November 2024

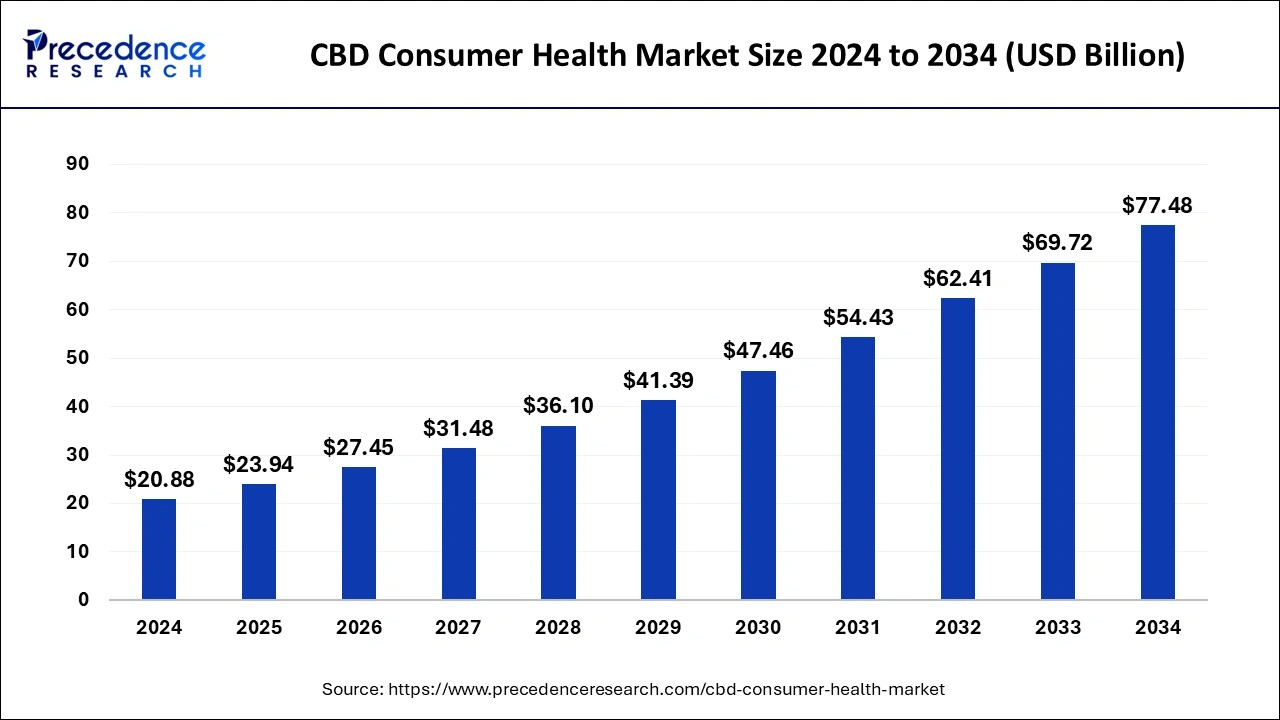

The global CBD consumer health market size is accounted at USD 23.94 billion in 2025 and is forecasted to hit around USD 77.48 billion by 2034, representing a CAGR of 14.01% from 2025 to 2034. The North America market size was estimated at USD 12.77 billion in 2024 and is expanding at a CAGR of 14.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global CBD consumer health market size was calculated at USD 20.88 billion in 2024 and is predicted to reach around USD 77.48 billion by 2034, expanding at a CAGR of 14.01% from 2025 to 2034.

