Buy Now Pay Later Market (By Component: Platform/Solutions, Services; By Purchase Ticket Size: Small Ticket Item (Up to US$ 300), Mid Ticket Items (US$ 300 - US$ 1000), Higher Prime Segments (Above US$ 1000); By Business Model: Customer Driven, Business Driven; By Mode: Online, Offline; By Vertical: Home & Furniture, Electronics, Fashion, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024–2033

The global buy now pay later market size was estimated at USD 15.82 billion in 2023 and is expected to hit around USD 76.46 billion by 2033 with a compound annual growth rate (CAGR) of 17.06% during the forecast period 2024 to 2033. The buy now pay later market is observed to grow with the implementation of interest-free installation plans on e-commerce platforms.

Data and statistics:

Buy now pay later is a sort of a short-term financing that allows people to buy everyday items like home consumer goods, electronics, and clothes. It is a point of sale (POS) installment loan mechanism that allows customers to buy things and administers the repayment.

The e-commerce enterprises, fintech companies, and even banks have begun to offer buy now pay later services to customers. This payment option is available on Amazon and Flipkart’s websites, as well as banks like ICICI bank and HDFC bank. The buy now pay later loans are also extended by a number of applications based fintech firms, including LazyPay, PayTM, Moneytap, PhonePe, and CASHe, among others. This option is now accessible for a wide range of purchases, from gadgets to fashion, as well as meal delivery, travel booking, grocery shopping, and other expenditures.

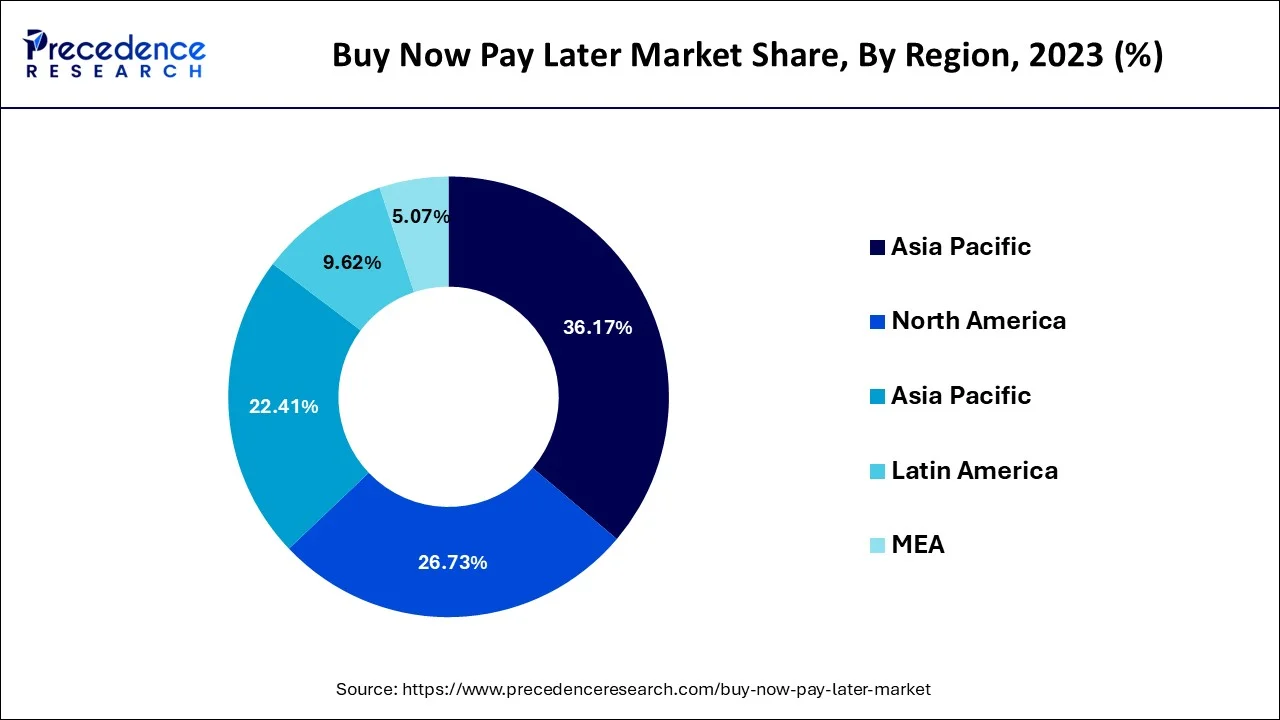

The Asia Pacific buy now pay later market size was valued at USD 5.72 billion in 2023 and it is expected to increase over USD 28.94 billion by 2033 with a CAGR of 17.59% from 2024 to 2033.

