January 2025

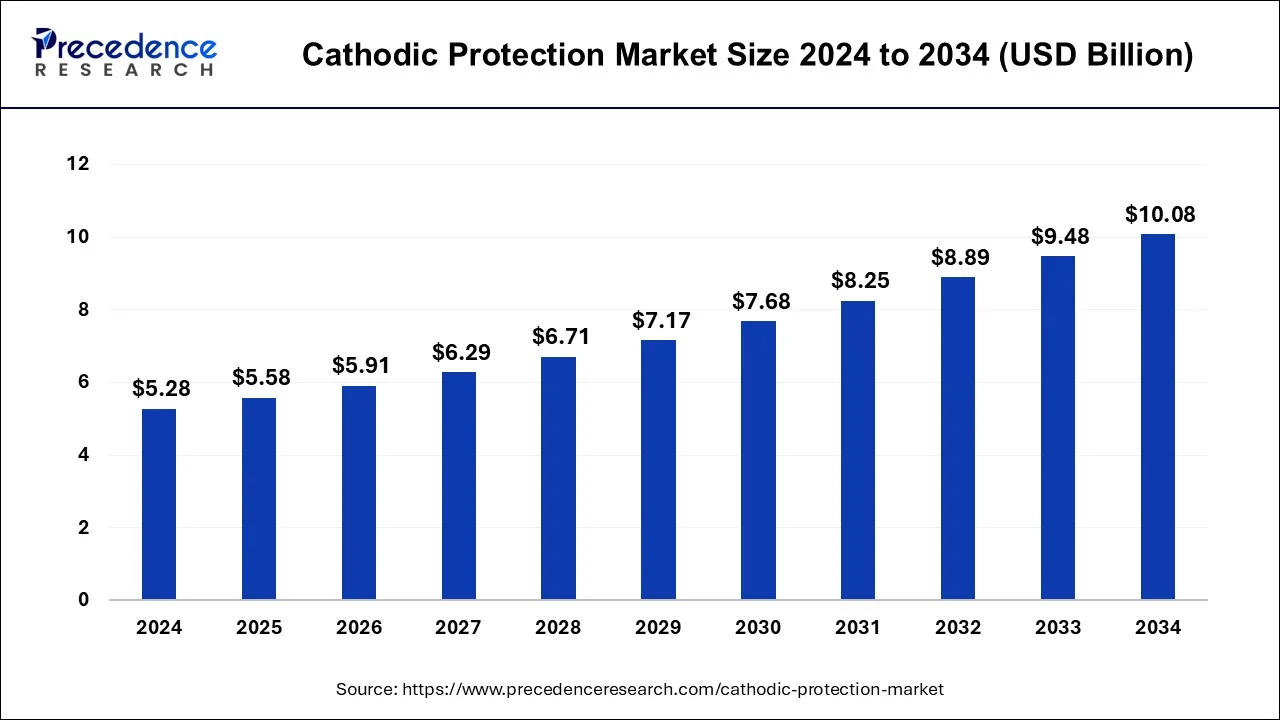

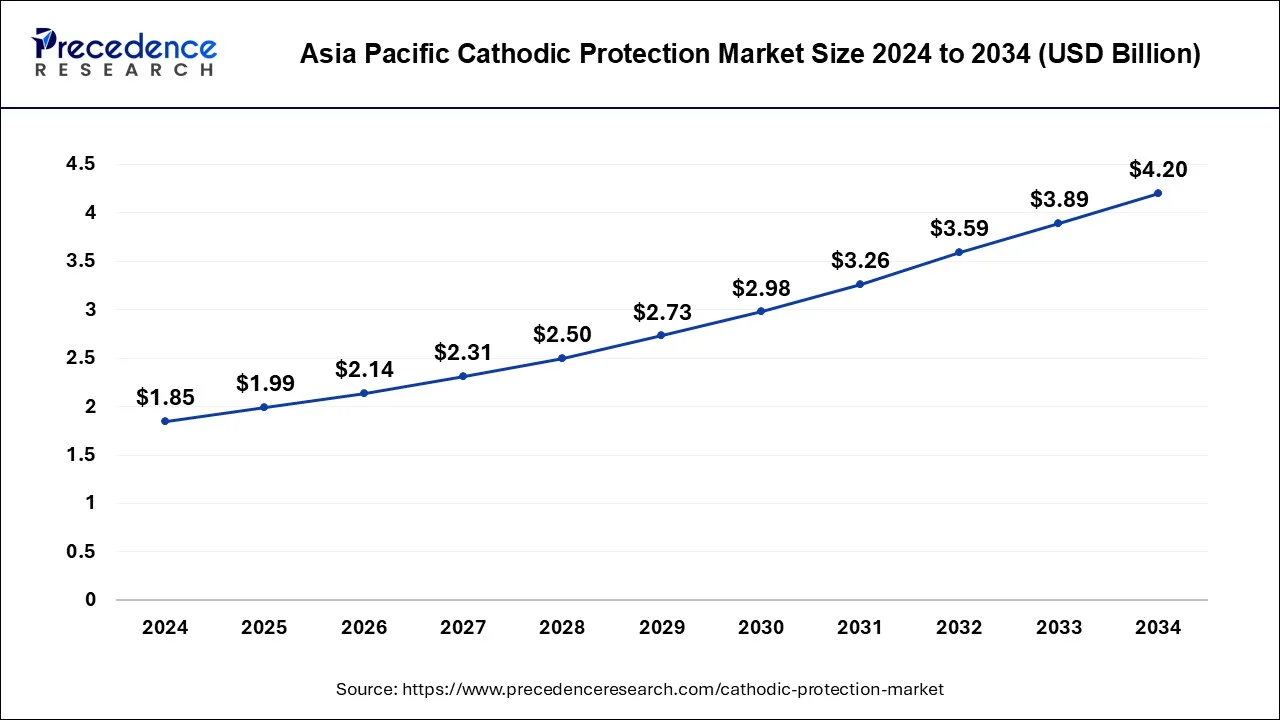

The global cathodic protection market size is calculated at USD 5.58 billion in 2025 and is forecasted to reach around USD 10.08 billion by 2034, accelerating at a CAGR of 6.79% from 2025 to 2034. The Asia Pacific cathodic protection market size accounted for USD 1.99 billion in 2025 and is expanding at a CAGR of 8.68% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cathodic protection market size was USD 5.28 billion in 2024, grew to USD 5.58 billion in 2025 and is projected to surpass around USD 10.08 billion by 2034, representing a healthy CAGR of 6.79% between 2025 and 2034.

The Asia Pacific cathodic protection market size accounted for USD 1.85 billion in 2024 and is expected to be worth around USD 4.20 billion by 2034, growing at a CAGR of 8.68% from 2025 to 2034.