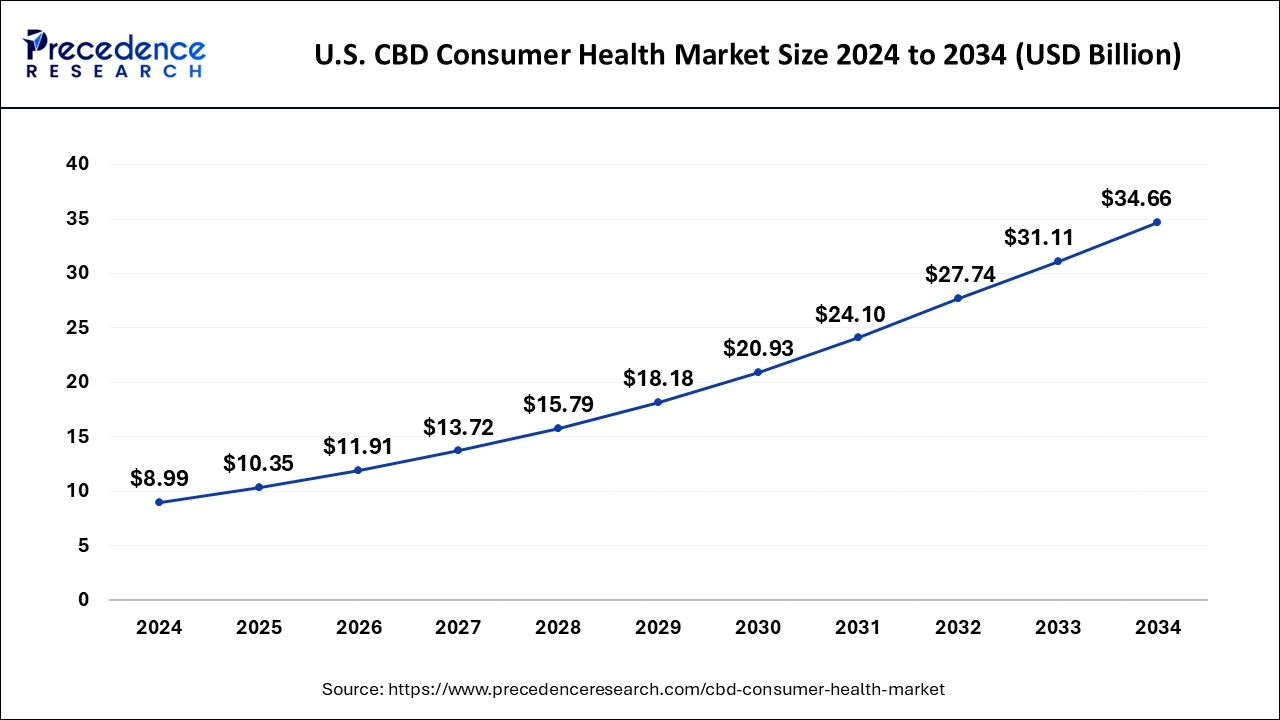

The U.S. CBD consumer health market size was evaluated at USD 8.99 billion in 2024 and is projected to be worth around USD 34.66 billion by 2034, growing at a CAGR of 14.45% from 2025 to 2034.

