January 2025

Ceramic Matrix Composites Market (By Product: Oxides, Silicon Carbide, Carbon, Others; By Application: Aerospace, Defense, Energy & Power, Electrical & Electronics, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

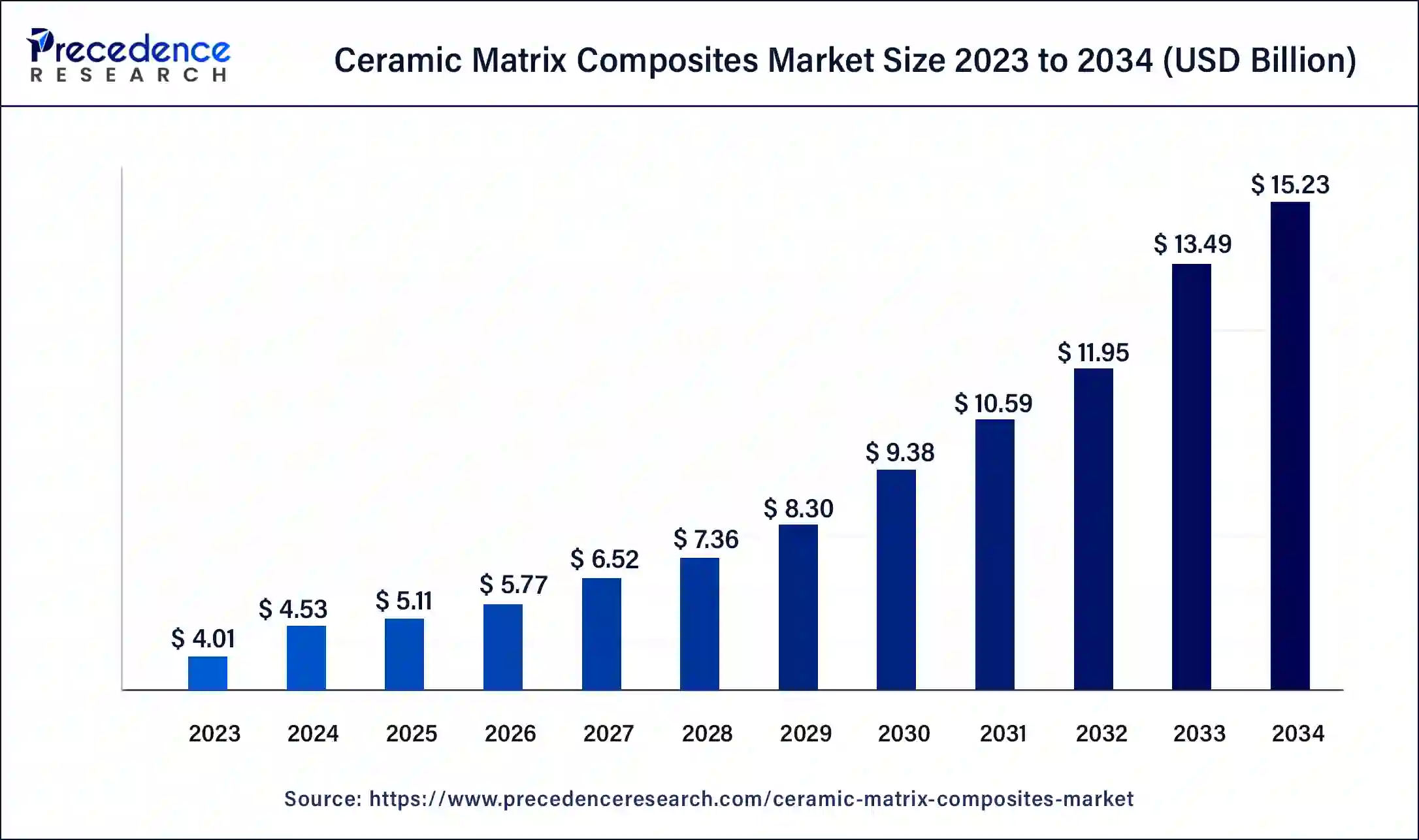

The global ceramic matrix composites market size was USD 4.01 billion in 2023, accounted for USD 4.53 billion in 2024, and is expected to reach around USD 15.23 billion by 2034, expanding at a CAGR of 12.9% from 2024 to 2034. The North America ceramic matrix composites market size reached USD 1.88 billion in 2023.

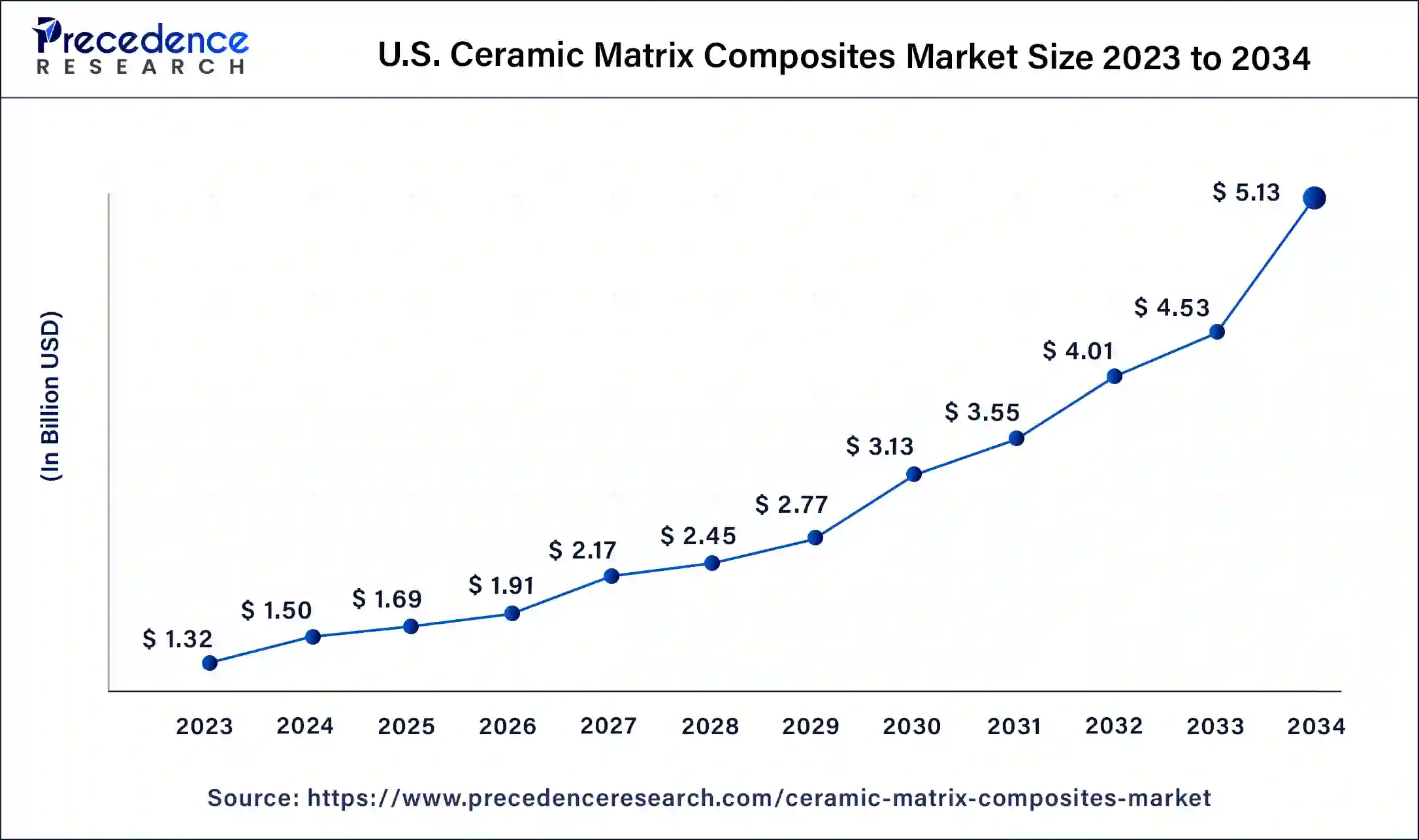

The U.S. ceramic matrix composites market size was estimated at USD 1.32 billion in 2023 and is predicted to be worth around USD 5.13 billion by 2034, at a CAGR of 13.1% from 2024 to 2034.

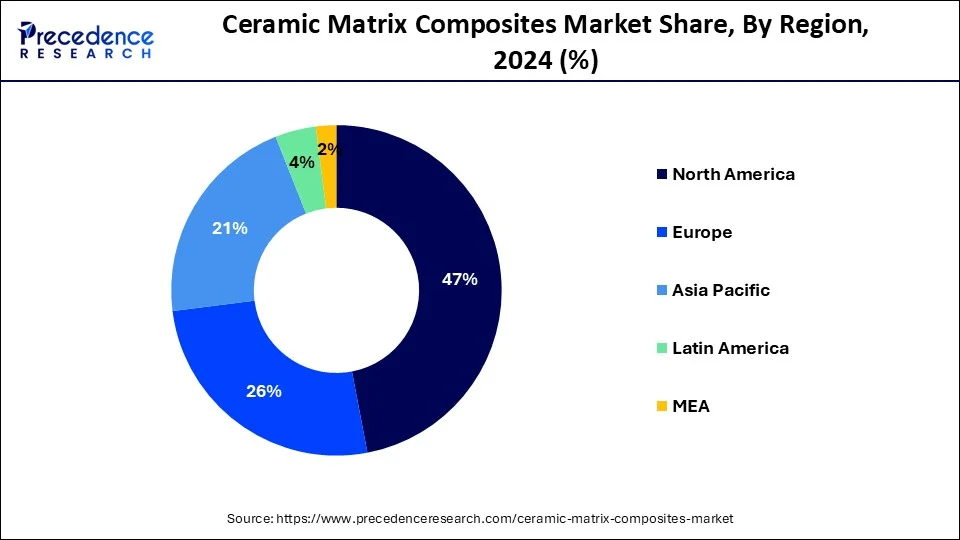

North America held the dominant share of the ceramic matrix composites market in 2023. The region is observed to witness prolific growth during the forecast period. The growth of the region is attributed to the presence of prominent aviation market players, increasing demand for ceramic matrix components for manufacturing aviation components, and increasing government investment in defense equipment. Moreover, the major demand for the ceramic matrix is driven by robust growth of the end-user industries such as aerospace, energy, defense, electrical & electronics, and others. Thereby dominating the market in the North American region.

The United States is the major contributor to the market owing to the rapid advancement in technology across various sectors. The country has the largest aerospace & defense industry in the world and is also one of the largest exporters of commercial aircraft.

Asia Pacific is observed to expand at a rapid pace during the forecast period. The rapid pace of industrialization, increasing government investment in the defense sector, and increasing demand for fuel-efficient aircraft engines are likely to propel the market’s growth to reduce operational costs. Additionally, the adoption of technology led to a surge in aerospace production, which is anticipated to fuel the demand for ceramic matrix composites in the region. Moreover, governments in countries such as China and India support the production of materials with various incentives for manufacturers.

The behavior of ceramic matrix composites (CMCs) differs from that of traditional ceramics. Even in hot conditions, CMCs can maintain a comparatively high mechanical strength. They provide very good mechanical, thermal, dimensional, and chemical stability together with exceptional rigidity. Unlike conventional ceramic materials, they are usually not brittle. They can withstand dynamic loadings with great effectiveness and have excellent corrosion resistance even at high temperatures. The three most alluring qualities of CMCs—their extreme lightweight, durability, and temperature tolerance—are what draw people to them.

Ceramic matrix composites are widely used in the aerospace sector and energy sector. As they can operate at elevated temperatures, they can reduce cooling requirements in some applications. The reduction in cooling requirements means that components can operate more efficiently in applications such as jet engines. When used in power turbines, Ceramic matrix composites (CMCs) can reduce the electricity cost. In addition, as they are lightweight, they can achieve better fuel efficiency and, in turn, less pollution.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 12.9% |

| Global Market Size in 2023 | USD 4.01 Billion |

| Global Market Size in 2024 | USD 4.53 Billion |

| Global Market Size by 2034 | USD 15.23 Billion |

| Largest Market | North America |

| Base Year | 2032 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of end-users

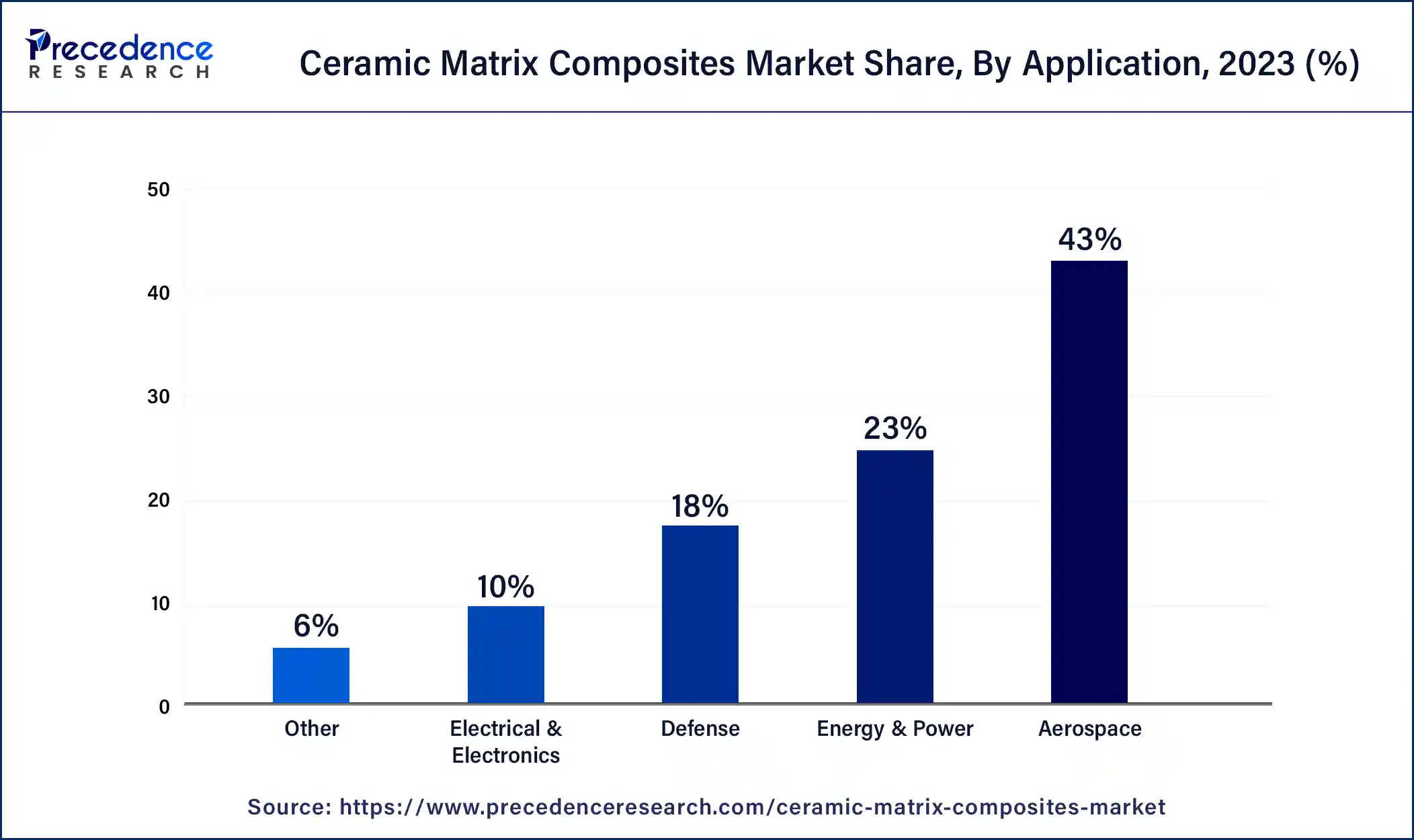

The increasing application of ceramic matrix composites is expected to boost the growth of the ceramic matrix composites market in the upcoming years. Ceramic matrix composites is widely used in energy, defense, and aerospace sector. Ceramic matrix composites possess exceptional performance properties at very high temperatures. Ceramic matrix composites are widely being used in the aerospace sector for structural re-entry thermal protection, gas turbines, and energy sector for heat exchangers, fusion reactor walls owing to its superior oxidation and radiation resistance properties. Such supportive factors are driving the growth of the market during the forecast period.

High cost of ceramic matrix composites

The high cost associated with the ceramic matrix composites acts as a major restraint for the ceramic matrix composites market. The manufacturing process for ceramic matrix composites is complex and labor-intensive, involving multiple steps such as fiber reinforcement, matrix deposition, densification, and finishing. These processes often require specialized equipment, skilled labor, and stringent quality control measures, all of which add to the production costs. Additionally, the low yield rates and scrap rates associated with ceramic matrix composites manufacturing further contribute to the overall cost of producing ceramic matrix composites components.

Increasing demand for lightweight and fuel-efficient automobiles

The growing demand for lightweight and fuel-efficient automobiles is projected to offer a lucrative opportunity for the growth of the ceramic matrix composites market during the forecast period. Global pollution has become a major concern. To reduce pollution, several governments around the world are promoting the use of fuel-efficient automobiles, which produce fewer emissions. It is important for manufacturers in the automobile industry to reduce the weight of their vehicles in order to achieve greater efficiency. Ceramic matrix composites are used in engines, exhaust systems, and brake systems, which can improve vehicle performance. The use of ceramic matrix composites can reduce pollution, enhance efficiency, reduce fuel costs and build lightweight automobiles. Thereby, driving the market’s growth.

The oxides segment dominated the ceramic matrix composites market in 2023; the segment is observed to grow at a significant rate during the forecast period. Oxide-based ceramic matrix composites demonstrate superior oxidation resistance compared to other types of ceramic matrix composites. This property is critical for applications where exposure to oxygen-rich environments can lead to material degradation over time. By resisting oxidation, oxide-based ceramic matrix composites ensure long-term durability and reliability in demanding environments. Oxide-based ceramic matrix composites have desirable mechanical properties and high strength. These materials have the capability to withstand mechanical stresses and enhance fracture resistance, making them ideal for structural components in aerospace, defense and industrial sectors.

The silicon carbide segment is observed to grow at a significant rate during the forecast period in the ceramic matrix composites market. Silicon carbide is observed to be an ideal thermal conductor and can be considered in multiple applications where temperature rises. Moreover, excellent chemical properties possessed by silicon carbide act as a potential factor for the application of the same in the industry.

In terms of market share for ceramic matrix composites, the aerospace sector led the pack in 2023. Ceramic matrix composites are appropriate for both fusion and fission applications due to their high temperature stability, increased oxidation resistance, and radiation resistance. Because of their high heat conductivity, they are also utilized in electronic circuits. Additional uses that are anticipated to propel the market include ceramics for fuel cells, LEDs, artificial teeth, and laser diodes. The aircraft sector finds ceramic matric composites to be suitable due to their environmental durability. These materials have the capacity to maintain spaceship velocity while using the same quantity of fuel. Although not all lightweight ceramic matrix composite materials are well suited for use in aerospace

In the ceramic matrix composites market, it is anticipated that the defense segment would grow at a significant rate throughout the forecast period. Demand in the aerospace market is expected to be driven throughout the projected period by customers' growing desire for manufacturing noses, rudders, fins, leading edges, body flaps, hot structures, tiles, and panels for aircraft. These composites' exceptional impact strength and high hardness make them ideal for use in the construction of armor and insulation for small arms weapons platforms. Because most ceramic materials are transparent to specific forms of light, energy, etc., they are frequently utilized for multi-spectral windows, sensor protection, and infrared domes.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2025

July 2024