List of Contents

Solvents MarketSize and Forecast 2025 to 2034

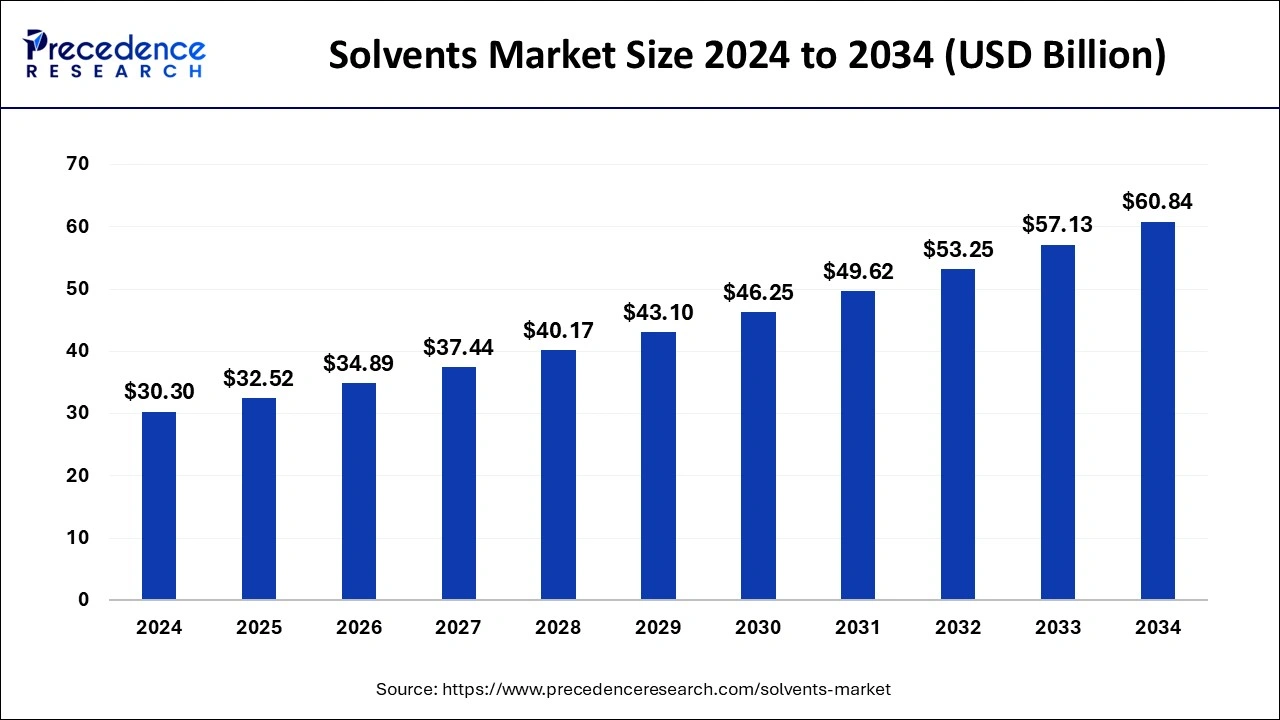

The global solvents market size accounted for USD 30.30 billion in 2024 and is expected to exceed around USD 60.84 billion by 2034, growing at a CAGR of 7.22% from 2025 to 2034.

Solvents Market Key Takeaways

- In terms of revenue, the market is valued at 32.52 billion in 2025.

- It is projected to reach 60.84 billion by 2034.

- The market is expected to grow at a CAGR of 7.22% from 2025 to 2034.

