October 2024

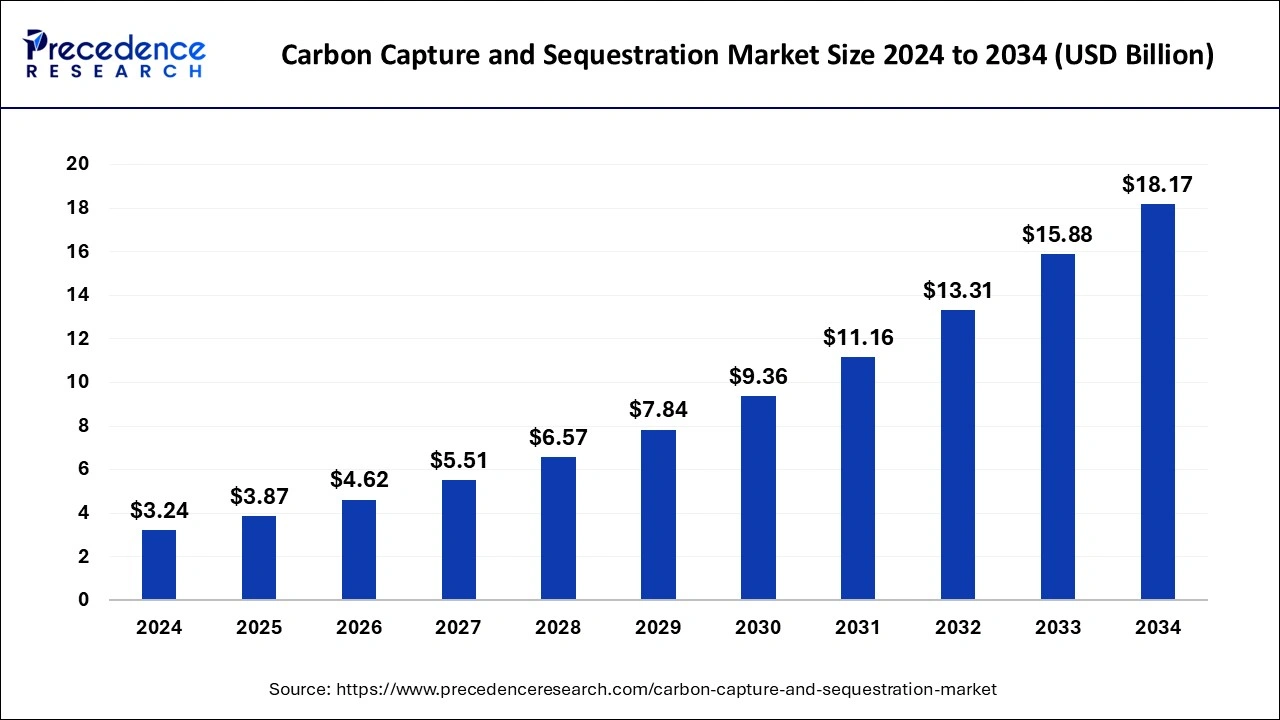

The global carbon capture and sequestration market size is calculated at USD 3.87 billion in 2025 and is forecasted to reach around USD 18.17 billion by 2034, accelerating at a CAGR of 18.82% from 2025 to 2034. The North America carbon capture and sequestration market size surpassed USD 2.27 billion in 2024 and is expanding at a CAGR of 18.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global carbon capture and sequestration market size was estimated at USD 3.24 billion in 2024 and is predicted to increase from USD 3.87 billion in 2025 to approximately USD 18.17 billion by 2034, expanding at a CAGR of 18.82% from 2025 to 2034. The carbon capture and sequestration market is constantly improving, which has increased process effectiveness and reduced cost.

