September 2024

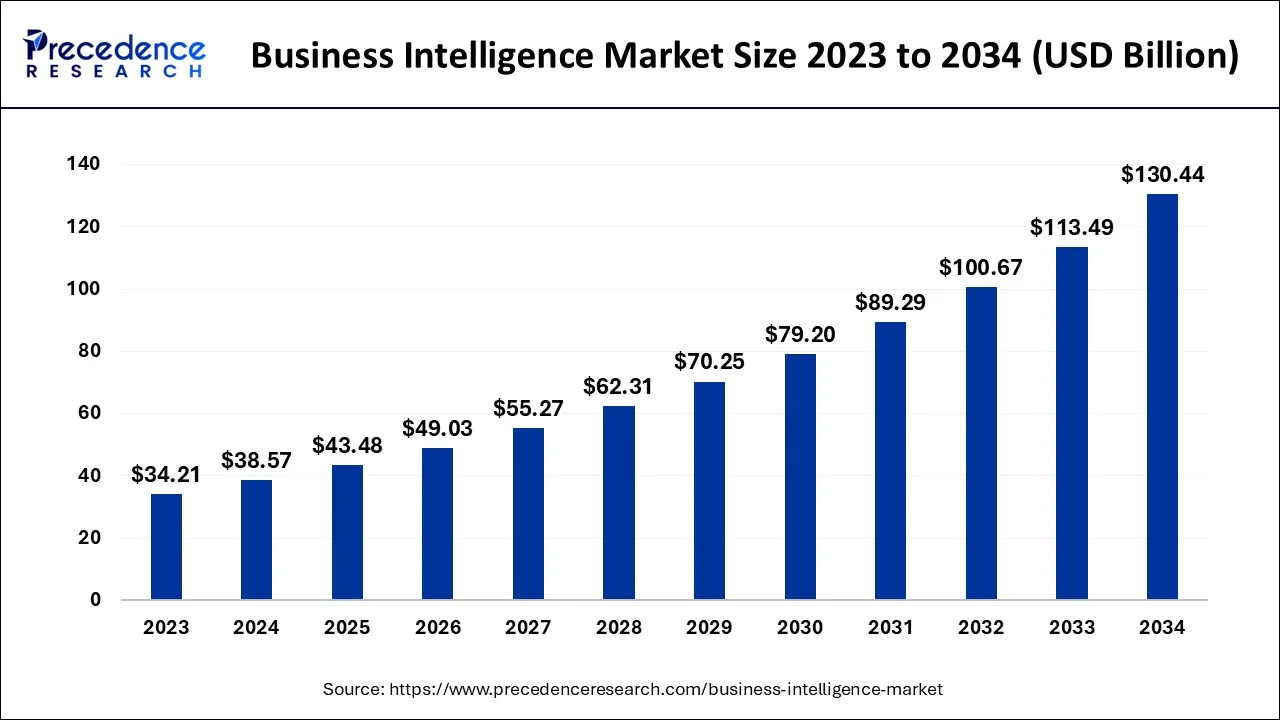

The global business intelligence market size accounted for USD 31.34 billion in 2024, grew to USD 33.62 billion in 2025 and is predicted to surpass around USD 63.17 billion by 2034, representing a healthy CAGR of 7.26% between 2024 and 2034.

The global business intelligence market size is estimated at USD 31.34 billion in 2024 and is anticipated to reach around USD 63.17 billion by 2034, expanding at a CAGR of 7.26% from 2024 to 2034.

Business intelligence software is the latest tool used by corporative businesses to process and analyze data with the use of cloud and big data integration programs to make efficient real-time market decisions. Earlier, BI was used for resolving queries, reporting, and designing dashboards. The use of advanced technology in BI is increasing competition in the market and top players to adopt BI software. The Business Intelligence market is also driven by the wide use of E-commerce, small, medium, and large organizations, and various governments.

For instance, According to the study made by Hewlett Packard Enterprise (HPE) in 2019, IT Trends for Government State and Local investment in technology will increase by 4% in the United States. The three basic resources of BI for practice include a database, an Extract, a Transform and Load (ETL) tool, and a visualization tool. However, with advances in technology, new tools are being launched often and competition is always growing for the end customers. North America region is anticipated to hold a significant revenue share during the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 31.34 Billion |

| Market Size by 2034 | USD 63.17 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.26% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Deployment, By Component, By Enterprise Size, By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The technological advancements and developments driving the business intelligence market.

