January 2025

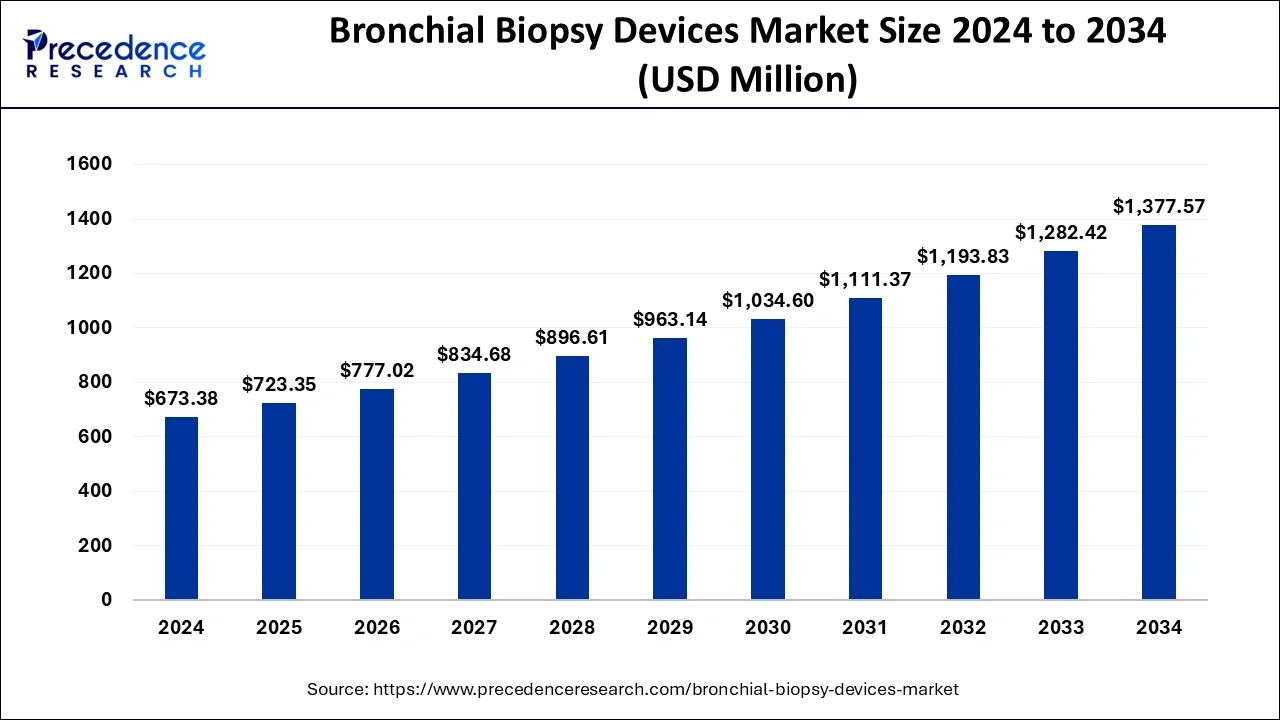

The global bronchial biopsy devices market size was accounted for USD 673.38 million in 2024, grew to USD 723.35 million in 2025 and is projected to surpass around USD 1,377.57 million by 2034, representing a CAGR of 7.42% between 2025 and 2034. The North America bronchial biopsy devices market size is calculated at USD 276.09 million in 2024 and is expected to grow at a CAGR of 7.55% during the forecast year.

The global bronchial biopsy devices market size was calculated at USD 673.38 million in 2024 and is predicted to reach around USD 1,377.57 million by 2034, expanding at a CAGR of 7.42% from 2025 to 2034. The bronchial biopsy devices market is growing because of the rising incidence of respiratory illnesses and lung cancer, as well as improved technologies, an increasing number of elderly, and growing awareness of people towards health, which also contributes to growth in demand.