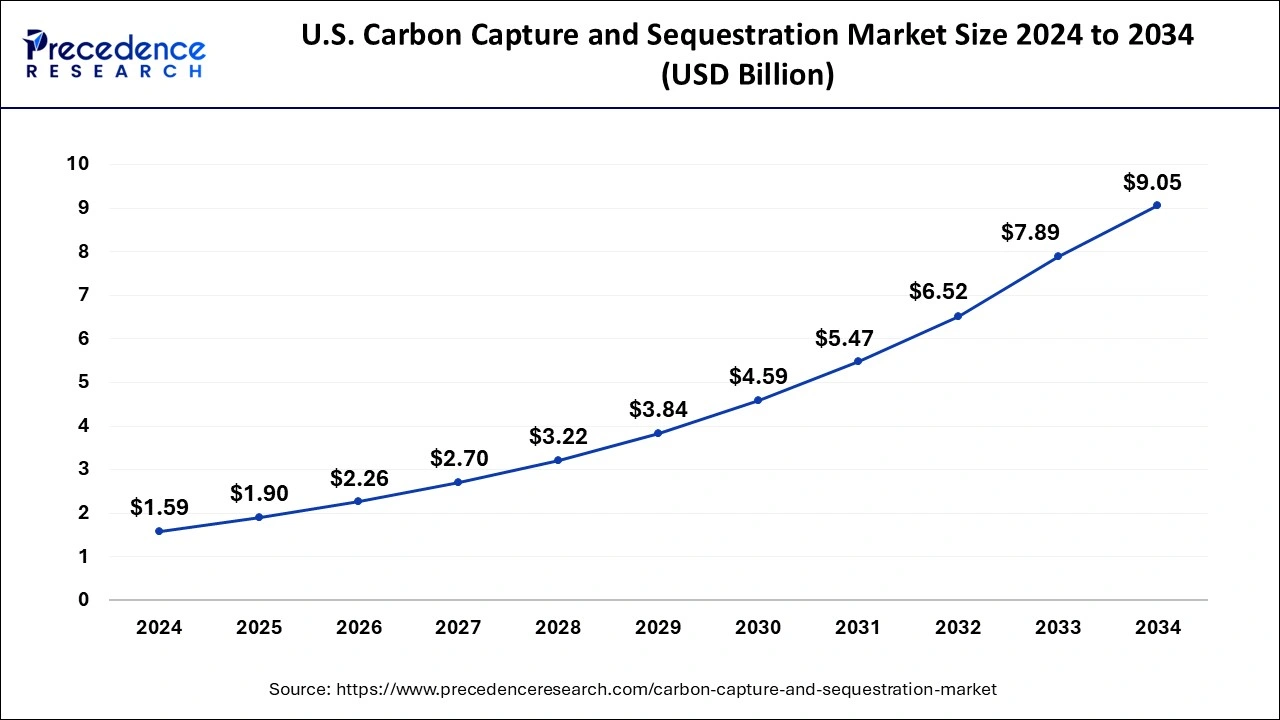

The U.S. carbon capture and sequestration market size was exhibited at USD 1.59 billion in 2024 and is projected to be worth around USD 9.05 billion by 2034, poised to grow at a CAGR of 18.99% from 2025 to 2034.

