August 2024

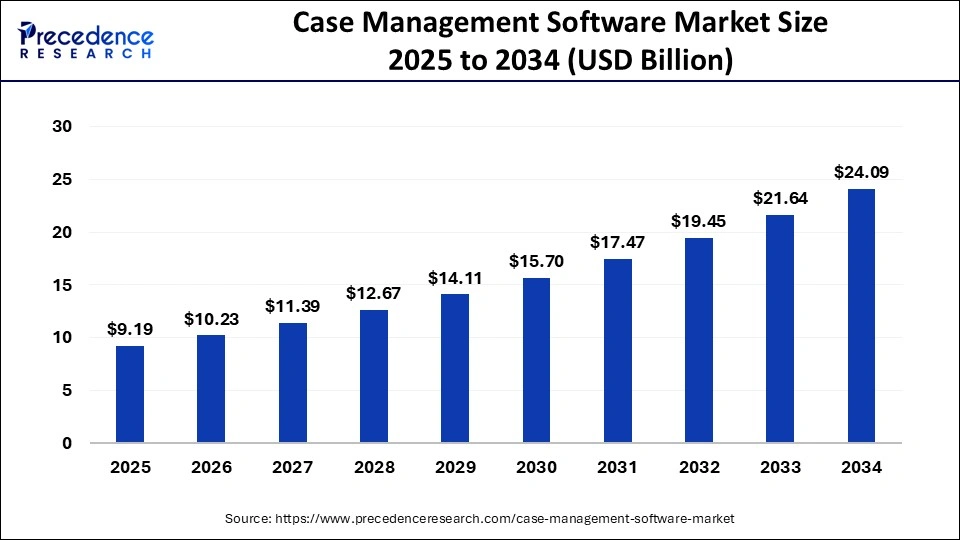

The global case management software market size is calculated at USD 8.26 billion in 2024, grew to USD 9.19 billion in 2025 and is predicted to hit around USD 24.09 billion by 2034, expanding at a CAGR of 11.30% between 2024 and 2034. The North America case management software market size is evaluated at USD 3.39 billion in 2024 and is expected to grow at a CAGR of 11.43% during the forecast year.

The global case management software market size accounted for USD 8.26 billion in 2024 and is expected to exceed around USD 24.09 billion by 2034, growing at a solid CAGR of 11.30% from 2024 to 2034. The demand for case management software market is driven by concerns about automation, cloud technologies, efficiency, and better customer satisfaction.

