January 2025

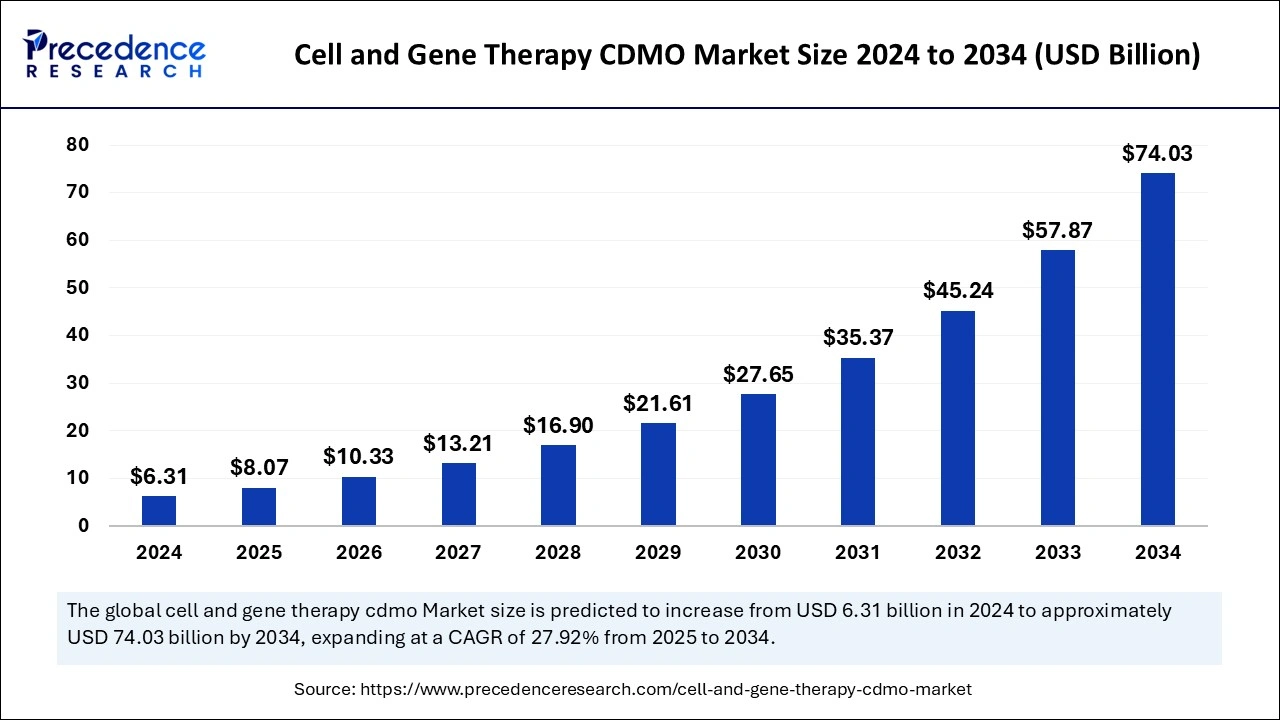

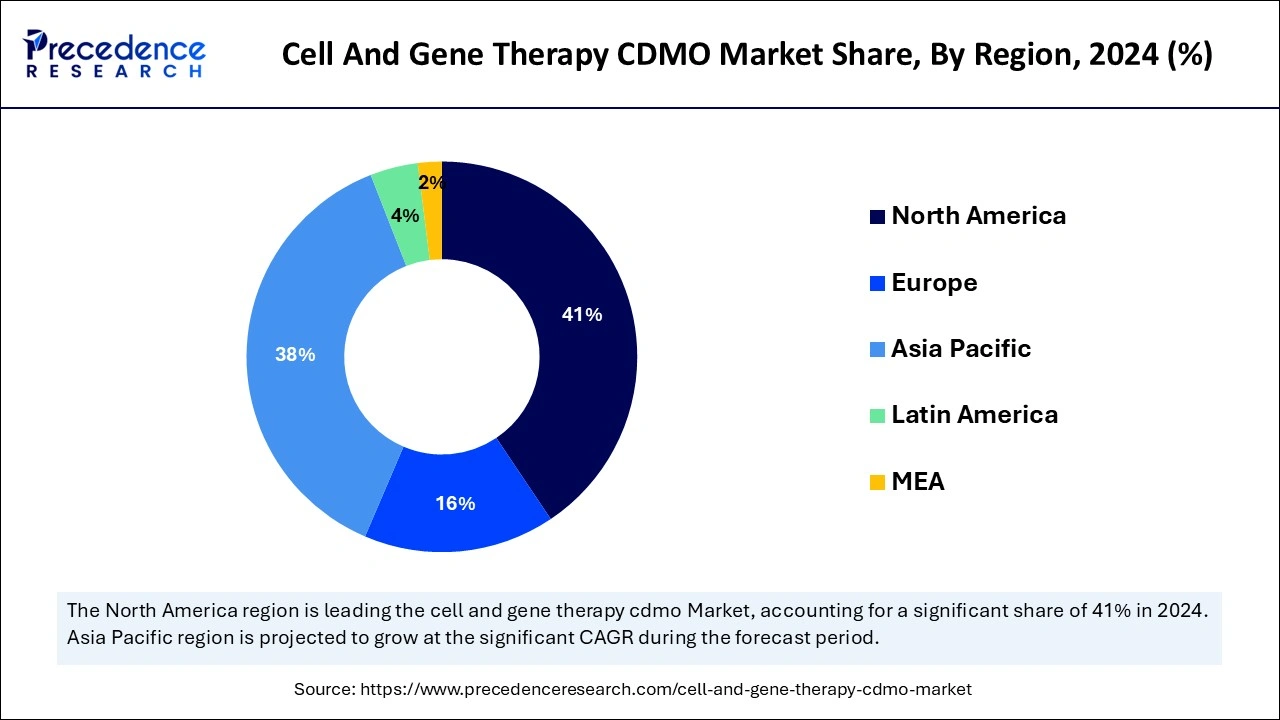

The global cell and gene therapy CDMO market size accounted for USD 8.07 billion in 2025 and is forecasted to hit around USD 74.03 billion by 2034, representing a CAGR of 27.92% from 2025 to 2034. The North America market size was estimated at USD 2.59 billion in 2024 and is expanding at a CAGR of 28.05% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell and gene therapy CDMO market size was estimated at USD 6.31 billion in 2024 and is predicted to increase from USD 8.07 billion in 2025 to approximately USD 74.03 billion by 2034, expanding at a CAGR of 27.92% from 2025 to 2034. The rising demand to put specialized expertise, facilities, and regulatory knowledge into developing and manufacturing cell and gene therapy is fueling the CDMO market for cell and gene therapy.

Integration of artificial intelligence into the cell and gene therapy CDMO market has significantly enhanced the development and manufacturing process by optimizing cell selection, predicting treatment results, analyzing large datasets to identify potential issues, and improving overall efficiency with the help of automated decision-making. AI delivers a great level of efficiency in cell and gene therapy manufacturing and offers more patients to benefit from vital treatments. Furthermore, AI facilitates the development of novel therapies throughout the research and development value chain in various stages, including target identification, payload design, and many more.

