September 2024

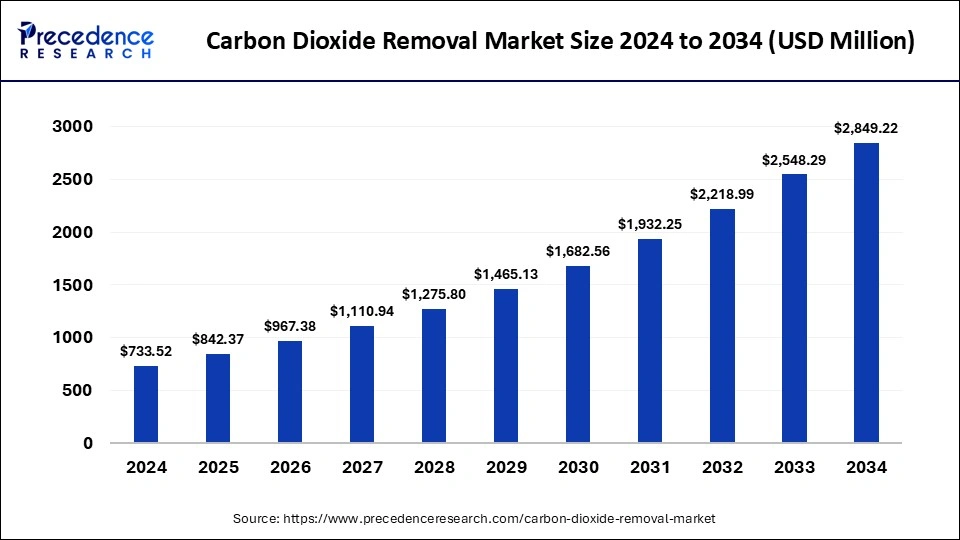

The global carbon dioxide removal market size is calculated at USD 842.37 million in 2025 and is forecasted to reach around USD 2,849.22 million by 2034, accelerating at a CAGR of 14.53% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global carbon dioxide removal market size was estimated at USD 733.52 million in 2024 and is predicted to increase from USD 842.37 million in 2025 to approximately USD 2,849.22 million by 2034, expanding at a CAGR of 14.53% from 2025 to 2034. The rising awareness of reducing CO2 emissions across the world is driving the growth of the carbon dioxide removal market.

The carbon dioxide removal market has grown rapidly with the developments in the chemical domain. This industry mainly deals with providing solutions for removing C02 from the environment using natural and artificial methods. The C02 removal strategy is mostly integrated into many climate policies, as CO2 is an important element of climate change. CDR includes several methods that are mainly used on land or in aquatic systems. Land-based methods consist of afforestation, reforestation, and other agricultural practices. The water-based methods include ocean alkalinity enhancement, ocean fertilization, wetland restoration, and some blue carbon approaches. There are several products that are used in the CDR process that mainly include Biochar, Direct Air Capture (DAC), Enhanced/Carbon Mineralization, Ocean Alkalinization, BECCS, Microalgae, and some others. The CDR mainly finds applications in the technology and finance sectors. This industry is expected to grow exponentially with the growth in chemical industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,849.22 Million |

| Market Size in 2025 | USD 842.37 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing investment and funding for the CDR industry

The CDR industry has gained prominent attention due to the rise in CO2 emissions around the world. This industry has received investments from public and private sectors along with funding from several governmental organizations, venture capitalists, and others. These investments and funding are mainly used for research and development of carbon removal technologies along with technological advancements related to CDR technologies. Thus, rising investments from various sectors are likely to drive the growth of the carbon dioxide removal market.

High cost and environmental issues

The application of carbon dioxide removal has increased significantly in recent times. Although the advantages of carbon dioxide removal are noteworthy, there are several problems in this industry. Firstly, the cost of setting up a CO2 removal plant is very high as the raw materials prices and labor wages have increased rapidly. Secondly, the construction sites of DAC centers and their surrounding areas are negatively affected by the release of CO2. Thus, the increased cost of setting up a CO2 removal plant, along with negative impacts on the environment, is likely to restrain the growth of the carbon dioxide removal market during the forecast period.

