November 2024

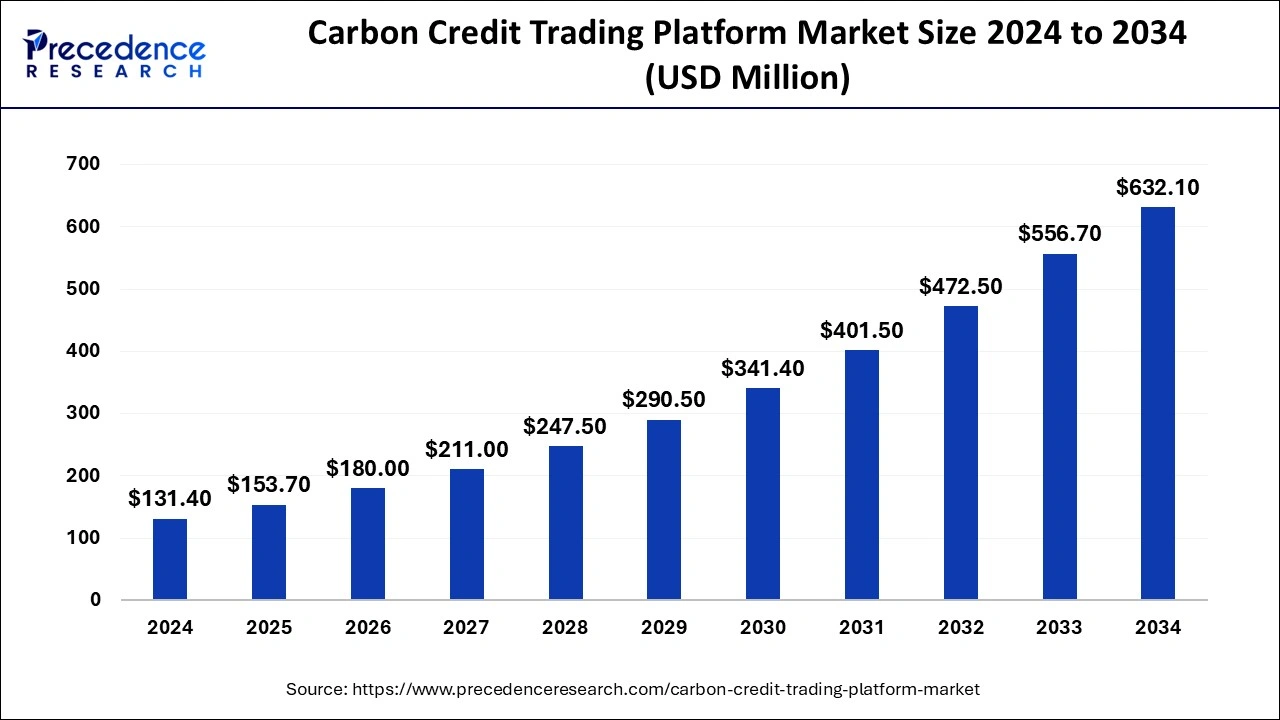

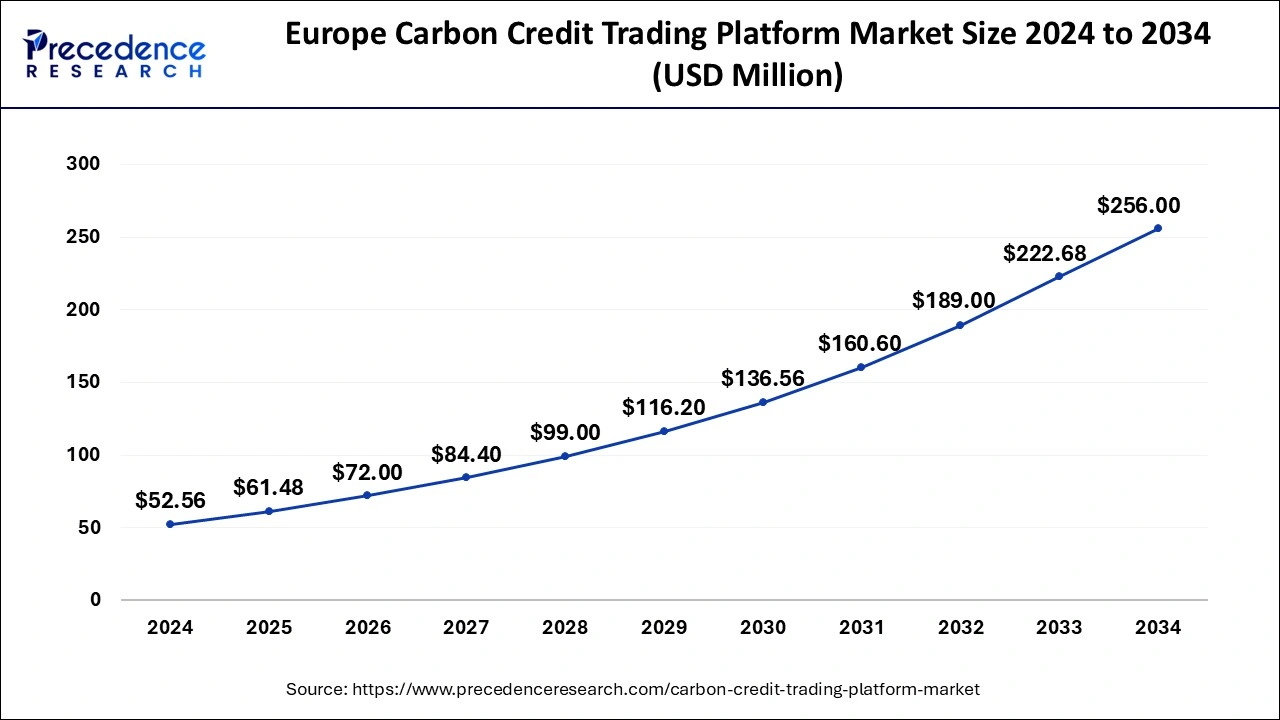

The global carbon credit trading platform market size is calculated at USD 153.70 million in 2025 and is forecasted to reach around USD 632.10 million by 2034, accelerating at a CAGR of 17.01% from 2025 to 2034. The Europe carbon credit trading platform market size surpassed USD 61.48 million in 2025 and is expanding at a CAGR of 17.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global carbon credit trading platform market size was estimated at USD 131.40 million in 2024 and is predicted to increase from USD 153.70 million in 2025 to approximately USD 632.10 million by 2034, expanding at a CAGR of 17.01% from 2025 to 2034.

The europe carbon credit trading platform market size was valued at USD 52.56 million in 2024 and is expected to reach around USD 256 million by 2034, growing at a CAGR of 17.15% from 2025 to 2034.

