January 2025

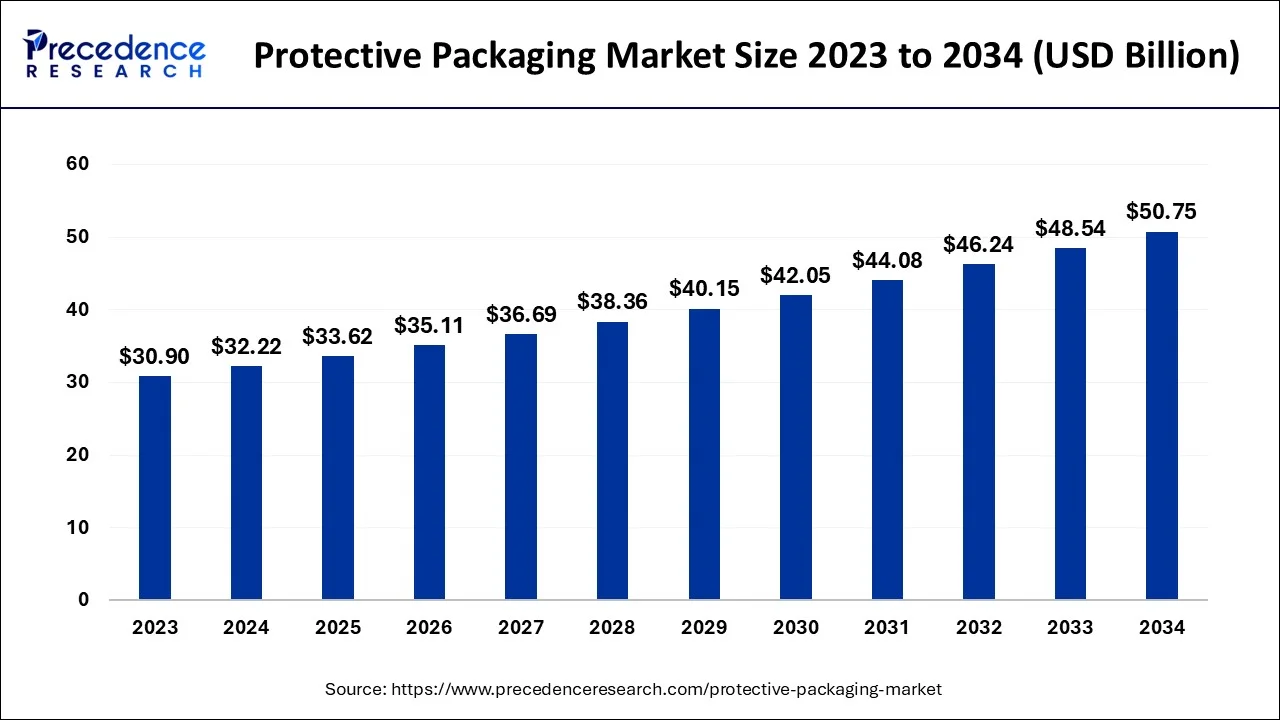

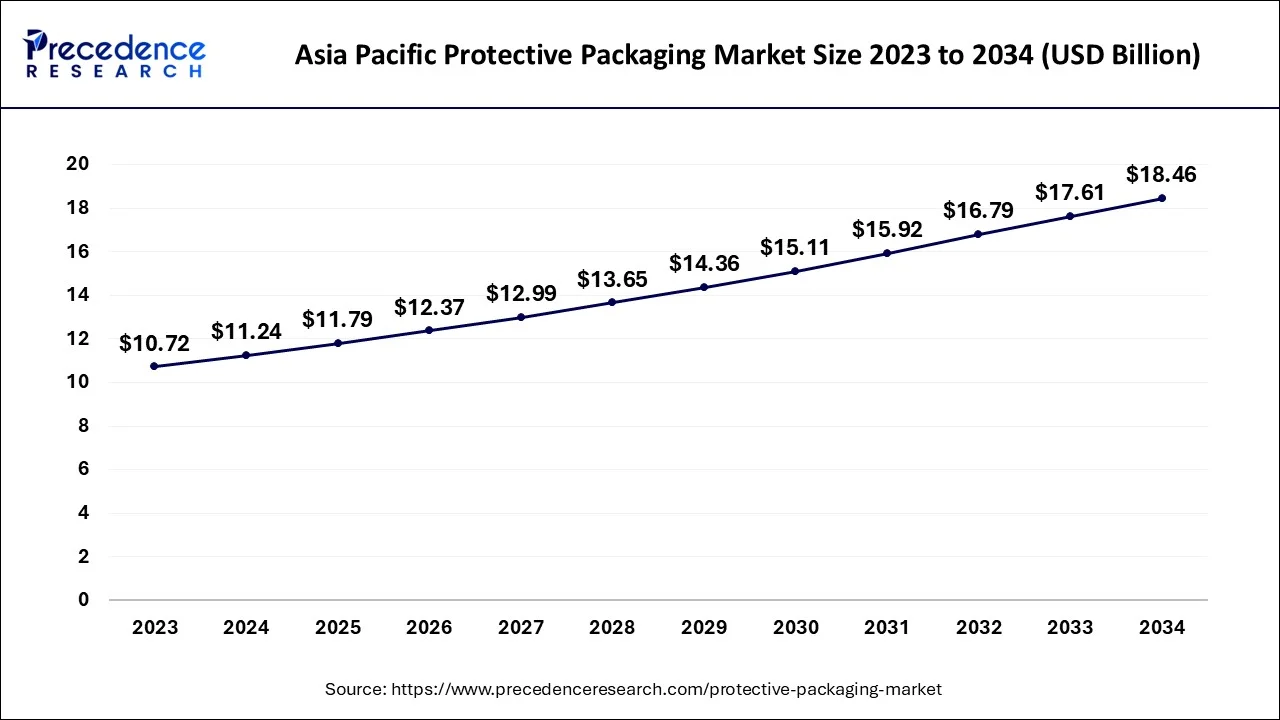

The global protective packaging market size accounted for USD 32.22 billion in 2024, grew to USD 33.62 billion in 2025 and is projected to surpass around USD 50.75 billion by 2034, representing a healthy CAGR of 4.70% between 2024 and 2034. The Asia pacific protective packaging market size is exhibited at USD 11.24 billion in 2024 and is expected to grow at a fastest CAGR of 5.10% during the forecast year.

The global protective packaging market size is estimated at USD 32.22 billion in 2024 and is anticipated to reach around USD 50.75 billion by 2034, expanding at a CAGR of 4.70% between 2024 and 2034.

The Asia Pacific protective packaging market size accounted for USD 11.24 billion in 2024 and it is expected to be worth around USD 18.46 billion by 2034 with a CAGR of 5.1% from 2024 to 2034.

