October 2024

The global call and contact center outsourcing market size is calculated at USD 111.95 billion in 2025 and is forecasted to reach around USD 242.80 billion by 2034, accelerating at a CAGR of 9.00% from 2025 to 2034. The North America call and contact center outsourcing market size surpassed USD 32.83 billion in 2024 and is expanding at a CAGR of 9.17% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global call and contact center outsourcing market size was estimated at USD 102.59 billion in 2024 and is predicted to increase from USD 111.95 billion in 2025 to approximately USD 242.80 billion by 2034, expanding at a CAGR of 9.00% from 2025 to 2034.

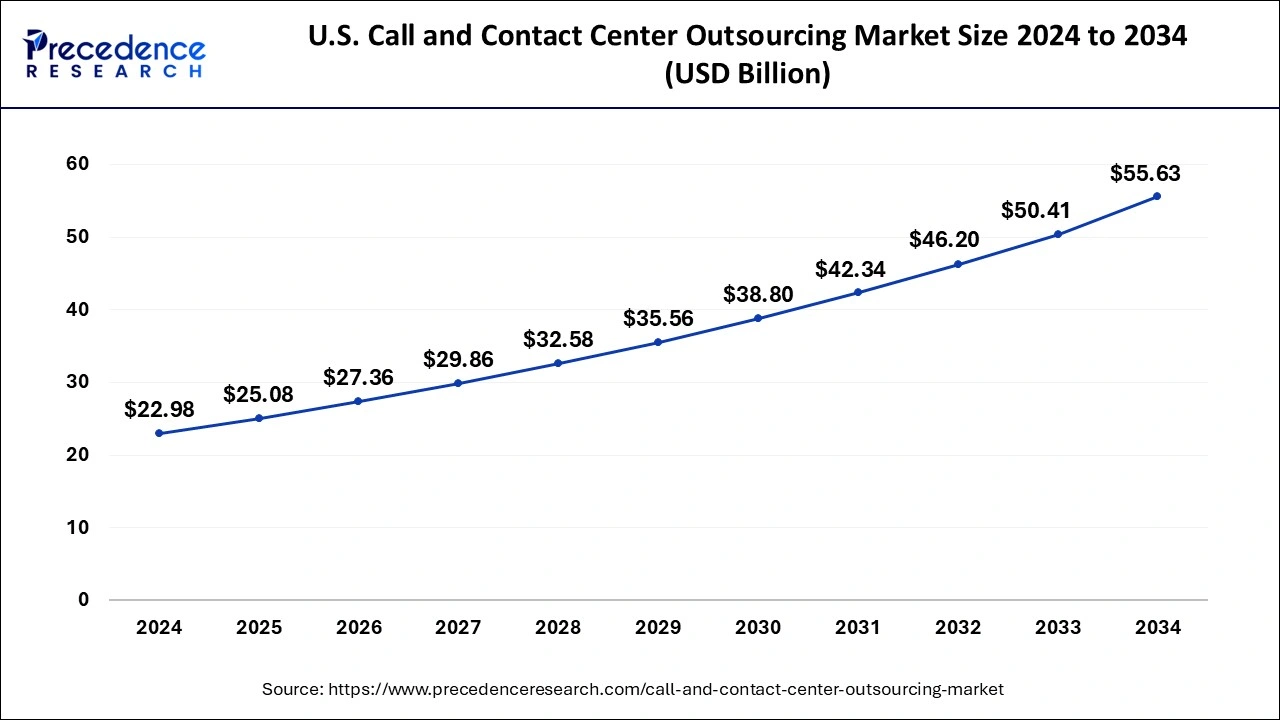

The U.S. call and contact center outsourcing market size was estimated at USD 22.98 billion in 2024 and is projected to surpass around USD 55.63 billion by 2034 at a CAGR of 9.24% from 2025 to 2034.

