November 2024

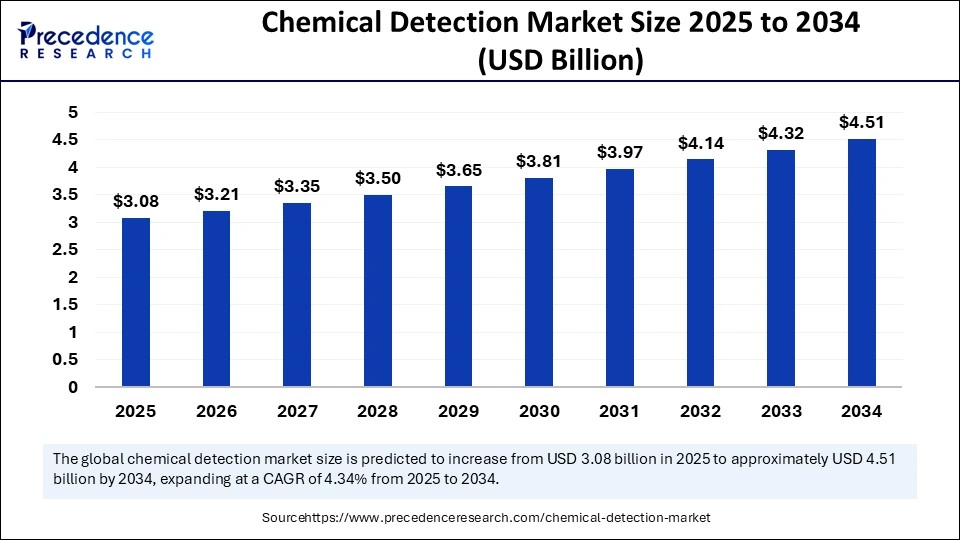

The global chemical detection market size is calculated at USD 3.08 billion in 2025 and is forecasted to reach around USD 4.51 billion by 2034, accelerating at a CAGR of 4.34% from 2025 to 2034. The North America market size surpassed USD 1.12 million in 2024 and is expanding at a CAGR of 4.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global chemical detection market size accounted for USD 2.95 billion in 2024 and is predicted to increase from USD 3.08 billion in 2025 to approximately USD 4.51 billion by 2034, expanding at a CAGR of 4.34% from 2025 to 2034. The market shows a rapid expansion because of safety needs, environmental rules, and innovations in detection technologies.

Artificial intelligence powered systems deliver enhanced precision and automated data analysis abilities, and predictive modeling capabilities that drive rapid and efficient chemical detection technologies through real-time operations. AI allows detection devices to learn continuously, which leads to their systemic intelligence growth and adaptation capacity over time. The automated assessment of complex analysis assignments increases safety and diminishes human errors based on AI systems. The evolving AI technology development will create additional uses in chemical detection, as well as heighten safety measures.

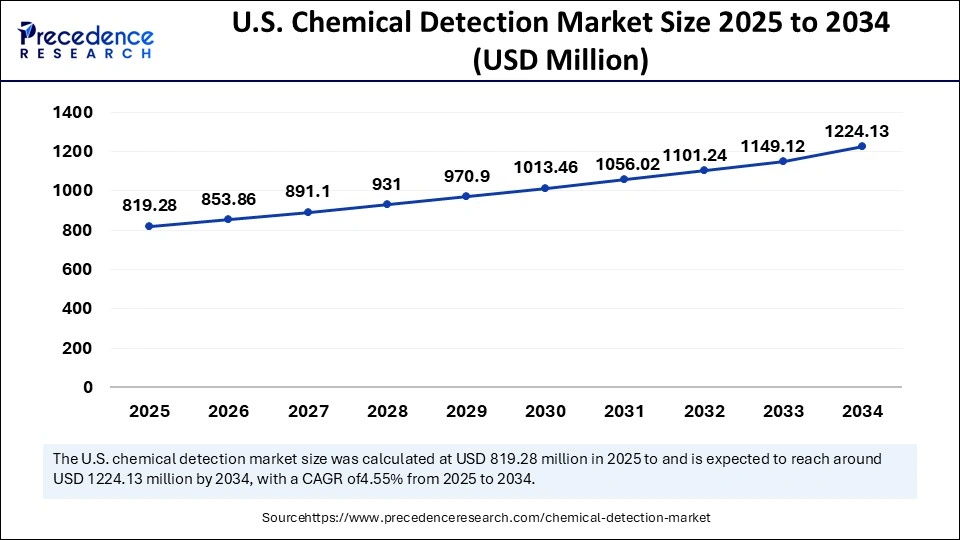

The U.S. chemical detection market size was exhibited at USD 784.70 million in 2024 and is projected to be worth around USD 1224.13 million by 2034, growing at a CAGR of 4.55% from 2025 to 2034.