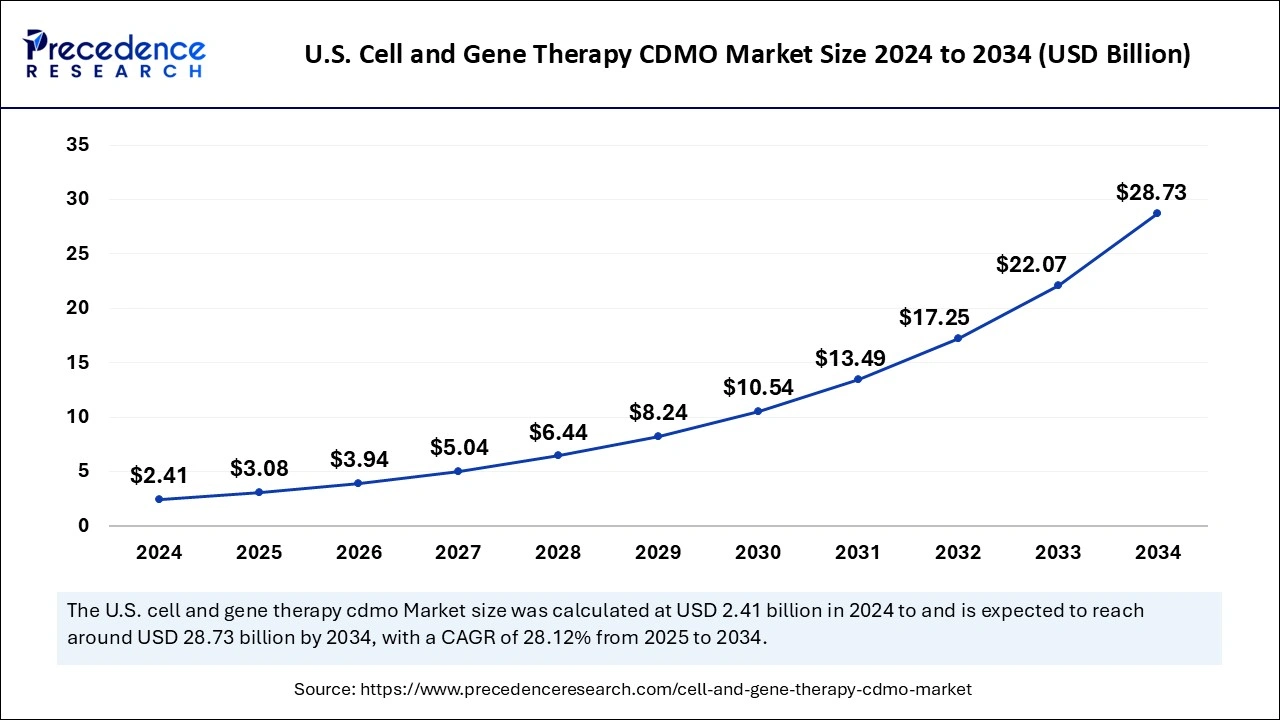

The U.S. cell and gene therapy CDMO market size was exhibited at USD 2.41 billion in 2024 and is projected to be worth around USD 28.73 billion by 2034, growing at a CAGR of 28.12% from 2025 to 2034.

North America accounted for the largest cell and gene therapy CDMO market share in 2024. The dominance of this region is experienced due to several factors, one of them is the expanding geographical reach. North America holds the largest market share due to its established healthcare infrastructure, high research and development investment, and supportive regulatory landscapes.

The region also has high adoption of cell and gene therapies, credited to its advanced technologies. The support from the regulatory environment in North America encourages innovation and development in cell and gene therapies.

Asia Pacific is projected to host the fastest-growing cell and gene therapy CDMO market in the coming years due to the rise in clinical trials for cell and gene therapies, driven by increasing patient needs for advanced treatment, growing government support, and an ascending ecosystem of innovation. This expansion is particularly observed in countries such as China with high cancer incidence, which leads to a strong push towards new treatment approaches. The government and regulatory support for CGT trials, in conjunction with increasing investment in products to get into the market.

Cell and gene therapy is a treatment that utilizes cells or genetic material to treat disease. CGT has the potential to treat the underlying cause of the disease, treat symptoms, and stop the progression of the disease. CDMO assists in providing specialized expertise and facilities to manufacture therapeutic products, which includes process development, clinical trial products, and scaling up to commercial manufacturing. This ensures high quality and adheres to strict regulatory compliance. 90% of biotech companies rely on contract development and manufacturer organization in the early stage and commercial launch of the product.

| Report Coverage | Details |

| Market Size by 2034 | USD 74.03 Billion |

| Market Size in 2025 | USD 8.07 Billion |

| Market Size in 2024 | USD 6.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered and Regions | Phase, Product Type, Indication, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Clinical trial for innovative Therapies

Cell and gene therapy (CGT) is rapidly expanding and evolving in healthcare through using living cells and genetic modification to treat disease. The cell and gene therapy CDMO market helps drug developers to successfully prepare for the execution of clinical trials in numerous ways. Presently, there are over 5,000 gene therapy trials listed in the National Institute of Health. The CDMO produces material for clinical trials, and if successful, it also assists in commercial manufacturing. Furthermore, CDMOs provide continuous monitoring and optimization of the manufacturing process, which ensures consistent product quality and meets the demands.

High manufacturing complexities

The cell and gene therapy CDMO market faces a challenge with manufacturing complexities due to the inherent nature of therapies, which involve live cells, viral vectors, and individual treatment plans. The successful achievement of all this requires specialized expertise, stringent quality control, and adequate equipment. Manufacturing complexities contribute to increasing the production cost of approved gene therapy for patients.

Access to specialized facilities and technologies

The cell and gene therapy CDMO market is expected to receive hefty investment in the coming years for specialized facilities and technologies, which will be essential tools for the development and manufacturing of the therapies. Partnering with a CDMO can give access to several resources. The next five years are anticipated to be a critical period for the adoption of a combination of technological advances, strategic partnerships, and a major shift toward drug discovery. There will be noticeable capacity constraints, but despite that, the executives are expecting a lot more potential application for cell and gene therapies for relatively common conditions such as Parkinson’s disease, where CDMO creates larger development and manufacturing facilities.

