What is the Telecom Services Market Size?

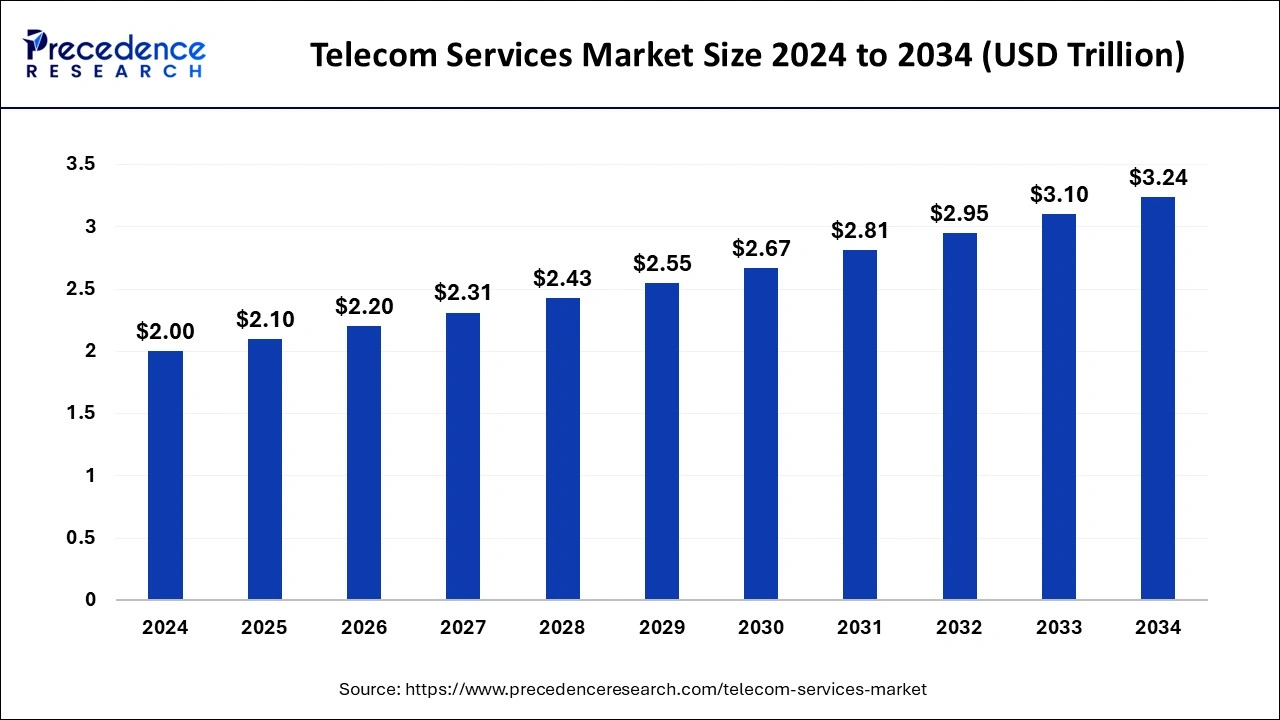

The global telecom services market size was estimated at USD 2.10 trillion in 2025 and is predicted to increase from USD 2.20 trillion in 2026 to approximately USD 3.39 trillion by 2035 with a registered CAGR of 4.91% from 2026 to 2035. The increased demand for 5G networks and cloud computing, leveraging growth in the telecom services market. Rising adoption of IoT technologies fueling demand for telecom services.

Telecom Services Market Key Takeaways

- In terms of revenue, the telecom services market is valued at $2.10 trillion in 2025.

- It is projected to reach $3.39trillion by 2035.

- The telecom services market is expected to grow at a CAGR of 4.91% from 2026 to 2035.