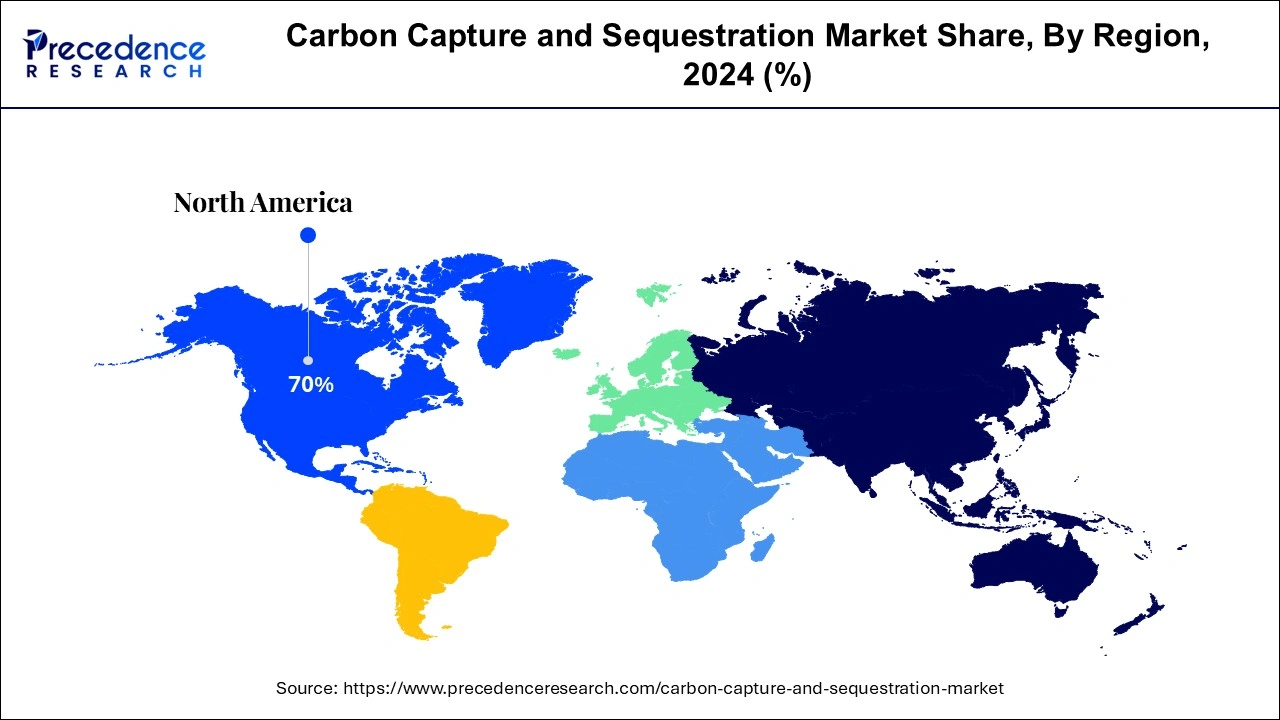

North America held the largest share of the carbon capture and sequestration market in 2024. The carbon capture and sequestration market is being driven by strict climate policies and regulations. North American governments, especially those in the United States and Canada, are taking action to lower greenhouse gas emissions, which is encouraging the usage of CCS. The process is becoming more economical and efficient thanks to advancements in CCS technologies. This covers advancements in methods of storage, transit, and capture. The public and commercial sectors are investing an increasing quantity of money. In order to achieve their corporate sustainability objectives, private businesses invest in CCS projects, while governments offer grants and subsidies. CO2 storage safety and environmental concerns may make it more difficult for the general public to accept and support CCS initiatives.

Asia Pacific is expected to host the fastest-growing market in the upcoming years. Asia Pacific's carbon capture and sequestration market is expanding significantly due to a number of factors, including growing investments, favorable government regulations, and the region's emphasis on lowering carbon emissions in order to fulfill climate targets. Stricter laws are being implemented in many Asia Pacific nations to reduce carbon emissions.

China has set high goals to become carbon neutral by 2060, which is encouraging the use of CCS technologies. The market is expanding thanks to advancements in carbon capture technology and the creation of more economical and effective solutions. In an effort to advance CCS technologies, businesses are spending more money on research and development. The region's dedication to cutting carbon emissions and meeting climate targets will accelerate the development of CCS technologies.

One essential element of international efforts to lessen greenhouse gas emissions and slow down climate change is the carbon capture and sequestration market. The market includes systems and procedures that transport, store, and utilize carbon dioxide (COâ‚‚) underground or utilize it for other purposes after it is emitted from industrial sources and power generation. The carbon capture and sequestration market has been expanding gradually thanks to rising governmental and private sector expenditures. The adoption of carbon capture and sequestration (CCS) technologies is being driven by international accords like the Paris Agreement and stricter climate policies in order to meet emission reduction targets.

Technological developments in CCS are lowering costs and increasing efficiency, increasing the likelihood that the carbon capture and sequestration market will be widely adopted. The efficiency of CCS systems is being improved by innovations in materials, procedures, and integration with renewable energy sources. The market for carbon capture and sequestration is expected to expand significantly as it becomes an essential instrument in the international effort to tackle climate change.

Notwithstanding obstacles, consistent technological breakthroughs, encouraging regulations, and rising investments are anticipated to propel the market forward in the upcoming years. It is probable that CCS will be combined with other technologies, such as bioenergy and hydrogen production, to improve total carbon reduction initiatives and foster synergies.

| Report Coverage | Details |

| Market Size by 2034 | USD 18.17 Billion |

| Market Size in 2025 | USD 3.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Capture Source Analysis, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enhanced Resource Recovery

A key idea in the carbon capture and sequestration market, enhanced resource recovery (ERR), seeks to minimize resource use and management while lowering carbon emissions. To maximize oil production, CO2 recovered from industrial operations is injected into established oil fields. This improves the recovery of the residual oil while simultaneously sequestering CO2. CO2 is stored in deep saline deposits. The CO2 that has been extracted is pumped into these formations, where the surrounding rock formations trap it. Energy-saving procedures should be introduced into enterprises to lower CO2 emissions. Funding from the public and commercial sectors to promote CCS technology development, deployment, and research.

