February 2025

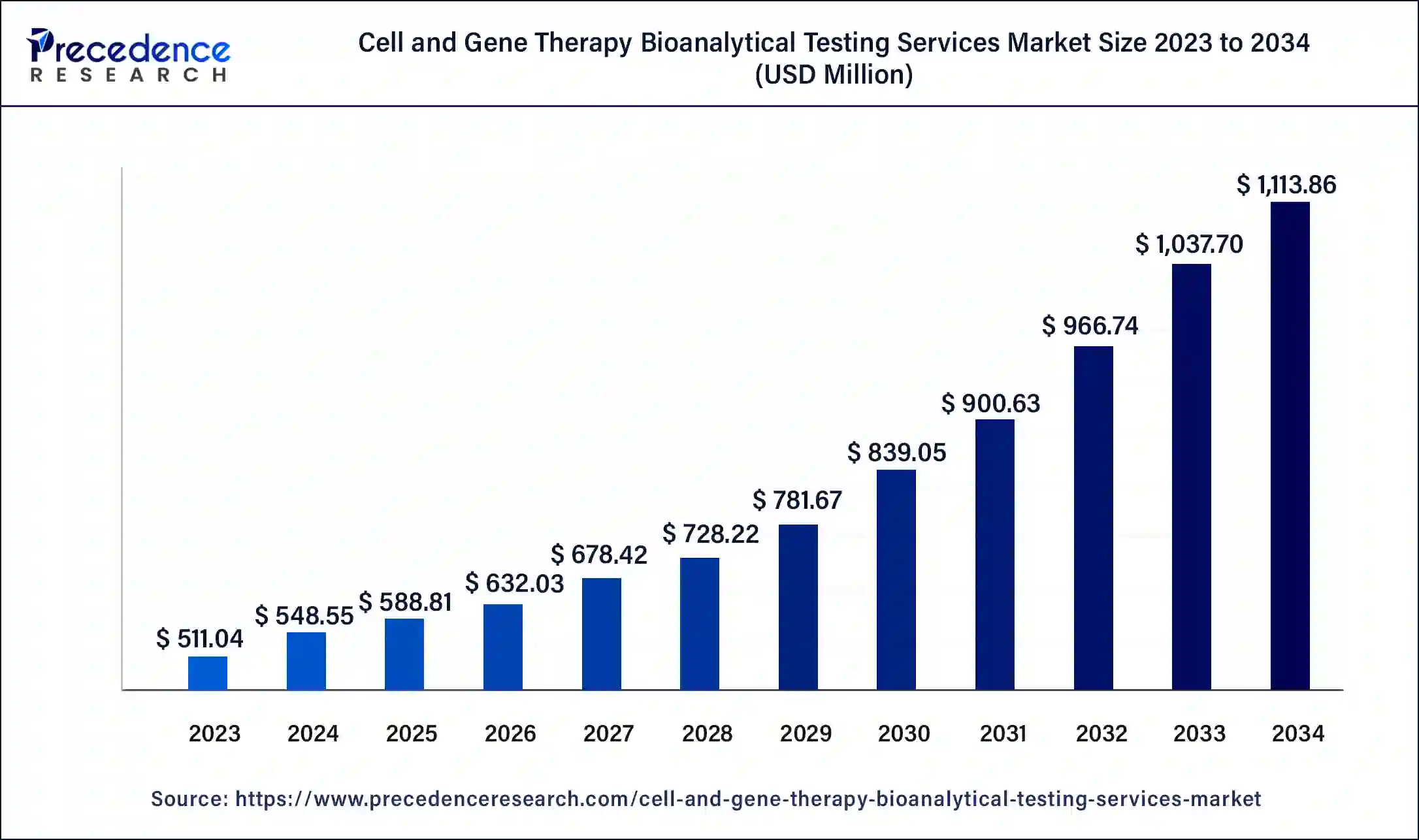

The global cell and gene therapy bioanalytical testing services market size was USD 511.04 million in 2023, calculated at USD 548.55 million in 2024 and is expected to be worth around USD 1,113.86 million by 2034. The market is projected to expand at a solid CAGR of 7.34% from 2024 to 2034.

