January 2025

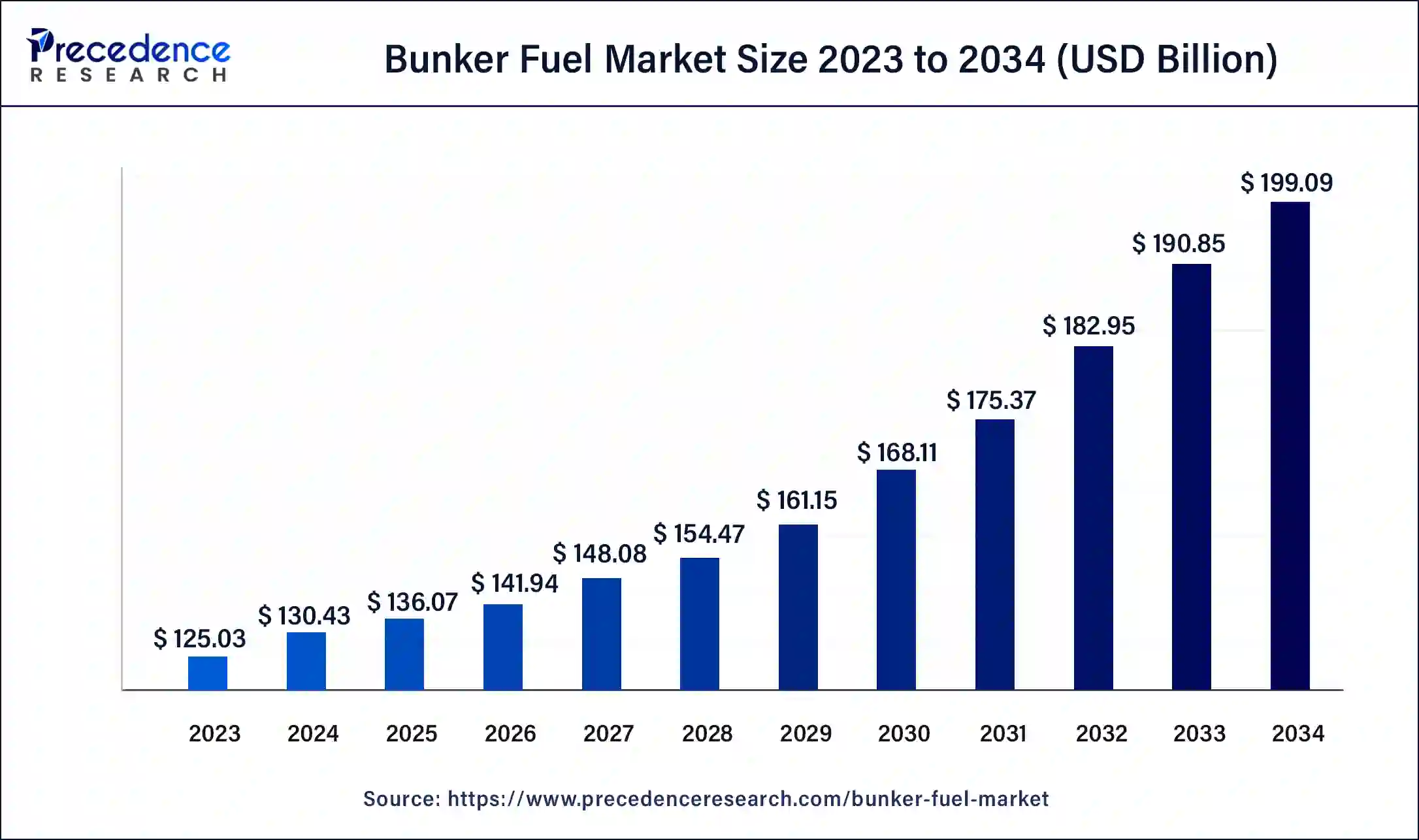

The global bunker fuel market size was USD 125.03 billion in 2023, calculated at USD 130.43 billion in 2024 and is expected to be worth around USD 199.09 billion by 2034. The market is slated to expand at 4.32% CAGR from 2024 to 2034.