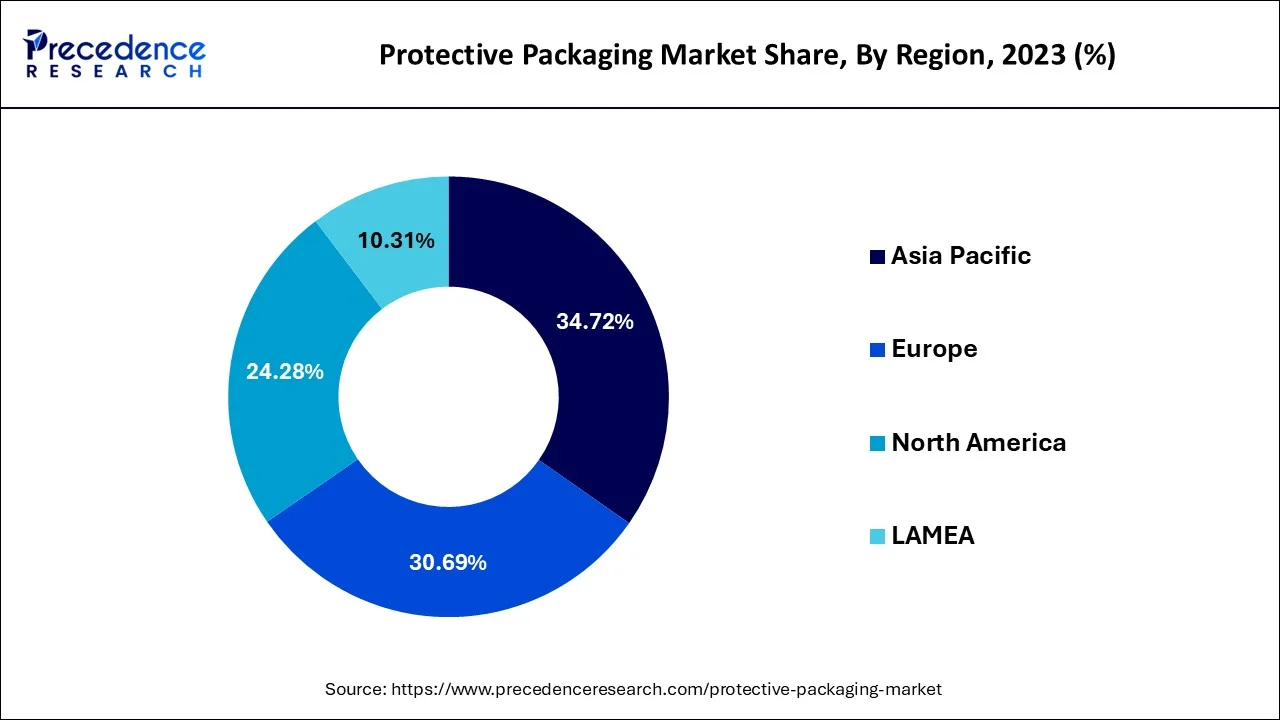

Asia- Pacific has its largest market share of 34.72% in the protective packaging market in 2023. The region’s protective packaging market is at a CAGR of 5.12%. Growing consumer awareness of sustainability and product safety has forced companies to invest in premium packaging that protects their products and complies with environmental standards. Reusable packaging options, recyclable materials, and biodegradable polymers are examples of eco-friendly packaging materials that are becoming more popular. The nations in the area have embraced these developments with great speed.

Growing numbers of customers are choosing to purchase online, leading to increased package deliveries. Sturdy packaging solutions are needed to guarantee the goods are transported safely. The growth of the retail industry, which now includes convenience stores, supermarkets, and hypermarkets, has also increased the demand for protective packaging for various goods.

Europe was considered as the second largest share of 30.69% in protective packaging market in 2023. European businesses are focused on making R&D investments to launch cutting-edge protective packaging solutions. This entails utilizing cutting-edge packing technology to track the state of the items while they are in transit, such as materials that react to temperature, shock-absorbing designs, and monitoring systems. Numerous significant protective packaging participants, including local and international businesses, call it home. The competitive landscape further enhances the region's market share, which encourages innovation, product variety, and effective supply chain management.

Protective packaging is designed to shield products from theft, loss, and damage while being transported, distributed, and stored. Using containers or wrapping to keep multiple goods together creates a sturdy platform for transportation. Protective packaging is used to endure varied static and dynamic stresses in a variety of supply chain locations, including the assembly line, transportation, warehouses, and order picking.

Moreover, it offers defence against environmental factors like precipitation, temperature, humidity, and sun radiation. Several applications, including those in the food, electronics, and pharmaceutical industries, embrace protective packaging. According to the type of goods, protective packaging can be divided into three basic categories: rigid, foam, and flexible.

protective packaging offers solutions that shield machinery, equipment, and industrial goods from harm while being stored and transported. Protective packaging also provides security through the void fill, wrapping, flexible cushioning, blocking and bracing, protective containment, and surface defense.

