September 2024

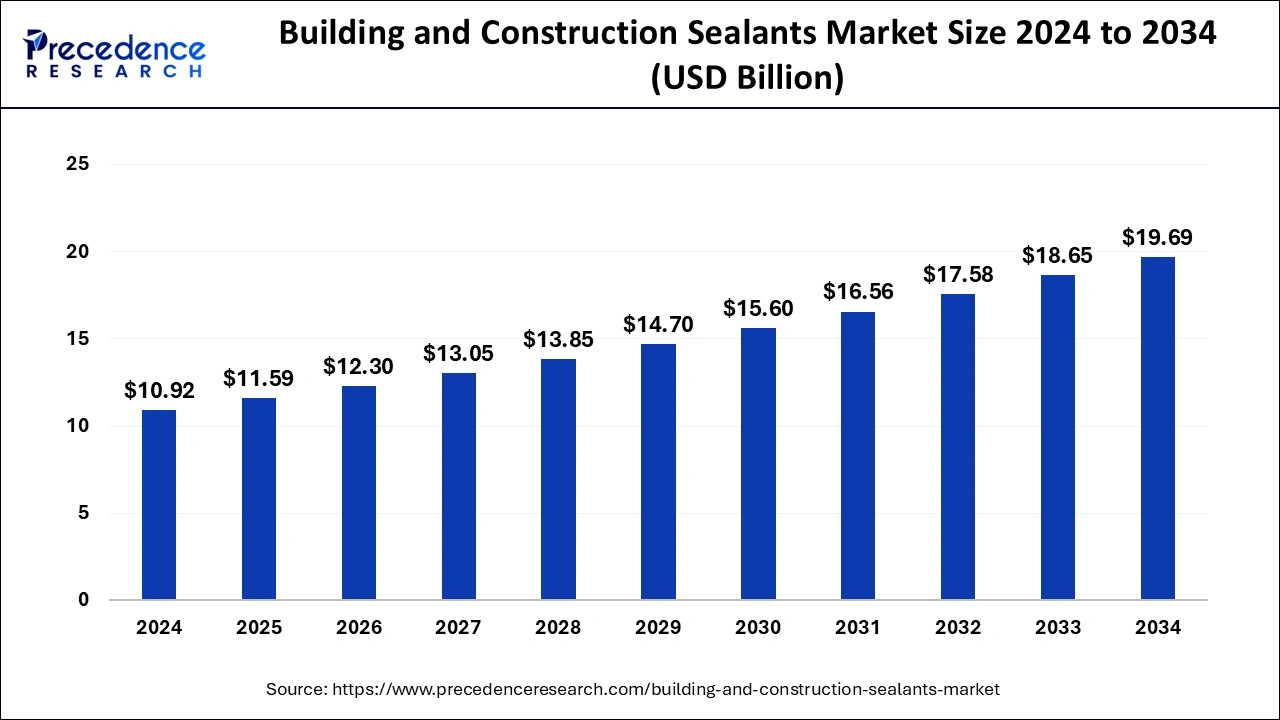

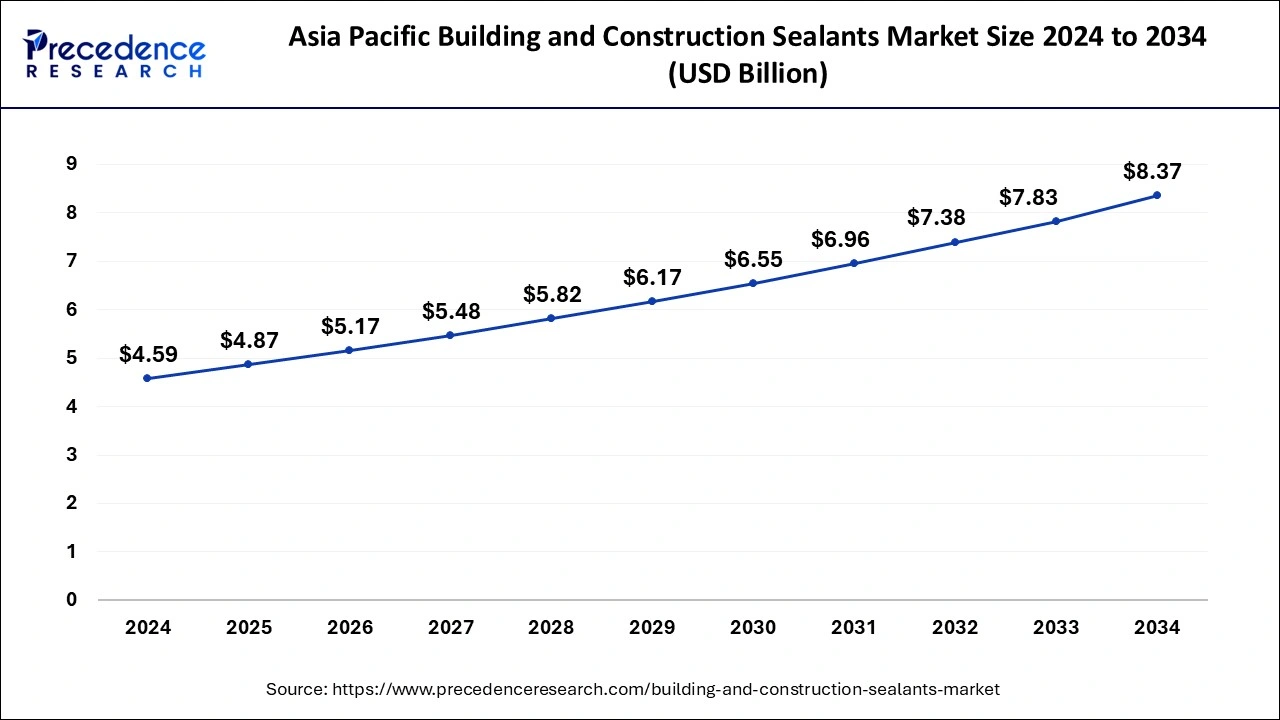

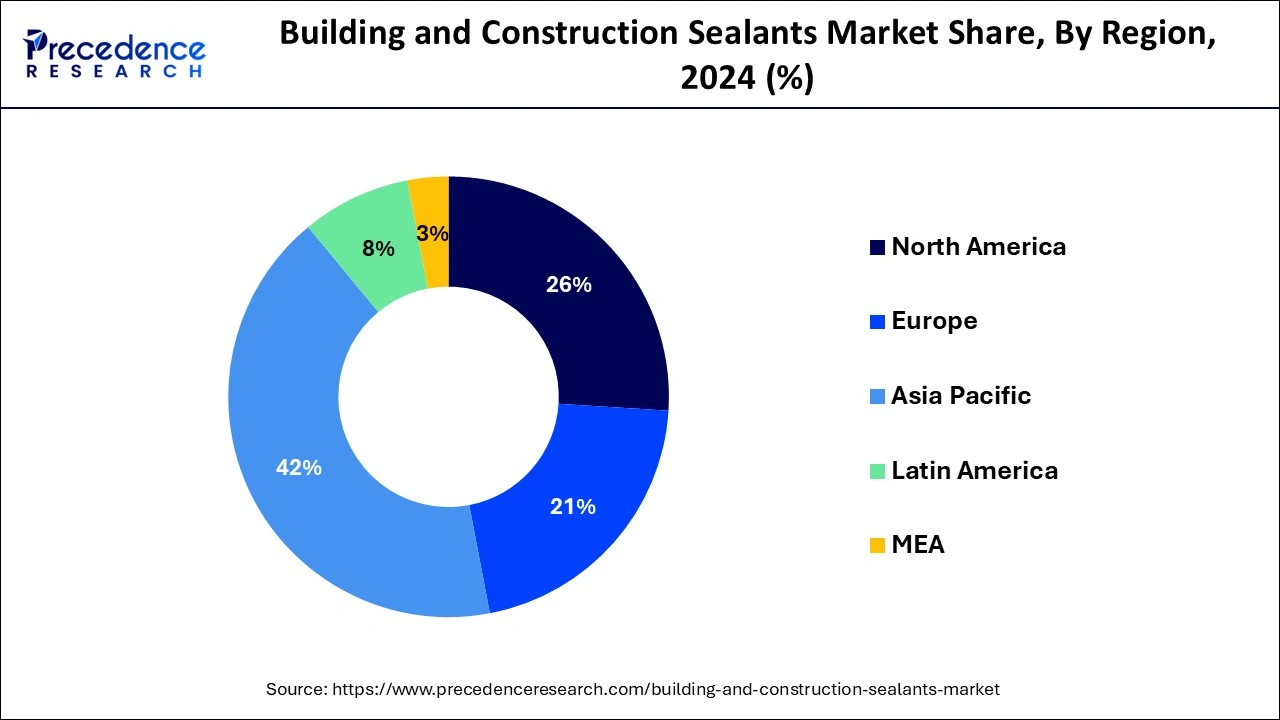

The global building and construction sealants market size is accounted at USD 11.59 billion in 2025 and is forecasted to hit around USD 19.69 billion by 2034, representing a CAGR of 6.07% from 2025 to 2034. The Asia Pacific market size was estimated at USD 4.59 billion in 2024 and is expanding at a CAGR of 6.19% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global building and construction sealants market size was calculated at USD 10.92 billion in 2024 and is predicted to increase from USD 11.59 billion in 2025 to approximately USD 19.69 billion by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The need for sealants in residential and commercial construction projects is rising due to global urbanization and infrastructural development.

The Asia Pacific building and construction sealants market size was evaluated at USD 4.59 billion in 2024 and is projected to be worth around USD 8.37 billion by 2034, growing at a CAGR of 6.19% from 2025 to 2034.

