September 2024

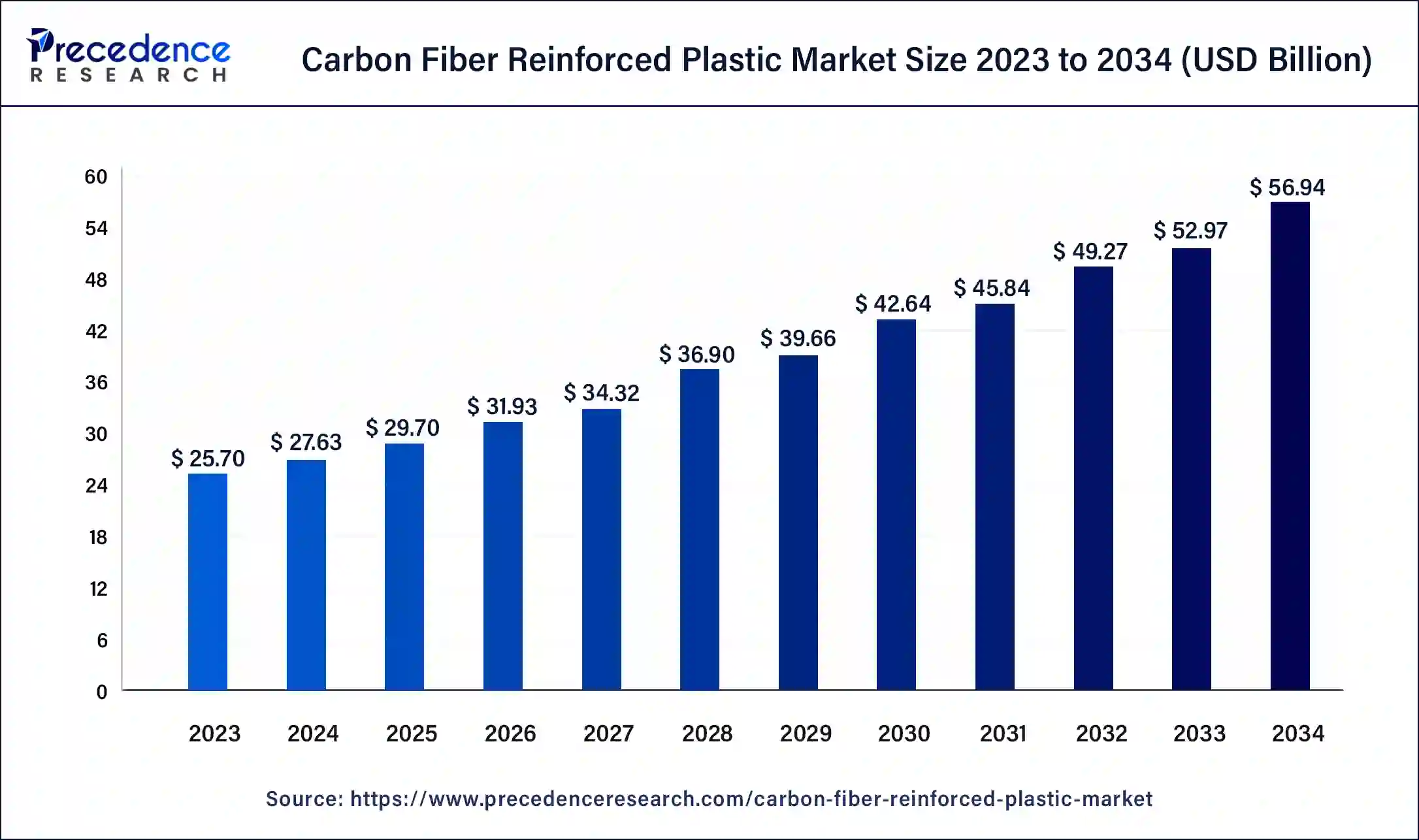

The global carbon fiber reinforced plastic market size was USD 25.70 billion in 2023, calculated at USD 27.63 billion in 2024 and is expected to be worth around USD 56.94 billion by 2034. The market is slated to expand at 7.50% CAGR from 2024 to 2034.