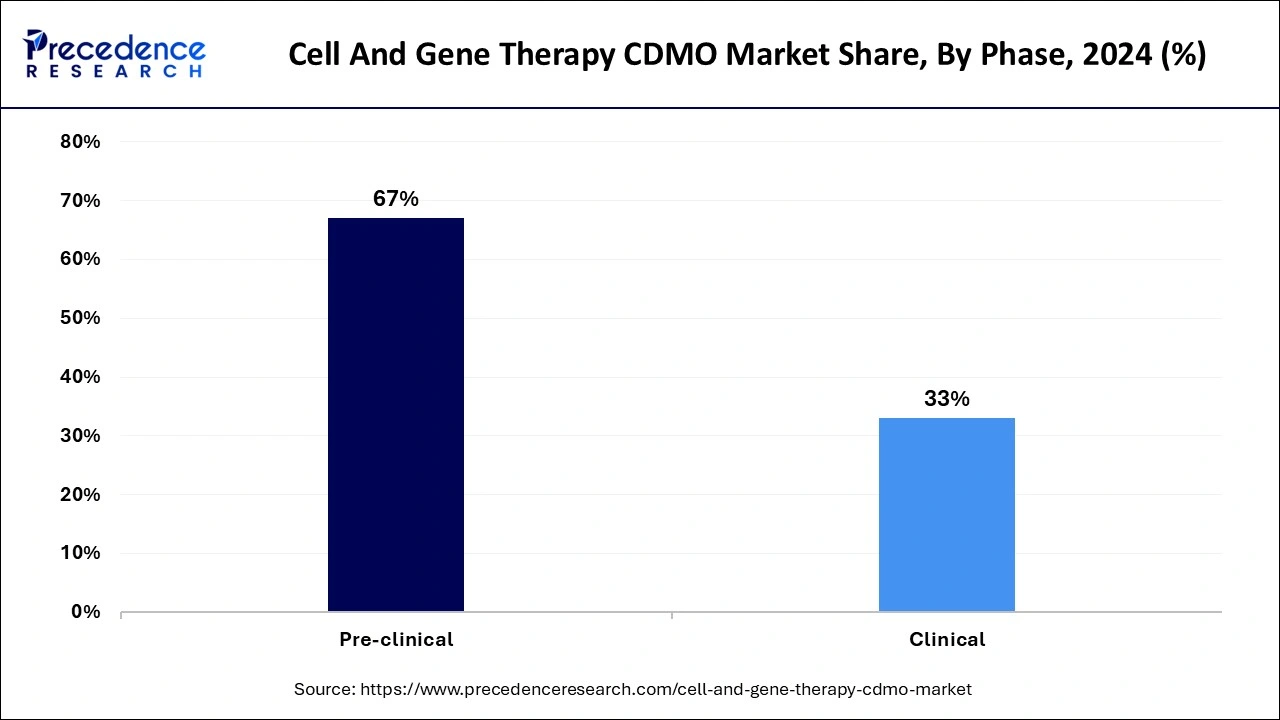

The pre-clinical segment held the largest share of the market in 2024. The major factor behind the dominance of the segment stands as the pre-clinical phase carries significant application in the research and development stage before the clinical trial. This stage is crucial for developing safe and effective treatment by addressing challenges such as vector design, delivery methods, cell manipulation, and potential side effects. The rising emphasis on investigational drug discoveries across the research sector is observed to sustain the segment’s position in the market.

The clinical segment is observed to grow at the fastest rate in the cell and gene therapy CDMO market during the forecast period. The growth of the segment is observed due to the evaluation conducted, which ensures the safety and efficacy of treating a specific disease. This also ensures that the regulatory standards for potential market approval are met. The clinical phase is a stage where the manufactured cell and gene therapy products are used in human clinical trials, consisting of all phases of testing – Phases 1, 2, and 3. The CDMO facilitates the production of high-grade therapy that is ready for administration to patients.

The cell therapy segment accounted for a considerable share of the cell and gene therapy CDMO market in 2024. Cell therapy is demanding as it offers a potential treatment option for diseases that have limited therapeutic options. This utilizes the body’s cells to repair damaged tissue, replace malfunctioning cells, and enhance the immune system. Some of the cells that may be utilized include hematopoietic (blood-forming) stem cells (HSC), mesenchymal stem cells, skeletal muscle stem cells, lymphocytes, pancreatic islet cells, and dendritic cells. Research is evolving with various cell types for the development of treatments as novel cell therapies and studies for potential application.