Asia Pacific held the largest share of the building and construction sealants market in 2024. The region's market has been steadily expanding, mostly because of rising construction activity in emerging nations like China, India, and Southeast Asia, as well as fast urbanization and infrastructural development. Sealants are essential for maintaining the resilience, longevity, and energy efficiency of structures because they stop air and water from leaking in through gaps, joints, and fractures. The demand for sealants has increased due to the continuous urbanization trend in nations like China and India, which has resulted in a spike in construction activity, including residential, commercial, and industrial projects.

Europe is expected to witness the fastest growth in the global building and construction sealants market. In Europe, the market for construction and building sealants was expanding steadily. In order to stop the intrusion of air, water, and noise, sealants are essential in the construction industry for sealing gaps, joints, and seams. They are employed in many different contexts, including flooring, roofing, glazing, and sanitary applications.

Significant construction activity has been taking place in Europe as a result of infrastructure development, urbanization, and renovation initiatives. As a result, the area is seeing an increase in demand for sealants. The European Union has strict laws governing buildings' environmental sustainability and energy efficiency. Because sealants ensure appropriate insulation and lower energy use, they are essential to complying with these rules.

Building and construction sealants have been in high demand due to a number of causes, including infrastructure expansion, urbanization, and the growing emphasis on sustainability and energy efficiency. The composition and purpose of sealants used in the building and construction sector vary greatly. These can include acrylic, silicone, polyurethane, polysulfide, and other materials, each with special qualities appropriate for a range of uses.

The building and construction sealants market is seeing a number of new trends, such as the increasing use of low-VOC (volatile organic compound) eco-friendly sealants, a greater emphasis on energy-efficient building envelopes, and developments in sealant technologies to enhance durability and performance. Regional variations in economic growth, infrastructural development, and regulatory standards impact the need for building and construction sealants. Rapid urbanization and industrialization drive strong growth in developing regions, especially in Asia Pacific and Latin America.