The global carbon fiber reinforced plastic market size is worth around USD 27.63 billion in 2024 and is anticipated to reach around USD 56.94 billion by 2034, growing at a solid CAGR of 7.50%. The rapid infrastructure development and extensive utilization of CFRP in the production of various building and construction materials are likely to promote the carbon fiber reinforced plastic market’s growth in the upcoming years.

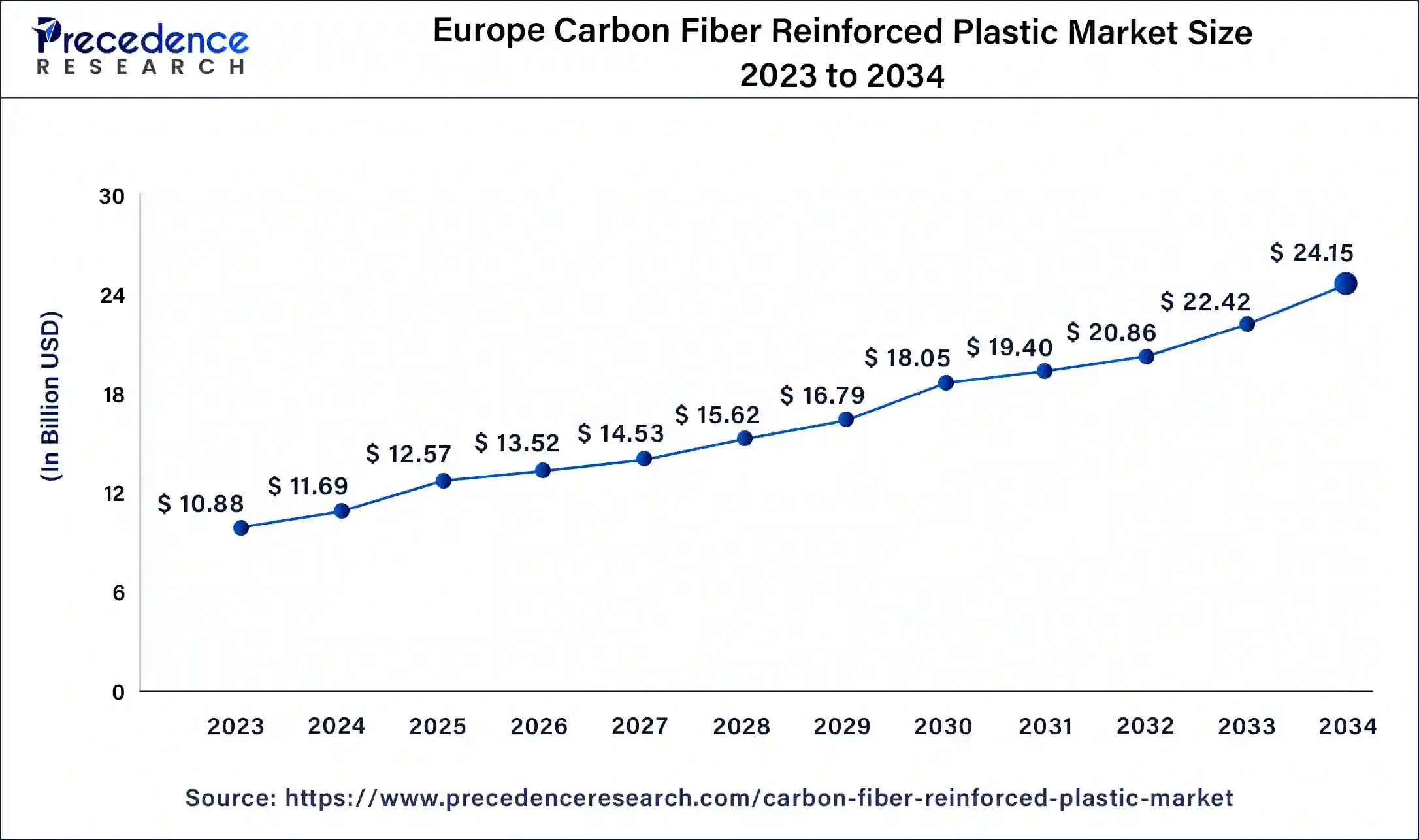

The Europe carbon fiber reinforced plastic market size was exhibited at USD 10.88 billion in 2023 and is projected to be worth around USD 24.15 billion by 2034, poised to grow at a CAGR of 7.52% from 2024 to 2034.