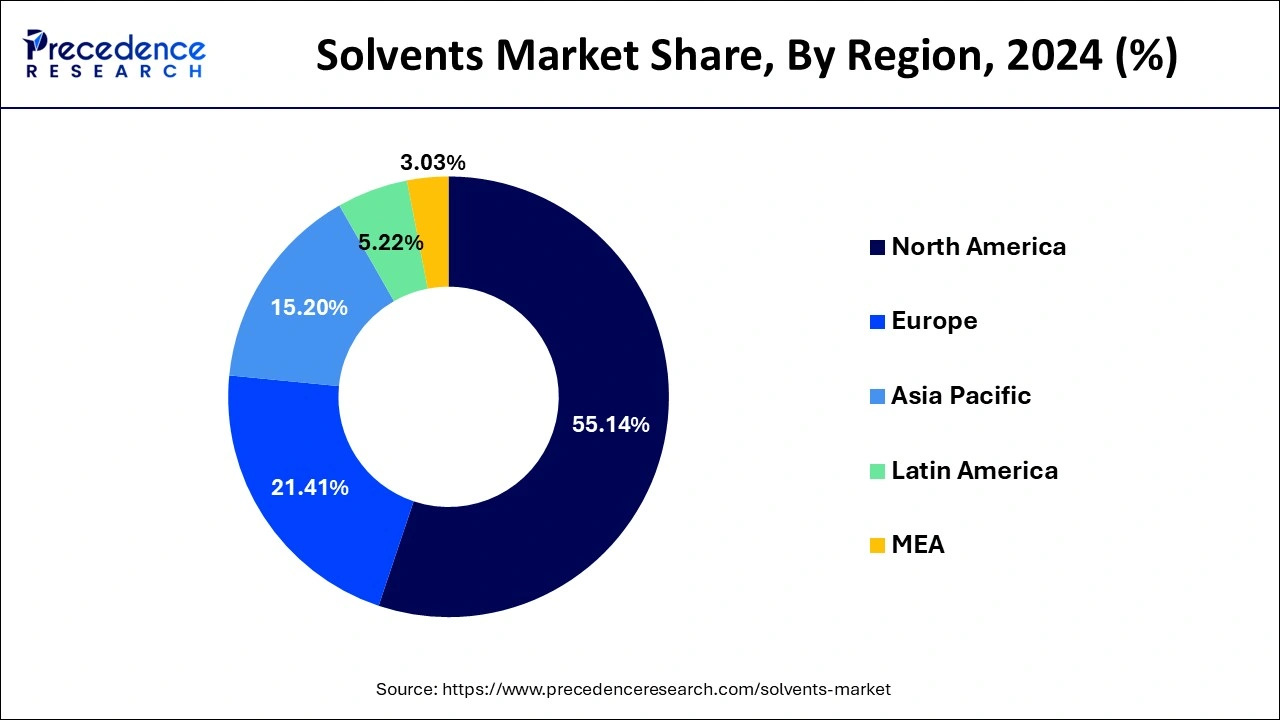

- Asia Pacific region contributed more than 55.14% of the revenue share in 2024.

- By product type, the alcohol segment generated the largest revenue share in 2024.

- By application, the paints and coatings segment generated the maximum market share of around 54% in 2024.

- By source, the derived sources segment captured more than 86% of the revenue share in 2024.