Growing application of blue carbon and microalgae in CDR

The CO2 removal industry is growing rapidly with the advancements in chemical sciences and its related fields. The rising applications of blue carbon and microalgae have gained attention in recent times as they are found to be highly suitable for removing carbon dioxide from the atmosphere. Blue carbon helps remove CO2 by leveraging photosynthesis in seaweed, coastal plants, or phytoplankton, and microalgae finds applications in absorbing the excessive amount of CO2 from the atmosphere. Thus, the rising use of microalgae and blue carbon for carbon dioxide removal is expected to create ample growth opportunities for carbon dioxide removal market players in the future.

The direct air capture (DAC) segment held the largest market share in 2024. The growth of this segment is generally driven by the rising developments in the chemical industry around the world. Also, the growing awareness of the need to prevent CO2 emissions, along with developments in electrochemical processes, boosts market growth. Moreover, the rise in the number of government investments related to the research and development of DAC is likely to drive market growth.

Additionally, several advantages of DAC, such as reduction of CO2, carbon recycling, smaller footprint, negative emissions, and some others, are likely to boost the growth of the carbon dioxide removal market. Furthermore, CRD companies are announcing several direct air capture and storage (DAC S) plants in various parts of the world, which is likely to drive market growth.

The enhanced/carbon mineralization segment is the fastest-growing segment during the forecast period. This segment is generally driven by the rising demand for lowering CO2 emissions in the environment. Also, the rising application of the natural weathering process for converting atmospheric CO2 into rocks is boosting the market growth. Moreover, several applications of enhanced/carbon mineralization in stabilizing and permanently storing CO2 waste from mining industries boost market growth. Additionally, carbon mineralization helps prevent the biosphere and reduce CO2 emissions much more quickly than other methods, which in turn drives market growth. Furthermore, the rise in the number of research and development activities related to enhanced CO2 weathering, along with growing government initiatives for the development of carbon mineralization, fosters carbon dioxide removal market growth.

The technology sector segment dominated the market in 2024 and is expected to continue its dominance during the forecast period. The growth of this segment is generally driven by the rising number of research projects related to C02 removal. Also, the rising technological developments in the C02 removal methodologies, along with numerous enhanced oil recovery (EOR) projects in developed countries such as the U.S., Canada, Russia, Oman, Saudi Arabia, and others, are likely to boost the growth of the carbon dioxide removal market.

The finance sector segment is expected to be the fastest-growing segment during the forecast period. This segment is generally driven by rising demand for a low-carbon economy and a sustainable future around the world. Also, the growing role of financial institutions towards climate change, along with supporting pricing, inter-temporal accounting, risk management, and cross-border investments for attaining net zero emission, is likely to drive the growth of the carbon dioxide removal market.

North America held the largest carbon dioxide removal market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by rising government initiatives in countries such as the U.S., Canada, Mexico, and others to strengthen the chemical industry. The rising investment from the public and private sectors for developing CO2 removal technologies drives market growth. Also, the rising advancements in science and technology, along with several government initiatives for carbon storage, are likely to drive market growth.

Moreover, the presence of several market players such as Blueplanet, Carbon Engineering, CarbonCure, CarbonFree, and some others are constantly engaged in developing CDR technologies and adopting several strategies such as launches, collaborations, and acquisitions, which in turn drives the growth of the carbon dioxide removal (CDR) market in this region.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growth of this segment is mainly driven by the rising demand for a carbon-free environment in this region. Also, the rising initiatives by public and private sector entities for developing the CDR industry are boosting the market growth. The growing number of research institutions engaged in research and development of CO2 removal technologies in countries such as China, India, Japan, South Korea, and others is likely to boost the market growth in this region. The growing investment by several chemical companies to maintain carbon neutrality is also driving carbon dioxide removal market growth.

The presence of several market players such as Greenovate Solutions Pvt Ltd, UNAKTI, KARDLE Industries, Gohemp Agroventures, Mitsubishi Heavy Industries, Sinopec, Caliche Inventions Private Limited, Organic Ledger and some others are constantly engaged in developing CDR technologies and adopting several strategies such as launches, collaborations and acquisitions, which in turn drives the growth of the carbon dioxide removal (CDR) market in this region.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

December 2024