October 2024

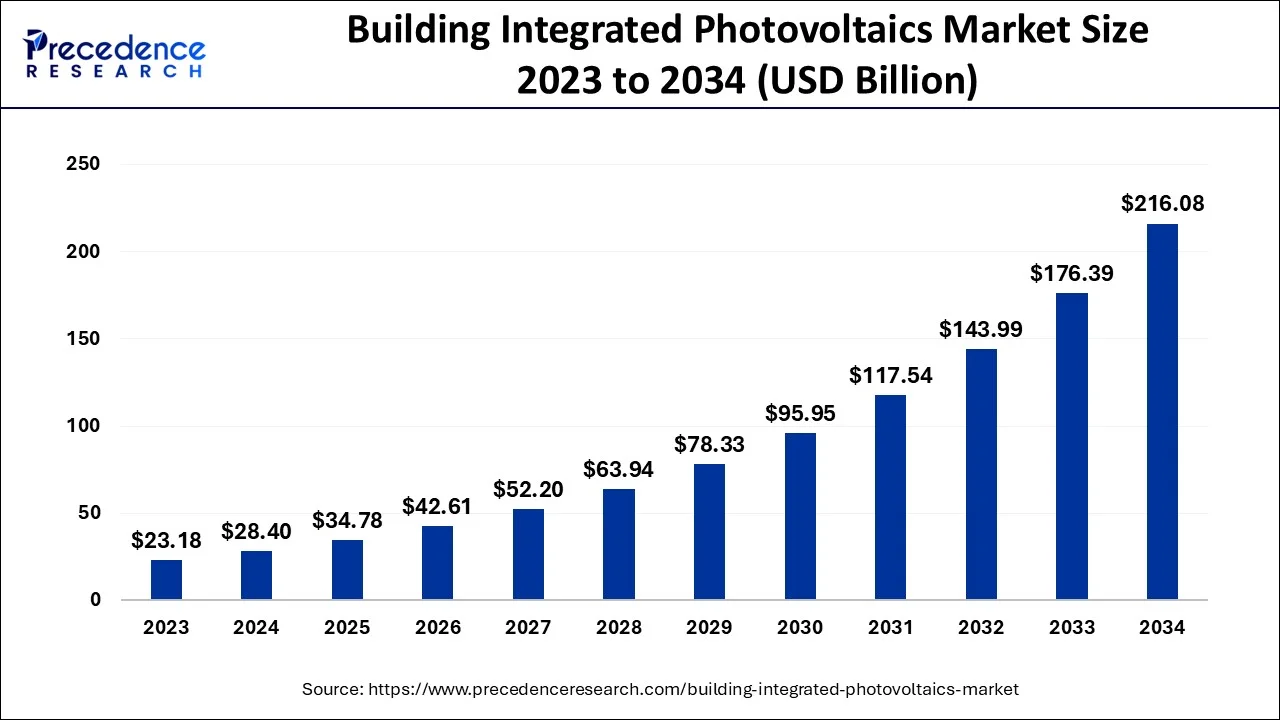

The global building integrated photovoltaics market size accounted for USD 28.40 billion in 2024, grew to USD 34.78 billion in 2025 and is predicted to surpass around USD 216.08 billion by 2034, representing a healthy CAGR of 22.50% between 2024 and 2034.

The global building integrated photovoltaics market size is estimated at USD 28.40 billion in 2024 and is anticipated to reach around USD 216.08 billion by 2034, expanding at a CAGR of 22.50% from 2024 to 2034.

