September 2024

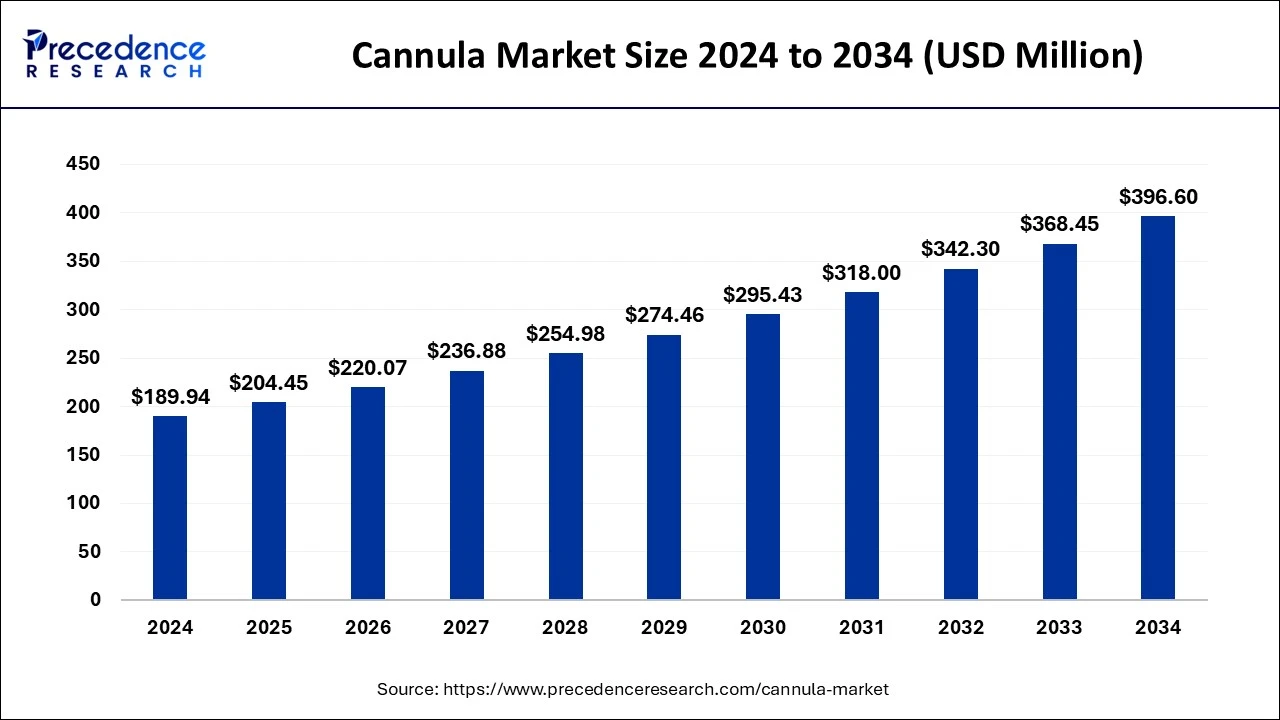

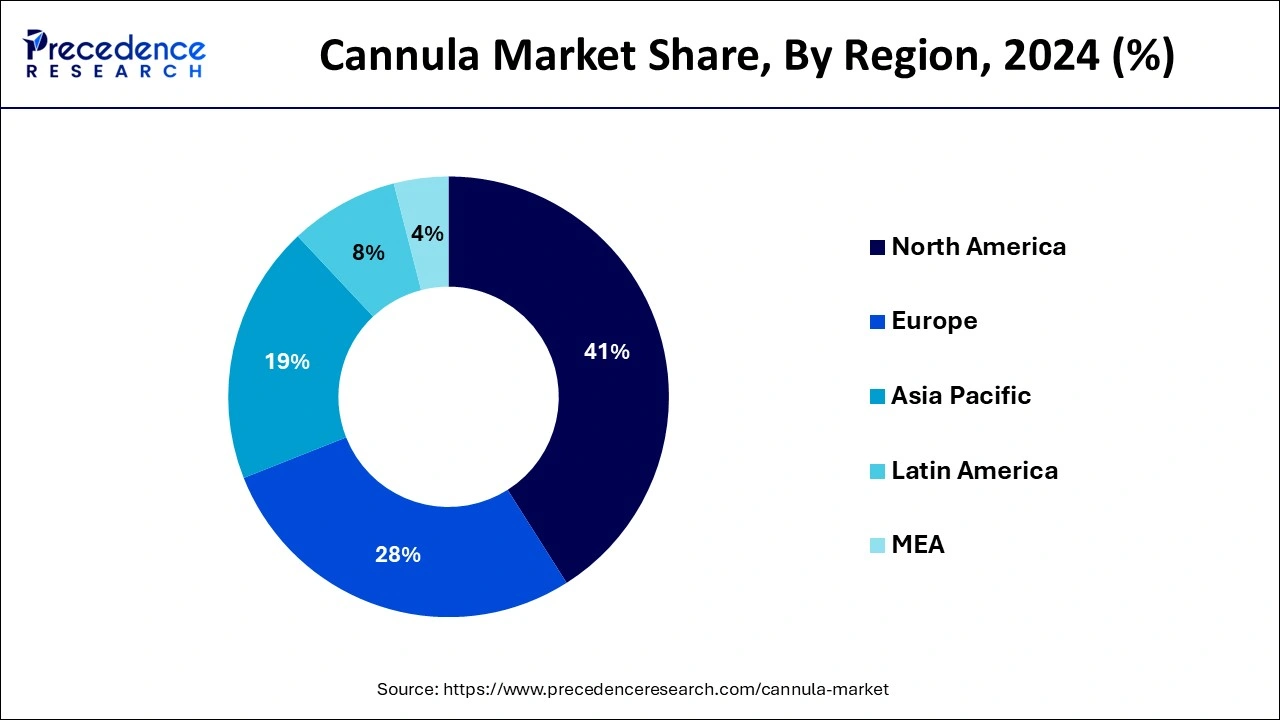

The global cannula market size was accounted for USD 189.94 million in 2024, grew to USD 204.45 million in 2025 and is projected to surpass around USD 396.60 million by 2034, representing a CAGR of 7.64% between 2025 and 2034. The North America cannula market size is evaluated at USD 77.88 million in 2024 and is expected to grow at a CAGR of 7.76% during the forecast year.

The global cannula market size was calculated at USD 189.94 million in 2024 and is predicted to reach around USD 396.60 million by 2034, expanding at a CAGR of 7.64% from 2025 to 2034. The cannula market is driven by the increasing prevalence of minimally invasive surgeries.

Engineers can more precisely build cannulas for various medical applications, such as IVs, oxygen administration, or specific procedures, with the aid of AI-driven simulations. To forecast the best designs that minimize patient discomfort and improve efficacy, machine learning (ML) algorithms examine variables such as clinical requirements and patient anatomy. Through the analysis of variables like immunological state, past medical data, and procedure details, it can identify which patients may be more susceptible to infections associated with cannulas. More proactive care efforts may result from this.