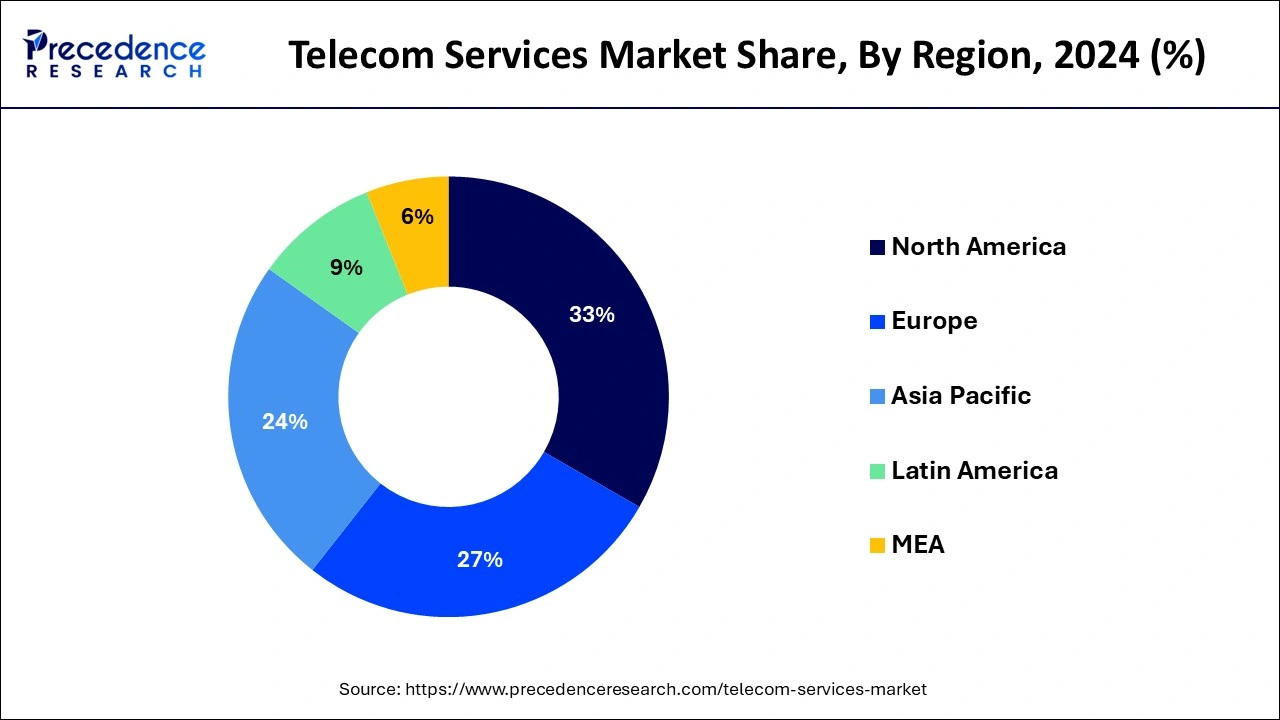

- Asia Pacific led the global market with the highest market share of 33% in 2025.

- By service type, the mobile data services segment has held the largest market share of 34% in 2025.

