May 2024

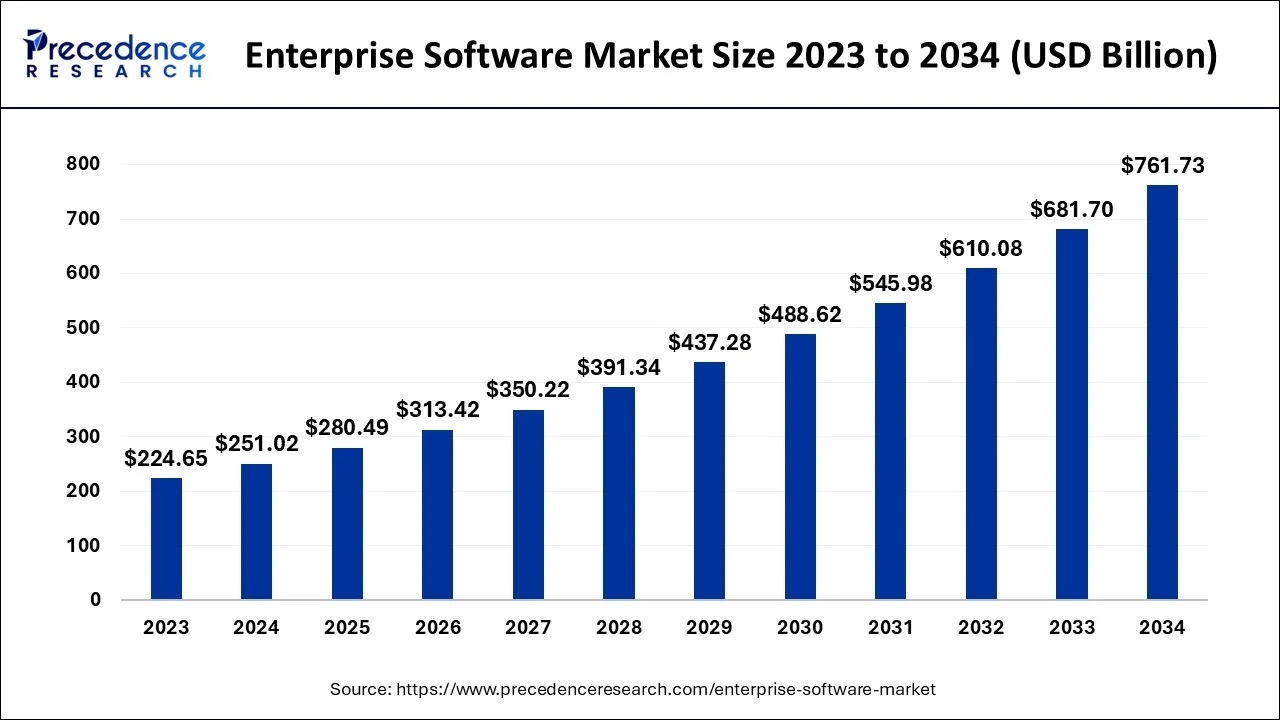

The global enterprise software market size is estimated at USD 251.02 billion in 2024, grew to USD 280.49 billion in 2025 and is predicted to surpass around USD 761.73 billion by 2034, expanding at a CAGR of 11.74% between 2024 and 2034. The North America enterprise software market size accounted for USD 92.11 billion in 2024 and is anticipated to grow at a fastest CAGR of 11.86% during the forecast year.

The global enterprise software market size accounted for USD 251.02 billion in 2024 and is anticipated to reach around USD 761.73 billion by 2034, expanding at a CAGR of 11.74% from 2024 to 2034.