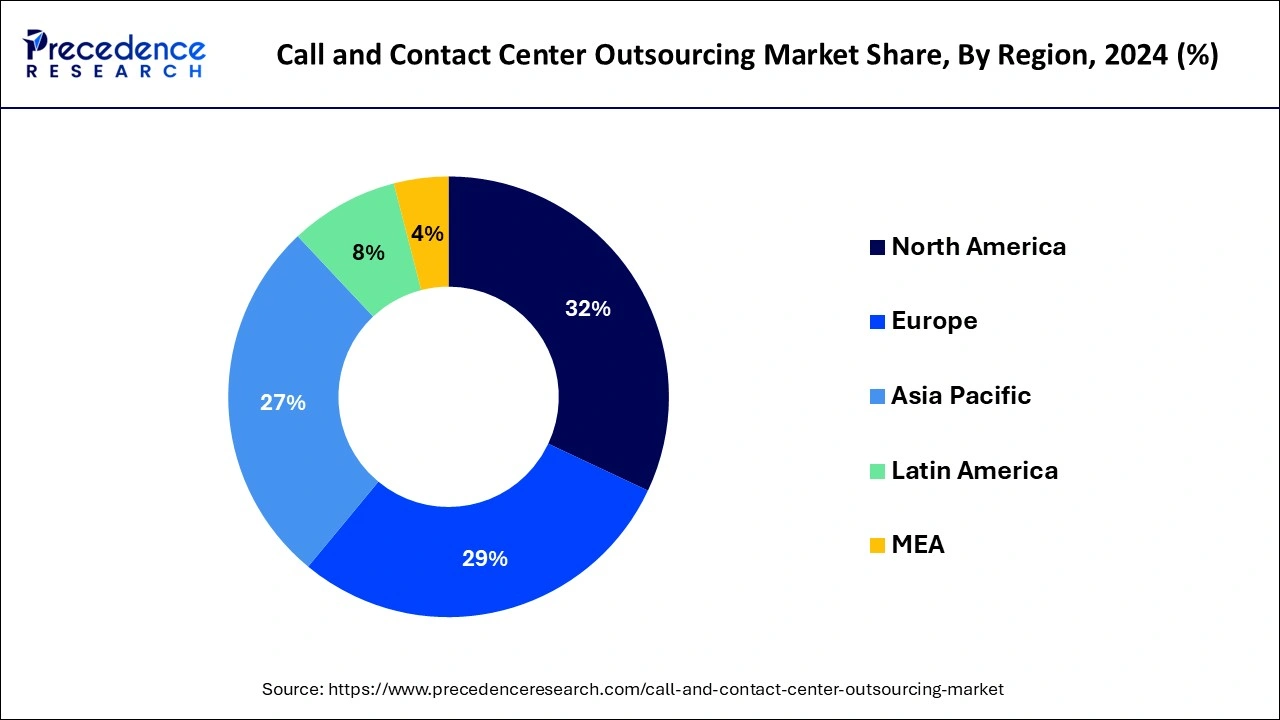

North America has held the maximum market share of 32% in 2024. The region boasts a robust technological infrastructure, a skilled workforce, and a favorable business environment, making it an attractive destination for outsourcing operations. Additionally, North American companies prioritize customer service excellence and are early adopters of outsourcing solutions to enhance operational efficiency and cost-effectiveness. Furthermore, the region's large base of multinational corporations across diverse industries drives the demand for outsourcing services, consolidating North America's position as a dominant player in the market.

Asia-Pacific is experiencing rapid growth in the call and contact center outsourcing market due to several factors. This growth is fueled by the region's large, skilled, and cost-effective labor pool, making it an attractive destination for outsourcing operations. Additionally, the increasing adoption of digital technologies and the rise of emerging economies are driving demand for outsourced customer service solutions. Furthermore, the region's strategic location and cultural affinity with Western markets contribute to its appeal as a preferred outsourcing destination, leading to substantial growth in the call and contact center outsourcing sector.

Meanwhile, Europe is witnessing notable growth in the call and contact center outsourcing market due to several factors. These include the region's highly skilled multilingual workforce, offering a competitive advantage in serving diverse customer bases. Additionally, favorable government policies and infrastructure support contribute to the market's expansion. The rising demand for cost-effective solutions, coupled with increasing investments in technology and customer experience enhancements, further drive growth in the outsourcing industry across Europe. This growth trajectory positions Europe as a key player in the global call and contact center outsourcing market.