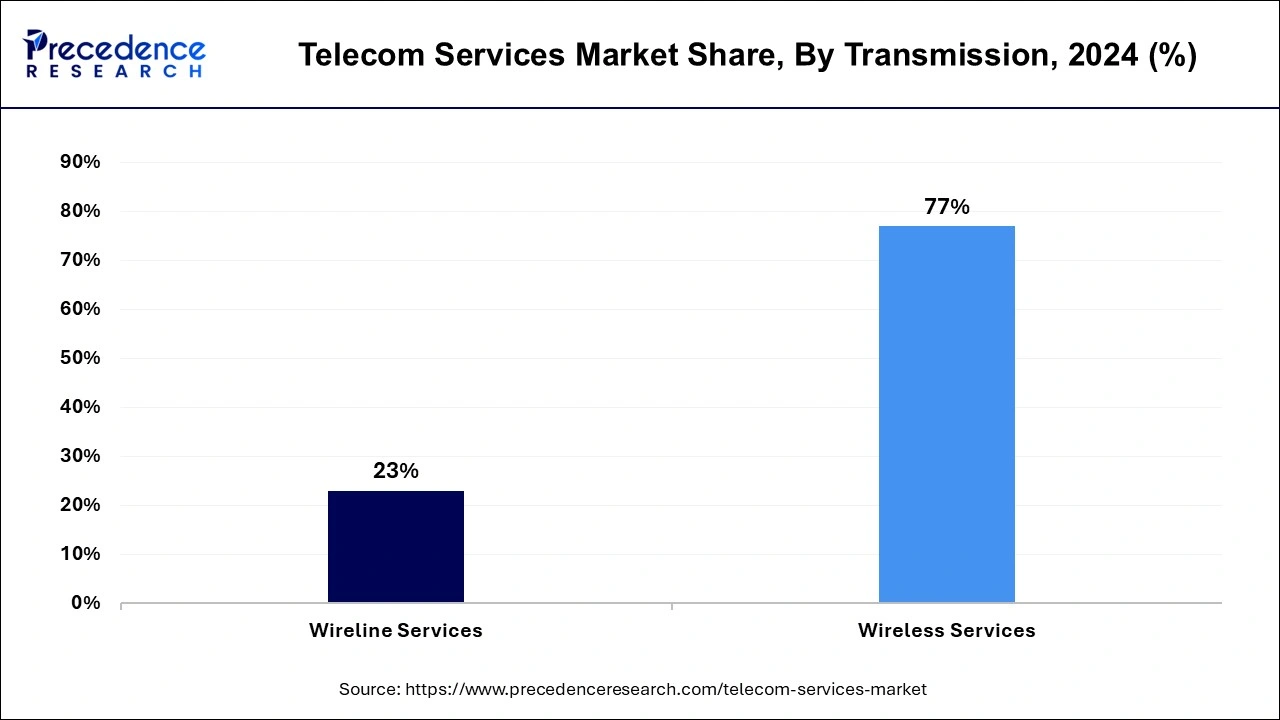

- By transmission, the wireless services segment captured the biggest revenue share of 77% in 2025.

- By end user, the consumer/residential segment generated over 61% of market share in 2025.

What is the Telecom Service?

The basic elements of telecommunication technologies are the transmitter, the transmission medium and the receiver. The market for telecommunications services has also witnessed significant improvements. The exchange of information over long range distances by the means of electronic media and refers to all types of voice data and video transmission.

Telecommunications services are a broad term that includes. A range of communication infrastructure and information transmitting technologies are like the mobile devices, cell phones, microwave communication, satellite radio, television, fiber optics, internet and telegraphs. The Internet is the largest example of telecommunications sector work. In many countries, the telecom service providers were government owned, that is no longer the case, and now there are private companies that are providing this service. Residential and small business market among the customer markets is toughest. There are many market players that function solely on competitive prices.

Artificial intelligence (AI) integration

AI has been a game changer in the telecom services. AI-assisted chatbots and virtual assistants are able to provide customer support and reduce issues more efficiently and quickly. AI is a significant tool that emulates human intelligence and assists decision-making capabilities. AI in telecom services is a significant transformer that improves predictive maintenance and network optimization as per the requirements of devices. Furthermore, the ability of AI to detect possible fraud and security protection makes them popular among businesses. The ongoing innovations in location-based data services and patterns are being leveraged thanks to AI. The surge of business for the adoption of telecom to build their own services is emerging due to AI integration.

Telecom Services Market Growth Factors

- Owing to increased spending on next-generation wireless communication setups due to the shift in the preferences towards 5G networks and cloud-based technology is driving the demand.

- There is great demand for high-speed data connectivity, and also, as there is rapid digitalization across the world and the explosion of OTT platforms, the market is expected to grow significantly.

