February 2025

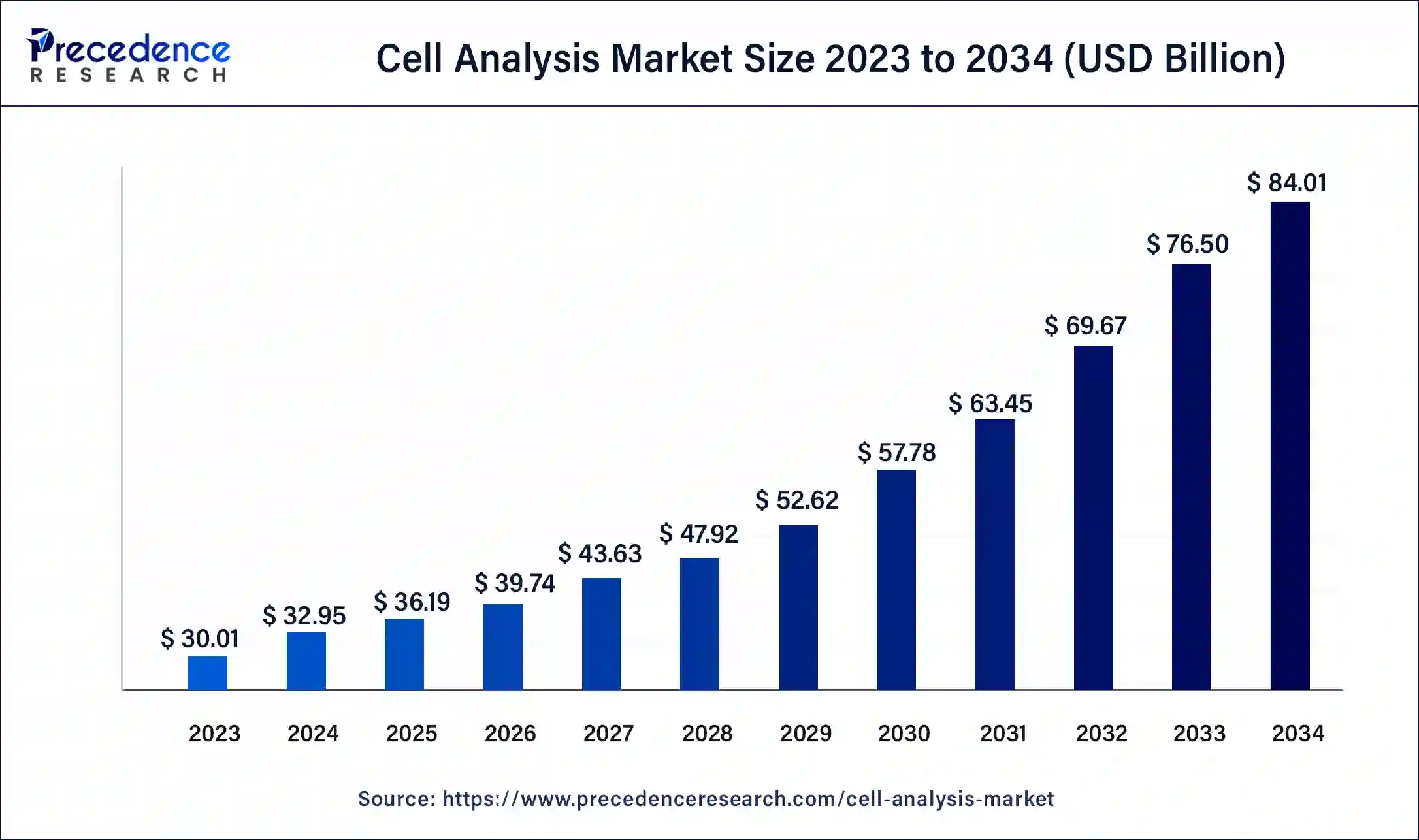

The global cell analysis market size surpassed USD 30.01 billion in 2023 and is estimated to increase from USD 32.95 billion in 2024 to approximately USD 84.01 billion by 2034. It is projected to grow at a CAGR of 9.81% from 2024 to 2034.

