January 2025

Burn Care Centers Market (By Facility Type: In-hospital, Standalone; By Procedure Type: Wound Debridement, Skin Graft, Wound Management, Respiratory Intubation & Ventilation, Pain Management, Blood Transfusion, Infection Control, Rehabilitation; By Burn Severity: Minor Burns, Partial Thickness Burns, Full-thickness Burns; By Service Type: In-patient, Outpatient, Rehabilitation) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

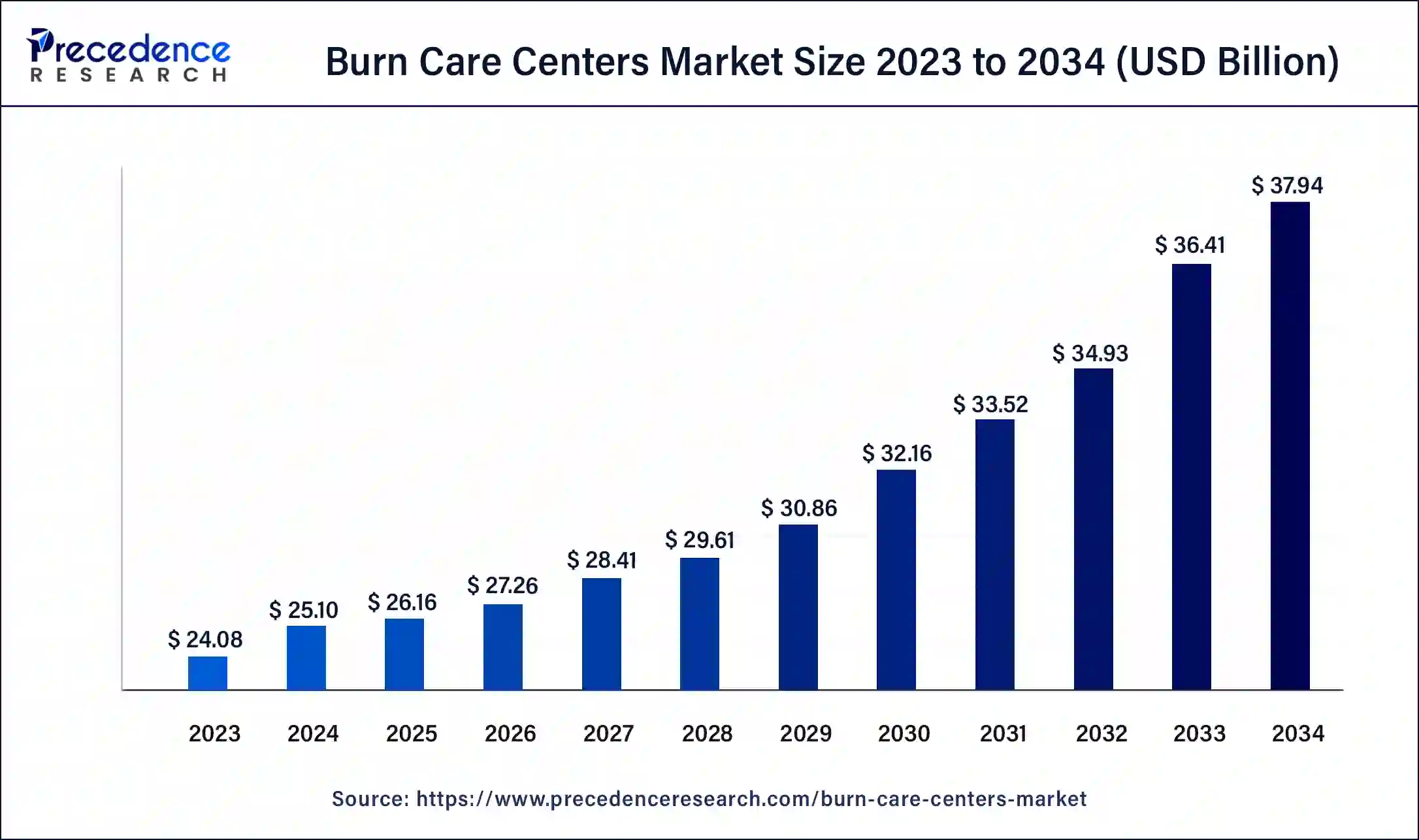

The global burn care centers market size was USD 24.08 billion in 2023, calculated at USD 25.10 billion in 2024 and is expected to reach around USD 37.94 billion by 2034, expanding at a CAGR of 4.22% from 2024 to 2034. The North America burn care centers market size reached USD 10.84 billion in 2023. The increasing incidence of trauma cases globally and the hospitalizations related to these are the primary drivers for the burn care centers market.