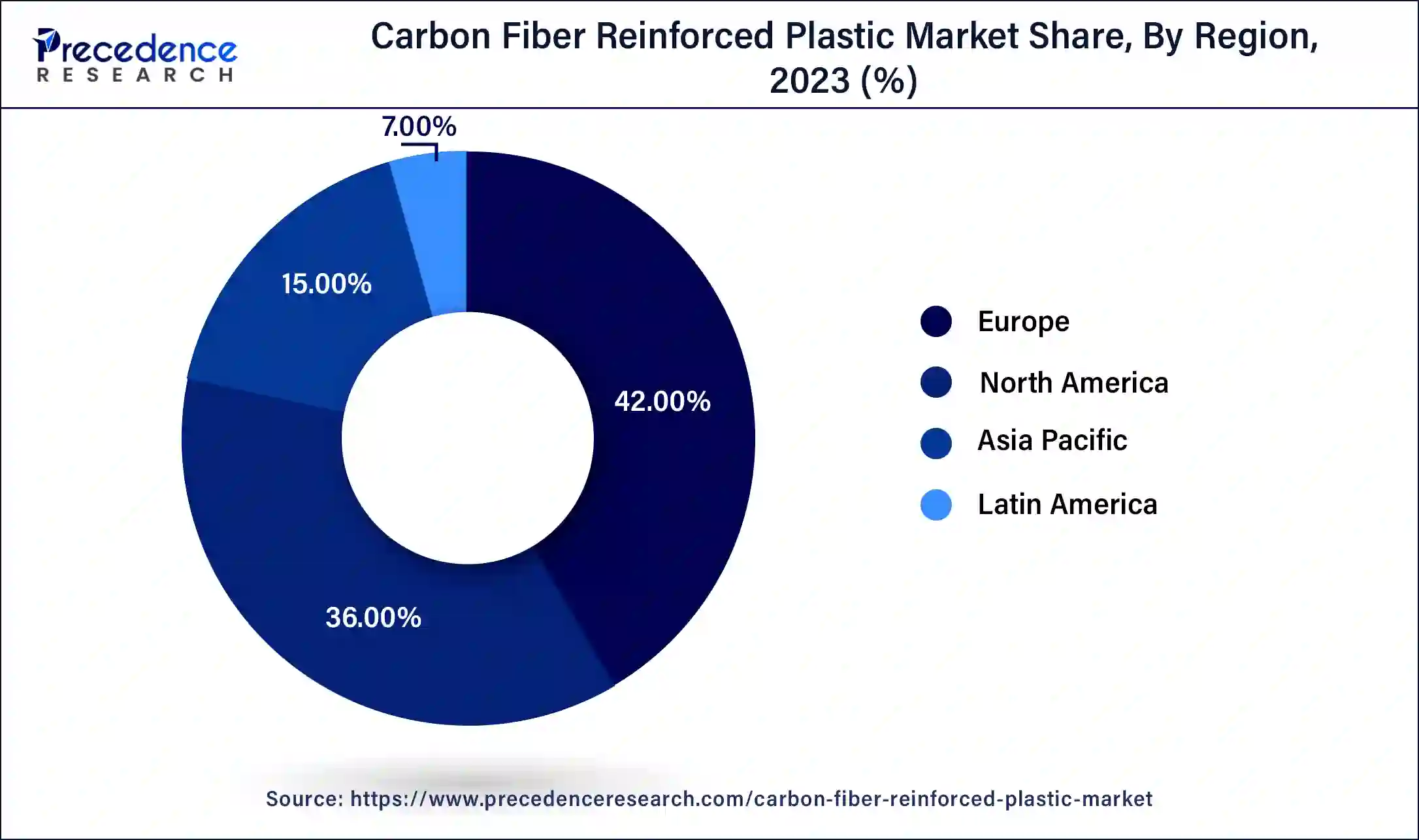

Europe held the largest share of the carbon fiber reinforced plastic market in 2023. The region has a strong presence of prominent aircraft and automotive manufacturers. Europe is a homeland for numerous major aircraft composite producers. European businesses and citizens want affordable, reliable, and clean energy. Wind is a strategic industry for Europe. Every new turbine added reduces Europe’s energy imports and exposure to volatile fossil fuel prices and also assists in reducing power bills. Europe's wind energy sector significantly benefits from CFRP's application in manufacturing wind turbine blades.

The European market has a strong focus on improving vehicle fuel efficiency and reducing carbon emissions. Other factors include extensive R&D activities, rising demand for high-performance products in the defense sector, rising utilization of CFRP in the building and construction industry, rising production of wind turbines, rapid industrialization and accessories, and supportive government framework. Moreover, there is a rise in demand from aerospace, marine, military, automotive, sporting goods, wind energy, industrial equipment, and other end-users.