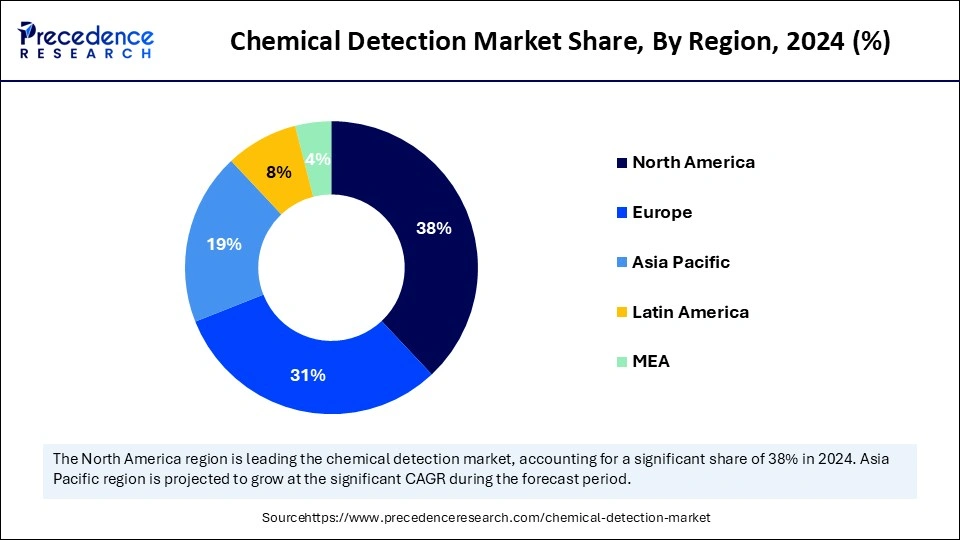

North America accounted for the largest share of the chemical detection market in 2024. These regions demand modern and advanced chemical detection devices to fulfill their stringent environmental security and health-related requirements. The implementation of cutting-edge technologies by businesses through regulatory compliance includes maintaining operational efficiency and incident prevention. North America hosts substantial private companies and research institutions, which support the research and development of new types of chemical detection technologies. The increasing need to control pollution and sustainability initiatives also motivates companies to fully adopt chemical sensor equipment throughout many stages of production.

Asia Pacific is anticipated to witness the fastest growth in the chemical detection market during the forecasted years. The rapid industrialization and urbanization of businesses, organisations, and cities in China, India, and Southeast Asian countries have been the driving forces in the market for chemical detection devices. The increasing number of environmental regulations with air and water pollution issues has created strong demand for precise detection systems that can ensure regulatory compliance. The healthcare and food safety sectors of Asia Pacific are progressing in their use of chemical detection solutions because these systems help protect public health and improve product quality.

Europe holds a significant presence in the global chemical detection market. New manufacturing facilities and developing industries have created a larger need for advanced detection systems to identify environmental and industrial chemical hazards. The positions taken as leaders in the market are due to the numerous government agencies, industrial plants, and scientific institutions located in the region that rely on chemical detection technologies to ensure compliance and safety. The demand for reliable chemical detection tools in Europe also responds to existing and increasingly tighter environmental protection laws, occupational health and safety regulations, and public health requirements in many sectors.

The chemical detection sector remains important by including the detection of harmful substances to secure the sectors, such as defense, healthcare, environmental management, and industrial production facilities. The healthcare organizations employ chemical sensors as monitoring devices used for diagnostic testing while following patient conditions. Environmental regulations related to air and water environmental conditions continued to reinforce demand for environmental monitoring systems provided by regulatory agencies.

Governments and organizations continue to spend on process funding that supports new chemical detection technologies that protect against chemical warfare and accidents involving hazardous materials. The chemical detection market is guaranteed to expand through technological advances, as manufacturers are producing chemical detection tools in smaller portable form factors, with a wireless interface, and integrated AI-based computing capabilities.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.51 Billion |

| Market Size in 2025 | USD 3.08 Billion |

| Market Size in 2024 | USD 2.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.34% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | the detection method , sample type, target analytes, detection sensitivity, application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing industrialization

The process of industrialization has driven technological innovations in detection methods. The demand to develop detection systems has expanded to include accurate performance and easy compatibility with existing operational frameworks. The increasing difficulty of industrial processing operations creates more dangerous situations for chemical leaks, spills, and emissions, thus demanding innovative chemical detection solutions for workplace and environmental safety. To prevent these risks, regulatory organizations worldwide have implemented stronger health as well as safety, and environmental standards. These markets experience exceptional growth in their industrial sectors, which generates major opportunities for detection systems.