The market for protective packaging is expanding quickly due to a number of factors, including the rising demand from the food and beverage and healthcare industries as well as consumer preference for easy packaging. The production of manufactured goods on a global scale, ongoing technical advancements, and rising consumer demand for packaged goods are expected to drive the growth of the protective packaging market.

The e-commerce sector is expected to contribute significantly to cushioning the protective packaging market throughout the forecast period. Companies must make sure that they fully grasp their customers' needs and satisfy them. Major manufacturers are focusing on R&D efforts to enhance the creation of environmentally friendly and renewable packaging materials that can be recycled and regenerated.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.22 Billion |

| Market Size by 2034 | USD 50.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.7% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Material, By Function and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

E-commerce industry to drive the usage of protective packaging

Electronic commerce, also known as e-commerce, is the exchange of products and services as well as the transmission of money and data via an electronic network, most commonly the internet. These commercial exchanges take place between businesses, consumers, other businesses, or between consumers and businesses.

The E-commerce sector's growing use of protective packaging is the main factor fueling the market's expansion worldwide. The demand for the worldwide protective packing business is projected to increase as online shopping becomes more widely accepted in both emerging and developed parts of the world. Additionally, global industrial production will accelerate, consumer spending on packaged products will increase globally, and demographic trends including an increase in the number of urban residents will further fuel this growth.

The potential for technological innovation to create packaging materials that are sustainable, reusable, and recyclable can be further investigated in the global market for protective packaging. The worldwide market for protective packaging is significantly constrained by the availability and high cost of raw materials. Therefore, the market for protective packages could expand with the excessive use of the E-commerce sector.

Stringent regulation for packaging

Since many plastic packaging wastes are non-biodegradable, they pose a serious threat to the ecosystem. Governments all over the world have put strict laws and regulations in place that the packaging business must follow to address this problem. The European green deal, for instance, which was introduced in December 2019 and outlined a route to zero net greenhouse gas emissions by 2050 while putting an emphasis on economic growth unrelated to resource use, is one example.

The Commission announced that it would continue the plastics strategy by concentrating on enacting new legislation, such as legal requirements to boost the market for secondary raw materials with mandatory recycled content, targets and measures to combat excessive packaging, and waste generation regulations to ensure that all packaging is reusable or recyclable in the EU in an effort to reduce waste. Governments in developing countries are taking action to encourage sustainable packaging as they become more environmentally conscious.

The enacted laws forbid businesses from obtaining basic materials from suppliers who do not follow environmental laws. As a consequence, the price of raw materials is gradually rising, pushing up the cost of operations. As a result, protective packaging revenues as a whole experience a drop in profits.

Globalization and international trade

Construction and industrialization are expanding quickly in emerging nations. As a consequence, there is an increase in demand for construction and chemical products. To satisfy this demand, international trade is expanding. Two major reasons are driving the global protective packaging market: greater trade and capital market liberalization, which has increased export and import activity, and technological advancements, which have reduced transportation costs.

As a consequence of globalization, businesses are also exporting their goods to other countries, which is increasing the demand for protective packaging to protect goods from damage over long distances.