The global cell analysis market size is projected to be worth around USD 84.01 billion by 2034 from USD 32.95 billion in 2024, at a CAGR of 9.81% from 2024 to 2034. The growing prevalence of rare diseases around the world has driven the growth of the cell analysis market. Also, the rising number of cloud-based cell analysis services boosts industrial growth. Moreover, the rise in the number of hospitals and clinical settings contributes positively to the market.

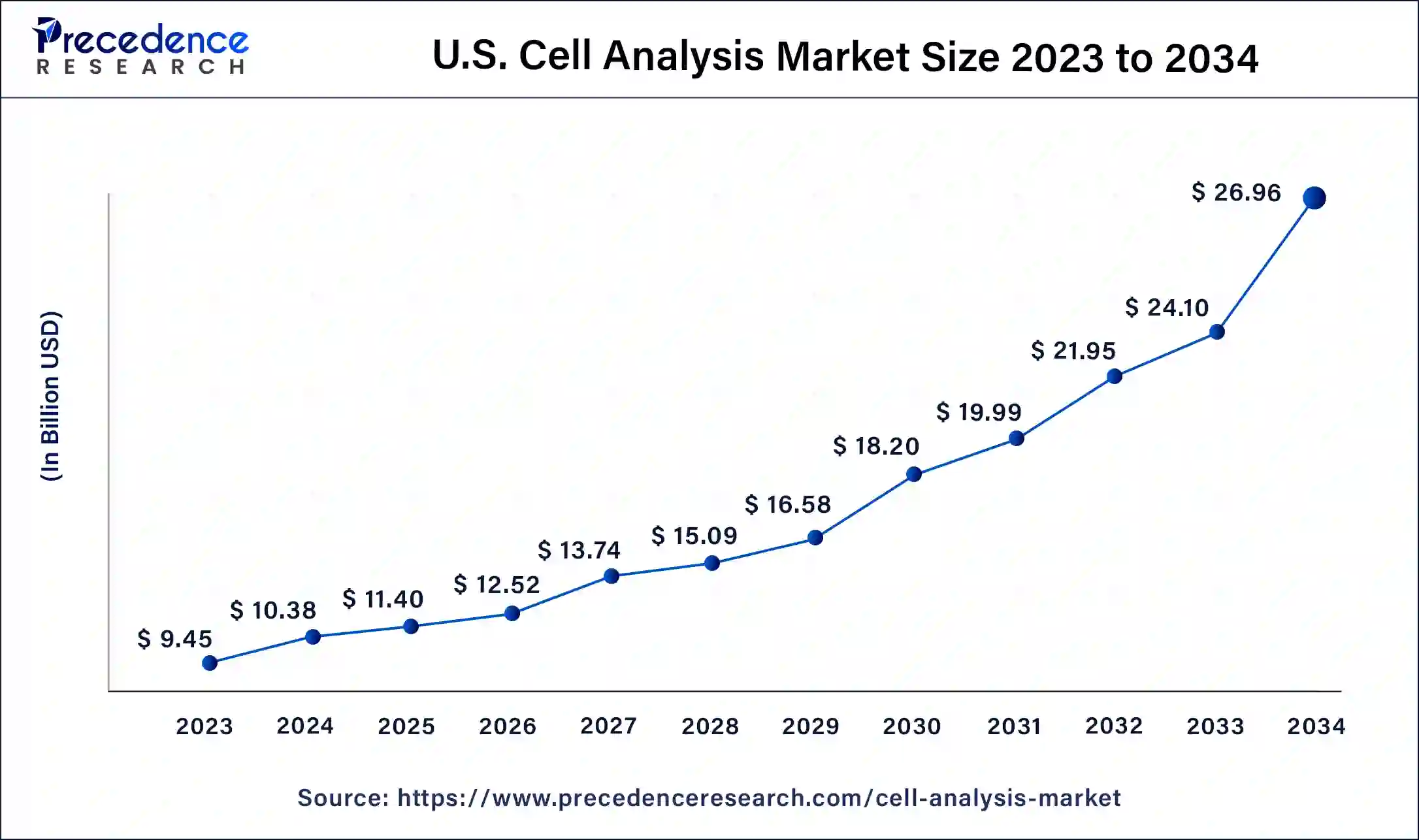

The U.S. cell analysis market size was exhibited at USD 9.45 billion in 2023 and is projected to be worth around USD 26.96 billion by 2034, poised to grow at a CAGR of 9.99% from 2024 to 2034.