The global bunker fuel market size is projected to be worth around USD 125.03 billion by 2034 from USD 130.43 billion in 2024, at a CAGR of 4.32% from 2024 to 2034. The bunker fuel market is expected to grow due to growing global shipping, demand for clean fuels, and improvement in the efficiency and effectiveness of bunker fuel, which promote fuel consumption and the market’s growth.

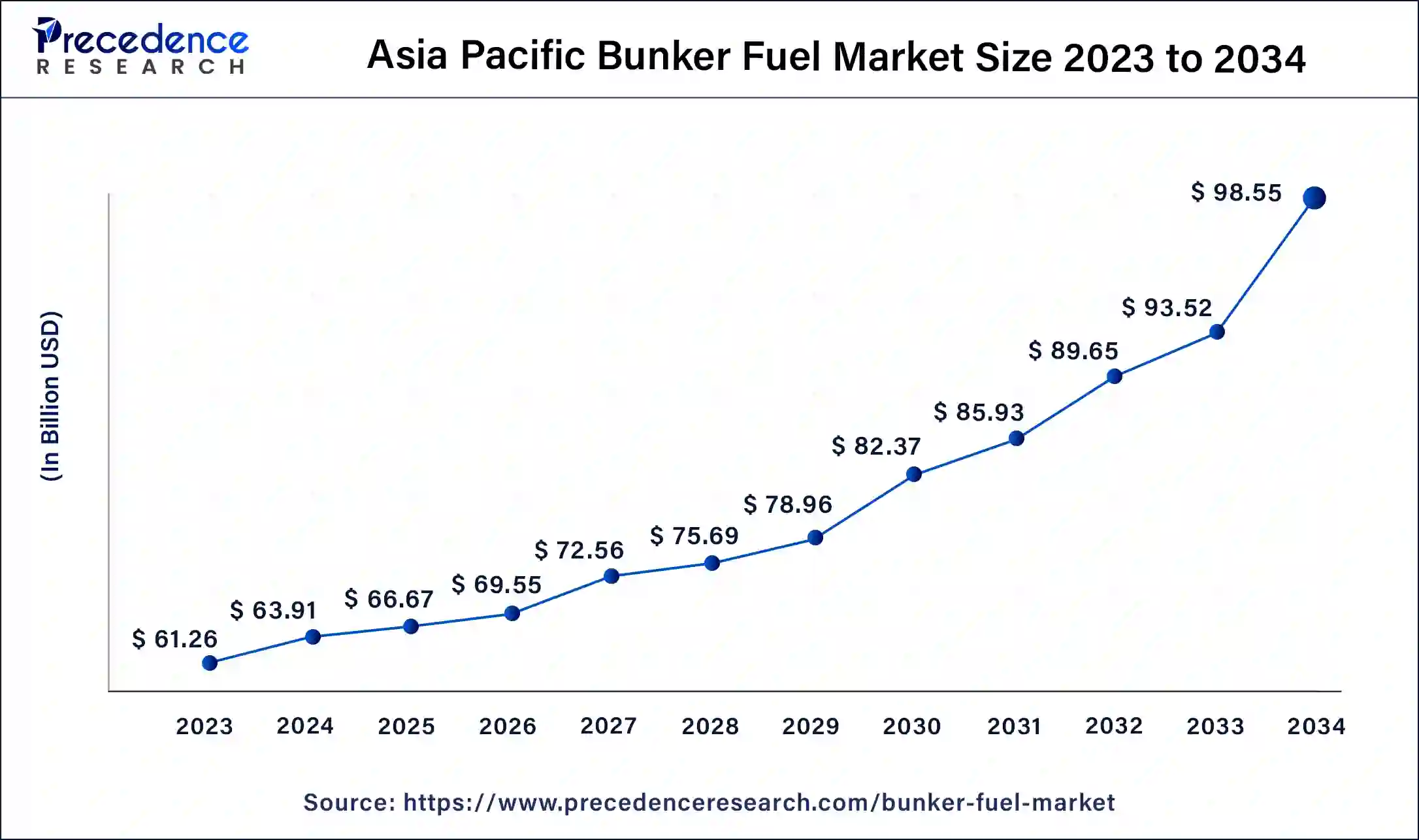

The Asia Pacific bunker fuel market size was exhibited at USD 61.26 billion in 2023 and is projected to be worth around USD 98.55 billion by 2034, poised to grow at a CAGR of 4.41% from 2024 to 2034.