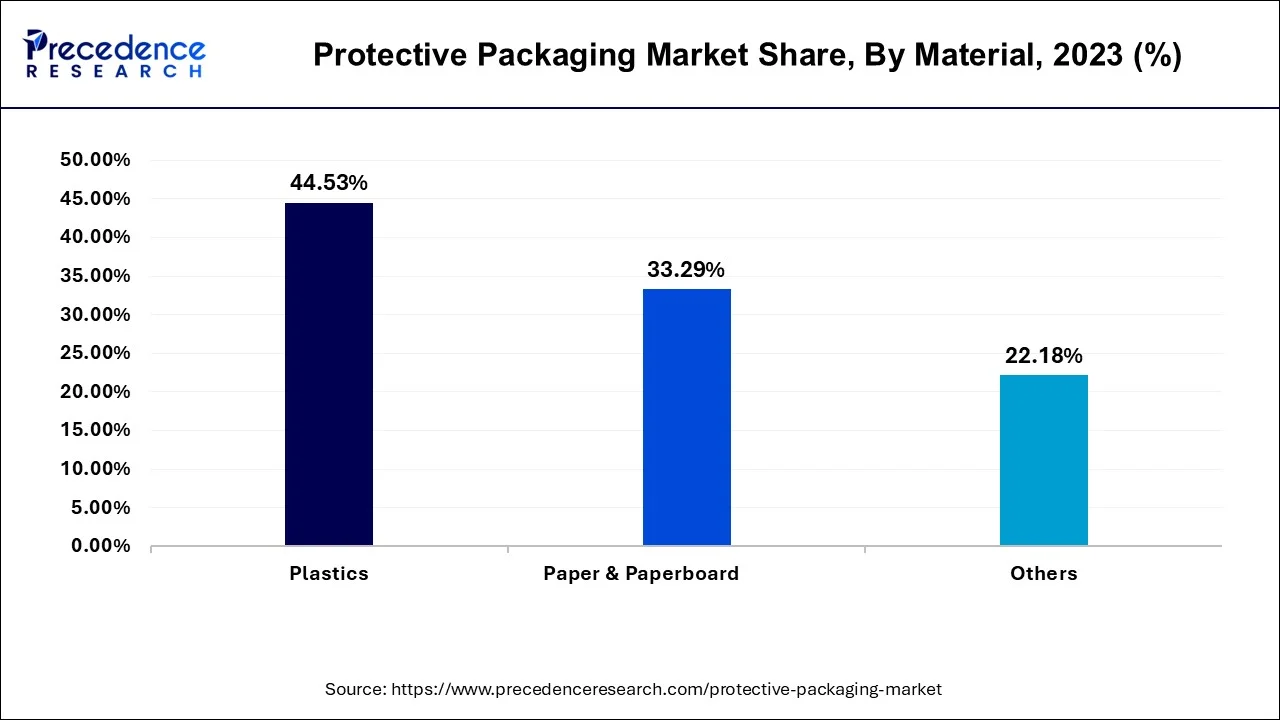

The plastics segment held the largest share of the protective packaging market in 2023. Expanded polystyrene (EPS) and polyethylene (PE) foam are two examples of foam plastics with good shock-absorption and cushioning qualities. These materials can lower the chance of breakage or damage by shielding delicate and sensitive products from harm during handling and transportation. This feature is essential in the electronics, pharmaceutical, and automotive industries, where products are vulnerable to impact-related problems.

Due to their inherent moisture resistance, several foam plastics can be used to protect items susceptible to humidity or environmental exposure. Food, medicine, and electronics all need a dry, stable environment during storage and transportation. Therefore, this characteristic is essential.

Protective Packaging Market Revenue, By Material, 2021 to 2023 (US$ Million)