The increasing accuracy and reducing tissue trauma in the bronchial biopsy devices market when AI-powered systems were used. Compared to other surgical methods, the robotic system allows precise control, which is essential, especially when the lesion is hard to locate. In addition to enhancing the physician diagnostic capabilities, the ability of patient treatment and management is also impacted positively by AI integration in the robotic system to add further value to these biopsies. They use AI algorithms for target identification, image processing, calculation of the optimal path for needle placement, and operation feedback. Robotic technology and AI can be potential implementations to overcome human mistakes.

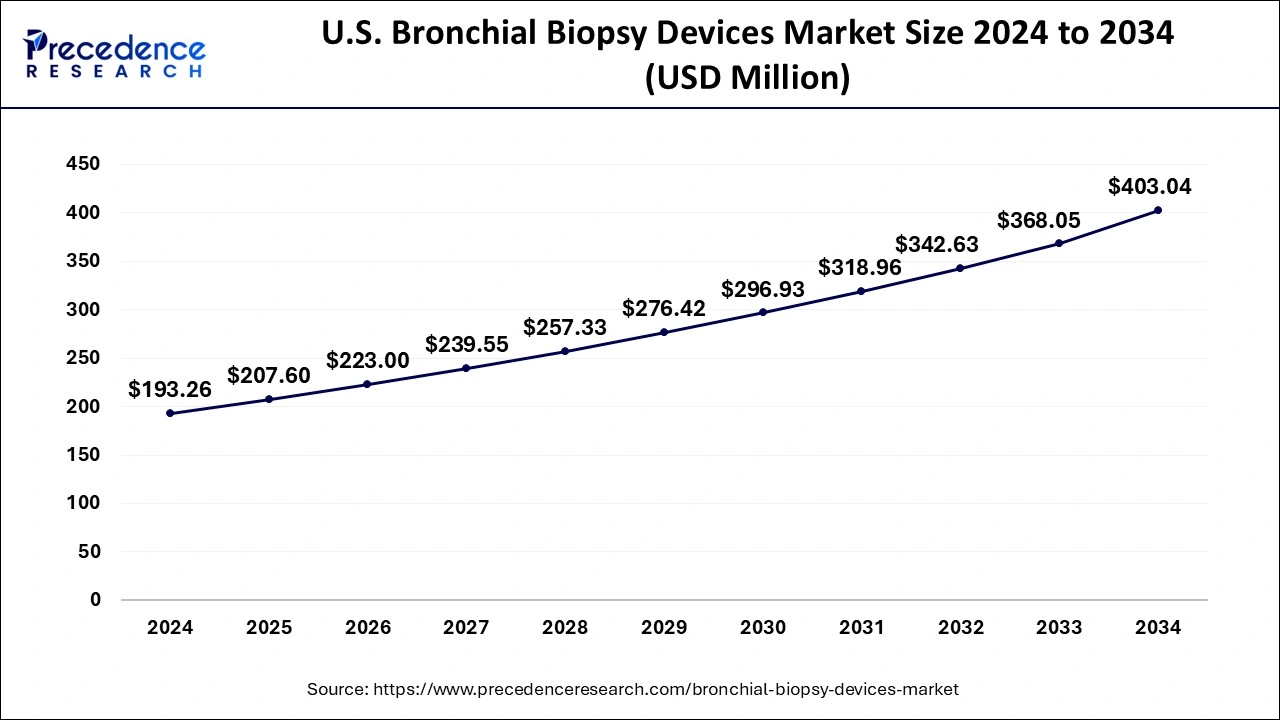

The U.S. bronchial biopsy devices market size was exhibited at USD 193.26 million in 2024 and is projected to be worth around USD 403.04 million by 2034, growing at a CAGR of 7.63% from 2025 to 2034.