Infrastructure Challenges

Large-scale pipeline networks are lacking in the ability to move sequestered CO2 from emission sources to sequestration locations. Public opposition, regulatory obstacles, and exorbitant expenses are all involved in the development of new pipelines. It is crucial to make sure that storage locations can safely retain CO2 without leaking and have the requisite capacity.

It is quite difficult to monitor and keep these locations intact for extended periods of time. The CO2 capture systems available today can be expensive and energy-intensive. To make the carbon capture and sequestration market more economically feasible, capture efficiency and cost reduction must be improved. Without carbon pricing or subsidization mechanisms, the economic rationale for CCS is sometimes weak. In the current state of the market, the expenses of capturing, moving, and storing CO2 may outweigh the profits.

Energy Sector Integration

Several energy sectors are involved in the carbon capture and sequestration market, such as direct air capture, industrial operations like the manufacturing of steel and cement, and electricity generation from biomass and fossil fuels. In order to produce standardized CCS technologies that can be deployed across several industries, integration necessitates cooperation between these sectors. Constructing the CCS infrastructure is a major undertaking. This comprises monitoring systems to make sure the CO2 is kept safely stored underground, pipelines for moving captured CO2 to storage locations, and storage facilities (such as saline aquifers or depleted oil and gas reservoirs). Involving the private sector is essential to scaling up CCS technologies. This covers funding for studies, pilot programs, and large-scale commercial implementations.

The natural gas processing segment dominated the carbon capture and sequestration market in 2024. Natural gas's carbon dioxide (CO2) content and the requirement to reduce emissions make it a major player in the carbon capture and sequestration market. CO2 is a common contaminant found in natural gas after processing, especially in establishments like refineries or natural gas processing plants. Reducing greenhouse gas emissions requires capturing this CO2 before it is released into the environment. After being captured, this CO2 might be moved for storage or utilized in additional industrial processes. Enhanced oil recovery procedures can make use of CO2 that is captured during the processing of natural gas or other industrial activities. In order to increase oil output in exhausted oil fields, carbon dioxide is injected into the earth and stored there indefinitely.

The power generation segment is expected to witness the fastest growth in the carbon capture and sequestration market during the forecast period. With the carbon capture and sequestration market, power plants may absorb CO2 emissions before releasing them into the environment. This makes the production of electricity using fossil fuels more environmentally benign by lowering greenhouse gas emissions. Existing power stations, such as coal-fired and natural gas-fired ones, can be retrofitted with CCS. This feature allows these plants to operate for longer periods of time while adhering to ever stricter environmental laws. Cleaner energy sources are becoming more prevalent worldwide, and CCS offers a technological bridge. It permits the more sustainable use of plentiful fossil fuel resources (such as coal and natural gas) up until the point at which renewable energy sources can completely replace them.

The dedicated storage & treatment segment led the global carbon capture and sequestration market in 2024. The infrastructure and procedures necessary for securely burying captured carbon dioxide (CO2) or storing it in other long-term storage options are referred to as dedicated storage and treatment. This includes the buildings and natural formations that are used to hold CO2 after it has been drawn from the atmosphere via industrial processes. Depleted oil and gas reserves, deep saline aquifers, and unmineable coal seams are common locations for storage. The treatment process is to prepare the captured CO2 for storage. Purification to get rid of contaminants and moisture that can compromise the security and effectiveness of storage is one way to do this. After CO2 is injected into storage locations, continuous verification and monitoring are essential. By doing this, it is ensured that the CO2 is kept under control and does not seep into the atmosphere or contaminate groundwater.

The enhanced oil recovery (EOR)segment is expected to grow at the highest CAGR in the carbon capture and sequestration market during the forecast period. In the context of the carbon capture and sequestration market, enhanced oil recovery (EOR) is important, especially when it comes to the dynamics of the market and technological developments targeted at lowering carbon emissions. EOR offers financial incentives for CCS initiatives. Businesses may be able to defray the expense of carbon capture and storage by employing CO2 for EOR. As a result, CCS projects may become more appealing to stakeholders and investors and more financially feasible. EOR is now a more successful strategy for increasing oil recovery and subterranean CO2 sequestration because of advancements in reservoir modeling, CO2 injection technology, and monitoring systems.

By Capture Source Analysis

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

February 2025

January 2025