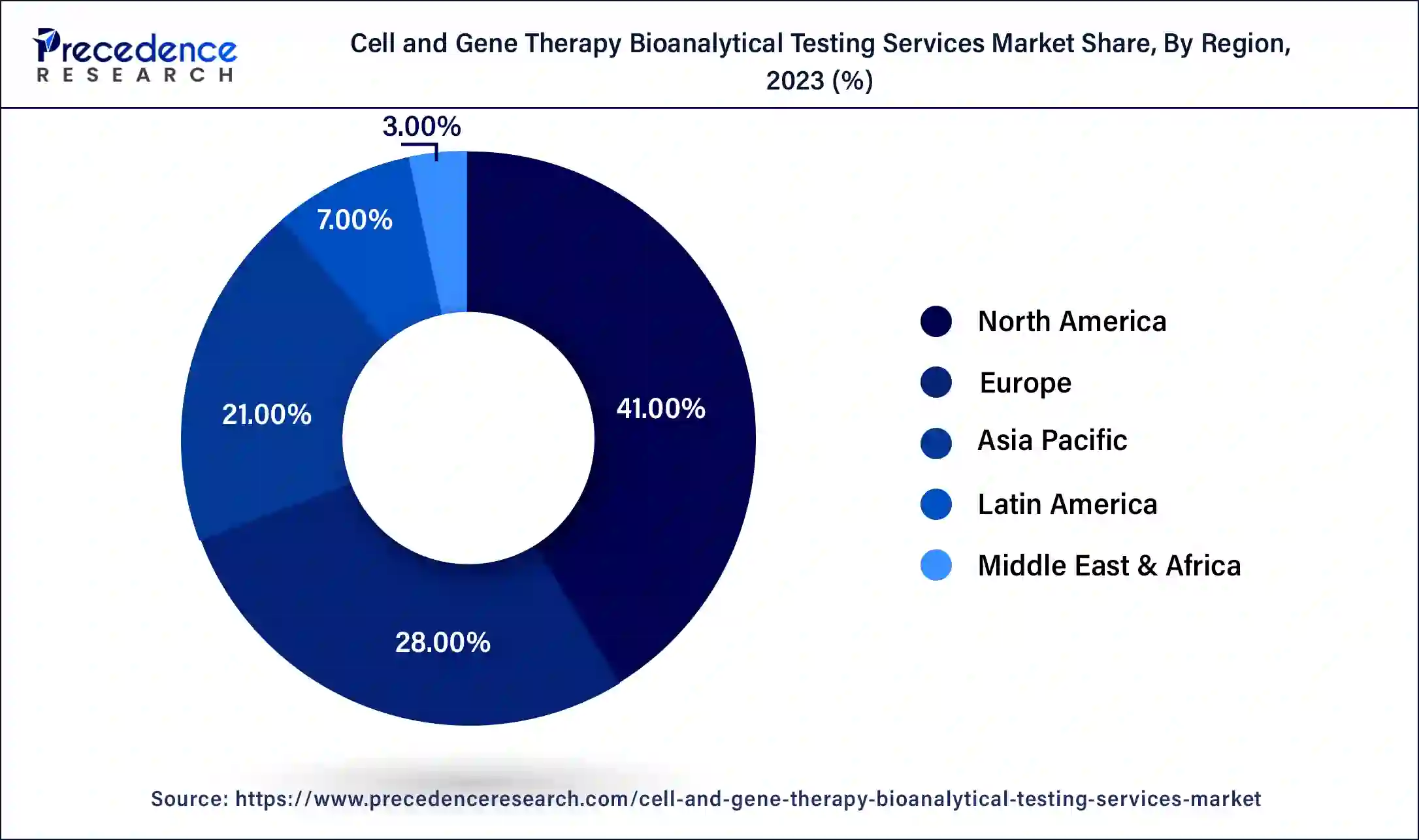

The global cell and gene therapy bioanalytical testing services market size is projected to reach around USD 1,113.86 million in 2034 from USD 548.55 million in 2024, at a CAGR of 7.34% between 2024 and 2034. The North America cell and gene therapy bioanalytical testing services market size reached USD 209.53 million in 2023.