The technological advancements and developments in the Business Intelligence market is driving growth during the forecast period. Business intelligence is applicable in several industries such as corporate firms, IT, Government, manufacturing firms, and the healthcare sector as it helps to manage financial aspects as well as data processing. Moreover, business intelligence in healthcare is expanding due to the rising implementation of different platforms and devices in the healthcare industry. The data and information collected through business intelligence healthcare software and tools help to provide the best care and treatment to patients. For instance, AREU was using a business intelligence application daily tracker to track infectious people in the COVID-19 pandemic.

Furthermore, big data and Cloud computing have a better impact on the business intelligence market in recent years due to increasing advancements in technology. Cloud computing is referred as an ideal platform to operate in BI. However, big data has attributed these tools to process a huge number of data to provide actionable results to companies that help them to understand growth and improve sales techniques. For instance, In, August 2019, IBM announced to launch the IBM Cloud Multizone Region to deploy applications across cloud infrastructure. These factors are foreseen to drive the BI market.

The high cost it infrastructure investment hampers the market growth.

The high cost of IT infrastructure investment is expected to hamper the growth of the business intelligence market during the forecast period. The cost of installing business intelligence infrastructure is a major concern for various firms. Also adequate factors such as consulting analysts skilled IT experts, and professional data science experts are hindering the BI market growth. The high-cost software such as cloud computing, big data, tableau, SQL server express, QLIK, and Power BI are expensive to install and maintain in small and medium-sized businesses which impact on the BI market.

Furthermore, business intelligence applications are in the early phases of the evolution cycle and will not go outdated in the upcoming years. Capital is the primary thing considered when companies invest in new technologies. Businesses face stringent finances and resources, especially small-medium enterprises. The price of installing BI is a primary concern among small-medium enterprises. SMEs are discouraged by the expensive costs of getting the right tool.

However, business intelligence software provides productive benefits but the high capital cost and unjustified return of investment (ROI), including implementation, training cost, and maintenance don’t justify the ROI.

Business intelligence in various industries is creating growth opportunities

The increasing utilization of business intelligence systems in various sectors such as corporate businesses, E-commerce, small, medium, and large organizations, manufacturing companies, healthcare, banking, financial services, insurance (BFSI), and various governments are creating growth opportunities for the market in upcoming years. However, the BI is still in its initial phase, and businesses taking advantage of this technology. As it saves time and cuts labor costs which benefit to businesses in many ways. Moreover, implementing advanced analytics for big data with BI is expected to create lucrative opportunities for the global BI market.

The BFSI industry is increasing, attributed to digitization and the speed at which various technological advancements were embraced in past years. The beginning of technologies and tools, like business intelligence, has always supported the banking sector and reflected all required regulations, and stay competitive while attending to existing customers' digital requirements. These solutions support financial institutions in making smarter decisions, both financially and operationally. For instance, according to a study by Goldman Sachs, in 2018, AI technology may deliver up to $44 billion in savings, thus possible to generate revenue opportunities in the financial sector by 2026.

Furthermore, business intelligence in the healthcare industry is creating growth opportunities for BI globally. All the data of patients are stored with the help of healthcare business intelligence systems. This data helps healthcare providers to track and monitor the health of patients. For this, electronic health records (EHR) have been established which keep records of health-related data and information of patients. For instance, In October 2019, Northwell health collaborated with All Scripts, presenting an innovative agreement to create the next-generation electronic health record, the launch of this artificial intelligence (AI)-sourced EHR.

COVID-19 Impact

The COVID-19 outbreak is an incomparable global public health emergency that has obstructed most sectors and the long term impacts are expected to hamper industry growth over the upcoming years. COVID-19 has caused destruction on global markets. In addition, labor cutting, supply chain disruptions, and other constraints have intensified the situation. The COVID-19 pandemic is not just a short-term pandemic. This has long-lasting suggestions for how people work, how we should treat customers, and how industries will operate and be seen by the world.

The COVID-19 outbreak positively impacted on business intelligence market. The an increasing need for solution-finding and applications that make things easier for the customer as there was no strong support system while working from home. However, Covid-19 also hampered the supply chains through online and offline platforms. Business intelligence systems supported the industries to reach the dead-end of their marketing and sales pipe to carry on their businesses with the same strength. BI systems are also used in creating new strategies for the recovery programs introduced for countering the impact of novel coronavirus.

Furthermore, the opportunities provided by the restrictions and lockdown, and new markets opening up because of market restrictions have also helped the BI market, pushing the sales and revenue of the business intelligence market. In addition, BI solutions have provided excessive help to companies in looking at their revenue generation, operations, and sales during the covid-19 crisis. It provided an estimated idea of a company’s performance with the help of data visualization.