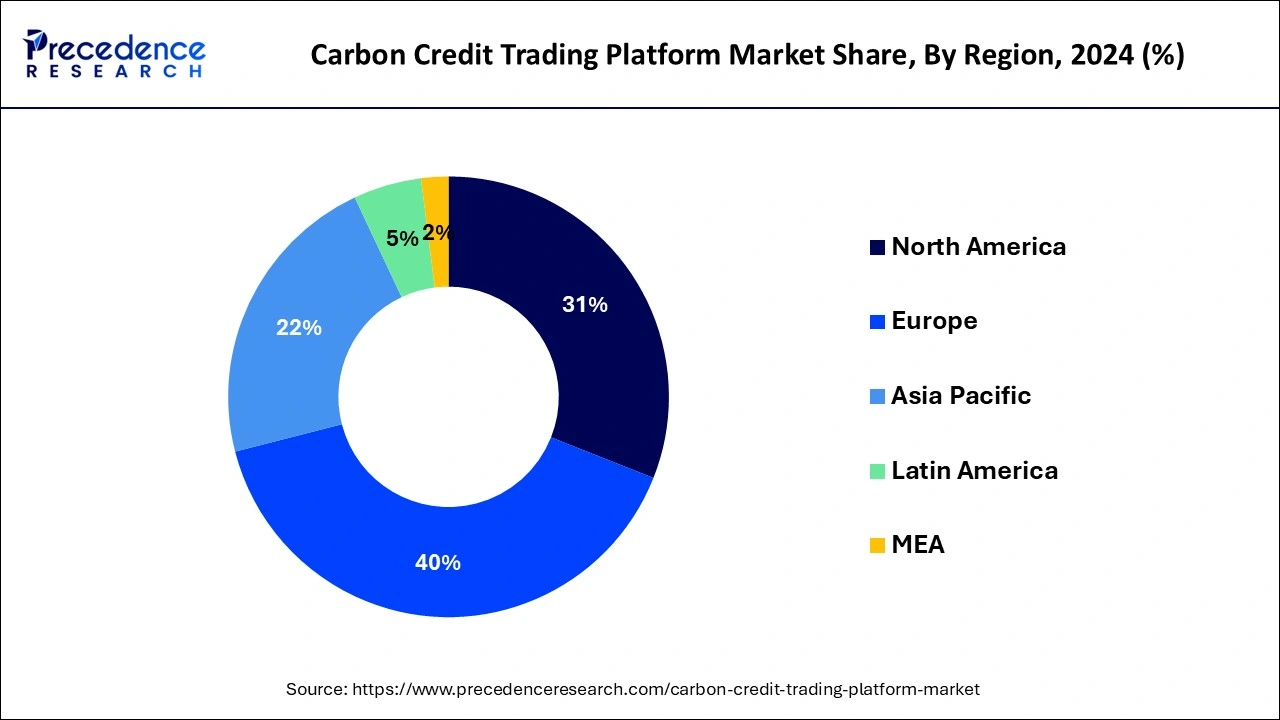

Europe held the biggest market share of 40% in 2024 due to its proactive approach toward environmental sustainability. The region has implemented robust carbon pricing mechanisms, such as the European Union Emissions Trading System (EU ETS), creating a structured framework for carbon credit trading. Stringent emission reduction targets, supportive government policies, and a strong commitment to combating climate change have driven widespread adoption of Credit Trading Platforms across industries, solidifying Europe's leading position in the global carbon credit market.

North America is poised for rapid growth in the carbon credit trading platform market due to increasing climate consciousness, stringent emission regulations, and corporate sustainability commitments. The region's robust economy fosters a conducive environment for businesses to engage in carbon credit trading. As more companies seek to offset their carbon emissions, the demand for transparent and efficient platforms rises. Additionally, supportive government policies and a focus on green investments contribute to the region's favorable outlook, positioning North America as a key player in the expanding carbon credit trading market.

Asia-Pacific is witnessing notable growth in the carbon credit trading platform market due to a combination of factors. Increasing governmental emphasis on environmental sustainability, rising corporate interest in offsetting emissions, and the implementation of carbon pricing mechanisms in countries like China contribute to the market's expansion. As the region embraces green initiatives and recognizes the economic potential of carbon credit trading, businesses are actively participating in the market, driving its substantial growth in Asia-Pacific.

A carbon credit trading platform market offers organizations a digital marketplace to buy and sell carbon credits to reduce their overall carbon footprint. These credits represent a quantifiable reduction in greenhouse gas emissions, achieved through eco-friendly practices or projects. In simple terms, companies that produce fewer emissions than allowed can sell their excess credits to those exceeding their limits. Conversely, businesses exceeding their emission limits can purchase these credits to offset their carbon output. These platforms facilitate transparent and standardized transactions, promoting environmental sustainability by encouraging companies to adopt cleaner practices. By creating a financial incentive for emissions reduction, carbon credit trading platforms play a crucial role in the global effort to combat climate change.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.01% |

| Global Market Size in 2025 | USD 153.70 Million |

| Global Market Size by 2034 | USD 632.10 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By System Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Corporate sustainability initiatives

Corporate sustainability initiatives play a pivotal role in driving the market demand for carbon credit trading platforms. As businesses globally recognize the importance of environmental responsibility, many are adopting sustainability goals and committing to reduce their carbon footprint. To achieve these targets, companies often seek carbon credits through trading platforms, allowing them to offset their unavoidable emissions by supporting verified emission reduction projects. Participation in carbon credit trading not only helps corporations fulfill their sustainability pledges but also aligns with the increasing expectations of environmentally conscious consumers and investors.

As businesses actively demonstrate their commitment to mitigating climate change and promoting eco-friendly practices, the demand for carbon credits rises. This surge in demand not only supports the growth of the carbon credit trading platform market but also contributes to a more sustainable and greener global business landscape.

Volatility in carbon prices

Volatility in carbon prices poses a significant challenge to the credit trading platform market by introducing uncertainty for businesses and investors. Fluctuations in carbon prices can be influenced by various factors, including changes in government policies, economic conditions, and shifts in global supply and demand dynamics. This unpredictability makes it challenging for companies to plan and implement long-term strategies for carbon emissions reduction effectively.

