January 2025

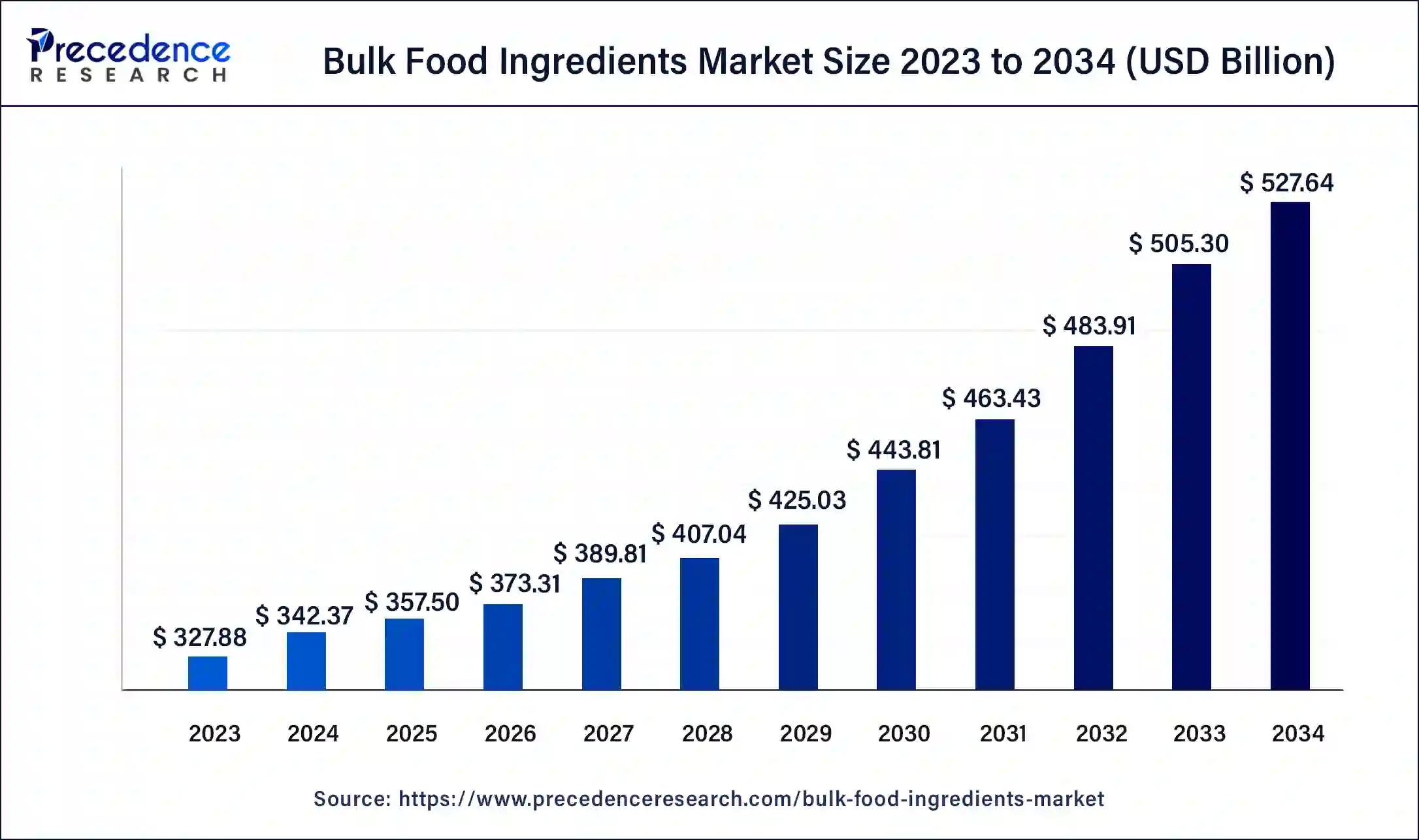

The global bulk food ingredients market size surpassed USD 327.88 billion in 2023 and is estimated to increase from USD 342.37 billion in 2024 to approximately USD 527.64 billion by 2034. It is projected to grow at a CAGR of 4.42% from 2024 to 2034.

The global bulk food ingredients market size is expected to be valued at USD 342.37 billion in 2024 and is anticipated to reach around USD 527.64 billion by 2034, expanding at a solid CAGR of 4.42% over the forecast period 2024 to 2034. The bulk food ingredients market growth is attributed to the growing demand for cost efficiency, reduced packaging waste, easy inventory control, and operational effectiveness, which is beneficial in the long run to survive constant industry changes.

