April 2025

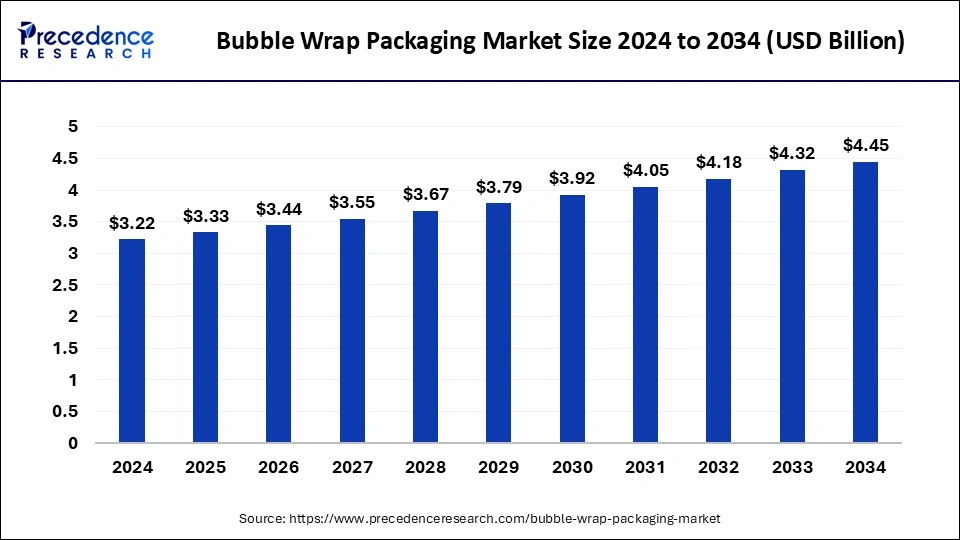

The global bubble wrap packaging market size is calculated at USD 3.33 billion in 2025 and is forecasted to reach around USD 4.45 billion by 2034, accelerating at a CAGR of 3.29% from 2025 to 2034. The Asia Pacific bubble wrap packaging market size surpassed USD 1.43 billion in 2025 and is expanding at a CAGR of 3.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bubble wrap packaging market size was estimated at USD 3.22 billion in 2024 and is predicted to increase from USD 3.33 billion in 2025 to approximately USD 4.45 billion by 2034, expanding at a CAGR of 3.29% from 2025 to 2034. The bubble wrap packaging market is expanding because corporations are seeking safe, and environmentally responsible ways to protect their goods while they are being transported and improve consumer happiness.

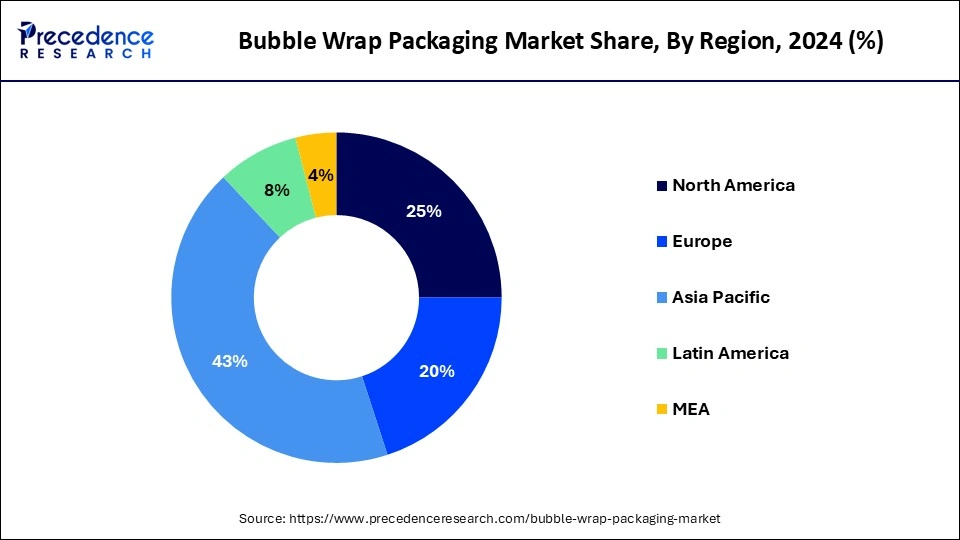

The Asia Pacific bubble wrap packaging market size surpassed USD 1.38 billion in 2024 and is projected to attain around USD 1.94 billion by 2034, poised to grow at a CAGR of 3.46% from 2025 to 2034.

