September 2024

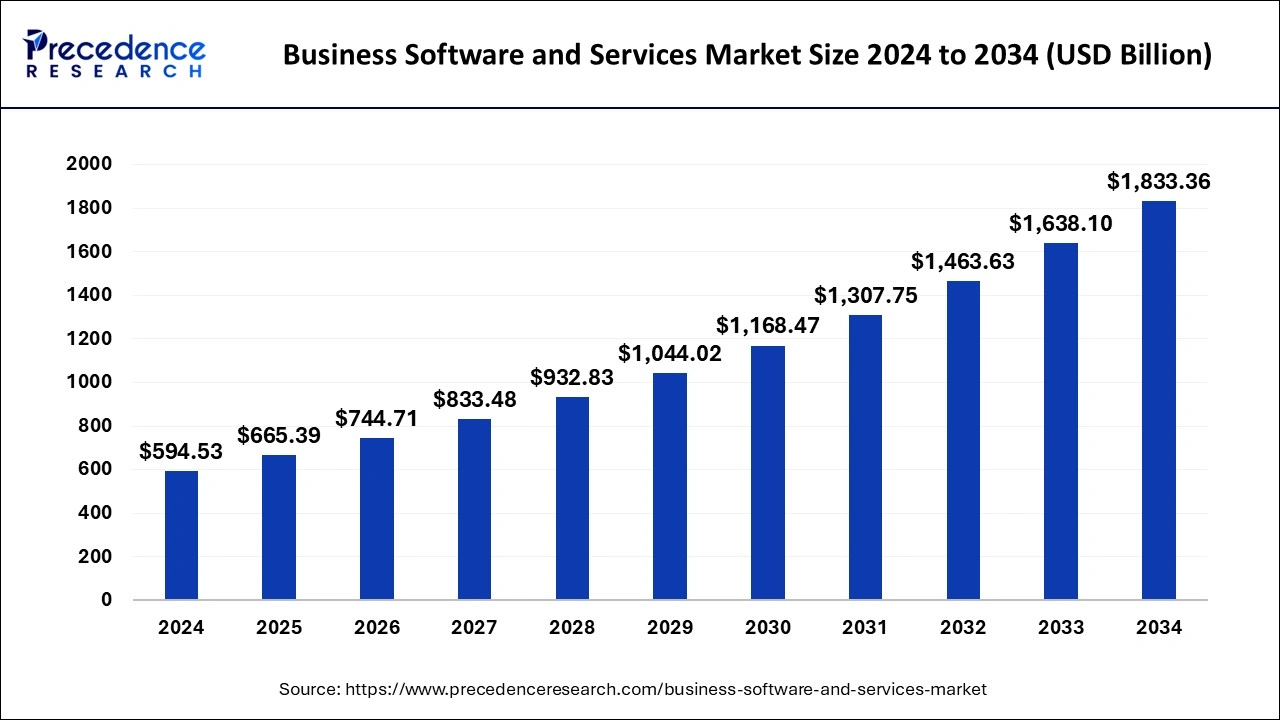

The global business software and services market size is calculated at USD 665.39 billion in 2025 and is forecasted to reach around USD 1,833.36 billion by 2034, accelerating at a CAGR of 11.92% from 2025 to 2034. The North America market size surpassed USD 178.36 billion in 2024 and is expanding at a CAGR of 12.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global business software and services market size accounted for USD 594.53 billion in 2024 and is expected to exceed around USD 1,833.36 billion by 2034, growing at a CAGR of 11.92% from 2025 to 2034. The rising industrial collaborations for enhancing the global reach, technological advancements for improving scalability and customer experience are driving the business software and services market.

The integration of AI tools in business software and services has helped in enabling the automation of tasks, AI-powered chatbots are improving customer experience, in personalized recommendations, for sentiment analysis, in lead scoring, providing predictive insights, in operations and supply chain management and improved decision making across various departments such as sales, marketing, finance among others thereby optimizing the efficiency, scalability and cost reductions driving the business growth.