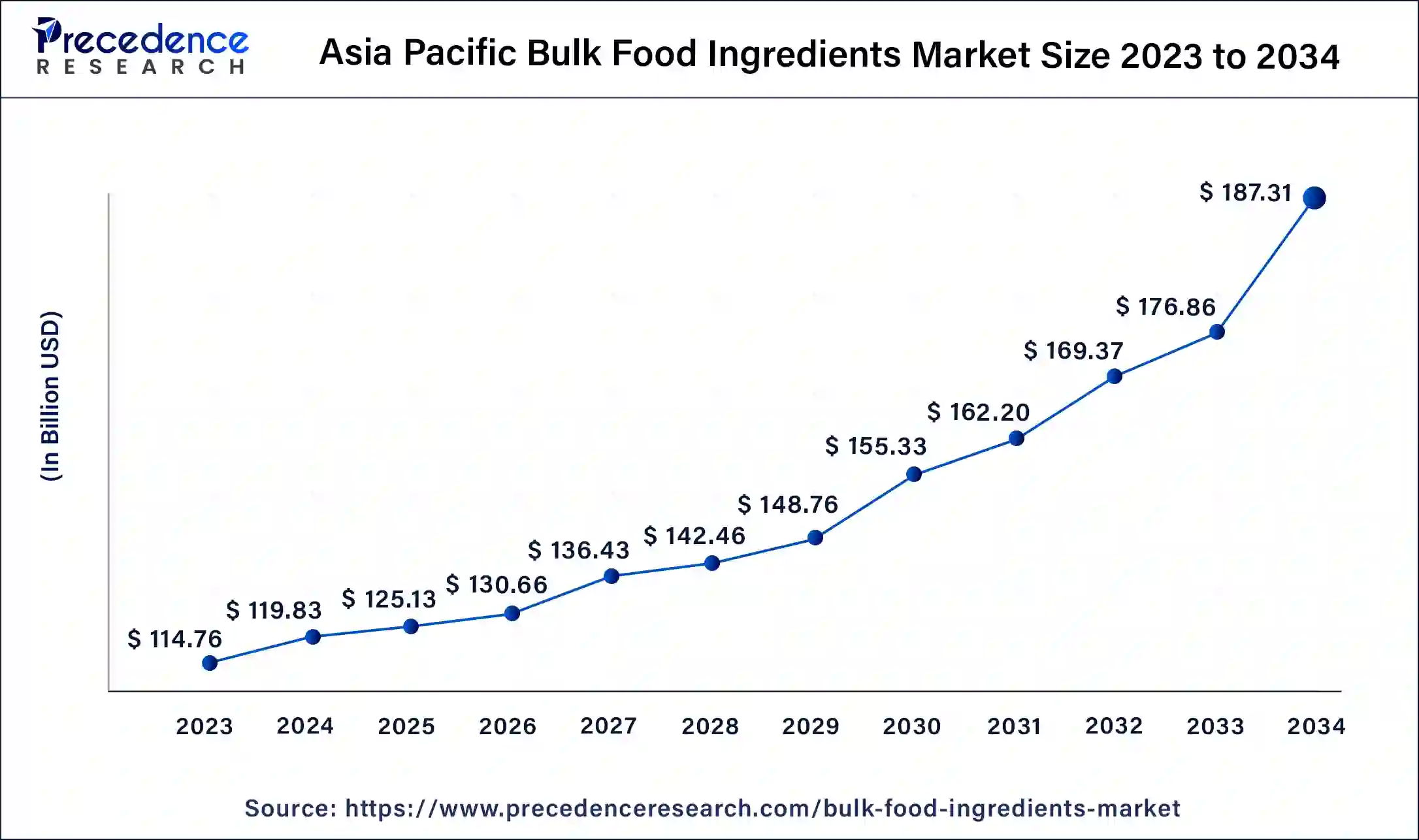

The Asia Pacific bulk food ingredients market size was exhibited at USD 114.76 billion in 2023 and is projected to be worth around USD 187.31 billion by 2034, poised to grow at a CAGR of 4.55% from 2024 to 2034.

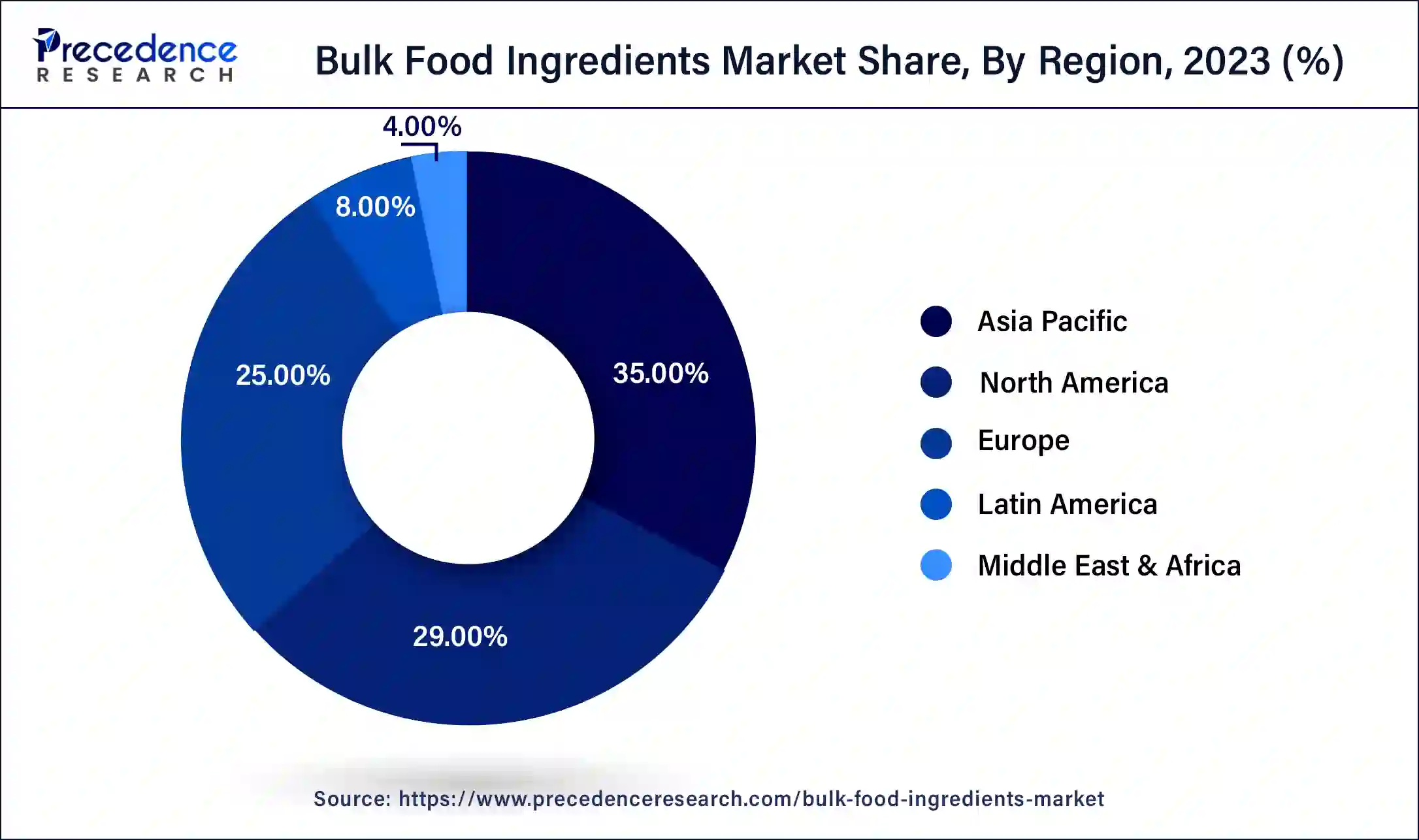

Asia Pacific held the largest share of the bulk food ingredients market in 2023. The demand for food products due to health awareness is growing due to consumers' concerns about heart disease, obesity, and high cholesterol. The high consumption of food products such as meat, bakery & cereals, dairy & soy food, fish & seafood, oils, fats, and others are witnessed in the region, which contributes to the growth of the market.

North America is observed to witness the fastest rate of expansion throughout the forecast period in the bulk food ingredients market. The U.S. and Canada have the largest food and beverage companies, such as PepsiCo., Tyson Foods, JBS USA, Nestle, and Kraft Heinz. The beverage industry in the United States is experiencing growth due to the increasing demand for nutrition-focused products such as shakes, bars, powder, and others. Additionally, there is a growing awareness of healthy drinks, which has led to a rise in consumption of both alcoholic and non-alcoholic beverages. The U.S. is home to 37,000 food and beverage processing plants.

Bulk food ingredients consist of components used in packaged, processed, and ready-to-eat food purchased in large quantities. A wide range of food ingredients are distributed globally, from farm-grown raw food, processed and semi-processed to ultra-processed food. The bulk food ingredients market is in high demand by distributors, wholesalers, restaurants, consumers, and retailers.