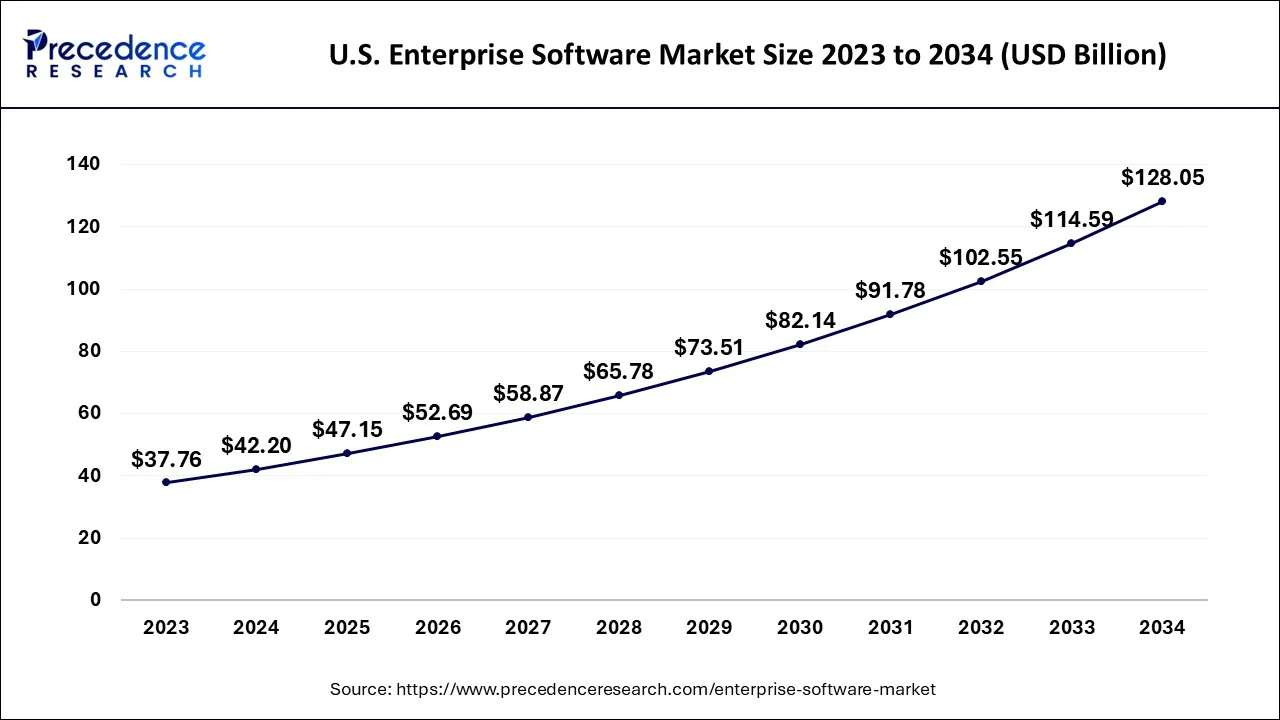

The U.S. enterprise software market size is estimated at USD 72.04 billion in 2024 and is expected to be worth around USD 222.86 billion by 2034, growing at a CAGR of 11.93% from 2024 to 2034.