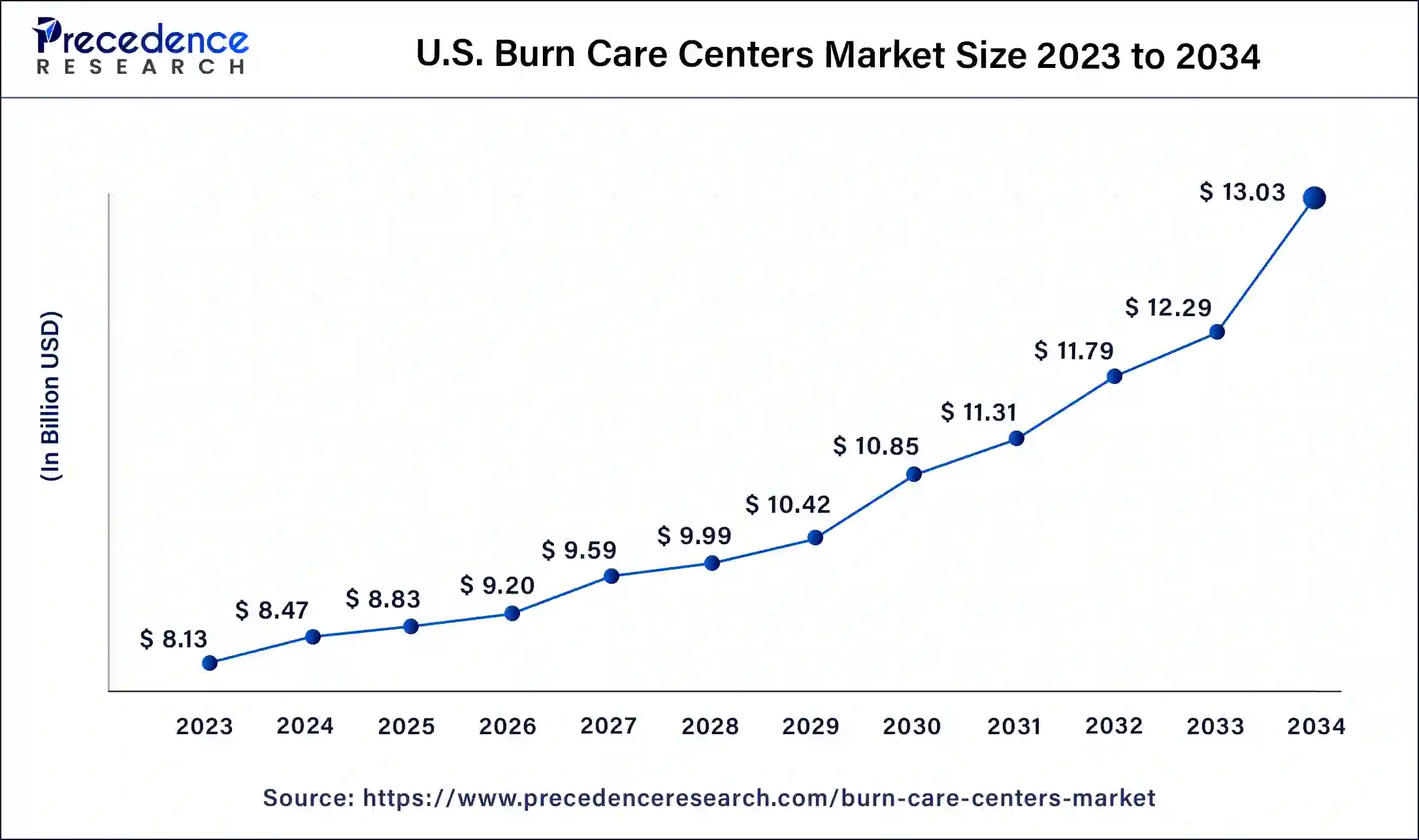

The U.S. burn care centers market size was exhibited at USD 8.13 billion in 2023 and is projected to be worth around USD 13.03 billion by 2034, poised to grow at a CAGR of 4.38% from 2024 to 2034.