- The market growth is fueled by 5 G-enabled smartphones that are generated and available across all the nations. The pandemic has also boosted the market size. When people are in home isolation across the world, entertainment platforms have become very famous.

- Increasing demand for video streaming services or applications, including Netflix, YouTube, and Amazon Prime.

- Also, the usage of data or Internet connectivity services was soaring during the pandemic as many people were working from home. The network architectures provide good connectivity at reduced infrastructure costs.

- These services will provide great 5G networks across the nations. As telecom services are providing improved voice services and also other value-added services, the market is expected to grow during the forecast period

- Due to a need for a global communication network, there have been continued technological advancements over the past few years.

- As the multiplexes and outdoor entertainment places were shut down due to strict social distancing, the internet applications have been used more.

Market Trends

- The growth of the market is driven by rising focus on cloud computing solutions, which is shifting the attention of the consumers to 5G infrastructure with improved connectivity and productivity.

- Integration of AI and MI to enhance consumer experience with improved network performance and automated tasks fuels the growth of the market.

- The rapid integration and development of 5G infrastructure with faster data speed and enhanced connectivity contribute to the growth of the market.

- Partnership and collaboration between major players enhance the affordability of telecom services and global connectivity.

- Virtual interactions and the metaverse are a growing trend that enhances experience and virtual interaction, which is a revolution in the telecom industry.

Market Outlook

- Industry Growth Overview: The expansion of telecom services is a steady process due to the improvement of connectivity, the increase in data usage, and the continued investments in fiber.

- Sustainability Trends: The telecom companies are using AI energy management, renewables, and circular designs to help cut network emissions.

- Global Expansion: The focus of the growth will be on the tillers of new regions, the connections of remote areas, and the satellite-enabled service extension.

- Major Investors: KKR, Macquarie Group, Tata Communications, Bharti Airtel, Vodafone Group, Verizon Ventures, and Reliance Jio are key players in the telecoms industry and their expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD2.10 Trillion |

| Market Size by 2035 | USD 3.39 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 4.91% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Service, By Transmission, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Driver

Demand for cutting-edge technologies

The Internet of Things, devices, and sensors have provided people with a quality life. The governments were also able to decrease their expenses related to information technology. The next-gen upgrade for telecommunications services is 5G technology. Machine learning and artificial intelligence are also impacting the industry.

Virtual reality, augmented reality, and mixed reality are all new types of content that require low latency Internet and good speed transmission. In order to reduce lag and create a seamless experience for the gamer, the startup subspace based in the US uses a combination of software and hardware solutions. There are cyber security issues across the globe. Saudi Arabia has developed the cyber security tool Cybersenshi, which discovers and fixes customer websites and network security issues. The British start-up Angoka is providing hardware solutions for managing cybersecurity risks.

Restraint

High upgradation cost

Upgradation is designed to support 5G networks and their investments in infrastructures, including network equipment and cell towers. High upgrade costs are due to the costs of maintenance, repair, and replacements. Such costs hamper small-scale businesses and newly developed businesses from entering existing markets. High upgrade costs lead to delayed adoption of novel technologies and services, which possibly restrain the market growth.

Opportunity

Adoption of IoT technology

The rising adoption of smart cities and automation integration in healthcare, transportation, and logistics has urged demand for IoT technologies. Additionally, the surge of large-scale businesses developing their own service platforms is leveraging this adoption. The increased utilization of IoT technologies has further increased demands for reliable and secure connectivity. The ability of IoT to provide data analytics, management, and storage services to telecom operators is making them popular. The adoption of IoT further surged due to its ability to offer innovative services and access, like smart homes and wearable devices, to telecom operators. The rising adoption of IoT technologies is projected to enhance demand for advanced telecom services.