| Material | 2021 | 2022 | 2023 |

| Paper & Paperboard | 9,309.62 | 9,815.03 | 10,288.62 |

| Plastics | 12,727.64 | 13,271.88 | 13,760.15 |

| Others | 6,262.73 | 6,571.50 | 6,855.28 |

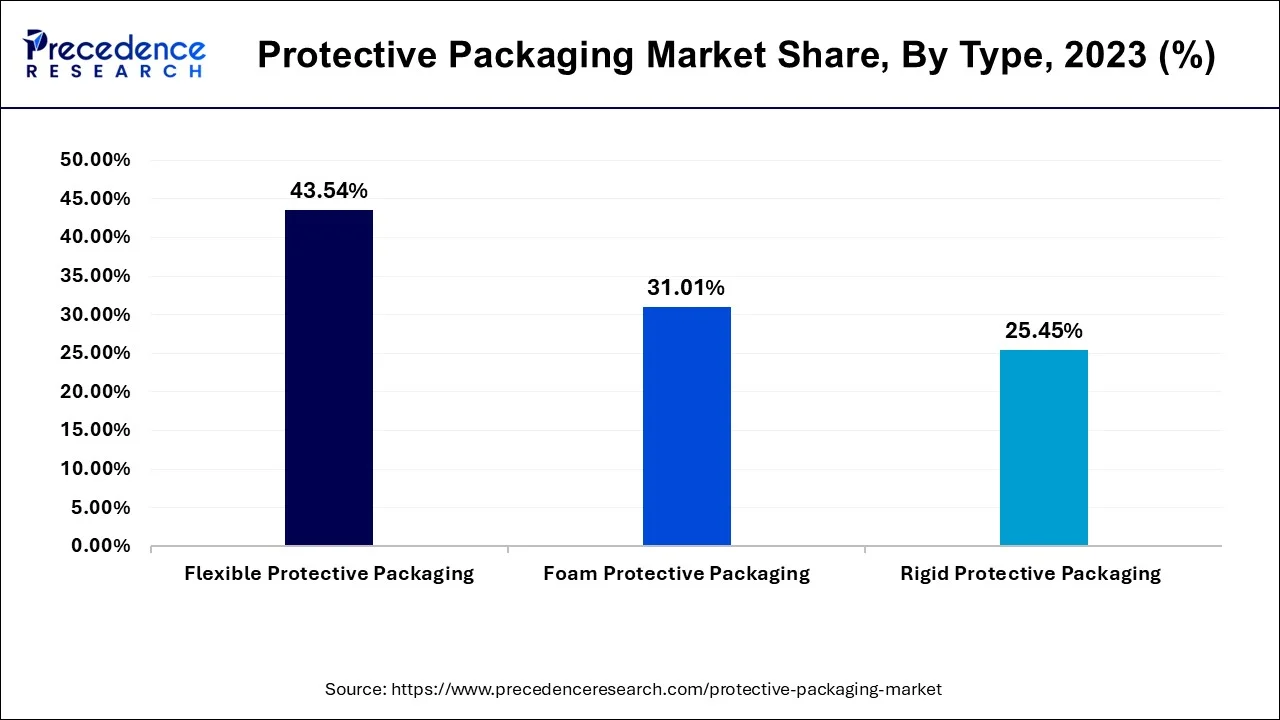

The flexible protective packaging segment dominated with a share of 43.54% in the protective packaging market in 2023. The quality of food is preserved and indicated by flexible packaging. Flexible packaging has a favorable sustainability profile and increases the shelf life of many products, particularly food. Its materials are usually lighter compared to more solid options like metal containers or corrugated boxes. Shipping expenses are lowered by this lightweight design, particularly for e-commerce companies that depend significantly on parcel delivery services.

It offers cushioning and protection for delicate or breakable items during transit, even though it is lightweight. Good shock absorption is provided by foam, air cushions, and bubble wrap, which lowers the possibility of breakage or damage. This degree of security is essential in sectors like electronics, drugs, and consumer goods.

Of the cheaper material costs, lower shipping costs, and increased operational efficiencies, it is frequently more affordable than rigid alternatives. Purchasing materials in bulk and utilizing automated packaging technologies can help businesses realize economies of scale.

On the other hand. the foam protective packaging segment held a share of 31.01% in the protective packaging market in 2023. Whether composed of polyethylene (PE), polyurethane (PU), or expanded polystyrene (EPS), foam packaging provides excellent cushioning and stress absorption qualities. Because of this, it is incredibly effective in safeguarding delicate and breakable objects during handling and transportation. The foam packaging sector has advanced significantly in creating eco-friendly solutions. For instance, compared to conventional foam products, biodegradable and recyclable foam materials are now available to lessen environmental effects. Solutions for sustainable packaging are becoming more and more important to both consumers and businesses. It can be personalized for branding as well as security needs.

Companies can brand foam packing with logos, colors, and other components to give customers an unforgettable unboxing experience. This personalization strengthens brand identity and enhances the overall product presentation.

