April 2025

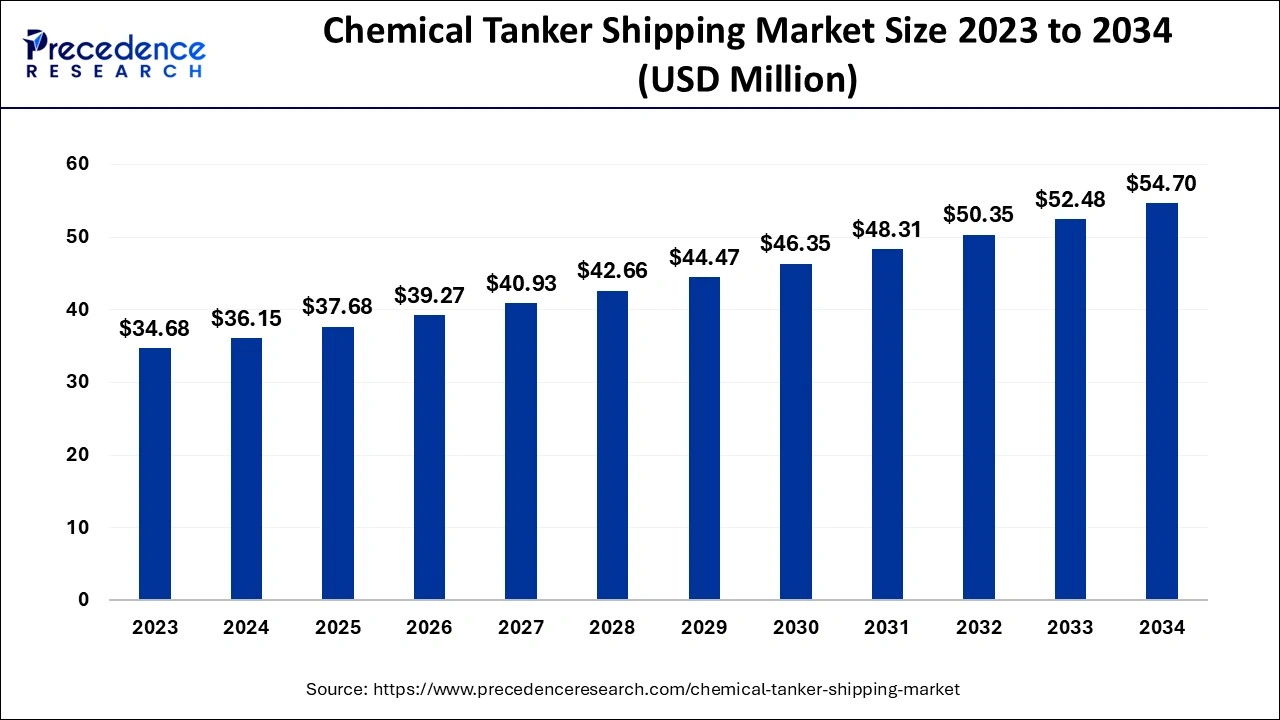

The global chemical tanker shipping market size is estimated at USD 36.15 million in 2024, grew to USD 37.68 million in 2025 and is projected to surpass around USD 54.70 million by 2034, expanding at a CAGR of 4.23% between 2024 and 2034. The North America chemical tanker shipping market size is calculated at USD 13.38 million in 2024 and is growing at a CAGR of 4.36% during the forecast year.

The global chemical tanker shipping market size is worth around USD 36.15 million in 2024 and is predicted to hit around USD 54.70 million by 2034, growing at a CAGR of 4.23% from 2024 to 2034. The wide adoption of the chemical industry in different end-use industries is driving the chemical tanker shipping market growth.

The integration of artificial intelligence (AI) into the chemical tanker shipping market for the advancements in technology and improving the efficiency of the services. AI improves real-time monitoring; its algorithms analyze the different sources such as sea conditions, weather, and vessel traffic, which offers real-time data, helps in decision-making, and enables automated alerts to ship operators for efficient navigation. AI helps with predictive modeling, such as predicting potential dangers such as collisions, storms, and equipment failure.

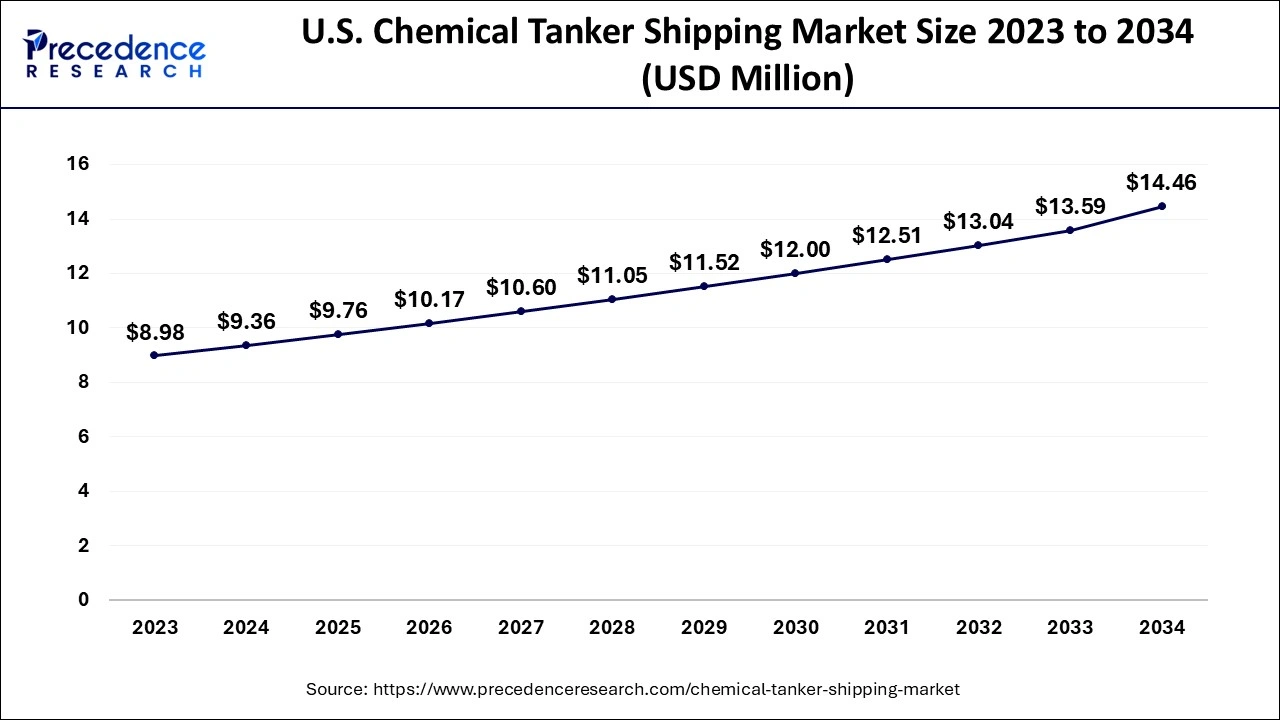

The U.S. chemical tanker shipping market size is evaluated at USD 9.36 million in 2024 and is expected to be worth around USD 14.46 million by 2034, growing at a CAGR of 4.43% from 2024 to 2034.

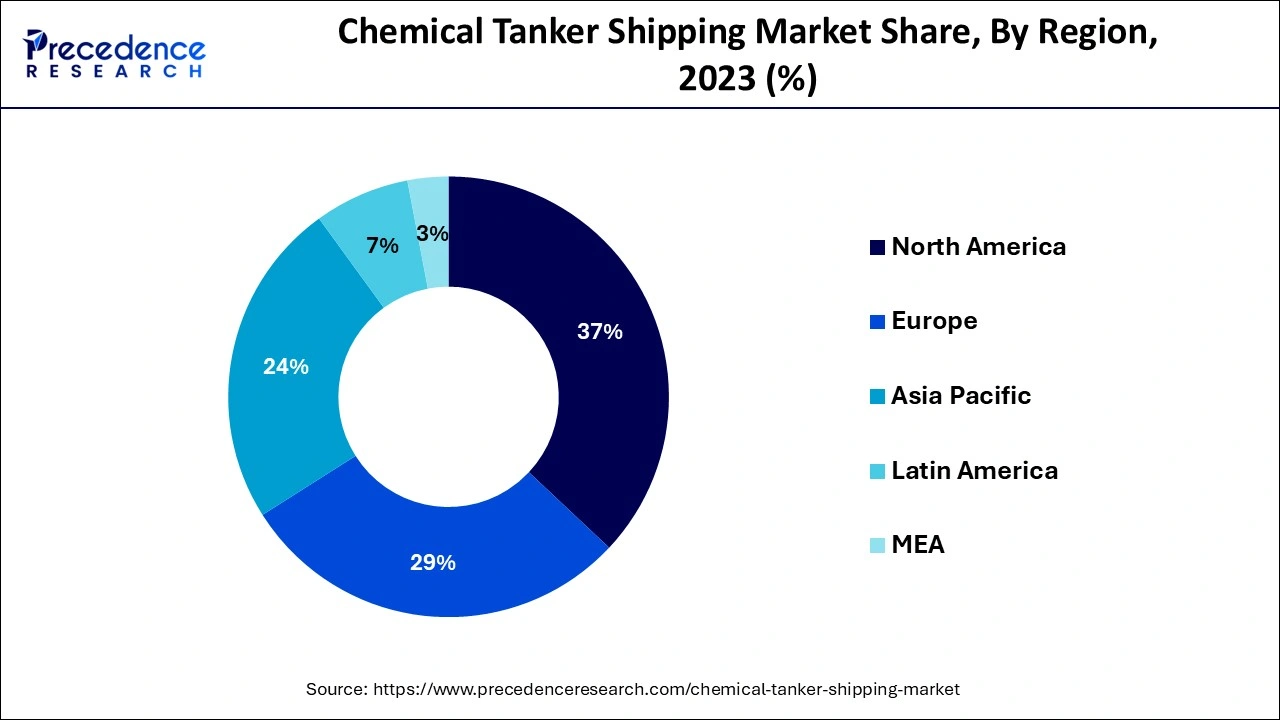

North America dominated the global chemical tanker shipping market. The growth of the market is attributed to the rising growth of industrialization and international trade across countries, which are driving the demand for the market. The increasing availability of leading ship manufacturers, the continuous investment in the oil and refinery industries, and the government interventions to strengthen the shipping industry for international trade are collectively leading to a higher demand for chemical shipping tankers across the region.

