Carbonated Beverage Market Size and Manufacturers

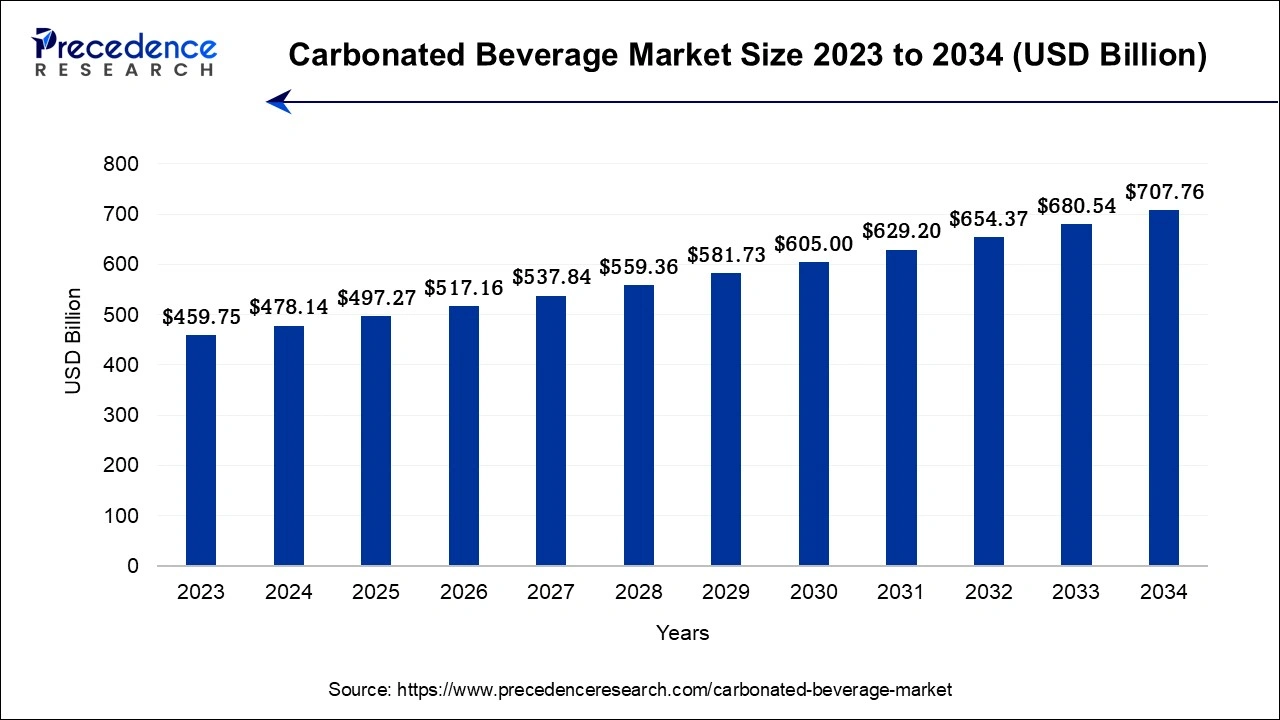

The global carbonated beverage market size is calculated at USD 478.14 billion in 2024 and is projected to be worth around USD 707.76 billion by 2034, growing at a CAGR of 4% from 2024 to 2034.

Carbonated Beverage Market Key Takeaways

- North America dominated the global market in 2023.

- By Type, the standard carbonate segment led the market in 2023.

- By Distribution Channel, the supermarket segment led the global market in 2023.

- By Drinks, the soft drink segment dominated the global market in 2023.

Market Overview

- The carbonated beverage market refers to the industry that produces and sells carbonated drinks, also known as fizzy drinks or soda. These beverages are infused with carbon dioxide gas, creating effervescence, and giving them a characteristic bubbly or fizzy texture. The increase in customers becoming health-conscious is one of the major factors reshaping the industry. People are actively seeking better alternatives to sugary beverages as awareness of health and fitness rises. Demand for low- and zero-calorie carbonated products, such as diet sodas and sparkling water, has increased as a result.

- The market is also being driven by innovation in flavour. To attract consumers attention and satisfy their wide range of tastes, manufacturers constantly create new and different flavours. The carbonated beverage business has made flavour innovation a prominent theme, luring customers with an ever-growing menu of options.

- Sustainability has also become a crucial factor in the market's landscape. Environmentally conscious consumers are demanding eco-friendly and recyclable packaging solutions. As a result, companies are increasingly focusing on sustainable packaging options to lessen their environmental impact and meet consumer expectations. The trend of premiumization is on the rise. Premium carbonated beverages, often positioned as craft or artisanal products, have gained popularity among consumers who are willing to pay a premium for exceptional quality and unique offerings.

- The carbonated beverage market is experiencing global expansion, with a particular focus on emerging markets in Asia-Pacific and Latin America. The rapid urbanization, changing lifestyles, and rising disposable incomes in these regions are fuelling the growth of the carbonated beverage industry. North America, especially the United States, has been a leading region in terms of carbonated beverage consumption and market size.

