September 2023

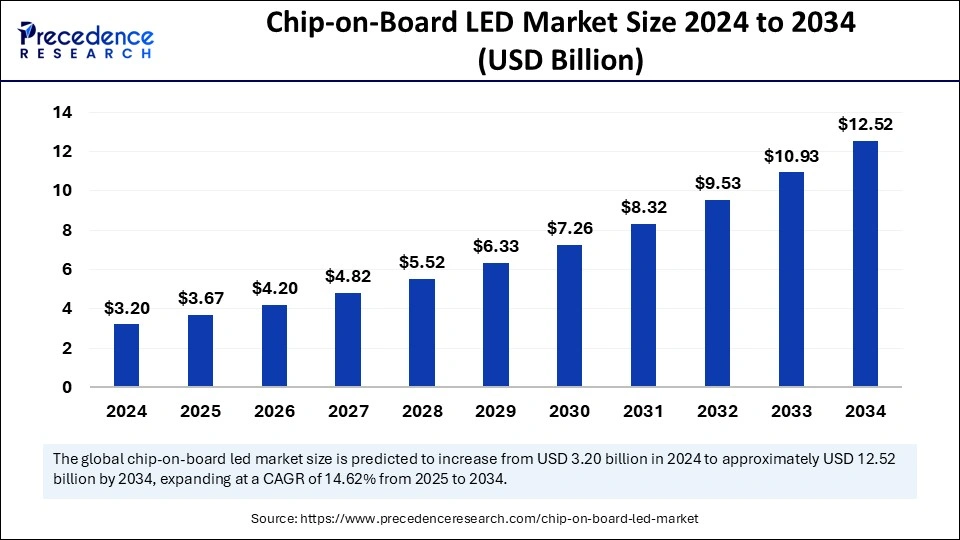

The global chip-on-board LED market size is calculated at USD 3.67 million in 2025 and is forecasted to reach around USD 12.52 million by 2034, accelerating at a CAGR of 14.62% from 2025 to 2034. The Asia Pacific market size surpassed USD 1.44 million in 2024 and is expanding at a CAGR of 14.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global chip-on-board LED market size accounted for USD 3.20 million in 2024 and is predicted to increase from USD 3.67 million in 2025 to approximately USD 12.52 million by 2034, expanding at a CAGR of 14.62% from 2025 to 2034. The increasing demand for energy-efficient lighting sources is the key factor driving the growth of the market. Also, the rising use of IoT-enabled devices, coupled with the ongoing shift toward solid-state lighting technologies, can fuel market growth further.

Artificial Intelligence powered chip design improves the performance of consumer electronics by improving hardware for AI use to enable more intelligent and faster devices. The chip-on-board LED market growth will be boosted by increasing utilization of AI in consumer electronics and healthcare and growing funding in AI research and development. Furthermore, AI-powered analytics are optimizing design and production processes, which leads to enhanced efficiency and significant reductions in manufacturing costs.

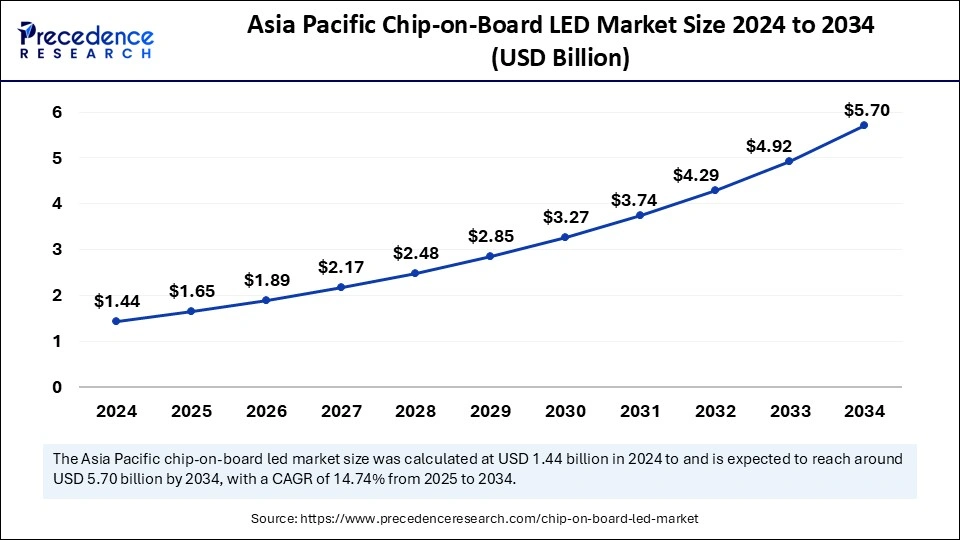

The Asia Pacific chip-on-board LED market size was exhibited at USD 1.44 million in 2024 and is projected to be worth around USD 5.70 million by 2034, growing at a CAGR of 14.74% from 2025 to 2034.

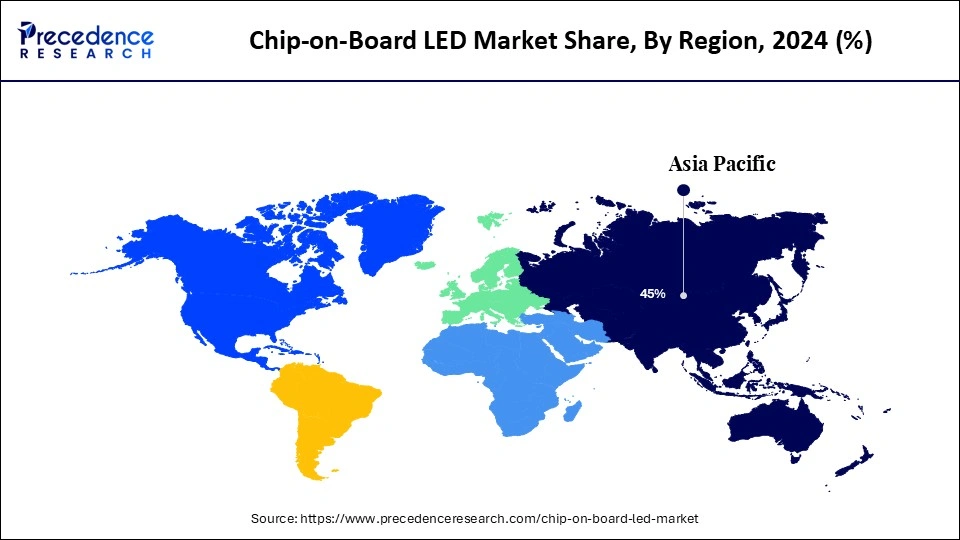

Asia Pacific held the largest chip-on-board LED market share in 2024. The dominance of the region can be attributed to the growing COB LED manufacturing in South Korea and China, coupled with the ongoing technological advancements in COB LED technology. Moreover, the region also benefits from strong production capabilities and an increasing demand for more sophisticated lighting solutions. All these factors position Asia-Pacific as a leading player in the market.

In Asia Pacific, India is anticipated to grow at a significant rate over the studied period. The growth of the market in the country is mainly driven by rapid urbanization and rising adoption of COB LED products in commercial buildings and industrial sites. Also, the growing awareness regarding efficient energy solutions and climate change is boosting the demand for this product in the country.

The Middle East and Africa are expected to grow at the fastest rate in the chip-on-board LED market during the projected period. The growth of the region can be credited to the stringent environment-associated norms in many economies, which have led to the widespread adoption of sustainable practices in the market. Furthermore, the automobile sector is highly developed in Middle Eastern countries, which facilitates raised awareness regarding the advantages of COB LEDs in various automotive parts.

In Middle East and Africa, UAE is expected to witness significant growth owing to the stringent regulations regarding using conventional lighting sources along with supportive government policies like tax breaks and subsidies for energy-efficient lighting solutions.

The chip-on-board LED market is an industry that emphasizes LED packaging technology, where a number of LED chips are mounted directly on a PCB or substrate, forming a uniform and single light source. The market further encompasses the manufacturing, distribution, and application of COB LED-related components and modules such as substrates, adhesives, and phosphor coatings. This LED creates better color-mixing and lighting effects, hence improving the overall consumer experience.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.52 Billion |

| Market Size by 2025 | USD 3.67 Billion |

| Market Size by 2024 | USD 3.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.62% |

| Dominated Region | North America |

| Fastest Growing Market | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Substrate Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for energy-convenient lighting solutions

There is an increasing demand for energy-efficient lighting solutions that can reduce operational costs and energy usage, fueling the demand for r COB LEDs. In addition, these LEDs are becoming popular in many applications such as commercial, residential, and industrial lighting as the focus on sustainability and energy conservation grows. COB LED market players are focusing on improving the intensity and quality of light created by COB LEDs.

Complex thermal management process

COB LEDs generate a lot of heat during operation. Hence, effective heat dissipation is important for maintaining maximum performance and reliability. Monitoring thermal issues, particularly in applications with limited ventilation and high ambient temperatures, can pose a hurdle to market growth. Moreover, the production process for COB LEDs is complex, which can lead to higher manufacturing costs, further hindering the chip-on-board LED market.