Segment Insights

Service Type Insights

For the rapidly growing usage of data over smartphones for cloud augmented reality, virtual reality gaming, smart cities, and OTT platforms there has been a substantial rise in the mobile data services segment. The mobile data services segment accounted largest revenue share of around 34% in 2024. As the demand for high speed broadband services is high in residential areas, the segment is expected to grow during the forecast. The market is expected to grow owing to online cloud gaming. Increased adoption of mobile devices has surged in increased demand for mobile data and high-speed internet. The demand for 4G and 5G networks to improve mobile data speed and capacity is leveraging the segment growth

Transmission Insights

Based on the type of transmission, the wireless segment is expected to have the largest revenue share 77% in 2024 and expected to witness fastest growth during the forecast. Other than increased sales of mobile services among customers and businesses the demand for machine to machine services segment may grow during the forecast. as there is rapidly growing IoT devices that will require higher speed data connectivity to communicate effectively, the wireless local area networks have provided Internet access to cellular devices in home, in public spaces, in airports, at cafeterias, other areas or office buildings.

The system of wireless local area networks is expected to result in the growth of the market. The communication involves transfer of information via coax, coaxial twisted pair or optical fiber cables. Due to a rise in MNC,s and SME's in UK, USA and China there will be a growth in this market.

On the other hand, the wireline services segment is expected to grow in the forecast period due to the ability of this service to deliver consistent and reliable connectivity to work for e-commerce and online banking. The increased adoption of online payments and online shopping is fueling segment expansion. Advanced services, including triple-play and quad-play, are enhancing the consumer experience and gathering their preferences.

End User Insights

The consumer/residential segment accounted revenue share of around 61%. The residential segment has accounted for the largest revenue share among all the other end user type segments. During the forecast period, the sub segment is expected to maintain its lead. More than 60% of the population is using smartphones. The applications in the residential areas are helping in the significant growth of the market. Online gaming is also expected to give a boost to this segment during the forecast.

The business segment accounted for the fastest-growing segment in the market. The segment growth is attributed to increased digitalization in business and demands for high-speed internet connections. The adoption of private LTE and 5G networks is high among businesses. The rising consumer base and downtime to develop and deliver services have burdened businesses with the adoption of such advanced internet services. The ability of telecom services to enhance business outlook makes them popular among large-scale businesses.

- For instance, In January 2024, Anatel approved an agreement between Claro and Nucommerce to provide Nucommerce's administrators from Nubank. This agreement includes the agency of services, intermediation, and business in general, except real estate, development and licensing of tailored computer programs, information technology consulting, portals, content providers, and other information services on the internet.

Regional Insights

What is the Asia Pacific Telecom Services Market Size?

