is expanding because blood warmers have traditionally proved essential in lowering mortality among citizens of industrialized countries from hypothermia brought on by transfusion or infusion.

The portable blood/IV warmers market, however, is predicted to grow at the greatest CAGR between 2025 and 2034. The demand for portable devices will remain larger than for non-portable devices in the future years. The market is dominated by the ambulatory/paramedic services, rescue teams, and defence industries.

The category is also predicted to grow as a result of increased demand from remote clinics and emergency rooms. Moreover, the volume demand for portable blood/IV warmers is still slightly higher than that for blood/IV warmers that are stationary. The paramedical and ambulatory services, the military, and rescue teams all need the most portable IV warmers. Outlying clinics and emergency rooms are also predicted to have a greater requirement for portable blood-IV warmers.

The hospitals/clinics category led the market and generated more than 66% of revenue share in 2024. As more individuals across the world undergo surgical operations, the demand for blood warmers has increased. In order to prevent hypothermia while a patient is on the operating table, these tools assist surgeons in maintaining a patient's body temperature within normal ranges. Blood warming machines are often employed in hospitals because they are more cost-effective and easier to use, and they can heat a larger volume of blood or IV fluids.

Also, firms are working hard to develop hemodialysis machines that can be altered with a variety of treatments, which is anticipated to affect the end-user experience. Hospitals are regarded as major buyers for another reason: the fact that they have long-term contracts with suppliers of blood-IV warming equipment gives them more negotiating strength and broadens their market for product after-sales services.

A higher CAGR is projected for the ambulatory services segment during the projection period. Government organizations are ordering blood warmers in a lot of nations in order to supply appropriate care in emergency scenarios, which is anticipated to prompt segment expansion shortly. For instance, in March 2021, the medical technology company MEQU received a request for portable blood warmers from the Norwegian National Air Ambulance Services. Emergency circumstances are frequently handled by air ambulance services. Before administering any therapies to the patient, they should all be warmed up. As a result, ambulance services offer blood warmers to make this procedure simpler. These programmes need to boost market demand.

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024