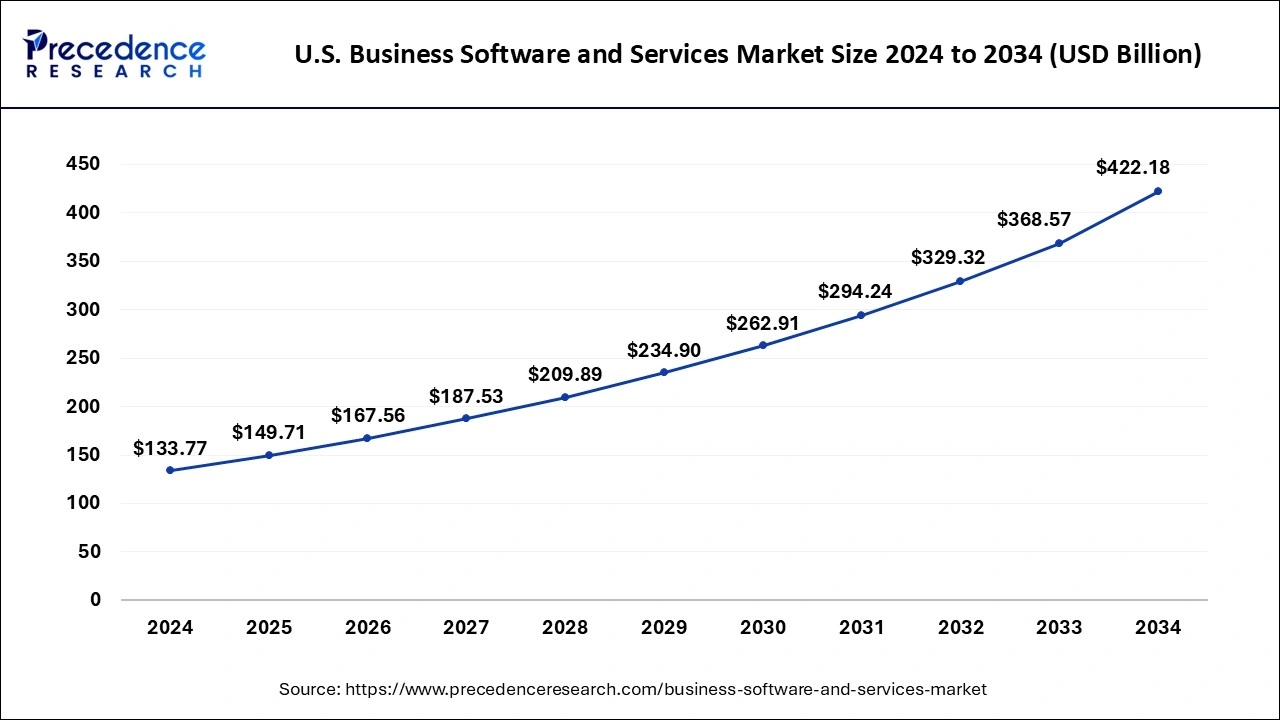

The U.S. business software and services market was exhibited at USD 133.77 billion in 2024 and is projected to be worth around USD 422.18 billion by 2034, growing at a CAGR of 12.18% from 2025 to 2034.