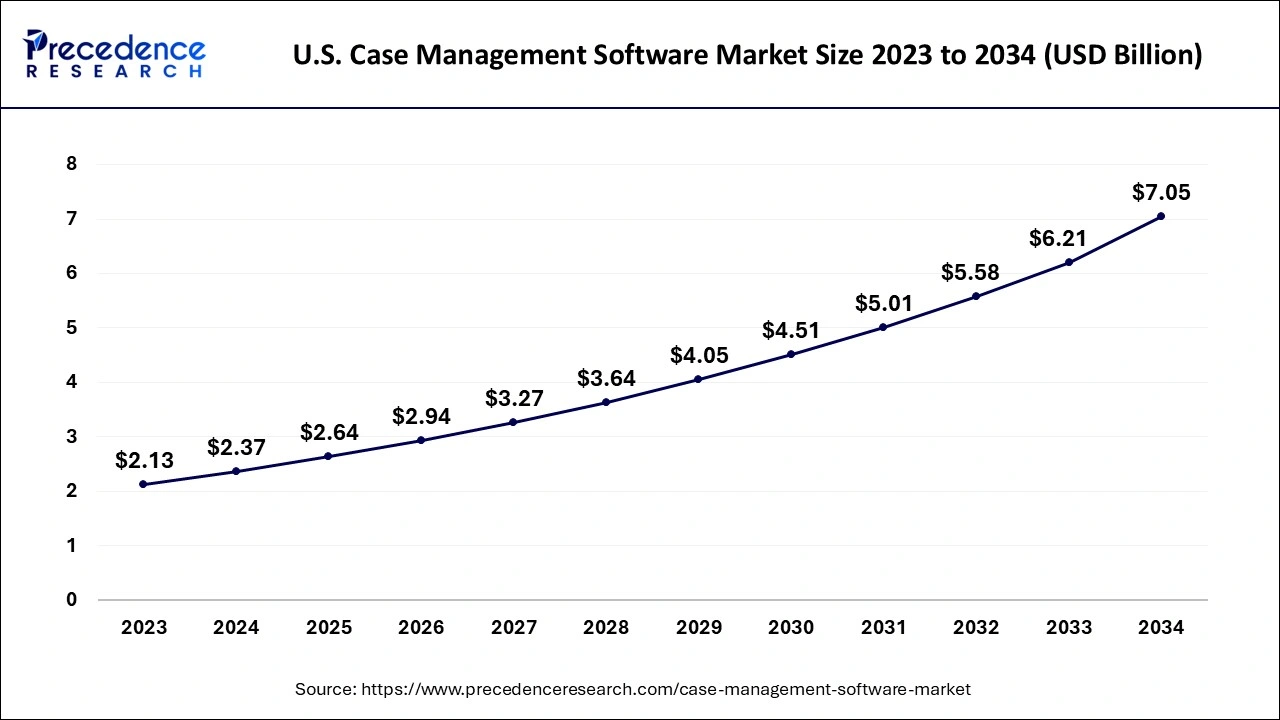

The U.S. case management software market size is evaluated at USD 2.37 billion in 2024 and is projected to be worth around USD 7.05 billion by 2034, growing at a CAGR of 11.49% from 2024 to 2034.

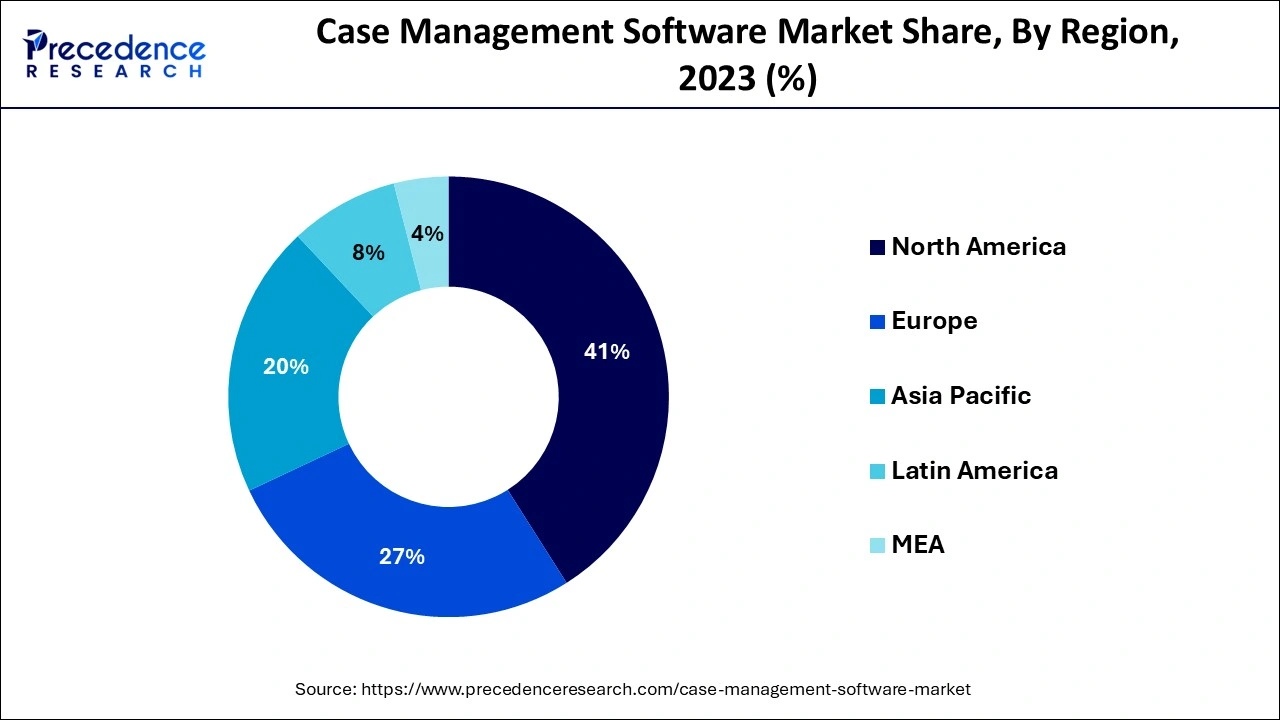

North America led the global case management software market in 2023. The healthcare and financial services industries of North America require industry-specific regulatory compliance. Case management software observes these regulations since this type of software supplies tools for tracking, managing, and documenting compliance activities.