Protective Packaging Market Revenue, By Type, 2021 to 2023 (US$ Million)

| Type | 2021 | 2022 | 2023 |

| Rigid Protective Packaging | 7,001.05 | 7,445.27 | 7,865.30 |

| Flexible Protective Packaging | 12,149.07 | 12,822.43 | 13,455.60 |

| Foam Protective Packaging | 9,149.88 | 9,390.70 | 9,583.15 |

The insulation segment held the largest share of 28.17% in the protective packaging market in 2023. Expanded polystyrene, or EPS, and polyethylene (PE) foam are two foam-based insulations with good cushioning and impact resistance. They lessen the chance of product breakage or distortion by absorbing shocks and vibrations during transportation. Another well-liked option for protecting delicate things is bubble wrap. The air-filled bubbles surround fragile objects with protection by acting as shock absorbers.

Since heat-sensitive medications aid in patient treatment, cold-chain transportation is crucial. Drugs become less effective and, in the worst-case scenario, poisonous if they are not stored at the proper temperature. Thus, these medications aid in the patient's course of treatment. Since the patient's health depends on the packaging solutions, they must be dependable.

Anticancer, insulin, and vaccines are among the medications that are transported in insulated packaging solutions. These medications are based on living cells. They are costly and the culmination of many years of pharmaceutical study. They provide incredibly efficient, focused treatment. These medications are delicate and need special handling from the point of storage and shipping to the end of patient administration.

A critical benefit of insulation materials is their ability to be customized. They can be made to fit various product sizes and shapes, offering a tight, secure fit that reduces movement and possible damage during transportation.

The cushioning segment is the fastest growing segment, whereas the segment held a share of 25.30% in the protective packaging market in 2023. The demand for protective packaging solutions has increased due to the constant growth of e-commerce worldwide. Cushioning materials are essential for ensuring product safety during transportation, particularly for delicate goods like electronics, glassware, and ceramics. Businesses invest in effective and dependable cushioning solutions as more customers purchase online to guarantee safe delivery and satisfied customers.

As a result of their versatility, cushioning solutions are used in a wide range of industries, including consumer goods, electronics, automotive, pharmaceuticals, and food & beverage. Cushioning materials can be customized to satisfy unique needs, such as temperature-sensitive packaging for medicinal products or static protection for electronic components. Every industry has different packaging requirements.

Protective Packaging Market Revenue, By Function, 2021 to 2023 (US$ Million)

| Function | 2021 | 2022 | 2023 |

| Cushioning | 7,103.30 | 7,474.04 | 7,819.10 |

| Blocking & Bracing | 4,806.19 | 5,031.85 | 5,237.94 |

| Void Fill | 3,385.81 | 3,537.69 | 3,675.21 |

| Insulation | 7,939.85 | 8,337.60 | 8,705.16 |

| Wrapping | 5,064.85 | 5,277.23 | 5,466.64 |

The industrial goods segment held the largest share in the protective packaging market in 2023. With the growth of biotechnology, advanced manufacturing, and renewable energy, there is a greater need for specialist industrial goods. These sectors frequently work with unusual goods, machinery, or componentry requiring specific protective packaging options. In general, industrial commodities are more valuable than consumer goods. As a result, the expense of potential loss or damage brought on by shoddy packing may be high.

Purchasing reliable protective packaging is an economical way to preserve the value of products, reduce returns and replacements, and keep customers happy. Industries are prepared to spend large sums of money on high-quality packaging solutions to protect their capital.

Protective Packaging Market, By Application, 2021 to 2023 (US$ Million)

| Application | 2021 | 2022 | 2023 |

| Food & Beverage | 9,679.73 | 10,205.23 | 10,697.65 |

| Industrial Goods | 5,784.75 | 6,074.54 | 6,342.33 |

| Healthcare | 2,996.80 | 3,137.51 | 3,266.01 |

| Automotive | 2,311.32 | 2,412.57 | 2,503.84 |

| Household Appliances | 3,597.04 | 3,743.31 | 3,873.23 |

| Others | 3,930.36 | 4,085.24 | 4,220.99 |

By Type

By Material

By Function

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025