February 2025

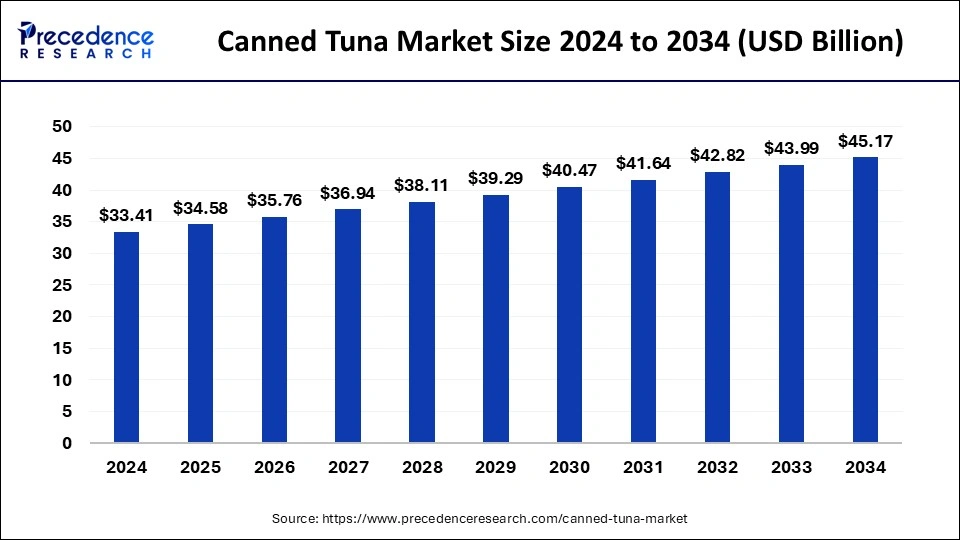

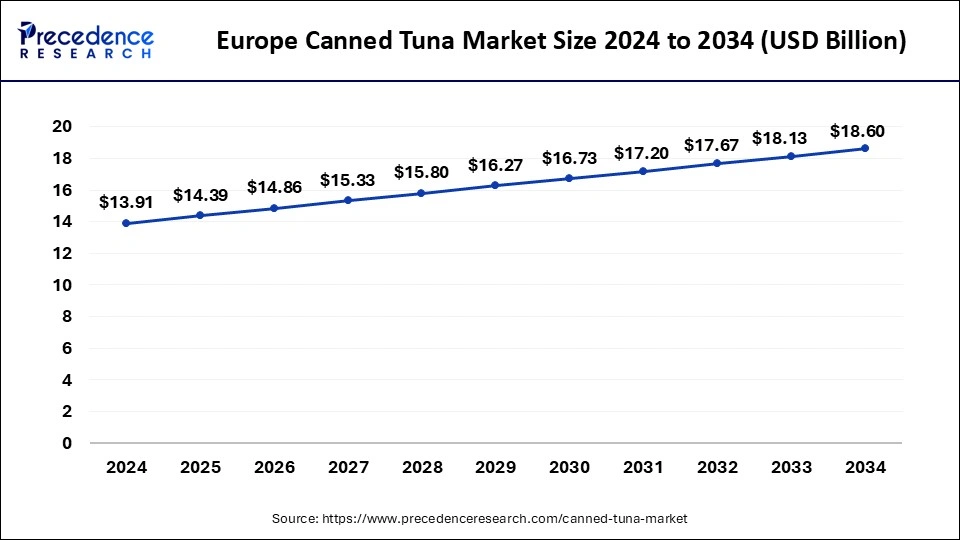

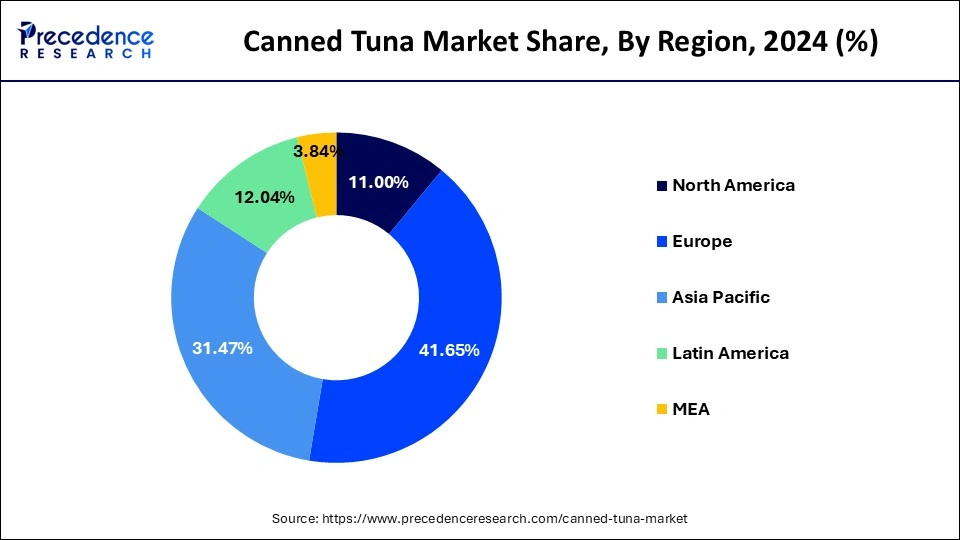

The global canned tuna market size accounted for USD 34.58 billion in 2025 and is forecasted to hit around USD 45.17 billion by 2034, representing a CAGR of 3.00% from 2025 to 2034. The Europe market size was estimated at USD 13.91 billion in 2024 and is expanding at a CAGR of 2.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global canned tuna market revenue was calculated at USD 33.41 billion in 2024 and is predicted to increase from USD 34.58 billion in 2025 to approximately USD 45.17 billion by 2034, expanding at a CAGR of 3.00% from 2025 to 2034.

The Europe canned tuna market size was exhibited at USD 13.91 billion in 2024 and is projected to be worth around USD 18.60 billion by 2034, growing at a CAGR of 2.90% from 2025 to 2034.

Europe led the canned tune market in 2024. Canned tuna has long been a well-liked and practical fish option in Europe. Because of its high protein and omega-3 fatty acid content, health-conscious consumers frequently prefer tuna. Several factors, including customer tastes, the state of the economy, and sustainability concerns, affect the market. A growing consciousness of sustainability and ethical fishing methods has affected consumer choices.

The European canned tuna market has competition from major food corporations and seafood brands. Specific consumers have a preference for brands that emphasize environmental responsibility and sustainability. European consumers are becoming more interested in seafood supplied sustainably, especially tuna in cans. Several certification schemes, like the Marine Stewardship Council (MSC), have become more significant.

The market for tuna in cans is enormous and has grown steadily over time. The nutritional advantages, lengthy shelf life, and ease of use of tuna in a can are some of the factors driving this expansion. Consumer preferences for ready-to-eat and convenient seafood items have driven the demand for canned tuna. Because canned tuna has a high protein level and omega-3 fatty acids. Health-conscious consumers frequently choose it. Various canned tuna varieties, such as skipjack, yellowfin light tuna, and albacore white tuna, are usually available in the market. Because light tuna contains less mercury, it is frequently selected.

The canned tuna sector has begun to include sustainability as a critical consideration. Eco-friendly and sustainably sourced items are becoming more and more popular among consumers. Some businesses have implemented sustainable fishing certifications and procedures to satisfy customer demands. Supply chain dynamics and customer behavior may have been impacted by the COVID–19 pandemic. A possible benefit to the canned tuna business during lockdowns was increased demand for shelf-stable items. The canned tuna business is anticipated to keep expanding, emphasizing innovation and sustainability. A business that responds to customer concerns about product diversity, environmental effects, and sources may gain a competitive advantage.

| Report Highlights | Details |

| Market Size in 2025 | USD 34.58 Billion |

| Market Size by 2034 | USD 45.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.00% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Tuna Species, Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

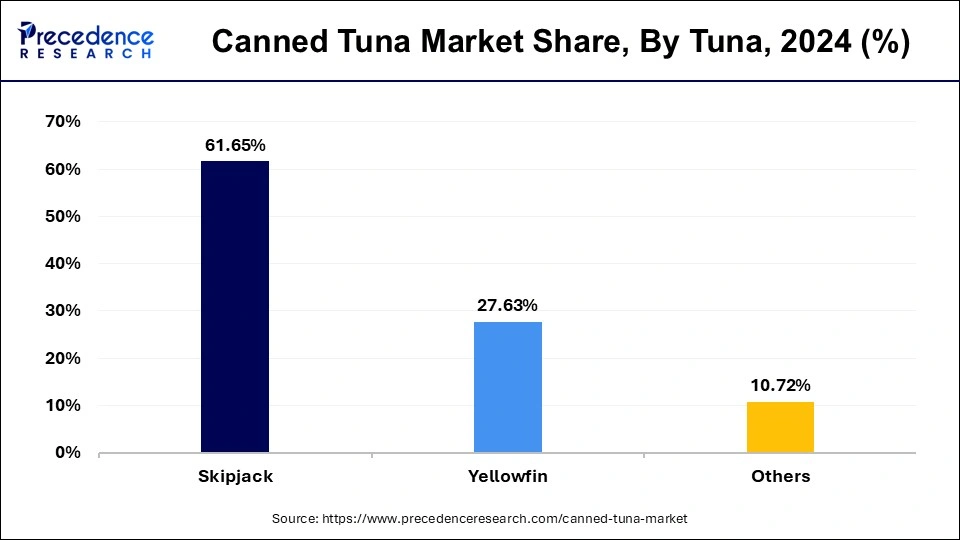

The skip jack segment holds the largest share of the canned tuna market. Katsuwonus pelamis, often known as skipjack tuna, is one of the species most frequently used to make tuna sauce. It is valued for its tasty and dark-colored meat and is noted for being comparatively tiny compared to other tuna species like albacore or yellowfin. Products from canned tuna frequently come in various cuts, like pieces or flakes.

One type of tuna commonly found in the market is a skipjack chunk. Because skipjack has a gentler flavor and a lighter color than other tuna species, it is frequently called "light tuna." The sustainability of tuna products could pique the curiosity of specific customers. There may be a niche for skipjack tuna sourced sustainably and with certifications from groups such as the Marine Stewardship Council (MSC). Different market sectors may target customers seeking particular flavor profiles, such as smoked or sauce-based skipjack tuna. Tuna can be processed in a variety of ways.

Yellowfin segment is expected to grow at the fastest rate during the forecast period. One of the main kinds of tuna frequently captured and prepared for the canned market is yellowfin tuna (Thunnus albacores). Because of its reputation for having delicate and tasty flesh, yellowfin is commonly used in canned tuna products. This highly migratory species can be found worldwide in tropical and subtropical waters. Different tuna species, such as skipjack, and yellowfin, are used in the canned tuna industry. Because of its flavor and texture, yellowfin tuna is frequently used for more expensive and superior canned tuna products. A substantial portion of the world's seafood market comprises canned tuna, which comes in various varieties, from plain to flavored and sauce-mixed.

Canned Tuna Market Revenue, By Tuna Species, 2022-2024 (USD Billion)

| Tuna Species | 2022 | 2023 | 2024 |

| Skipjack | 19.12 | 19.86 | 20.60 |

| Yellowfin | 8.61 | 8.93 | 9.25 |

| Others | 3.33 | 3.45 | 3.56 |

The ready-to-eat segment held a significant share in the canned tuna market in 2024. These products are gaining popularity due to their convenience and alignment with busy lifestyles. The demand for RTE canned tuna is increasing as consumers seek quick, nutritious meal options. There's a growing consumer awareness regarding health and sustainability, leading to increased demand for protein-rich, ready-to-eat meals like canned tuna. This trend is influencing product offerings and marketing strategies within the industry.

By Tuna Species

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

March 2025

October 2024