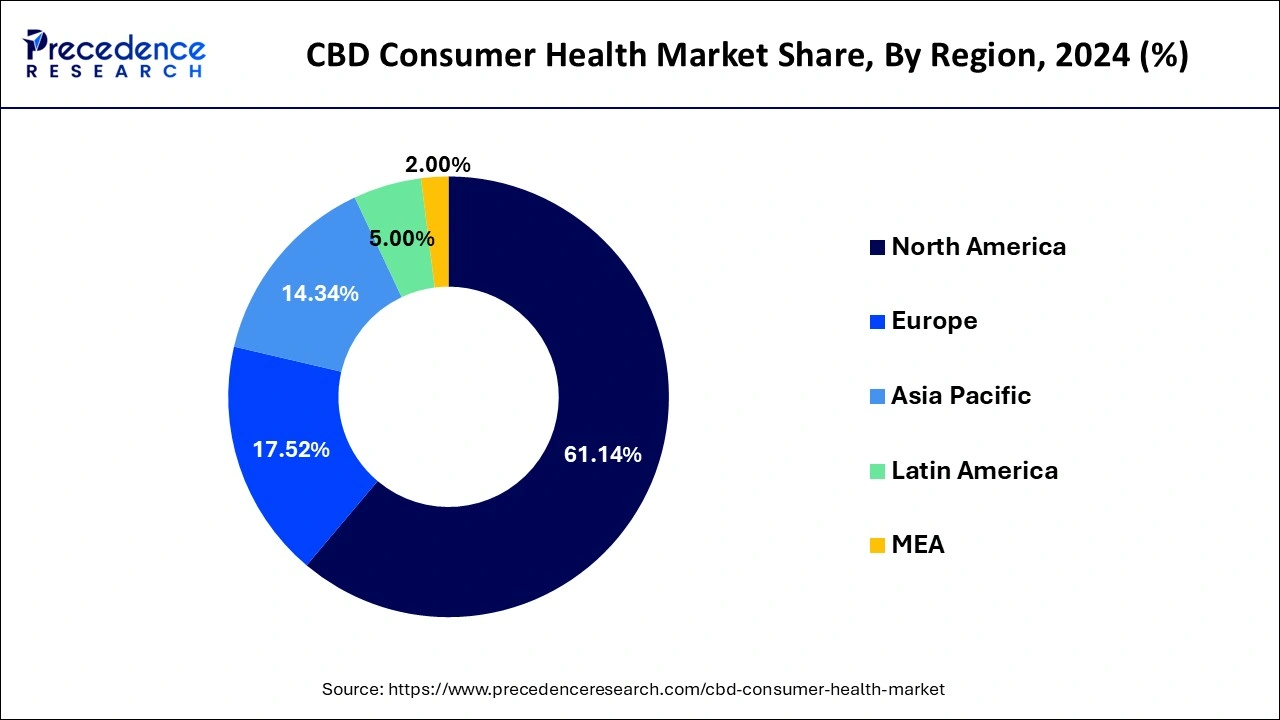

North America generated more than 61.14% of revenue share in 2024, owing to the higher utilization of CBD in the medical sector. The United States Food and Drug Administration (FDA) has approved using CBD for medicinal purposes; the administration has also approved Epidiolex, a CBD-based medicine used for treating seizure disorders. Relaxation for the consumption of CBD products has supplemented the growth of the CBD consumer health market in North America.

Moreover, the increasing prevalence of insomnia and other sleep disorders in the region has boosted the demand for CBD from the medicinal sector. According to the American Psychiatric Association, insomnia is the most common sleep disorder in American countries; about one-third of adults report insomnia symptoms.

Europe is the second largest region for the CBD consumer health market. Europe's CBD consumer health market is expected to witness the fastest growth during the forecast period owing to the rising awareness for products developed to improve neurological health. Moreover, the increasing number of key players and the potential for investing capital in product development are observed as major driving factors for the market’s growth in Europe.

In February 2023, a 12-month collaboration between UK Scientific Body and Patient advocacy organization Medcan Support launched a real-data study program to explore how medical cannabis can be helpful in treating the symptoms of epilepsy in children. This program is intended to develop a new point-of-view for the utilization of cannabis in the medical sector.

Asia Pacific is expected to witness noticeable growth during the forecast period. The rising legalization of CBD compounds for medicinal purposes is accelerating the market’s growth in Asia Pacific. According to the World Health Organization, nearly 15% of Indians struggle with depression; additionally, the rising case of other neurologic illnesses is predicted to grow the demand for medicines or products with CBD compounds in India. Moreover, the increasing sales of nutritional supplements in the region are expected to boost the demand for CBD compounds. On the other hand, the strict restrictions on cannabis in China may hinder the market’s growth.

Furthermore, the emerging economies and rising awareness about the health benefits of cannabis for humans are propelling the growth of the CBD consumer health market in Latin America, the Middle East and Africa.

In January 2023, Argentina officially launched a new government agency, ‘Regulatory Agency for Hemp and Medical Cannabis Industry’, to boost the country’s medical cannabis industry. The new agency aims to open doors for new medical marijuana businesses in upcoming years by generating income for nearby Latin American countries.

