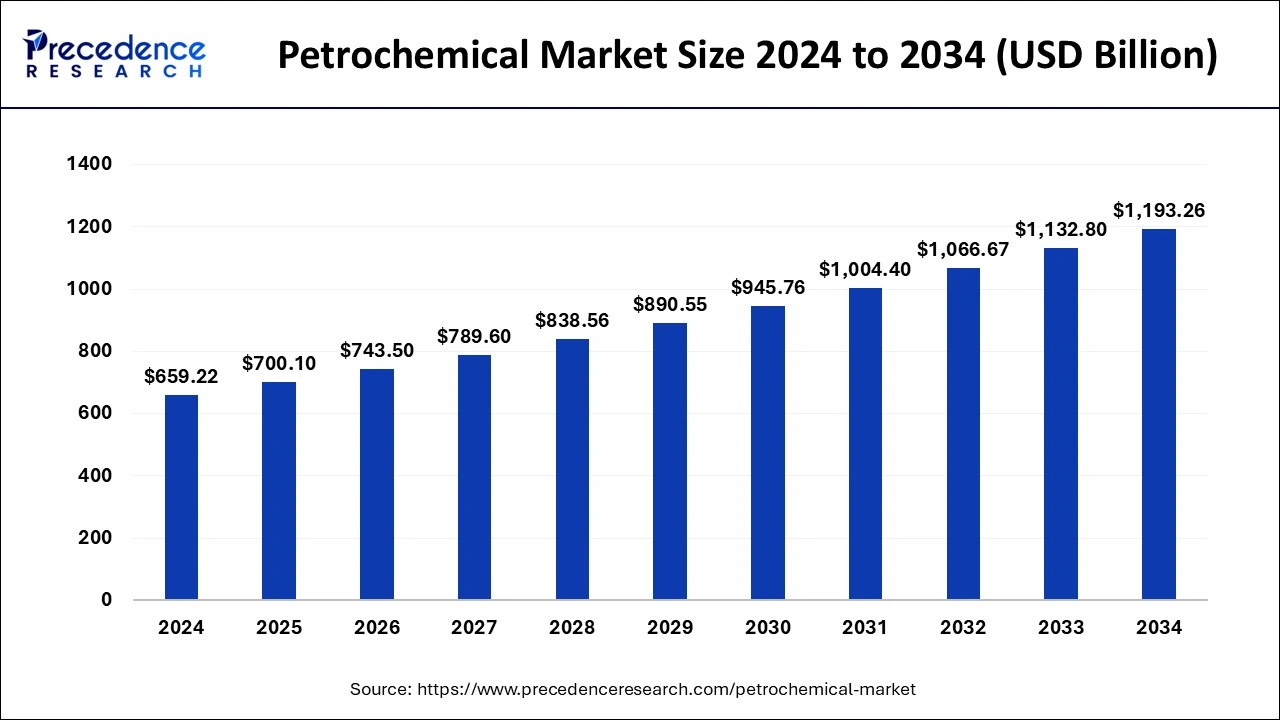

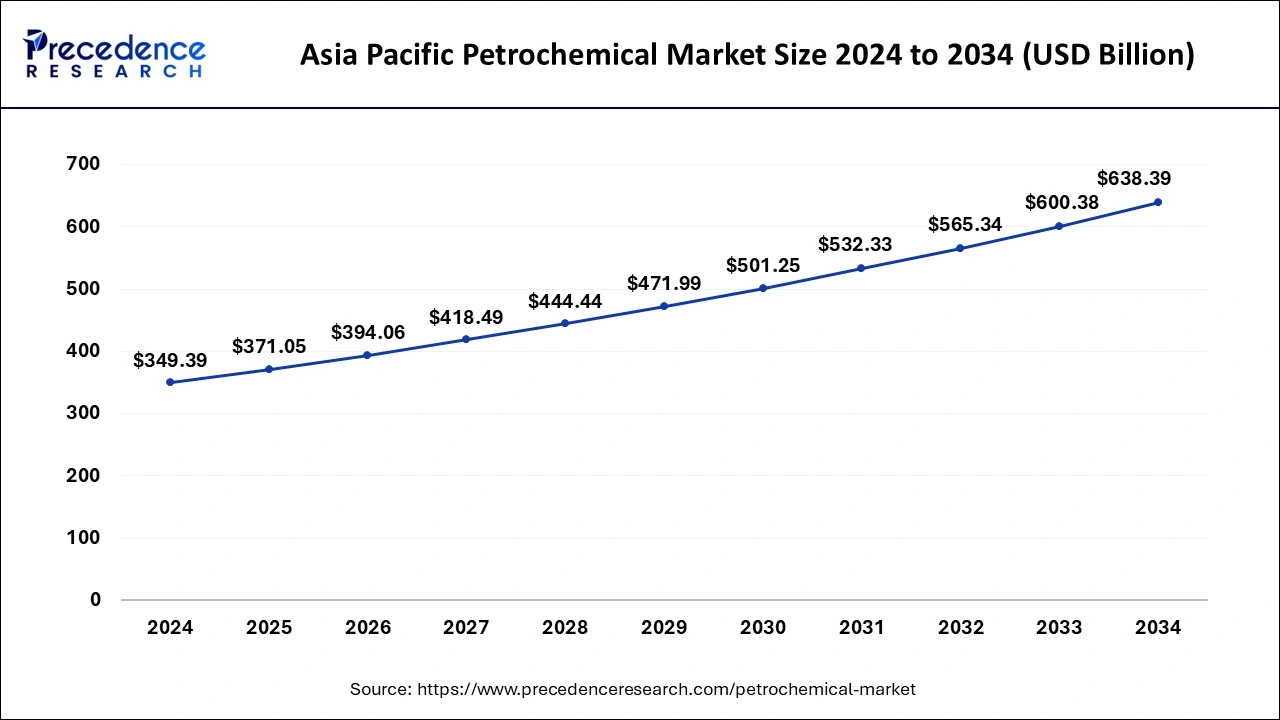

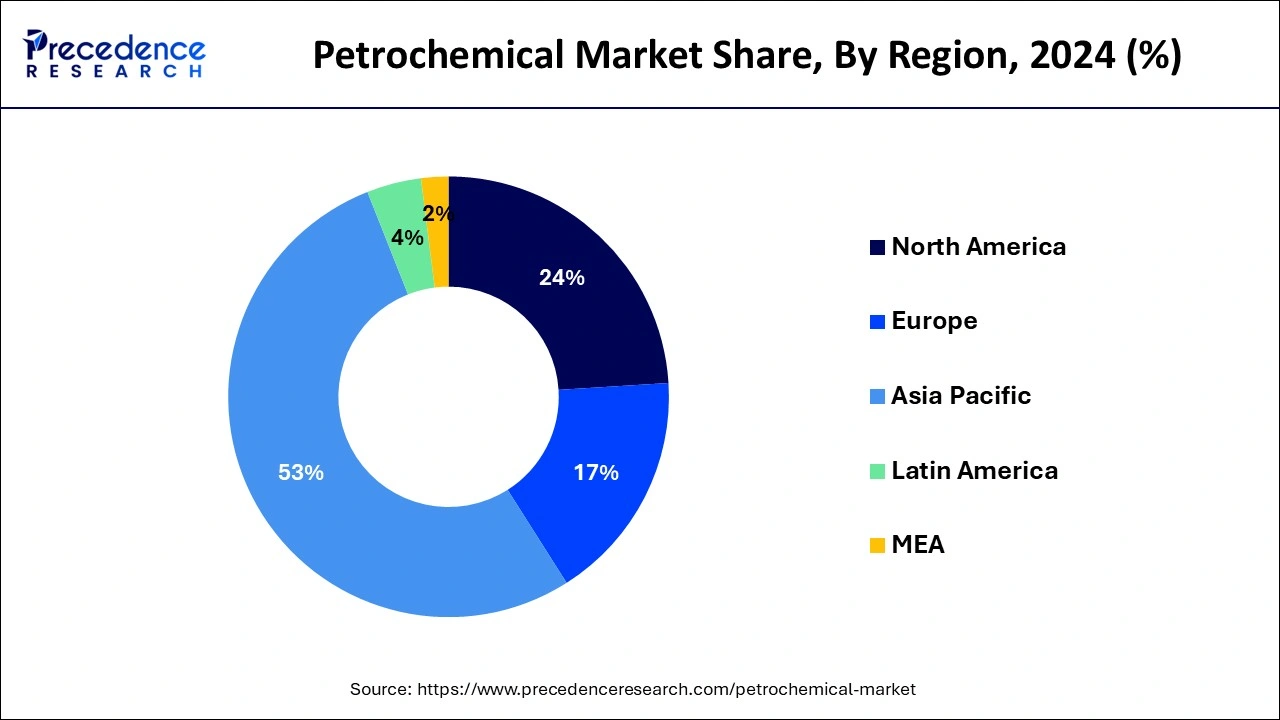

The global petrochemical market size is accounted at USD 700.10 billion in 2025 and is forecasted to hit around USD 1,193.26 billion by 2034, representing a CAGR of 6.11% from 2025 to 2034. The Asia Pacific market size was estimated at USD 349.39 billion in 2024 and is expanding at a CAGR of 6.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global petrochemical market size was calculated at USD 659.22 billion in 2024 and is predicted to reach around USD 1,193.26 billion by 2034, expanding at a CAGR of 6.11% from 2025 to 2034. A key driver of the petrochemical market's expansion is the rise in demand for downstream goods from a variety of end-use sectors, including construction, pharmaceuticals, and the automotive sector. This is the reason for the product's increased demand.