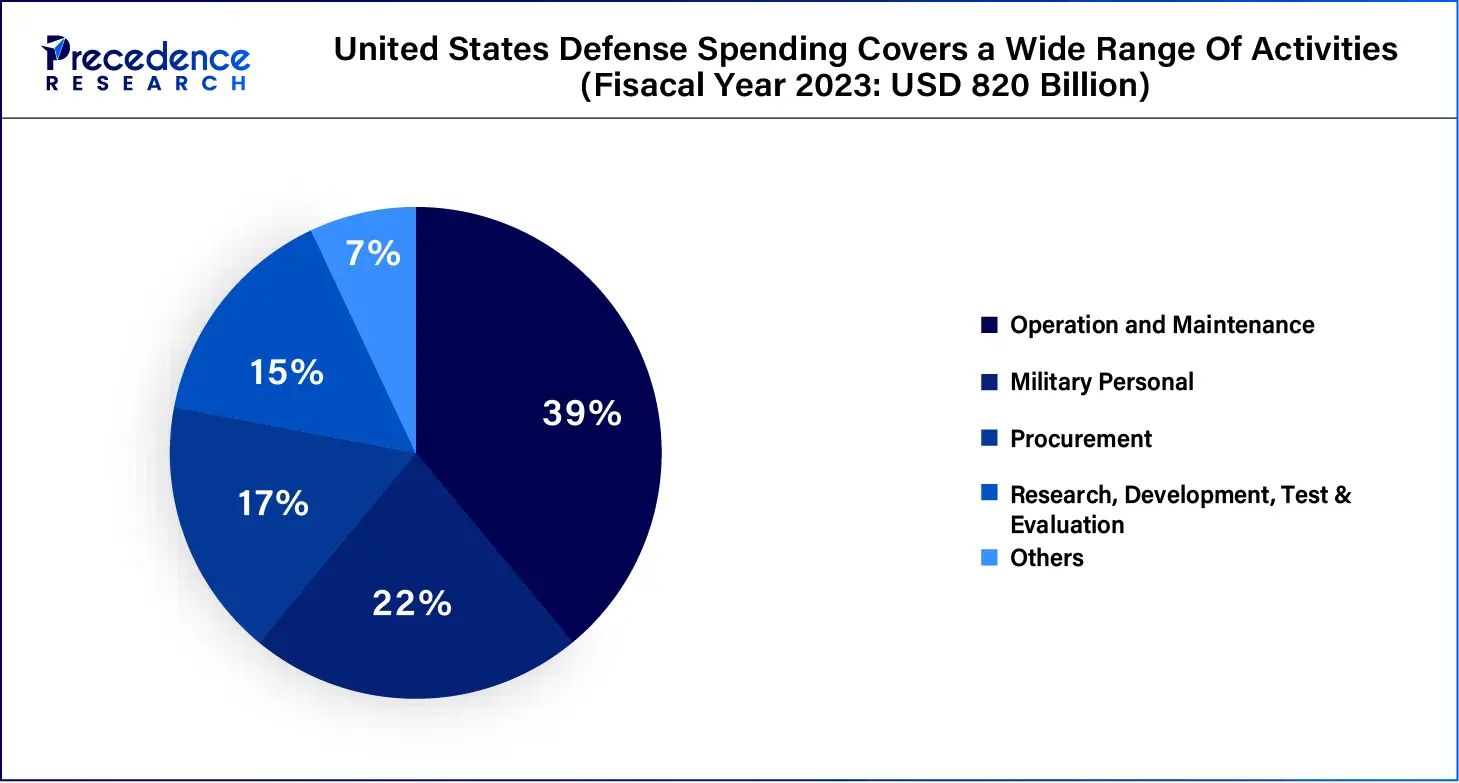

North America is anticipated to grow at the fastest rate in the carbon fiber reinforced plastic market during the forecast period. The region has a strong demand for CFRP, with the United States, Canada, and Mexico as significant contributors. The growth of the region is attributed to the rapid expansion of wind energy, increasing CFRP utilization in various medical applications, rising investment in research and development, presence of well-established automotive manufacturers, increasing use of CFRP in the aerospace industry, increasing production of defense weapons, and increasing demand for carbon-fiber-reinforced plastic solutions for automotive weight reduction.

Additionally, the robust focus on infrastructure development coupled with the increasing use of CFRP in construction also drives the product demand. Furthermore, technological innovation along with the government regulations on energy-efficient and environmentally friendly products are expected to significantly increase the CFRP demand in North America.

Carbon fiber reinforced plastic (CFRP) is a composite material that consists of carbon fibers and a polymer matrix. Carbon fiber reinforced plastic (CFRP) has gained immense popularity in various industries for its lightweight and high-strength characteristics. The unique characteristics of the carbon fiber reinforced plastic market products have led to increasing its usage in a variety of applications such as aerospace, wind energy, automotive, recreational equipment, robotics, sporting goods, medical technology, measurement technology, automation technology, and many more. In the field of advanced engineering materials, CFRP stands out as a remarkable innovation. It has constantly opened up new areas of application over the years. Its attractive combination of low weight, high durability, and high strength has made it a game-changer in several industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 56.94 Billion |

| Market Size in 2024 | USD 27.63 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.50% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapid expansion of the wind energy industry