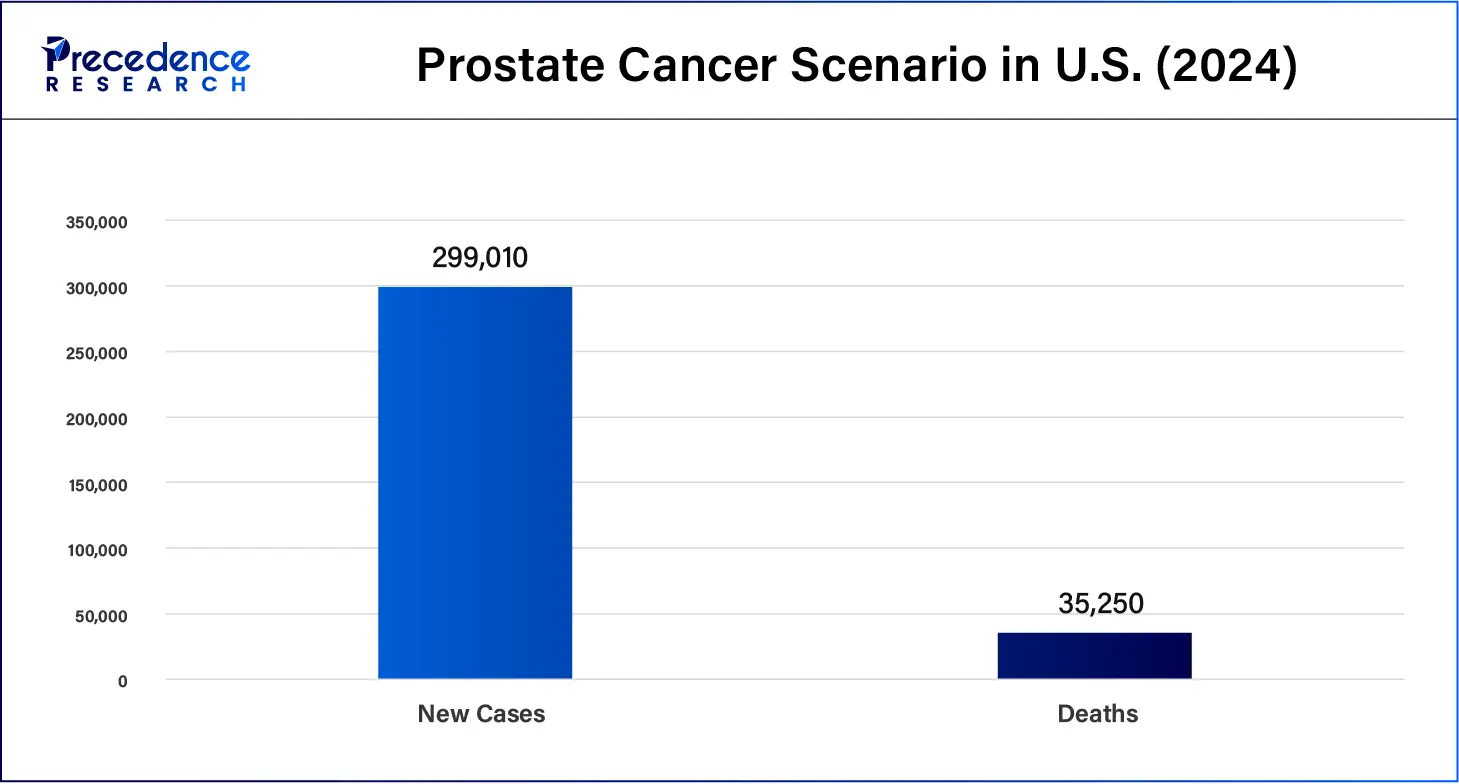

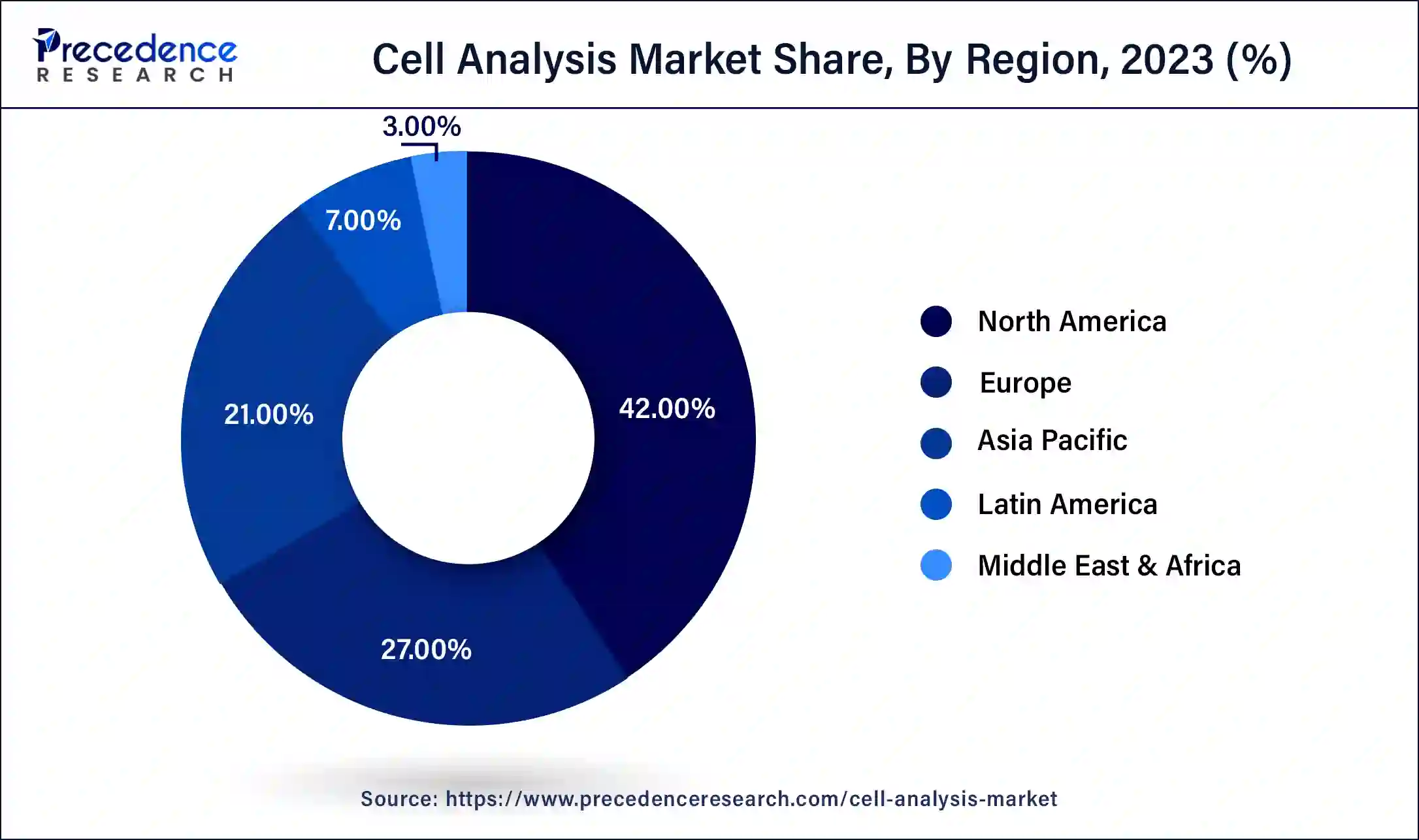

North America held the largest share of the cell analysis market in 2023. The rise in the number of research institutes associated with cell analysis processes, along with several government initiatives to develop the healthcare and biomanufacturing infrastructure in the U.S. and Canada, has increased the demand for cell analysis tools in this region. The prevalence of various types of cancers, such as breast cancer, prostate cancer, lung cancer, and some others, has increased significantly in this region, which in turn increases the demand for cell analysis tools for developing advanced therapeutics to cure these diseases. North America comprises several local companies of cell analysis such as Thermo Fisher Scientific, Inc., Danaher, Agilent Technologies, Inc., 10x Genomics, Inc., and some others are continuously developing superior quality cell analysis tools for numerous end-users in this region, which in turn is expected to foster the development of the cell analysis market.

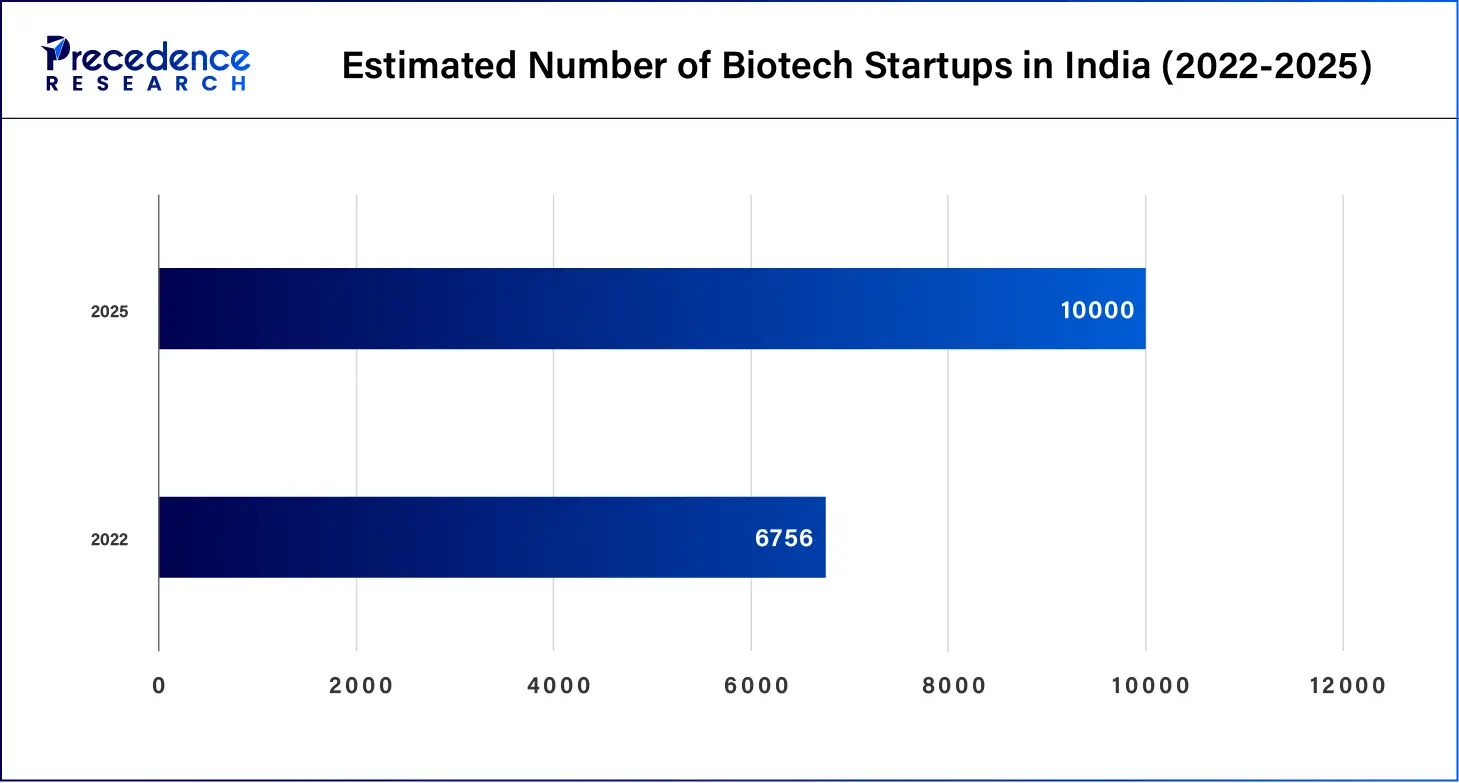

Asia Pacific is anticipated to grow at the fastest growth rate during the forecast period. The rising development in the biotechnology sector in countries such as China, India, Japan, South Korea, Taiwan, Israel, Australia, and others has contributed to the increasing applications of cell analysis tools. The cell analysis market in Japan is highly developed due to the presence of numerous biotechnology companies along with various technological advancements associated with cell analysis. Also, the rising prevalence of cardiovascular diseases in the Asia Pacific region has increased the application of cell analysis for developing novel therapies.

This region consists of various market players in cell analysis, including Olympus Corporation, Nikon Corporation, Shanghai Ruiyu Biotechnology Co. Ltd, BGI Group, Takara Bio, and some others that are constantly engaged in developing cell analysis tools and providing services to numerous end-users. Also, these companies are adopting several strategies, such as partnerships, acquisitions, collaborations, launches, and business expansions, that are driving the growth of the cell analysis market in this region.

The Asia Pacific Cohort Studies Collaboration (APCSC) estimated that there will be a 60% increase in CVD patients in Asia countries in 2023-24. It further made an estimation mentioning the total number of patients with hypertension in China and India is anticipated to increase and reach around 500 million in 2025.

The cell analysis market is an important industry in the biopharmaceutical sector. This industry deals with distributing cell analysis techniques and services to different end-users. There are various products and services in this industry that include reagents & consumables, instruments, accessories, software, and services. This industry comprises several techniques, such as flow cytometry, cell microarrays, microscopy, PCR, and others.