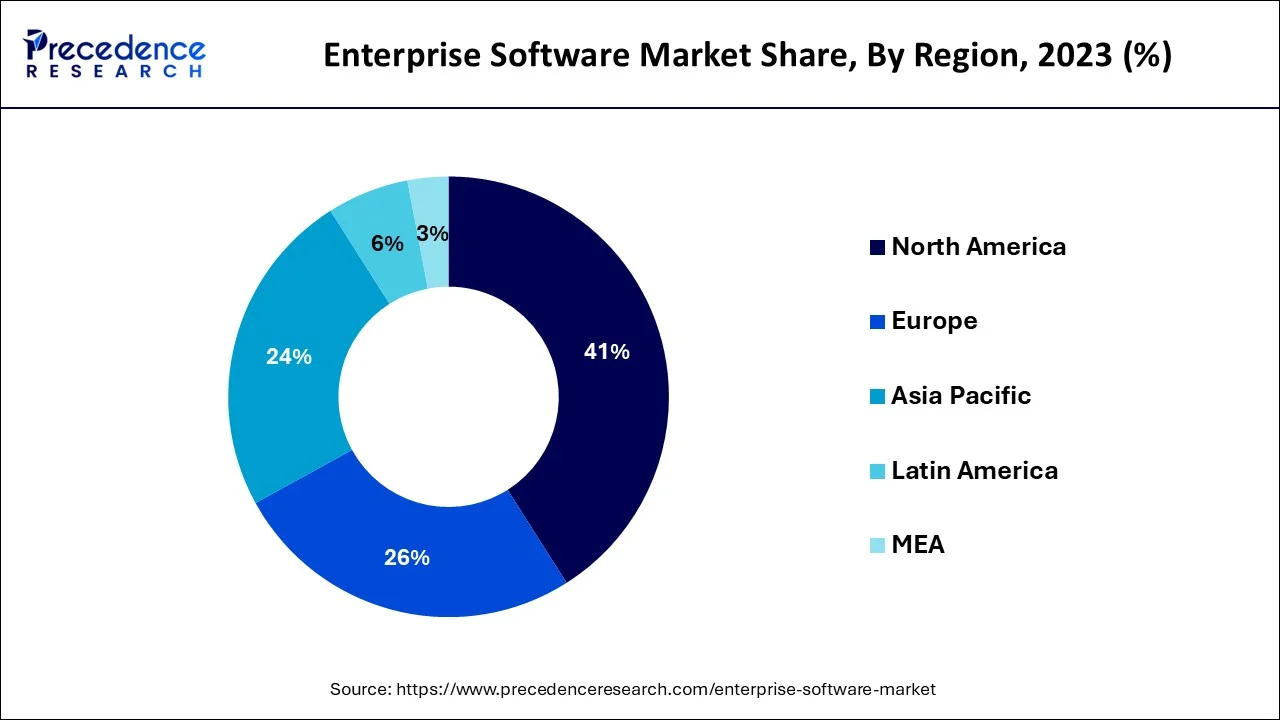

In 2023, North America has captured the maximum share, more than 41%. The growth can be attributed to the increased adoption of cloud-based enterprise software solutions due to high operational efficiency and low maintenance costs. To remain competitive in the market, key regional players such as Salesforce.com, Inc., Broadcom Inc. (C.A. Technologies, Inc.), Hewlett Packard Enterprise (HPE), and ECi Software Solutions are focusing on expanding their service offerings. For example, in July 2021, HPE paid USD 374 million to cloud data management company Zerto. HPE improved its HPE Green Lake services in software-defined data service businesses because of this acquisition.

Due to increased investment by end-use companies in digitalizing their businesses, Asia Pacific is expected to grow at a CAGR of 13.79% from 2023 to 2032. To increase their market revenues, industry players in the region focus on forming strategic partnerships with technology providers. Versa Networks, for instance, partnered with Axiata in August 2022 to provide Secure Access Service Edge (SASE) technology to Asian enterprises. Versa Networks' enterprise service offerings will be expanded through the partnership in cyber security, cloud, intelligent services, and other enterprise-managed services.

To gain a competitive advantage, enterprise software increases efficiency and productivity. Organizations of all sizes in various industry sectors, including large, medium, and small businesses, use it. End-use industries include telecommunications, finance, retail, advertising, media, medicine, and manufacturing. With the expansion of global knowledge and competition in enterprise software, the global market is reaching new heights. In recent years, the industry has seen several technological advancements, and the market has also seen widespread adoption of new software that enters the market from time to time. The primary factor driving the growth of the enterprise software market is the expansion of technology-driven projects and the improvement of I.T. budgets in organizations worldwide.

The technological trend of improving business standards, norms, and data accessibility is expected to concentrate on data-centric solutions to help in the growth of the enterprise software market during the assessment period. Enterprise software improves precision and increases a company's net productivity, resulting in increased adoption of this software worldwide. Business intelligence, web conferencing collaboration, customer relationship management software, enterprise planning system, supply chain management, and enterprise resource planning are the different types of enterprise software mainly demanded by the industry. CRM software assists businesses in communicating a consistent message about customer insights by constructing the most recent data about a lead. Furthermore, the high-level approval for several companies' I.T. projects is expected to catalyze the market's growth over the forecast period.

| Report Coverage | Details |

| Market Size in 2023 | USD 251.02 Billion |

| Market Size by 2032 | USD 761.73 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.74% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Software, By Deployment, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased demand for excellent customer service

Enterprise software facilitates customer relationship management processes, improving the customer experience and increasing customer retention. According to Facebook Inc.'s annual report, monthly active users (MAUs) of Facebook were 2.32 billion on December 31, 2018, a 9% year-over-year increase, and the company recorded a 37% increase in revenue during 2017-2018, demonstrating the prolific rise in social media websites.

Because of the increase in digitization and the emergence of social media marketing platforms, businesses now require enterprise software to record and manage massive amounts of customer data. Furthermore, enterprise software makes it easier for companies to create personalized marketing content for their customers.

High costs hinder the market growth

Enterprise software deployment requires significant money, time, and expertise. Due to the lengthy implementation processes that include project planning, organization, installation, training, and system configuration, enterprise software adds a high cost. In addition to ERP software deployment, the organization may require new hardware, updated network equipment, and security software installations, which will almost certainly incur additional costs. Furthermore, charges, such as employee training, skilled employee recruitment, and maintenance, are expected to raise the initial deployment cost of enterprise software, potentially stifling market growth during the forecast period.

R&D investing and funding provide future opportunities

Key players investing in software development as digital platforms are present everywhere. Most of the key players are investing in research and development of software and testing. Cohesity, a hyper-converged secondary storage company, announced that it had raised $250 million in an oversubscribed Series D funding round led by the SoftBank Vision Fund, with strong contributions from strategic stockholders such as Cisco Investments, Hewlett Packard Enterprise (HPE), Morgan Stanley Expansion Capital, and others.

This investment is expected to increase enterprise software development activities to achieve greater operational efficiency and cost savings, driving revenue growth for end users. Furthermore, R&D investments in enterprise software have risen significantly in the European region. For example, Dassault Systems SE spent $337.72 million on R&D in 2018, accounting for 24.6% of their software revenue.