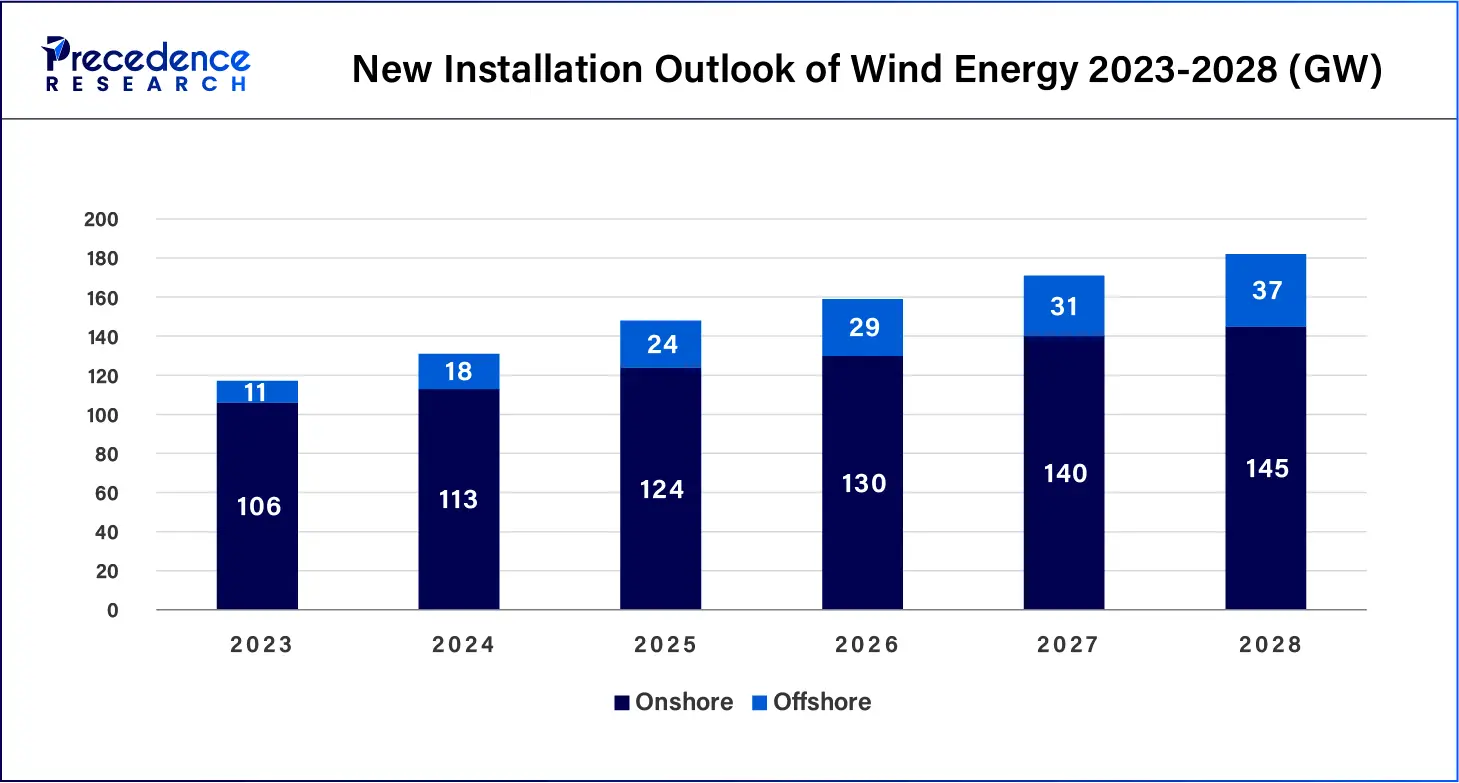

The expansion of the wind energy industry is expected to boost the growth of the carbon fiber reinforced plastic market during the forecast period. The demand for wind energy has been increasing over the years due to extensive R&D, supportive policies, increasing fuel prices, and rising adoption of clean energy. Wind is being widely used to produce electricity by converting the kinetic energy of air in motion into electricity. Carbon fiber reinforced plastics are highly used for longer wind turbine blades with diameters exceeding 100 meters that can capture more energy efficiently. CFRP offers lighter weight and greater rigidity. It is lighter than conventional glass fiber composite materials.

According to the GWEC’s Global Wind Report 2023

High cost

The high cost is anticipated to hamper the growth of the carbon fiber reinforced plastic market. Carbon fiber reinforcement plastic is an expensive material and its high cost restricts its usage in many industries. In addition, the easy availability of cheap-rated materials that act as a substitute for CFRP limits the adoption of carbon fiber reinforced materials.