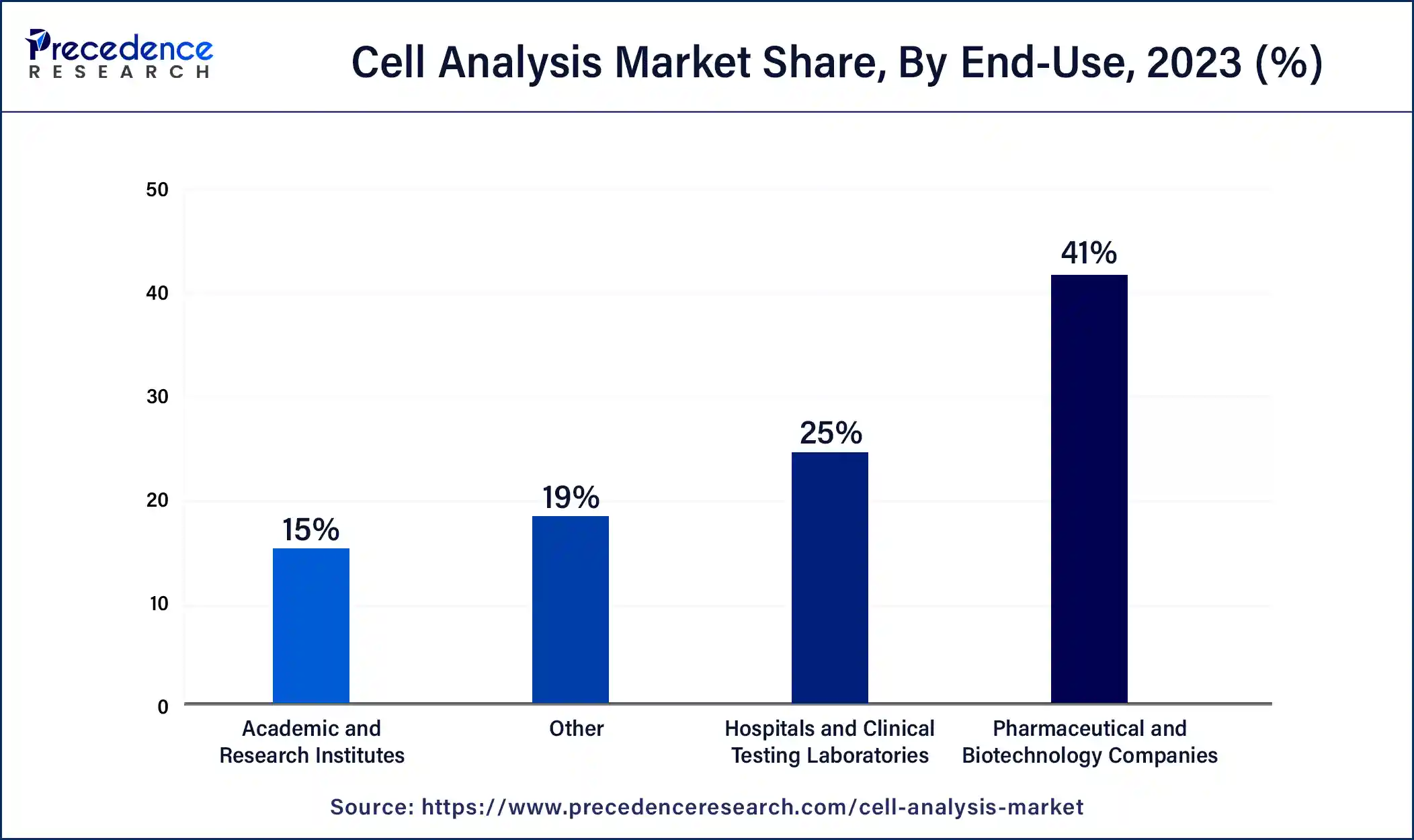

The processes used for cell analysis include cell identification, cell signaling pathways, cell interaction, cell structure study, single-cell analysis, and others. The end-users of this market include pharmaceutical & biotechnology companies, academic & research institutes, hospitals & clinical testing laboratories, and others. This industry is anticipated to grow significantly with the development of the biopharma industry.

How is AI changing the Cell Analysis Market?

The AI industry is developing rapidly with the advancements in modern science and technologies. The advancements in AI technology are crucial for the development of numerous industries. Nowadays, researchers have started using AI to develop novel therapies and cell analysis technology. AI plays an integral role in cell analysis by enhancing the capability of cell monitoring, cell movement, understanding cell morphology, and others. Thus, the integration of AI in the cell analysis market is changing the landscape of the market in a positive way.

Top 10 Biotechnology Companies

| Report Coverage | Details |

| Market Size by 2034 | USD 84.01 Billion |

| Market Size in 2023 | USD 30.01 Billion |

| Market Size in 2024 | USD 32.95 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.81% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product & Service, Technique, Process, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased prevalence of disease around the world

The cases of various chronic and acute diseases are rapidly increasing around the world. The prevalence of chronic diseases such as cancer, CVD, and some others is rising due to unhealthy food habits, genetic reasons, obesity, and others. Also, the prevalence of acute diseases such as pneumonia, asthma, appendicitis, and others has also grown significantly in various parts of the world. With the rising prevalence of diseases, the application of cell analysis increases for manufacturing therapies for treatment.