The petrochemical sector is undergoing a change thanks to the synergistic influence of AI and IoT convergence. Large volumes of data produced by sensors integrated into petrochemical equipment may be analyzed by AI and machine learning algorithms, allowing for the early detection of equipment faults. IoT sensors make real-time visibility into different phases of the petrochemical manufacturing process possible. This data may then be used by AI algorithms to locate bottlenecks, adjust process variables, and improve overall productivity. Wearable technology with IoT capabilities and AI-powered video analytics can track employee behavior and environmental factors, spotting possible safety risks and averting mishaps. AI algorithms can further improve transportation timetables and logistical routes, lowering carbon emissions and expenses.

Petrochemical firms may increase customer satisfaction, save costs, and better respond to market needs by streamlining their supply networks. Rapid prototyping and simulation made possible by AI can hasten the development of novel petrochemical products and processes. Large volumes of chemical data may be analyzed by machine learning algorithms to find possible novel substances and forecast their characteristics.

The Asia Pacific petrochemical market size was evaluated at USD 349.39 billion in 2024 and is projected to be worth around USD 638.39 billion by 2034, growing at a CAGR of 6.21% from 2025 to 2034.

The Asia Pacific region has been undergoing rapid industrialization and urbanization, particularly in countries like China and India. This growth drives the demand for petrochemical products, which are essential for various industries, including construction, automotive, and manufacturing. The demand for plastics, a major product of the petrochemical industry, has been consistently rising in the Asia Pacific region. Plastics are widely used in packaging, construction, consumer goods, and automotive applications, contributing to the overall growth of the petrochemical market.

North America hosted the dominant petrochemical market in 2024. In the past ten years, North America's petroleum industry has been propelled by technological advancements, especially in the area of hydraulic fracturing, which produces shale oil. The region's domestic fuel consumption has been outpaced by oil and gas production, and investors are anticipated to step up their efforts to build additional production facilities. It is anticipated that the presence of crude oil and the intention of several multinational chemical companies to build new facilities or enlarge existing ones in the area would greatly accelerate regional growth.

In North America, the United States dominated the market in 2024 and is expected to continue to do so for the duration of the projection. Among the top 10 manufacturers of petrochemicals, the nation generates substantial demand from end-use sectors including paints and coatings, construction, and automobiles. Furthermore, the region's need for green petrochemical goods is anticipated to be fueled by growing government activities related to sustainability and recycling

Emergence of new applications of petrochemical is predicted to create potential opportunities for the crucial players operating in global market. According to the data published by International Energy Agency in 2018, the manufacturing of thermoplastics will be more than doubles over the period of 2020 to 2050, in order to satisfy the consumer demand worldwide. Further, major companies of the global petrochemical market are increasing their capacity to enrich position. As per the data by IEA petrochemicals report, almost all regions, will increase manufacturing of primary chemicals to 2050, except Europe.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.11% |

| Market Size in 2025 | USD 700.10 Billion |

| Market Size by 2034 | USD 1,193.26 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Manufacturing Processes |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

A decrease in demand for fuel drives interest in Petrochemicals

The fuel industry across various regions is declining, which leads to an increase in demand for petrochemicals. As per a survey, the need for gasoline is anticipated to be lower by 15% from 2018 to 2035. Similarly, the demand for diesel will decrease by 6%. The factors which are contributing to the decline are continuous improvement in technology, autonomous vehicles, renewable substitution, connected and shared vehicles, as well as changing demographics. The demand for petrochemicals is anticipated to expand 3 to 6 times. The need is expected to grow due to the rising middle class in developing countries. To boost the profitability of those investments, expansion into petrochemicals will be incorporated. A refiner is able to opt to cut crude capacity or diversify into higher-value petrochemicals to offset the predicted decline in US fuel consumption and dwindling export markets. The former would result in stranded capacity and reduced refining margins. Modification into petrochemical manufacturing allows the preservation of crude capacity and results in a considerably better margin than simply generating fuels.