Asia Pacific has accounted highest revenue share 36.17% in 2023. Emerging economies in countries including India, China, South Korea, and Japan are observed to contribute to the growth of the market. Meanwhile, the emergence of e-commerce services is observed to integrate even more accessible buy now pay later services to boost the market’s potential in Asia Pacific. Surrounded by a huge tech-savvy generation, China is observed to become the fastest growing cashless nation.

North America hit remarkable revenue share in 2023. The presence of major credit card and fintech companies in the region has supplemented the growth of the market over the past few years. Credit cards remain the most popular and primarily used payment method by most of the Americans. With the increasing consumer base for online shopping, multiple businesses in the region have started offering buy now pay later, EMI or credit card payment services.

Buy Now Pay Later Market Value (US$ Mn), by Region, 2020 – 2023

| Region | 2020 | 2021 | 2022 | 2023 |

| North America | 2,380.75 | 2,881.11 | 3,489.79 | 4,230.89 |

| Europe | 2,007.09 | 2,424.55 | 2,931.47 | 3,547.56 |

| Asia Pacific | 3,145.82 | 3,837.24 | 4,684.66 | 5,724.14 |

| MEA | 866.75 | 1,045.10 | 1,261.25 | 1,523.46 |

| Latin America | 476.96 | 566.05 | 672.12 | 798.42 |

The introduction of online payment methods by people in developing countries is speeding up the growth of the buy now pay later market. The economical and convenient payment service of buy now pay later platforms, as well as the global e-commerce industry’s expansion, are the primary reasons driving the growth the global buy now pay later market.

The retailers are now offering buy now pay later options, allowing customers to acquire everyday necessities by selecting a reasonable financing plan and paying in installments rather than paying the entire cost up front. Several business owners around the world have been using the buy now pay later platform to finance huge equipment, purchase raw materials, and pay staff salaries, which is propelling the global buy now pay later market growth.

Furthermore, as a result of the surge in acceptance and adoption of buy now pay later payment technology among the young people, which provides benefits such as purchasing high-cost laptops and smartphones, paying the canteen bill, paying tuition fees, and purchasing the stationary products, the buy now pay later market is expected to grow during the forecast period.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.06% |

| Market Size in 2023 | USD 15.82 Billion |

| Market Size by 2033 | USD 76.46 Billion |

| Base Year | 2023 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Component, Verticle, Mode, Business Model, Purchase Ticket Size, Region |

| Companies Mentioned | Sezzle, Afterpay, Klarna Bank AB, Laybuy Group Holdings Limited, Quadpay, Splitit, Affirm Holdings Inc., Payl8r (Social Money Ltd.), PayPal Holdings Inc., Perpay |

Rising Integration of Artificial Intelligence (AI) Technology with Apps to Augment Growth

Strategic Partnerships & Product Launches Intended to Strengthen Market Position

Rising Green Energy Sources Coupled with Growth of Solar Power Industry

Adoption of Buy Now Pay Later Pay Method in Online Shopping

Increasing Adoption of Online Payment Method Among People

Regulatory scrutiny

Regulatory scrutiny in the buy now pay later market acts as a major restraint while imposing potential restrictions and compliance requirements on providers. This scrutiny aims to ensure consumer protection. However, increased regulations may lead to operational challenges, additional practices to maintain the regulatory framework and even can cause limitations on certain business practices.

The platform/solution segment led the buy now pay later market while holding the share of 66.95% in 2023. Platform providers play a crucial role in facilitating customer acquisition and user engagement for BNPL services. They offer marketing support, promotional tools, and analytics capabilities to help merchants promote BNPL offers, target specific customer segments, and optimize conversion rates. By leveraging data analytics and machine learning algorithms, platform providers enable merchants to identify trends, personalize offers, and maximize the effectiveness of their BNPL marketing campaigns. Effective risk management is essential for the sustainable growth of BNPL services. Platform providers develop sophisticated fraud detection algorithms, credit risk models, and compliance protocols to mitigate risks associated with offering deferred payment options. By monitoring transaction data in real-time and implementing dynamic risk assessment strategies, platform solutions help merchants minimize losses due to fraud, delinquencies, and default rates, while maintaining a positive customer experience.

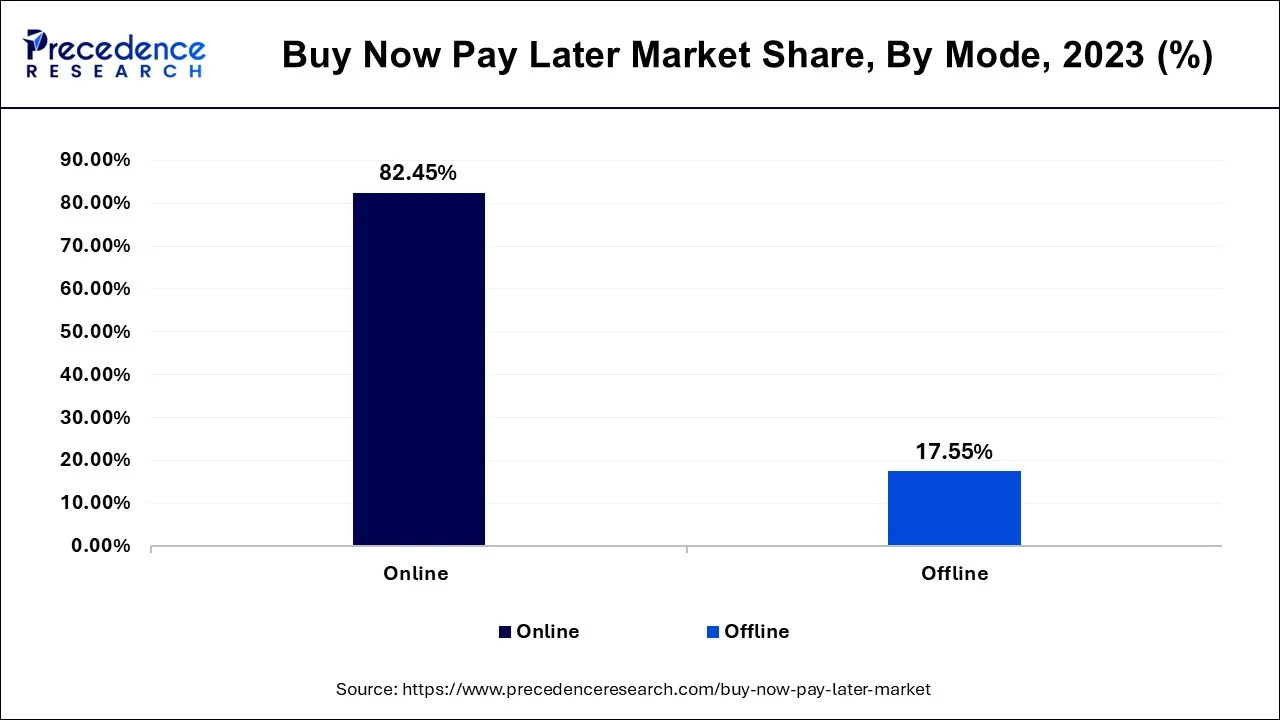

In 2023, the online segment held the dominating share of 82.45% in the buy now pay later market. The increasing prevalence of mobile commerce aligns with BNPL dominance in the online segment. BNPL services are well-suited for mobile-friendly platforms, catering to the growing number of users making purchases through smartphones and tablets.

In recent years, multiple e-commerce platforms have started forming partnerships with buy now pay later service providers to offer their services directly within the checkout process. This strategic collaboration enhances the visibility and adoption of BNPL options in the online shopping ecosystem.

The rising emphasis on offering zero interest or low-interest EMI and buy now pay later services on e-commerce platforms is observed to promote the segment’s growth in the upcoming period.

Buy Now Pay Later Market Value (US$ Mn), by Mode, 2020 – 2023

| Mode | 2020 | 2021 | 2022 | 2023 |

| Online | 7,278.74 | 8,833.64 | 10,730.40 | 13,046.21 |

| Offline | 1,598.63 | 1,920.41 | 2,308.88 | 2,778.26 |

The small ticket item (up to $ 300) segment led the market with the largest share of 43.01% in 2023. Small ticket items, typically priced at $300 or below, are often impulse purchases or everyday essentials. Offering BNPL options for these items makes them more affordable and accessible to consumers, especially those who may not have immediate access to funds or prefer to spread out payments over time. The convenience of BNPL allows consumers to make purchases without upfront payment and budget more effectively.

The business driven segment held the largest share of 71.14% in 2023. Businesses, especially e-commerce retailers and online marketplaces, have widely adopted BNPL solutions as a way to offer flexible payment options to their customers. By integrating BNPL services into their checkout processes, merchants can attract more shoppers, increase conversion rates, and drive higher average order values. The business-driven segment benefits from the widespread adoption of BNPL by merchants across various industries. Businesses play a significant role in promoting BNPL services to their customers through targeted marketing campaigns, promotions, and incentives. By highlighting the benefits of BNPL, such as interest-free installment payments, no credit checks, and instant approval, businesses can encourage more consumers to choose BNPL as their preferred payment method.