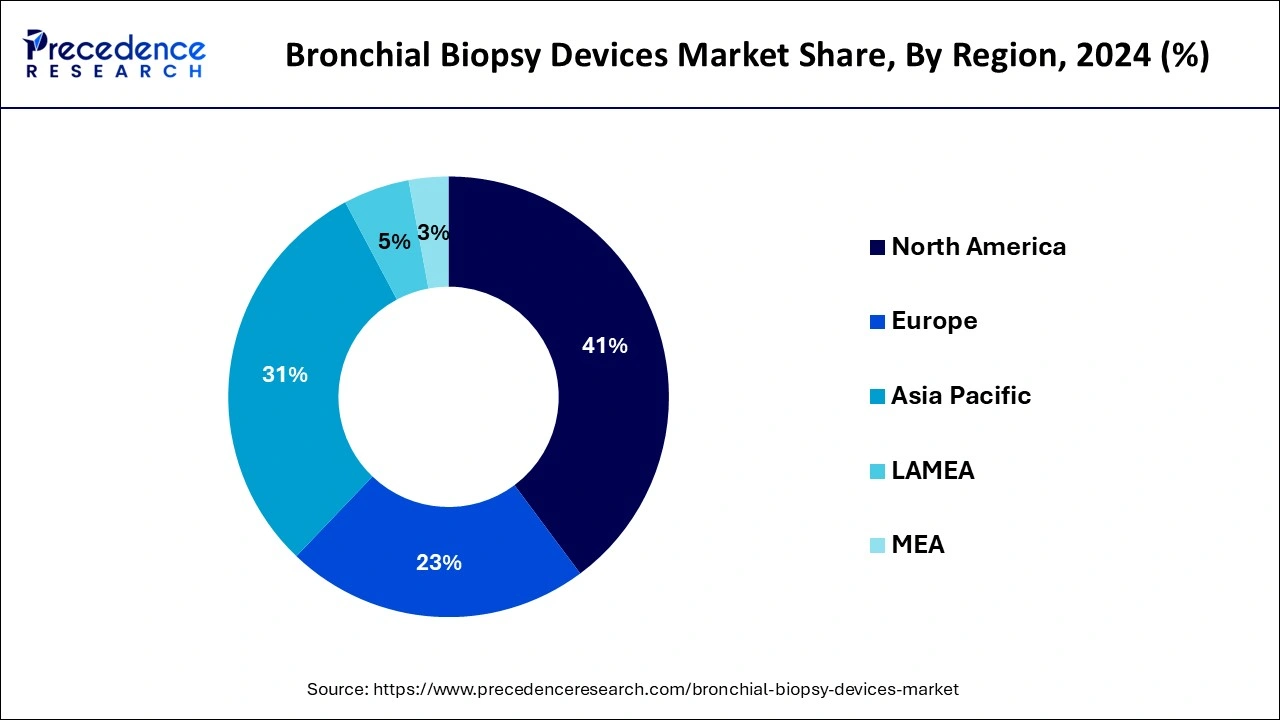

North America dominated the bronchial biopsy devices market with the largest market share in 2024. The market is driven by technological advancements, an effectively developed healthcare system, a high prevalence of chronic diseases, and a growing population of geriatrics. North America has enough financial resources for progressive medical equipment, and well-developed regulations and research collaborations are contributing to its dominance. Diagnostic insurance reimbursement in the region and the competitive insurance markets in the region also enhance the suitability of biopsy technologies. Also, several product launches and funding are prevalent in the region.

On the other hand, Asia Pacific is expected to grow at the fastest rate in the bronchial biopsy devices market during the forecast period. A prominent upsurge in respiratory conditions, including asthma, COPD, and lung cancer. Moreover, there is an increasing prominence on health campaigns intended to grow awareness of respiratory diseases and the importance of regular health check-ups. These initiatives are expected to increase the usage of bronchial biopsy procedures for early diagnosis and treatment of respiratory diseases. This increasing prevalence of the diseases is anticipated to drive the need for better diagnosis techniques, including bronchial biopsy equipment.