The novel supply-demand relationship for the chemical sector is contributing to enhancing the global competition in the market. Owing to the shale gas resolution, the United States have again gained its position as a low-cost area for production of chemicals after many decades of decline. Presently, the United States manufactures approximately 40% of the global ethane-based petrochemical. Followed by U.S., Middle East led by Iran and Saudi Arabia remains the low-cost region for various petrochemicals, with various projects planned across globe. Europe and China accounts for approximately 1/4th of the global capacity for high value chemicals which are naphtha-based and have minor share of capacity.

Environmental Concerns and Regulations

The petrochemical sector witnesses rising scrutiny due to environmental factors such as greenhouse gas emissions, air pollution, and plastic waste. Strict regulations as well as carbon reduction targets are able to require significant investments in emission control technologies, sustainability practices, and waste management, along with potentially increasing production costs.

Various challenges faced by petrochemicals are climate, water pollution, and air quality. Along with this, petrochemical products provide advantages, such as the rising number of applications in various advanced technologies. However, the use, production, and disposal of petrochemical products act as a challenge that needs to be addressed. Though the chemical industry consumes a larger amount of energy than the cement and steel sector, it emits less amount of CO2. The rising demand for bio-based alternatives and renewable alternatives to petrochemical products, like bio-based polymers or biodegradable materials, are expected to impact the market growth potential.

Use of Machine Learning and Artificial Intelligence in chemical manufacturing and data mining

Machine learning techniques are processes that are able to mimic human thinking ability and are able to detect patterns and mine data. They are also capable of evaluating context and conflicting evidence at a faster pace than humans. These technologies are used to assist in the prediction of the outcome of a process or reaction, help in developing hypotheses, and determine gaps in existing scientific literature. A continued trend in the chemical production sector embraces AI, IoT, and machine learning. These advanced technologies are used to enhance efficiency and productivity, as well as decrease energy loss and risk.

The ethylene segment holds the largest share in the petrochemical market. The primary process used to manufacture ethylene is the steam cracking of hydrocarbons derived from natural gas or crude oil, such as ethane, propane, and naphtha. The competitiveness of ethylene production is impacted by the cost and availability of feedstocks, particularly ethane from shale gas, in areas like the United States. There are several uses for the adaptable chemical ethylene. It is an essential raw ingredient used in manufacturing textiles, resins, polymers, and other industrial chemicals. The expansion of end-use sectors such as consumer products, packaging, buildings, and automobiles affects the demand for ethylene. Global economic conditions, feedstock pricing, and supply-demand balance are some factors affecting ethylene prices.

Numerous businesses use ethylene-based products to keep up with the increasing demand for ethylene worldwide, the petrochemical industry frequently invests in ethylene production facilities and expands its capacity. Technological developments, market trends, and regulatory frameworks are observed to impact investment decisions.

The fluid catalytic cracking segment holds the largest share in the petrochemical market. The primary goal of FCC is to convert heavy, high-boiling-point hydrocarbons from crude oil into lighter, more valuable products. By using a catalyst and a fluidized bed of catalyst particles, FCC makes it easier for giant hydrocarbon molecules to break down into smaller, more usable ones. Gasoline, diesel, and light olefins (such as propylene and butylene), crucial ingredients in synthesizing numerous petrochemicals, are the principal products acquired through the FCC. The FCC industry has grown in size and significance due in part to the rising demand for refined goods, including gasoline. Global energy demand, regulatory restrictions, and crude oil prices are some elements that impact the FCC industry.

In the FCC process, catalysts are essential because they encourage the right chemical reactions. The goal of ongoing research and development in catalyst technology is to improve selectivity and conversion efficiency. Zeolite-based catalysts are active and selective, making them a popular choice for FCC units. FCC units are made to comply with emission requirements and lessen their adverse effects on the environment as environmental rules get stricter. FCC unit operators are concentrating on integrating modern emission control technology and catalyst regeneration processes—demand for particular refined products and regional expansions of refining capacity impact the FCC segment. The rise of FCC units is primarily due to emerging nations with rising energy needs, especially in Asia and the Middle East.

The building and construction segment heavily influences the petrochemical market since petrochemical products are widely used in various construction-related applications. Petrochemicals are essential raw materials for manufacturing building materials, chemicals, and goods. They are obtained from petroleum or natural gas. Plastics are widely used in building materials like pipes, cables, insulation, roofing, and flooring, and their manufacture requires petrochemicals. These polymers are frequently utilized in construction applications such as fittings and pipes. In the construction sector, petrochemical-based adhesives and sealants are used to join and seal various materials, extending the life and durability of structures.

By Product Type

By Manufacturing Processes

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client