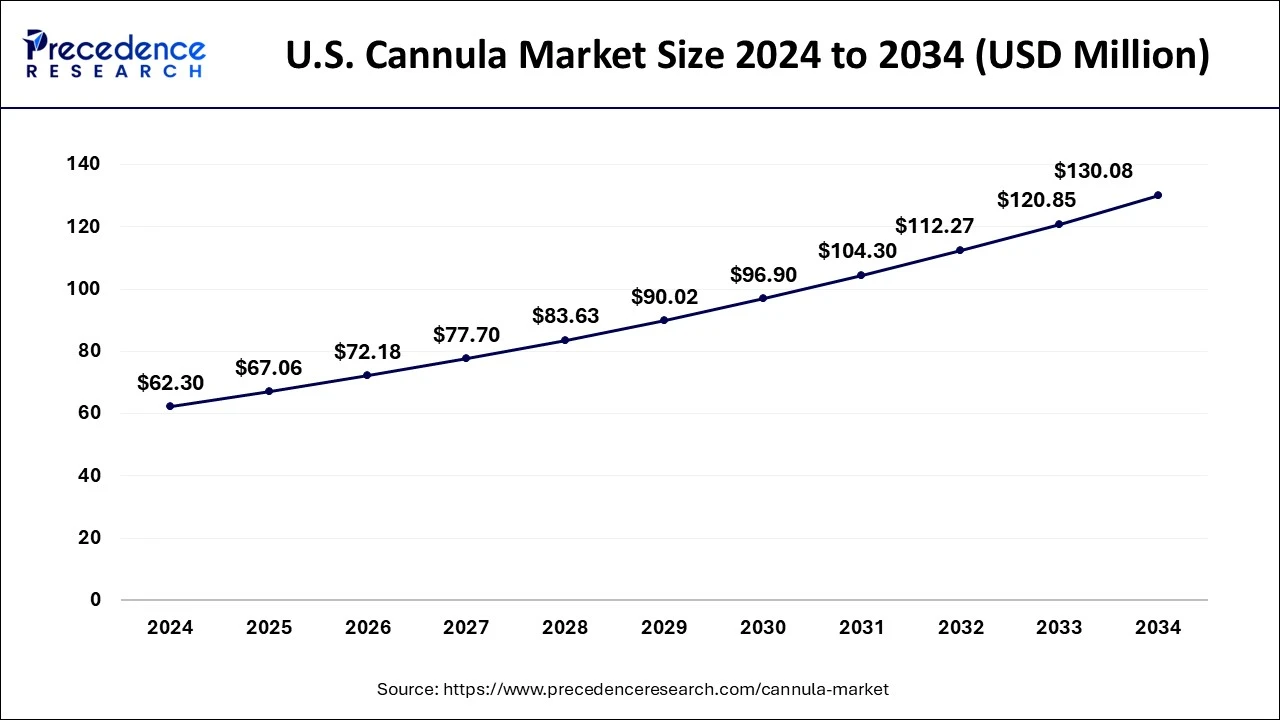

The U.S. cannula market size was exhibited at USD 62.30 million in 2024 and is projected to be worth around USD 130.08 million by 2034, growing at a CAGR of 7.82% from 2025 to 2034.

North America dominated cannula market in 2023. The United States is renowned for having a highly developed healthcare system in North America. This comprises a large number of hospitals, outpatient clinics, and high-tech surgery centers. For a wide range of medical requirements, including everyday medical care and procedures, such a sophisticated system may easily use different cannulas. Guidelines and approvals from regulatory agencies such as the U.S. Food and Drug Administration (FDA) guarantee cannulas. This encouraging regulatory environment encourages Businesses to launch novel and inventive cannula products.

Asia-Pacific is observed to be the fastest growing the cannula market during the forecast period. Chronic disorders including diabetes, renal failure, and cardiovascular diseases are more common in aging populations, especially in nations like South Korea and Japan. These illnesses necessitate regular medical procedures that depend on cannulas, including dialysis, blood transfusions, and intravenous therapy. The number of elective and urgent surgical treatments is increasing in the area.

A cannula is a tiny tube placed for medical reasons into a duct, cavity, or vessel in the body. One significant substitute for cosmetic filling technique treatments is the use of microcannulas. It has numerous benefits, including increased safety and speed while filling deep planes, the potential to reach far-off places with a single opening, reduced discomfort, shock to the body and mind, edema and hematoma formation, and a quicker recovery.

| Report Coverage | Details |

| Market Size by 2034 | USD 396.60 Million |

| Market Size in 2025 | USD 204.45 Million |

| Market Size in 2024 | USD 189.94 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.64% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Material, Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in demand for minimally invasive surgeries

Smaller incisions are usually needed for minimally invasive operations than for regular ones. Less trauma, less pain, quicker recovery, decreased infection risk, and fewer scars are some benefits of MIS. MIS is now a preferred option in many medical specialties, including orthopedic, cardiovascular, gastrointestinal, and plastic operations, thanks to technologies like laparoscopy, endoscopy, and robotic surgery.

Growing cases in asthma and COPD

Long-term oxygen therapy (LTOT) is necessary for COPD patients to maintain appropriate blood oxygen levels, particularly for those in the latter stages of the illness. Similarly, additional oxygen may be necessary to support breathing during severe asthma attacks. Because nasal cannulas are simple to use, affordable, and offer a steady oxygen flow, there is a growing need for them.

Side effects while using nasal cannulas

The nasal cannula is placed around the patient's ears and on their face. Pressure sores or pain may result from prolonged use, particularly if the cannula is not fitted or adjusted correctly. Although uncommon, oxygen poisoning can result from misusing nasal cannulas for extended periods of time at high oxygen concentrations. This happens when too much oxygen harms the lungs or other tissues, especially in people who already have respiratory disorders.

Rising investments toward cannula market expansion

High-quality medical equipment like cannulas is becoming increasingly necessary as healthcare systems in these areas continue to advance, especially for surgical procedures, intravenous therapy, and diagnostic applications. Better funding enables manufacturers to expedite research and development, which shortens the time it takes for new cannulas to hit the market and, as a result, increases the selection of products that healthcare professionals may choose from.