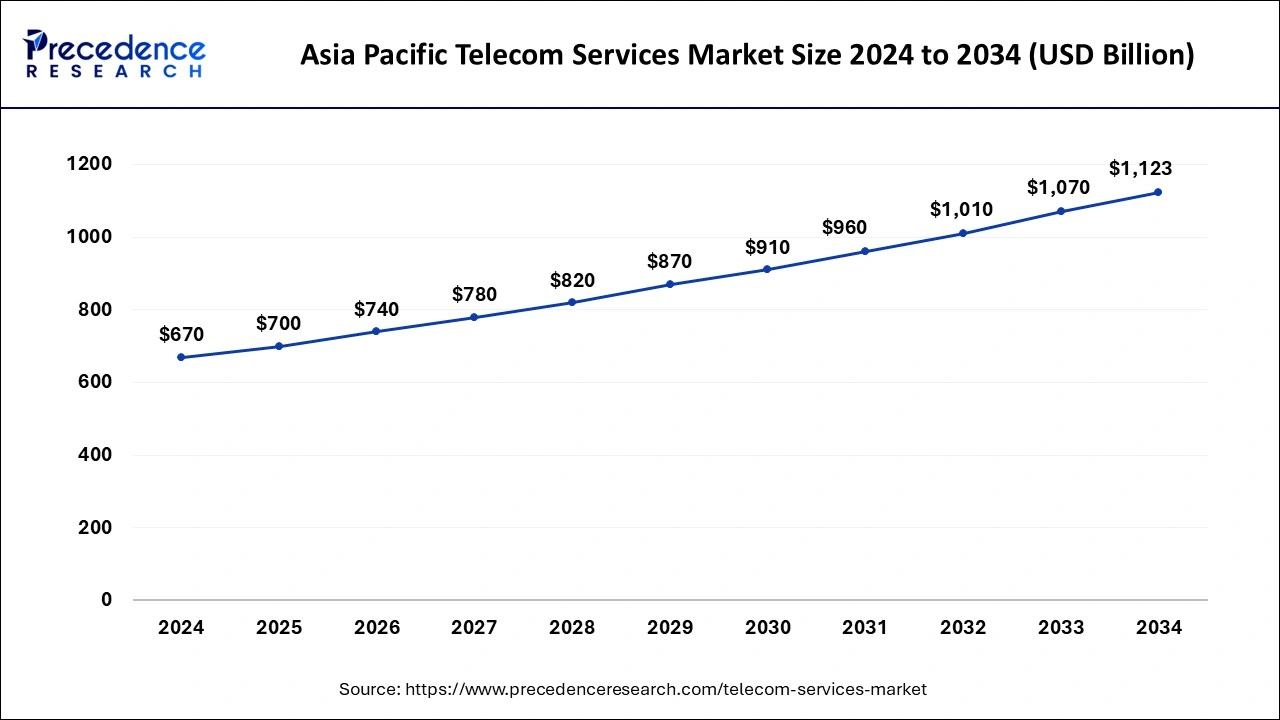

The Asia Pacific telecom services market size was estimated at USD 700 billion in 2025 and is predicted to be worth around USD 1,181 billion by 2035, at a CAGR of 5.37% from 2026 to 2035.

The Asia Pacific region accounted for 33% revenue share in 2024 and is expected to expand at a faster pace during the forecast due to rapidly growing population, significant adoption of smartphones and as there is rising penetration even in the niche markets. T-Mobile USA Inc, or acquired Sprint Corp, which is a telecom Company, the merger is aiming for a 5G network infrastructure in US that will help in capturing the rural as well as the urban areas. It is likely to invest 40 million U.S. dollars over the next three years. Significant investments are made across many nations to acquire next generation services and provided to the customers. AT&T Inc and Verizon Communications together have spent U.S. dollars 70 billion on the 5G spectrum. Vodafone Group PLC, BT Group PLC and China Mobile Limited are investing to procure millimeter wave for delivering enhanced connectivity for business and consumer applications. It is estimated that India's 5G subscriptions will reach up to 350,000,000 by the year 2026. Due to growing use of technologies such as Internet of Things, artificial intelligence, robotics and cloud computing, there will be a lot of jobs generated in this sector in India. Under the Department of Telecom, U.S. dollars, 1.65 billion has been allotted for telecom and networking products.

North America is projected to witness significant growth in the market in the upcoming period due to increased digitalization in the region. The presence of advanced and well-established infrastructures and key competitors is contributing to the market growth. The United States leads the regional market due to the country's large base of mobile adopters. Growing decentralization covering the United States market. The increased demand for high-speed internet in the country is fueling market growth. Additionally, innovations and the adoption of 5G networks are shaping the U.S. market.

The commission for communications regulation Ireland has released an extra radio spectrum to enable mobile network operators to provide their customers who access 3G as well as 4G technologies. An additional spectrum has been added to the communication network service provider, by the federal communications commission, ensuring continuity of broadband in US. The moderate growth of the wireline segment is because of the rising number of MNC,s and SME,s.

What Are the Driving Factors of The Telecom Service Market in Europe?

Europe is expected to grow at a remarkable rate during the forecast period, mainly due to fiber installation, better connectivity, and digital sovereignty projects. The common regulatory framework brings about the formation of the network for the long run, secure data management, and strong infrastructure, while the telecommunication companies switch over to the next generation of services that support enterprise digitization and industrial connectivity in the whole of Europe.