Asia Pacific dominated the global bubble wrap packaging market in 2024. This growth is largely attributed to the region's increased internet penetration. The flourishing e-commerce sector, coupled with rising purchasing power in India and China, will significantly boost the global bubble wrap packaging market in the coming year. South Asian markets, particularly Japan and Thailand, are projected to expand at a much faster rate than most other neighboring countries.

North America is expected to host the fastest-growing bubble wrap packaging market over the forecast period. The expansion of e-commerce companies in this region is also contributing to market growth. The U.S. holds the largest market share, followed by Canada and Mexico. The strong presence of e-commerce companies drives significant demand in this area. Furthermore, the U.S. bubble wrap packaging market holds the largest market share in North America, while the Canadian market is the fastest growing.

Bubble wrap is a transparent plastic material with air-filled bubbles, primarily made from polyethylene film. The packaging consists of a two-layer polyethylene film with trapped air to form bubbles, cushioning the packaged products. Bubble sizes typically range from 6mm to 26mm in diameter, with 10mm being the most commonly used size in various industries. Manufacturers widely use bubble wrap as a packaging solution, especially for fragile items, to ensure protection and safety during transportation.

Bubble wrap is available in two main types: single-layer regular grade and double-layer heavy-duty, with thicknesses ranging from 10 mm to 20 mm. It is lightweight, durable, and cost-effective, which makes it an ideal packaging option to protect objects from damage during handling, storage, and shipment. It is extensively used across different industries for wrapping fragile items that need a thick layer of support to shield them from direct contact with other objects.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.33 Billion |

| Market Size by 2034 | USD 4.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.29% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth in the retail market

The bubble wrap packaging market is experiencing significant changes across all sectors, including supermarkets, megastores, and retail e-commerce websites. Manufacturers and distributors invest substantial effort and resources into their products to achieve performance targets. The impact of damaged items can result in losses amounting to thousands of dollars. However, bubble wrap packaging offers a positive user experience while focusing on product safety.

The increased use of mobile devices and the digital revolution in the telecom sector have driven the expansion of the e-commerce industry. Bubble wrap is essential in the shipping and transporting of fragile and delicate items as it reduces the risk of product damage from manufacturing and warehousing until the products reach their destination.

The increasing emphasis on environmental sustainability

As the retail market expands both online and in physical stores, the demand for protective packaging solutions like bubble wrap also increases. This need arises from the necessity to safeguard products during transit, enhance visual appeal on shelves, and ensure product quality upon delivery. As consumer preferences shift towards convenient, ready-to-use products, effective packaging becomes crucial for maintaining brand reputation and customer satisfaction. This highlights the importance of the bubble wrap packaging market in preserving product integrity and supporting the evolving retail landscape.

Emphasis on I-bubble packaging

I-bubble wrap packaging's unique functionality positions it to capture a significant share of the bubble wrap packaging market. Its innovative design and superior protective qualities enhance the customer experience while safeguarding items during transit. As the retail industry evolves with increased e-commerce activity and a greater focus on sustainable packaging, I-bubble wrap emerges as a distinctive choice.

Retailers and consumers favor it for its ability to meet diverse product needs with minimal environmental impact. The growing demand for reliable and efficient packaging solutions, driven by expanding online shopping and mobile connectivity, offers numerous opportunities for I-bubble wrap to secure its place in the bubble wrap packaging market.

The high-grade bubble wrap segment was the dominant product in the bubble wrap packaging market in 2024. High-grade bubble wraps are commonly used for demanding packaging needs, particularly for protecting fragile electronic devices and medical equipment during transportation. They are utilized in bubble sheets, which are in high demand for vertically transporting electronic equipment, especially during long-distance shipping. These bubble wraps feature larger bubbles that can absorb significant shocks, providing a high level of protection during transit.

The general grade bubble wrap segment is projected to grow at the fastest rate in the bubble wrap packaging market over the forecast period. General-grade bubble wraps offer an efficient and cost-effective packaging solution for wrapping products and protecting them from damage. The wrap rolls can be conveniently cut to the desired width. General Wrap is available in two types—regular and heavy-duty, with thicknesses of 10mm and 20mm, respectively.

The e-commerce segment dominated the bubble wrap packaging market in 2024 and is expected to continue growing during the forecast period. The increasing trend of online shopping for fragile and electronic items has significantly boosted the demand for bubble wrap packaging. Customers expect their orders to arrive in perfect condition, hence driving the need for reliable protective packaging. The growth of e-commerce has increased the demand for materials like bubble wrap to ensure the safe and secure delivery of goods to consumers. These factors positively influence the market growth for bubble wrap packaging.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

March 2025