May 2025

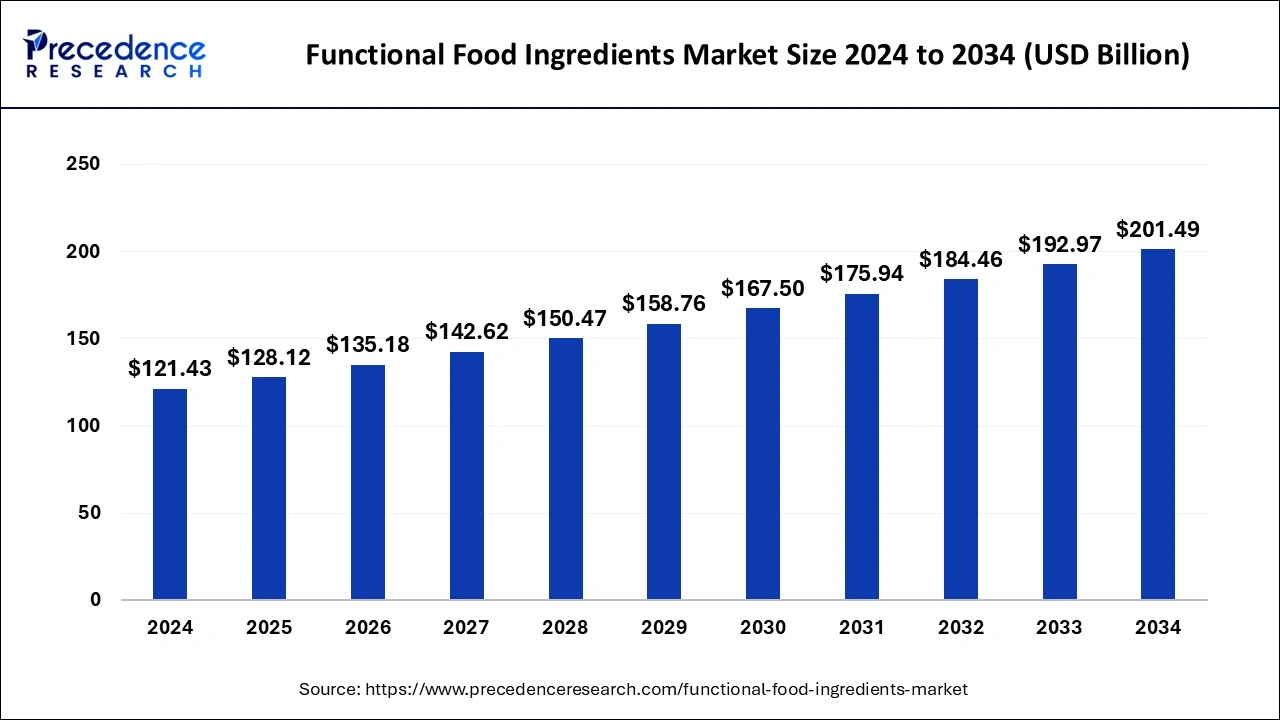

The global functional ingredients market size is calculated at USD 128.12 billion in 2025 and is forecasted to reach around USD 201.49 billion by 2034, accelerating at a CAGR of 5.19% from 2025 to 2034. The North America functional ingredients market size surpassed USD 42.50 billion in 2024 and is expanding at a CAGR of 5.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global functional ingredients market size was estimated at USD 121.43 billion in 2024 and is anticipated to reach around USD 201.49 billion by 2034, expanding at a CAGR of 5.19% from 2025 to 2034. The global functional ingredients market growth is attributed to the increasing demand for functional food and beverage products and increasing consumer awareness about the health benefits of functional ingredients.

Artificial intelligence is revolutionizing various industries, and the functional ingredients industry is no exception. By optimizing multiple aspects of production, research, and development, AI is changing the functional ingredients industry. AI technologies can be preferred through massive amounts of data from several sources such as chemical libraries, genomic databases, and scientific literature. By analyzing their molecules structure, AI can predict the potential health effects of compounds. AI can control and monitor fermentation processes in real time and improve conditions to produce ingredients such as enzymes and probiotics. In addition, Artificial intelligence can recommend personalized formulations and analyze individual health data. Functional ingredients provide great potential for preventing various health diseases, such as blood glucose regulation by using artificial intelligence. A functional ingredient is predicted and produced from Pisum sativum (pea) protein by hydrolysis, using artificial intelligence. These advanced trends are expected to revolutionize the growth of the functional ingredients market.