Several global industries, such as healthcare, legal services, and government entities, are adopting digital solutions, products, and services across industries that propel market growth. Various organizations are gradually embracing case management software to automate and modernize their processes. Such a shift assists in minimizing the amount of paperwork, preventing mistakes, and enhancing overall performance.

Asia Pacific is anticipated to grow notably in the case management software market during the forecast period. The region is experiencing a robust wave of digital transformation across many industries such as healthcare, financial, and government. Businesses are engaging in case management software for the purpose of digitalization in order to reduce costs and work more effectively. The digital transformation of the public sector is resulting in higher adoption of case management solutions that will assist with case management and data processing.

The case management software market provides solution meant to facilitate different stages related to case management occurring across diverse industries, such as legal, healthcare, social services, and customer service. It incorporates features of document handling, collaboration, project organization, and reporting and analysis and is intended for improving processes and decision-making.

The case management software market has the advantage of reducing paperwork and providing data that can be easily retrieved in real-time and by the use of centrally managed cases, thus issuing real-time status updates and also increasing customer satisfaction through individualized and transparent correspondence. Case management is a process that has five main activities: planning, assessment, facilitation, evaluation, and monitoring.

Some case management software

| Softwares | Highlight |

| Clio | Clio is an online system that centers on transforming the legal experience for law firms and clients. This program is client-based and has some options like document flow, electronic bills, and repetitive procedures. |

| Trialworks | Trialworks helps law firms and government agencies to organize information about cases and track them. It features document management, calendar programs, and expense tracking for users of this software. |

| MyCase | MyCase provides small legal firms with several case management functions aimed at enhancing the organization of cases and clients. MyCase also has features that enable sharing, cooperation on documents, time, and billing. |

| Smokeball | Smokeball is a program that unitizes case management features for users and enables them to search for case information. This software enables businesses to deal with their operations with features such as reporting tools, auto-logging, and flexible process maps. |

| CASEpeer | CASEpeer is a case management software designed to be used by firms that specialize in PI law. This application allows firms to manage their personal injury cases through the framework of tasks, calendars, and documents. |

How is Artificial Intelligence (AI) Changing the Case Management Software Market?

Artificial Intelligence (AI) and machine learning are rapidly being incorporated into the case management software market. Increased compliance pressures from industries across banking and financial services, insurance, and government are forcing organizations to implement case management systems for improved compliance and risk. AI-applied legal case management means the utilization of artificial intelligence technology in managing certain aspects of legal cases, including document management, the assignment of tasks, timelines, and communication. There are many advantages of automating legal case management. These include efficiency, accuracy, and organization. With the help of repetitive activities and the offer of smart solutions, lawyers can focus on the sensitive and strategic aspects of their cases.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.09 Billion |

| Market Size in 2024 | USD 8.26 Billion |

| Market Size in 2025 | USD 9.19 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.30% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment, Enterprise Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing sales of medical case management software

Medical case management software is gradually finding its way into hospitals, social services organizations, mental health clinics, and non-profit organizations. It assists in developing the treatment plans, appointment timings, and also billing systems of the healthcare organization. There has been an increase in the adoption of advanced case management solutions in healthcare organizations, which has had a constructive impact on the growth of the case management solution market. The healthcare setting relates to several things: planning, paperwork, billing, and other planned and emergent activities, right from appointments, check-ups, treatments, insurance claims, and any issues pertaining to any of their stages.

Lack of awareness and trust

The limiting factor for the case management software market growth is the organization’s unwillingness to migrate from traditional systems to new solutions. The core of many companies across industries, such as healthcare, government, and legal services, is still heavily invested in applications and processes that may have been put in place for several years. As organizations move from traditional case management systems, there may be substantial expenses to be met in buying new software, creating the new system, and training staff to use it. Moreover, the processes of transferring historical data from old systems to new systems might generate concerns over data accuracy and security.