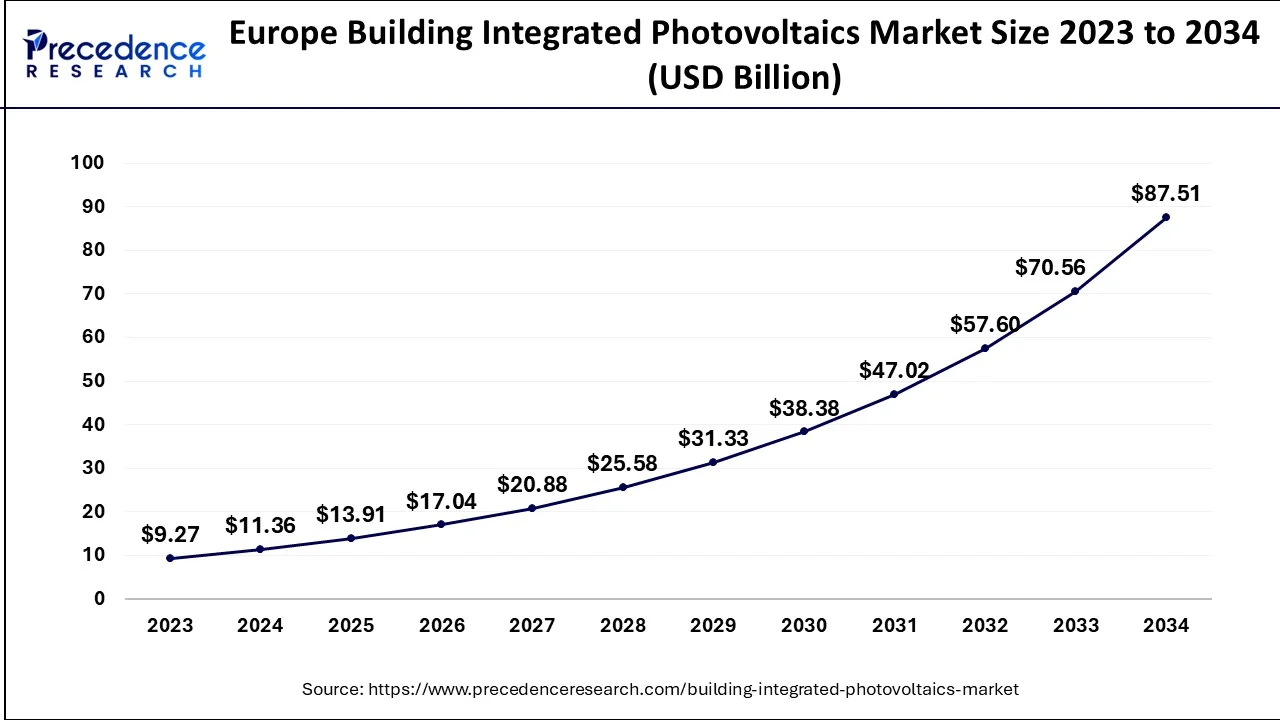

The Europe building integrated photovoltaics market size is evaluated at USD 11.36 billion in 2024 and is predicted to be worth around USD 87.51 billion by 2034, rising at a CAGR of 22.64% from 2024 to 2034.

The European Commission's supportive directives which provide financial incentives and subsidies for the Photovoltaic integration have led to an increase in the growth of the European market. UK, Italy, France and Spain are also contributing to the regional growth. There has been a lucrative growth in European market due to the increased installation of solar panels. With US and Canada being the major players, the North American market also occupies a significant position due to favorable regulations from the government.

The building integrated photovoltaics are used as substitutes for the certain conventional building materials. They could be used in the roof, the skylights and the facades. Building integrated photovoltaics are incorporated in construction and they are also known as solar panels.

The manufacturing activities of the building integrated photovoltaics market had been affected significantly due to the lockdown. A large number of PV modules are manufactured in China and the production and supply chain had taken a significant hit during the pandemic. Disruptions in transporting of goods and delay in supply chains had drastically affected the manufacturing capacity of China. The recovery of the market has commenced since the year 2021.

The reason for a rise in demand for the building integrated photovoltaic is an increase in the integration of solar energy solutions in various commercial buildings. They provide architectural optimization and conservation of energy. In order to comply with government regulations and for sustainable development the demands are high for solar power generation. The depleting of non-renewable power sources are also leading to an increase in demand for PVs. Various construction and building sectors are focusing on clean energy, as there's a rise in demand for zero-emission buildings. The awareness about the ecological benefits of IPV have also resulted in the demand for the same. It helps in reducing carbon footprints as it is a clean source of energy. Constant technological advancements and increased wireless connectivity have increased the use of automated IPV components which helped in the growth of the market of Building Integrated Photovoltaics market.

| Report Coverage | Details |

| Market Size in 2024 | USD 28.40 Billion |

| Market Size by 2034 | USD 216.08 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 22.50% |