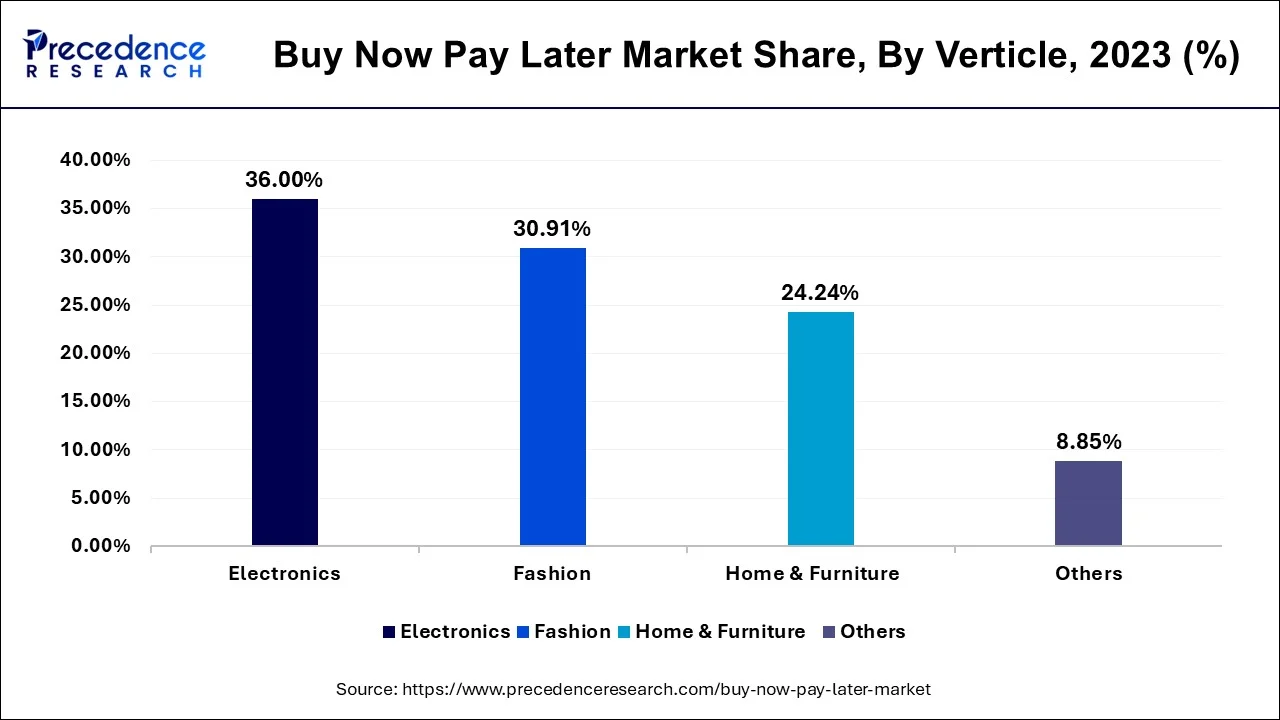

The electronics segment dominated the buy now pay later market in 2023 and has garnered 36% market share. Electronics, such as smartphones, laptops, and other gadgets, often have higher price points compared to many other consumer goods. BNPL services are attractive to consumers making significant purchases as they can spread the cost over time without the need for immediate payment.

The fashion segment is expected to drive remarkable growth over the forecast period. The customers enjoy a huge number of discounts on products. If the customers are provided with the option to buy now pay later, it has been observed that sales of fashion and garment sectors rise on a large scale.

Buy Now Pay Later Market Value (US$ Mn), by Verticle, 2020 – 2023

| Verticle | 2020 | 2021 | 2022 | 2023 |

| Home & Furniture | 2,127.23 | 2,587.14 | 3,149.30 | 3,837.03 |

| Electronics | 3,214.13 | 3,886.43 | 4,703.60 | 5,697.73 |

| Fashion | 2,697.60 | 3,286.71 | 4,007.99 | 4,891.83 |

| Others | 838.41 | 993.76 | 1,178.39 | 1,397.88 |

The major market players are highly investing in research and development to improve the technical features of buy now pay later systems. Several strategic initiatives have been attempted by industry players, including supplying varied product ranges, joint ventures, mergers, acquisitions, and collaborations. These tactics help firms and market players to gain a stronger presence in the global buy now pay later market.

The buy now pay later market has a moderate level of fragmentation. Both consumers and businesses benefit from the buy now pay later option. Leading providers like Afterpay, Affirm Inc., and Klarna Inc. have already established themselves in the e-commerce ecosystem by growing their footprints and acquiring new consumers.

Buy now pay later is becoming a more common way for customers to make in store and online purchases. The use of this point of scale and online installment loans as a payment mechanism by a large number of retailers is creating growth prospects for buy now pay later service providers. Over the forecast period, the expanding e-commerce industry is likely to boost the buy now pay later market expansion.

Segments Covered in the Report

By Component

By Purchase Ticket Size

By Business Model

By Mode

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client