Rising demand for workflow automation

The trend in the case management software market is the increasing demand for the case management software market. Many organizations realize the need to automate many redundant functions, and there has been a rising call for case management tools that improve organizational functions and minimize human errors. Automation in case management supports the enhancement of the speed and accuracy of processing a case by automating what is traditionally known as ordinary tasks, which include data entry, letter generation, messages, and more. This shift towards automation is particularly significant in those industries with considerable caseloads and paperwork, such as healthcare, legal, and financial.

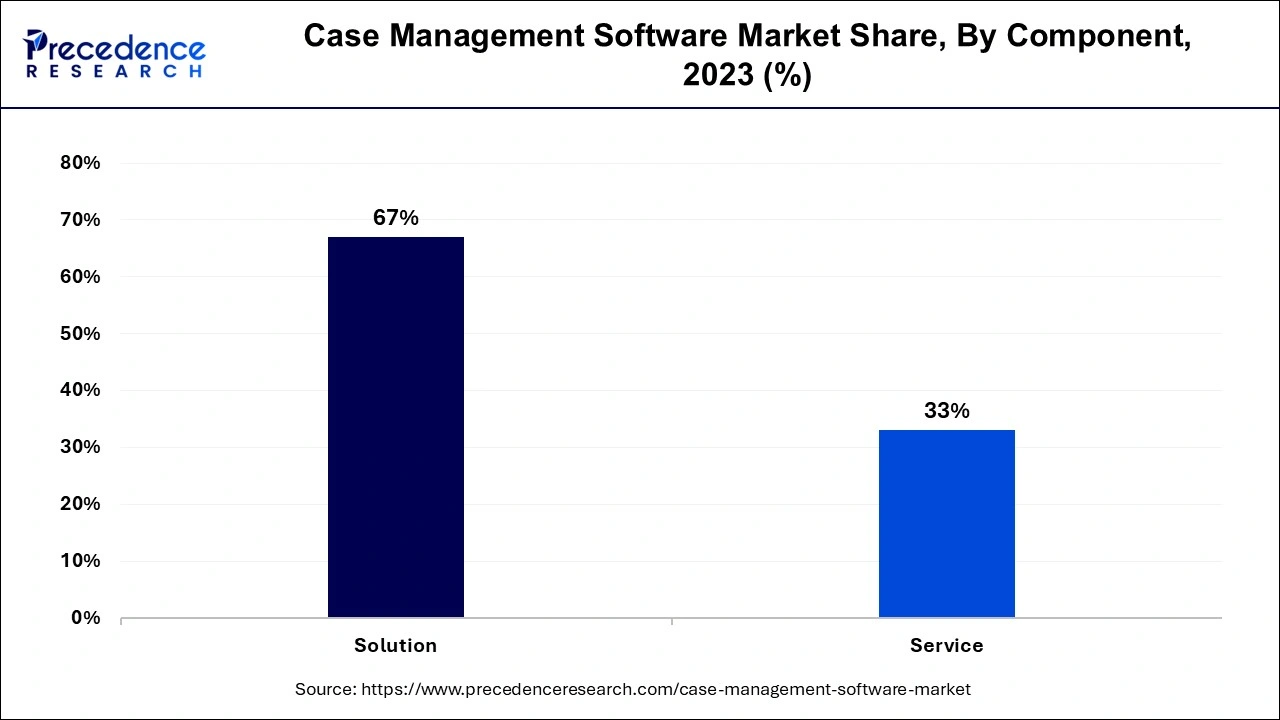

The solution segment accounted for the biggest share of the case management software market in 2023. The different sectors, such as legal, healthcare, insurance, and government bodies, are seeking case management solutions that allow for different forms of cases, processes, and regulations. These solutions enable organizations to gain control over operational requirements for processing cases more effectively and efficiently. Case management solutions are applications designed to assist in complex processes, such as handling an incoming application, processing a submitted claim, addressing a complaint, or managing a claim progressing to litigation.

The service segment is expected to witness significant growth in the case management software market during the forecast period. It offers solutions to suit industries' needs, which can improve service, quality, and customer satisfaction. The AI-automated services assist corporations in a number of ways, including the elimination of time-consuming and superfluous tasks and the introduction of intelligent case management and resolution.