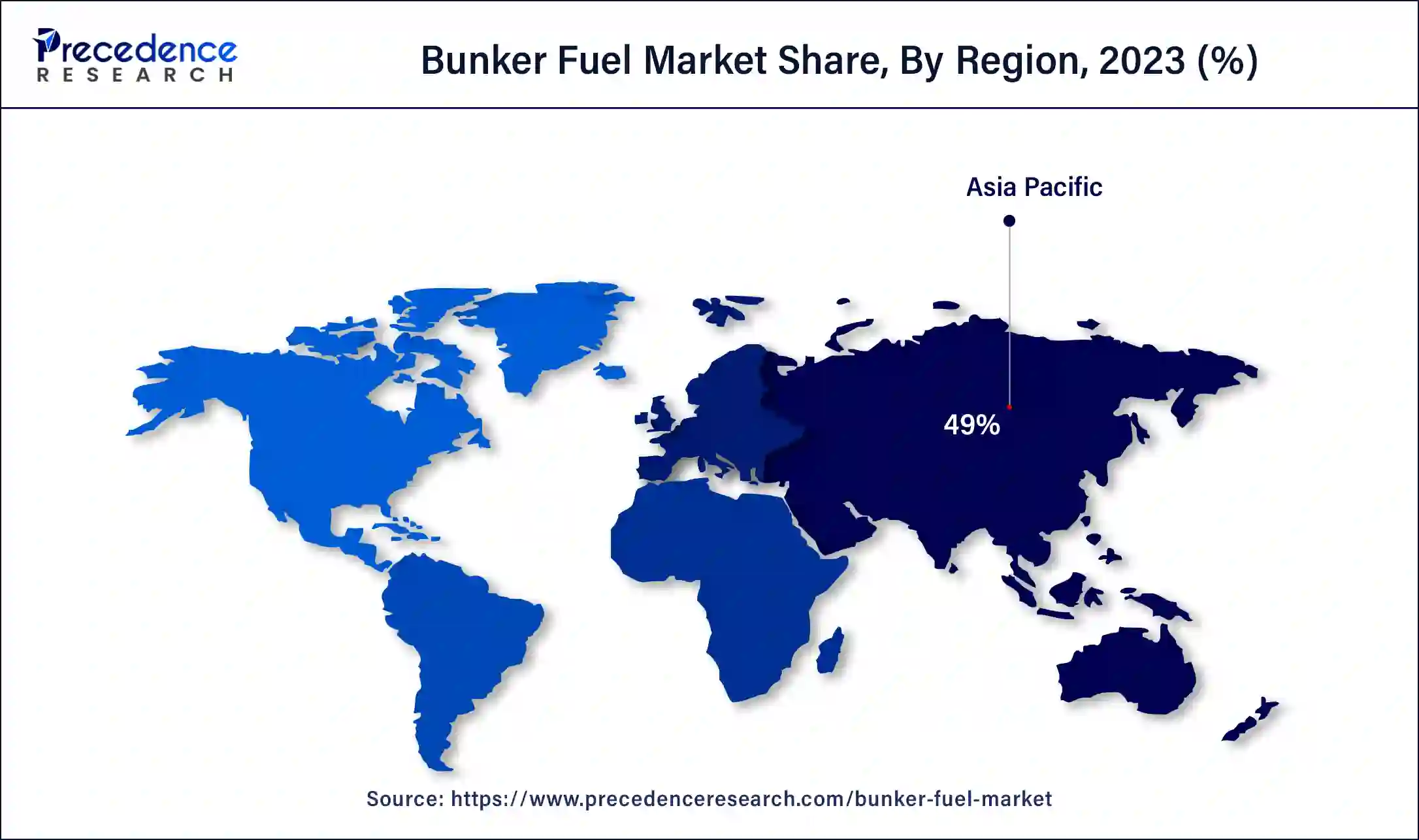

Asia Pacific led the bunker fuel market in 2023. The Asia Pacific bunker fuel market is growing as a result of healthy sea-borne trade, rising shipping activities, and stringent emission standards on ships. Large-scale operation ports and shipbuilding centers across the world, rising technological advancement, and a growing economy all contribute to the growth of this market.