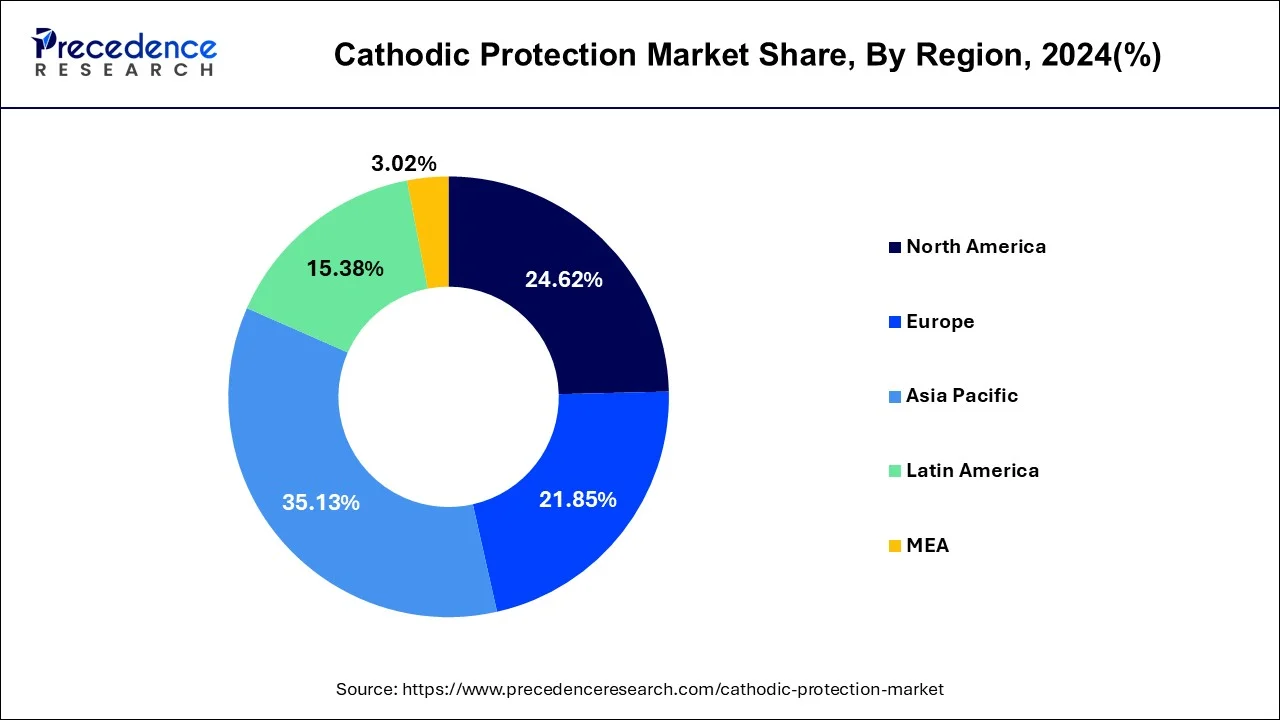

Asia Pacific is expected to hold the largest share of the market during the forecast period. The rising demand for the autonomous industry will boost the market demand in the countries like India, China, Japan, etc. the major market competitors in the autonomous industries like TATA, Mahindra & Mahindra Ltd, and Bajaj Auto Limited are investing in the research and development program in the region will result in the growth in the market demand.

According to the various survey, India is becoming the global economy in the upcoming era. The growing infrastructure and industrial investments in developing areas are expected to expand the end-users during the forecast period.

China has emerged as one of the fastest-growing global economies in the last decade. With the ever-going increase in the heavy industrial sector, the nation is expected to be the significant end-user of the cathodic prevention methods.

North America shows significant market growth in terms of global share revenue during the forecast period. Due to higher investment and technological advancement, North America becomes the dominating market in the cathodic prevention market. In North America, the U.S. took the highest share of the market due to the higher demand for oil and gas. Also the demand for zinc cathodic for the deterioration of the water pipes in the U.S. region boosts the demand of the market.

Corrosion is a naturally formed thing that can occur when some metal and the environment come in contact. It is derived from the reaction between water, air, and metal. In steel and iron-based metal, these reaction form corrosions also known as rust. Cathodic protection is used for the prevention form rust or corrosion in steel or iron metal which can be useful in industrial as well as domestic use. Hence the demand increase in the end-use industries including heavy and small industries.

Corrosion is a slow process that disrupts the properties of metal and breaks down the strength of metal. It is the byproduct of the environmental reaction between specific metals, water, and air. Corrosion occurs when the metal comes in a chemical reaction with oxygen in nature that has moisture or water in it. Corrosion can be primarily prevented by choosing a quality and long-lasting surface covering which create the prevention wall between rusting or corrosion cycle and sacrificed metal. There are various forms of corrosion prevention techniques used for the prevention of corrosion. The cathodic protection system is one of the methods for preventing the destruction of metals from corrosion.