The instability in carbon prices can also deter businesses from actively participating in the carbon credit trading platform market. Concerns about the financial feasibility of carbon credit projects may lead companies to hesitate in investing, as the potential returns on these projects can be affected by the unpredictable nature of carbon prices. This volatility creates a barrier to widespread adoption, hindering the market's ability to attract consistent and sustained demand from businesses seeking to offset their carbon emissions through credit trading.

Financial incentives and green investments

Financial incentives and green investments play a crucial role in creating significant opportunities within the carbon credit trading platform market. As financial institutions and investors increasingly prioritize environmentally sustainable initiatives, the availability of funding for emission reduction projects supported by credit trading platforms expands. This influx of capital not only boosts the overall market but also encourages innovation and the development of new, impactful projects.

Companies engaged in carbon credit trading can benefit from the growing trend of green investments. These financial incentives not only provide financial support for businesses striving to offset their carbon emissions but also attract more participants to the market. As a result, the credit trading platform landscape becomes more robust and dynamic, offering a wider array of options for companies looking to align their operations with sustainable practices while capitalizing on the financial opportunities presented by the market.

The voluntary segment held the highest market share of 55% in 2024. In the carbon credit trading platform market, the voluntary segment refers to the voluntary carbon market, where participants voluntarily offset their carbon emissions beyond regulatory requirements. Companies engage in voluntary carbon credit trading to enhance their environmental credentials and meet self-imposed sustainability goals. A trend in this segment involves increased corporate participation, driven by heightened awareness of environmental responsibility. Companies, motivated by consumer demands and ESG considerations, are actively seeking voluntary carbon credits to demonstrate commitment to sustainability and achieve carbon neutrality.

The compliance segment is anticipated to witness rapid growth at a significant CAGR of 18.7% during the projected period. In the carbon credit trading platform market, the compliance segment refers to the trading of carbon credits to meet regulatory requirements and obligations set by governments and international agreements. Companies involved in this segment engage in buying and selling credits to comply with emission reduction targets. A growing trend in the compliance segment is the increasing adoption of carbon pricing mechanisms globally, leading businesses to actively participate in credit trading to meet their regulatory commitments and demonstrate adherence to environmental regulations.

According to the system type, the cap and trade segment has held 57% market share in 2024. In the carbon credit trading platform market's cap and trade segment, a cap is set on total allowable emissions, and businesses receive tradable allowances. Companies exceeding their limit must purchase credits, while those with surplus allowances can sell them. An emerging trend in this segment is the integration of technology, like blockchain, for transparent and secure transactions. Additionally, increasing global collaboration and the expansion of cap and trade initiatives contribute to the growth and effectiveness of this system in reducing carbon emissions.

The baseline and credit segment is anticipated to witness rapid growth over the projected period. In the carbon credit trading platform market, the "baseline" refers to the established level of emissions that a project aims to reduce, acting as a reference point. The "credit segment" involves the issuance and trading of carbon credits based on emission reductions achieved. A notable trend is the increasing demand for projects with robust baselines, ensuring credible and verifiable emissions reductions. This trend reflects the market's emphasis on transparency and the need for high-quality carbon credits, driving the adoption of projects that adhere to stringent baseline standards for credible environmental impact.

The utilities segment held the largest market share of 26% in 2024. The utilities segment in the carbon credit trading platform market refers to companies involved in electricity generation, distribution, and other utility services. In this sector, the trend involves utilities actively participating in carbon credit trading to offset their emissions and meet regulatory requirements. Utilities are increasingly leveraging credit trading platforms to invest in sustainable projects, such as renewable energy initiatives, and acquire carbon credits, aligning with their commitment to reducing environmental impact and achieving carbon neutrality. This trend not only aids utilities in meeting emission targets but also contributes to the overall growth of the carbon credit trading platform market.

The aviation segment is anticipated to witness rapid growth over the projected period. The aviation segment in the carbon credit trading platform market pertains to the use of carbon credits by airlines to offset their greenhouse gas emissions. A notable trend in this sector involves the increasing adoption of carbon credit trading platforms by airlines to meet emission reduction targets. As the aviation industry faces growing pressure to address its environmental impact, leveraging carbon credits through these platforms enables airlines to mitigate their carbon footprint and work towards a more sustainable and eco-friendly operation.

By Type

By System Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

April 2024

February 2025

December 2024