Growing adoption of COB LEDs in horticulture

The chip-on-board LED market is experiencing substantial growth, fueled by innovations in energy-efficient lighting solutions. The latest trend in the market is the growing adoption of COB LEDs in horticulture and automotive lighting. Furthermore, in the automotive industry, these LEDs are gaining traction due to their compact design and higher brightness, facilitating better illumination in automobile taillights and headlights.

Product Insights

The COB LED modules segment dominated the chip-on-board LED market in 2024. The dominance of the segment can be attributed to the increasing demand for these products in the residential sector. COB LED technology includes the mounting of various LED chips onto a substrate to form a cohesive single lighting module. Additionally, the growing demand for energy-efficient lighting along with the higher quality of COB LED output, particularly in applications such as food and street lighting, can impact segment growth positively.

The COB LED arrays segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the ongoing integration of COB LEDs in many applications and their higher performance characteristics, such as high efficiency and brightness. Also, COB LED arrays can get a better color-rendering index (CRI) than conventional LEDs. The rising global focus on decreasing carbon emissions with energy conservation is the major impacting factor for segment expansion.

The ceramic substrates segment will lead the chip-on-board LED market in 2024. The dominance of the segment can be linked to the thermal stability, high durability, and light output efficacy of ceramic-based COB LEDs. Moreover, ceramic substrates have greater thermal conductivity than other materials, allowing for more effective heat dissipation with higher power densities. Improved resistance capacity for high temperature, humidity, and other environmental factors has resulted in the increasing utilization of ceramic-based COB LEDs globally.

The metal core PCBs segment is anticipated to show the fastest growth over the forecast period. The growth of the segment can be driven by the growing need for energy-efficient lighting, particularly LEDs, which depend on MCPCBs for efficient heat dissipation coupled with the expansion of automotive and smart lighting segments. Furthermore, copper is a common material in MCPCBs, providing excellent thermal and electrical conductivity, which makes it ideal for high-functioning applications.

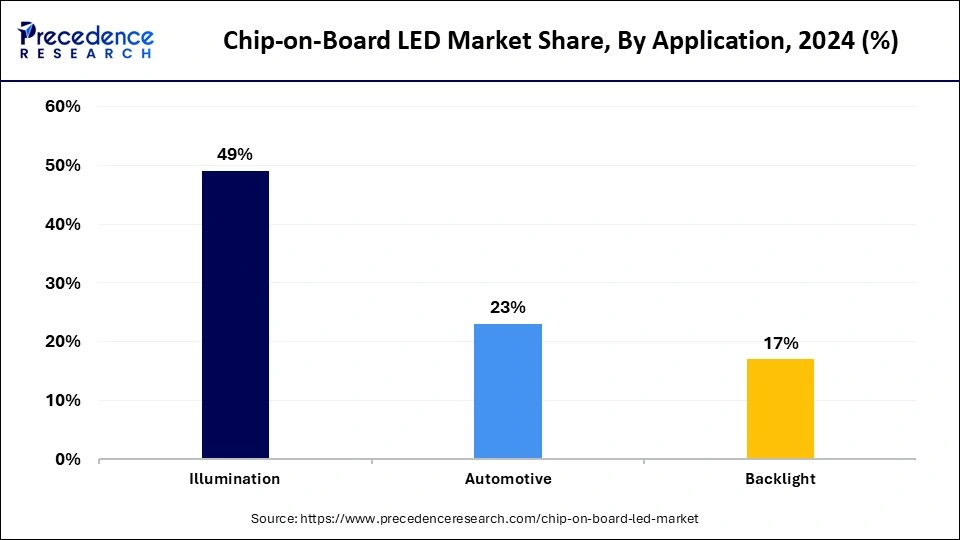

In 2024, the illumination segment dominated the chip-on-board LED market by holding the largest market share. The dominance of the segment is due to the rise of smart homes and smart cities, coupled with government regulations supporting sustainable practices. In addition, the surge in smart cities and green building initiatives across the globe is fueling the demand for energy-efficient lighting solutions in commercial and residential sectors.

The automotive segment is estimated to witness the fastest growth over the projected period. The growth of the segment is owing to the increasing adoption of COB LEDs in the automobile industry. COB LEDs are widely utilized in ambient lighting, dashboards, taillights, turn indicators, and headlights. The main benefits of COB LEDs over other options include improved safety and visibility with more uniform light output and aesthetics.

By Product

By Substrate Material

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2023

June 2024

November 2024

November 2024