March 2025

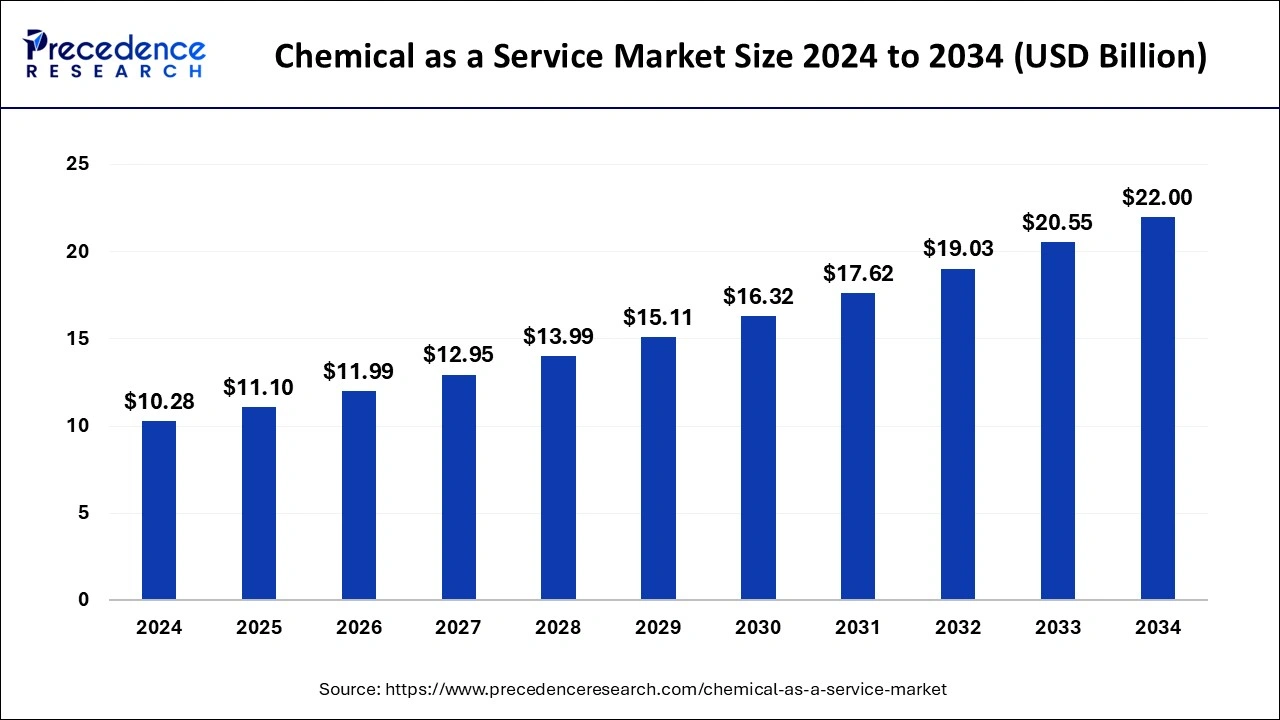

The global chemical as a service market size is calculated at USD 11.1 billion in 2025 and is forecasted to reach around USD 22 billion by 2034, accelerating at a CAGR of 7.91% from 2025 to 2034. The North America chemical as a service market size surpassed USD 3.70 billion in 2024 and is expanding at a CAGR of 7.93% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global chemical as a service market size accounted for USD 10.28 billion in 2024, grew to USD 11.1 billion in 2025 and is projected to surpass around USD 22 billion by 2034, representing a healthy CAGR of 7.91% between 2024 and 2034.

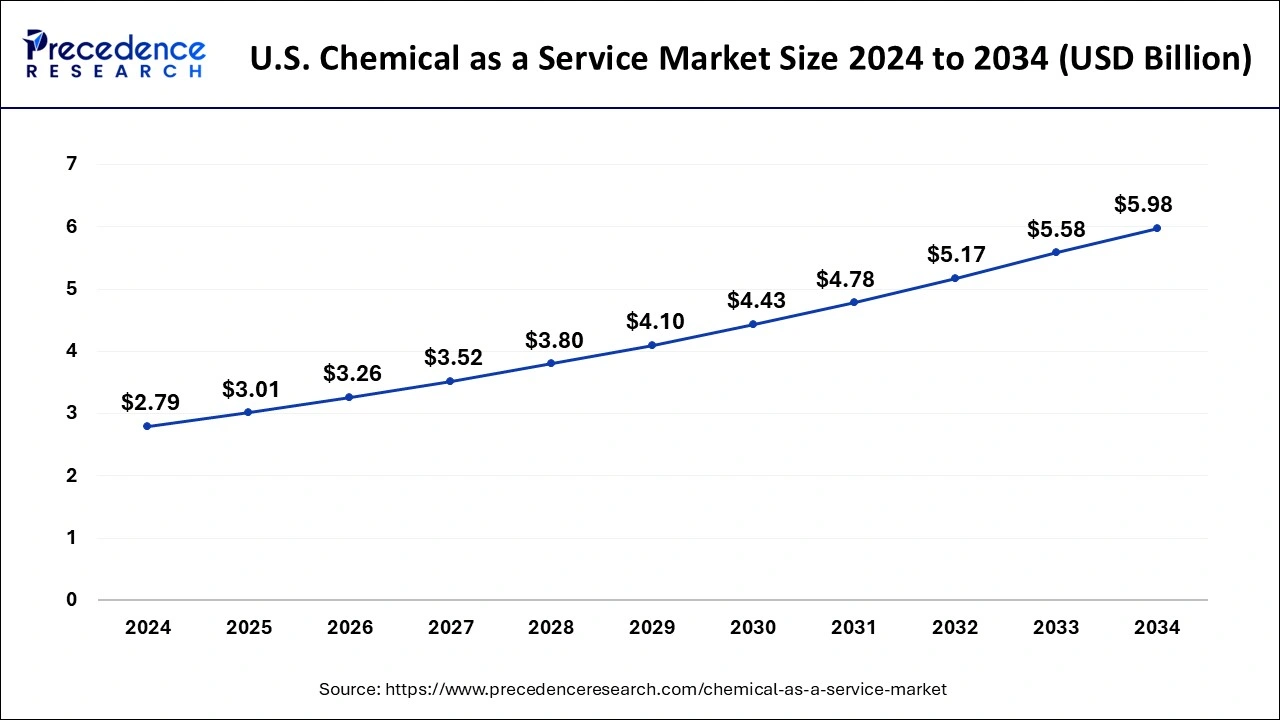

The U.S. chemical as a service market size was valued at USD 2.79 billion in 2024 and is anticipated to reach around USD 5.98 billion by 2034, poised to grow at a CAGR of 7.93% from 2025 to 2034

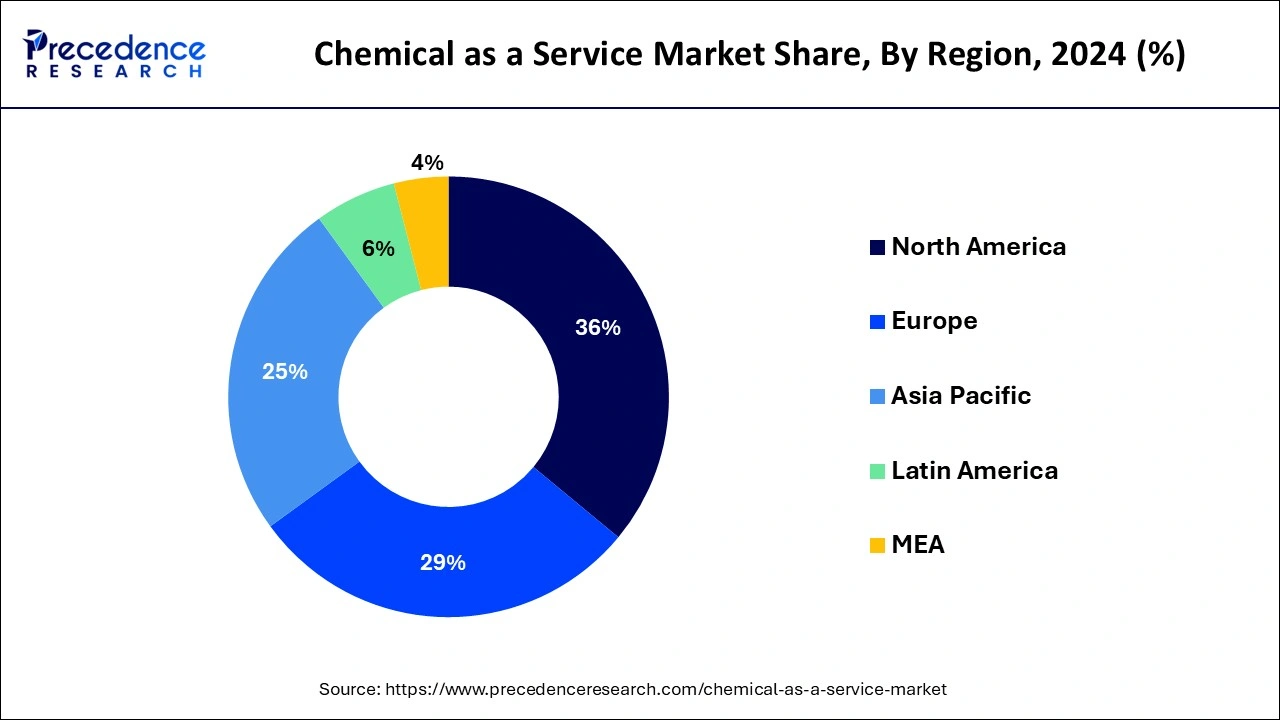

North America led the market with the biggest market share of 36% in 2024 due to the region's advanced industrial landscape, technological innovation, and a heightened focus on sustainability. The United States and Canada, as key contributors to the market, showcase a robust adoption of CaaS across various industries.

Additionally, in North America, industries such as agriculture, manufacturing, water treatment, and automotive are leveraging CaaS to enhance operational efficiency and environmental sustainability. The region's commitment to digital transformation, including the integration of IoT, data analytics, and automation, further accelerates the evolution of the chemical as a service market. This technology-driven approach allows businesses to optimize chemical processes, reduce waste, and respond swiftly to market demands.

Asia Pacific is poised for rapid growth in the chemical as a service market driven by a convergence of factors that underscore the region's rapid industrialization, economic growth, and increasing emphasis on sustainability. With a burgeoning demand for chemicals across diverse industries, including agriculture, manufacturing, and water treatment, the CaaS market in Asia-Pacific is experiencing substantial growth. The region's robust adoption of digital technologies, such as IoT and data analytics, is contributing to the evolution of efficient and responsive chemical services. Countries like China and India, with their expanding industrial bases, are embracing CaaS to optimize chemical usage, reduce waste, and enhance operational flexibility. The agriculture sector in the Asia-Pacific region is also a key beneficiary, leveraging CaaS for customized fertilizers and agrochemicals.

Meanwhile, Europe is growing at a notable rate in the chemical as a service market driven by its progressive adoption of on-demand chemical solutions across a spectrum of industries, reflecting the region's commitment to technological advancements, environmental sustainability, and industrial efficiency. European countries, including Germany, France, the United Kingdom, and others, are actively integrating CaaS into their industrial processes.

Moreover, in Europe, the chemical as a service market is experiencing notable traction in agriculture, manufacturing, water treatment, and specialty chemicals. The region's emphasis on precision farming has led to the adoption of CaaS in agriculture, offering farmers customized fertilizers and agrochemicals tailored to specific crop needs. The manufacturing sector benefits from the flexibility and efficiency of CaaS, particularly in metal parts cleaning, coatings, and industrial gases.

The chemical as a service market represents a transformative shift in the chemical industry, where traditional manufacturing and supply chain models are replaced by on-demand, cloud-based services. Chemical products are offered as scalable, subscription-based solutions, allowing businesses to access a wide range of chemicals without the need for extensive infrastructure or capital investment. The CaaS model leverages advancements in digital technologies, automation, and data analytics to optimize chemical production, distribution, and consumption. The market include various features such as flexibility, efficiency, and sustainability. The cloud-based nature of CaaS enables real-time monitoring and control, enhancing safety and compliance.

In addition, it encourages collaboration and transparency throughout the supply chain, fostering innovation and cost-effectiveness. As businesses increasingly prioritize sustainability and seek to streamline operations, Chemical as a Service emerges as a strategic solution, offering a more agile and environmentally conscious alternative to traditional chemical procurement and manufacturing methods. This market evolution reflects the ongoing digital transformation in the chemical industry, heralding a new era of efficiency, resource optimization, and responsiveness to evolving market demands.

Chemical as a Service Market Data and Statistics

| Report Coverage | Details |

| Market Size by 2034 | USD 22 Billion |

| Market Size in 2024 | USD 10.28 Billion |

| Market Size in 2025 | USD 11.1 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.94% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reduction in chemical consumption

The increasing focus on sustainability and resource efficiency has led to a notable reduction in chemical consumption across industries, catalyzing a heightened demand for the chemical as a service market. Businesses are actively seeking ways to optimize their chemical usage, minimize waste, and align with environmentally conscious practices. CaaS emerges as a strategic solution to address this shift in consumption patterns by providing companies with the flexibility to access chemicals as needed, without the commitment to large-scale manufacturing facilities. The subscription-based model allows for precise control over chemical quantities, enabling businesses to tailor their usage to specific requirements, thereby curbing excess and mitigating environmental impact.

Moreover, the chemical as a service market promotes a circular economy approach, encouraging the recycling and reuse of chemicals, further contributing to sustainability goals. As companies strive to meet regulatory standards and demonstrate their commitment to environmental stewardship, the efficiency gains and reduced ecological footprint offered by CaaS become increasingly appealing. This reduction in chemical consumption not only aligns with broader corporate sustainability initiatives but also positions the market as a pivotal enabler of an eco-friendlier and resource-efficient future for the chemical industry.

Quality control and standardization

Quality control and standardization challenges pose potential restraints for the chemical as a service market. The traditional model of in-house chemical manufacturing often provides companies with direct oversight and control over the entire production process, ensuring consistent quality and adherence to industry standards. In contrast, the outsourcing nature of CaaS may raise concerns regarding the ability to maintain stringent quality control measures and standardized processes across various service providers. Ensuring uniformity in chemical formulations and maintaining high-quality standards becomes crucial, especially when dealing with diverse industries with unique specifications.

Companies may be hesitant to fully embrace CaaS if they perceive a risk of variations in product quality or if standardized processes are not clearly defined and enforced across providers. The lack of standardized protocols may also hinder interoperability between different CaaS platforms, potentially complicating the integration of these services into existing operational frameworks. Businesses, particularly those in highly regulated sectors, may be cautious about navigating potential compliance issues and ensuring that the chemicals procured through CaaS meet the required quality benchmarks.

Digital transformation in the chemical industry

The ongoing digital transformation within the chemical industry is unlocking significant opportunities for the chemical as a service market. As the industry embraces advanced technologies, including data analytics, artificial intelligence, and IoT, CaaS providers can leverage these innovations to enhance operational efficiency and deliver tailored solutions. Real-time data analytics enables predictive maintenance, optimizing production processes and reducing downtime. Digitalization facilitates seamless communication and collaboration between stakeholders in the chemical supply chain, fostering a more agile and responsive industry ecosystem. CaaS platforms can capitalize on this connectivity to offer dynamic and on-demand chemical services, responding swiftly to market demands and fluctuations.

Furthermore, the integration of digital technologies enhances transparency and traceability in the supply chain, assuring clients of the quality and origin of the chemicals procured through CaaS. This increased visibility contributes to building trust and confidence among businesses seeking reliable and compliant chemical solutions. Automation and smart manufacturing, integral components of the digital transformation, empower CaaS providers to streamline production processes, reduce manual errors, and optimize resource utilization. These advancements position CaaS as a cutting-edge solution that aligns with the industry's trajectory towards Industry 4.0.

The industrial cleaning segment held the largest share of the chemical as a service market in 2024. CaaS finds application in industrial cleaning processes, providing businesses with the necessary chemicals for effective and tailored cleaning solutions. This ensures a clean and safe working environment while optimizing resource utilization.

The agriculture & fertilizer segment is expected to generate a notable revenue share in the market. In the agriculture sector, CaaS may provide farmers with access to customized fertilizers and agrochemicals based on specific crop requirements. This enables precise and efficient nutrient management, contributing to increased crop yields and sustainable farming practices.

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

September 2024

September 2024