A biopsy is defined as a medical operation carried out to remove tissues from an organ to determine the existence of a disease, specifically inflammatory and neoplastic diseases. Lung Biopsy is the extraction of the lung tissues to diagnose any lung disease, infection, or cancer. Increased incidence of cancer, especially the breast, prostate, and lung, coupled with increased technological development in biopsy, has propelled the bronchial biopsy devices market. This surgical procedure is mandatory for detecting some diseases, including coeliac disease, malignancies, etc, and is mainly carried out by radiologists, surgeons, and interventional cardiologists.

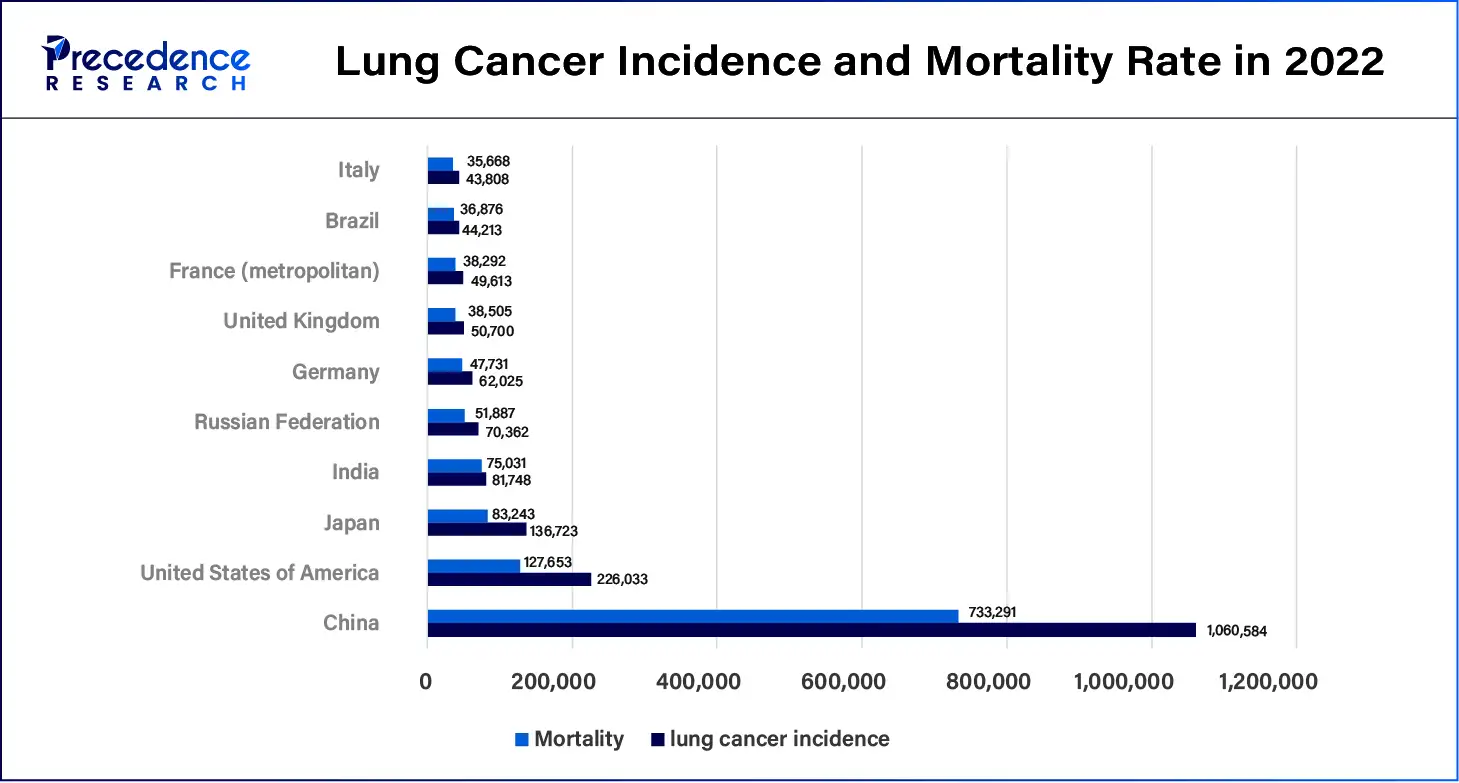

The constantly rising incidence of lung diseases requires new diagnostic tools. The cases of respiratory diseases such as lung cancer and interstitial lung disease are on the rise worldwide, and there is a need for prompt and accurate lung biopsies. This diagnostic procedure is necessary for determining the presence, extent, and nature of lung diseases, posing insights that are crucial for effective treatment planning.

| Report Coverage | Details |

| Market Size by 2024 | USD 673.38 Million |

| Market Size in 2025 | USD 723.35 Million |

| Market Size in 2034 | USD 1,377.57 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.42% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of respiratory diseases

Lung cancer continues to become one of the most prevalent types of cancer, and the incidence rate is still rising. Long-term respiratory diseases include chronic obstructive pulmonary disease (COPD), lung cancer, asthma, and interstitial lung disease. Such an increase in respiratory diseases has put more demand for higher and more accurate methods of diagnosis. The leading factors that may have resulted in this rise include increased environmental pollution, smoking, working conditions, and demographic factors. Bronchial biopsy devices facilitate accurate diagnosis early enough for intervention. Lung ailments, including COPD, asthma, and lung malignancy, are progressively being realized in the global populace. The growing operation of bronchial biopsies for diagnosing lung cancer and related conditions.

Cost constraints

The growth of the bronchial biopsy devices market is limited by high production and purchasing costs, especially for devices that are equipped with the latest technologies. These advanced devices are expensive to develop. The maintenance, training, and other operational costs of these advanced biopsy devices also augment the overall medical care expenses. Many of these devices are costly, putting a financial burden on both healthcare centers and patients to acquire the diagnostic tools that are needed to improve the generation and application of diagnostic procedures.