Food such as dried beans and lentils, frozen fruits and meat, nuts in shells, whole grains, honey, oats, dried pasta, and oils are bought and stored in large quantities. The dehydrated and unprocessed food items have an extended shelf life, maintaining quality even when stored at room temperature, lasting from 3-5 years to 10 years when stored under suitable conditions. Hence, there is no unnecessary wastage of food.

| Report Coverage | Details |

| Market Size by 2034 | USD 527.64 Billion |

| Market Size in 2023 | USD 327.88 Billion |

| Market Size in 2024 | USD 342.37 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Category, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Driver

Sustainable packaging

Purchasing food in bulk saves time, cost, and packaging material. The practice of buying food in large quantities is efficient and sustainable for the environment. This awareness-conscious practice drives the growth of the bulk food ingredients market. The primary advantage of bulk packaging is the ability to reduce cost and minimize environmental impact. Packaging waste is reduced by businesses packing the food in large quantities. This contributes to promoting an eco-friendly planet and also saves substantial costs for companies.

Transportation of goods has made a significant impact on the environment by increasing its carbon footprint. The shipment of large quantities is achieved in a single container and one-way travel. This cuts down on fuel consumption and decreases emissions associated with transportation. This responsible practice performed by the bulk food ingredients market creates a positive impact on the environment. Bulk packaging bags can transport and store larger quantities of products, optimizing logistics, reducing storage costs, and enhancing overall operational efficiency for business operations.

Inadequate storage

Improper storage of bulk food leads to food spoilage through decay, bacteria and mold growth, and wastage of food. The consumption of spoiled or contaminated food causes foodborne illness. Food services, industries, and households need to have an equipped storage area and procedures to be able to purchase supplies in large quantities; the ability to store supplies on the premises reduces the cost and time when needed; menu planning is easier when aware of the available ingredients that are on hand.

In present days, many food service industries are reducing the amount of stocks on hand because storage is expensive. Many operators pay extra amounts for supplies to avoid the stress of keeping track of expensive items such as large quantities of high-quality meat, wine, and spirits. However, some necessary items such as dry foods, dairy products, frozen foods, produce, and fresh meats are stored in the industry. The storage area for these items has a required design for efficient handling.

Different ways of food production

In the coming future, an innovative style of food is expected to be produced. With the rising world population, global warming, unavailability of food, and changing perspectives on sustainability, food will undergo major changes. Considering all the factors, mankind is anticipated to shift to alternate crops that are grown with less carbon footprint, sufficient quantity, and high nutritional value. Options such as lab-grown meat, edible insects, seaweed, and plant-based food are expected to bring about new changes in food production and the agriculture industry.

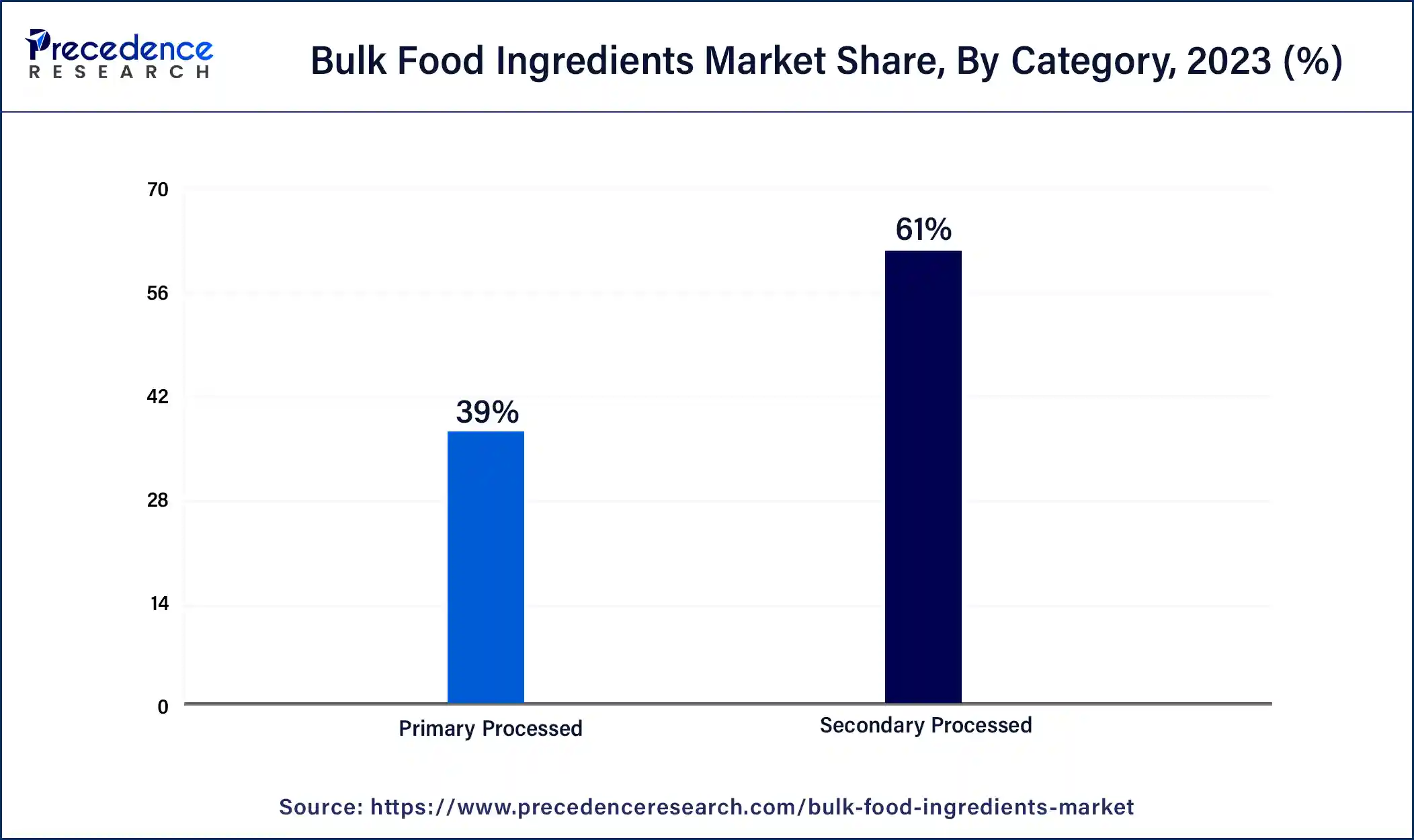

The secondary segment held the largest share of the bulk food ingredients market in 2023. The rising demand for ready-made meals, breakfast cereals, cured meats, chicken nuggets, and pet foods is boosting the growth of the bulk food ingredients market. Secondary processed food involves converting raw food into more processed and edible form. These are more refined, purified, transformed, or extracted from primarily processed food. Examples of secondary food products are processed dairy, flours, edible oils, sugars/sweeteners, and starches. They vary depending on the type of food group but include physical processes such as pressing, milling, and dehydration and chemical processes such as hydrolysis, hydrogenation, or using enzymes. North America and Europe are the biggest consumers of secondary processed food. In Europe, the United Kingdom, France, and Germany hold half the sales of ready-to-eat food. Asian countries currently consume very few ready meals; on average, consumption amounts to only 3.5 kg per year and per person. This is nearly half the amount that Americans eat.

The primary segment is expected to grow at the fastest rate in the bulk food ingredients market during the forecast period. Increasing demand for more palatable and digestible food is projected to grow the primary processed food segment. Primary processing turns agricultural feed into edible food such as wheat or corn kernels, which are further processed into flour or maize. Some examples of it are vegetables, fruits, legumes/beans/pulses, cereals, tubers, meat, milk, poultry, egg, fish and other seafood. Canning fruits and vegetables, deboning and cutting meat, candling eggs, and pasteurizing milk are also processes that fall in the initial stages of food processing. India is the largest agricultural production country in the world for milk, jute, and pulses. China is the world's largest producer of rice, wheat, corn, and potatoes.

The bakery & confectionery segment dominated the bulk food ingredients market in 2023. This dynamic industry is driven by urbanization, rising disposable income, and a growing preference for convenience food, which offers a wide range of products that cater to consumers' tastes. This segment continues to grow and evolve in terms of breads, biscuits, and confectionery chocolates. Under bread, a variety of products are produced, such as white bread, wholewheat bread, rye bread, and many more, with specialized bread dough such as sourdough, cornbread, and yeast. Under biscuits, a variety of tastes and textures for a wide range of occasions and appetites, such as rolled biscuits, drop biscuits, scones, and shortcakes. Asia is the largest producer of bakeries, and Europe is second.

The beverage segment is anticipated to grow rapidly in the bulk food ingredients market in the coming years. With the increasing population, demand for no-alcohol and low-alcohol beer, wine, seltzers, and more is growing. The market is expected to rise steadily with growing urbanization in nations like India and China. The demand for convenient, on-the-go beverages has surged, leading to advancements in recipes and packaging.

Segments Covered in this Report

By Category

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

September 2024

January 2025