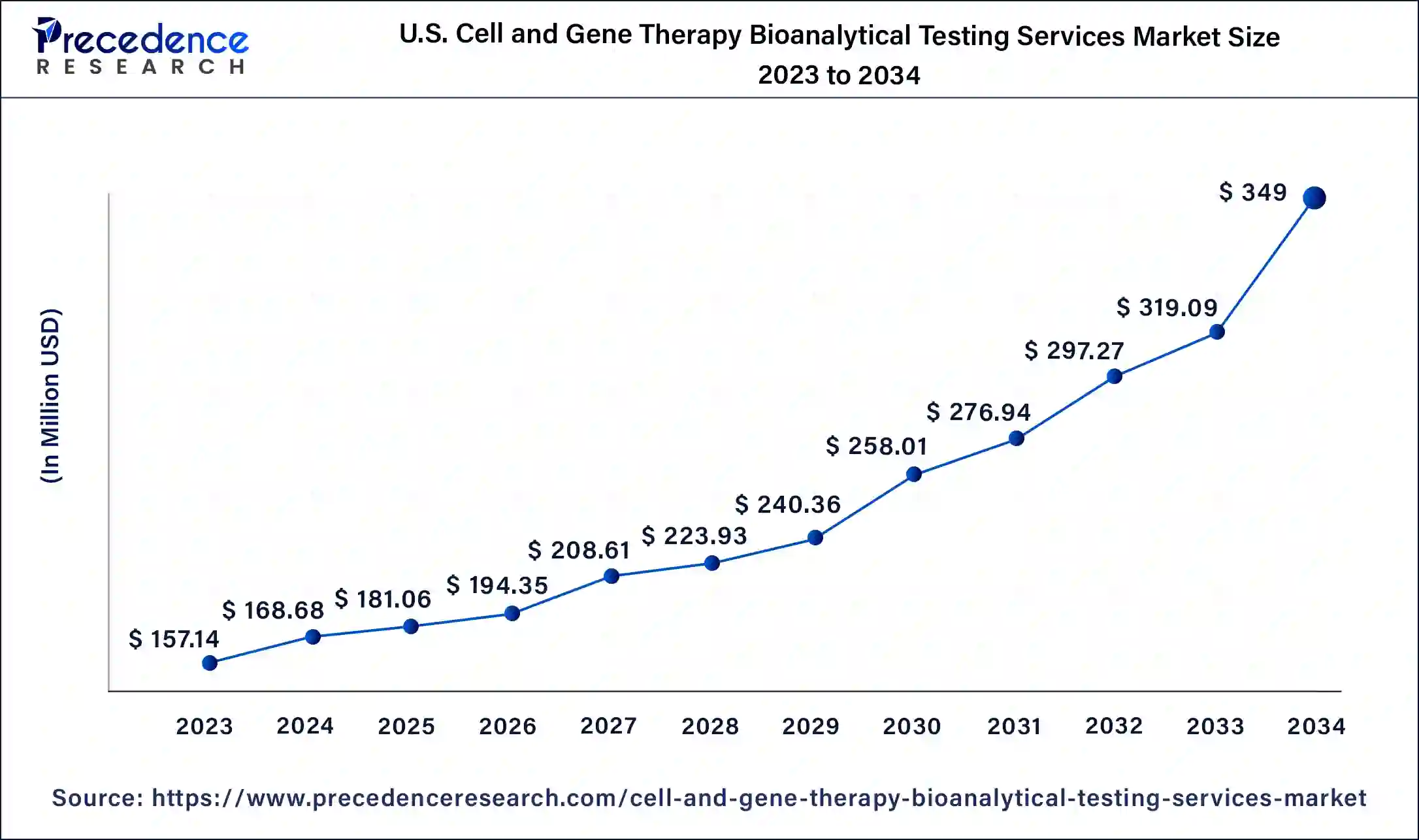

The U.S. cell and gene therapy bioanalytical testing services market size was exhibited at USD 157.14 million in 2023 and is projected to be worth around USD 349 million by 2034, poised to grow at a CAGR of 7.52% from 2024 to 2034.

North America held the dominant share of the cell and gene therapy bioanalytical testing services market in 2023. The region is observed to witness prolific growth during the forecast period. Several factors accelerate the growth of the market in the North American region. This region is the home to numerous biotech companies involved in the process of developing and commercializing cell and gene therapies. The region has also been an early adopter of advanced medical therapies, including cell and gene therapies. Renowned universities, medical centers, and research institutions in the region are aggressively working to be at the forefront of cell and gene therapy research. The surge in research activities is boosting the demand for bioanalytical testing services to support preclinical and clinical studies.

The United States is the major contributor to the market and has a sophisticated and vibrant biotechnology industry. Regulatory bodies such as the U.S. FDA have created regulatory pathways for cell and gene therapies. Cell & gene therapy is gaining rapid popularity for several diseases, including heart disease, cancer, cystic fibrosis, hemophilia A, sickle cell disease, and others. CAR T-cell therapy is one of the most prevalent types among developed genetically modified cell therapies and represents 52 percent of the pipeline.