CBD is increasingly being used in consumer health products such as oils, capsules, topicals, and gummies, as well as in foods and beverages. The rising importance of cannabis in the healthcare sector for multiple medicinal purposes is observed to fuel the growth of the CBD consumer health market.

In July 2024, Health Canada published a report stating that CBD is clinically proven and safe yet tolerable for short-term use for treating multiple health conditions. The report paved the way for CBD and other cannabis components to be utilized in non-prescription products for human health.

The global CBD consumer health market is fragmented with multiple companies; Charlotte's Web, Medterra, PlusCBD, and green roads are a few brands that produce CBD oil, CBD capsules, CBD gummies, and CBD topicals.

A study published in the Journal of Clinical Psychology found that CBD significantly reduced anxiety symptoms in 79.2% of participants. Another study published in the Journal of Psychopharmacology found that CBD reduced subjective anxiety in participants undergoing a public speaking test.

The rising legalization of cannabis for medical purposes in various geographical areas is observed as a significant driver for the growth of the CBD consumer health market. Countries such as Germany, the United States, Canada and Italy have legalized the cultivation of cannabis for medical purposes. Also, medical cannabis is legal in France and Portugal. This factor is expected to fuel the growth of the CBD consumer health market.

The growth of the CBD consumer health market is attributed to the rising awareness about CBD products and the rapid acceptance across the globe, fueling the demand for CBD compounds for consumer health purposes. Many consumers are turning to CBD as a natural alternative to pharmaceuticals; this has shown a significant increase in the customer base.

Moreover, a rising number of business activities, such as partnerships, acquisitions and new product launches, along with the increasing involvement of key players in the market, are observed as propelling factors for the growth of the CBD consumer health market. Additionally, brand expansion by leading market players drives the market’s growth.

In October 2022, a leading retail company focused on cannabis products, High Tide, announced the official launch of its NuLeaf Naturals Multicannabinoid products in Ontario. NuLeaf Naturals’ CBD oil and plant-based gels are listed for sale in Ontario.

Along with this, in February 2023, Canada’s leading CBD products company, Aurora Cannabis and Australia-based company, MedReleaf, together announced the launch of CraftPlant, a new cannabis medicine brand for patients in Australia. The new brand ‘CraftPlant’ includes three products: Greendae, Navana and HiVolt, developed from cultivated with moderate THC percentage.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.01% |

| Market Size in 2025 | USD 23.94 Billion |

| Market Size by 2034 | USD 77.48 Billion |

| Largest Market | North America |

| Second Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rising cases of epilepsy and other neurological illnesses.

According to the World Health Organization (WHO), approximately five million people are diagnosed with epilepsy each year. In recent years, the cases of epilepsy have been observed to increase in children due to abnormal brain development, infection or brain injury.

The rising number of patients with neurological illnesses, including epilepsy, cerebral issues, mental disabilities, and ADD, is accelerating the consumption of CBD. CBD has been shown to be effective in treating certain types of epilepsy, such as Lennox-Gastaut syndrome and Dravet syndrome, in children and adults. In fact, the FDA has approved a CBD medication called Epidiolex to treat these conditions.

According to the National Institute of Health, anxiety is the most common symptom of a neurologic illness or may occur in individuals with neurological disorders. Considering the rising cases of neurologic disease, market players have shifted their focus to developing CBD medicines or CBD-derived products that promote anxiety reduction. Considering the increasing prevalence of neurological disorders, the demand and development of CBD products will rise during the forecast period.

For instance, in August 2022, a renowned consumer wellness company, CV Sciences Ltd, announced the launch of +Plus CBD, Reserve Collection Soft gels to reduce anxiety and stress and promote relaxation. The company has made the product available on its official website. +Plus CBS Reserve Collection Soft gels are formulated to offer a full spectrum of cannabinoids. With the development of +Plus CBD, the company continues to provide thoughtfully developed products to improve the quality of life.