The cardiac segment dominated the cannula market in 2023. Heart failure, arrhythmias, coronary artery disease, and other cardiovascular conditions remain the world's leading causes of death. Specialized cardiac cannulas are required as a result of the increase in CVD, which has increased demand for cardiac treatments. The World Health Organization (WHO) states that heart disease continues to be a major cause of death worldwide, which raises the number of surgical procedures requiring cannulas.

The dermatology segment is observed to be the fastest growing in the cannula market during the forecast period. Due to their practical anti-wrinkle impact and minimally invasive treatment method, dermal filler injectable therapies are growing in popularity. However, because injectable fillers require needles for each syringe, dermal fillers were not previously as minimally invasive as they are now. Dermal fillers are injected below the skin's surface using blunt-tipped needles called microcannulas. When administering facial filler injections (such as lip filler) to improve cosmetic treatment areas, these are utilized in place of a sharp needle. Furthermore, the FDA has approved the use of cannulas in the lips, cheeks, and jowls. The aesthetic injector who facilitates the treatment session is essential when using a cannula.

The straight cannula segment dominated the cannula market in 2023. Straight cannulas are frequently employed in a variety of medical operations, particularly in cosmetic, cardiovascular, and general surgery. They can be used for a variety of purposes, including as blood sample and transfusions, as well as the delivery of fluids and medications, thanks to their straight shape. Straight cannulas are frequently used in minimally invasive treatments, such as cosmetic surgery, for injecting fluids, transferring fat, and other objectives. The demand for these procedures has increased recently.

The winged cannula segment is observed to be the fastest growing in the cannula market during the forecast period. Winged cannulas, sometimes referred to as butterfly needles, are easier for medical personnel to handle during insertion because of the flexible, wing-like attachments on either side of the needle. By increasing control, accuracy, and stability during fluid administration or blood collection, this design lowers the possibility of problems.

The plastic segment dominated the cannula market in 2023. Cannulas made of plastic are far less expensive than those made of metal. Plastic cannulas are preferred by healthcare facilities, particularly those with tight budgets, because they offer a high-quality substitute without sacrificing performance or safety. These cannulas are now more affordable and feasible to buy in bulk, which has increased demand in clinics, hospitals, and other specialized medical institutions.

The silicone segment is observed to be the fastest growing in the cannula market during the forecast period. Due to its hypoallergenic qualities, silicone is appropriate for individuals with delicate skin or those who are prone to allergic responses, in contrast to certain plastics and metals. This broadens its application to a larger group of patients. Silicone cannulas are perfect for both disposable and reusable applications since silicone is a very resilient material that can tolerate numerous sterilizing procedures without deteriorating.

The 18G segment dominated the cannula market in 2023. The 18G cannula's ideal flow rate makes it a popular choice for intravenous therapy since it enables quick fluid resuscitation. This makes it perfect for emergency, trauma, and critical care situations where quick fluid delivery is crucial. With a diameter of 1.30 mm, this cannula is frequently used for applications requiring a slightly smaller size, such as the delivery of medications and general fluid administration.

The 22G segment is observed to be the fastest growing in the cannula market during the forecast period. The 22G cannula is adaptable for a variety of applications because it strikes a compromise between size and flow rate. It offers a moderate flow rate that effectively administers drugs and fluids to the patient without making them uncomfortable. The 22G cannula, which has a 0.85 mm diameter and is regarded as a small gauge, is frequently used for drugs, blood transfusions, and other treatments that call for a more sensitive technique.

The hospital segment dominated the cannula market in 2023. Numerous medical cases involving intravenous (IV) therapy, transfusions, and respiratory treatments, all of which require cannulae, are among the many patients that hospitals treat. Hospital critical care units must continuously monitor and treat patients, many of whom are on life support. To dispense medications and take blood samples, cannulae are essential for maintaining steady access to veins and arteries.

The ambulatory surgical centers segment is observed to be the fastest growing in the cannula market during the forecast period. Due to their affordability and ease, outpatient care, especially in ASCs, is gradually replacing inpatient hospital settings in the healthcare industry. Patients looking for electives and minor surgeries are drawn to ASCs because they provide quicker procedures, shorter waiting periods, and quicker recovery. Commonly utilized in various treatments, cannulas allow for less intrusive methods, reducing recuperation time and allowing for same-day release.

By Product

By Type

By Material

By Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

December 2024