Per Evaluate, CGT made up 10% of all U.S. FDA novel approvals in 2023, up from 7% and 6% in 2022 and 2021, respectively. With the rise in approvals, such as the first CRISPR-based therapeutic approved for marketing in the U.S.

Asia Pacific is observed to expand notably in the cell & gene therapy bioanalytical testing services market during the forecast period. The market is experiencing remarkable economic growth, which results in significant investment in sophisticated healthcare infrastructure and improvement in research activities. The rise in the number of clinical trials for cell and gene therapies is conducted in the Asia Pacific region, which increases the need for extensive bioanalytical testing to assess efficacy and safety and comply with regulatory guidelines.

Developing nations such as India, China, Singapore, South Korea, and Japan are emerging as hubs for pioneering research. The rise in investments from governments and private institutions has helped in the establishment of state-of-the-art facilities and the rapid adoption of groundbreaking technologies. The regulatory improvements offer a predictable environment for testing services and commercialization. Such factors are propelling the region’s market revenue.

Bioanalytical testing refers to the process of identifying and quantifying drugs and metabolites within several biological matrices, including plasma, blood, cerebrospinal fluid, urine serum, and saliva. These tests are generally carried out in pathological labs, diagnostic centers, and research laboratories. They are conducted during the development of drugs and also assist in the drug’s commercialization. Cell and gene treatments are highly preferred in treating autoimmune illnesses, cancer, genetic diseases, and other health conditions. Cell & gene therapy bioanalytical testing services involve robust analysis and evaluation of cellular and genetic therapies to ensure efficacy, safety, and quality. Bioanalytical testing services comply with stringent regulatory guidelines to guarantee the integrity and consistency of results.

| Report Coverage | Details |

| Market Size by 2034 | USD 1113.86 Million |

| Market Size in 2023 | USD 511.04 Million |

| Market Size in 2024 | USD 548.55 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.34% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Test Type, Product Type, Stage of Development by Product Type, Indication, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of chronic disorders

The increasing incidence of chronic disorders is anticipated to boost the growth of the cell & gene therapy bioanalytical testing services market during the forecast period. The market has witnessed a high burden of chronic diseases, which increases the demand for cell & gene therapies. Cell and gene therapies are gaining significant popularity for the effective treatment of cancer, rheumatoid arthritis, diabetes, Parkinson's disease, Alzheimer's disease, rare diseases, autoimmune diseases, and other chronic disorders. In recent years, these therapies have shown remarkable results in patients' clinical conditions, owing to the numerous cell and gene therapy drug candidates in the pipeline. Therefore, strengthening the pathways for cell and gene therapies boosts the expansion of the market during the forecast period.

Lack of standardization

The lack of standardization is expected to slow down the growth of the cell and gene therapy bioanalytical testing services market. Cell and gene therapies are complex and involve intricate cellular and genetic modifications. This complexity can lead to challenges in developing accurate and standardized testing methods. Regulatory bodies require rigorous testing to ensure the quality, efficacy, and safety of cell and gene therapies. Meeting these strict regulatory standards takes time. Moreover, the scarcity of skilled professionals with expertise in diverse scientific fields in middle and lower-income countries may limit the global market's expansion.

Increasing investment in cell and gene therapies

The significant rise in investment in cell and gene therapies is projected to offer significant growth opportunities to the cell & gene therapy bioanalytical testing services market in the coming years. Several private and government organizations are aggressively investing in cell and gene therapy-based research. These therapies are developed by research institutions and academic and biopharma companies and have progressed from preclinical research to being evaluated in patients in clinical settings. Cell and gene therapies are a wide group of medicines, such as cell-based immunotherapies, gene therapies, cell therapies, and tissue-engineered products for treating chronic disorders.

Additionally, Regulatory agencies such as the FDA (Food and Drug Administration) and EMA (European Medicines Agency) mandate strict requirements for the approval of cell and gene therapies. Bioanalytical testing services are important for demonstrating product safety, efficacy, and quality, as well as ensuring compliance with the regulatory framework. They necessitate rigorous testing to identify adverse effects, potential risks, and toxicity associated with cell and gene therapies. Such factors are driving the cell & gene therapy bioanalytical testing services market.