Regulatory uncertainties for CBD products.

The regulatory environment around CBD products is still evolving, and it can be difficult for companies to navigate the rules and regulations. This uncertainty could lead to increased scrutiny from regulators and potential legal challenges, which could impact on the growth of the market. Despite the growing popularity of CBD products, there is still limited scientific research on their efficacy and safety. This makes it difficult for regulators to establish clear guidelines for their use and distribution.

The lack of clear guidelines for labeling CBD products has resulted in confusion or misleading information about their content and intended uses. CBD products, especially used in the medicinal sector, have different regulatory policies in every country. Thus, it becomes difficult for manufacturers to comply with every regulatory standard for CBD products, which limits the international expansion of business. Considering such regulatory issues, the uncertainties in regulations are observed to hamper the growth of the market.

Rising demand for alternative medications.

Alternative medicines, which are different from conventional therapies, are developed to re-harmonize the body. Such medications are generally created using natural ingredients which do not cause side effects. The demand for alternative treatments is seen increasing due to dissatisfaction with conventional medicines, rising focus on holistic health and the growing involvement of patients in self-health care.

The considerable demand for alternative treatment for various health issues is observed to boost the demand, utilization and consumption for CBD compounds by creating a plethora of opportunities for market players, as CBD compounds contain natural antioxidant properties, which is considered a holistic approach for every health condition. Moreover, CBD's anti-inflammatory and anti-depressant properties promise a potential treatment for chronic diseases.

Covid-19 Impact:

The Covid-19 pandemic has mildly affected the global CBD consumer health market in the initial phase of the lockdown. The Covid-19 pandemic has disrupted global supply chains, which has resulted in shortages of some CBD healthcare products with a lack of raw materials. The pandemic has led to fluctuations in the price of CBD products, with some products becoming more expensive due to increased demand and supply chain disruptions. Additionally, the strict restrictions during the pandemic have forced the closure of many physical stores, which has impacted the sale of CBD consumer health products.

The pandemic caused massive negative impacts on large-scale market players involved in the global CBD consumer health market. C V Science Inc is a prominent player involved in the production and distribution of hemp-derived CBD lifestyle products. The company's 2020 annual report reported a net loss of $24.4 million for the year, compared to a net loss of $9.4 million in the previous year. The company cited several factors that contributed to the loss, including the impact of the pandemic on its sales and operations.

However, the pandemic, health concerns and prolonged lockdown resulted in increased anxiety and stress, which has led to an increased demand for CBD healthcare products that are known for their calming and relaxing effects. Products such as CBD oils, gels, and creams have been reported to help reduce stress and anxiety in some individuals. Considering the moderately increased demand for CBD healthcare products and the broken supply chain during the lockdown period, the impacts of COVID-19 on the CBD consumer health market have been mixed.