Carbonated Beverage Market Growth Factors

- The carbonated beverage market is a dynamic and ever-evolving industry driven by various growth factors. One key factor is the continuously changing consumer preferences. As consumer tastes evolve, there is a rising demand for a wide array of carbonated beverages. To meet these preferences, manufacturers are constantly innovating, introducing new flavours, healthier options, and unique combinations to entice consumers. Health and wellness trends also play a significant role in the market's growth.

- There is a rising demand for low-calorie and sugar-free carbonated beverages as people become more aware of the health risks associated with excessive sugar intake. Health-conscious consumers are actively seeking alternatives to traditional sugary sodas, leading to the development of diet sodas and sparkling water options. Innovation in ingredients and formulations is another critical factor driving the market's expansion. Manufacturers are investing in research and development to create innovative formulations that enhance the taste, texture, and nutritional value of carbonated beverages.

- This includes the use of natural flavours, functional ingredients, and additives that appeal to health-conscious consumers. The convenience of carbonated beverages aligns well with the on-the-go lifestyles of consumers. Ready-to-drink cans and bottles make carbonated drinks easily accessible, making them a popular choice for refreshment and hydration.

- Effective marketing and branding strategies also contribute to the market's growth. Innovative marketing campaigns, celebrity endorsements, and a strong social media presence help increase brand visibility and attract new consumers. The carbonated beverage market is expanding globally, with a focus on emerging markets such as Asia-Pacific and Latin America. The increasing disposable incomes, urbanization, and westernization of lifestyles in these regions present significant growth opportunities for manufacturers.

- The trend towards premiumization is influencing the market as well. Consumers are willing to pay more for high-quality, artisanal carbonated drinks with unique and sophisticated flavours. In addition to product innovation, the industry is also focusing on eco-friendly and sustainable packaging solutions to cater to environmentally conscious consumers. This shift towards sustainable practices can attract a larger consumer base. Diverse distribution channels, including supermarkets, convenience stores, restaurants, cafes, vending machines, and online platforms, ensure wider market penetration and accessibility for consumers.

- The carbonated beverage market also adapts to evolving beverage consumption patterns. It incorporates trends such as increased snacking, the demand for premium beverages during social gatherings, and the popularity of healthier drink alternatives. The carbonated beverage market is a dynamic and developing business as a result of the combination of these development drivers. It continues to be attentive to the shifting demands and preferences of customers throughout the world, which supports its success and development.

Market Scope

| Report Coverage |

Details |

| Market Size by 2034 |

USD 707.76 Billion |

| Market Size in 2024 |

USD 478.14 Billion |

| Market Growth Rate from 2024 to 2034 |

CAGR of 4% |

| Largest Market |

North America |

| Base Year |

2023 |

| Forecast Period |

2024 to 2034 |

| Segments Covered |

Type, Distribution Channel, Drinks, and Regions |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Premiumization trend

- The market for carbonated beverages is seeing a premiumization trend, which is being driven by customer’s shifting preferences and expectations. Customers are prepared to pay more for goods that offer more quality, creativity, and exclusivity as they grow more discriminating and seek out distinctive and sophisticated experiences. The premiumization trend is not just seen in the market for carbonated beverages; it is also shown in other sectors where customers are prepared to pay more for goods or services that provide extra value.

Restraint

Plastic packaging waste

- The substantial amount of plastic packaging waste produced by carbonated beverage items, particularly plastic bottles, and single-use cans, is one of the main worries which could hamper the market growth. The improper disposal of these containers increases pollution, particularly in landfills and the oceans.

Opportunity

Flavor innovation

- Flavor innovation presents a significant opportunity in the carbonated beverage market. Demand for novel and distinctive taste sensations is rising as consumer tastes continue to change. The industry may appeal to the varied and adventurous palates of customers and entice them to try various carbonated beverages by developing unique flavors. Flavor innovation allows manufacturers to differentiate their products and stand out in a competitive market. Offering a wide range of appealing flavors, including exotic and natural options, can attract and retain consumers, leading to increased sales and brand loyalty.

Challenge

Intense competition

- Intense competition poses a significant challenge in the carbonated beverage market. The sector has grown extremely competitive as a result of the large number of firms seeking for market share, making it difficult for both existing businesses and new entrants to achieve a competitive edge.

Type Insights

The standard carbonate segment dominated the carbonated beverage market in 2023. Standard carbonate represents the traditional and timeless offerings in the market, including popular choices like cola, lemon-lime, and orange sodas. These beverages are typically sweetened with sugar or high-fructose corn syrup, providing a familiar and indulgent taste. Despite increasing health concerns related to sugar consumption, standard carbonates continue to enjoy popularity among consumers who seek classic and refreshing soda experiences.