Call and contact center outsourcing involves contracting third-party service providers to manage inbound and outbound customer communications on behalf of a business. These centers handle various tasks, including customer support, technical assistance, sales, and inquiries through multiple channels such as phone calls, emails, live chat, and social media platforms. Outsourcing these functions allows companies to leverage the expertise and resources of specialized call center providers, leading to improved efficiency, cost savings, and scalability.

Service providers employ trained agents equipped with communication tools and technologies to deliver high-quality customer service experiences while ensuring adherence to established service level agreements (SLAs) and industry standards. By outsourcing call and contact center operations, businesses can focus on core activities while benefiting from enhanced customer satisfaction, increased productivity, and the flexibility to adapt to changing market demands.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.00% |

| Market Size in 2025 | USD 111.95 Billion |

| Market Size by 2034 | USD 242.80 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Outsourcing Type, and By Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

24/7 support capability

The 24/7 support capability plays a crucial role in surging the market demand for call and contact center outsourcing. In today's fast-paced world, customers expect round-the-clock assistance and immediate resolution of their queries or issues. Businesses that offer 24/7 support demonstrate a commitment to customer satisfaction and retention. As a result, companies seek outsourcing partners that can provide continuous support to their customers, regardless of the time zone they are in. This surge in demand for outsourcing partners capable of offering 24/7 support drives the growth of the call and contact center outsourcing market.

Furthermore, 24/7 support capability enables businesses to cater to a global customer base effectively. With outsourcing partners handling customer inquiries and issues round-the-clock, companies can extend their reach to international markets without worrying about time zone differences or operational constraints. This expanded global reach enhances customer satisfaction, fosters loyalty, and ultimately contributes to business growth. As a result, the demand for call and contact center outsourcing services with 24/7 support capability continues to rise, driving market growth and creating opportunities for outsourcing providers to expand their offerings.

Loss of direct control over customer interactions

The loss of direct control over customer interactions poses a significant restraint on the demand for call and contact center outsourcing. When companies outsource customer service functions, they relinquish direct oversight and management of customer interactions to third-party vendors. This lack of control can lead to inconsistencies in service quality, as outsourcing partners may not adhere to the same standards or priorities as the company itself. As a result, businesses may be hesitant to outsource critical customer-facing operations, fearing potential damage to their brand reputation and customer relationships.

Moreover, the loss of direct control over customer interactions can hinder businesses' ability to maintain a personalized and seamless customer experience. Without direct oversight, companies may struggle to ensure that customer inquiries are handled promptly, accurately, and in alignment with their brand values and messaging. This lack of control over the customer experience can erode trust and loyalty among customers, ultimately limiting the attractiveness of call and contact center outsourcing solutions in the call and contact center outsourcing market.

Partnership opportunities with industry-specific solutions

Partnership opportunities with industry-specific solutions present significant opportunities in the call and contact center outsourcing market. By collaborating with specialized solution providers catering to specific industries such as healthcare, finance, or retail, outsourcing companies can offer tailored services that address the unique needs and challenges of these sectors. This partnership allows outsourcing providers to leverage industry-specific expertise, technologies, and best practices, enabling them to deliver more effective and customized solutions to clients within those sectors.

Additionally, partnering with industry-specific solution providers enhances the outsourcing company's credibility and reputation within targeted verticals. By aligning with trusted and established brands in specific industries, outsourcing providers can access new markets, attract niche clientele, and differentiate themselves from competitors. This strategic collaboration not only expands the outsourcing company's service offerings but also strengthens its position in the market, opening doors to new business opportunities and driving growth in the call and contact center outsourcing sector.

The voice segment held the highest market share of 31% in 2024. In the call and contact center outsourcing market, the voice segment refers to the traditional method of customer communication through phone calls. This segment involves handling inbound and outbound calls for various purposes, including customer support, sales, and inquiries. Trends in the voice segment of call and contact center outsourcing include the integration of advanced technologies such as speech analytics, interactive voice response (IVR) systems, and natural language processing (NLP) to enhance call routing efficiency, improve agent productivity, and deliver personalized customer experiences.