According to the IQVIA report in March 2024

The bioavailability & bioequivalence studies segment accounted for the dominating share of the cell & gene therapy bioanalytical testing services market in the year 2023 and is projected to continue its dominance over the forecast period. Bioavailability & bioequivalence studies are typically conducted for drug development. This test verifies the safety and efficacy of the drug during all stages of the trials. A surge in the number of biosimilar versions of cell & gene drugs entering the pipeline increases the demand for bioequivalence studies in the market. As biopharma companies strive for quality assurance and regulatory compliance, the demand for these tests continues to increase and boost the growth of the segment.

The pharmacokinetics segment is expected to witness considerable growth in the global cell & gene therapy bioanalytical testing services market over the forecast period. Pharmacokinetics is the study of the duration of the absorption, distribution, metabolism, and excretion (ADME) of a drug after its administration to the body. This study plays a crucial part in drug development, and it aids in identifying the drug's safety and efficacy in the body. Therefore, the rise in the pipeline of cell & gene products is expected to spur the demand for pharmacokinetics services during the forecast period.

The cell therapy segment held the largest share of the cell & gene therapy bioanalytical testing services market in 2023 and is expected to sustain its position throughout the forecast period. Cell therapy involves the transplantation of cells to replace or repair damaged cells or tissue for therapeutic purposes. The cells that will be transplanted into a patient depend on the situation and treatment. Cells can be autologous or allogeneic. Cell therapy is highly effective for the treatment of various diseases, such as cancers, autoimmune diseases, neurological disorders, and urinary problems, rebuilding damaged cartilage in joints, repairing spinal cord injuries, and other infectious diseases. A rise in the number of clinical research studies conducted in cell therapy increases the need for cell & gene therapy bioanalytical testing services across the globe and is expected to boost the growth of the segment.

The gene-modified cell therapy segment is expected to grow significantly in the cell & gene therapy bioanalytical testing services market during the forecast period. Gene-modified cell therapy includes CAR-NK cell therapy, CAR T-cell therapies, TCR-T cell therapy, and others. In recent years, CAR T-cell therapies have gained immense popularity as they are considered very effective against various types of cancer. CAR T cell therapy has shown tremendous results in the treatment of Lymphoma and Leukemia. The continuous advancements in genetic engineering fuel innovation in this field, thus propelling the growth of the gene-modified cell therapy segment in the coming years.

The non-clinical segment held the dominating share of the cell & gene therapy bioanalytical testing services market in 2023 owing to the robust pipeline of cell and gene therapeutics in the non-clinical developmental stage. Pharmaceutical firms prioritize safety, quality, and efficacy in drug development. Moreover, the rising demand among researchers for transitioning the therapy into the clinical stage is accelerating the demand for non-clinical bioanalytical testing services.

The clinical segment is expected to grow at a notable rate in the cell & gene therapy bioanalytical testing services market during the forecast period. Clinical stages play an integral role in the development of new drugs and in determining their safety, efficacy, and optimal dosage forms before they are approved for patient use. During the clinical phase, human samples of plasma, urine, and serum are used for bioanalytical testing and provide researchers with useful insights into drug safety. Moreover, with the stringent regulatory standards, the demand for clinical trial services is anticipated to increase, driving the expansion of the segment.

The oncology segment held the largest share of the cell & gene therapy bioanalytical testing services market in 2023. The rapid growth of the segment is attributed to the rising burden of cancer globally, which increases the demand for cancer treatment. Cell and gene therapies represent a remarkable approach to cancer treatment. These therapies work by changing the DNA of a patient's existing cells, giving those cells new instructions that can assist in detecting and fighting against cancer. With the surge in cancer cases globally, there is an increasing demand for innovative and effective treatment options. Therefore, the oncology segment is anticipated to maintain its growth rate in the market.

The rare diseases segment is expected to grow at the fastest rate in the cell & gene therapy bioanalytical testing services market during the forecast period owing to the significant progress in cell and gene therapy, including targeted and personalized treatment modalities for several incurable health conditions. Cell and gene therapies have shown remarkable efficacy in addressing clinical indications associated with rare diseases. These therapies have demonstrated promising results for patients with life-threatening rare diseases by targeting the underlying cause of the condition. As the research continues to expand in this field, more therapies are likely to advance through clinical trials. Thereby driving the segment’s growth.

Segments Covered in the Report

By Test Type

By Product Type

By Stage of Development by Product Type

By Indication

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025