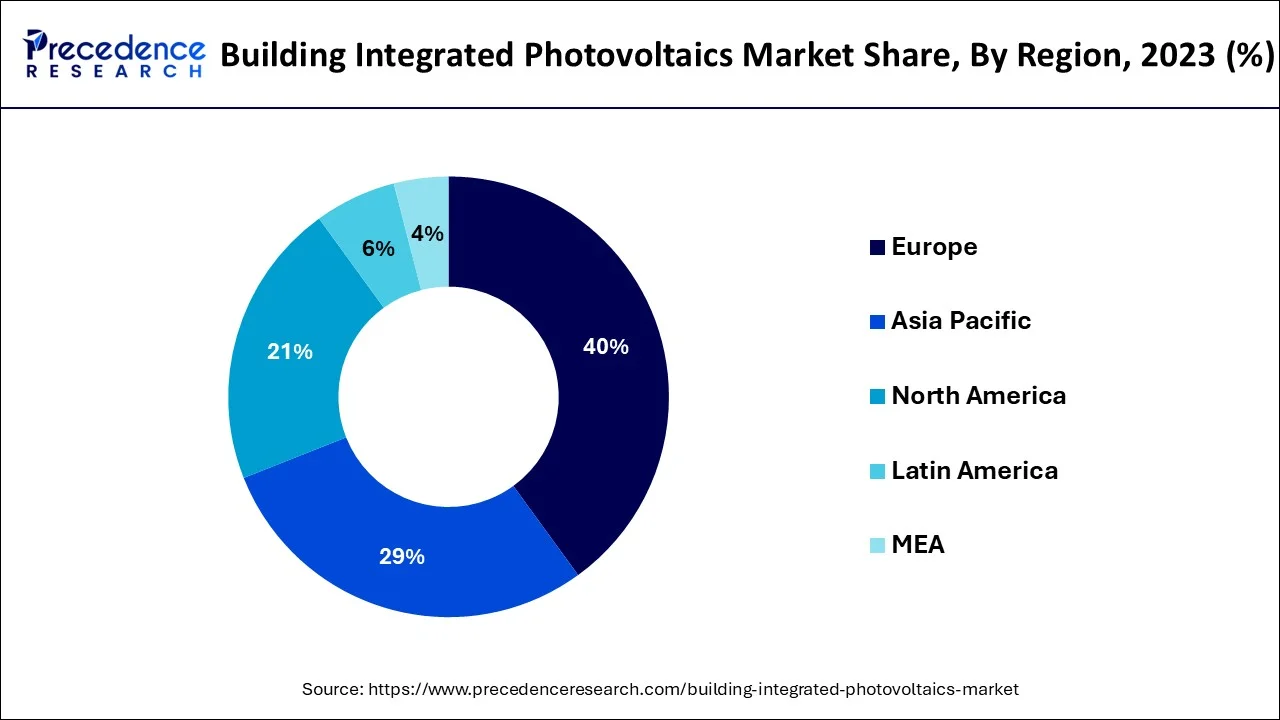

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, End-User, and Geography |

The technology segment of building integrated photovoltaics market uses either crystalline silicon or the thin film technology. Crystalline silicon technology has superior resistance to extreme weather conditions and it has a high strength, owing to these attributes the global market is expected to see a growth in this segment.

The declining prices of crystalline silicon will also result in the growth of the market. The thin film modules are used for the Windows. These thin films are manufactured with flexible materials which are lightweight, strong and durable. Crystalline silicon technology is expected to drive the market during the forecast period, and it has dominated the market till 2021 having a share of about 71%.

The building integrated photovoltaics market has applications in glass and roofs. In the residential sectors of US, Germany, France and the UK, there shall be an increased demand for roof installations. The use of building integrated photovoltaics in the roof provides a larger panel installation area. Till the year 2023, the roof application segment had a larger revenue compared to the glass segment. The demand for the off-grid PV systems shall increase during the forecast period as there is a growing deployment of energy storage systems.

The aesthetic appeal of the glass segment is expected to help in the growth of the market during the forecast. The ease of installation provided with the integration of photovoltaic energy systems in glass, the market is expected to grow. The construction of solar integrated curved glass buildings has increased as these buildings can receive higher concentration of solar rays which can help in meeting larger demands of growing urbanization.

The building integrated photovoltaics market serves residential areas, industrial areas and commercial spaces.

The commercial segment has had the largest revenue share in the previous years. In order to build a green infrastructure that has zero emissions, the commercial segment is expected to grow. Building integrated photovoltaics Provide an enhanced aesthetic appeal to the commercial buildings. And it also helps in saving the cost of the consumption of electricity thereby increasing the demand in the commercial segment. There's a growing demand for off-grid solar photovoltaic panels in the residential segment due to a rise in the availability of energy storage systems, the residential segment is estimated to have significant growth during the forecast. The rooftop building integrated photovoltaic system. Is expected to have a good demand in the residential segment.

The industrial segment is also expected to show considerable growth during the forecast period. An increased number of utility scale projects in various countries helps in giving a boost to the industry segment growth. These countries are focusing on reducing their dependence on conventional power generation sources and substituting that with renewable sources. These initiatives taken by various governments across the globe are helping in the growth of the market.

By Technology

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024