Complexity and high cost

The cell analysis industry faces different problems at present time. Some of the cell analysis platforms are very complex to operate and require experienced professionals for smooth processing. Also, the cost of various products required in cell analysis platforms is increasing rapidly. Both the above-mentioned factors are restraining the growth of the cell analysis market during the forecast period.

Research activities associated with SWAT cells to shape the future

The cell analysis market is developing rapidly due to scientific advancements in the field of medical sciences. Nowadays, researchers have increased their emphasis on SWAT cells to develop several novel therapeutics. The SWAT cells consist of various benefits, including flexibility, multipotency, adiponectin secretion, hormone response, and some others. Thus, the rising emphasis on research related to SWAT cells is projected to change the landscape of the industry in the near future.

The reagents & consumables segment held the dominant share of the cell analysis market in 2023. The demand for reagents and consumables has increased with the rise in the number of scientific laboratories around the world. Also, the growing use of cellular kits and reagents for cellular imaging applications such as fluorescence microscopy, HCS, IHC, ISH, LCM, and others has contributed positively to the market. Moreover, the advancements in cell analysis reagents such as cell dissociation, cell counting, and viability assays will help the industry in a positive way.

The service segment is anticipated to grow with the highest CAGR during the forecast period. The rising application of cell analysis services in research centers and laboratories is prominent for industrial growth. Also, the demand for cell analysis services has increased from the biopharmaceutical sector for discovering novel cell-based therapeutics. Moreover, the increase in the number of CROs around the world that are providing a variety of cell analysis services at affordable prices is integral to the development of the industry.

The flow cytometry segment dominated the cell analysis market in 2023. The demand for flow cytometry has increased for large sample analysis and cell identification. Also, the application of flow cytometry in analyzing phenotypic sequences, along with its several benefits, such as automation, speed, and objectivity, has contributed to industrial growth.

The high-content screening segment is expected to grow with the highest CAGR during the forecast period. The advancements in technologies such as AI and Machine learning that are related to medical fields are integral for high content screening. Also, the growing application of high-content screening in drug discovery and biological research has increased the interest of pharmaceutical companies. Moreover, the rising development of high-content screening systems for identifying microsubstances such as peptides, small molecules, RNAi, and others is crucial for the biotechnology industry.

The cell identification segment led the cell analysis market in 2023. The rising application of the cell identification process in the biopharma industry for drug discovery and the manufacturing of novel therapies is prominent for market growth. Also, the growing usage of cell identification for diagnosing cancer, immunological disorders, stem cells, and others has gained the utmost attention from the healthcare sector.

The single-cell analysis segment is assumed to grow with the highest CAGR during the forecast period. The demand for the single-cell analysis process has increased due to its capacity to interrogate heterogeneous cells. Also, the rising application of single-cell analysis processes in biotech research institutes & pharma industry for drug development and bioinformatic analysis boosts the market growth. Moreover, the use of single cells in detecting cancerous tissues in humans contributes to industrial growth.

The pharmaceutical and biotechnology companies segment held the largest share of the cell analysis market in 2023. The rising developments in the pharmaceutical industry around the world, along with several government initiatives for strengthening the biotech sector, are crucial for market growth. Also, the growing application of cell analysis in the pharmaceutical industry for drug discovery and manufacturing novel therapeutics is an important driving factor of this market. Moreover, the upsurge in demand for cell analysis in the biotechnology sector to perform clinical applications and identify phenotypes of different organisms has propelled industrial development.

The hospitals and clinical testing laboratories segment is likely to grow with the highest CAGR during the forecast period. The rising developments in hospital infrastructure across the world due to government funding and private investment are integral for cell analysis market growth. Also, the growing application of cell analysis in clinical testing and hospitals for diagnosing chronic diseases has contributed to the growth of the market. Moreover, the market benefits from the advancements in technologies associated with cell analysis, along with the increasing use of cell analysis systems and services in hospitals and clinics.

Segments Covered in the Report

By Product & Service

By Technique

By Process

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025