Rising demand for minimally invasive device

This shift towards minimally invasive techniques is contributing to the expansion of the bronchial biopsy devices market. The biopsy devices are tissue-sparing, which means that the recovery is quicker, skin closures are better with less scar tissue, and the chances of complications are much less than with an open biopsy. As a result, there is a rising preference for these devices among both patients and healthcare providers.

Innovations in bronchial biopsy devices are making processes less invasive, which aids both patients and healthcare providers. Further specific instruments and techniques lessen patient discomfort and recovery times. The trend towards minimally invasive procedures will continue to gain traction. The bronchial biopsy devices market is estimated to develop significantly over the period due to the rising inclination for minimally invasive diagnostic procedures.

In the bronchial biopsy devices market, the transbronchial needle aspiration (TBNA) needles segment held the dominating share in 2024. Transbronchial needle aspiration is the method of taking tissue through a needle, which passes through the bronchial wall. It is used to obtain tissue from lung or hilar/mediastinal lesions that are near the endobronchial tree. The development of this segment can be attributed to the advantages of EBUS-TBNA over conventional TBNA and other biopsy methods like mediastinoscopy. Transbronchial needle aspiration (EBUS-TBNA) is a technique that integrates bronchoscopy with ultrasonography, where biopsy is done using a thin needle in real-time visualization of the airway, mediastinum, and lungs.

The biopsy forceps product segment is expected to grow at a notable rate in the bronchial biopsy devices market during the forecast period. The Biopsy Forceps consists of the manufacturing and sales of tools that are used to biopsy tissues and remove them for diagnosis, especially in instances of cancer as well as other diseases. These are crucial in an ailment diagnosis, as they ensure accuracy and efficiency in sampling. The market comprises various types of forceps, jaws, and needles depending on the diseases/health conditions and procedural requirements. The developments in the biopsy forceps, including accuracy and the ability to perform less invasive biopsies, continue to increase the use of biopsies among healthcare providers.

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

July 2024

August 2022