Asia Pacific is expected to witness the fastest growth in the chemical tanker shipping market during the forecast period. The growth of the market is attributed to the rising regional population and economic development in countries such as India, China, and Japan, which results in the increasing industrialization that anticipated the increased demand for transportation that boosts the growth of the maritime industry. The rising oil and gas industries in the countries and the demand for petrochemicals and pharmaceutical chemicals are accelerating.

Chemical tanker shipping is the type of ship that is specially designed for the transportation of chemicals in heavy amounts. It is a cargo shipment that is used for the transportation of any type of chemicals. The rising import and export activities and the rising demand for the chemical industry across the industries are driving the demand for chemical tanker shipping. The rising investment in the development of new and advanced chemical tanker ships is accelerating the growth of the chemical tanker shipping market.

| Report Coverage | Details |

| Market Size by 2034 | USD 54.70 Million |

| Market Size in 2024 | USD 36.15 Million |

| Market Size in 2025 | USD 37.68 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Fleet Type, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Expansion of the chemical industry

The increasing demand for the chemical industry and the rising importance of the chemical industry in daily life are driving the growth of the chemical tanker shipping market. The chemical industry is used in different industrial applications such as agriculture, decor, hygiene, agriculture, mobility, and others. Chemicals are used in the manufacturing of plastic and polymers and help in advanced research; the chemical industry plays an important role in the manufacturing of fertilizers, pesticides, personal products, toiletries, and food.

The risk associated with the leakage

The handling of hazardous chemicals in the tanker and managing the leakproof tankers are among the leading challenges, and the maritime environmental impact due to chemical tanker shipping is restraining the expansion of the chemical tanker shipping market.

Increasing import and export activities

The increasing international trade across borders and the increasing chemical import and export activities are driving the growth of the chemical tanker shipping market. The increasing demand for the chemical industry from the different end-use industries, such as personal care and food processing, drives the demand for the chemical industry globally. Additionally, increasing demand for petrochemical products and crude oil is driving the demand for the chemical industry.

The IMO 2 fleet segment dominated the chemical tanker shipping market in 2023. The IMO is the international maritime organization, the specialized agency that works under the United Nations to ensure the responsibility of the security and safety of shipping and prevent the atmosphere and marine pollution by ships. The IMO 2 is the type of ship that is made for transporting oils, chemicals, and other fluid materials. The rising demand for industries such as oil and chemicals, agrochemicals, pharmaceuticals, and others is driving the demand for efficient fleet management for the safer transportation of chemicals.

The IMO 1 fleet segment will witness significant growth in the chemical tanker shipping market during the forecast period. There is an increasing demand for the chemical fleet to transport hazardous oils and chemicals without leakage and polluting the marine environment. The increasingly stringent regulations associated with the pollution level and transport security of hazardous chemicals and the increasing demand for industries such as petrochemicals, pharmaceuticals, and chemical manufacturing industries.

The deep-sea chemical tankers segment accounted for the largest share of the chemical tanker shipping market in 2023. Deep-sea chemical tankers are specially designed ships that are used to transport heavy-weight and hazardous chemicals via the deep sea. The increasing demand for the oils and chemical industries such as pharmaceuticals, agriculture, and petrochemicals worldwide and the rising international trade between the countries are driving the demand for the deep-sea chemical tankers products segment.

The inland chemical tankers segment is expected to grow at a notable rate in the chemical tanker shipping market during the forecast period. The increasing demand for localized chemical transportation into the region, the rapid demand for chemicals such as pharmaceuticals, petrochemicals, and other hazardous chemicals for the different applications and manufacturing of the different products are highly driving the demand for the regional extensive inland waterways.

The vegetable oil and fats segment dominated the chemical tanker shipping market in 2023. Vegetable oils and fats are used in different products and applications, such as cosmetics and pharmaceutical products. The vegetable oils are extracted from different types of seeds, nuts, fruits, and grains. The rising global population is accelerating the demand for vegetable oil and fats, which anticipated the demand for chemical tanker shipping. The increasing preference for organic products and plant-based products is driving the adoption rate of vegetable oil and fats.

The inorganic chemicals segment will experience substantial growth in the chemical tanker shipping market during the predicted period. Inorganic chemicals are used in a wide range of industrial applications and products, such as it used in medication, coatings, paints, chemical catalysts, pigments, surfactants, jewelry, and others. The increasing industrialization and the international trade between the countries are fueling the import and export of inorganic chemicals.

By Fleet Type

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025