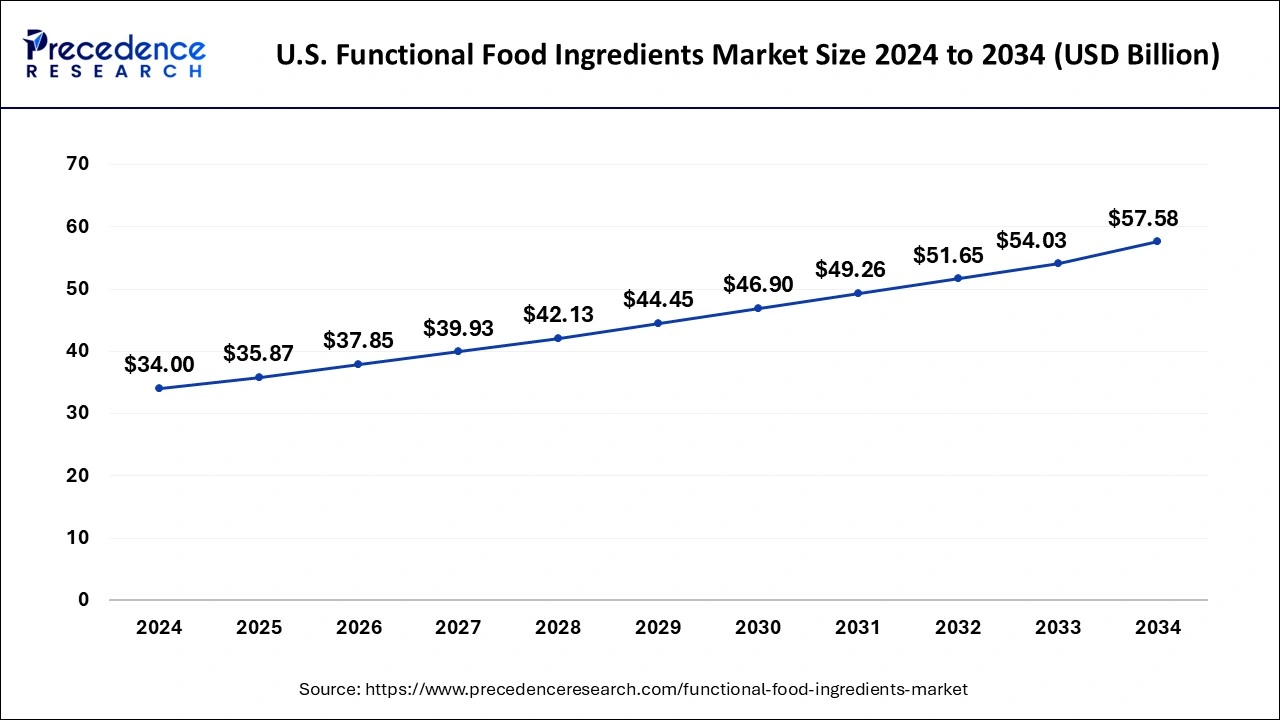

The U.S. functional ingredients market size was evaluated at USD 34 billion in 2024 and is predicted to be worth around USD 57.58 billion by 2034, rising at a CAGR of 5.40% from 2025 to 2034.