Increasing demand for fuel-efficient and light-weight vehicles

The rising demand for fuel-efficient and lightweight vehicles is projected to offer a lucrative opportunity for the growth of the carbon fiber reinforced plastic market during the forecast period. The rise in fuel prices and stringent government regulations have driven the need for fuel-efficient vehicles, which spurs the demand for carbon fiber-reinforced plastic in automotive production.

Several Governments around the world are promoting the use of fuel-efficient automobiles, which produce fewer emissions. Automotive manufacturers around the world are increasingly focusing on cutting down automotive curb weight to reduce pollution. The automotive industry has increasingly adopted the carbon fiber reinforced plastic market products to substitute conventional materials such as iron and aluminum for reducing weight and enhancing the overall performance of automobiles.

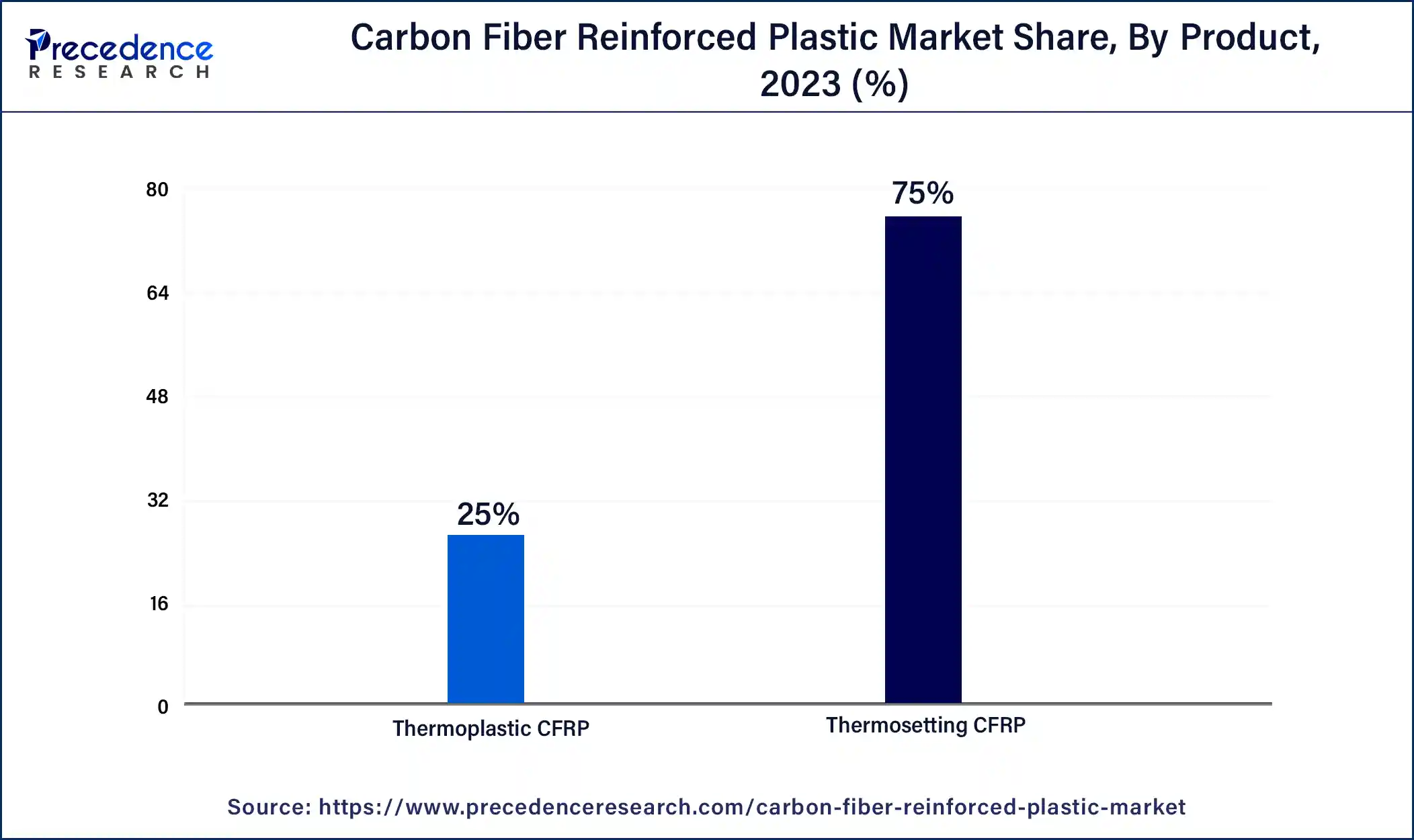

The thermosetting CFRP segment held a dominant presence in the carbon fiber reinforced plastic market in 2023. Thermosetting resins including polyester, epoxy, and vinyl resins are extensively used during the formulation of carbon fiber reinforced plastic. Thermoset resins have several benefits such as resistance to heat and high temperature, excellent resistance to solvents and corrosives, excellent finishing qualities for polishing and painting, excellent adhesion, high fatigue strength, and others. They are widely used across various sectors, including sports equipment, civil engineering, automotive, and aerospace.

The thermoplastic CFRP segment will witness considerable growth in the carbon fiber reinforced plastic market over the forecast period. Thermoplastics are used in structural composite parts, including Acrylonitrile Butadiene Styrene (ABS), Polyaryletherketones (PAEK), and Polyetheretherketone (PEEK). Extensive research and development activities enable companies to develop manufacturing techniques to produce thermoplastic CFRP with superior properties. Thermoplastic composites offer two major benefits for some manufacturing applications: increased impact resistance and the ability to be rendered malleable. Such factors are boosting the segment’s expansion.

