January 2025

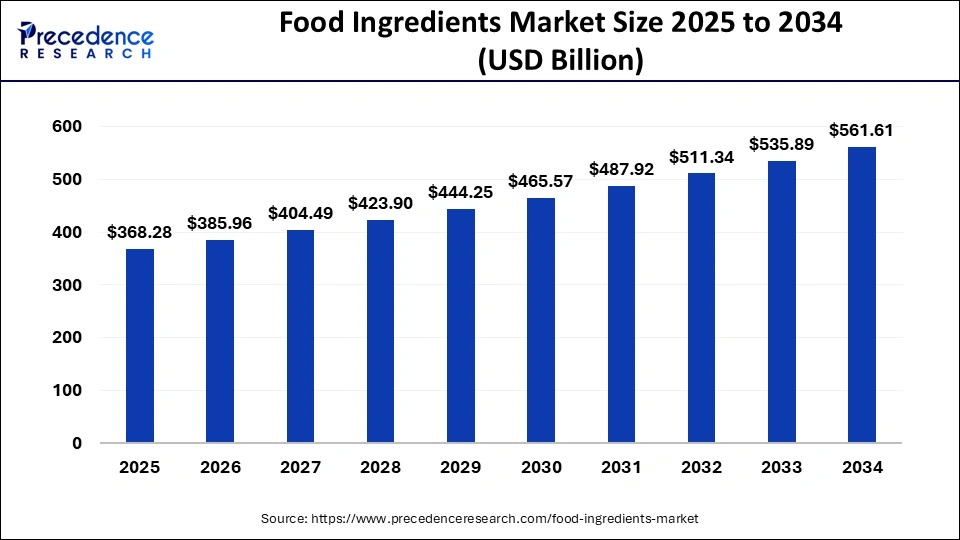

The global food ingredients market size accounted for USD 351.42 billion in 2024, grew to USD 368.28 billion in 2025, and is projected to surpass around USD 561.61 billion by 2034, representing a healthy CAGR of 4.8% between 2024 and 2034. The North America food ingredients market size is calculated at USD 154.25 billion in 2024 and is expected to grow at the fastest CAGR of 4.85% during the forecast year.

The global food ingredients market size is expected to be valued at USD 351.42 billion in 2024 and is anticipated to reach around USD 561.61 billion by 2034, expanding at a CAGR of 4.8% over the forecast period from 2024 to 2034.

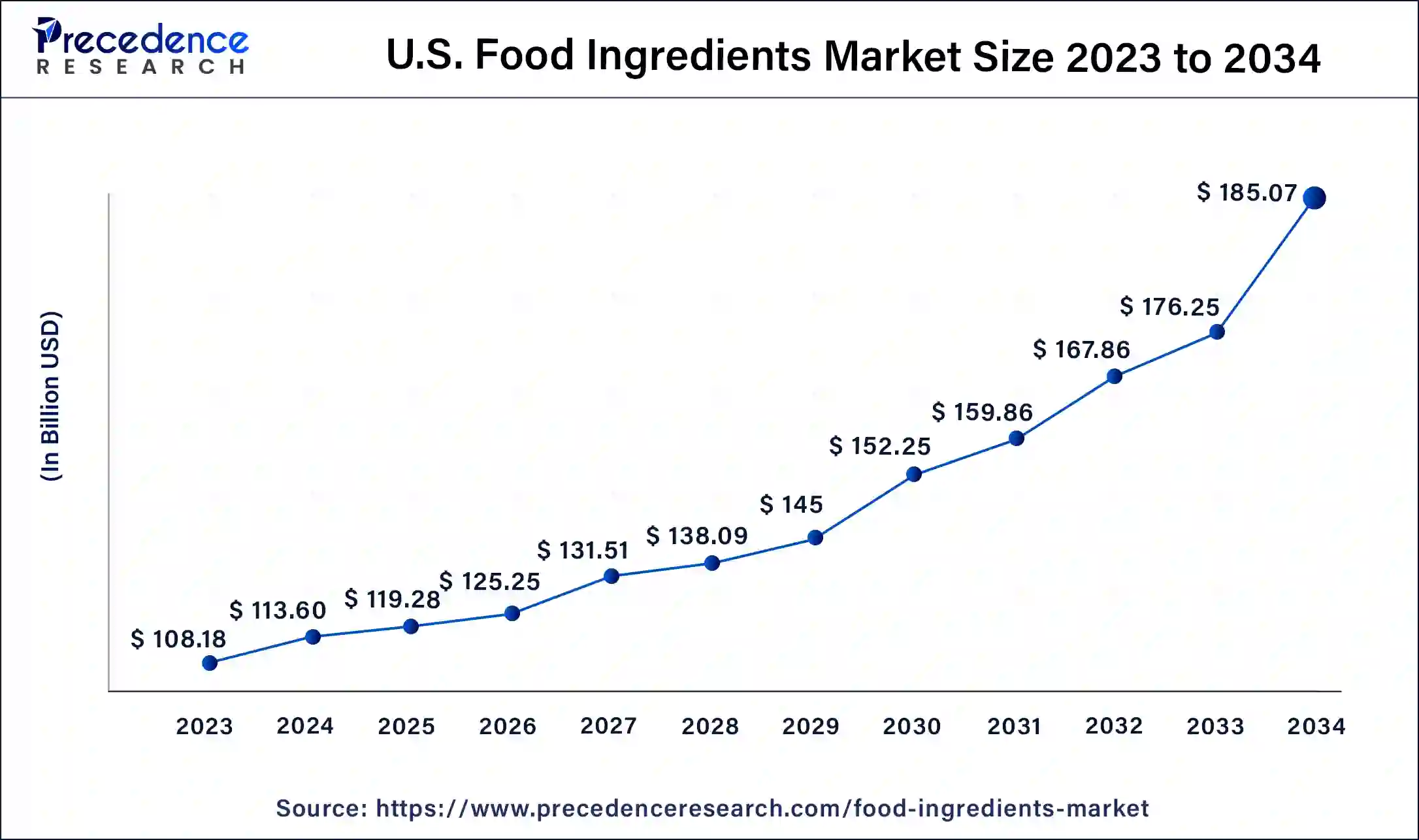

The U.S. food ingredients market size is calculated at USD 113.60 billion in 2023 and is projected to be worth around USD 185.07 billion by 2034, poised to grow at a CAGR of 5% from 2024 to 2034.

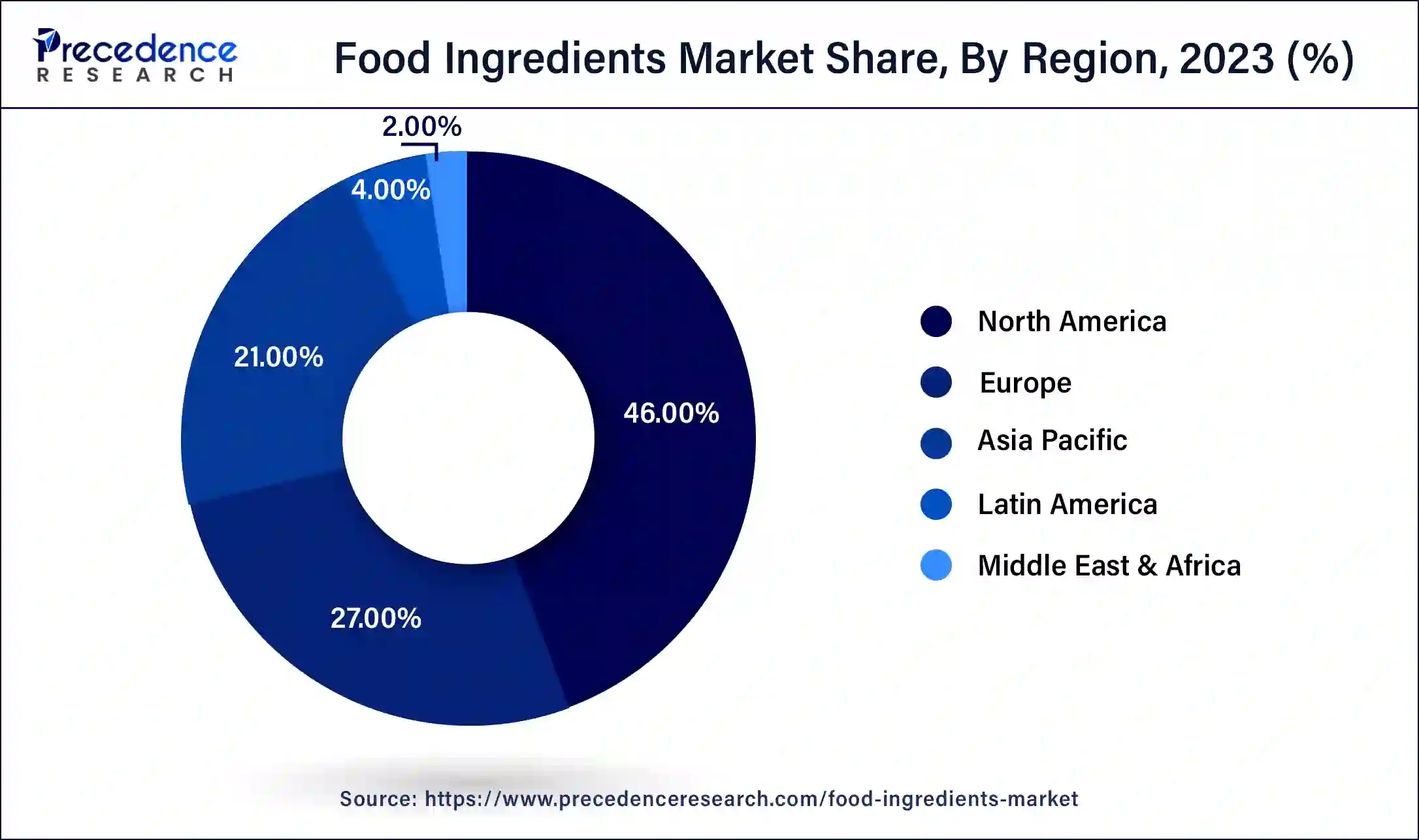

North America has held the largest revenue share 46% in 2023. In North America, the food ingredients market reflects a trend towards cleaner labels, with consumers showing a preference for natural and organic ingredients. The region experiences a surge in demand for functional and health-oriented ingredients, driven by a health-conscious consumer base. Plant-based and alternative protein ingredients are gaining prominence, aligning with the growing popularity of plant-forward diets. Innovations in sustainable and ethical sourcing practices also characterize the North American market, with a focus on meeting diverse dietary needs and addressing environmental concerns.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific is witnessing dynamic growth in the food ingredients market marked by a robust demand for flavor enhancers and unique taste profiles. As culinary preferences diversify, there is a notable emphasis on innovative ingredients to cater to varied tastes. With a growing population and rising disposable incomes, there is increased interest in premium and functional ingredients. Additionally, the adoption of Western dietary trends contributes to the popularity of specialty ingredients. The market in Asia Pacific is characterized by a balance between tradition and innovation, creating a vibrant and evolving landscape.

In Europe, the food ingredients market showcases a commitment to sustainable and ethically sourced ingredients, aligning with the region's emphasis on responsible consumption. The market experiences a surge in demand for plant-based and alternative proteins, reflecting a growing preference for environmentally friendly and plant-forward diets. Europe's rich culinary heritage blends with a focus on innovative and diverse ingredient offerings, creating a dynamic landscape that addresses evolving consumer preferences.

The food ingredients market is characterized by the continual evolution of clean-label and plant-based ingredients to meet changing consumer preferences. Growing demand for convenience food and functional ingredients, coupled with a focus on sustainable and ethically sourced components, further drives innovation and market expansion. Key players strive to address these trends through research, development, and the introduction of novel ingredients to enhance the overall quality and nutritional profile of food products.

In response to increasing health consciousness, the food ingredients market witnesses a surge in demand for organic and natural additives. Innovations in food technology and biotechnology contribute to the development of novel ingredients. As globalization impacts culinary preferences, the market adapts with a diverse range of ingredients, ensuring a dynamic landscape that caters to the complex and evolving needs of the global food and beverage industry.

| Report Coverage | Details |

| Market Size in 2024 | USD 351.42 Billion |

| Market Size by 2034 | USD 561.61 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Consumer demand for clean label products and technological advancements in food processing

Consumer demand for clean label products and technological advancements in food processing synergistically drive the surge in the food ingredients market. The increasing preference for clean label products, characterized by simple, natural ingredients, stimulates innovation in response to heightened transparency expectations. Food ingredient manufacturers respond by incorporating cutting-edge technologies in processing, ensuring the production of minimally processed, high-quality ingredients that meet clean label criteria.

Technological advancements further enhance the functionality, nutritional value, and sensory attributes of food ingredients. Advanced processing techniques enable the extraction of key compounds, preservation of nutritional integrity, and the creation of unique textures and flavors. This not only aligns with clean label demands but also caters to the evolving tastes and preferences of consumers seeking healthier and more diverse food options. Together, consumer demand for transparency and technological innovations propels the food ingredients market forward, shaping a landscape of wholesome, technologically refined, and consumer-friendly offerings.