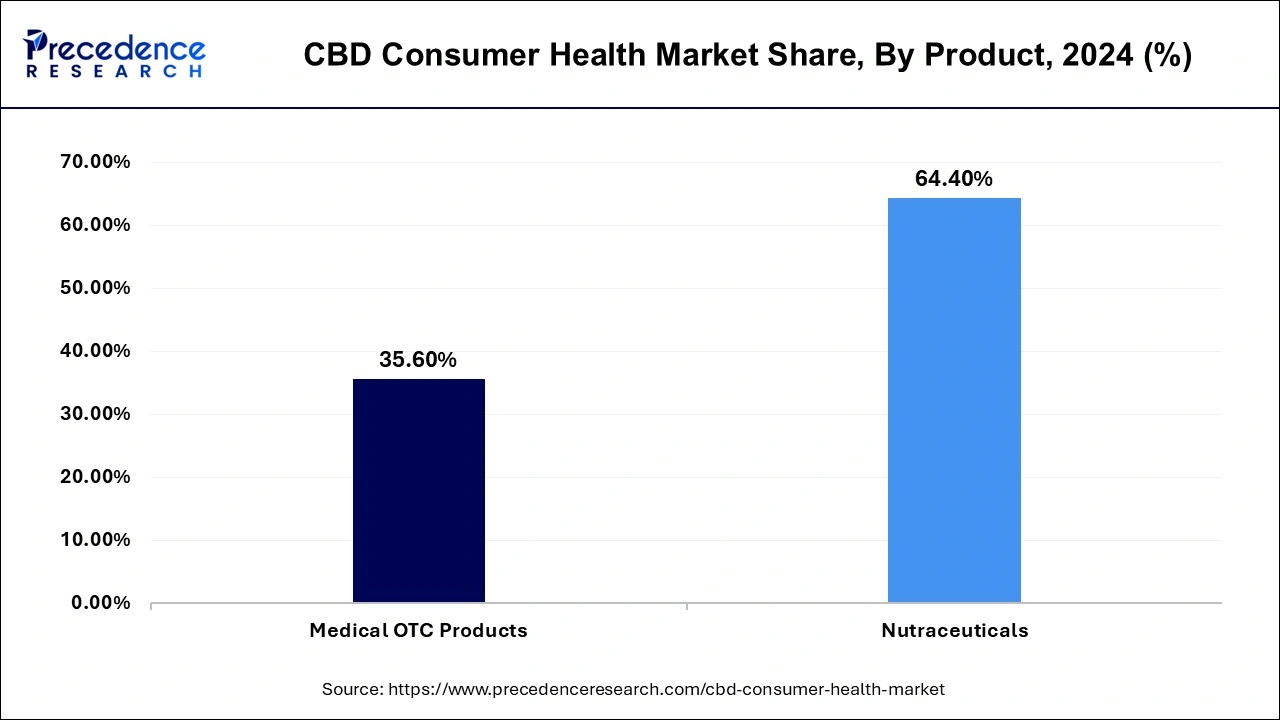

The nutraceuticals segment generated more than 64.40% of the revenue share in 2024. The rising awareness about the health benefits of nutritional supplements has boosted the segment’s growth. Moreover, the nutraceutical is further segmented into CBD vitamins and minerals, CBD weight management nutrition, and CBD sports nutrition. The rising consumption of fast and junk food products and a sedentary lifestyle have increased the risks of obesity in the younger generation. Such concerns fuel the demand for weight management supplements with CBD compounds, as CBD helps suppress the appetite and boost energy.

A survey conducted by the Japan Ministry of Health, Labor, and Welfare found that approximately 43% of Japanese adults reported taking dietary supplements, including vitamins and minerals. According to the America Osteopathic Association, almost 4 of every 5 Americans prefer vitamin supplements. Consumption is predicted to grow with the rising unhealthy living habits; this is intended to boost the demand for CBD vitamins and minerals in the upcoming period.

At the same time, the medical over-the-counter (OTC) products segment is expected to hold a noticeable share of the market. The legalization of CBD products has increased the sales of CBD products for dermatological treatment, sleep disorders and analgesic products with no prescription. Moreover, the increasing demand for pain relievers with CBD compounds is accelerating the growth of the medical OTC products segment.

The retail pharmacy segment accounted for more than 41% of the total share in 2024. The legalization of CBD products in various geographical areas has increased the sales of non-prescription CBD products from retail pharmacies. CBD products for consumer health have become increasingly popular in recent years. As a result, many retail pharmacies have started to stock CBD products to meet the growing demand from their customers. In addition, many retail pharmacies are regulated by government agencies.

At the same time, the online store segment is expected to register a significant increase during the forecast period. The covid-19 pandemic has shown a massive demand for CBD products through online stores. Online stores often have a more comprehensive selection of CBD products than retail pharmacies, as they are open to physical space constraints. Overall, the availability of CBD products in online stores provides a convenient and accessible way for people to purchase these products; competitive pricing and reviewed products are propelling the growth of the online store segment.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

September 2024

October 2024