The chat support segment is anticipated to witness rapid growth at a significant CAGR during the projected period. The chat support segment in call and contact center outsourcing involves providing customer assistance and resolving inquiries through text-based chat platforms. This type of support offers real-time communication between agents and customers, enhancing efficiency and convenience. Recent trends in this segment include the integration of AI-powered chatbots for automated responses, the adoption of omnichannel support to provide seamless customer experiences across multiple platforms, and the emphasis on personalized interactions to improve customer satisfaction and retention.

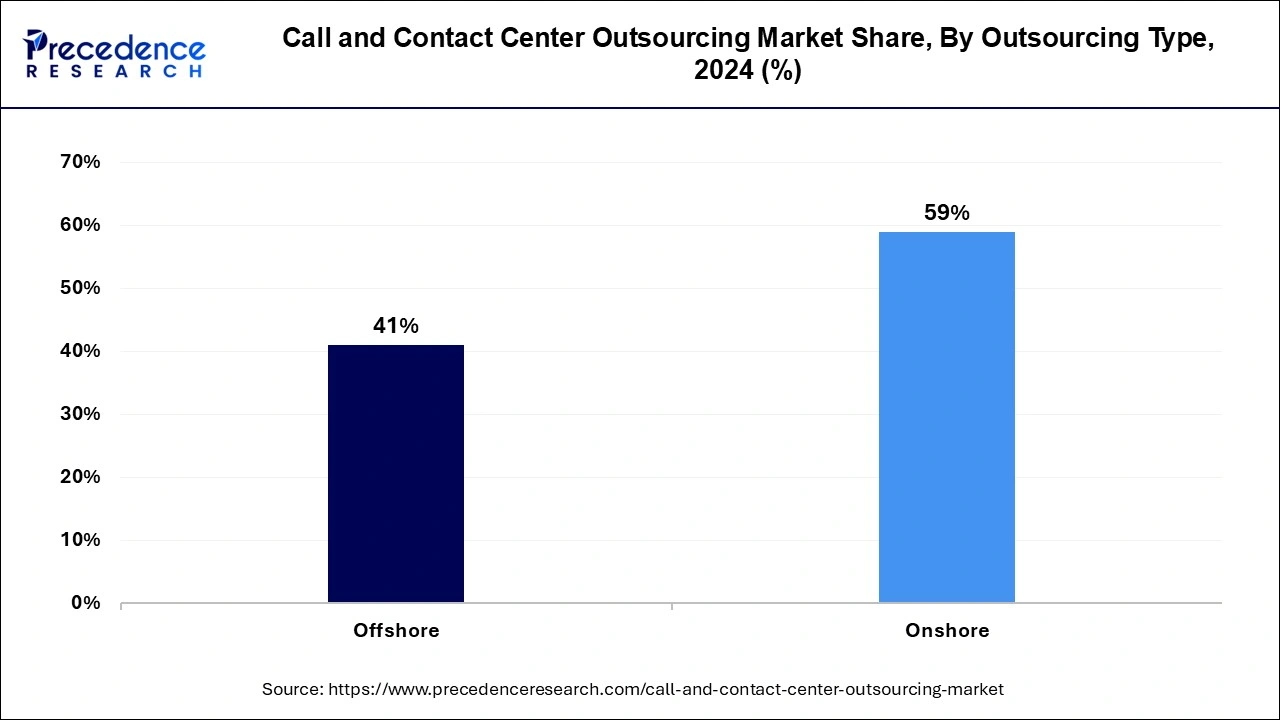

The onshore segment held a 59% market share in 2024. In the call and contact center outsourcing market, the onshore segment involves contracting services within the same country where the business operates. Onshore outsourcing offers advantages such as cultural alignment, language proficiency, and proximity to the client's headquarters. Recent trends indicate a growing preference for Onshore outsourcing due to its ability to provide high-quality customer service with minimal communication barriers. Additionally, Onshore outsourcing mitigates risks associated with data security and regulatory compliance, contributing to its increasing adoption among businesses.

The offshore segment is anticipated to witness rapid growth over the projected period. The offshore segment in call and contact center outsourcing involves contracting services to providers located in foreign countries, typically with lower labor costs. This outsourcing type enables businesses to access a global talent pool and benefit from cost savings while maintaining service quality. Trends in the Offshore segment include the continued expansion of outsourcing destinations, such as India and the Philippines, advancements in communication technology facilitating seamless international collaboration, and a focus on cultural sensitivity and language proficiency to enhance customer experiences.