In 2023, the customer relationship management (CRM) segment has generated more than 26% of the largest share. CRM software collects consumer analytics, improves customer retention, creates a centralized client information database, generates automatic sales reports, forecasts sales, and streamlines internal communications. Industry players are focusing on launching new CRM solutions for businesses to expand their customer bases.

Fresh works Inc., for example, introduced a new CRM solution, Fresh works CRM for e-commerce, in April 2022, which provides a unified platform for managing sales, customer support, and retention. This solution also assists end-user companies in improving customer interaction via modern messaging channels such as e-mail and WhatsApp.

From 2024 to 2034, the enterprise resource planning (ERP) segment is expected to grow at a CAGR of 10.91%. ERP software is in high demand due to its ability to assist end-user organizations in reducing inventory and raw material costs while also providing a smooth cross-functional information flow. ERP software vendors are collaborating with technology providers to improve ERP software productivity and reduce software development costs. For example, in April 2022, A.I. solution provider Conversight collaborated with software provider GreeneStep Technologies to create a unified ERP business suite to help small and medium-sized businesses streamline their end-to-end business operations.

In 2023 the on-premises segment held the largest market share of more than 51%. The ability of on-premises software to provide enhanced data security and consistent services without requiring an internet connection is driving the segment. Furthermore, multiple users can access the system flexibly in on-premises software without affecting data transmission speed. However, on-premises software is more expensive than cloud-based software due to external hardware such as servers and high license fees. As a result, various end-use companies are shifting their focus toward cloud-based software, affecting industry statistics for the on-premises software segment.

From 2024 to 2034, the cloud segment is expected to grow at the fastest rate of 13.90%. The benefits of cloud-based enterprise software include low subscription and maintenance fees, 24*7 system access, improved collaboration, and unlimited storage capacity. To increase the value of their brand, enterprise software companies are shifting their focus to cloud-based solutions. Micro Focus, for instance, announced the availability of its Enterprise Suite on Google Cloud for application modernization in September 2022. With this Google Cloud availability, Micro Focus clients can quickly and affordably deploy enterprise-grade infrastructure solutions on Google Cloud.

In 2023, the large enterprise segment held more than 60.49% of the largest share. Enterprise software is used by large corporations to manage their business operations, such as finance, marketing, sales, talent management, production, and inventory management. These businesses are focusing on automating their various business tasks to reduce human intervention and workforce costs, which is driving demand for ML and AI-enabled enterprise software. HPE launched the HPE Machine Learning Development System in April 2022 to enable organizations to build A.I. and ML models and scale up their businesses faster without needing additional platforms. In their ML development system, the company has provided various types of tools for model creation, which reduces programming complexity and improves the software's operational efficiency.

From 2024 to 2034, small and medium-sized enterprises (SMEs) are expected to grow at a significant rate of 13.72%. SMEs rapidly adopt enterprise software to boost employee productivity, expand their customer base, reduce compliance risks, and boost business profitability. To increase the value of their brand, enterprise software developers are focusing on developing SME-specific enterprise software at low costs. For example, Tally Solutions Pvt. Ltd. launched Tally Prime in November 2020 to assist small and medium-sized businesses in managing various finance-related services such as payroll, banking, taxation, and accounting.

In 2023, the I.T. and telecom segment held the largest market share, more than 22%. I.T. and telecom companies are digitizing their business operations to increase transparency and speed up the product development process. Increase profitability in the I.T. and telecom sectors, I.T. and telecom enterprise software providers focus on developing 5G-specific enterprise software. For instance, Dell Technologies, Inc. introduced new telecom software in October 2021 to help organizations accelerate their cloud-native and open-network deployments in India. This software is critical in automating the deployment and management of thousands of servers across the region's diverse geographic locations.

The healthcare segment is expected to grow at the fastest rate, with a CAGR of 14% from 2024 to 2034, owing to the increased use of big data for gaining actionable insights in the healthcare segment, rising demand for telemedicine services, and rising adoption of electronic health records (EHRs) and Electronic Medical Records (EMRs). Improvements in I.T. infrastructure, combined with the widespread use of cloud computing services in healthcare, are expected to drive industry growth. Furthermore, various medical research institutions have increased their use of I.T. infrastructure to Improve Chronic Disease Management (CDM). Industry players such as Allscripts Healthcare, LLC, EPIC Systems Corporation, and Cerner Corporation are launching emerging technologies equipped with healthcare enterprise software to increase brand representation.

Segments Covered in the Report:

By Software

By Deployment

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

November 2024

November 2024

November 2024