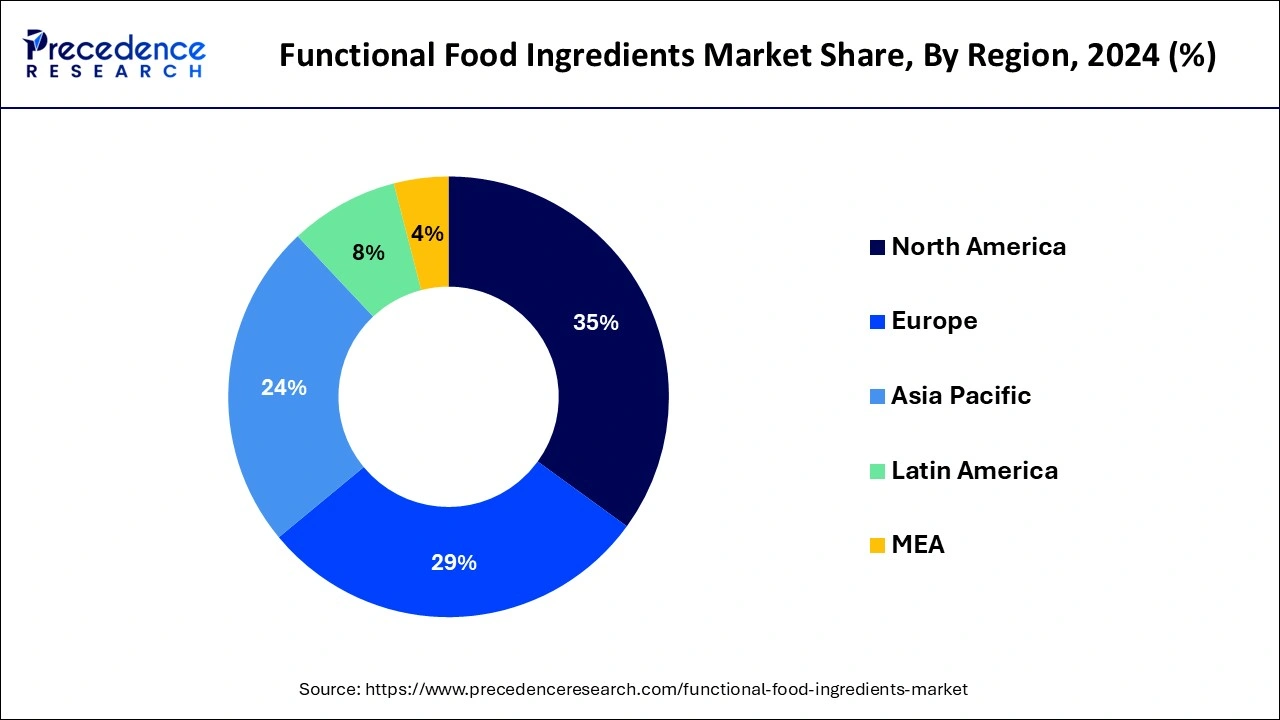

On the basis of region, the market is classified into North America, Europe, Asia-Pacific and LAMEA. Asia Pacific region is estimated to grow at a considerable pace during the forecast period. Growing urbanization, spending capacity and rising population with more health consciousness are majorly boosting the growth of the functional ingredients market in developing countries of the region of Asia-Pacific including India and China. In addition, rising old age population and obese population has been significantly contributing for the growth of functional ingredients market in Asia Pacific region. As clinical nutrition and weight management are the surging applications of the functional food due to proportional and significant sources of proteins, vitamins and fatty acids which helps to improve the health of human body.

Furthermore, North America had the major market share of the functional ingredients market in the year 2024 with a revenue share of 35%. Increasing buying power, improved access to the digital technologies, higher penetration of internet, and increased adoption online sales channels are some of the major factors that has propelled the growth of the North America functional ingredients market. The high demand for the health supplements coupled with the busy and hectic schedules of the consumers is boosting the demand for the functional ingredients.

| Report Coverage | Details |

| Market Size by 2034 | USD 201.49 Billion |

| Market Size in 2025 | USD 128.12 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 5.19% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Nature, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By application, the food & beverages segment led the global market. The global rise in demand for food and beverages, especially in markets such as Asia Pacific, is leading to substantial growth in this segment. Rising disposable income, high urbanization, and changing consumer preferences toward functional foods are driving demand in the market.

By application, the personal care market is predicted to see significant growth over the forecast period. Consumers' preference for personal care products with natural ingredients and functional foods is driving demand and innovation in this sector. Growing access to e-commerce and online shopping has also increased the consumer base for functional food ingredients.

Based on the type, the vitamins segment was the dominating segment. This is majorly credited to benefits associated with functional food rich in vitamin such as healthy skin, improved vision, improved blood circulation and better immune system of the body. Furthermore, some consumers require vitamin supplements as they have certain medical conditions which can lead to insufficiencies and functional food provides essential nutrients and vitamins in order to fulfill that particular deficiencies. Casual food or regular meal is not that much efficient enough to provide essential vitamin which led consumer to consume functional food as an additional food to have a healthy body.

On the other hand, the probiotics & prebiotics segment is estimated to be the most opportunistic segment during the forecast period. This is attributed owing to the growing popularity of probiotics among the population which is fuelled by the rising health awareness among the consumers

The natural segment is the dominating functional ingredient segment in the year 2024 owing the abundant sources of ingredients. Nutritional and epidemiological studies have shown that plants are a rich source of nutraceutical ingredients by having disease-preventing and health-promoting properties. Various plant-based foods arebioactive compound rich in nature with physiological effects, like antioxidant, antimutagenic, anti-inflammatory or antibacterial activities. However, synthetic functional ingredient is the fastest growing segment in the market owing to the myriad demand of the ingredients and inadequate availability fosters huge opportunities to for the synthetic ingredients in the market.

By Type

By Nature

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

April 2025

May 2025