Cathodic protection is the layers between these reactions which prevent the metal from corrosion protection. A cathodic prevention system is the secondary form of defense from preventing the structure of starting point to the aging of the infrastructure and maintaining the cycle. Cathodic protection is used in water, automobile, oil and gas, building, and construction industries. The rising demand for cathodic prevention systems in these industries results in the growth in the demand for the market.

Cathodic prevention is used for extending the life cycle of the service of the structural infrastructure. Cathodic prevention can be found in the galvanic design or impressed current system as per the design requirement and applications. Cathodic prevention system is widely accepted by various industries for preventing their infrastructure from corrosion and increasing the life expectancy of the services. Due to their durability and effectiveness the demand for cathodic protection systems in the global anticorrosion market.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.28 Billion |

| Market Size by 2034 | USD 10.08 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.79% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solutions, By Type, and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Galvanic cathodic protection is the economically affordable process for the anticorrosion of metals

Cathodic prevention systems had the properties of preventing the corrosion of metals used in industrial as well as domestic use. Cathodic prevention market demand rising due to its anticorrosion properties as well as there is no need for some specific technologies to install it. There are two types of technologies included in it. The galvanic and impressed current cathodic protection. The Galvanic anode has a simple installation process, there is no need for the external power supply to install or maintain the process. Galvanic anode protection requires very little maintenance and operations. There is no external cost for the expensive cables or accessories, and efficient and easy to design, and most importantly economically friendly for small structures.

Higher maintenance cost

For the last several years cathodic prevention systems is used as corrosion-protecting layers of metal in various industries. But there are some factors that are limiting the market form growth is how the structure is constructed is one of the complex issues other than these in the impressed current cathodic prevention systems the higher installation/on cost and the time-to-time maintenance requirement becomes one of the major hampering factors in the cathodic prevention market. They need a constant need of power supply so the constant supply of electricity results in higher maintenance costs. All these factors prevent the market expansion.