The PAN-based segment registered its dominance over the global carbon fiber reinforced plastic market in 2023. Polyacrylonitrile (PAN) is the widely used raw material for CFRP production. PAN is the most used precursor for carbon fiber owing to its superior strength, stability, and higher carbon yield. The properties of carbon fiber-reinforced plastic, including high tensile strength, majorly depend on the precursor used in its production. Additionally, nearly 90% of the carbon fiber produced is made from polyacrylonitrile. Hence, such factors are likely to support the growth of the segment.

The pitch-based segment is projected to expand rapidly in the carbon fiber reinforced plastic market in the coming years. Pitch-based CFRP has excellent mechanical properties and thermal properties. The rising demand for various applications in aerospace, sports & leisure, and thermal management is expected to boost the segment’s growth in the coming years.

The aerospace segment held the largest share of the carbon fiber reinforced plastic market in 2023. The segment’s growth is majorly driven by the rising demand demand for fuel-efficient and lightweight aircraft. Carbon fiber reinforced plastic materials are most widely used in helicopters, planes, and space shuttles. CFRP has excellent specific tensile strength, modulus, and fatigue strength and has been most commonly used in airframe structural applications, especially for aircraft structures. CFRP continues to replace conventional metals in aircraft structures due to their higher strength-to-weight ratio. CFRP are critical materials for space development as their excellent specific strength, elasticity modulus, and high dimensional stability are maintained even in environments with extremely large temperature changes, which have enabled high-precision observations in space. In addition, rapid technological developments and rising R&D activities are expected to reduce flight weight, improve fuel consumption, and enhance overall performance in military aircraft and helicopters.

The automotive segment is expected to grow at the fastest rate in the carbon fiber reinforced plastic market during the forecast period. The rising concern for automotive fuel efficiency along with stringent environmental regulations is anticipated to propel the growth of the segment. Over the years, the automotive industry increasingly adopted carbon fiber reinforced plastic owing to its potential to improve fuel efficiency, high strength-to-weight ratio, and lightweight characteristics.

Segments Covered in the Report

By Material

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

December 2024