The gene-modified cell therapy segment is anticipated to grow with the highest CAGR during the studied years. Gene-modified cell therapy holds the potential to treat a wide range of diseases by directly manipulating a patient’s own cells to correct genetic defects. This approach aims towards fixing the faulty gene or replacing it with a healthy gene. It helps cure disease and makes the body better capable of fighting it. Car T-cell is an advancement towards cancer treatment by harnessing the patient’s own immune system to destroy cancer cells.

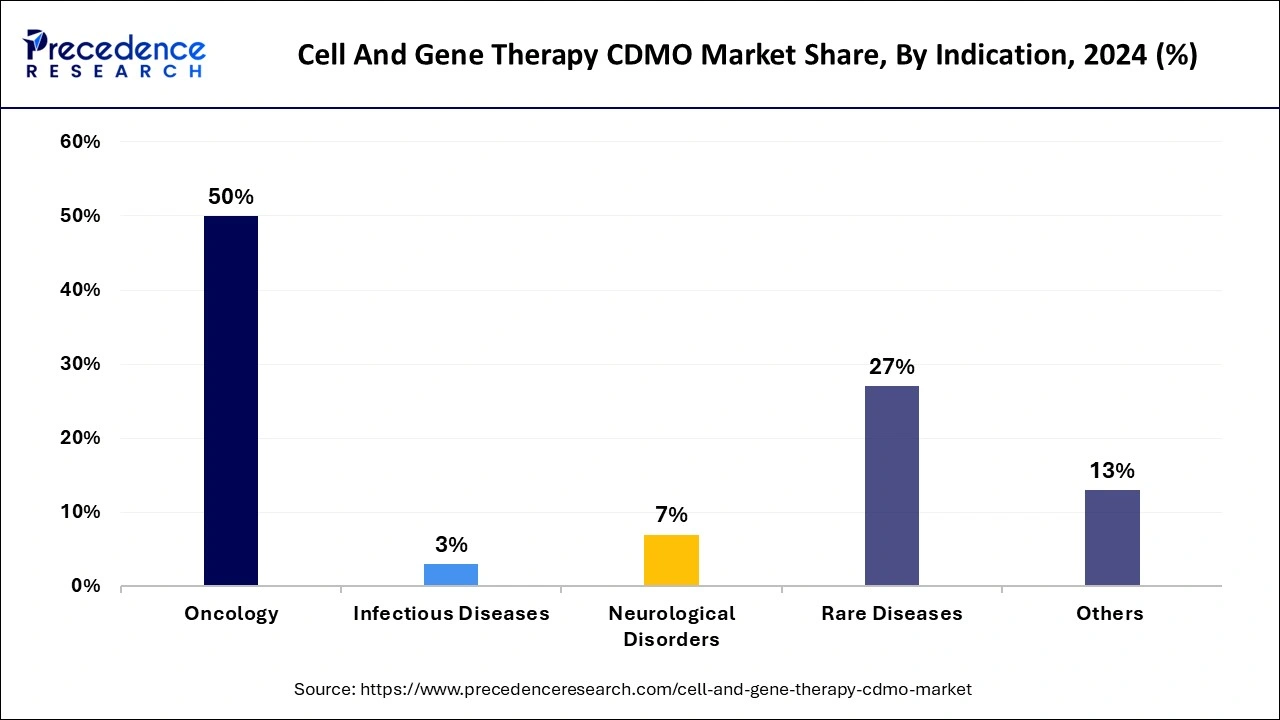

The oncology segment held a dominant presence in the cell and gene therapy CDMO market in 2024. The dominance is credited to the innovative program focusing on clinical evaluation to help expedite the development of transformative cancer therapies with modern technologies with curative potential. The therapeutic approach includes CAR-T cells, TCR-T cells, Tumor-Infiltrating lymphocytes, and Oncolytic virus therapy.

The rare diseases segment is expected to grow at the fastest rate over the forecast period of 2024 to 2034. The segment has a noticeable growth as it involves genetically modifying cells outside the body and then returning the cells back to the patient’s body. Diseases including blood disorders, inborn errors of immunity, and inherited blindness come under rare diseases. The Therapeutics for Rare and Neglected Diseases (TRND) is a program that helps develop treatments for rare diseases.

By Phase

By Product Type

By Indication

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025