Based on deployment insights, the global business intelligence markets is segmented into On-premise and cloud. The cloud segment is expected to hold the major market revenue share in 2023. The growth of this segment is due to it allowing a business to manage BI applications by outsourcing the BI infrastructure. This helps the company in increasing reducing operating costs, and productivity, and optimizing operation timeframes. As a result, the cloud deployment segment is projected to increase at a fast pace. Furthermore, on-premise deployment holds a significant revenue share during the forecast period.

Based on Component insights, the global business intelligence markets is segmented into software, and services. The software segment is dominating the business intelligence market holding the largest revenue share during the forecast period. The growth of this segment is due to the increasing utilization of technological software in various industries is driving the market. The software provided by companies such as SAP, AI, Board 11, Yellowfin BI, Power BI, and Tableau is used by the companies to analyze data processing by tracking historic and real-time performance. In addition, BI software’s also used in the healthcare sector for clinical analysis, financial analysis, and operational analysis. The software of healthcare business intelligence uses data analytics for accurate results.

The service segment is the fastest-growing segment of the business intelligence market in 2023. The Service segment includes consulting, support and maintenance, deployment, and integration, these factors surging the demand for services in the BI market and growing advancements in business intelligence software are driving the growth of the segment. In addition, information technology businesses are also offering good services for various industries as business intelligence solutions.

Based on Enterprise insights, the global business intelligence markets is segmented into Small Medium-sized and Large Sized. The Large size segment is dominating the business intelligence market holding the largest revenue share during the forecast period. The growth of this segment is due to a substantial investment, and availability of IT infrastructure, telecom, retail and banking, corporate businesses, healthcare sector, and educational sectors.

On the other hand, the small and medium-sized segment is the fastest-growing of business intelligence market during the forecast period. SMEs are expected to service business intelligence solutions to increase market share and customer fulfillment through targeted marketing campaigns and ads. In addition, resource optimization and constant productivity evaluation are few factors that fuel the requirement for advanced BI solutions among SMEs these factors drive the business intelligence market.

Based on End-User Insights, the global business intelligence markets are segmented into Manufacturing, Healthcare, Retail, and Consumer Goods, Banking, finance, services, Insurance (BFSI), IT, and Telecommunications. The IT and Telecommunication segment accounted for more than 26% of revenue share in 2023. The BFSI segment is expected to dominate the business intelligence market during the forecast period. The growth of the segment is attributed to the sensitivity of financial data and requires to synchronize with numerous other sectors such as, tax authorities, stock exchanges, securities controlling authorities, central banks, revenue departments, developing new investment strategies, Improving marketing strategies, and customer retention policies, and reducing risks are some of the key factors responsible for driving the growth of the segment.

However, the IT and telecommunication segment is expected to hold a significant revenue share during the forecast period in the Business Intelligence market. BI includes the initiation of an operation support system (OSS) and business support system (BSS) to discover new business opportunities. The healthcare sector came up with new challenges as the COVID-19 pandemic started across the sector. However, COVID-19 will impact the long term, the healthcare sector is expected to prove significant use of business intelligence tools that support driving the market.

Furthermore, retailers accept this software to achieve retail goals. Knowing consumer's behavior, and leveraging location intelligence are some of the key factors in the retail sector. The BI tools help retailers to keep records and analyze data to generate results and represent in graphical form.

North America dominated the Business Intelligence market and accounted for the largest revenue share in 2023. The growth is credited to rapid development and emerging technology and the presence of major industry players in the region such as, IBM Corporation, Microsoft Corporation, Tableau Software, Oracle Corporation, and others are anticipated to drive the growth across the region. For instance, according to Cisco Systems, around more than 40% of the ERP projects failed due to the absence of data integration. The limits of ERP solutions have fueled the growth of business intelligence tools across regions. This growth may continue to sustain, as BI enters new verticals across sectors.

Europe holds a significant revenue share for the business intelligence market following North America. Increasing research and development infrastructure and government initiatives driving the growth of the BI market in this region. For instance, In February 2022, The European Commission announced to the investment of €292 million in digital technologies. Such as, European blockchain infrastructure, digital solutions for better government services, Artificial Intelligence (AI) to fight crime, and AI testing facilities. In addition, the government of the United Kingdom is committed to driving enormous infrastructure to enable big data analysis. For instance, according to the United Kingdom trade and investment report, the government has invested $222 million funding in energy-efficient computing data centers.

Asia Pacific, the market for business intelligence is predicted to have lucrative growth in the forecast period. Top key players in other regions focusing to expand their business in this region to increase their market share. For instance, in February 2020, Sisense expanded its existence across Australia to support the increasing demand for BI. The company also announced investment of $ 100 million with more $ 1 billion in valuations to boost its growth.

By Deployment

By Component

By Enterprise Size

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

May 2025