The Asia Pacific, bunker fuel industry, is important because of the prominent shipping centers in regions such as Singapore and Shanghai. It is driven by growing import and export volumes, higher standards on emission, and the greater use of low-sulfur products. Technological development and growth of the regional economy also help in the market development.

North America is observed to grow at a notable rate in the bunker fuel market during the forecast period. The maritime industry is one of the most globally significant industries, and the United States is one of its leading participants. As has been highlighted earlier, almost all the states in the country have very big ports. The transport means most commonly used for these goods is the maritime transport industry. Thus, this is parallel with the changes in exports and imports. This was so because the global downturn, particularly in the maritime business, led to a decline in the bunker fuel business in the country.

United States Coast Guard (USCG) regulations include regulations relating to the design, equipment, operation of the vessel and personnel on board vessels that transport LNG as cargo and regulations for boil-off gas fueling systems used on LNG carriers. The use of LNG as fuel for Ships other than the Ships that transport LNG as a commodity is still in its early stages in North America.

Bunker fuel can be defined as the different categories of marine fuel that are used to propel ships, with elements such as viscosity, pour point, sulfur, carbon, and metal residue being the differentiating factors. Also, it is a heavy fuel oil that is most commonly used in ships, especially by cruises, oil tankers, and container ships, due to the sticky nature of the fuel. Bunker fuel is applied as fuel for power generation and lighting on big ships and as a fuel for heating and electricity.

AI Impact on the Bunker Fuel Market

AI application in the bunker fuel market demonstrated the potential to be optimized with the help of pre-calculation conducted by Artificial Intelligence, and this is capable of enhancing the parameters of accuracy as well as the time of operation and eliminating human factors and operational inefficiencies. Furthermore, astute bunkering stations can monitor fuel quality in real time, thus ensuring vessels have a quality fuel supply that meets set standards.

AI plays a significant role in the bunker fuel market, ensuring that control requirements are being met by different bunkering companies by monitoring and managing fuel composition. With the help of AI frameworks, bunkering operations can ensure that vessels obtain correct fuel blends, thus reducing sulfur emissions and paving the way for cleaner oceans.

| Report Coverage | Details |

| Market Size by 2034 | USD 199.09 Billion |

| Market Size in 2023 | USD 125.03 Billion |

| Market Size in 2024 | USD 130.43 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Grade, Distributor, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing global trade

The steady growth of demand for the bunker fuel market is due to the seaborne transportation business and offshore market. Bunkering is the provision of fuel to a ship, which terms the fuel as bunker, and it involves the process of how the fuel is disposed in the available shipboard tanks. Bunker fuels are marine fuels that are categorized depending on their viscosity, pour point, sulfur, carbon, and metals residues.

Bunker fuel can be defined as a category of heavy oil processed from crude oil. Without it, the maritime business would have thrived, and it would have remained one of the most valuable sources of business and trade around the world. The maritime industry is on the path to a sustainable future, and therefore, sustainable changes in bunker fuels are charting the course in the right direction. Moreover, the need to lower emissions and avoid pollution besides meeting set standards and regulations has also forced the quick advancement of cleaner ones.

Shift towards alternative fuel

The alternative fuels for the shipping industry have identified LNG, LPG, methanol, biofuel, and hydrogen as the most promising solutions that hinder the growth of the bunker fuel market. The International Maritime Organization (IMO) has established the guidelines for the life cycle GHG analysis of marine fuels. Biofuel is emerging as a promising alternative to traditional fossil fuels in the shipping industry.