Germany Telecom Service Market Trends

Germany promotes its nationwide gigabit goal with a fiber grid and private communication network buildings. The manufacturing and automotive sectors are the main ones that are getting done with the dedicated networks. Telecom operators are boosting bundled service offerings through customer value improvement; however, sustainability is still a priority through energy-efficient infrastructural setup and circular equipment management strategies.

Telecom Services Market Companies

- AT&T Inc.: It provides wireless, fiber broadband, enterprise networking, and cloud-based communication services to customers all over the world.

- Verizon Communications Inc.: Offers high-speed mobile access, fixed broadband, enterprise solutions, and digital media services.

- China Mobile Limited: It provides mobile network and multimedia, voice, and data services that operate nationally.

Other Major Key Players

- SoftBank Group Corp.

- Duetsche Telecom AG.

- KT Corp.

- Vodafone Group.

- Bharti Airtel limited.

- Reliance JioInfocomm limited.

- KT Corp.

- Nippon Telegraph and Telephone Corporation

- Comcast Corporation

Leaders' announcements

- In January 2025, CEO Akshaya Moondra, a Vodafone Idea spokesperson, announced that Vodafone Idea (Vi) is setting the launch of 5G services and aims to provide exceptional value and performance with these services.

Recent developments

- In May 2025, Ericsson and Zain Jordan initiated a transformation project for Business Support Systems (BSS) designed to improve digital services, customer experiences, and operational agility. This strategic collaboration seeks to modernize Zain Jordan's BSS architecture to a cloud-native framework, fostering innovation and adaptability in the evolving telecommunications and Information Technology (IT) landscape of the Hashemite Kingdom. (Source: https://www.ericsson.com)

- In May 2025, Vodafone Idea officially unveiled its 5G service in the Mumbai telecom circle. The company is preparing to expand its 5G offerings to more telecom circles nationwide, having completed its groundwork. They have even launched a dedicated webpage for 5G on their site, which details plans, potential issues, and network specifics. According to details provided on Vodafone Idea's website, the next phase will see the introduction of 5G services in Delhi, Bihar, Karnataka, and Punjab, following the initial launch in Mumbai. (Source: https://www.myvi.in)

- In January 2025, the Union Minister of Communications launched a telecommunicating app Sanchar Saathi mobile app, which is designed to enhance security and user empowerment. The app has several features like reporting suspected fraudulent communications, identifying unauthorized mobile connections, and blocking lost or stolen devices. (Source: https://www.sancharsaathi.gov.in)

- In January 2025, Vodafone Idea (Vi) announced the launching of company 5G mobile broadband services in March 2025. The company plans to deliver these services at competitive pricing in order to gain customers from rivals Reliance Jio and Bharti Airtel.

- In December 2024, the Telecom Regulatory Authority of India (TRAI) introduced new regulations of "Telecom Consumers Protection (Twelfth Amendment) Regulations, 2024" to make telecom services more affordable and consumer-friendly in India.

- In July 2024, the series of Nebula Telecom Large Model products, which includes the telecom large model, agent's factory, and large model application innovation, was introduced by the ZTE Corporation, a leading global provider of integrated information and communication technology solutions.

Segments covered in the report.

By Service

- Fixed Voice Services

- Fixed Internet Access Services

- Mobile Voice Services

- Mobile Data Services

- Pay-TV Services

- Machine-to-Machine (Mobile IoT) Services

By Transmission

- Wireline services

- Wireless services

By End User

- Consumer/Residential

- Business

- IT & Telecom

- Manufacturing

- Healthcare

- Retail

- Media & Entertainment

- Government & Defense

- Education

- BFSI

- Energy and utilities

- Transportation & Logistics

- Travel & Hospitality

- O&G and Mining

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting