October 2023

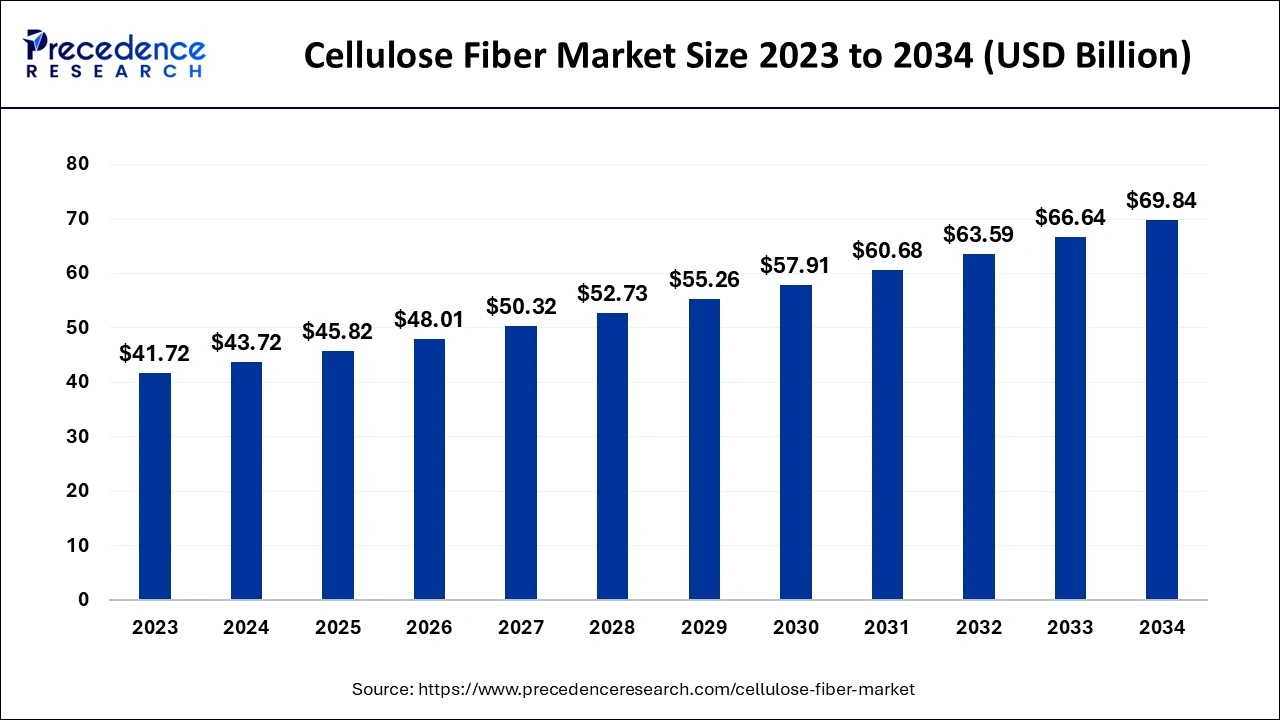

The global cellulose fiber market size accounted for USD 43.72 billion in 2024, grew to USD 45.82 billion in 2025 and is projected to surpass around USD 69.84 billion by 2034, representing a CAGR of 4.79% between 2024 and 2034. The Asia Pacific cellulose fiber market size is evaluated at USD 16.83 billion in 2024 and is projected to be worth around USD 26.89 billion by 2034, growing at a CAGR of 4.80% from 2024 to 2034.

The global cellulose fiber market size is calculated at USD 43.72 billion in 2024 and is anticipated to reach around USD 69.84 billion by 2034, expanding at a CAGR of 4.79% from 2024 to 2034. Increasing environmental concerns across industries is the key factor driving the growth of the market. Also, the rising demand for sustainably sourced material, along with the technological advancements in cellulose fiber production, can fuel market growth shortly.

Asia Pacific dominated the cellulose fiber market in 2023. The region's dominance is attributed to the well-established textile sectors, which are major consumers of cellulose fibers. Furthermore, Asia Pacific contains abundant resources that are crucial inputs for cellulose fiber manufacturing. In Asia Pacific, China leads the market by holding the largest market share. This is due to increasing demand from neighboring economies like India and Bangladesh.

North America held a significant share of the cellulose fiber market in 2023. The growth of the region can be linked to the increasing demand for fashion apparel created from biodegradable fibers. The region also has wide forestlands that offer a sustainable and robust supply of wood pulp, which is the key raw material for fiber production. However, increasing the domestic market for these products, especially in sectors like textiles, hygiene, and construction, is fuelling the cellulose fiber market growth in the region.

Cellulose fiber is a natural fiber extracted from cellulose, the key element of plant cell walls. Generally, it is obtained from wood pulp, but it can also be obtained from flax, cotton, and hemp. This fiber is known for its renewability, biodegradability, and environmental friendliness. Cellulose fiber can be used in textiles to design technical textiles that have a special purpose and involve physical properties. Future environmental issues have shifted toward more eco-friendly practices over the technological textile supply chain.

Biggest Textile Exporter Countries Statistics (2022)

| Country | Value of export in billions |

| China | $303 billion |

| Bangladesh | $57.7 billion |

| Vietnam | $48.8 billion |

| India | $41.1 billion |

| Germany | $40 billion |

| Italy | $36.71 billion |

| Turkey | $36.7 billion |

| US | $29.8 billion |

| Pakistan | $22.1 billion |

| Spain | $20.3 billion |

Impact of AI on Cellulose Fiber Market

Artificial Intelligence (AI) is increasingly revolutionizing the market by improving production quality and efficiency. AI-driven technologies are used to optimize production processes, reduce operational costs, and enhance supply chain management. Furthermore, the advancement in AI technology enables consumers to fulfill rising consumer demand and adapt to changing industry standards.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.84 Billion |

| Market Size in 2024 | USD 43.72 Billion |

| Market Size in 2025 | USD 45.82 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.79% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Demand in Textile Industry

The textile industry is a major driver of cellulose fibers, particularly in manufacturing fabrics like lyocell, rayon, and modal. The fashion industry's requirement for breathable, comfortable, and sustainable textiles has raised the utilization of cellulose fibers. Fashion labels also leverage cellulose fibers in their clothing lines, including Tencel. These fibers are convenient for performance and activewear textiles due to their breathability, softness, and moisture absorption properties.

Fluctuations in raw material prices

The fluctuating raw material prices have a significant negative impact on the growth of the cellulose fibers market. This, in turn, results in inconsistent prices, posing a big construed issue regarding market expansion. Moreover, changes in forestry methods, growing demand for wood pulp, and climate-related issues can negatively influence the overall supply chain of cellulose fiber.

Increasing awareness of biodegradability

The rising global awareness of environmental concerns, coupled with the increasing issues about the influence of non-biodegradable materials, creates substantial market opportunities. Furthermore, Consumers search for products with high biodegradability and less environmental footprints, which aligns with ongoing sustainability practices in the industry. Also, regulatory standards promoting eco-friendly practices encourage market players to utilize materials like cellulose fibers.