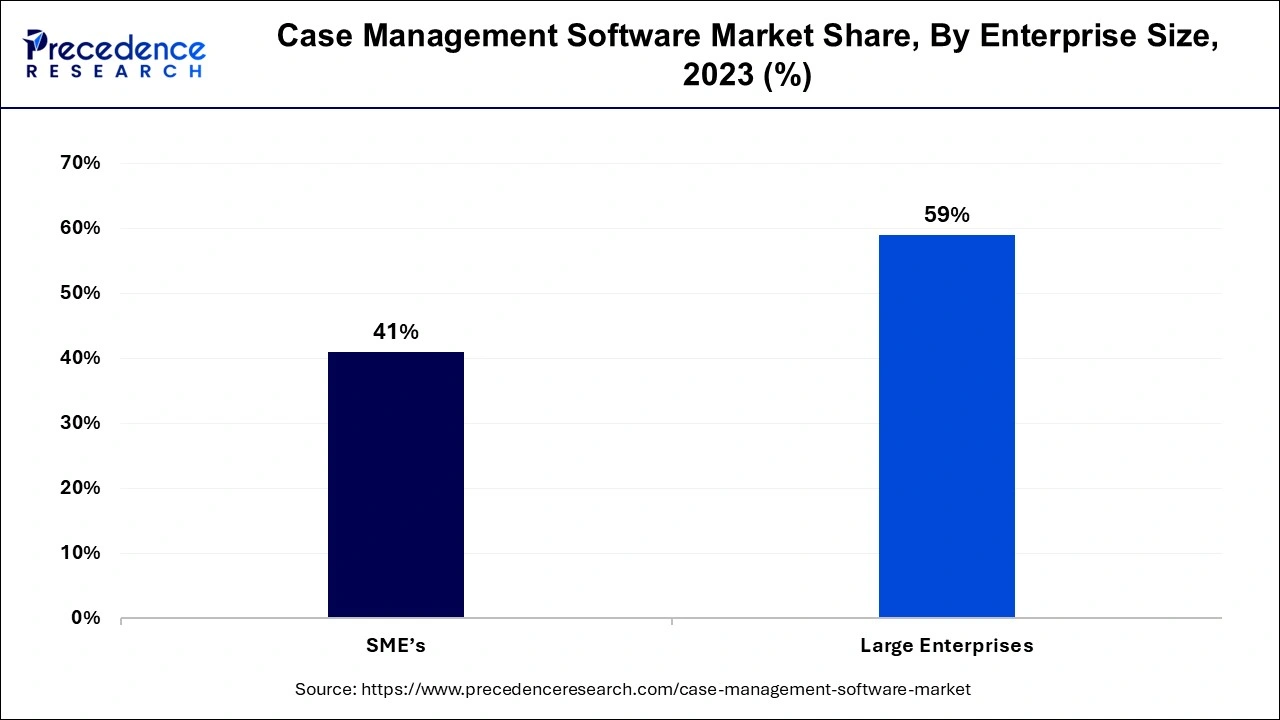

The large enterprises segment led the global case management software market in 2023. Large businesses generally work in regulated environments where compliance with set standards and laws is paramount. The case management software helps provide compliance such as in terms of processes where caseload activities are automated, documenting compliance processes and an audit trail of certain processes, and security features of storage and data management. Large enterprises deal with huge systems or software through which they acquire a vast quantity of data; thus, the concern for large volumes of enterprise data has led to the increased adoption of case management software in large firms.

The SME segment is anticipated to grow significantly in the case management software market during the forecast period. Cloud-based case management software has a factor of scaling and cost-effectiveness, which is fundamentally advantageous for SMEs with limited IT facilities or capital. These also provide remote access, helping SMEs to be more adaptable to current work arrangements as remote work most SMEs have embraced digital evolution. The market is rapidly growing due to the transition of most of the companies to automated workflow systems.