Asia Pacific Solvents Market Size and Growth 2025 to 2034

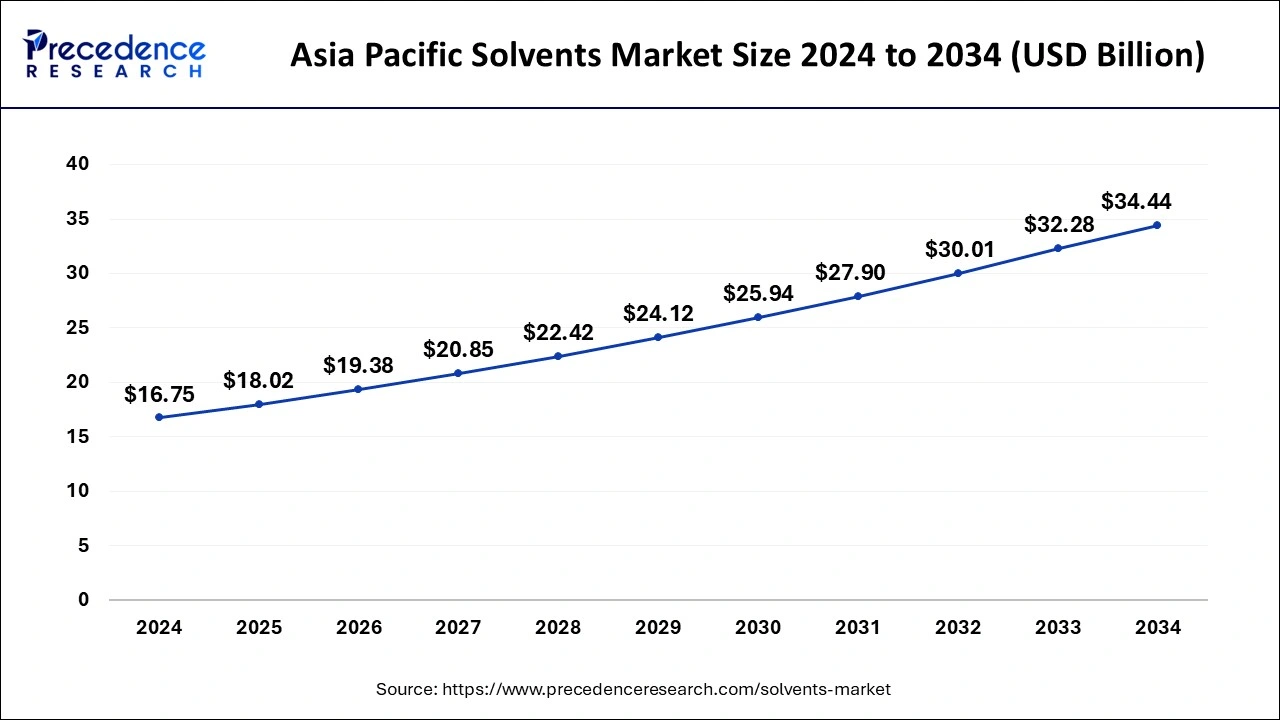

The Asia Pacific solvents market size was exhibited at USD 16.75 billion in 2024 and is projected to be worth around USD 34.44 billion by 2034, growing at a CAGR of 7.47% from 2025 to 2034.

Asia Pacific region generated more than 55.14% of the revenue share in 2024, Asia Pacific is dominating the solvents market. The increased urbanization and industrialization help in performing innovations and development in the areas required. The solvent-based market is expanding in various other markets, specifically in paints/coatings and automotive. The region is highly developed in most of the markets, supporting solvent-based products. The extraction is conducted from natural sources. The green and bio-based solvent is a sustainable advancement. The solvents produced from renewable sources such as biomass and plants are popularly replacing the traditional petrochemical-based solvents.

In addition, the market for solvents is anticipated to expand as a result of rising urbanization and industrialization as well as high car demand. China possesses 28% of the region's proved gas reserves, which make up 10% of the global total, and 3% of the world's proven oil reserves. As a result, petrochemical output is increasing, which is predicted to further support the market expansion for solvents.

Additionally, the need for solvents in the paints and coatings application is anticipated to be driven by the fast expansion of building and construction activities and the increasing demand for vehicles. Additionally, the region's personal care industry is experiencing tremendous growth, which is feeding the solvents market's expansion. The demand for solvents in the area is anticipated to rise throughout the projected period as a result of the aforementioned causes.

Technological Advancement

Technological advancements in the solvents market feature AI, green and bio-based solvents, and solvent extraction and processing. AI-powered tools help in the solvent selection process; the most recent Solvay laboratory of the future in Bordeaux has adopted AI tools for the solvent selection process. The extraction techniques use advanced technology such as the enzymatic procedure and supercritical fluid extraction. These technologies have effectively benefited the solvents market and other industries. The advanced technology and social acceptance of innovations are easing the developmental projects focusing on sustainable and valuable growth. The technological efforts are paving the way for several other new businesses.

Solvents Market Growth Factors

The majority of the solvents are liquids, but they can also take the shape of solids or gases and come in both conventional and organic varieties. They are often used as cleaning and degreasing agents as well as components of goods including nail polish removers, printing inks, varnishes, adhesives, cosmetics, fragrances, detergents, and spot removers. The key element fueling market expansion is the expanding number of product applications across various end-use industries. Solvents, for instance, are used in paints and coatings to dissolve pigments and binders, offer uniformity, and have several uses in the production of medicinal drugs. Additionally, there has been a significant increase in the use of cleaning and personal care products for the home.

Additionally, the increased use of solvents in pesticide formulations is spurring an increase in product demand. Additionally, customers are gravitating more and more toward eco-friendly and organic goods, which provide minimal or no risks to the environment and public health, as a result of growing environmental concerns. As a result, a number of big manufacturers are investing heavily and forming partnerships with the leading biotechnology firms in order to introduce eco-friendly and bio-based solvents and attain sustainability.