Fluctuating raw material prices and consumer concerns about additives

Fluctuating raw material prices present a significant restraint for the food ingredients market. The industry relies heavily on diverse raw materials, including agricultural products, flavoring agents, and preservatives. Sudden changes in commodity prices, influenced by factors such as weather conditions, geopolitical events, and supply chain disruptions, impact the cost structure for manufacturers. This volatility can lead to increased production costs and decreased profit margins. To mitigate these challenges, companies may face the need to adjust pricing, which can potentially affect their competitiveness in the market. The unpredictability of raw material prices poses challenges in long-term planning and strategic decision-making for food ingredient manufacturers.

Consumer concerns about additives, including artificial colors, flavors, and preservatives, pose another restraint on the food ingredients market. As consumers become more health-conscious and prioritize clean eating, there is a growing aversion to synthetic additives perceived as unnatural or potentially harmful. Heightened awareness of food labels and ingredients prompts consumers to seek products with minimal additives and a focus on natural, wholesome alternatives. This trend places pressure on manufacturers to reformulate products or seek natural alternatives, impacting the market demand for traditional additives. Addressing consumer concerns about additives requires innovation, transparency, and a commitment to providing clean-label solutions to maintain consumer trust and meet evolving dietary preferences.

Functional, nutraceutical ingredients, plant-based and alternative proteins

Functional, nutraceutical ingredients and the surge in plant-based and alternative proteins are key drivers propelling the food ingredients market. The demand for functional and nutraceutical ingredients is driven by consumers seeking foods with added health benefits, such as antioxidants, vitamins, and probiotics. This trend aligns with the growing global emphasis on wellness and preventive health, spurring innovation in ingredient formulations to meet these health-conscious preferences.

Simultaneously, the rise in plant-based and alternative proteins caters to the increasing popularity of vegetarian, vegan, and flexitarian diets. Consumers are drawn to these protein sources for health reasons, ethical considerations, and environmental sustainability. This shift prompts the development of diverse plant-based ingredients and protein alternatives, ranging from plant-derived meat substitutes to dairy alternatives. The market's response to these trends reflects a dynamic landscape, with food ingredient manufacturers continually innovating to meet the evolving demands of health-conscious and environmentally aware consumers.

According to the type, the sweeteners segment has held 59% revenue share in 2023. Sweeteners in the food ingredients market refer to substances used to impart sweetness to food and beverages. The market trend involves a growing demand for natural sweeteners like stevia and monk fruit due to health-conscious consumer preferences. Additionally, there is an increasing focus on low-calorie and sugar-free sweeteners, driven by the rise in conditions like diabetes and obesity. The industry responds with innovations in sweetener formulations that balance taste and health considerations.

The nutrients segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. Nutrients in the food ingredients market encompass essential components providing nutritional value. Trends highlight a shift towards fortifying foods with vitamins, minerals, and functional nutrients to address specific health needs. Consumers seek nutrient-rich products, leading to the inclusion of superfoods and fortified ingredients in various food categories. The market sees a surge in demand for ingredients promoting overall well-being, reflecting a broader consumer trend towards healthier and functional food choices.

Based on the application, the food and beverages segment held the largest market share of 62% in 2023. In the food ingredients market, the application of food and beverages is central to delivering taste, texture, and nutritional value. From flavors and preservatives to emulsifiers and sweeteners, food ingredients play a crucial role in enhancing product quality. Current trends involve a shift toward natural and clean-label ingredients, meeting consumer demands for healthier and more transparent food options. Innovations in functional ingredients, such as plant-based proteins and natural sweeteners, are notable, reflecting the industry's response to evolving dietary preferences.

On the other hand, the nutraceuticals segment is projected to grow at the fastest rate over the projected period. Nutraceuticals, encompassing functional food and dietary supplements, represent a growing application in the food ingredients market. The market caters to the demand for ingredients promoting health and wellness, including vitamins, antioxidants, and probiotics.

Trends in nutraceutical ingredients focus on bioavailability, efficacy, and natural sourcing. There's a notable rise in demand for ingredients supporting immune health, cognitive function, and overall well-being, aligning with consumers' proactive approach to personal health through dietary choices., encompassing functional food and dietary supplements, represent a growing application in the food ingredients market.

The market caters to the demand for ingredients promoting health and wellness, including vitamins, antioxidants, and probiotics. Trends in nutraceutical ingredients focus on bioavailability, efficacy, and natural sourcing. There's a notable rise in demand for ingredients supporting immune health, cognitive function, and overall well-being, aligning with consumers' proactive approach to personal health through dietary choices.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025