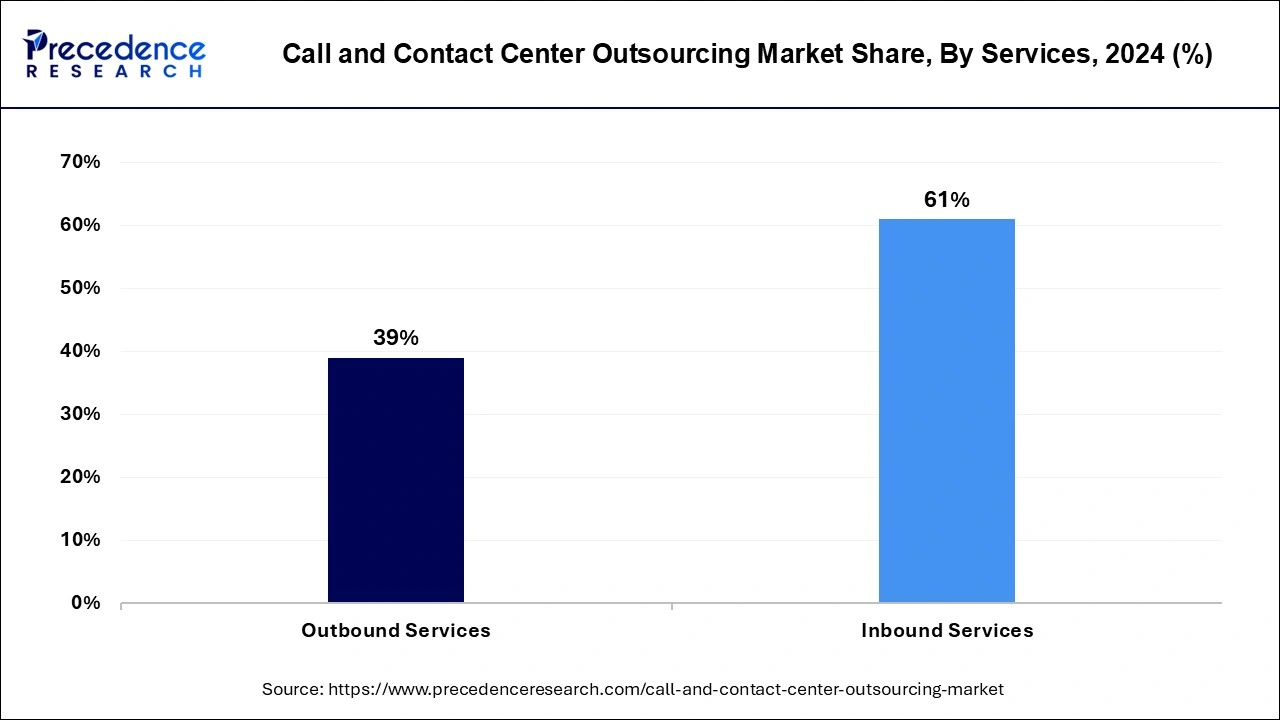

The inbound services segment has held a 61% market share in 2024. Inbound services in the call and contact center outsourcing market refer to handling incoming customer communications, such as phone calls, emails, and chat inquiries. These services typically involve addressing customer inquiries, providing technical support, processing orders, and handling complaints. Trends in the inbound services segment include a growing emphasis on personalized customer interactions, the adoption of advanced technologies like AI and chatbots to enhance efficiency, and a focus on first-call resolution to improve customer satisfaction and retention rates.

The outbound services segment is anticipated to witness rapid growth over the projected period. outbound services in the call and contact center outsourcing market involve initiating customer communications, such as sales calls, surveys, and appointment scheduling, on behalf of client companies. Trends in this segment include the increasing adoption of predictive dialing technology to optimize call volumes and improve agent productivity. Additionally, there's a growing emphasis on personalized outbound communications to enhance customer engagement and drive sales conversions. As businesses seek to maximize outbound campaign effectiveness, outsourcing providers are focusing on refining their strategies and leveraging data analytics for targeted outreach.

By Type

By Outsourcing Type

By Services

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

January 2025

February 2025