The building and construction sealants market has opportunities for growth, but it also faces obstacles like volatile raw material prices, strict regulations governing product safety and environmental impact, and the constant need for innovation to keep up with changing consumer demands and industry standards. In the construction industry, sealants are used for many different purposes, including caulking joints, spaces, and fissures in buildings, bridges, roads, and other constructions. They are necessary for thermal insulation, soundproofing, waterproofing, and weatherproofing.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Market Size in 2025 | USD 11.59 Billion |

| Market Size in 2024 | USD 10.92 Billion |

| Market Size by 2034 | USD 19.69 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin, Technology, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Focus on energy efficiency

The building and construction sealants market's emphasis on energy efficiency has had a substantial impact on a number of industries, including the sealants market. By sealing cracks and crevices, sealants help buildings become more energy-efficient by preventing the intrusion of moisture and air, which can cause structural damage and energy loss. A growing number of contractors and builders are looking for high-performance sealants with excellent moisture and air sealing capabilities. By lowering heating and cooling loads, these sealants contribute to the overall energy efficiency of buildings, hence lowering energy consumption and utility expenses. Advancements in sealant technologies are propelling the creation of sophisticated formulas that yield increased benefits in energy efficiency.

Dependency on the construction industry

The need for building and construction sealants is largely driven by the construction sector. Sealants are necessary materials used in construction for a number of reasons, including preventing water and air penetration and extending the lifespan and durability of structures by sealing seams, gaps, and cracks. The need for sealants is driven by the development of new infrastructure, residential complexes, and buildings.

The requirement for sealing materials to maintain buildings' structural integrity and energy efficiency grows as construction activities occur. In order to handle age, weathering, and wear and tear, existing structures need to be regularly maintained and repaired. Sealants are frequently used in repair and maintenance tasks to stop leaks, seal joints, and stop more damage.

Weatherproofing solutions

A wide range of goods intended to shield structures are available for weatherproofing solutions in the building and construction sealants market. These sealants are essential for stopping damage that could jeopardize the longevity and structural integrity of buildings, such as air leaks and water ingress. Different formulas of waterproofing sealants are available to accommodate a range of substrates and applications. Polyurethane sealants, acrylic sealants, silicone sealants, and hybrid sealants are common varieties. Weatherproofing sealants offer protection from wind, moisture, and temperature changes. They can enhance indoor comfort and air quality as well as increase energy efficiency by lowering air leakage.

The silicone segment held the largest share of the building and construction sealants market in 2024 and is expected to grow further during the forecast period. Silicones are renowned for being long-lasting and resilient. They are perfect for outdoor applications like weatherproofing windows and doors because they can tolerate high temperatures, UV rays, and weather without deteriorating. Wide temperature variations don't cause silicone sealants to break or lose their adherence; thus, they can tolerate movement in construction materials. This adaptability is essential to preserving an impenetrable seal over time. Silicones stick well to a wide range of substrates that are frequently used in construction, such as masonry, metal, glass, and wood. This guarantees a solid seal and consistent sealing performance. Because silicone sealants are waterproof by nature, they can be used to seal gaps and cracks in damp areas like kitchens, baths, and swimming pools.

The polyurethane segment is expected to be the fastest-growing segment in the building and construction sealants market during the forecast period. Sealants made of polyurethane are very important in the building and construction sector. Because of their superior adhesion, strength, flexibility, and resistance to chemicals and weathering, they are frequently employed to seal seams and gaps in a variety of structures. Polyurethane sealants are frequently employed in glazing systems and facades to seal the connections between various building elements. They improve the building envelope's structural integrity and offer weatherproofing. In flooring applications, polyurethane sealants are used to cover concrete floor joints and gaps, offering defense against chemical spills and moisture intrusion. Additionally, they provide flexibility to allow for substrate movement.

The water-based segment dominated the building and construction sealants market in 2024. Within the market, water-based sealants constitute a sizable portion. Water is used in the formulation of these sealants rather than conventional solvents like acetone or xylene. Compared to solvent-based sealants, they provide a number of benefits, such as easier application and cleanup, fewer volatile organic compounds (VOCs), and a smaller environmental effect. Water-based sealants are widely used for a variety of sealing applications, including caulking joints, filling spaces, and caulking cracks in roadways, buildings, and other structures. They are frequently used to seal expansion joints, window and door joints, concrete constructions, and roofing applications. Regulations intended to reduce VOC emissions and growing environmental consciousness have led to an increase in the market for water-based sealants.

The reactive & other sealants segment is expected to show the fastest growth in the building and construction sealants market in the upcoming years. Polyurethane sealants, silicone sealants, and epoxy sealants are a few examples of reactive sealants. Every variety has distinct benefits and works well for particular purposes. For example, polyurethane sealants are well-known for their versatility and adherence to various substrates, which makes them perfect for areas that are vulnerable to movement and expansion joints. Because of their resilience to weather and long-lasting nature, silicone sealants are highly appreciated for use in outdoor applications subjected to inclement weather. Because of their great strength and resilience to chemicals, epoxy sealants are highly valued and frequently employed in industrial settings or other situations requiring strong bonding. Environmentally friendly sealant formulations that minimize environmental effects without sacrificing performance have also been developed as a result of sustainability concerns.

The flooring segment dominated the building and construction sealants market in 2024. Applications for flooring comprise a sizeable portion of the market for building and construction sealants. For different kinds of flooring materials to be long-lasting, aesthetically pleasing, and useful, sealants are essential. In order to stop water seepage, which could harm the subfloor and jeopardize the installation's integrity, sealants are used in the spaces between tiles. Sealants also aid in keeping the grout lines clean by avoiding the accumulation of dirt and grime. For concrete floors, sealants are necessary to stop discoloration, chemical deterioration, and water penetration. They also improve the floor's look by offering choices for shine and color enhancement.

The roofing segment is expected to grow the fastest in the building and construction sealants market. Sealants are commonly used in different roofing applications and are commonly referred to as the roofing segment in the market. Sealants are essential to roofing because they provide weatherproofing, waterproofing, and gap or joint sealing to stop air leaks and water infiltration. Sealants are utilized in a variety of roofing materials used in the construction industry, including asphalt shingles, metal roofing, concrete roofing tiles, and membrane roofing systems like thermoplastic polyolefin (TPO) and EPDM (ethylene propylene diene terpolymer). Through the sealing of joints, seams, and penetrations, these sealants contribute to the creation of a strong and long-lasting roof structure. Trends in roofing materials, building laws and regulations, construction activity, and technological improvements all have an impact on the demand for roofing sealants.

The bonding segment was estimated to hold a significant share of the building and construction sealants market in 2024. Adhesive sealants are often utilized to bond metal plates to the primary framework of buildings and other structures. The sealants can be used for both ferrous and non-ferrous articles. They can also be used to attach non-functional items such as panels and tabletops. The compound can easily be used to attach wood to metal surfaces. This option allows for a cleaner, non-interrupted finish, along with its lightweight quality.

The residential segment led the building and construction sealants market in 2024. Homeowners increasingly prioritize energy efficiency, comfort, and indoor air quality in their residential properties. Sealants play a crucial role in achieving these objectives by sealing gaps and improving the overall performance of building envelopes, thereby reducing energy consumption, minimizing drafts, and enhancing occupant comfort. Sealants serve multiple purposes in residential construction, including weatherproofing, waterproofing, thermal insulation, soundproofing, and aesthetic enhancement. They are used in both interior and exterior applications to address different sealing requirements based on the specific needs of residential buildings.

The direct distribution channel segment held the largest share of the building and construction sealants market in 2024. Direct distribution channels enable manufacturers to offer customized solutions tailored to the specific needs and requirements of customers. By directly engaging with customers, manufacturers can better understand their preferences, project specifications, and performance expectations, leading to the development of tailored sealant solutions.

By Resin

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

November 2024

November 2024