Additionally, the market is expanding due to the new solvent uses in deicers, cooling circuits, dry cleaning, and chemical production processes. Other reasons, such as quick urbanization and industrialization, strict government rules requiring the use of environmentally friendly solvents, continuous research and development (R&D) efforts, and technical breakthroughs, are also boosting market expansion.

- Increasing demand for chemical solvents from a variety of end-use industries, including the pharmaceutical, building, and automotive sectors, among others.

- One of the key factors fueling the expansion of the solvents market is the sector for paints and coatings, which is quickly expanding.

- The main reason for boosting market expansion is the expanding product applications in various end-use industries.

- This market's expansion is anticipated to be fueled by new product discoveries and rising spending in solvent research & development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 32.52 Billion |

| Market Size in 2024 | USD 30.30 Billion |

| Market Size by 2034 | USD 60.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.22% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for green and bio solvents.

The terms "bio" and "green" solvents refer to ecologically friendly or biological solvents. These are made from agricultural crops that have been processed. More sectors, including engineering, pharmaceuticals, printing, and construction, are using solvents. Scientists began working on green or bio-based solvents since they are more environmentally friendly and safer for people to use. They also go by the name "agrochemicals." Their popularity as a substitute for solvents based on crude oil is rising. Therefore, rising demand for bio and green solvents is anticipated to propel market expansion.

Utilization of solvents in personal care, industrial coatings, and pharmaceutical products.

There are several applications for solvents. They are used by thousands of firms and industrial facilities to meet their manufacturing demands. A solvent is used as a cleaning and degreasing agent in routine household cleanings tasks, such as cleaning toiletries, floors, windows, or any other debris.

The Covid 19 epidemic has rekindled customers' interest in skin care within the beauty industry. People are being urged to enhance their general skin health and fairness by the current social media trend. As a result, the demand for critical skin products has increased at numerous cosmetics merchants and producers. Solvents are essential to many of the goods used on a daily basis, from medications to industrial coatings. The product's market is expanding as a result of the increasing demand for solvents from end-use industries.

Key Market Challenges:

Chemical solvents have risky side effects that limit the expansion of the solvent sector. Solvents made of chemicals can have a variety of negative effects on human health. They have a negative impact on both human and animal health in addition to the environment. Additionally, because of their repeated exposure to these chemicals, factory employees who work in chemical companies frequently struggle with serious health problems.

For instance, the U.S. department of labor states that the health risks linked to solvent exposure include cancer, dermatitis, liver and kidney damage, respiratory impairment, reproductive harm, and nervous system toxicity. These are a few of the elements that could prevent the product from being adopted.

Key Market Opportunities:

Increasing end-use industry demand.

In the majority of emerging regions, the population of cities is gradually growing. Less than 35% of people live in metropolitan centers in many APAC nations. Future predictions indicate that these economies will expand at a promising rate. The need for paints and coatings is being driven by the expansion of the construction sector, which is also fueling the market for solvents.

Additionally, the International Monetary Fund (IMF) predicts that the rapid growth rates of several developing economies will present opportunities for producers and suppliers of petrochemical-based solvents, particularly those serving the infrastructure and construction industries in emerging economies.

Increasing demand from the automotive and construction sectors.

Demand for solvents is increasing as a result of the strong demand in the automobile industry, which is creating profitable prospects for innovation in the paints and coatings aftermarket.

Due to their propensity to have a high solid content and low viscosity, ketones are frequently used in paints and coatings. Ester solvents are frequently used as an industrial cleaning and as a hardener in paints. In order to breakdown binders and pigments and provide uniformity, bio-based solvents are used in paints and coatings. Some spray paints and decorative paints contain solvents like glycol ether esters to prevent them from drying in midair.

Paints, thinners, and glues are just a few of the construction-related items that employ solvents. The expansion of the paints and coatings application category is anticipated to be aided by rising building activity in nations like China, India, the United States, and Brazil.

Solvents are used in a variety of ways in the automobile sector. Gasoline additives aid in preventing the separation of water from the fuel. Solvents also help the gasoline burn more efficiently, which can help lower exhaust emissions. Solvents help to clean carburetors, keep the engine cool, de-ice frozen door locks, and maintain clean upholstery and carpet.

Product Type Insights

The market is divided into categories for alcohols, ketones, esters, and other products based on the kind of product. The market share that belonged to the alcohol industry was the greatest. The demand for ethanol, methanol, n-butanol and isopropanol for diverse uses is on the rise, which is the cause of the growth. Methanol is extensively used in inks and adhesive applications, whereas ethanol is consumed in fragrances, vegetable essences, and pharmaceuticals. Thus, throughout the projection period, the segment's expansion will be aided by the growing acceptance of these items. Ketones, on the other hand, are often used as solvents due to their low molecular weight.

They are used in printing inks, surface coatings, adhesives, and chemical intermediates. Additionally, during the projected period, the esters sector will experience considerable increase due to rising demand for ester products to remove organic solutes from aqueous solutions.

Application Insights

Due to its extensive use in the construction sector, the paints and coatings category accounted for the largest market share of around 54% in 2024 and is anticipated to expand at the highest CAGR. The development of the paints and coating application segment is being fueled by the construction industry's explosive growth as well as improvements made to paints to make them more environmentally friendly. The second largest market sector is printing inks. In printing applications, solvents including methanol, ethyl acetate, and aromatic hydrocarbons are employed.

The industrial cleaning market will be driven by the increased production to remove dirt, greases, containments, flux, and baked-on oil in various sectors. The increased product demand from applications including composites, glass, metals, and plastic is blamed for the adhesive market's expansion.

Source Insights

In 2024, the Derived Sources category accounted for 86% of the market for solvents. The majority of solvents come from synthetic compounds and petroleum. These derived sources are formulated appropriately to expand the solvent uses into fresh fields. Petroleum-derived hydrocarbon fractions used in industrial processes and commercial formulations to suspend, dissolve, or transport other components.

The development of refinery operations intended largely for the conversion of low-octane feedstock to high-octane fuels, as well as environmental restrictions and concerns, have resulted in a significant growth in the diversity of petroleum solvents in recent years.

Solvents Market Companies

- Ashland Global Holdings Inc.

- BASF SE

- BP plc.

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- CITGO Petroleum Corporation

- Eastman Chemical Company

- Exxon Mobil Corporation

- Honeywell International Inc.

- Huntsman International LLC

- INEOS AG

- Kuraray Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- Maruzen Petrochemical Co., Ltd.

- Sasol Limited

- Shell International B.V.

- Solvay S.A.

- The Dow Chemical Company

- TotalEnergies SE

Recent Developments

- In August 2024, Eastman launched a new electronic grade solvent to deliver superior quality. Eastman electronic grade isopropyl alcohol (IPA) is the latest addition to the Eastapure electronic chemicals line that offers U.S. semiconductor manufacturers a domestically made solvent as reliable in quality as it is in supply.

- In May 2025, Epson introduced the next-generation SureColor S8160 eco-solvent printer. The eco-solvent signage printer offers outstanding productivity, exceptional image quality, and a wide color gamut in a compact, user-friendly design.

- In October 2024, Clariant introduced Vitipure LEX 3350 S, Vitipure LEX 4000 S, and Polyglykol 1450 S to solve active pharmaceutical ingredient (API) delivery and bioavailability challenges. This co-solvent is optimized for sensitive applications.

Segments Covered in the Report

By Product Type

- Glycols

- Ethylene

- Propylene

- Hydrocarbons Solvents

- Aliphatic Solvents

- Aromatic Solvents

- Halogenated Solvents

- Methylene Chloride

- Trichloroethylene

- Perchloroethylene

- Acetic Acid

- Alcohols

- Methanol

- Ethanol

- Propanol

- Butanol

- Esters

- Ethyl Acetate

- Butyl Acetate

- Ketones

- Acetone

- MEK

- MIBK

- Chlorinated

- Others

By Application

- Printing inks

- Paints and coatings

- Pharmaceuticals

- Adhesives

- Cosmetics

- Agriculture Chemicals

By Source

- Natural Sources

- Derived Sources

- Petroleum Sources

- Synthetic Sources

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client