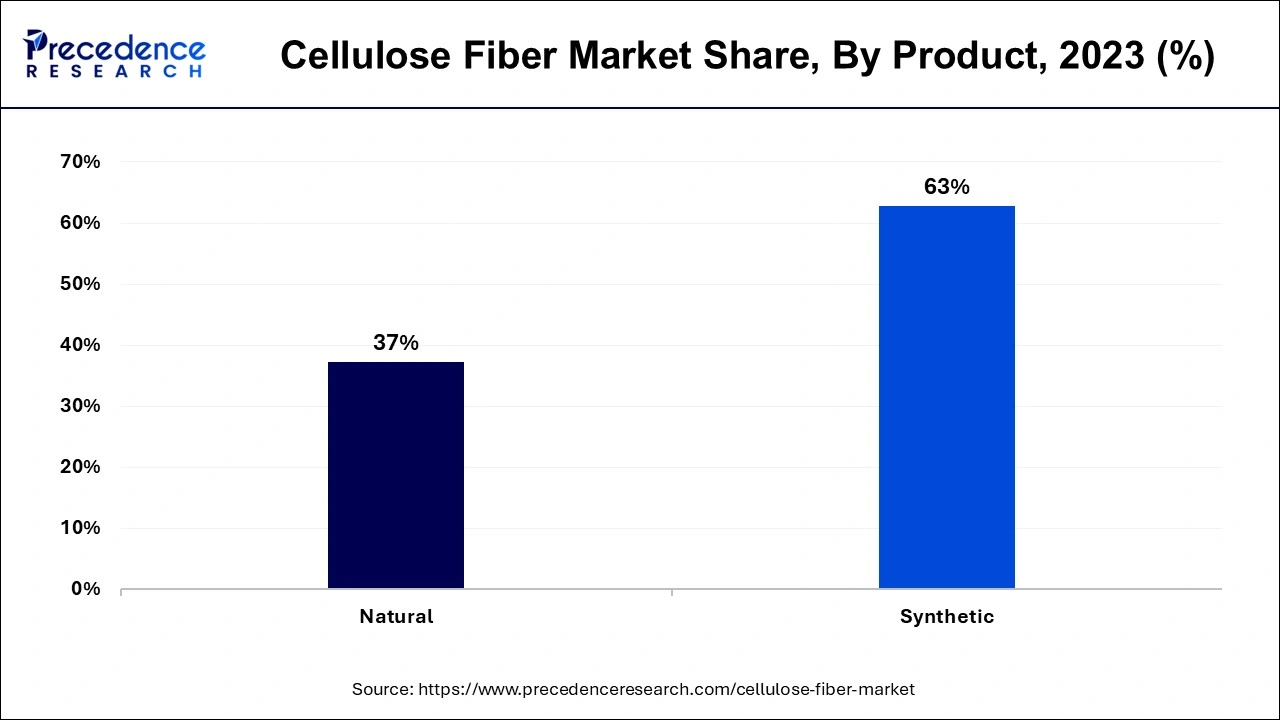

The synthetic products segment dominated the cellulose fiber market in 2023. The dominance of the segment can be attributed to the scalability, cost-effectiveness, and superior performance provided by artificial fibers. Synthetic fibers have numerous advantageous characteristics, such as elasticity, low absorbency, durability, and resistance to atmospheric factors when distinguished from natural fibers. Additionally, the manufacturing of synthetic fibers depends less on environmental conditions and location than on natural fibers.

The natural products segment is anticipated to grow at a significant rate in the cellulose fiber market over the projected period. The growth of the segment can be driven by the rising focus on eco-friendly and sustainable practices by end users. Natural fibers are soft to the touch which makes them suited for textiles. However, they promote renewable methods in different industries like construction and fashion. Also, the breathability, biodegradability, and sustainability of these fibers are of high importance.

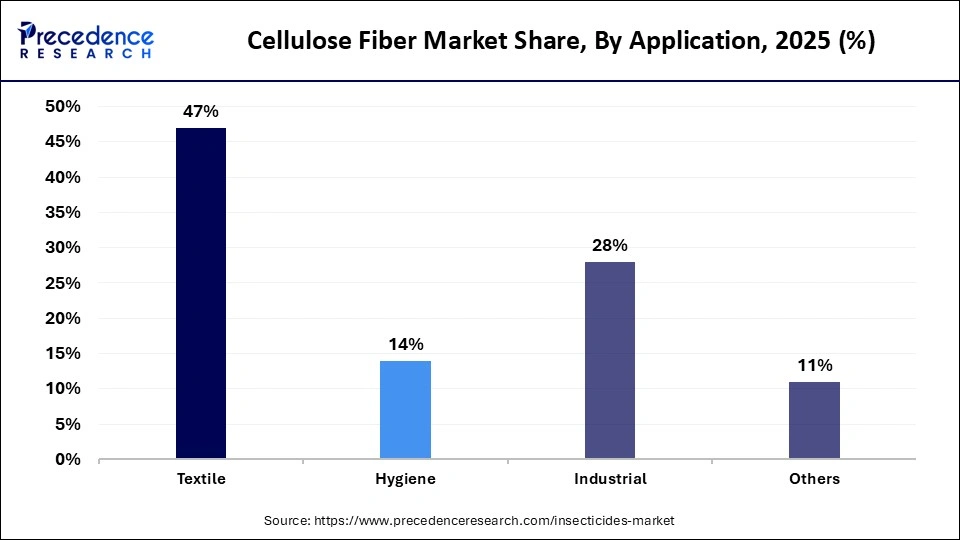

In 2023, the textile segment led the cellulose fiber market by holding the largest market share. The dominance of the segment can be credited to the wide consumer base offered by the textile industry to cellulose fibers, using them as a major raw material in the manufacturing of an extensive range of products, like home furnishings, apparel, and industrial textiles. Furthermore, these fibers are in demand because of their eco-friendly properties and natural feel, which contribute to comfortable and sustainable textile products ranging from high-end fashion to casual wear.

The industrial segment is expected to witness notable growth in the cellulose fiber market during the projected period. The growth of the segment can be credited to the development of cellulose fiber technology along with the sector's increasing demand for cellulose fibers. Cellulose fibers have unique physical properties, including absorbency, high strength, and biodegradability, which makes them important in applications ranging from filtration and paper production to construction and insulation.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2023

July 2024

May 2025

May 2025