The advancement of switch mode technology

The Advancement in the cathodic protection systems from the recent innovation of switch mode technology. The Second generation rectifier system had several filtrations. The brand new switch mode-specific component is introduced to the market to increase the efficiency and effectiveness of the product. The system includes a control system and a remote monitoring system for communication technologies. The switch mode technology was also useful for the environmental protection strategies. The system was designed to integrate analog and digital control loops, to allow exact cathodic protection. Similarly, the single-module cathodic protection system was launched. Which can be integrated with the digital control loop technology as well as component technologies. These technologies are integrated with the broadband connectivity from satellite to fiber optic and internet connectivity as well.

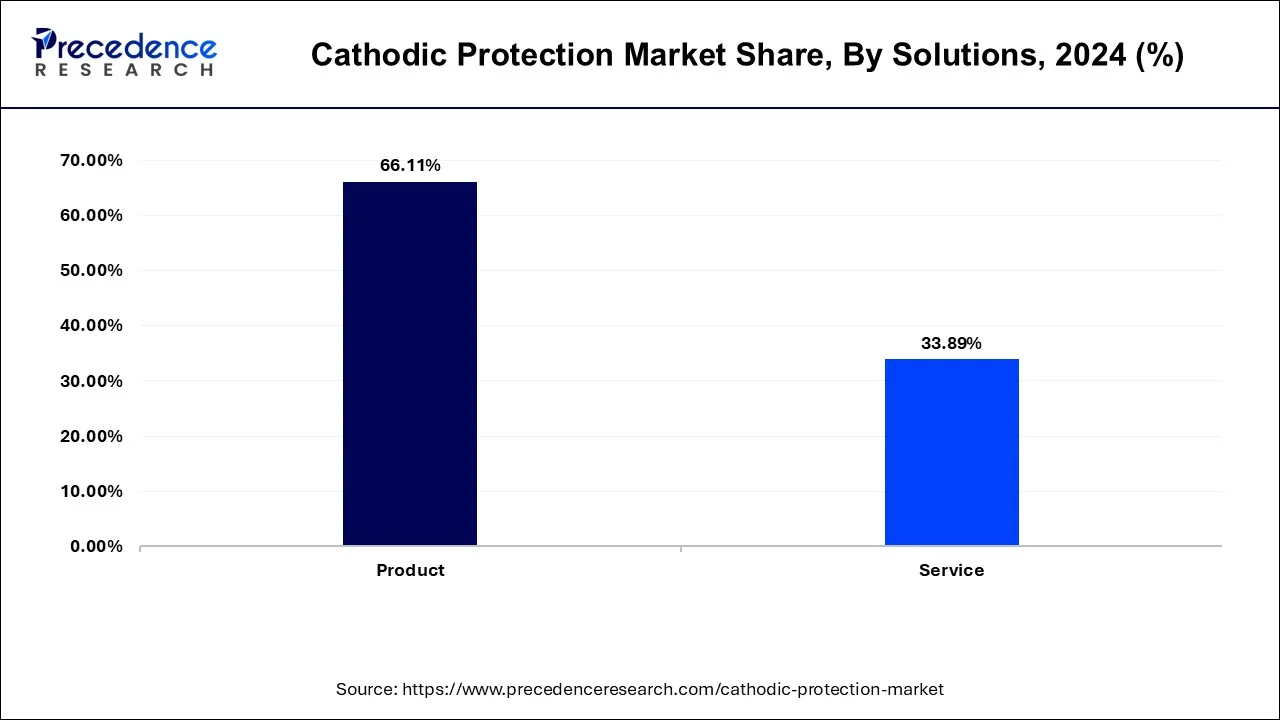

In 2024, the product segments dominated the market in terms of revenue share in the market. The product segments include anodes, power supplies, junction boxes, test stations, remote monitors, and coating. Cathodic protection anode provides direct current to the metal for preventing corrosion. There are various forms of coating material that can be used in cathodic protecting technology.

Global Cathodic Protection Market Revenue, By Solution, 2022-2024 (USD Million)

| By Solution | 2022 | 2023 | 2024 |

| Product | 3,129.9 | 3,307.2 | 3,491.1 |

| Service | 1,622.9 | 1,705.0 | 1,789.7 |

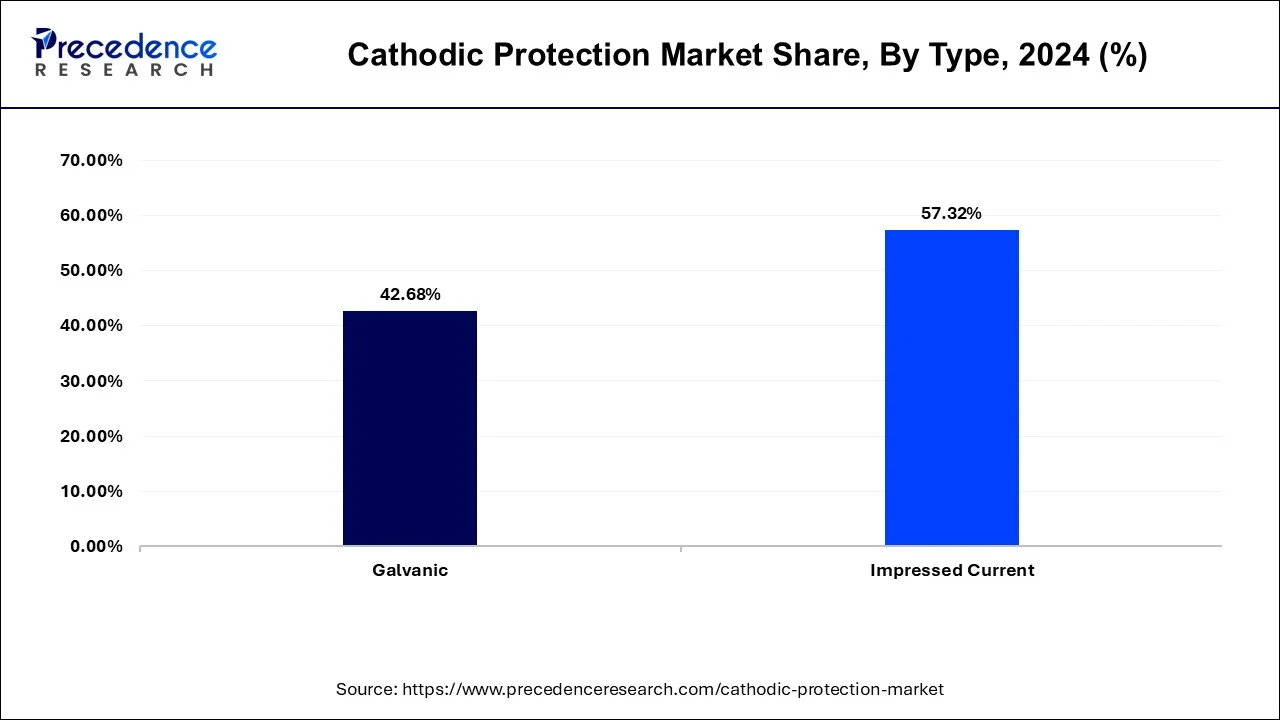

Impressed current technologies share the highest revenue in the global cathodic protecting market, the segment is predicted to act as the most attractive segment during the projected timeframe. The impressed current technologies are used in the industrial and commercial sectors to prevent the metal from corrosion by the electrolysis process. It has a high maintenance cost compared to other technologies. The rising demand for cathodic protection methods for onshore and offshore purposes is predicted to continue the growth of the segment.

On the other hand, the galvanic is another significant segment of the market. Galvanic technology is fundamentally simple. This method is also known as sacrificial cathodic protection, it is a more active metal that installs as an anode and sacrifices itself for the prevention of the working structure.

Global Cathodic Protection Market Revenue, By Type, 2022-2024 (USD Million)

| By Type | 2022 | 2023 | 2024 |

| Galvanic | 2061.4 | 2158.4 | 2253.7 |

| Impressed Current | 2691.4 | 2853.8 | 3027.1 |

The Pipeline segment is expected to witness a significant increase in the market share of the global cathodic protection market. The pipeline is widely used in the industrial sector and for many other sectors. The cathodic protection process is applied to the pipelines to prevent them from corrosion, in order to extend their life.

On the other hand, the building segment is expected to show a noticeable growth during the forecast period. The growth of the segment is attributed to the high requirement of cathodic protection technology for preventing rust and disrupting the corrosion process happened due to the chemical reaction between metal and environment, and water.

Global Cathodic Protection Market Revenue, By Applications, 2022-2024 (USD Million)

| By Applications | 2022 | 2023 | 2024 |

| Pipeline | 869.3 | 910.2 | 951.6 |

| Storage facilities | 937.8 | 1,001.6 | 1,068.5 |

| Processing plants | 1,069.4 | 1,133.5 | 1,200.3 |

| Water & Wastewater | 529.0 | 554.3 | 580.3 |

| Transportation | 480.1 | 500.2 | 520.7 |

| Transportation | 507.2 | 531.5 | 556.6 |

| Others | 359.9 | 381.0 | 402.8 |

By Solutions

By Type

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024