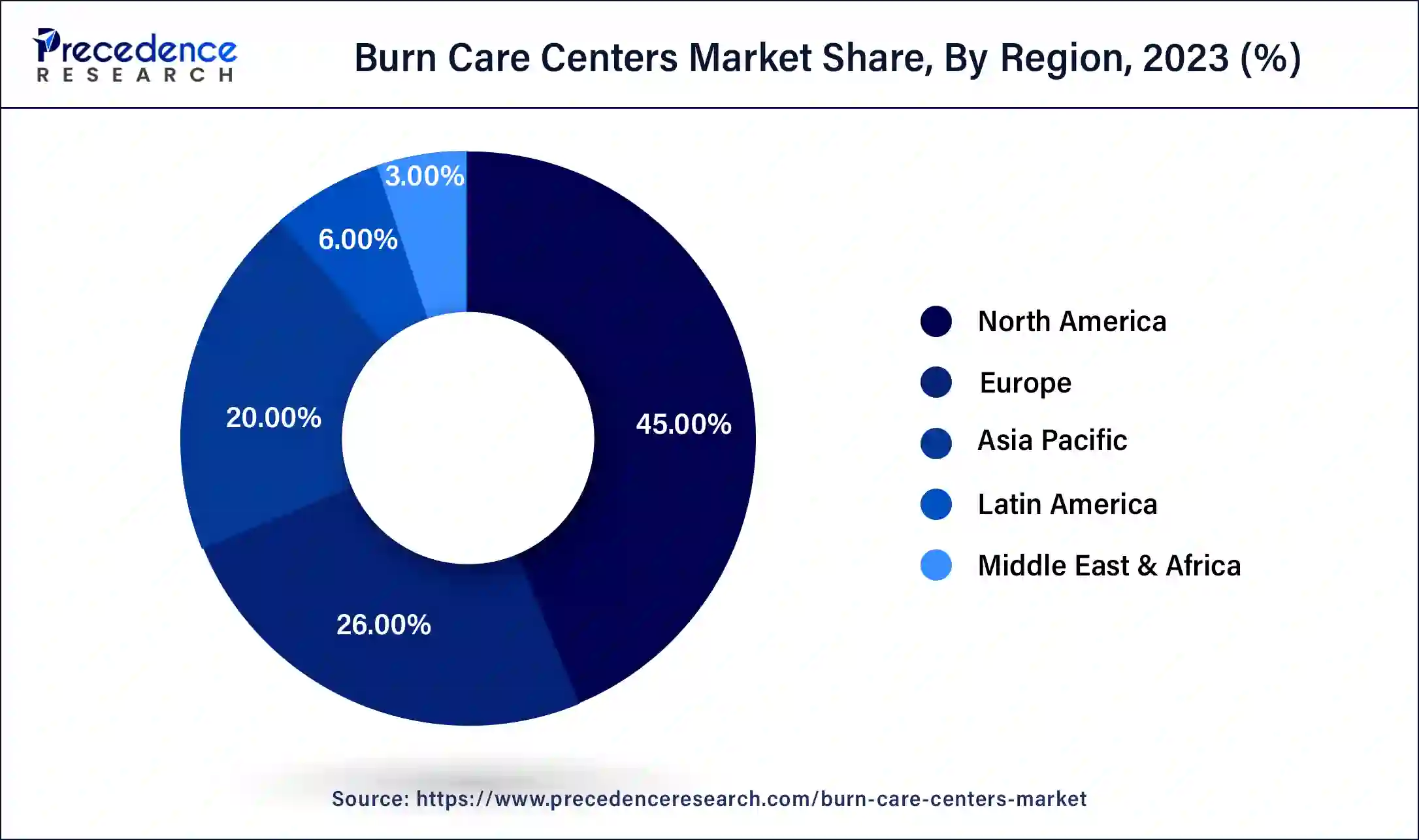

North America dominated the global burn care centers market in 2023. Regional growth drivers include the establishment of well-developed medical facilities and dedicated standalone centers. Additionally, favorable reimbursement policies covering a substantial portion, approximately 70%, of treatment costs contribute to the region's expansion, alongside the availability of advanced treatment modalities. The emphasis on personalized, high-quality care further supports growth in this region.

The United States emerges as the primary market, driven by initiatives to improve burn care, such as those addressing incidents involving kerosene cookstoves in South Africa, and bolstered by organizations like the American Burn Association.