Dietary carbonates have gained prominence due to the growing emphasis on health and wellness. These beverages are formulated with artificial sweeteners or natural sugar substitutes, delivering the same fizzy and carbonated experience with significantly reduced calorie content. Diet carbonates cater to health-conscious consumers who desire guilt-free options without compromising on taste.

The fruit-flavoured carbonates segment offers a diverse array of non-cola options, such as lemon, lime, grape, cherry, and berry-flavoured beverages. These carbonates appeal to consumers seeking unique and refreshing fruit-infused flavours. Many fruit-flavoured carbonates use natural fruit extracts or flavours, making them an attractive choice for those seeking more natural and less artificial beverage options.

Distribution Channel Insights

In 2022, the supermarket segment dominated the carbonated beverage market. Supermarkets are essential players in the distribution network, offering a diverse selection of carbonated beverage brands and flavours all in one place. Supermarkets serve a wide variety of customers with differing interests and inclinations. Ample shelf space allows manufacturers to effectively showcase their products, while promotional displays within supermarkets increase visibility and drive sales.

Convenience stores serve as easily accessible points of purchase for carbonated beverages, targeting consumers seeking quick refreshments on the go. Operating with extended hours and strategic locations, these stores focus on the best-selling carbonated beverage brands and popular flavours due to limited shelf space. Their proximity to high-traffic areas ensures a continuous stream of customers seeking immediate satisfaction.

The digital revolution has significantly impacted the distribution landscape through online stores. Increasingly, consumers are turning to e-commerce platforms to purchase carbonated beverages. Online stores offer convenience, variety, and the opportunity to explore niche and hard-to-find flavours. Manufacturers benefit from direct-to-consumer interactions, which enable them to engage with their audience and tailor offerings to specific preferences. Targeted marketing and personalised promotions in the online space enhance the overall customer experience.

Drinks Insights

The market for carbonated beverages was controlled by the soft drink category. traditional and widely available in the market, soft drinks include cola, lemon-lime, orange, and different flavored sodas. Soft drinks, which are often sweetened with sugar or high-fructose corn syrup, offer a comfortable and indulgent beverage experience that appeals to a wide customer base.

Sparkling beverages, a more varied category, provide tastes other than those found in typical sodas. It consists of sparkling water, club soda, and mildly flavored sparkling drinks. Sparkling beverages draw people who value their health and prefer a fizzy feel without the additional sugars or artificial flavors found in soft drinks.

The section of carbonated beverages with added health benefits or useful components is called functional drinks. This group of beverages includes energy drinks, sports drinks, and liquids fortified with vitamins, electrolytes, or botanical extracts. Functional beverages are popular among athletes, fitness enthusiasts, and others seeking an active lifestyle as they appeal to consumers looking for health benefits or an energy boost.

Regional Insights

The market for carbonated beverages in 2023 was led by North America. The demand for both conventional soft drinks and cutting-edge effervescent and functional beverages has been particularly high in the United States, which has been a large market for carbonated beverages. The region's dominance in the market is a result of its established and mature customer base as well as a strong distribution network.

Europe has a long history of soft drink consumption and many well-known brands, there is a clear trend towards healthier choices such naturally flavored and low-sugar beverages. A combination of urbanization and rising affluence, markets in the Asia-Pacific region, including China, India, and Japan, are expanding quickly. As a result of its warm temperature and diverse cultures, Latin America, which includes Mexico, Brazil, and Argentina, is popular, but there are also new trends in health-consciousness. Although regional differences in consumer patterns exist, the Middle East and Africa is seeing increased demand, driven by youthful, urban populations with rising disposable incomes.

Recent Development

- On June 22, Food and beverage giant PepsiCo India invested an additional Rs 186 crore for the expansion of its food manufacturing facility at Kosi Kalan, Mathura, in Uttar Pradesh, to produce nacho chip brand Doritos. PepsiCo's overall investment in its largest greenfield food manufacturing plant, which produces Lay's potato chips, would be Rs 1,022 crore.

Carbonated Beverage Market Companies

- The Coca-Cola Company

- PepsiCo Inc.

- Keurig Dr Pepper Inc.

- Suntory Holdings Limited

- Nestlé S.A.

- The Coca-Cola Bottling Co. Consolidated

- The Dr Pepper Snapple Group

- Cott Corporation

- National Beverage Corp.

- Britvic PLC

Recent Development

- On June 22, Food and beverage giant PepsiCo India invested an additional Rs 186 crore for the expansion of its food manufacturing facility at Kosi Kalan, Mathura, in Uttar Pradesh, to produce nacho chip brand Doritos. PepsiCo's overall investment in its largest greenfield food manufacturing plant, which produces Lay's potato chips, would be Rs 1,022 crore.

Segments Covered in the Report

By Type

- Standard

- Diet

- Fruit-Flavoured Carbonates

By Distribution Channel

- Supermarkets

- Specialty Stores

- Convenience Stores

- Online Store

By Drinks

- Soft Drink

- Sparkling Drinks

- Functional Drinks

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa