March 2025

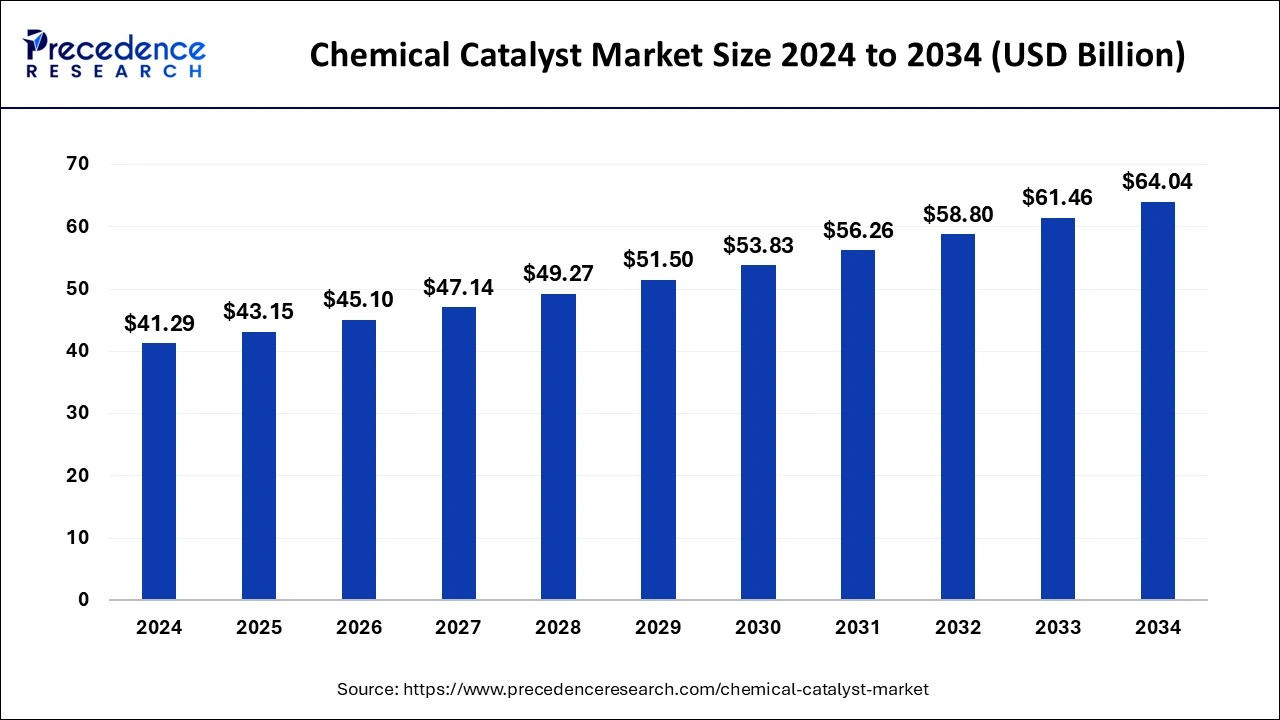

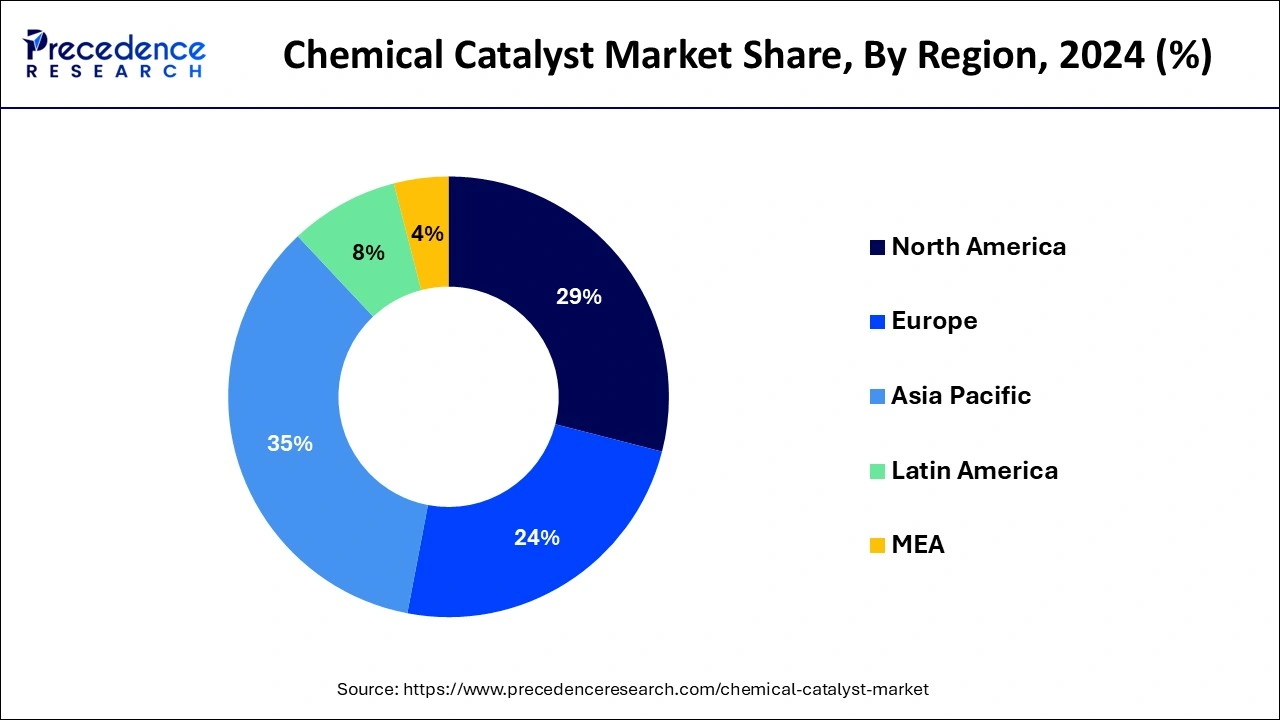

The global chemical catalyst market size is calculated at USD 43.15 billion in 2025 and is forecasted to reach around USD 64.04 billion by 2034, accelerating at a CAGR of 4.48% from 2025 to 2034. The Asia Pacific chemical catalyst market size surpassed USD 15.10 billion in 2025 and is expanding at a CAGR of 4.68% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global chemical catalyst market size was estimated at USD 41.29 billion in 2024 and is predicted to increase from USD 43.15 billion in 2025 to approximately USD 64.04 billion by 2034, expanding at a CAGR of 4.48% from 2025 to 2034. The chemical catalyst market is driven by the increasing need across various sectors for chemicals with excellent performance and versatility.

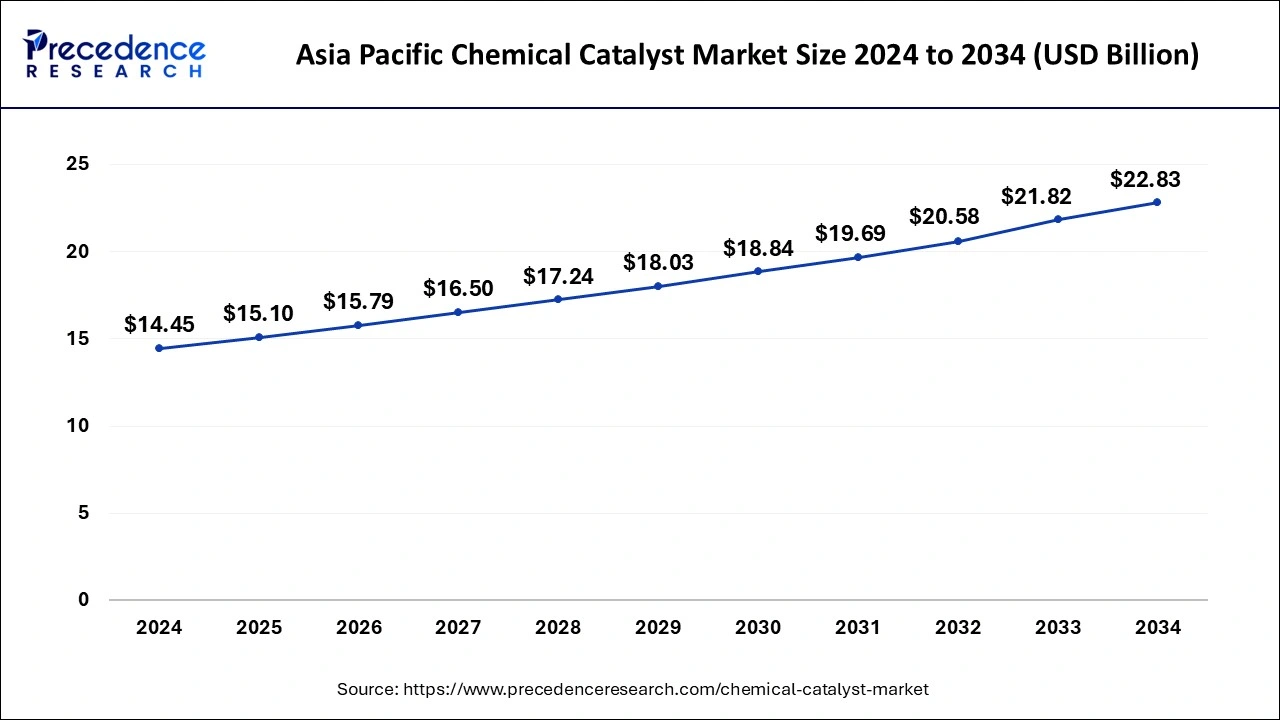

The Asia Pacific chemical catalyst market size was valued at USD 14.45 billion in 2024 and is predicted to be worth around USD 22.83 billion by 2034, growing at a CAGR of 4.68% from 2025 to 2034.

Asia Pacific had dominated in the chemical catalyst market in 2024. Asia Pacific nations, particularly China and India, have seen tremendous industrial growth. Catalysts are needed in many different chemical processes, such as those in the petrochemical, polymer, and refining sectors, and their demand has increased due to this industrial development. The governments have implemented measures to encourage technical innovation and industrial expansion. These include financial support for R&D initiatives, tax breaks, and subsidies. Thus, growing automotive industry requires catalysts to produce cleaner fuels and catalytic converters, which lower car emissions.

North America is the fastest growing in the chemical catalyst market during the forecast period. Green chemistry and sustainability are becoming more and more critical. High demand exists for catalysts that allow for more economical use of resources and lower waste. This movement is robust in North America, where environmental concern is high. Both public and commercial sector efforts aid the creation of novel catalysts. Catalyst market innovation is stimulated by subsidies and programs to lower environmental impact and increase industrial efficiency. More effective and efficient nano-catalysts have been developed due to advancements in nanotechnology. Companies in North America are leading the way in incorporating nanotechnology into catalyst design.

Chemical catalysts are materials that speed up chemical reactions without being consumed; this market includes them. These catalysts are essential to many industries, such as chemical production, pharmaceuticals, environmental protection, and petroleum refining. Catalysts facilitate processes at lower temperatures and pressures by lowering the activation energy required for reactions, which reduces energy consumption and greenhouse gas emissions. They can also support more sustainable and clean production techniques, which helps to safeguard the environment. Catalysts facilitate the efficient use of reactants, hence using less raw materials and energy resources. This resource conservation helps industries function more responsibly and aligns with sustainability goals.

| Report Coverage | Details |

| Market Size in 2025 | USD 43.15 Billion |

| Market Size by 2034 | USD 64.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.48% |

| Largest Market | Asia- Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Form, Process, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth of various industrial processes

As the world economy grows, industrial activity is increasing in several sectors, including petrochemicals, chemicals, medicines, and the environmental industry. Chemical processes play a significant role in manufacturing, refining, and treating these sectors. The need for catalysts, which quicken these chemical reactions, rises in lockstep with industrialization. Several industries, such as manufacturing, agriculture, and healthcare, are based on the chemical industry.

Catalysts are critical to satisfying increasing market needs, cutting costs, and streamlining industrial processes as population increase, urbanization, and economic development propel chemical demand. Global chemical manufacturing capacity expansion is driving demand for catalysts in various applications. Eventually, drives the growth of the chemical catalyst market.

Increasing prices of raw materials

Cost inflation is the main effect of growing raw material prices. Various metals, rare earth elements, and other specialty compounds are frequently used to make chemical catalysts. The cost of producing catalysts is directly affected by any rise in these materials' price. Higher costs for obtaining, processing, and refining raw materials into catalysts will ultimately force manufacturers to raise the price of their finished goods. The supply chain of companies that make chemical catalysts may be affected by abrupt rises in the cost of raw materials.

Suppliers may find it challenging to obtain sufficient raw materials at reasonable costs, which could cause production to stall or stop altogether. Such hiccups can potentially affect downstream industries like petrochemicals, autos, and pharmaceuticals, which depend on chemical catalysts throughout the supply chain. This limits the growth of the chemical catalyst market.

Use of AI and ML in catalyst development

Among the many industries that artificial intelligence is transforming, the chemical sector has seen the most rapid advancements in AI-driven innovation in recent years. Chemical catalyst manufacturers have much to gain from applying AI and ML in catalyst development since it expedites design, optimization, and discovery. These technologies can analyze large volumes of data from simulations and experiments to find new catalyst shapes and compositions with higher performance and selectivity. With AI and ML, highly effective catalysts customized for specific industrial processes can be developed faster and at a lower cost through trial-and-error expenses. This promotes the development of greener and more sustainable chemical processes and increases the competitiveness of catalyst producers, by opening an opportunity for the growth of the chemical catalyst market.

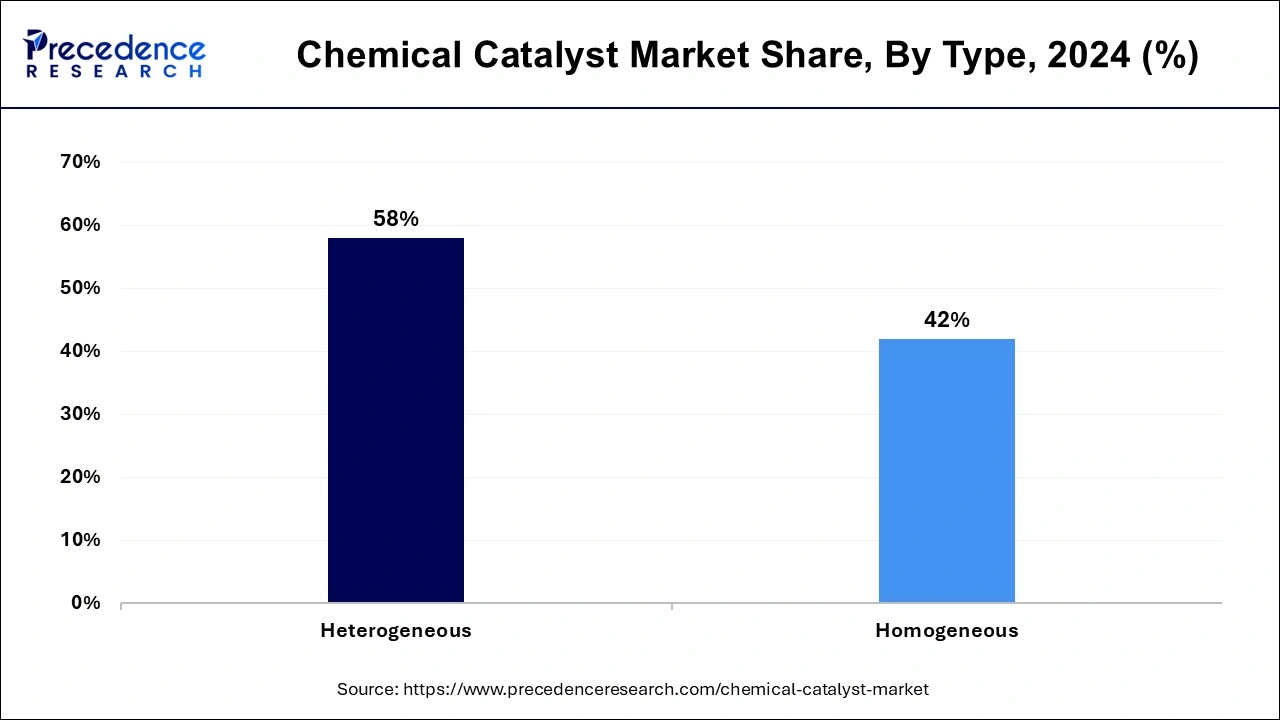

The heterogeneous segment dominated the chemical catalyst market in 2024. Filtration or centrifugation are easy methods for separating heterogeneous catalysts from reaction products. This is a significant benefit for industrial applications where the purification of the product is an essential step. Recovering and repurposing the catalyst effectively reduces waste and lowers operating expenses. Creating heterogeneous catalysts with qualities suited for specific processes is possible.

Particle size, shape, and active site composition can all be precisely altered as part of this modification, giving you exact control over reaction routes and product distribution. They work well when scaled up from the lab to the industrial level. Compared to the frequently more complicated setups needed for homogeneous catalysis, fixed-bed reactors, commonly employed in industry, are simpler to construct and scale.

The homogeneous segment shows notable growth in the chemical catalyst market during the forecast period. As homogeneous catalysts are in the same phase as the reactants, which are usually liquid, mixing is more effective and uniform. Because more active sites are available in homogeneous catalysts than in heterogeneous catalysts, they frequently exhibit higher activity. By carefully adjusting them, these catalysts can selectively reduce waste and by-products while producing the required goods. This selectivity is significant in the pharmaceutical and fine chemical sectors, where product purity is critical.

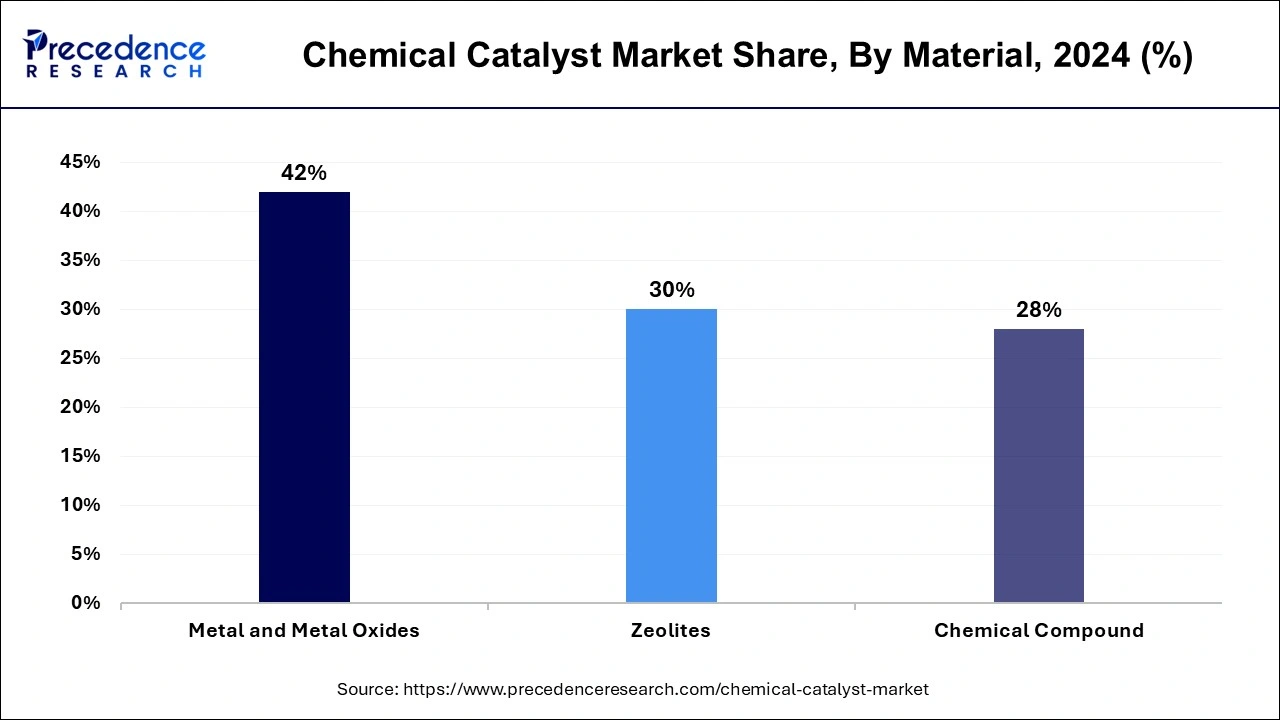

The metal and metal oxides segment dominated in the chemical catalyst market in 2024. Due to their high catalytic efficiency, metals and metal oxides can catalyze chemical reactions more quickly and selectively. Their distinct surface characteristics and electrical structures, which promote reactant adsorption and activation, are the sources of this efficiency. Many active sites in metals such as rhodium, palladium, and platinum make them excellent catalysts for oxidation, polymerization, and hydrogenation. High surface area metal oxides, including titanium dioxide (TiO2) and zirconium dioxide (ZrO2), improve the interaction between the molecules of the reactant and the catalyst.

The zeolites segment is the fastest growing in the chemical catalyst market during the forecast period. Zeolites have a well-defined microporous structure with high selectivity and a vast surface area. This enables efficient catalytic activity, making them useful in a variety of chemical reactions. Excellent ion exchange characteristics are essential for catalytic reactions, and zeolites have them. Their ability to exchange cations within their structure without causing substantial structural changes allows for various catalytic uses.

Zeolites are used in automobile catalytic converters to lower dangerous emissions. They contribute to cleaner air by assisting in the reduction of nitrogen oxides (NOx) and the oxidation of carbon monoxide (CO) and hydrocarbons (HC).

The powder segment dominated the chemical catalyst market in 2024. Due to their high surface area to volume ratio, powder catalysts provide more active sites for chemical reactions. This increases their catalytic efficiency over other forms, such as pellets or granules, making them more efficient at accelerating processes. Powders are easily combined with reactants to guarantee a uniform catalyst dispersion within the reaction mixture. Catalytic activity must be consistent, and this consistency is necessary. They are appropriate for various industrial operations since they are easily dissolved in different solvents or substrates.

The fluid catalytic cracking (FCC) segment dominated in the chemical catalyst market in 2024. A chemical process known as fluid catalytic cracking uses a catalyst to break down bigger molecules into smaller ones to produce gasoline and distillate fuels. This technique greatly increases the production of high-demand fuels from crude oil, which is crucial for supplying the world's energy needs. FCC units provide economic efficiency by optimizing the transformation of heavy oil fractions into lighter, more valuable products.

Their capacity to transform low-grade crude oils into highly sought-after fuels makes them an economical option for refineries. This economic advantage bolsters their market domination and broad adoption in the chemical catalyst industry.

The petrochemicals segment dominated the chemical catalyst market in 2024. Since petrochemical goods are widely used in many industries, including electronics, automotive, construction, packaging, and textiles, there has been an increase in demand for them globally. Catalyst use has increased due to the growth of petrochemical production facilities in response to this expanding demand. Industry has adopted more ecologically friendly and efficient catalytic processes due to environmental regulations and the movement towards sustainability.

Catalysts that lower emissions and energy consumption in petrochemical processes have been used due to stricter environmental restrictions and the drive for more environmentally friendly manufacturing techniques. Due to catalysts, the industry can comply with regulations while upholding high standards of output quality and production efficiency.

By Type

By Material

By Form

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

September 2024

September 2024