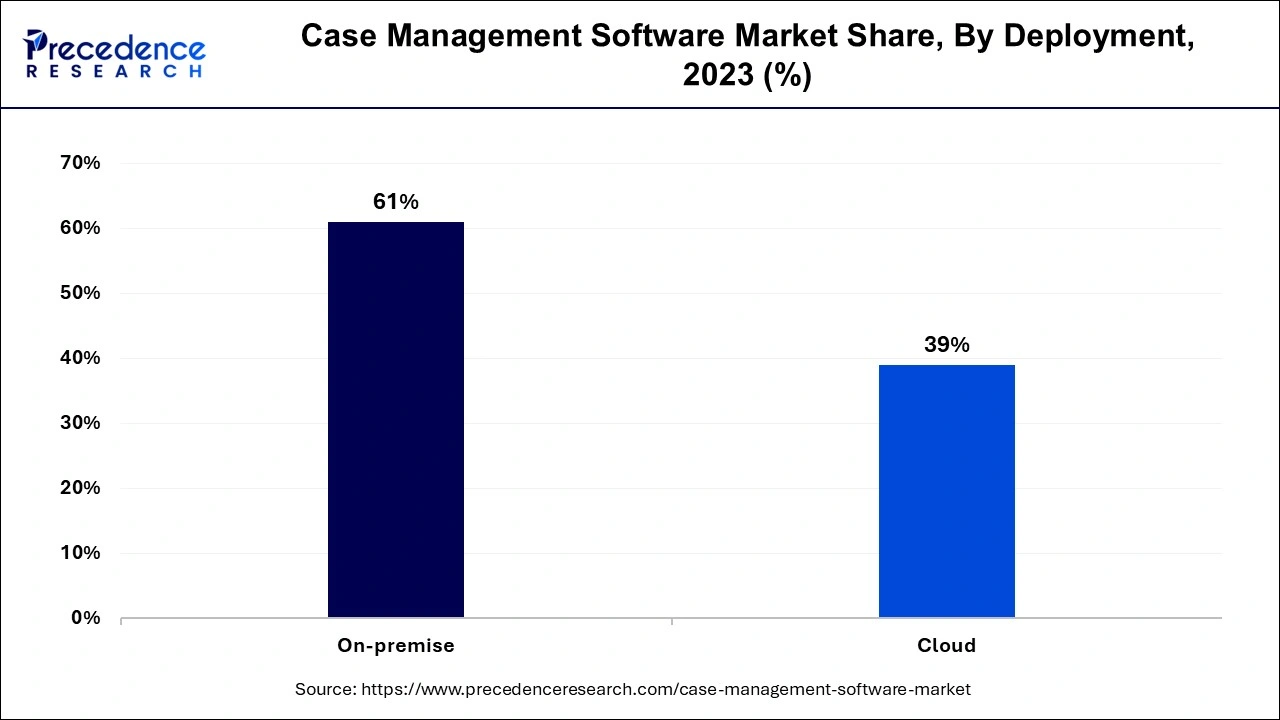

The cloud segment held the largest share of the case management software market in 2023. Cloud-based case management allows organizations to access the most important case files on time and in their updated versions. The Cloud providers have been improving their security measures, providing encrypted storage of data, auto backup of data, and compliance with various regulations, including GDPR and HIPAA. This, combined with the growing adoption of cloud-based software platforms across various enterprises, has led to a steadily growing need for case management solutions. The increasing popularity of digital technology, along with the advanced use of legal workflow management systems in financial organizations.

The on-premise segment is expected to grow at the fastest rate in the case management software market over the forecast period. Case management software and data are contained within an organization, which means that it can have full control of access and storage, minimizing the risk of data breaches. On-premise case management software is a software solution that is installed and run on an organization's own hardware and infrastructure. The organization is liable for the software's maintenance, updates, and security.

The telecom & IT segment held the largest share of the case management software market in 2023. The telecom companies are extending telecom services to more and more people, and the burden of entertaining more complaints and phone calls or other services is also increasing. These include telecom and IT firms that use the case management system for information storage, data tracking, recording, and documentation services. That can make operations less time-consuming, deliver the best services to customers, and even eliminate the participation of people in processes.

The manufacturing segment is expected to grow at the fastest rate in the case management software market over the forecast period. The usage of AI along with IoT in manufacturing drives the need for greater case management adoption. These technologies are integrated to support the use of powerful analytical tools such as predictive maintenance, real-time monitoring, and case generation of possible equipment failures or production problems. Thus, manufacturers have the chance to minimize downtime, decrease the risks of operations, and enhance efficiency. Manufacturing companies can benefit from case management software by making the various processes efficient, managing information in one place, and minimizing errors.

By Component

By Deployment

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

September 2024

February 2025