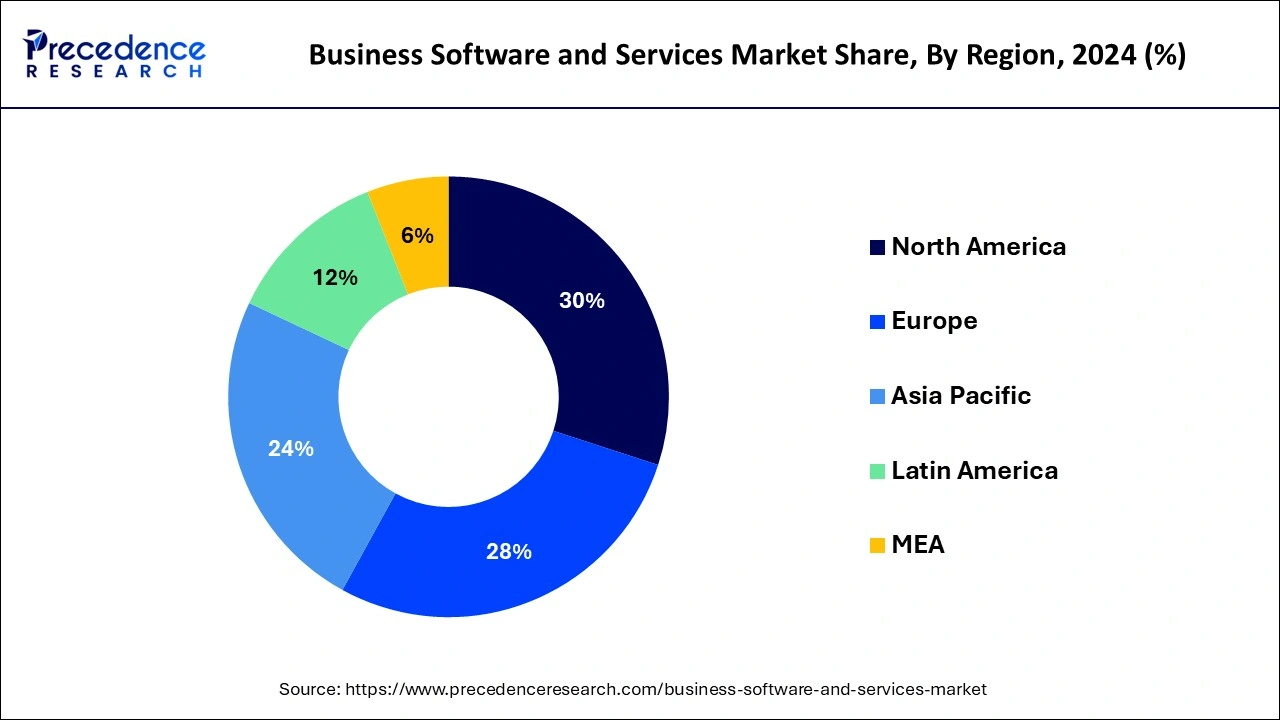

North America dominated the market in 2024 with market share of 20%. The expanding demand for high-speed data networks, as well as the considerable presence of software vendors in the region, might contribute to the growth of the business software and services market over the projected period.

Asia Pacific is expected to develop at the fastest rate during the forecast period. The expansion of the regional market is being driven by significant investments by large firms and the adoption of new technologies across industries and enterprises.

| Report Coverage | Details |

| Market Size in 2025 | USD 665.39 Billion |

| Market Size in 2034 | USD 1,833.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.92% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Software, Service, Deployment, Enterprise, End Use, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The finance segment dominated the business software and services market in 2022 with revenue share of 20%. This is attributed to the growing relevance of financial management tools in businesses and enterprises for budgeting, planning, analysis, and reporting.

The human resource segment is fastest growing segment of the business software and services market in 2022. The human resource functions like as payroll, training, and recruitment can all benefit from the solution’s integration and computerization.

ServiceInsights

In 2022, the support and maintenance services segment accounted revenue share of around 40%. This is due to the growing popularity of business and enterprise management systems as well as the development of software models to detect and resolve product quality concerns.

The managed services segment, on the other hand, is predicted to develop at the quickest rate in the future years. The managed services segment is expected to develop as businesses become more reliant on information technology assets and infrastructure to boost productivity.

Deployment Insights

The on-premise segment leads the business software and services market with revenue share of 60% in 2022. Over the projection period, the demand for on-premise deployment is predicted to increase due to the growing preference and demand of companies of various enterprise software and services that enable customization of software according to the client’s requirements.

The cloud segment is fastest growing segment of the business software and services market in 2022. The cloud-based services allow businesses to use and pay for exactly the resources they require, reducing energy usage and increasing efficiency.

Enterprise Insights

The large enterprise segment dominated the market in 2022 with market share of 55%. The use of business solutions and services in large enterprises is being driven by factors such as the use of real time data compilation tools, complex analytical engines, and process blueprints.

Thesmall and medium enterprise segment is fastest growing segment of the business software and services market in 2020. This is due to an increase in government activities, including digital campaigns like social media marketing, search engine marketing, and video marketing.

End Use Insights

The BFSI segment accounted largest market share in 2022 around 15%. This is attributed to the rising deployment of business software, which provides benefits such as secure transactions and constant access to client databases, as well as better client experience. Moreover, the rising digitalization of banking and financial institutions in order to provide better end user experiences is expected to boost the demand for business software and services in the BFSI sector.

The IT and telecom segment is fastest growing segment of the business software and services market in 2022. The importance and necessity of re-evaluating strategies and incorporating advanced technology into company operations is predicted to drive the growth of the segment during the forecast period.

By Software

By Service

By Deployment

By Enterprise

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

November 2024

November 2024