Regulatory compliance challenges

Multinational organizations face distinct operational challenges when attempting to navigate the more than one regulations that can be found in authorities around the world. Each geographical space and national governing agency maintains its own chemical safety detection directives to deal with the significant barriers for multinational organizations exercising their operational capabilities in those spaces. The change in regulations obligates organizations to keep monitoring and have updates made to existing systems. This ongoing process extends the timeline for the development of industrial products and raises costs in terms of regulatory obligations.

Development of customized detection solutions

Companies in the chemical detection market can capture significant opportunities by designing tailored chemical detection systems. There is a range of industries that want chemical detection systems designed uniquely for them, from food and beverage, pharmaceuticals, agriculture, to healthcare, and they all need a detection system specified for their needs. Companies gain customer loyalty from unique, customized products that solve an individual's concern, causing greater satisfaction for their customers. Manufacturers receive market size and positioning opportunities by designing trailered chemical detection systems that serve their safety and quality assurance obligations and govern regulatory requirements for their industries.

The gas chromatography segment held a significant chemical detection market share in 2024. The widespread use of GC enables organizations in environmental monitoring, food safety, pharmaceuticals, and petrochemicals to separate, identify, and count volatile and semi-volatile organic compounds. Gas chromatography is highly sensitive, produces accurate results, and has a great ability in complicated mixtures. GC performs important functions because it accurately detects trace chemicals in a sample, as well as identifies both pollutants and contaminants.

The mass spectrometry segment is anticipated to show considerable growth over the forecast period. MS operates as a highly sensitive analytical method for ion mass-to-charge ratio analysis through its combination with GC-MS and LC-MS chromatographic techniques. The ability to identify a range of chemical compounds, with high accuracy and sensitivity, makes mass spectrometry a clear solution for drug testing and environmental monitoring, in addition to food safety and forensic analysis.

The air segment donated the largest chemical detection market share in 2024. The detection of chemicals in the air serves essential operations ranging from environmental observation to industrial protection and healthcare protection. Checks of air quality represent a vital element for industrial safety in manufacturing and mining, and chemical operations that need environmental hazard monitoring. The expanding air pollution-related worries with rising safety standards and environmental regulations produce increased demand for devices that detect chemicals in air environments.

The soil segment is anticipated to show considerable growth in the forecast period. The detection techniques used on soil evaluate samples to identify chemical compounds consisting of vital nutrients and pollution substances, and environmental contaminants that include heavy metals, pesticides, and hydrocarbons. Studying soil composition with the additional detection of harmful substances enables this technology to support proper land management and agricultural productivity, and environmental restoration efforts. Rising environmental regulations and a growing understanding of soil pollution consequences will drive the market demand for sophisticated detection systems for soil contamination.

The organic compounds segment dominated the chemical detection market in 2024. Widespread industrial use of organic compounds exists throughout pharmaceuticals, food and beverage, as well as environmental monitoring and petrochemical production sectors. As concerns rise over air and water quality across multiple industries (e.g., manufacturing, agriculture, construction, and energy), end users are demanding more and more chemical detection technologies. In addition, the rise of public concern over environmental sustainability, climate change, and risk to public health and safety from pollution and increasing socio-economic disparity will help spur demand for chemical detection technology.

The inorganic compounds segment is anticipated to show considerable growth in the coming years. The detection methods identify multiple compounds that exist in environmental monitoring, industrial processes, water quality testing, and food safety applications. The detection of dangerous heavy metals such as lead, mercury, and arsenic, as well as regulatory compliance assessment, requires inorganic analysis. Advanced detection technologies are gaining momentum because environmental conservation and public health regulations, with industrial inorganic pollutant control requirements, push industries to adopt such systems.

The parts per billion (ppb) segment held a significant chemical detection market share in 2024. At the ppb detection level, chemicals are detected at low concentration levels that can be as minute as 1 part per billion. Accurate minimum detection levels at the ppb level are critical to many industries when minimal traces of chemicals can create significant environmental impacts and pose serious safety and security issues to human health. Assessing the quality of air, water, and soil requires determining pollutants at the precision of one part per billion during environmental monitoring operations.

The parts per trillion (ppt) segment is anticipated to show considerable growth in the forecast period. Laboratories can use PPT as detection levels in detection systems to determine the presence of low concentrations of chemicals. Clinical and biomedical applications are reliant on low-stakes detection of trace biomarkers of disease or contaminants in biological samples and identifying disease at the earliest possible stage.

The environmental monitoring segment held a significant share of the chemical detection market in 2024. Safety needs chemical detection devices for real-time pollutant monitoring, which combines location identification with substance characterization and monitoring practices of hazardous substances in air, water, and soil. The evolution of the world has shifted multiple industrial sectors toward chemical detection systems to address growing environmental health concerns about air and water quality. The preventative protection of public health, together with sustainability and climate change developments, will drive the continuous growth of chemical detection applications with rising environmental concerns.

By Detection Method

By Sample Type

By Target Analytes

By Detection Sensitivity

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024