Europe is the second largest market for burn care centers, driven by a high incidence of burn injuries and advanced healthcare infrastructure. Leading countries like Germany, France, and the UK contribute significantly due to their well-established medical facilities and focus on specialized burn care treatments. The market benefits from strong government support, innovative treatment options, and robust rehabilitation programs.

Asia Pacific is expected to grow at the fastest rate in the burn care centers market throughout the forecast period. The growth of the region is driven by several factors, including greater investments in burn treatment, an increase in burn incidents, enhanced healthcare infrastructure, and heightened awareness of burn care. Significant advancements in medical facilities and technologies in emerging Asian-Pacific economies like China and India have also propelled the burn care sector's expansion. Furthermore, there has been a rising demand for specialized burn care services due to regional efforts to improve healthcare standards and accessibility alongside government-led initiatives.

A burn is an injury to the skin or tissue caused by radiation, heat, electricity, or chemicals. Fire and hot liquids are among the most common causes of burns, but factors such as alcoholism, smoking, and interpersonal violence can also result in burn injuries. These wounds can be extremely painful, traumatic, disfiguring, and even fatal. Burn management depends on the severity of the injury and involves using burn care products to prevent complications, such as reducing scarring, removing dead tissue and infections, controlling pain, and restoring function. The burn care centers market is experiencing growth, primarily driven by the increasing adoption of skin grafts and related treatments to regenerate new skin cells.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.94 Billion |

| Market Size in 2023 | USD 24.08 Billion |

| Market Size in 2024 | USD 25.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Facility Type, Procedure Type, Burn Severity, Service Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

An increasing number of burn injuries can drive market growth

Burn care facilities must respond smoothly to the growing number of burn injuries that result from domestic accidents, industrial incidents, and natural disasters. As urbanization and population growth persist, the demand for specialized care and rehabilitation programs is set to rise. Moreover, burn care centers need to adapt to evolving injury patterns by implementing proactive preventative measures and promptly addressing emerging issues to meet the diverse needs of their patient population effectively. This drives the growth of the burn care centers market.

Limited access to burn care facilities

The major limitation in the burn care centers market is the rare availability of specialized burn care centers, particularly in rural or less developed regions. Access to facilities equipped with skilled healthcare professionals, innovative equipment, and comprehensive burn care services is essential for achieving optimal patient outcomes. However, disparities in healthcare infrastructure and resources can impede access to these facilities, especially for marginalized communities.

3D printing technology can create market opportunity

The burn care centers market offers numerous opportunities for growth and enhancement in treating burn injuries and improving patient outcomes. A primary opportunity is the development and implementation of innovative technologies and advanced therapies for burn care. This covers ongoing research and development of new wound dressings, biologics, and skin grafting techniques aimed at promoting healing and minimizing scarring in burn patients. Furthermore, integrating technologies such as 3D printing for personalized skin grafts and regenerative medicine approaches shows great potential for improving treatment effectiveness.

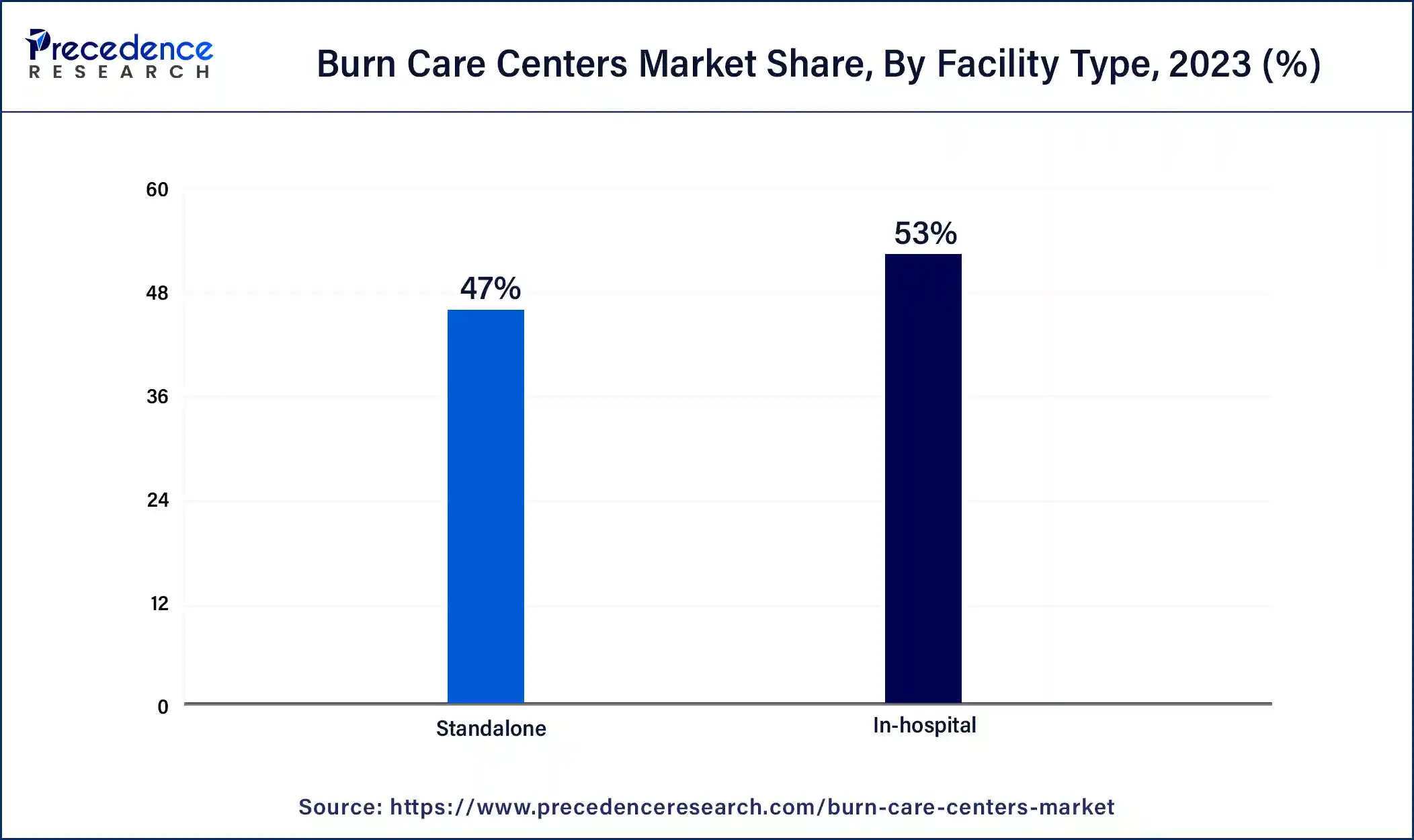

The in-hospital segment dominated the burn care centers market in 2023. The scarcity of specialized treatment centers, particularly in less developed regions, contributes to the high popularity and market share of in-hospital facilities. Unlike in the U.S., areas such as the Asia Pacific, Latin America, and the Middle East have fewer and more dispersed specialized treatment facilities, shifting the focus to in-hospital settings. Also, the COVID-19 pandemic caused a significant decline in visits and admissions, especially for work-related injuries, which notably reduced the number of cases.

The standalone segment is expected to grow at a faster rate in the burn care centers market over the forecast period. This can be attributed to the rising demand for specialized injury treatment, which has been a major factor in the expansion of standalone facilities. Additionally, these centers focus exclusively on treating burns of various types and provide specialized care that leads to improved patient outcomes, quicker recovery, and fewer complications throughout the treatment process.

The wound debridement segment led the burn care centers market in 2023. Wound debridement is a thorough approach to treating various types of wounds, including those from burns, injuries, and surgical procedures. This process involves wound assessment, cleaning, and the use of advanced wound care products and techniques to enhance healing. The increasing prevalence of chronic wounds, an aging population, and the rising incidence of conditions like diabetes are significant factors contributing to its growing prominence.

The pain management segment is anticipated to grow at a significant rate in the burn care centers market during the forecast period. The growth in this segment is being driven by advancements in pain management techniques, including enhanced pain medications and the use of immersive technologies like virtual reality for patient pain management. These factors can contribute to the expansion of this segment.

The partial-thickness burns segment dominated the burn care centers market in 2023. Because this burn severity is the most frequently encountered in both inpatient and emergency department visits. Additionally, the increasing demand for extended care for partial thickness injuries has led to elevated treatment costs, mainly due to prolonged hospital stays, which in turn drives this segment's growth.

The full thickness burns segment is expected to show the fastest growth in the burn care centers market over the projected period. The market growth is driven by the rising number of government and non-government organizations concentrating on burn care treatments. Chronic wounds, including both partial-thickness and full-thickness burns, cover over 15.0% of the body and require extended healing times. The partial thickness burn segment is expected to experience the fastest growth in the coming years, propelled by the increasing demand for biologics such as skin grafts and advanced dressings for treating partial burns.

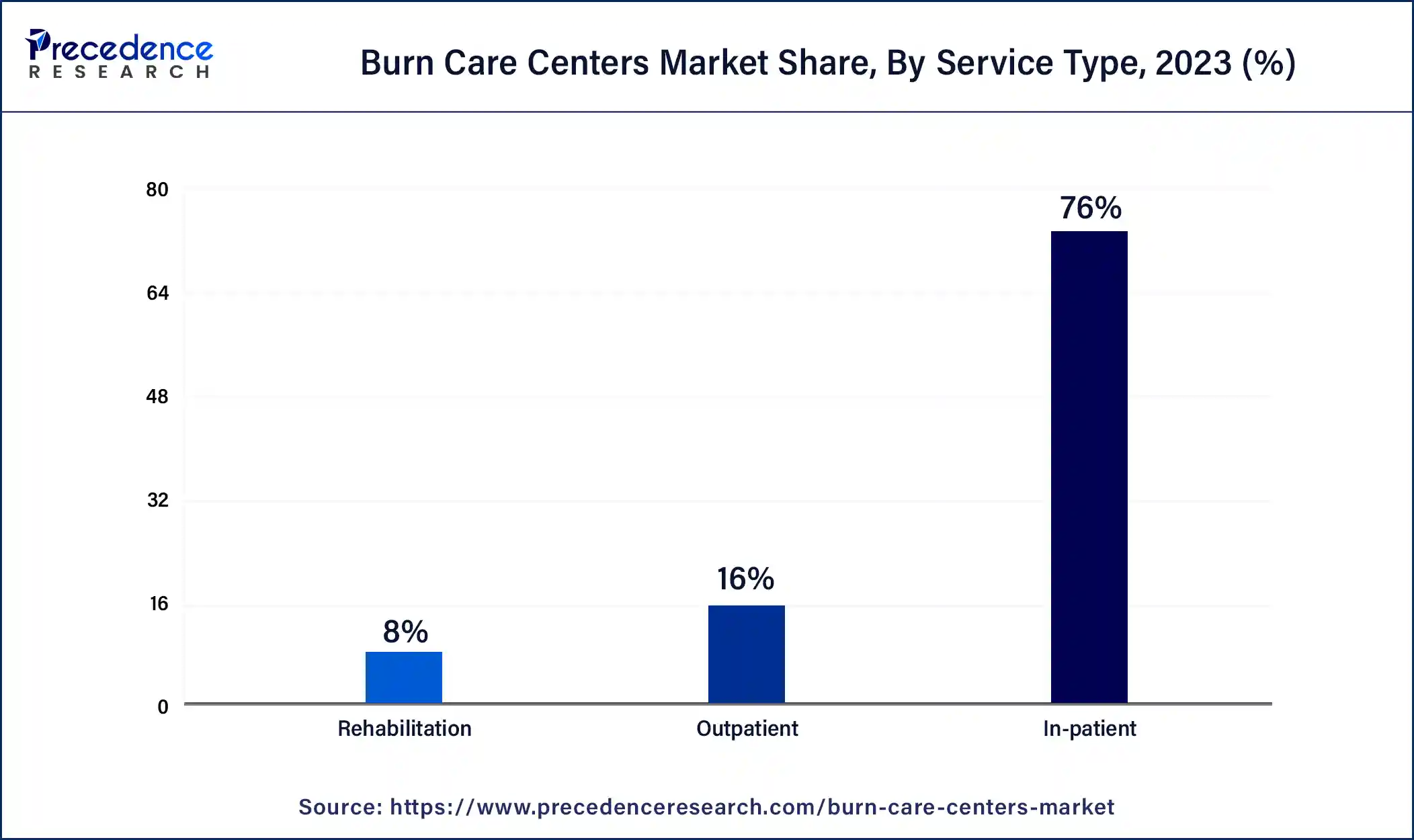

The in-patient segment led the market in 2023 and is expected to grow at a faster rate in the burn care centers market during the forecast period. This is because specialized care is frequently important for managing burn injuries, with inpatient services offering a wide array of essential treatments and therapies crucial for the recovery of burn patients.

These services also provide a controlled environment where patients can heal and receive necessary treatments under the careful supervision of healthcare professionals.

Segments Covered in the Report

By Facility Type

By Procedure Type

By Burn Severity

By Service Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2024

September 2024

January 2025