Regulations enhancing demands

In the bunker fuel market, the International Maritime Organization laid guidelines regarding the type of fuel to be used in ships to minimize the effects of shipping on the environment, particularly through pollution control. This is because of the continuing stricter air emission regulation through IMO Annex VI and other localized air quality regulations coupled with positive economic incentives for liquid fuel oil as a bunker fuel, leading to the increased intention of the owners of marine vessels to adopt LNG as a fuel.

The United States Coast Guard (USCG) regulations respond to the design and outfit, operational requirements, and personnel training on board Ships that transport LNG in their cargo and the fueling systems for boil-off gas used on LNG Carriers. LNG, not as the ship’s cargo but as the fuel for the ship that is not an LNG carrier, remains a rather new idea in North America.

The HFO segment contributed the largest share of the bunker fuel market in 2023. Heavy fuel oil is a by-product that results from the distillation of crude oil. It is applied to create movements and heat in processes of highly viscous and dense fluids. HFO is employed as a marine fuel, although other applications include fuel oil, heating, and electricity generation. Heavy fuel oil is a residual fuel that will always depend on the type of crude oil. These blends are also called intermediate fuel oils or marine diesel oil.

The LSHFO stimulation segment is expected to show considerable growth in the bunker fuel market over the forecast period. The new generation low sulfur marine fuel oils, also known as the ultra-low sulfur fuel oils with sulfur content below 0.1%, have progressively been replaced by traditional intermediate fuel oils and heavy fuel oils. Low Sulphur Fuel Oil not only helps reduce and repair environmental damage from Sulphur dioxide emissions globally but also provides economic and operational benefits to the world. In addition to that, it also eradicates the health issues identified with environmental pollution.

The IOC/NOC segment accounted for the largest share of the bunker fuel market in 2023. National oil companies control 77% of global oil and gas production compared to formerly dominant international oil companies. National oil companies appear to be recovering in global energy markets and control most of the world's oil and gas reserves. The preliminary research investigation of the current status of defining their public role in terms of job creation and national economy was conducted to determine the strategic developmental needs that are required for sustaining and expanding the companies’ public impact.

National oil companies (NOCs) like Saudi Aramco and Russia’s Gazprom produce half of the world’s oil and gas, control two-thirds of global reserves, and serve as political giants in their home economies.

The large independent distributor segment is anticipated to witness significant growth in the bunker fuel market over the studied period. The global independent bunker oil distributor serves and supplies marine fuels to the vessels without being affiliated with any of the oil companies. They are responsible for sourcing the bunker oil from different refiners, negotiating for a favorable deal, and dealing with the product's transport [transportation and warehousing]. With proper services and a constant supply of fuel, these distributors are, therefore, very important in ensuring that maritime businesses run as planned.

The bulk carriers segment generated the highest share of the bunker fuel market in 2023. These include the large carriers, which are highly essential in the international shipping business for moving the dry and the liquid bulk. Pressure from the increasing demand for raw materials means that efficient mass handling is essential to cut back on fuel usage. However, there is an emphasis on energy-efficient bulk carriers using considerably less fuel and emitting less carbon. Bulk carriers, in particular, constitute a large proportion of sea-borne trade.

Dry and liquid bulk carriers, which are large ships employed in the transportation of mass cargo through the sea, are gradually being developed with efficiency in energy and the fuel they require. This is due to environmental issues, such as greenhouse gas emissions, and the need to handle bulk cargo efficiently to minimize fuel costs.

The container ship segment is expected to grow at the fastest rate in the bunker fuel market during the forecast period. Most cargo ships utilize ‘bunker fuel,’ which is deemed to be the thick residue of petroleum. One would prefer to use fuel consumption by a containership, and it mainly depends on the ship's size and the speed of cruising. In order to minimize fuel consumption, shipping lines often opt for lower speeds. The amount of fuel used by a containership is mainly influenced by its size and cruising speed. However, the advantage of reduced fuel consumption needs to be weighed against longer shipping times and the potential need for more ships to maintain the same port call frequency on a pendulum service.

Segments Covered in the Report

By Grade

By Distributor

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

January 2025